North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market

Market Size in USD Billion

CAGR :

%

USD

366.03 Billion

USD

437.01 Billion

2024

2032

USD

366.03 Billion

USD

437.01 Billion

2024

2032

| 2025 –2032 | |

| USD 366.03 Billion | |

| USD 437.01 Billion | |

|

|

|

|

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Size

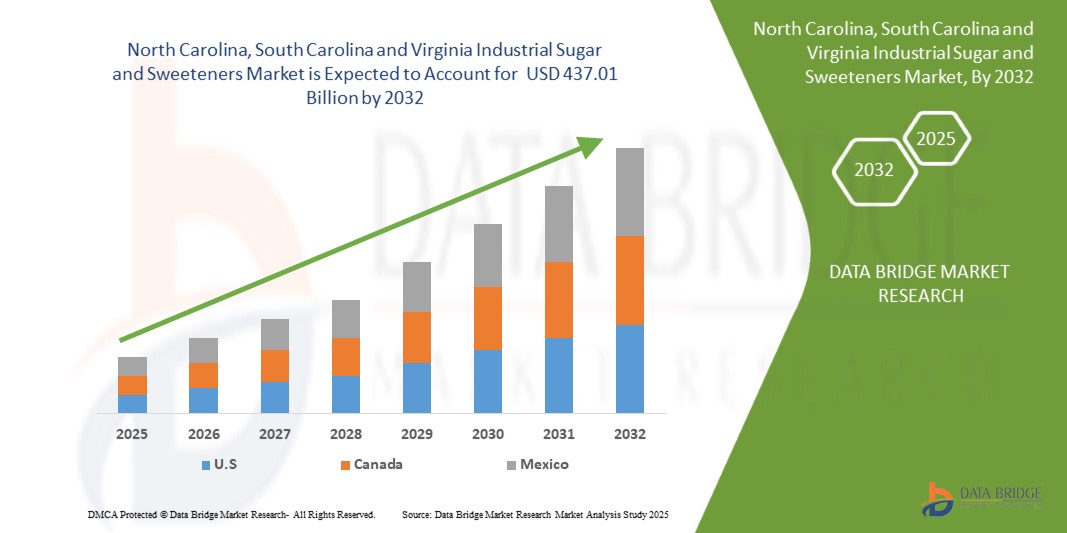

- The North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market size was valued at USD 366.03 billion in 2024 and is expected to reach USD 437.01 billion by 2032, at a CAGR of 2.24% during the forecast period

- The market growth is largely fueled by the increasing consumer preference for healthier, low-calorie, and natural sweeteners, coupled with rising awareness of the health impacts of excessive sugar consumption. Manufacturers are innovating with plant-based and natural sugar alternatives, enabling product diversification across bakery, beverages, confectionery, and processed food applications

- Furthermore, growing demand for clean-label products and regulatory support for natural sweeteners are driving adoption across global markets. These converging factors are accelerating the uptake of industrial sugar and sweeteners, thereby significantly boosting the industry’s growth

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Analysis

- Industrial sugar and sweeteners encompass a variety of natural and synthetic ingredients used to provide sweetness, texture, and functional properties in food and beverage products. These include liquid, crystalline, and powder forms sourced from fruits, dairy, and plant-based origins, catering to diverse applications such as bakery, beverages, confectionery, frozen desserts, infant formula, and processed foods

- The escalating demand for industrial sugar and sweeteners is primarily fueled by the shift toward healthier diets, innovation in sugar alternatives, and growing consumption of convenience and processed foods globally. Manufacturers are increasingly adopting advanced processing techniques to enhance taste, solubility, and functionality, meeting the evolving needs of consumers and the food industry

