Saudi Arabia Warehousing Market

Market Size in USD Million

CAGR :

%

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

USD

9,314.17 Million

USD

13,214.96 Million

2022

2030

| 2023 –2030 | |

| USD 9,314.17 Million | |

| USD 13,214.96 Million | |

|

|

|

Saudi Arabia Warehousing Market Analysis and Insights

Saudi Arabia is becoming a hub for regional trade and a key player in global supply chain networks as the largest economy in the Middle East. The warehousing industry in the kingdom is witnessing rapid development, with a surge in demand for modern, technologically advanced storage facilities that can meet the requirements of diverse industries. The growth of e-commerce, along with the government's focus on economic diversification and investments in infrastructure, is driving the need for efficient and strategically located warehousing solutions. With its strategic geographic location and ambitious Vision 2030 plan, Saudi Arabia warehousing market is poised for continued expansion and innovation to meet the evolving demands of the modern business landscape. The market is experiencing significant growth and transformation in response to the country's expanding logistics and e-commerce sectors.

Data Bridge Market Research analyzes that the Saudi Arabia warehousing market is expected to reach USD 13,214.96 million by 2030 from USD 9,314.17 million in 2022, growing with a substantial CAGR of 4.5% in the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Hardware/System, Software, and Services), Function (Inventory Control and Management, Asset Tracking, Yard & Dock Management, Order Fulfilment, and Workforce & Task (Process) Management, Shipping, Predictive Maintenance, and Others), Type (Insource Warehousing and Outsource Warehousing), Size (Small, Medium, and Large), Ownership (Public Warehouses, Private Warehouses, Bonded Warehouses, and Consolidated Warehouse), Warehousing Storage Nature (Ambient Warehousing (Around 80°F), Air Conditioned (56°F and 75°F), Refrigerated (33°F and 55°F), and Cold/Frozen (Of or Below 32°F)), WMS Tier Type (Advanced WMS, Basic WMS, and Intermediate WMS), End User (Retail and E-Commerce, Transportation and Logistics, Automotive, Healthcare, Food and Beverages, Electrical and Electronics, Chemical, Agriculture, Energy and Utilities, and Others) |

|

Country Covered |

Saudi Arabia |

|

Market Players Covered |

Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, S.A. TALKE Ltd., LogiPoint, and United Group |

Market Definition

Warehousing refers to the industry and infrastructure related to the storage, management, and distribution of goods and products within the Kingdom of Saudi Arabia. This market encompasses a wide range of services and facilities that play a crucial role in the supply chain and logistics of various industries. Warehousing comprises a network of storage facilities, distribution centers, and logistics services dedicated to the efficient and secure storage, handling, and movement of goods and products. These facilities can vary in size and specialization, serving industries such as manufacturing, retail, e-commerce, agriculture, and more.

Saudi Arabia Warehousing Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing E-Commerce Sector in Saudi Arabia

The burgeoning e-commerce sector in Saudi Arabia is a powerful driver behind the market growth and expansion. There is a heightened demand for efficient storage and distribution facilities to support e-commerce operations due to the rapid increase in online shopping and changing consumer preferences. Warehouses play a pivotal role in ensuring timely order fulfilment, inventory management, and the seamless delivery of products to online shoppers, thereby enhancing the overall customer experience.

- Rising Expansion of the Manufacturing Sector

The growth of manufacturing in Saudi Arabia is playing a big role in the warehousing market. Factories and industries are producing goods due to which they need places to store them. Warehouses are like big storage spaces where companies keep their products before they are sent to stores or customers. In addition, as manufacturing is on the rise in Saudi Arabia, so the demand for warehouses is going up because they provide a safe and organized way to store all the things that are made. This trend is boosting the warehousing market in Saudi Arabia creating opportunities for businesses that provide warehousing services.

Restraint

- High Land and Warehouse Setup Cost

High land and warehouse setup costs pose a significant restraint to market growth. The expenses associated with acquiring suitable land and constructing warehouses can be a substantial barrier for businesses looking to establish or expand their presence in the country. These costs encompass land prices, construction materials, labor, and compliance with local regulations, which collectively contribute to the overall financial burden.

