North America Wood Based Panel Market Analysis and Size

The wood based panels are widely used for ceiling, cladding, roofing, flooring, and furniture applications due to their strength and durability. The rising demand for wood-based products from end-use industries is accelerating the growth of the market across the globe. The adaptation of these technologies to the wood-based panels industry has been stimulated by the requirement to improve product quality and reduce manufacturing costs simultaneously, or, rather, to secure the competitiveness of wood based panel producers. Consequently, the growing demand for wood based panels is likely to drive the market growth in the projected period.

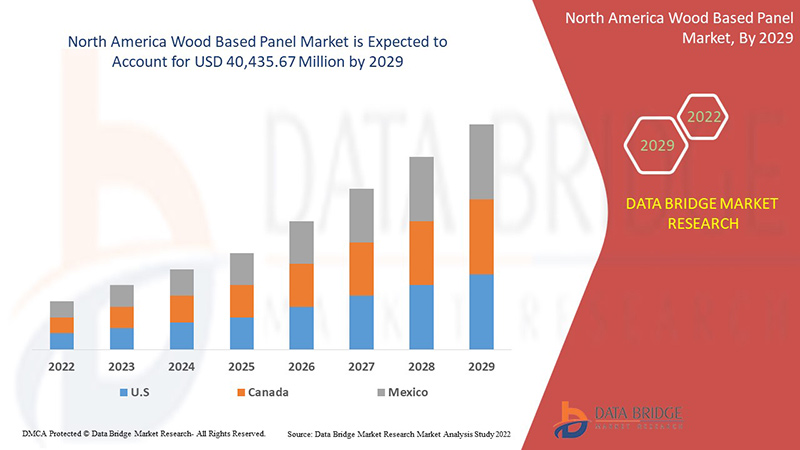

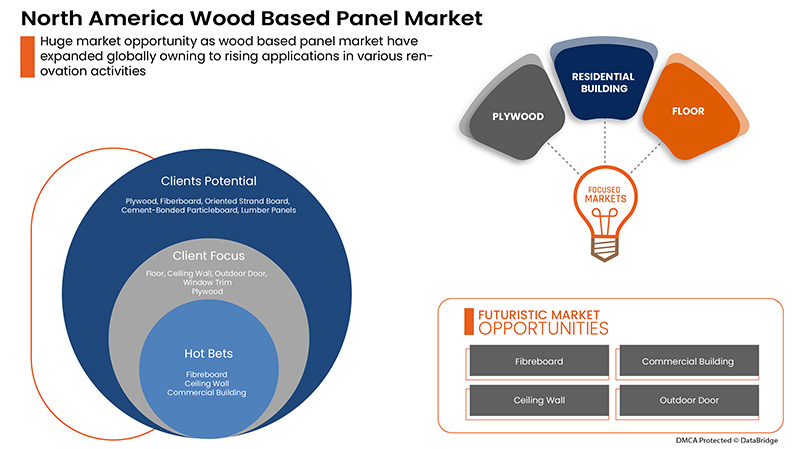

Data Bridge Market Research analyses that the wood based panel market is expected to reach the value of USD 40,435.67 million by the year 2029, at a CAGR of 3.6% during the forecast period. "Floor" accounts for the most prominent application segment in the respective market owing to the rise in the wood based panel. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product (Plywood, Fiberboard, Oriented Strand Board, Cement-Bonded Particleboard, Lumber Panels, T-Beam Panels, Stress-Skin Panels, and Others), Thickness (9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM, and Others), Distribution Channel (B2B, OEMS, Specialty Stores, E-Commerce, and Others), Application (Outdoor Door, Window Trim, Ceiling Wall, Mantel, Floor, and Others), End-User (Residential Building, Commercial Building, Hotels, Vila, Hospitals, School, Malls, and Others). |

|

Countries Covered |

U.S., Canada, and Mexico. |

|

Market Players Covered |

Boise Cascade, West Fraser, Dongwha Group, Kronoplus Limited, DARE panel group co., ltd., Georgia-Pacific, ARAUCO, Canfor, Sonae Industria, EVERGREEN FIBREBOARD BERHAD, Kastamonu Entegre, Weyerhaeuser Company, and Timber Products Company, among others. |