- Natural sugar segment dominated the market with a market share of 62.5% in 2024, due to increasing consumer preference for clean-label and health-conscious ingredients. Manufacturers are leveraging natural sugars to meet the growing demand for products with reduced artificial additives, and regulatory support for natural sweeteners further boosts their adoption. Natural sugars are widely used across bakery, confectionery, and beverage applications due to their perceived nutritional benefits, versatility, and compatibility with existing production processes. The segment also benefits from strong investments in product innovation and growing awareness about the negative health impacts of synthetic sweeteners, reinforcing its market dominance

Report Scope and North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Segmentation

|

Attributes |

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Trends

Rapidly Growing Food and Beverages Industry

- The robust expansion of the food and beverages industry is a key trend fueling demand for industrial sugar and sweeteners. As consumers increasingly shift toward packaged, ready-to-eat, and functional food products, sugar and sweeteners serve as essential ingredients for taste enhancement, shelf life extension, and formulation stability across multiple categories

- For instance, Cargill Incorporated continues to expand its sweetener portfolio to meet the requirements of beverage companies and confectionery manufacturers. Similarly, Tate & Lyle provides a range of traditional sugars and specialty sweeteners that cater to the growing need for flavor balance and calorie control in diverse food and drink products

- The high use of industrial sugar and sweeteners in bakery, confectionery, soft drinks, dairy, and processed foods underlines their role as indispensable additives. Their ability to provide consistent taste, texture, and bulk makes them integral to the mass production needs of global food manufacturers

- The rise of emerging markets with rapidly urbanizing populations is further contributing to this trend. Increasing disposable income levels and changing dietary habits are boosting consumption of snacks, breakfast cereals, soft drinks, and frozen foods, thereby driving greater reliance on sugar and sweetener solutions

- Manufacturers are also diversifying offerings to align with evolving consumer preferences and regulatory pressures. The growing demand for non-nutritive alternatives such as stevia, monk fruit extracts, and polyols is reshaping the market alongside traditional sugar, ensuring availability of solutions for both mainstream and health-conscious consumers

- In conclusion, the rapid growth of the food and beverages industry is directly driving the expansion of the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market. This trend confirms the essential role of these ingredients in ensuring taste, quality, and innovation across a wide spectrum of food applications globally

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Dynamics

Driver

Increasing Demand for Processed Packaged Foods and Specialty Product

- The rising consumer preference for processed packaged foods and specialty nutritional products is a primary driver for the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market. Busy lifestyles and growing urbanization are encouraging greater reliance on packaged convenience foods that depend on sugar and sweeteners for flavor, stability, and preservation

- For instance, Archer Daniels Midland (ADM) provides a broad range of sugar and sweetener ingredients to major snack and beverage manufacturers, supporting large-scale packaged food production. The company’s product development highlights the close association between processed foods and consistent demand for sweetening agents

- Industrial sugar and sweeteners play a central role in enhancing product appeal across bakery goods, confectionery, carbonated beverages, energy drinks, and instant cereals. Specialty products such as protein shakes, dietary supplements, and functional beverages also depend heavily on alternative sweeteners to balance taste without excessive caloric intake

- The continuous innovation in packaged food categories, including plant-based foods, fortified snacks, and no-sugar-added beverages, has reinforced the need for versatile sweetener solutions. This driver ensures that sugar and alternative sweeteners will remain integral to R&D pipelines across global food and beverage companies

- In conclusion, the steady rise in demand for processed and specialty products solidifies the industrial sugar and sweeteners industry as a vital link in supporting diverse consumer segments. This driver guarantees continued expansion of demand across traditional and emerging food categories worldwide

Restraint/Challenge

Health Risks of Excessive Sugar

- One of the most pressing challenges for the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market is the increasing awareness of health risks associated with excessive sugar consumption. Diets high in refined sugars are strongly linked to health concerns including obesity, type-2 diabetes, cardiovascular diseases, and dental problems, creating growing resistance among consumers and regulators

- For instance, governments in regions such as the UK and Mexico have introduced sugar taxes on sweetened beverages to discourage excessive consumption and promote healthier eating habits. Major beverage companies such as Coca-Cola and PepsiCo have reduced sugar content in several products to align with public health policies and changing consumer expectations

