North America Wine Market

Market Size in USD Billion

CAGR :

%

USD

76.21 Billion

USD

132.07 Billion

2024

2032

USD

76.21 Billion

USD

132.07 Billion

2024

2032

| 2025 –2032 | |

| USD 76.21 Billion | |

| USD 132.07 Billion | |

|

|

|

|

Wine Market Size

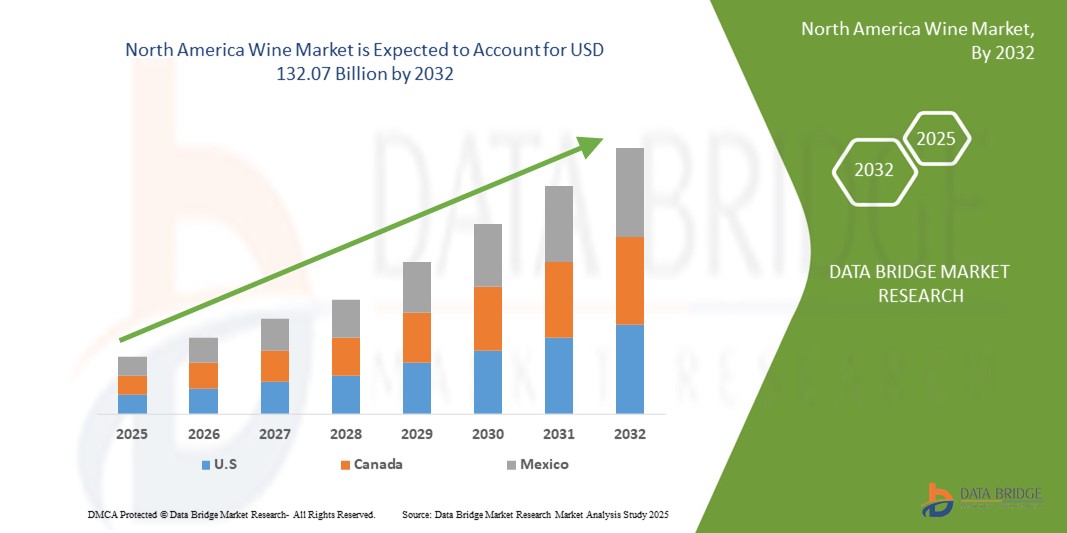

- The North America Wine Market size was valued at USD 76.21 Billion in 2024 and is expected to reach USD 132.07 Billion by 2032, at a CAGR of 6.3% during the forecast period

- This growth is driven by factors such as increase in demand for processed food across the globe

Wine Market Analysis

- Wine is an alcoholic beverage that is prepared using fermentation of rice, fruits, cherry, berries or pomegranate, grapes and others without the addition of acids, enzymes, sugars, water, and other nutrients.

- The earliest known traces of wine include wines from China, Iran, and Georgia and its consumption brings along a wide range of benefits such as reducing risks of heart disease, and lowering the cholesterol level.

- Rising fondness for exotic wine in the urban areas and surge in the demand for alcoholic beverages are the major factors fostering the growth of the market

- U.S. is expected to dominate the Wine market due to the presence of major companies such as E. & J. Gallo Winery

- U.S. is expected to be the fastest growing region in the Wine market during the forecast period due to rising demand for premium, organic, and low-alcohol wines

- The still wine segment is expected to dominate the market with a market share of 61.4% due to its broad appeal across age groups, affordability, and extensive varietal availability, particularly from California.

Report Scope and Wine Market Segmentation

|

Attributes |

Wine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wine Market Trends

“Premiumization and Low-Alcohol Alternatives Driving Consumer Shift”

- One prominent trend in the North America Wine Market is the rise of premium and low-alcohol wines, driven by health-conscious millennials and Gen Z consumers

- Winemakers are increasingly focusing on crafting quality-over-quantity offerings with organic grapes, sustainable practices, and authentic regional expressions

- For instance, California-based brands such as Avaline and Cupcake LightHearted have gained popularity for offering clean-label and low-calorie wine options, appealing to modern consumers seeking mindful indulgence.

- This shift is reshaping retail shelves and tasting room experiences across the region, with a notable uptick in demand for natural wines, non-alcoholic variants, and wines with transparent labeling

Wine Market Dynamics

Driver

“Growing Wine Tourism and Direct-to-Consumer (DTC) Sales Expansion”

- The growth of wine tourism in regions like Napa Valley, Finger Lakes, and British Columbia is fueling on-site sales, brand loyalty, and regional awareness.

- In addition, direct-to-consumer (DTC) channels are surging in popularity, supported by online platforms, subscription models, and virtual tastings that allow wineries to bypass traditional retail barriers

For instance,

- According to Wine Institute data (2023), DTC wine shipments in the U.S. surpassed $4 billion, marking a continued shift in consumer purchasing behavior.