Market Definition

Wood based panels are a common term for an array of different board products, which have a good range of engineering properties. While some panel types are relatively new on the market, others have been developed and successfully introduced more than a hundred years ago. However, panel types with a long history of continuous optimization are still a long way from being fully developed, and they may always have a chance for improvement. Technological developments, on the one hand, and new market and regulative requirements, along with a steadily changing raw material situation, drive continuous improvements of wood based panels and their manufacturing processes

Market Dynamics of the North America Wood Based Panel Market

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers/Opportunities faced by the North America Wood Based Panel Market

- Rise in consumer spending on wood based panels in the renovation of homes and furniture

The wood panel industry includes plywood sheets, engineered wood panels, MDF (Medium Density Fibre boards), furniture boards, particleboard, and decorative surface products such as laminates. A rise in consumer spending on wood based panels in the renovation of homes & furniture is expected to boost the wood based panels demand in commercial & residential buildings. Improvement and increase in building renovation activities with the adoption of wood based panels for an increase in the aesthetic is another factor driving the market's growth. Moreover, the increased construction of public buildings, grand hotels, and resorts with decorative wood panels has led to the market's growth.

- Balanced import and export procedures of wood panels among the countries

The global trade in wood products is highly regionalized, with Europe, North America, and Asia. In recent years, the global trade of wood products has changed greatly with the rise in demand for wood panels and the increase in emerging markets of wood panels. In recent years, the increased production & trade of wood based panels product such as plywood, particleboard, fibreboard, oriented strand board, and lumber panels is increased due to the rise in demand from the housing market and the global increase in population.

- Low product cost coupled with superior properties of wood panels, including strength and durability

The wood based panels are specialty products that provide advanced performance, long-term performance, and enhanced durability, being less expensive to produce and use. The wood-based panels provide an amazing array of possibilities in terms of both structural and aesthetic applications. Because of its affordability, superior performance, and flexibility in design, construction, and renovation, the rise in usage of wood based panels is increasing in residential constructions. Wood-frame construction has improved dramatically with faster construction, better utilization of fiber, less waste, and better quality control. New technological advances in EWPs and connections are positioning the wood products industry to compete successfully in constructing much larger and more complex structures.

- Rise in investments and initiatives towards construction activities for both commercial and residential

The construction industry has become a robust and efficient manufacturing sector worldwide. Across the countries, growth in demand for construction and real estate projects is driven by macro-economic and disruptive megatrends, such as increasing urbanization, expanding trade, demographic trends such as rising income levels, and technology and sustainable environments. With that, various projects have been initiated to create socially inclusive, sustainable communities, as the economic growth of any country is primarily dependent on the development of its infrastructure.

Restraints/Challenges Faced by the North America Wood Based Panel Market

- Rise in concerns of dust by wood panel usage

The wood-based panels cover the production of various products. While the production flow differs from product to product, there are some common features in terms of the key environmental issues. Emissions of dust, organic compounds, and formaldehyde are the main rising concerns while manufacturing wood panel products. Fine particulate matter emissions contribute to dust emissions from wood-based panel production, where particles below 3 µm can constitute up to 50 % of the total dust measured due to dust emissions from wood-based panels' manufacturing, causing health and environmental problems, which is high on the environmental policy agenda.

- Fluctuation in the prices of wood pulp

Fluctuation in the raw materials price will affect the production cost of the wood based panel’s products. The change in the production cost will change the revenue for the manufacturers. Wood pulp is taken from the trees, but due to the more demand in the different regions, import and export of the wood pulp are done within the specified quantity. The raw material is available in different quality and at different rates, due to which wood-based production is very difficult for the manufacturers. Highly fluctuating raw materials costs and ineffective price management can greatly endanger a manufacturer in the market. Due to the raw material price fluctuation, the manufacturers can now fix the product cost, resulting in a loss for manufacturers.

- Fluctuation of raw material prices and supply chain inconsistency

The supply chain ecosystem has become increasingly volatile due to a shortage of factors such as high product costs, transportation costs, etc. Wood product manufacturers face many challenges due to the high raw material variability. Each processing step in manufacturing impacts material utilization and cost efficiency, which is the reason for the higher material cost. The most common challenge for the wood products manufacturer is to make a profit and execute the manufacturing process at low cost but with high-cost variable raw material.