Opportunity

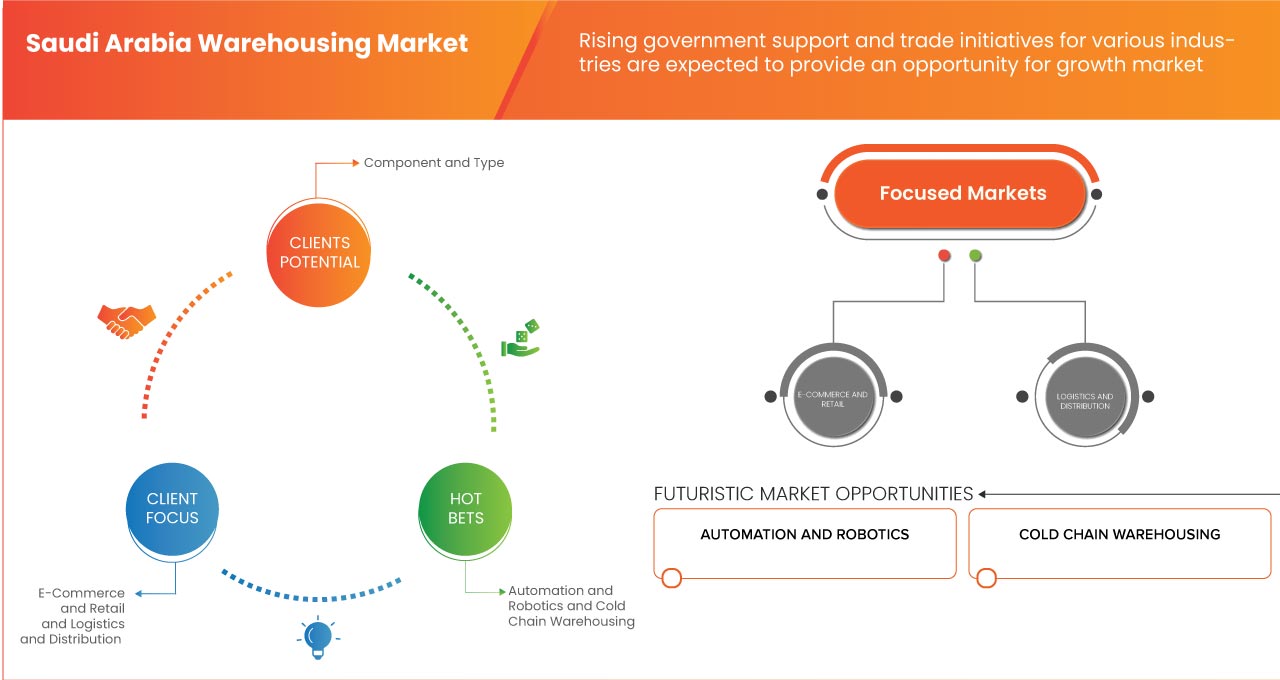

- Rising Government Support and Trade Initiatives for Various Industries

The increasing support and trade-related initiatives from the government present a significant opportunity for market growth. These measures foster a more favorable business environment, attracting a diverse range of industries to the region. The demand for modern warehousing facilities is expected to grow as various sectors expand their operations, offering a promising prospect for the industry's development and expansion.

Challenge

- Skilled Labor Shortage

A significant factor expected to challenge the market growth is the shortage of skilled labor. There is a growing demand for workers with specialized skills in areas such as warehouse management, logistics, and the operation of advanced automation and technology systems as the industry continues to grow and evolve. However, the availability of such skilled labor remains limited in the market, leading to recruitment difficulties and increased labor costs.

Recent Developments

- In May 2023, Tamer Logistics achieved a significant milestone by winning the Most Inspiring Logistics Company of the Year Award at the TLME Inspiration Awards 2023. This prestigious recognition not only celebrated their ability to adapt and innovate in a rapidly changing industry but also reinforced their position as a genuine leader in FMCG, Healthcare, Cosmetics, and Third-Party Logistics within the Kingdom of Saudi Arabia. This award served as a testament to their commitment to excellence and highlighted their role in redefining supply chain and logistics, ultimately contributing to enhanced reputation and industry leadership

- In September 2021, MLS secured an exclusive role as the sole aftermarket services provider for Hyundai and Nissan in Saudi Arabia. This strategic partnership has not only bolstered Mosanada's market presence but also enabled the company to offer comprehensive and specialized services to a wide range of customers, contributing to revenue growth and enhancing its reputation as a trusted provider in the automotive sector

Saudi Arabia Warehousing Market Scope

The Saudi Arabia warehousing market is segmented into eight notable segments based on component, function, type, size, ownership, and warehousing storage nature, WMS tier type, and end user. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Component

- Hardware/System

- Software

- Services

On the basis of component, the market is segmented into hardware/system, software, and services.

Function

- Inventory Control and Management

- Asset Tracking

- Equipment and Vehicle Tracking

- Yard & Dock Management

- Order Fulfillment

- Workforce & Task (Process) Management

- Shipping

- Predictive Maintenance

- Others

On the basis of function, the market is segmented into inventory control and management, asset tracking, yard & dock management, order fulfillment, workforce & task (process) management, shipping, predictive maintenance, and others.

Type

- Insource Warehousing

- Outsource Warehousing

On the basis of type, the market is segmented into insource warehousing and outsource warehousing.

Size

- Small

- Medium

- Large

On the basis of size, the market is segmented small, medium, and large.

Ownership

- Public Warehouses

- Private Warehouses

- Bonded Warehouses

- Consolidated Warehouse

On the basis of ownership, the market is segmented into public warehouses, private warehouses, bonded warehouses, and consolidated warehouse

Warehousing Storage Nature

- Ambient Warehousing (Around 80°F)

- Air Conditioned (56°F and 75°F)

- Refrigerated (33°F and 55°F)

- Cold/Frozen (Of or Below 32°F)

On the basis of warehousing storage nature, the market is segmented into ambient warehousing (around 80°F), air conditioned (56°F and 75°F), refrigerated (33°F and 55°F), and cold/frozen (of or below 32°F).

WMS Tier Type

- Advanced WMS

- Basic WMS

- Intermediate WMS

On the basis of WMS tier type, the market is segmented into advanced WMS, basic WMS, and intermediate WMS.

End User

- Retail and E-Commerce

- Transportation and Logistics

- Automotive

- Healthcare

- Food and Beverages

- Electrical and Electronics

- Agriculture

- Energy and Utilities

- Others

On the basis of end user, the market is segmented into retail and e-commerce, transportation and logistics, automotive, healthcare, food and beverages, electrical and electronics, chemical, agriculture, energy and utilities, and others.

Saudi Arabia Warehousing Market Country Analysis/Insights

Saudi Arabia warehousing market is analyzed and market size information is provided by component, function, type, size, ownership, and warehousing storage nature, WMS tier type, and end user.

On the basis of city, the market is segmented into Jeddah, Riyadh, Dammam, Al Khobar, and rest of Saudi Arabia. Riyadh, the capital city of Saudi Arabia dominated the Saudi Arabia warehousing market. Its dominance is driven by its central location, making it a strategic hub for the distribution of goods throughout the country. In addition, Riyadh's thriving business environment, in line with the government's Vision 2030 initiative, has attracted significant investment in logistics and warehousing infrastructure, further bolstering its position as a warehousing market leader in the kingdom.

