Turkey Starch Market

Market Size in USD Million

CAGR :

%

USD

341.30 Million

USD

459.96 Million

2024

2032

USD

341.30 Million

USD

459.96 Million

2024

2032

| 2025 –2032 | |

| USD 341.30 Million | |

| USD 459.96 Million | |

|

|

|

|

Turkey Starch Market Size

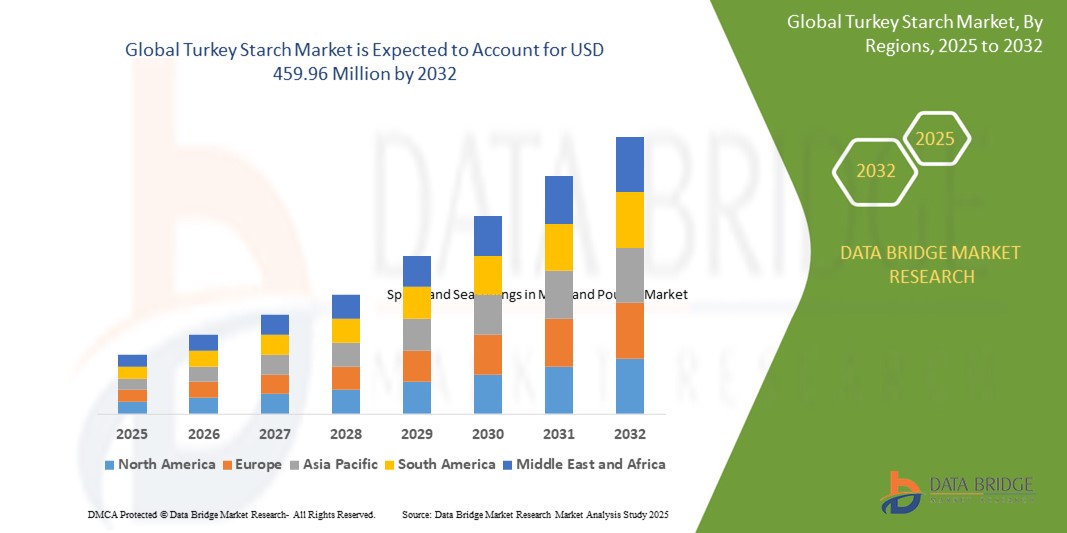

- The global Turkey starch market size was valued at USD 341.30 million in 2024 and is expected to reach USD 459.96 million by 2032, at a CAGR of 3.8% during the forecast period

- The market growth is primarily driven by increasing demand for sweeteners in food and beverage products and the high usage of starch in industrial applications such as textiles, paper, and adhesives

- Rising consumer preference for convenience foods, clean-label products, and versatile industrial applications is positioning starch as a key ingredient, accelerating market expansion

Turkey Starch Market Analysis

- Starch, a versatile carbohydrate derived from agricultural sources such as corn, wheat, potato, cassava, and rice, is a critical component in food, industrial, and pharmaceutical applications due to its functional properties such as thickening, stabilizing, and binding

- The growing adoption of starch in processed and convenience foods, coupled with increasing industrial applications in textiles, paper, and adhesives, is fueling market demand

- The Turkey starch market is experiencing a growing trend toward clean-label and sustainable starch products, driven by consumer demand for natural and minimally processed ingredients

- Turkey’s market is supported by a robust agricultural base, particularly for corn and wheat, ensuring a steady supply of raw materials. However, health concerns related to high-starch diets, such as risks of heart disease and diabetes, may pose challenges to market growth

- The modified starch segment dominated the largest market revenue share of 35.0% in 2024, driven by its enhanced functional properties such as thickening, stabilizing, and gelling, which cater to diverse applications in food, pharmaceuticals, and industrial sectors

Report Scope and Turkey Starch Market Segmentation

|

Attributes |

Turkey Starch Key Market Insights |

|

Segments Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Turkey Starch Market Trends