Post COVID-19 Impact on North America Wood Based Panel Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the market has experienced a downfall in sales due to the shutdown of retail outlets and the restrictions on customer access over the past few years.

However, the growth of the market post-pandemic period is attributed to more people working from home and increased disposable income. This has led to the increased demand for furnishing. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve their offerings. They are enhancing its market share by exploring different retail channels and expanding into new regions.

This North America wood based panel market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Wood based panel market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you to make an informed market decision to achieve market growth.

Recent Developments

- In November 2020, West Fraser acquired Norbord, creating a Diversified North America Wood Products Leader. This acquisition has increased the company's credibility in the market and thus will help the company diversify its business.

- In February 2021, Weyerhaeuser Company announced an agreement to purchase 69,200 acres of high-quality Alabama timberlands from Soterra. The company purchased these timberlands for approximately USD 149.00 million. The company will enhance its timberland operations and expand its customer base and future export opportunities.

North America Wood Based Panel Market Scope

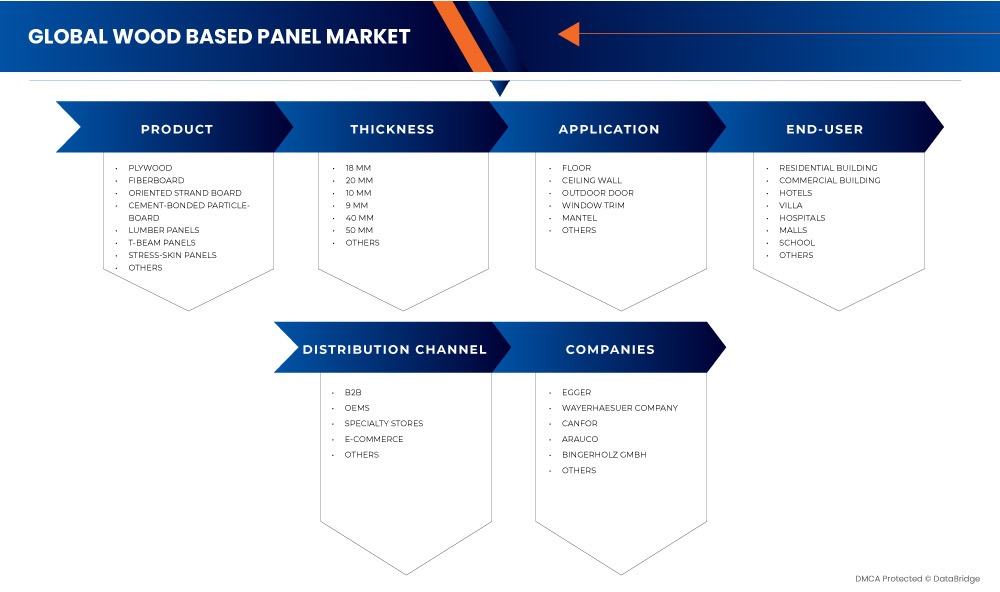

The North America Wood based panel market is segmented on the basis of product, distribution channel, thickness, application, and end users. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Plywood

- Fiberboard

- Cement-Bonded Particleboard

- Oriented Strand Board

- Lumber Panels

- T-Beam Panels

- Stress-Skin Panels

- Others

On the basis of product, the North America wood based panel market is segmented into plywood, fiberboard, oriented strand board, cement-bonded particleboard, lumber panels, t-beam panels, stress-skin panels, and others.

Distribution Channel

- E-Commerce

- OEMS

- B2B

- Specialty Stores

- Others

On the basis of distribution channel, the North America wood based panel market is segmented into B2B, OEMS, specialty stores, e-commerce, and others.

Thickness

- 9 MM

- 10 MM

- 18 MM

- 20 MM

- 40 MM

- 50 MM

- Others

On the basis of thickness, the North America wood based panel market is segmented into 9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM, and others.

Application

- Outdoor Door

- Window Trim

- Ceiling Wall

- Mantel

- Floor

- Others

On the basis of applications, the North America wood based panel market is segmented into the outdoor door, window trim, ceiling wall, mantel, floor, and others.