The city section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of country brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Saudi Arabia Warehousing Market Share Analysis

The Saudi Arabia warehousing market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the Saudi Arabia warehousing market are Kuehne+Nagel, CEVA Logistics, YBA KANOO, GAC, Tamer Logistics, Almajdouie Logistics, DB Schenker, Wared Logistics, Aramex, MLS, SMSA Express Transportation Company Ltd., Binzagr, DHL, HALA, Sign Logistics, LSC Warehousing & Logistics Company, Agility, Aiduk, Takhzeen, fourwinds-ksa, Camels Party Logistics, BAFCO, S.A. TALKE Ltd., LogiPoint, and United Group among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCE ANALYSIS

4.2 COMPANY COMPARATIVE ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 TECHNOLOGICAL TRENDS

4.5 KEY STRATEGIC INITIATIVES

4.6 CASE STUDY 1

4.6.1 PROBLEM STATEMENT

4.6.2 BACKGROUND

4.6.3 SOLUTION

4.7 CASE STUDY 2

4.7.1 PROBLEM STATEMENT

4.7.2 SOLUTION

4.8 LIST OF THE TOP WAREHOUSING COMPANIES AS PER SQM

4.9 PATENT ANALYSIS

4.9.1 IMAGE-BASED INSPECTION AND AUTOMATED INVENTORY AND SUPPLY CHAIN MANAGEMENT OF WELL EQUIPMENT

4.9.2 OPTIMIZED TASK GENERATION AND SCHEDULING OF AUTOMATED GUIDED CARTS USING OVERHEAD SENSOR SYSTEMS

4.9.3 SYSTEM AND METHOD FOR WORKFLOW MANAGEMENT

4.9.4 RETURN ORDERING SYSTEM AND METHOD

4.9.5 RETAIL SHELF SUPPLY MONITORING SYSTEM

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING EXPANSION OF THE MANUFACTURING SECTOR

5.1.2 SURGING GROWTH OF THE LOGISTICS SECTOR

5.1.3 TECHNOLOGICAL ADVANCEMENT IN WAREHOUSING

5.2 RESTRAINTS

5.2.1 HIGH LAND AND WAREHOUSE SETUP COST

5.2.2 COMPLEXITY TO OPERATE A WAREHOUSING BUSINESS IN SAUDI ARABIA

5.3 OPPORTUNITIES

5.3.1 RISING GOVERNMENT SUPPORT AND TRADE INITIATIVES FOR VARIOUS INDUSTRIES

5.3.2 SURGING GROWTH OF SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) IN SAUDI ARABIA

5.3.3 INCREASING PARTNERSHIP AND COLLABORATION AMONG MARKET PLAYERS

5.4 CHALLENGES

5.4.1 INCREASING GEOPOLITICAL TENSIONS AND GLOBAL ECONOMIC SLOWDOWN

5.4.2 SKILLED LABOR SHORTAGE

5.4.3 CHALLENGING CLIMATIC CONDITIONS

6 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE

6.1 OVERVIEW

6.2 INSOURCE WAREHOUSING

6.3 OUTSOURCE WAREHOUSING

7 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

7.1 OVERVIEW

7.2 PUBLIC WAREHOUSES

7.3 PRIVATE WAREHOUSES

7.4 BONDED WAREHOUSES

7.5 CONSOLIDATED WAREHOUSES

8 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE

8.1 OVERVIEW

8.2 SMALL

8.2.1 SMALL SCALE DISTRIBUTION CENTERS

8.2.2 MICRO WAREHOUSES

8.3 MEDIUM

8.3.1 REGIONAL WAREHOUSES

8.3.2 CROSS DOCKING FACILITIES

8.4 LARGE

8.4.1 NATIONAL DISTRIBUTION CENTERS

8.4.2 MEGA WAREHOUSES

9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE

9.1 OVERVIEW

9.2 AMBIENT WAREHOUSING (AROUND 80°F)

9.2.1 BY PRODUCT TYPE

9.2.1.1 FOOD & BEVERAGES

9.2.1.1.1 BY TYPE

9.2.1.1.1.1 BREADS AND CEREALS

9.2.1.1.1.2 SAUCES AND CONDIMENTS

9.2.1.1.1.3 TEA AND COFFEE

9.2.1.1.1.4 BISCUITS AND CAKES

9.2.1.1.1.5 PASTA AND RICE

9.2.1.1.1.6 OTHERS

9.2.1.2 ELECTRONICS

9.2.1.3 PAPER PRODUCTS

9.2.1.4 PHARMACEUTICALS

9.2.1.5 COSMETICS

9.2.1.6 OTHERS

9.3 AIR CONDITIONED (56°F AND 75°F)

9.3.1 BY PRODUCT TYPE

9.3.1.1 FOOD

9.3.1.1.1 BY TYPE

9.3.1.1.1.1 FRUITS & VEGETABLES

9.3.1.1.1.2 BY TYPE

9.3.1.1.1.3 TOMATOES

9.3.1.1.1.4 WATERMELON

9.3.1.1.1.5 BANANAS

9.3.1.1.1.6 COCONUT

9.3.1.1.1.7 BASILS

9.3.1.1.1.8 CANNED FISH AND MEATS

9.3.1.1.1.9 CANNED FRUIT AND VEGETABLES

9.3.1.1.1.10 CONFECTIONERY PRODUCTS

9.3.1.1.1.11 CHOCOLATE AND CANDIES

9.3.1.2 OIL & PETROLEUM

9.3.1.3 CHEMICALS

9.3.1.4 OTHERS

9.4 REFRIGERATED (33°F AND 55°F)

9.4.1 BY PRODUCT TYPE

9.4.1.1 FOOD AND BEVERAGES

9.4.1.1.1 BY TYPE

9.4.1.1.1.1 FRUITS AND VEGETABLES