- These channels enable wineries to maintain margins and build long-term customer relationships, boosting overall market resilience and innovation

Opportunity

“Rising Demand for Sustainable and Organic Wine Products”

- Consumers in North America are increasingly prioritizing environmental responsibility, creating significant opportunity for wineries that embrace sustainable, organic, and biodynamic production methods.

- Wineries are investing in eco-friendly packaging, water conservation, and regenerative agriculture practices to align with evolving consumer values

For instance,

- Bonterra Organic Vineyards saw double-digit growth in 2024 due to its carbon-neutral certification and commitment to regenerative farming.

- This trend opens doors for certification-driven product differentiation and appeals strongly to eco-conscious demographics across both retail and hospitality sectors.

Restraint/Challenge

“Supply Chain Disruptions and Climate-Related Vineyard Risks”

- North American wineries face significant challenges from climate variability—ranging from wildfires in California to unpredictable frost events in the Pacific Northwest—impacting grape yields and quality.

- In parallel, ongoing supply chain disruptions, including glass bottle shortages, shipping delays, and rising input costs, hinder timely product delivery and inflate operational expenses

For instance,

- Wildfire smoke taint led to the cancellation of entire vintages for some California wineries in 2023, affecting inventory levels and brand continuity

- These environmental and logistical risks increase production uncertainty, pressuring wineries to diversify sourcing strategies and invest in risk mitigation technologies

Wine Market Scope

The market is segmented on the basis of type, colour, product type, packaging, body type, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Colour |

|

|

By Product Type |

|

|

By Packaging |

|

|

By Body Type |

|

|

By Distribution Channel |

|

In 2025, the still wine segment is projected to dominate the market with a largest share in type segment

The still wine segment is expected to dominate the Wine market with the largest share of 61.4% in 2025 due to its broad appeal across age groups, affordability, and extensive varietal availability, particularly from California. Consumers favor still wines for everyday consumption and social occasions, making them the most accessible and widely distributed wine category.

The sparkling wine segment is expected to account for the highest CAGR during the forecast period in type market

In 2025, the sparkling wine segment is expected to account for the highest CAGR in the market due to increasing demand among younger consumers for celebratory and lower-alcohol beverages, along with rising popularity of affordable options like Prosecco and canned sparkling wines, especially in casual and social drinking occasions.

Wine Market Regional Analysis

“U.S. Holds the Largest Share in the Wine Market”

- U.S. dominates the Wine market with a share of 77.11%, driven by the presence of major companies such as E. & J. Gallo Winery, Constellation Brands, and The Wine Group dominate the U.S. wine industry.

- E. & J. Gallo Winery is the largest wine producer in the world, producing over 3% of the global annual supply

- The U.S. benefits from sophisticated distribution systems, including major distributors like Southern Glazer's Wine and Spirits, which operates in 44 states and Washington, D.C. This extensive network ensures efficient delivery from producers to consumers nationwide.

“U.S. is Projected to Register the Highest CAGR in the Wine Market”

- The U.S. leads in the market due to rising demand for premium, organic, and low-alcohol wines.

- Strong e-commerce growth, DTC models, and evolving consumer preferences toward health-conscious and sustainable offerings fuel this expansion.

Wine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Accolade Wines (Australia)

- The Wine Group (U.S.)

- Davide Campari-Milano S.p.A. (Italy)

- E. & J. Gallo Winery (U.S.)

- Constellation Brands, Inc. (U.S.)

- John Distilleries (India)

- Castel Group (France)

- CDV · Compagnia del Vino (Italy)

- AMVYX (Greece)

- BACARDI (Bermuda)

- Pernod Ricard (France)

- TREASURY WINE ESTATES (Australia)

- Caviro (Italy)

- Miguel Torres S. A. (Spain)

- Concha y Toro (Chile)

- Sula Vineyards Pvt. Ltd. (India)

- Chapel Down (U.K.)

Latest Developments in North America Wine Market

- In March 2022, Meiomi Wines introduced its new Red Blend, expanding its portfolio with a bold flavor profile crafted from California’s renowned wine regions. The brand emphasized that the release maintains its premium quality while offering greater variety

- In February 2022, Ventessa by Mezzacorona launched a new wine line tailored for health-conscious consumers, featuring naturally low-calorie options

- In May 2021, Treasury Wine Estates signed a long-term distribution partnership with Republic National Distributing Company (RNDC), extending its distribution network across key states including California, Texas, Louisiana, Oklahoma, Kentucky, Mississippi, Utah, Wyoming, and Nebraska

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Wine Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Wine Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Wine Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.