End-User

- Residential Building

- Commercial Building

- Hotels

- Villa

- Hospitals

- School

- Malls

- Others

On the basis of end-users, the North America wood based panel market is segmented into residential buildings, commercial buildings, hotels, villas, hospitals, schools, malls, and others.

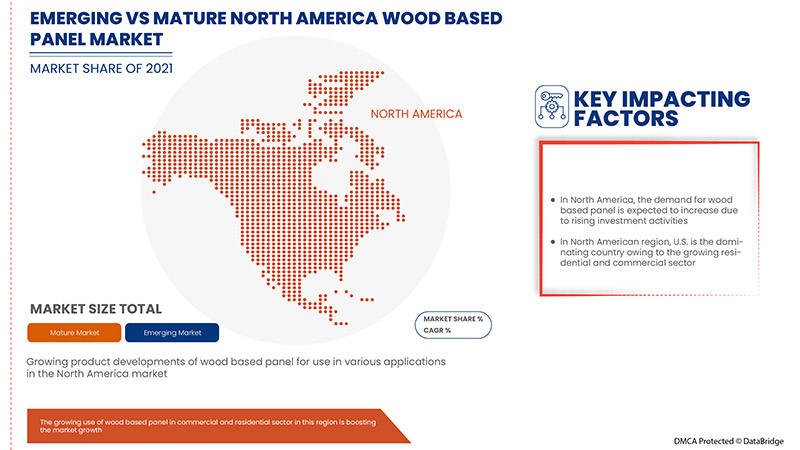

North America Wood Based Panel Market Regional Analysis/Insights

North America wood based panel market is analyzed, and market size insights and trends are provided by product, distribution channel, thickness, application, and end users, as referenced above.

The countries covered in the North America wood based panel market report are the U.S., Canada, and Mexico.

The U.S. is dominating the market due to a rise in consumer spending on wood based panels in the renovation of homes and furniture in the region. The rise in investments and initiatives towards construction activities for both commercial and residential is propelling the region's demand for wood-based panels.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Wood Based Panel Market Share Analysis

The North America wood based panel market competitive landscape provides details by the competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on North America wood based panel market.

Some of the major players operating in the Wood based panel market are Boise Cascade, West Fraser, Dongwha Group, Kronoplus Limited, DARE panel group co., ltd., Georgia-Pacific, Arauco, Canfor, Sonae Industria, Evergreen Fibreboard Berhad, Kastamonu Entegre, Weyerhaeuser Company, Timber Products Company among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WOOD BASED PANELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISTRIBUTION CHANNEL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 PRICING TREND SCENARIO

4.5 PRODUCTION & CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 REGULATORY FRAMWORK

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE

7.1.2 BALANCED IMPORT AND EXPORT PROCEDURES OF WOOD PANELS AMONG THE COUNTRIES

7.1.3 LOW PRODUCT COST COUPLED WITH SUPERIOR PROPERTIES OF WOOD PANELS, INCLUDING STRENGTH AND DURABILITY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES AND NORMS BY THE GOVERNMENT REGARDING DEFORESTATION

7.2.2 RISE IN CONCERNS OF DUST BY WOOD PANEL USAGE

7.2.3 FLUCTUATION IN THE PRICES OF WOOD PULP

7.3 OPPORTUNITIES

7.3.1 RISE IN INVESTMENTS AND INITIATIVES TOWARDS CONSTRUCTION ACTIVITIES FOR BOTH COMMERCIAL AND RESIDENTIAL

7.3.2 INCREASE IN PARTNERSHIPS FOR THE GROWTH OF CONSTRUCTION SECTOR IN EMERGING COUNTRIES

7.3.3 INCORPORATION OF APA STANDARDS FOR MANUFACTURERS AIDS THE PRODUCT ENTRY INTO THE MARKET

7.4 CHALLENGES

7.4.1 SHORTAGE OF TIMBER AND CLIMATE CHANGE

7.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

7.4.3 SHORTAGE IN LABOR AND FINANCIAL LOSSES

8 IMPACT OF COVID-19 ON THE NORTH AMERICA WOOD BASED PANEL MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON NORTH AMERICA WOOD BASED PANEL MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