9.4.1.1.1.2 BY TYPE

9.4.1.1.1.3 ORANGES

9.4.1.1.1.4 APPLES

9.4.1.1.1.5 CUCUMBER

9.4.1.1.1.6 BEANS

9.4.1.1.1.7 KIWIS

9.4.1.1.1.8 EGGPLANT

9.4.1.1.1.9 GUAVAS

9.4.1.1.1.10 BLUEBERRIES

9.4.1.1.1.11 OTHERS

9.4.1.1.1.12 DAIRY PRODUCTS

9.4.1.1.1.13 MEAT

9.4.1.1.1.14 FISH

9.4.1.1.1.15 EGGS

9.4.1.1.1.16 OTHERS

9.4.1.2 CHEMICALS

9.4.1.3 BIO-PHARMACEUTICALS

9.4.1.3.1 BY TYPE

9.4.1.3.1.1 VACCINE

9.4.1.3.1.2 BLOOD BANKS

9.4.1.3.1.3 OTHERS

9.4.1.4 PLANTS AND FLOWERS

9.4.1.5 OTHERS

9.5 COLD/FROZEN (OF OR BELOW 32°F)

9.5.1 BY PRODUCT TYPE

9.5.1.1 POULTRY AND SEA FOOD

9.5.1.2 FRUITS AND VEGETABLES

9.5.1.2.1 BY TYPE

9.5.1.2.1.1 GRAPES

9.5.1.2.1.2 SWEET CORN

9.5.1.2.1.3 CABBAGE

9.5.1.2.1.4 CHERRIES

9.5.1.2.1.5 STRAWBERRIES

9.5.1.2.1.6 MUSHROOMS

9.5.1.2.1.7 LETTUCE

9.5.1.2.1.8 BROCCOLI

9.5.1.2.1.9 BRUSSELS SPROUTS

9.5.1.2.1.10 OTHERS

9.5.1.3 ARTWORK

9.5.1.4 OTHERS

10 SAUDI ARABIA WAREHOUSING MARKET, WMS TIER TYPE

10.1 OVERVIEW

10.2 BASIC WMS

10.3 INTERMEDIATE WMS

10.4 ADVANCED WMS

11 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT

11.1 OVERVIEW

11.2 HARDWARE/SYSTEM

11.2.1 PALLETS

11.2.1.1 SELECTIVE

11.2.1.2 DRIVE ION DRIVE

11.2.1.3 DOUBLE DEEP

11.2.1.4 CANTILEVER

11.2.1.5 OTHERS

11.2.2 CONVEYOR SYSTEM

11.2.2.1 ROLLER SYSTEM

11.2.2.2 BELT CONVEYORS

11.2.2.3 SLAT CONVEYORS

11.2.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

11.2.3.1 UNIT LOAD

11.2.3.2 MINILOAD

11.2.3.3 DEEP LANE

11.2.3.4 MAN ON BOARD

11.2.4 TRANSPORT SYSTEM

11.2.4.1 INDUSTRIAL TRUCKS

11.2.4.2 CRANES

11.2.5 AUTOMATED GUIDED VEHICLES (AGVS)

11.2.5.1 MATERIAL HANDLING

11.2.5.2 PICKING

11.2.5.3 SORTING

11.2.6 SORTATION SYSTEM

11.2.6.1 UNIT SORTER

11.2.6.1.1 POP UP WHEEL/ ROLLER/BELT SORTER

11.2.6.1.2 PIVOTING ARM SORTER

11.2.6.1.3 PUSH SORTER

11.2.6.2 CASE SORTER

11.2.6.2.1 TILT-TRAY & CROSS BELT SORTERS

11.2.6.2.2 PUSH TRAY SORTER

11.2.6.2.3 CASE & UNIT SORTERS

11.2.6.2.4 OTHERS

11.2.7 AUTONOMOUS MOBILE ROBOTICS

11.2.7.1 MATERIAL HANDLING

11.2.7.2 ORDER FULFILMENT

11.2.7.3 INVENTORY SCANNING

11.2.8 BARCODE SYSTEM

11.2.9 OTHERS

11.3 SOFTWARE

11.3.1.1 CLOUD

11.3.1.2 ON PREMISES

11.4 SERVICES

11.4.1.1 MANAGED SERVICES

11.4.1.2 PROFESSIONAL SERVICES

11.4.1.2.1 MAINTENANCE

11.4.1.2.2 INTEGRATION

11.4.1.2.3 TRAINING AND CONSULTING

11.4.1.2.4 TESTING

12 SAUDI ARABIA WAREHOUSING MARKET, BY END USER

12.1 OVERVIEW

12.2 FOOD AND BEVERAGES

12.2.1 NON PERISHABLE GOODS

12.2.2 COLD CHAIN LOGISTICS

12.2.2.1 HARDWARE/SYSTEM

12.2.2.1.1 PALLETS

12.2.2.1.2 CONVEYOR SYSTEM

12.2.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.2.2.1.4 TRANSPORT SYSTEM

12.2.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.2.2.1.6 SORTATION SYSTEM

12.2.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.2.2.1.8 BARCODE SYSTEM

12.2.2.1.9 OTHERS

12.2.2.2 SOFTWARE

12.2.2.3 SERVICES

12.3 TRANSPORTATION AND LOGISTICS

12.3.1 LAST MILE DELIVERY PROVIDER

12.3.2 THIRD PARTY LOGISTIC PROVIDER

12.3.2.1 LAND TRANSPORT

12.3.2.2 OCEAN FREIGHT

12.3.2.3 AIR FREIGHT

12.3.2.3.1 B2C

12.3.2.3.2 B2B

12.3.3 FREIGHT FORWARDER

12.3.3.1 HARDWARE/SYSTEM

12.3.3.1.1 PALLETS

12.3.3.1.2 CONVEYOR SYSTEM

12.3.3.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.3.3.1.4 TRANSPORT SYSTEM

12.3.3.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.3.3.1.6 SORTATION SYSTEM

12.3.3.1.7 AUTONOMOUS MOBILE ROBOTICS

12.3.3.1.8 BARCODE SYSTEM

12.3.3.1.9 OTHERS

12.3.3.2 SOFTWARE

12.3.3.3 SERVICES

12.4 RETAIL AND E-COMMERCE

12.4.1 E-COMMERCE

12.4.1.1 ONLINE MARKET PLACES

12.4.1.2 DIRECT TO CONSUMERS BRANDS

12.4.2 BRICK AND MOTOR

12.4.2.1 HARDWARE/SYSTEM

12.4.2.1.1 PALLETS

12.4.2.1.2 CONVEYOR SYSTEM

12.4.2.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.4.2.1.4 TRANSPORT SYSTEM

12.4.2.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.4.2.1.6 SORTATION SYSTEM

12.4.2.1.7 AUTONOMOUS MOBILE ROBOTICS

12.4.2.1.8 BARCODE SYSTEM

12.4.2.1.9 OTHERS

12.4.2.2 SOFTWARE

12.4.2.3 SERVICES

12.5 ENERGY AND UTILITIES

12.5.1 OIL AND GAS

12.5.2 UTILITIES

12.5.3 RENEWABLE ENERGY

12.5.4 MINING AND RESOURCES

12.5.4.1 HARDWARE/SYSTEM

12.5.4.1.1 PALLETS

12.5.4.1.2 CONVEYOR SYSTEM

12.5.4.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.5.4.1.4 TRANSPORT SYSTEM

12.5.4.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.5.4.1.6 SORTATION SYSTEM

12.5.4.1.7 AUTONOMOUS MOBILE ROBOTICS

12.5.4.1.8 BARCODE SYSTEM

12.5.4.1.9 OTHERS

12.5.4.2 SOFTWARE

12.5.4.3 SERVICES

12.6 CHEMICAL

12.6.1 HARDWARE/SYSTEM

12.6.1.1 PALLETS

12.6.1.2 CONVEYOR SYSTEM

12.6.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.6.1.4 TRANSPORT SYSTEM

12.6.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.6.1.6 SORTATION SYSTEM

12.6.1.7 AUTONOMOUS MOBILE ROBOTICS

12.6.1.8 BARCODE SYSTEM

12.6.1.9 OTHERS

12.6.2 SOFTWARE

12.6.3 SERVICES

12.7 AUTOMOTIVE

12.7.1 HARDWARE/SYSTEM

12.7.1.1 PALLETS

12.7.1.2 CONVEYOR SYSTEM

12.7.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.7.1.4 TRANSPORT SYSTEM

12.7.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.7.1.6 SORTATION SYSTEM

12.7.1.7 AUTONOMOUS MOBILE ROBOTICS

12.7.1.8 BARCODE SYSTEM

12.7.1.9 OTHERS

12.7.2 SOFTWARE

12.7.3 SERVICES

12.8 ELECTRICAL AND ELECTRONICS

12.8.1 HARDWARE/SYSTEM

12.8.1.1 PALLETS

12.8.1.2 CONVEYOR SYSTEM

12.8.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.8.1.4 TRANSPORT SYSTEM

12.8.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.8.1.6 SORTATION SYSTEM

12.8.1.7 AUTONOMOUS MOBILE ROBOTICS

12.8.1.8 BARCODE SYSTEM

12.8.1.9 OTHERS

12.8.2 SOFTWARE

12.8.3 SERVICES

12.9 HEALTHCARE

12.9.1 PHARMACEUTICAL

12.9.2 MEDICAL DEVICE

12.9.3 BIOTECH AND RESEARCH

12.9.4 OTHERS

12.1 COMPONENT

12.10.1 HARDWARE/SYSTEM

12.10.1.1 PALLETS

12.10.1.2 CONVEYOR SYSTEM

12.10.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.10.1.4 TRANSPORT SYSTEM

12.10.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.10.1.6 SORTATION SYSTEM