- The shift toward health-conscious diets is negatively impacting the consumption of high-sugar processed foods, resulting in declining demand in certain categories such as soft drinks and traditional confectionery. At the same time, consumers are increasingly switching to low-calorie, natural sweetener alternatives which intensifies competitive pressures on traditional sugar manufacturers

- Regulatory restrictions and mandatory labeling requirements are also creating challenges for food and beverage companies. Transparent disclosure of sugar content and consumer concern over hidden sugars in packaged foods is reshaping purchasing behavior and pressuring companies to reformulate products

- As a result, the health risks associated with excessive sugar consumption remain a significant restraint on the industry. Overcoming this challenge will depend on strategic innovation in sugar reduction technologies, greater adoption of natural sweeteners, and balancing consumer demand for taste with regulatory and health considerations

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Scope

The market is segmented on the basis of type, product form, source, and application.

• By Type

On the basis of type, the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market is segmented into natural sugar and sweeteners. The natural sugar segment dominated the largest market revenue share of 62.5% in 2024, driven by increasing consumer preference for clean-label and health-conscious ingredients. Manufacturers are leveraging natural sugars to meet the growing demand for products with reduced artificial additives, and regulatory support for natural sweeteners further boosts their adoption. Natural sugars are widely used across bakery, confectionery, and beverage applications due to their perceived nutritional benefits, versatility, and compatibility with existing production processes. The segment also benefits from strong investments in product innovation and growing awareness about the negative health impacts of synthetic sweeteners, reinforcing its market dominance.

The sweeteners segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for low-calorie and diabetic-friendly alternatives. Innovations in natural and plant-based sweeteners, along with their integration into functional foods and beverages, are driving adoption. Consumers are increasingly seeking alternatives that provide sweetness without adding excess calories or affecting blood sugar levels. The segment’s growth is further supported by ongoing R&D in taste enhancement and formulation stability, enabling manufacturers to replace traditional sugars without compromising product quality.

• By Product Form

On the basis of product form, the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market is segmented into liquid, crystalline, and powder. The crystalline segment held the largest market revenue share in 2024, owing to its extensive use in bakery, confectionery, and processed food products. Crystalline sugars offer consistency in sweetness, ease of handling, and long shelf life, making them ideal for large-scale industrial applications. Manufacturers also prefer crystalline forms due to their compatibility with automated processing equipment, which reduces operational challenges. Strong demand from both traditional and emerging markets, coupled with increasing consumer awareness of natural crystalline sugar options, has reinforced this segment’s dominance.

The liquid segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing adoption in beverages, sauces, and processed food applications. Liquid sugars and sweeteners provide ease of blending, uniform sweetness distribution, and better solubility, making them highly attractive for industrial use. The rising demand for ready-to-drink beverages and functional drinks, along with innovations in liquid natural sweeteners, is propelling growth. In addition, liquid sweeteners help manufacturers reduce processing time and energy costs, further boosting their popularity.

• By Source

On the basis of source, the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market is segmented into fruits, dairy, and plant-based. The plant-based segment dominated the market in 2024, driven by increasing demand for vegan-friendly, sustainable, and health-conscious ingredients. Plant-based sweeteners such as stevia, agave, and monk fruit are highly favored for their natural origin, low glycemic index, and compatibility with various applications. Manufacturers are focusing on integrating plant-based sources into bakery, confectionery, and beverage products to cater to the growing consumer shift toward clean-label and environmentally sustainable products. The segment’s growth is further supported by regulatory approvals and strong investments in plant-based product innovation.

The dairy-based segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for lactose-based and functional sweeteners in infant formula, frozen desserts, and specialized processed foods. Dairy-based sugars provide unique functional properties such as browning, moisture retention, and texture enhancement, making them highly suitable for industrial applications. Advances in dairy processing technologies and increased consumer preference for naturally derived ingredients contribute to the segment’s accelerated adoption.