8.3 STRATEGIC DECISION FOR MANUFACTURES AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PLYWOOD

9.2.1 SOFTWOOD PLYWOOD

9.2.2 HARDWOOD PLYWOOD

9.2.3 OTHERS

9.3 FIBERBOARD

9.3.1 MDF

9.3.2 HDF

9.3.3 PARTICLEBOARD

9.3.4 HARDBOARD

9.3.5 OTHERS

9.4 ORIENTED STRAND BOARD

9.5 CEMENT-BONDED PARTICLEBOARD

9.6 LUMBER PANELS

9.7 T-BEAM PANELS

9.8 STRESS-SKIN PANELS

9.9 OTHERS

10 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 OEMS

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 18 MM

11.3 20 MM

11.4 10 MM

11.5 9 MM

11.6 40 MM

11.7 50 MM

11.8 OTHERS

12 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FLOOR

12.3 CEILING WALL

12.4 OUTDOOR DOOR

12.5 WINDOW TRIM

12.6 MANTEL

12.7 OTHERS

13 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESIDENTIAL BUILDING

13.2.1 PLYWOOD

13.2.2 FIBERBOARD

13.2.3 ORIENTED STRAND BOARD

13.2.4 CEMENT-BONDED PARTICLEBOARD

13.2.5 LUMBER PANELS

13.2.6 T-BEAM PANELS

13.2.7 STRESS-SKIN PANELS

13.2.8 OTHERS

13.3 COMMERCIAL BUILDING

13.3.1 PLYWOOD

13.3.2 FIBERBOARD

13.3.3 ORIENTED STRAND BOARD

13.3.4 CEMENT-BONDED PARTICLEBOARD

13.3.5 LUMBER PANELS

13.3.6 T-BEAM PANELS

13.3.7 STRESS-SKIN PANELS

13.3.8 OTHERS

13.4 HOTELS

13.4.1 PLYWOOD

13.4.2 FIBERBOARD

13.4.3 ORIENTED STRAND BOARD

13.4.4 CEMENT-BONDED PARTICLEBOARD

13.4.5 LUMBER PANELS

13.4.6 T-BEAM PANELS

13.4.7 STRESS-SKIN PANELS

13.4.8 OTHERS

13.5 VILLA

13.5.1 PLYWOOD

13.5.2 FIBERBOARD

13.5.3 ORIENTED STRAND BOARD

13.5.4 CEMENT-BONDED PARTICLEBOARD

13.5.5 LUMBER PANELS

13.5.6 T-BEAM PANELS

13.5.7 STRESS-SKIN PANELS

13.5.8 OTHERS

13.6 HOSPITALS

13.6.1 PLYWOOD

13.6.2 FIBERBOARD

13.6.3 ORIENTED STRAND BOARD

13.6.4 CEMENT-BONDED PARTICLEBOARD

13.6.5 LUMBER PANELS

13.6.6 T-BEAM PANELS

13.6.7 STRESS-SKIN PANELS

13.6.8 OTHERS

13.7 MALLS

13.7.1 PLYWOOD

13.7.2 FIBERBOARD

13.7.3 ORIENTED STRAND BOARD

13.7.4 CEMENT-BONDED PARTICLEBOARD

13.7.5 LUMBER PANELS

13.7.6 T-BEAM PANELS

13.7.7 STRESS-SKIN PANELS

13.7.8 OTHERS

13.8 SCHOOL

13.8.1 PLYWOOD

13.8.2 FIBERBOARD

13.8.3 ORIENTED STRAND BOARD

13.8.4 CEMENT-BONDED PARTICLEBOARD

13.8.5 LUMBER PANELS

13.8.6 T-BEAM PANELS

13.8.7 STRESS-SKIN PANELS

13.8.8 OTHERS

13.9 OTHERS

13.9.1 PLYWOOD

13.9.2 FIBERBOARD

13.9.3 ORIENTED STRAND BOARD

13.9.4 CEMENT-BONDED PARTICLEBOARD

13.9.5 LUMBER PANELS

13.9.6 T-BEAM PANELS

13.9.7 STRESS-SKIN PANELS

13.9.8 OTHERS

14 NORTH AMERICA WOOD BASED PANEL MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA WOOD BASED PANEL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.2 MERGER & ACQUISITION

15.3 PRODUCT LAUNCH

15.4 PARTNERSHIP

15.5 EXPANSIONS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 WEST FRASER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 WEYERHAEUSER COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANFOR

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EGGER GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ARAUCO

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BINDERHOLZ GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BOISE CASCADE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DARE PANEL GROUP CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 DONGWHA GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EVERGREEN FIBREBOARD BERHAD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GEORGIA-PACIFIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GREEN RIVER HOLDING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KASTAMONU ENTEGRE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 KRONOPLUS LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MIECO CHIPBOARD BERHAD

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 PFEIFER GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SONAE INDUSTRIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 STARBANK PANEL PRODUCTS LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TIMBER PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 IMPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 3 EXPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 4 IMPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 5 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 7 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ORIENTED STRAND BOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA CEMENT-BONDED PARTICLEBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA LUMBER PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA T-BEAM PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA STRESS-SKIN PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA B2B IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA OEMS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SPECIALTY STORES IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA E-COMMERCE IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA 18 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA 20 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA 10 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA 9 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA 40 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA 50 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA FLOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA CEILING WALL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA OUTDOOR DOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA WINDOW TRIM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA MANTEL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (MILLION CUBIC METERS)

TABLE 57 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 59 NORTH AMERICA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 U.S. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 U.S. WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 75 U.S. PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 U.S. FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 U.S. WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 U.S. WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 79 U.S. WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 U.S. WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 U.S. RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 U.S. COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 U.S. HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 U.S. VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 U.S. HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 U.S. MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 U.S. SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 U.S. OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 CANADA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 CANADA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 91 CANADA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 CANADA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 CANADA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 CANADA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 95 CANADA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 CANADA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 CANADA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 CANADA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 CANADA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 CANADA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 CANADA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 CANADA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 103 CANADA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 CANADA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 MEXICO WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 MEXICO WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 107 MEXICO PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 MEXICO FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 MEXICO WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 MEXICO WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 111 MEXICO WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 MEXICO WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 MEXICO RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 MEXICO COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 MEXICO HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 MEXICO VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 MEXICO HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 MEXICO MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 MEXICO SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 MEXICO OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

List of Figure

FIGURE 1 NORTH AMERICA WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WOOD BASED PANEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WOOD BASED PANELS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WOOD BASED PANELS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WOOD BASED PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WOOD BASED PANELS MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA WOOD BASED PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA WOOD BASED PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA WOOD BASED PANELS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA WOOD BASED PANELS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA WOOD BASED PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 NORTH AMERICA WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 13 RISING CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE EXPECTED TO DRIVE THE NORTH AMERICA WOOD BASED PANELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PLYWOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WOOD BASED PANELS MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR NORTH AMERICA WOOD BASED PANEL MARKET, 2018-2022

FIGURE 17 EUROPE, EECCA, NORTH AMERICA WOOD BASED PANELS PRODUCTION, AND NET APPARENT CONSUMPTION, 2018-2020 FROM 2018-2020 (1,000 M3)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 SUPPLY CHAIN ANALYSIS- NORTH AMERICA WOOD BASED PANEL MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA WOOD BASED PANEL MARKET

FIGURE 21 EUROPE WOOD BASED PANEL PRODUCTION, IN 2018

FIGURE 22 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 23 WOOD PULP PRICE IN 2020 (USD DOLLAR)

FIGURE 24 NORTH AMERICA WOOD BASED PANEL MARKET, BY PRODUCT, 2021

FIGURE 25 NORTH AMERICA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA WOOD BASED PANEL MARKET, BY THICKNESS, 2021

FIGURE 27 NORTH AMERICA WOOD BASED PANEL MARKET, BY APPLICATION, 2021

FIGURE 28 NORTH AMERICA WOOD BASED PANEL MARKET, BY END-USER, 2021

FIGURE 29 NORTH AMERICA WOOD BASED PANEL MARKET: SNAPSHOT (2021)

FIGURE 30 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2021)

FIGURE 31 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 NORTH AMERICA WOOD BASED PANEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 NORTH AMERICA WOOD BASED PANEL MARKET: BY PRODUCT (2022-2029)

FIGURE 34 NORTH AMERICA WOOD BASED PANEL MARKET: COMPANY SHARE 2021 (%)

North America Wood Based Panel Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Wood Based Panel Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Wood Based Panel Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.