12.10.1.7 AUTONOMOUS MOBILE ROBOTICS

12.10.1.8 BARCODE SYSTEM

12.10.1.9 OTHERS

12.10.2 SOFTWARE

12.10.3 SERVICES

12.11 AGRICULTURE

12.11.1 HARDWARE/SYSTEM

12.11.1.1 PALLETS

12.11.1.2 CONVEYOR SYSTEM

12.11.1.3 AUTOMATED STORAGE AND RETRIEVAL SYSTEM

12.11.1.4 TRANSPORT SYSTEM

12.11.1.5 AUTOMATED GUIDED VEHICLES (AGVS)

12.11.1.6 SORTATION SYSTEM

12.11.1.7 AUTONOMOUS MOBILE ROBOTICS

12.11.1.8 BARCODE SYSTEM

12.11.1.9 OTHERS

12.11.2 SOFTWARE

12.11.3 SERVICES

12.12 OTHERS

13 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION

13.1 OVERVIEW

13.2 INVENTORY CONTROL AND MANAGEMENT

13.2.1 BY TYPE

13.2.1.1 INVENTORY OPTIMIZATION

13.2.1.1.1 BY TYPE

13.2.1.1.1.1 SAFETY STOCK MANAGEMENT

13.2.1.1.1.2 DYNAMIC REORDERING

13.2.1.1.1.3 DEMAND SENSING

13.2.1.2 REAL TIME INVENTORY TRACKING

13.2.1.2.1 BY TYPE

13.2.1.2.1.1 RFID BASED TRACKING

13.2.1.2.1.2 BARCODE SCANNING

13.2.1.2.1.3 GPS BASED TRACKING

13.2.1.2.1.4 FIXED LOCATION

13.2.1.2.1.5 FLOATING (RANDOM) LOCATION

13.3 ORDER FULFILMENT

13.3.1 BY TYPE

13.3.1.1 PICKING AND PACKAGING AUTOMATION

13.3.1.1.1 BY TYPE

13.3.1.1.1.1 COBOTS

13.3.1.1.1.2 ROBOTS PICKERS

13.3.1.1.1.3 GOODS-TO-PERSON PICKING (GTP)

13.3.1.1.2 ORDER ROUTING AND OPTIMIZATION

13.3.1.1.2.1 MULTI CHANNEL ORDER MANAGEMENT

13.3.1.1.2.2 ROUTE PLANNING ALGORITHM

13.3.1.1.2.3 DYNAMIC SLOTTING

13.3.1.1.3 RECEIVING AND PUT AWAY

13.4 ASSET TRACKING

13.4.1 BY TYPE

13.4.1.1 PRODUCT AND PACKAGE TRACKING

13.4.1.1.1 BY TYPE

13.4.1.1.1.1 RFID TAGGING

13.4.1.1.1.2 SMART PACKAGING

13.4.1.1.1.3 BLOCK CHAIN BASED TRACKING

13.4.1.1.2 EQUIPMENT AND VEHICLE TRACKING

13.4.1.1.3 BY TYPE

13.4.1.1.3.1 GPS TRACKING

13.4.1.1.3.2 TELEMATICS

13.4.1.1.3.3 CONDITION MONITORING

13.5 SHIPPING

13.6 WORKFORCE AND TASK( PROCESS) MANAGEMENT

13.7 YARD AND DOCK MANAGEMENT

13.8 PREDICTIVE MAINTENANCE

13.8.1 BY TYPE

13.8.1.1 FAILURE MODE AND EFFECT ANALYSIS

13.8.1.2 SENSOR BASED

13.8.1.3 AI DRIVEN

13.9 OTHER

14 SAUDI ARABIA WAREHOUSING MARKET, BY CITY

14.1 SAUDI ARABIA

14.1.1 JEDDAH

14.1.2 RIYADH

14.1.3 DAMMAM

14.1.4 AL KHOBAR

14.1.5 REST OF SAUDI ARABIA

15 SAUDI ARABIA WAREHOUSING MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

16 SWOT ANALYSIS

17 COMPANY PROFILINGS

17.1 KUEHNE+NAGEL

17.1.1 COMPANY SNAPSHOT

17.1.2 SERVICES PORTFOLIO

17.1.3 RECENT DEVELOPMENTS

17.2 CEVA LOGISTICS

17.2.1 COMPANY SNAPSHOT

17.2.2 SERVICES PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 YBA KANOO

17.3.1 COMPANY SNAPSHOT

17.3.2 SERVICE PORTFOLIO

17.3.3 RECENT DEVELOPMENTS

17.4 GAC

17.4.1 COMPANY SNAPSHOT

17.4.2 SERVICES PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 TAMER LOGISTICS

17.5.1 COMPANY SNAPSHOT

17.5.2 SERVICES PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 AGILITY (A SUBSIDIARY OF DSV)

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 SOLUTION PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 AIDUK

17.7.1 COMPANY SNAPSHOT

17.7.2 SERVICES PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ALMAJDOUIE LOGISTICS

17.8.1 COMPANY SNAPSHOT

17.8.2 SERVICES PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 ARAMEX

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 SERVICES PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BAFCO

17.10.1 COMPANY SNAPSHOT

17.10.2 SERVICES PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BINZAGR

17.11.1 COMPANY SNAPSHOT

17.11.2 SERVICES PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 CAMELS PARTY LOGISTICS

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICES PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 DB SCHENKER (A SUBSIDIARY OF DEUTSCHE BAHN)

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 SERVICES PORTFOLIO

17.13.4 RECENT DEVELOPMENTS

17.14 DHL

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 SOLUTION PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 FOURWINDS-KSA

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 HALA

17.16.1 COMPANY SNAPSHOT

17.16.2 SERVICES PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 LOGIPOINT

17.17.1 COMPANY SNAPSHOT

17.17.2 SERVICES PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 LSC WAREHOUSING AND LOGISTICS SERVICES CO.

17.18.1 COMPANY SNAPSHOT

17.18.2 SERVICES PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 MLS

17.19.1 COMPANY SNAPSHOT

17.19.2 SOLUTION PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 S.A. TALKE LTD.

17.20.1 COMPANY SNAPSHOT

17.20.2 SERVICES PORTFOLIO

17.20.3 RECENT DEVELOPMENTS

17.21 SIGN LOGISTICS

17.21.1 COMPANY SNAPSHOT

17.21.2 SERVICES PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 SMSA EXPRESS TRANSPORTATION COMPANY LTD.

17.22.1 COMPANY SNAPSHOT

17.22.2 SERVICES PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 TAKHZEEN

17.23.1 COMPANY SNAPSHOT

17.23.2 SERVICE PORTFOLIO

17.23.3 RECENT DEVELOPMENT

17.24 UNITED GROUP

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 WARED LOGISTICS

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 COMPARISON OF AUTOMATED WAREHOUSE AND TRADITIONAL WAREHOUSE

TABLE 3 SAUDI ARABIA WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 SAUDI ARABIA WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 5 SAUDI ARABIA WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 6 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 SAUDI ARABIA SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 9 SAUDI ARABIA WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 10 SAUDI ARABIA AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 SAUDI ARABIA FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 12 SAUDI ARABIA AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 SAUDI ARABIA FOOD IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 14 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 SAUDI ARABIA REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 16 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 SAUDI ARABIA FRUITS & VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 SAUDI ARABIA BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 19 SAUDI ARABIA COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 20 SAUDI ARABIA FRUITS AND VEGETABLES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 SAUDI ARABIA WAREHOUSING MARKET, BY WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 22 SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 23 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 SAUDI ARABIA PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 SAUDI ARABIA CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 SAUDI ARABIA AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 27 SAUDI ARABIA TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 SAUDI ARABIA AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 SAUDI ARABIA SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 30 SAUDI ARABIA UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 SAUDI ARABIA CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 SAUDI ARABIA AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 33 SAUDI ARABIA SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 SAUDI ARABIA SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 35 SAUDI ARABIA PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 36 SAUDI ARABIA WAREHOUSING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 38 SAUDI ARABIA FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 39 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 41 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 42 SAUDI ARABIA THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 43 SAUDI ARABIA TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 44 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 45 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 SAUDI ARABIA E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 SAUDI ARABIA RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 48 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 SAUDI ARABIA ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 51 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 SAUDI ARABIA CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 53 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 SAUDI ARABIA AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 55 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 56 SAUDI ARABIA ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 SAUDI ARABIA HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 60 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 61 SAUDI ARABIA AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 62 SAUDI ARABIA HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD THOUSAND)

TABLE 64 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 68 SAUDI ARABIA ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 69 SAUDI ARABIA PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 72 SAUDI ARABIA PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 SAUDI ARABIA EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 SAUDI ARABIA PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SAUDI ARABIA WAREHOUSING MARKET, BY CITY, 2021-2030 (USD MILLION)

TABLE 76 JEDDAH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 77 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 78 JEDDAH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 79 JEDDAH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 80 JEDDAH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 JEDDAH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 JEDDAH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 JEDDAH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 84 JEDDAH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 85 JEDDAH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 86 JEDDAH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 87 JEDDAH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 88 JEDDAH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 JEDDAH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 BY FUNCTION

TABLE 91 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 92 JEDDAH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 93 JEDDAH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 JEDDAH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 95 JEDDAH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 96 JEDDAH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 JEDDAH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 JEDDAH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 JEDDAH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 100 JEDDAH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 101 JEDDAH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 102 BY TYPE

TABLE 103 BY SIZE

TABLE 104 JEDDAH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 JEDDAH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 JEDDAH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 JEDDAH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 JEDDAH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 109 JEDDAH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 110 JEDDAH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 111 JEDDAH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 112 JEDDAH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 113 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 114 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 115 JEDDAH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 116 JEDDAH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 JEDDAH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 118 JEDDAH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 119 JEDDAH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 120 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 JEDDAH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 122 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 124 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 125 JEDDAH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 126 JEDDAH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 127 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 128 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 JEDDAH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 JEDDAH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 131 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 132 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 133 JEDDAH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 134 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 135 JEDDAH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 136 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 137 JEDDAH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 138 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 139 JEDDAH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 140 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 141 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 142 JEDDAH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 143 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 144 JEDDAH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 145 JEDDAH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 146 RIYADH WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 147 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 148 RIYADH PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 149 RIYADH CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 150 RIYADH AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 151 RIYADH TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 152 RIYADH AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 153 RIYADH SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 154 RIYADH UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 155 RIYADH CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 156 RIYADH AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 157 RIYADH SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 158 RIYADH SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 159 RIYADH PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 160 RIYADH WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 161 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 162 RIYADH INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 163 RIYADH REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 164 RIYADH INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 165 RIYADH ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 166 RIYADH PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 167 RIYADH ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 168 RIYADH ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 169 RIYADH PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 170 RIYADH EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 171 RIYADH PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 172 RIYADH WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 173 RIYADH WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 174 RIYADH SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 175 RIYADH MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 176 RIYADH LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 177 RIYADH WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 178 RIYADH WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 179 RIYADH AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 180 RIYADH FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 181 RIYADH AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 182 RIYADH FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 183 RIYADH FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 184 RIYADH REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 185 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 186 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 187 RIYADH BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 188 RIYADH COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 189 RIYADH FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 190 RIYADH WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 191 RIYADH WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 192 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 193 RIYADH FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 194 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 195 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 196 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 197 RIYADH THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 198 RIYADH TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 199 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 200 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 201 RIYADH E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 202 RIYADH RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 203 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 204 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 205 RIYADH ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 206 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 207 RIYADH CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 208 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 209 RIYADH AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 210 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 211 RIYADH ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 212 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 213 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 214 RIYADH HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 215 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 216 RIYADH AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 217 RIYADH HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 218 DAMMAM WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 219 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 220 DAMMAM PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 221 DAMMAM CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 222 DAMMAM AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 223 DAMMAM TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 224 DAMMAM AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 225 DAMMAM SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 226 DAMMAM UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 227 DAMMAM CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 228 DAMMAM AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 229 DAMMAM SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 230 DAMMAM SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 231 DAMMAM PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 232 DAMMAM WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 233 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 234 DAMMAM INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 235 DAMMAM REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 236 DAMMAM INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 237 DAMMAM ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 238 DAMMAM PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 239 DAMMAM ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 240 DAMMAM ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 241 DAMMAM PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 242 DAMMAM EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 243 DAMMAM PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 244 DAMMAM WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 245 DAMMAM WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 246 DAMMAM SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 247 DAMMAM MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 248 DAMMAM LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 249 DAMMAM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 250 DAMMAM WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 251 DAMMAM AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 252 DAMMAM FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 253 DAMMAM AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 254 DAMMAM FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 255 DAMMAM FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 256 DAMMAM REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 257 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 258 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 259 DAMMAM BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 260 DAMMAM COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 261 DAMMAM FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 262 DAMMAM WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 263 DAMMAM WAREHOUSING MARKET, END USER, 2021-2030 (USD MILLION)

TABLE 264 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 265 DAMMAM FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 266 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 267 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 268 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 269 DAMMAM THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 270 DAMMAM TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 271 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 272 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 273 DAMMAM E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 274 DAMMAM RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 275 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 276 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 277 DAMMAM ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 278 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 279 DAMMAM CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 280 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 281 DAMMAM AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 282 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 283 DAMMAM ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 284 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 285 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 286 DAMMAM HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 287 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 288 DAMMAM AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 289 DAMMAM HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 290 AL KHOBAR WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 291 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 292 AL KHOBAR PALLETS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 293 AL KHOBAR CONVEYOR SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 294 AL KHOBAR AUTOMATED STORAGE AND RETRIEVAL SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 295 AL KHOBAR TRANSPORT SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 296 AL KHOBAR AUTOMATED GUIDED VEHICLES (AGVS) IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 297 AL KHOBAR SORTATION SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 298 AL KHOBAR UNIT SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 299 AL KHOBAR CASE SORTER IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 300 AL KHOBAR AUTONOMOUS MOBILE ROBOTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 301 AL KHOBAR SOFTWARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 302 AL KHOBAR SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 303 AL KHOBAR PROFESSIONAL SERVICES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 304 AL KHOBAR WAREHOUSING MARKET, BY FUNCTION, 2021-2030 (USD MILLION)