• By Application

On the basis of application, the North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market is segmented into bakery, confectionery, frozen desserts, processed food, infant formula, beverages, and others. The bakery segment dominated the largest market revenue share in 2024, driven by the consistent demand for bread, cakes, and pastries. Industrial sugar and sweeteners are critical for texture, flavor, and shelf-life enhancement in bakery products, and manufacturers increasingly prefer natural and functional sweeteners to meet health-conscious consumer demands. The segment also benefits from growing urbanization, rising disposable incomes, and expanding bakery chains, which are accelerating the adoption of high-quality sugar and sweetener products.

The beverages segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by increasing consumption of ready-to-drink beverages, energy drinks, flavored water, and functional drinks. Beverage manufacturers are increasingly incorporating low-calorie and natural sweeteners to address health concerns while maintaining taste and product appeal. Innovations in liquid sweeteners, ease of formulation, and growing consumer demand for sugar alternatives in cold and hot beverages are key factors driving the rapid growth of this segment.

North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market Share

The industrial sugar and sweeteners industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Südzucker AG (Germany)

- Cargill, Incorporated (U.S.)

- International Flavors & Fragrances Inc. (U.S.)

- Ingredion (U.S.)

- Wilmar International Ltd. (Singapore)

- Layn Natural Ingredients (China)

- SweeGen, Inc., (U.S.)

- Imperial Sugar (U.S.)

- HOWTIAN (China)

- Pyure (U.S.)

Latest Developments in North Carolina, South Carolina and Virginia Industrial Sugar and Sweeteners Market

- In April 2024, Ingredion introduced a groundbreaking stevia solution that outperformed competing products in consumer taste tests. This new sweetener provides food and beverage manufacturers with a superior option for sugar reduction, enabling them to meet the rising consumer demand for healthier, lower-sugar products. By maintaining excellent taste and a clean-label profile, Ingredion’s innovation strengthens its position in the natural sweeteners market and supports growth in applications across bakery, beverages, and processed foods. The development reinforces industry trends toward functional and health-conscious ingredients

- In January 2024, Cargill Incorporated launched its EverSweet stevia sweetener, leveraging a proprietary fermentation process to improve taste while retaining a natural origin. This advancement addresses a key challenge in the stevia segment—the bitter aftertaste—allowing manufacturers to deliver sweet products with a cleaner flavor. By enhancing product versatility across food and beverage applications, EverSweet positions Cargill to capitalize on the growing demand for natural, low-calorie sweeteners, further expanding its market influence

- In August 2024, ADM was recognized with the 2024 Sustainability Leadership Award by the Business Intelligence Group. This accolade highlights ADM’s strategic commitment to sustainable practices and innovations, strengthening its reputation as a market leader in environmentally and socially responsible sugar and sweetener production. The recognition is likely to enhance ADM’s brand value and influence, particularly among health- and sustainability-conscious consumers, further driving adoption of its products in global markets

- In April 2023, SweeGen, Inc., unveiled Sweetensify flavors, a new tool for food and beverage manufacturers designed to create healthier, sugar-reduced products. Powered by novel sweet protein technology including brazzein and thaumatin II, Sweetensify enhances and modulates sweetness to mimic sugar’s taste profile. This innovation expands opportunities in the functional and natural sweeteners market, allowing manufacturers to develop products that satisfy consumer demand for healthier options without compromising flavor

- In March 2022, Cargill Incorporated launched the EverSweet ClearFlo platform, a stevia-based sweetener line engineered for a cleaner taste and enhanced versatility in food and beverage applications. Utilizing a proprietary fermentation process to optimize steviol glycosides, the platform offers manufacturers a practical solution for sugar reduction while maintaining sweetness and taste appeal. This development solidified Cargill’s competitive positioning in the natural sweeteners market, catering to a growing global shift toward low-calorie and health-oriented products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North Carolina South Carolina And Virginia Industrial Sugar And Sweeteners Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.