“Increasing Adoption of Clean-Label and Sustainable Starch Solutions”

- The Turkey starch market is experiencing a growing trend toward clean-label and sustainable starch products, driven by consumer demand for natural and minimally processed ingredients

- Advanced processing technologies, such as enzymatic and physical modification, are being utilized to enhance the functionality of starches while maintaining their natural properties, aligning with clean-label preferences

- Starch manufacturers are leveraging data analytics to optimize production processes, ensuring consistent quality and sustainability in sourcing raw materials such as corn, wheat, and cassava

- For instances, companies are developing modified starches that provide enhanced texture and stability in food products without synthetic additives, catering to health-conscious consumers.

- This trend is making starch products more appealing to food manufacturers and industrial applications, particularly in eco-friendly packaging and biodegradable materials

- Sustainable starch solutions are also being tailored for specific applications, such as biodegradable films and coatings, to meet environmental regulations and consumer expectations

Turkey Starch Market Dynamics

Driver

“Growing Demand for Functional Ingredients in Food and Non-Food Applications”

- The rising consumer preference for processed and convenience foods, such as bakery products, snacks, and ready-to-eat meals, is a key driver for the Turkey starch market

- Starch products, including modified and native starches, enhance food quality by providing texturizing, thickening, and stabilizing properties, meeting the needs of modern food production

- Government initiatives in Turkey promoting sustainable agricultural practices and food safety standards are encouraging the adoption of high-quality starch products in food and industrial sectors

- The expansion of IoT and automation in manufacturing is enabling more efficient starch production and application, supporting scalability for industries such as pharmaceuticals and textiles

- Major food and beverage companies in Turkey are increasingly incorporating starches as functional ingredients to improve product shelf life and meet consumer demand for gluten-free and plant-based options

Restraint/Challenge

“High Production Costs and Raw Material Price Volatility”

- The significant costs associated with starch extraction, modification, and processing equipment pose a barrier to market growth, particularly for smaller manufacturers in Turkey

- Integrating advanced starch solutions into existing production lines can be complex and expensive, limiting adoption in cost-sensitive markets

- Fluctuations in the prices of raw materials, such as corn, wheat, and potatoes, driven by weather conditions and global supply chain disruptions, create challenges for consistent production and pricing

- In addition, compliance with stringent food safety and environmental regulations in Turkey and the EU increases operational costs for starch producers, particularly for export-oriented companies

- These factors may deter investment in new starch-based products and restrict market expansion, especially in price-sensitive segments and regions with limited infrastructure

Turkey Starch market Scope

The market is segmented on the basis of type of starch, source/raw material, form, grade, function, and application.

- By Type of Starch

On the basis of type of starch, the Turkey starch market is segmented into starch hydrolysate, native starch, modified starch, and sugars/sugar alcohol. The modified starch segment dominated the largest market revenue share of 35.0% in 2024, driven by its enhanced functional properties such as thickening, stabilizing, and gelling, which cater to diverse applications in food, pharmaceuticals, and industrial sectors. Modified starch’s versatility and ability to withstand high temperatures and acidic environments make it a preferred choice for processed food and non-food industries.

The starch hydrolysate segment is expected to witness the fastest growth rate of 5.2% from 2025 to 2032, fueled by increasing demand for sweeteners such as glucose and fructose syrups in the food and beverage industry. This segment’s growth is supported by its wide application as thickeners, stabilizers, and sweeteners in beverages, confectionery, and pharmaceuticals.

- By Source/Raw Material

On the basis of source/raw material, the Turkey starch market is segmented into corn, wheat, potato, cassava, rice, and others. The corn segment dominated with a market revenue share of 60.0% in 2024, owing to Turkey’s significant corn production and its widespread use in food processing, industrial adhesives, and pharmaceuticals. Corn starch’s versatility and cost-effectiveness drive its dominance.

The cassava segment is projected to experience the fastest growth rate of 6.1% from 2025 to 2032, driven by its cost-effectiveness and high starch content, making it a viable alternative to corn and wheat. Its increasing use in gluten-free products and biodegradable materials further accelerates adoption.

- By Form

On the basis of form, the Turkey starch market is segmented into dry and liquid forms. The dry form segment accounted for the largest market revenue share of 68.5% in 2024, due to its ease of storage, longer shelf life, and widespread use in food processing, pharmaceuticals, and industrial applications such as paper and textiles.

The liquid form segment is anticipated to grow at the fastest rate of 5.8% from 2025 to 2032, propelled by its direct usability in food production without requiring dissolution, enhancing efficiency and reducing processing time.

- By Grade

On the basis of grade, the Turkey starch market is segmented into food grade, industrial grade, and feed grade. The food grade segment held the largest market revenue share of 55.0% in 2024, driven by the rising demand for clean-label and natural ingredients in food and beverage products such as sauces, bakery items, and confectionery. Regulatory support for sustainable production and labeling transparency further boosts this segment.

The industrial grade segment is expected to witness the fastest growth rate of 4.9% from 2025 to 2032, fueled by expanding applications in non-food industries such as paper, textiles, and adhesives, where starch’s biodegradable and sustainable properties align with eco-friendly trends.

- By Function

On the basis of function, the Turkey starch market is segmented into texturizing, binding/adhesion, gelling, stabilizing, thickening, moisture-retention, film forming agents, sizing, and coating. The thickening segment dominated with a market revenue share of 40.0% in 2024, due to its critical role in food processing (e.g., soups, sauces, and bakery products) and industrial applications such as adhesives and paper manufacturing.

The texturizing segment is projected to grow at the fastest rate of 5.5% from 2025 to 2032, driven by consumer demand for enhanced texture and mouthfeel in food products such as dairy, snacks, and ready meals. Starch’s ability to improve consistency and stability supports its rapid adoption.

- By Application

On the basis of application, the Turkey starch market is segmented into food industry, industrial, pharmaceutical, animal feed, and others. The food industry segment held the largest market revenue share of 65.0% in 2024, driven by high demand for starch in processed foods, beverages, and confectionery for functions such as thickening, stabilizing, and sweetening. The growing preference for convenience foods and clean-label products further fuels this segment.

The pharmaceutical segment is anticipated to witness the fastest growth rate of 6.3% from 2025 to 2032, propelled by starch’s increasing use as a binder, disintegrant, and excipient in tablet and capsule formulations. The demand for cost-effective and sustainable pharmaceutical ingredients supports this growth.

Turkey Starch Market Share

The Turkey starch industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- Tate & Lyle (U.K.)

- Roquette Frères (France)

- AVEBE (Netherlands)

- Emsland Group (Germany)

- AGRANA Beteiligungs-AG (Austria)

- Südzucker AG (Germany)

- Omnia Nisasta Sanayi ve Ticaret A.S (Turkey)

- Tat Nisasta (Turkey)

- Sunar Misir (Turkey)

- Beşan Starch (Turkey)

- GRANDIUM TURKEY (Turkey)

- Ak Nişasta (Turkey)

- WPPZ S.A. (Poland)

- Everest Starch India Pvt. Ltd. (India)

What are the Recent Developments in Global Turkey Starch Market?

- In May 2025, Roquette Frères expanded its texturizing solutions portfolio by introducing four new tapioca-based cook-up starches: CLEARAM® TR 2010, TR 2510, TR 3010, and TR 4010. These hydroxypropylated starches are tailored to meet diverse texture needs in food applications such as sauces, dairy desserts, and bakery fillings. Designed to enhance viscosity, elasticity, and consistency, they also offer clean taste, excellent clarity, and high heat resistance. Naturally allergen- and gluten-free, the new CLEARAM® TR range supports label-friendly formulations and reinforces Roquette’s commitment to plant-based innovation

- In April 2021, