North America Wound Care Biologics Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

2.06 Billion

2024

2032

USD

1.06 Billion

USD

2.06 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 2.06 Billion | |

|

|

|

|

North America Wound Care Biologics Market Size

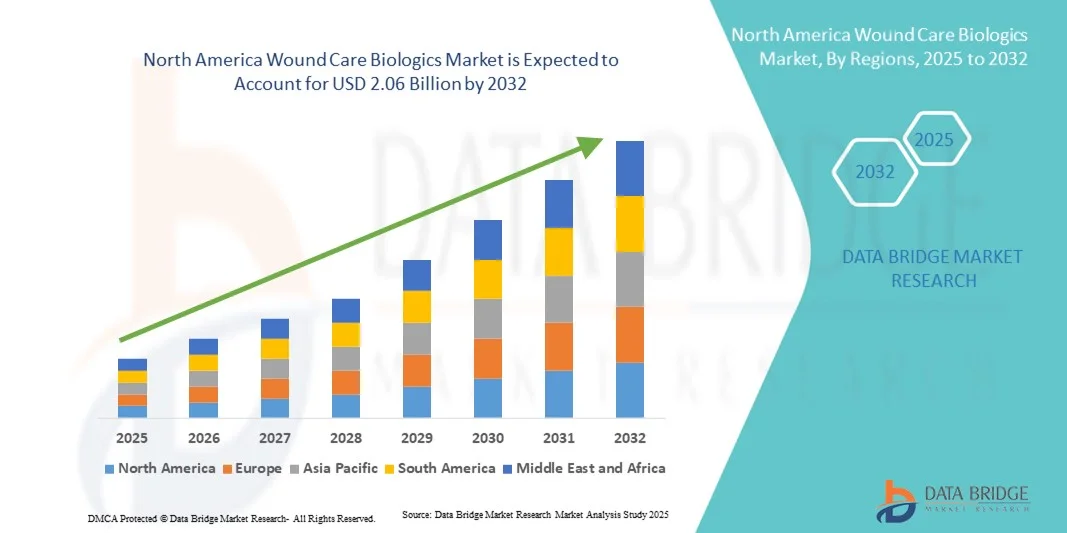

- The North America wound care biologics market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 2.06 billion by 2032, at a CAGR of 8.56% during the forecast period

- This market growth is primarily driven by the increasing prevalence of chronic conditions such as diabetes and obesity, which complicate natural wound healing processes. In addition, there is a growing demand for advanced wound care solutions that offer faster healing and improved patient outcomes

- Furthermore, the rising awareness among healthcare providers and patients about the benefits of advanced wound care techniques is fueling the adoption of wound care biologics. These factors collectively accelerate the uptake of biologic solutions, significantly boosting the industry's growth in North America

North America Wound Care Biologics Market Analysis

- Wound care biologics, including synthetic skin grafts, growth factors, allografts, and xenografts, are becoming essential components of advanced wound management in hospitals, burn centers, and ambulatory care centers due to their ability to accelerate healing, reduce complications, and improve patient outcomes

- The increasing prevalence of chronic conditions such as diabetes, obesity, and venous ulcers, coupled with rising awareness among healthcare providers and patients about the benefits of biologic therapies, is driving strong demand for wound care biologics in North America

- The U.S. dominated the North America wound care biologics market with the largest revenue share of 85% in 2024, characterized by high healthcare expenditure, early adoption of advanced therapies, and a strong presence of key industry players, with hospitals and specialized wound care centers experiencing substantial growth driven by innovations in allografts and xenografts

- Canada is expected to be the fastest growing country in the North America wound care biologics market during the forecast period, supported by rising investment in healthcare infrastructure and increasing adoption of technologically advanced biologic solutions

- Ulcers segment dominated the North America wound care biologics market with a market share of 41.5% in 2024, driven by its high prevalence among patients with chronic conditions such as diabetes and venous insufficiency, the increasing need for advanced wound healing solutions, and growing awareness among healthcare providers about the clinical benefits of biologic therapies

Report Scope and North America Wound Care Biologics Market Segmentation

|

Attributes |

North America Wound Care Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Wound Care Biologics Market Trends

Technologically Advanced Biologics and Regenerative Therapies

- A significant and accelerating trend in the North America wound care biologics market is the growing adoption of advanced biologic therapies such as synthetic skin grafts, growth factors, and xenografts that enhance wound healing outcomes

- For instance, ReCell® Autologous Cell Harvesting Device enables rapid preparation of regenerative skin cells for treatment of burns and chronic wounds, improving healing rates and patient recovery times

- Integration of biologics with digital wound monitoring systems is enabling personalized treatment plans and real-time progress tracking, enhancing the overall efficiency and effectiveness of wound care management

- The use of combination therapies, such as applying growth factors alongside acellular matrices, is creating more comprehensive treatment protocols that accelerate tissue regeneration and reduce complication rates

- This trend towards innovative, high-efficacy biologic solutions is driving increased adoption in hospitals, burn centers, and specialized wound care clinics across North America

- The demand for advanced biologics that improve healing speed, reduce hospital stays, and lower recurrence rates is rising rapidly, as healthcare providers seek better patient outcomes and cost-effective care solutions

North America Wound Care Biologics Market Dynamics

Driver

Rising Prevalence of Chronic Wounds and Aging Population

- The increasing incidence of chronic wounds such as diabetic foot ulcers, pressure ulcers, and venous leg ulcers is a major driver for the growth of the wound care biologics market

- For instance, studies indicate that over 6.5 million people in the U.S. suffer from chronic wounds, prompting hospitals and clinics to adopt advanced biologic treatments to improve healing outcomes

- An aging population with slower regenerative capacity is further boosting demand for biologic solutions that accelerate wound repair and prevent complications

- Furthermore, growing awareness among healthcare providers and patients regarding the clinical benefits of biologic therapies is encouraging wider adoption across hospitals, burn centers, and wound clinics

- Availability of reimbursement support for biologic treatments in North America is facilitating market growth by reducing financial barriers for patients and healthcare facilities

- Healthcare providers increasingly prefer biologics due to demonstrated improvements in healing times, reduced infection rates, and enhanced patient satisfaction

Restraint/Challenge

High Costs and Regulatory Hurdles

- The relatively high cost of advanced wound care biologics compared to conventional treatments limits their adoption, particularly among smaller clinics and budget-conscious healthcare providers

- For instance, premium biologics such as acellular dermal matrices and xenografts can cost several thousand dollars per treatment, making them less accessible to certain patient segments

- Strict regulatory requirements for approval of biologic products in the U.S. and Canada can delay product launches and increase development costs for manufacturers

- Furthermore, concerns regarding product safety, immunogenic reactions, and variability in clinical outcomes pose challenges for broader acceptance in the healthcare community

- While healthcare reimbursement programs help mitigate costs, navigating complex approval and insurance processes can slow adoption among providers

- Overcoming these challenges through cost optimization, robust clinical evidence, and streamlined regulatory pathways is critical for sustained market growth in North America

North America Wound Care Biologics Market Scope

The market is segmented on the basis of product type, wound type, and end user.

- By Product Type

On the basis of product type, the North America wound care biologics market is segmented into synthetic skin grafts, growth factors, allografts, and xenografts. The allografts segment dominated the market with the largest revenue share of 38.4% in 2024, driven by their high clinical efficacy in treating chronic wounds and surgical wounds. Allografts are widely used in hospitals and wound care centers due to their ability to promote tissue regeneration while reducing the risk of infection. They are often preferred by clinicians for patients with complex or non-healing ulcers, as they provide a biologically active scaffold supporting cell growth. The segment’s dominance is also supported by the established supply chains of major manufacturers and broad physician familiarity with allograft procedures. In addition, insurance reimbursement policies in the U.S. and Canada favor allograft treatments, further driving adoption. Their versatility across multiple wound types makes them a cornerstone in North American wound care biologics.

The synthetic skin grafts segment is anticipated to witness the fastest growth rate of 10.6% from 2025 to 2032, fueled by technological advancements in bioengineered materials that mimic natural skin properties. Synthetic grafts offer consistent quality, lower risk of disease transmission, and scalability for mass production, making them attractive for hospitals and burn centers. Increasing adoption in outpatient wound clinics and ambulatory surgical centers is contributing to growth as these grafts enable faster treatment cycles and reduce dependency on donor tissue. Furthermore, ongoing research into combining synthetic grafts with growth factors is enhancing their effectiveness, expanding clinical applications. Their customizable nature allows for targeted treatment of burns, ulcers, and surgical wounds, supporting their rapid uptake in the North American market.

- By Wound Type

On the basis of wound type, the market is segmented into ulcers, surgical and traumatic wounds, and burns. The ulcers segment dominated the market with the largest revenue share of 41.5% in 2024, driven by the high prevalence of diabetic foot ulcers, pressure ulcers, and venous leg ulcers in North America. Ulcers are chronic in nature, requiring long-term care, which increases the demand for advanced biologic solutions such as allografts and growth factors. Hospitals and wound clinics prioritize effective ulcer management to reduce complications, hospital stays, and recurrence rates. The segment’s dominance is also supported by insurance coverage for ulcer treatment and government programs targeting chronic disease management. In addition, clinicians prefer biologics that accelerate healing and minimize infection risks in ulcer patients. The growing incidence of lifestyle-related diseases and an aging population further propels demand for ulcer-specific biologics.

The burns segment is expected to witness the fastest growth during the forecast period, driven by rising incidence of traumatic burns and increased investment in specialized burn centers. Biologics such as synthetic skin grafts and xenografts are increasingly used to enhance healing, reduce scarring, and improve functional recovery. Innovations in regenerative therapies tailored for burn treatment are expanding clinical adoption. Moreover, rising patient awareness and demand for advanced cosmetic and functional outcomes contribute to accelerated growth. Burn centers are rapidly integrating biologics into treatment protocols, further boosting market expansion.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers (ASCs), burn centers, and wound clinics. The hospitals segment dominated the market with the largest revenue share of 64.6% in 2024, owing to the high volume of chronic wound cases, surgical procedures, and burn admissions handled in hospital settings. Hospitals have established protocols for advanced wound care, including the use of allografts, xenografts, and growth factors, which ensures consistent adoption of biologic solutions. They also have access to reimbursement frameworks and sophisticated infrastructure for biologic treatment administration. The segment’s dominance is reinforced by the preference of healthcare providers for hospital-based care for complex wounds.

The wound clinics segment is expected to witness the fastest growth rate during the forecast period, driven by the increasing number of specialized outpatient centers focusing on chronic wound management. These clinics provide targeted care using advanced biologics, shorter treatment cycles, and personalized care plans. Rising patient preference for outpatient treatment and reduced hospital visits is contributing to the segment’s rapid growth. In addition, integration of telemedicine and digital wound monitoring in clinics enhances treatment efficiency, further propelling adoption of biologic therapies.

North America Wound Care Biologics Market Regional Analysis

- The U.S. dominated the North America wound care biologics market with the largest revenue share of 85% in 2024, characterized by high healthcare expenditure, early adoption of advanced therapies, and a strong presence of key industry players

- Healthcare providers in the region highly value the efficacy, safety, and accelerated healing outcomes offered by biologic treatments such as allografts, xenografts, and synthetic skin grafts

- This widespread adoption is further supported by government initiatives, reimbursement policies, rising patient awareness, and the presence of key industry players, establishing wound care biologics as a preferred solution for hospitals, burn centers, and specialized wound clinics.

Canada Wound Care Biologics Market Insight

The Canada wound care biologics market is expected to grow at the fastest CAGR during the forecast period, driven by increasing investments in healthcare infrastructure and rising prevalence of chronic wounds among the aging population. The adoption of advanced biologic therapies, such as synthetic skin grafts and growth factors, is rising in hospitals, burn centers, and outpatient wound clinics. Increasing government support, insurance coverage for biologics, and growing focus on improving patient outcomes are key factors stimulating market growth. The integration of digital wound monitoring and telemedicine solutions is further enhancing the accessibility and efficiency of biologic treatments in Canada.

Mexico Wound Care Biologics Market Insight

The Mexico wound care biologics market is anticipated to grow steadily during the forecast period, supported by rising incidence of chronic wounds, surgical wounds, and burns. Hospitals and specialized wound care centers are increasingly adopting biologic therapies such as allografts and xenografts to improve healing outcomes. The market is driven by growing awareness among healthcare providers and patients about advanced wound care solutions, along with improvements in healthcare infrastructure. In addition, government initiatives to enhance access to quality care and the expansion of private healthcare services contribute to the steady adoption of wound care biologics in Mexico.

North America Wound Care Biologics Market Share

The North America Wound Care Biologics industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Bioventus (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Organogenesis Inc. (U.S.)

- Smith & Nephew (U.K.)

- Mölnlycke AB (Sweden)

- Convatec Group Plc (U.K.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medline Industries, Inc. (U.S.)

- Hollister Incorporated (U.S.)

- 3M (U.S.)

- KCI Medical (U.S.)

- Derma Sciences, Inc. (U.S.)

- Tissue Regenix (U.K.)

- AROA BIOSURGERY LIMITED (U.S.)

- Sonoma Pharmaceuticals, Inc. (U.S.)

- Cuprina Holdings (Cayman) Limited. (U.S.)

- Wound Biologics (U.S.)

- Scapa (U.S.)

What are the Recent Developments in North America Wound Care Biologics Market?

- In September 2025, Precision Biologics Manufacturing initiated construction of a state-of-the-art biologics facility in the U.S., creating 200–300 jobs. This expansion aims to bolster U.S.-based wound care manufacturing capabilities, enhancing the production of advanced biologic therapies

- In August 2025, Australian medtech company PolyNovo anticipated a significant market opportunity in the U.S. due to proposed changes by the Centers for Medicare & Medicaid Services (CMS). These reforms, planned for January 2026, aim to reduce spending on skin substitutes in outpatient settings by introducing a flat reimbursement fee of USD 806 per square inch, replacing the current model which incentivizes high-priced products

- In July 2025, Merakris Therapeutics spotlighted its investigational new drug, MTX-001, at the Advanced Wound Care Summit. MTX-001 represents a novel class of regenerative biologics aimed at addressing chronic wound closure. The company emphasized its commitment to advancing care for underserved patient populations

- In April 2025, the U.S. Food and Drug Administration approved Zevaskyn (pz-cel), the first cell-based gene therapy for recessive dystrophic epidermolysis bullosa (RDEB). This therapy involves inserting healthy COL7A1 genes into patients' skin cells, which are then transplanted back via skin grafts, promoting wound healing in individuals with this rare genetic condition

- In October 2024, U.S.-based Royal Biologics introduced two innovative products at the symposium on advanced wound care: the Peak Powder Collagen Matrix and ElectroFiber 3D. The Peak Powder Collagen Matrix enhances healing in various wounds by creating a gel-such as barrier that supports tissue regeneration, while ElectroFiber 3D is a bioengineered matrix that promotes cellular migration and reduces healing time

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.