TABLE 305 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 306 AL KHOBAR INVENTORY OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 307 AL KHOBAR REAL TIME INVENTORY TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 308 AL KHOBAR INVENTORY CONTROL AND MANAGEMENT IN WAREHOUSING MARKET, BY STOCK LOCATION, 2021-2030 (USD MILLION)

TABLE 309 AL KHOBAR ORDER FULFILMENT IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 310 AL KHOBAR PICKING AND PACKAGING AUTOMATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 311 AL KHOBAR ORDER ROUTING AND OPTIMIZATION IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 312 AL KHOBAR ASSET TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 313 AL KHOBAR PRODUCT AND PACKAGE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 314 AL KHOBAR EQUIPMENT AND VEHICLE TRACKING IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 315 AL KHOBAR PREDICTIVE MAINTENANCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 316 AL KHOBAR WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 317 AL KHOBAR WAREHOUSING MARKET, BY SIZE, 2021-2030 (USD MILLION)

TABLE 318 AL KHOBAR SMALL IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 319 AL KHOBAR MEDIUM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 320 AL KHOBAR LARGE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 321 AL KHOBAR MEDIUM WAREHOUSING MARKET, BY OWNERSHIP, 2021-2030 (USD MILLION)

TABLE 322 AL KHOBAR WAREHOUSING MARKET, BY WAREHOUSING STORAGE NATURE, 2021-2030 (USD MILLION)

TABLE 323 AL KHOBAR AMBIENT WAREHOUSING (AROUND 80°F) IN WAREHOUSING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 324 AL KHOBAR FOOD & BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 325 AL KHOBAR AIR CONDITIONED (56°F AND 75°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 326 AL KHOBAR FOOD IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 327 AL KHOBAR FRUITS & VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 328 AL KHOBAR REFRIGERATED (33°F AND 55°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 329 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 330 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 331 AL KHOBAR BIO-PHARMACEUTICALS IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 332 AL KHOBAR COLD/FROZEN (OF OR BELOW 32°F) IN WAREHOUSING MARKET, PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 333 AL KHOBAR FRUITS AND VEGETABLES IN WAREHOUSING MARKET, TYPE, 2021-2030 (USD MILLION)

TABLE 334 AL KHOBAR WAREHOUSING MARKET, WMS TIER TYPE, 2021-2030 (USD MILLION)

TABLE 335 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 336 AL KHOBAR FOOD AND BEVERAGES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 337 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 338 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 339 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY MEDIUM, 2021-2030 (USD MILLION)

TABLE 340 AL KHOBAR THIRD PARTY LOGISTIC PROVIDER IN WAREHOUSING MARKET, BY BUSINESS TYPE, 2021-2030 (USD MILLION)

TABLE 341 AL KHOBAR TRANSPORTATION AND LOGISTICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 342 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 343 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 344 AL KHOBAR E-COMMERCE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 345 AL KHOBAR RETAIL AND E-COMMERCE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 346 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 347 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 348 AL KHOBAR ENERGY AND UTILITIES IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 349 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 350 AL KHOBAR CHEMICAL IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 351 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 352 AL KHOBAR AUTOMOTIVE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 353 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 354 AL KHOBAR ELECTRICAL AND ELECTRONICS IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 355 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 356 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 357 AL KHOBAR HEALTHCARE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 358 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 359 AL KHOBAR AGRICULTURE IN WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

TABLE 360 AL KHOBAR HARDWARE/SYSTEM IN WAREHOUSING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 361 REST OF SAUDI ARABIA WAREHOUSING MARKET, BY COMPONENT, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA WAREHOUSING MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA WAREHOUSING MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA WAREHOUSING MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA WAREHOUSING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA WAREHOUSING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SAUDI ARABIA WAREHOUSING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SAUDI ARABIA WAREHOUSING MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SAUDI ARABIA WAREHOUSING MARKET: MULTIVARIATE MODELLING

FIGURE 10 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT TIMELINE CURVE

FIGURE 11 SAUDI ARABIA WAREHOUSING MARKET: SEGMENTATION

FIGURE 12 GROWING E-COMMERCE MARKET IN SAUDI ARABIA IS EXPECTED TO DRIVE THE GROWTH OF THE SAUDI ARABIA WAREHOUSING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 HARDWARE/SYSTEM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SAUDI ARABIA WAREHOUSING MARKET FROM 2023 TO 2030

FIGURE 14 VALUE CHAIN FOR SAUDI ARABIA WAREHOUSING MARKET

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA WAREHOUSING MARKET

FIGURE 16 GROWING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 17 RISING E-COMMERCE SECTOR IN SAUDI ARABIA

FIGURE 18 COMPARISON OF E-COMMERCE SALES IN SAUDI ARABIA WITH OTHER COUNTRIES IN 2020

FIGURE 19 LAST-MILE GOODS DISTRIBUTION IN SAUDI ARABIA (NUMBER OF ORDERS IN MILLION) (2017-20)

FIGURE 20 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 21 IMPACT OF GEOPOLITICAL TENSIONS

FIGURE 22 SAUDI ARABIA WAREHOUSING MARKET: BY TYPE, 2022

FIGURE 23 SAUDI ARABIA WAREHOUSING MARKET: BY OWNERSHIP, 2022

FIGURE 24 SAUDI ARABIA WAREHOUSING MARKET: BY SIZE, 2022

FIGURE 25 SAUDI ARABIA WAREHOUSING MARKET: BY WAREHOUSING STORAGE NATURE, 2022

FIGURE 26 SAUDI ARABIA WAREHOUSING MARKET: WMS TIER TYPE, 2022

FIGURE 27 SAUDI ARABIA WAREHOUSING MARKET: COMPONENT, 2022

FIGURE 28 SAUDI ARABIA WAREHOUSING MARKET: BY END USER, 2022

FIGURE 29 SAUDI ARABIA WAREHOUSING MARKET: BY FUNCTION, 2022

FIGURE 30 SAUDI ARABIA WAREHOUSING MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.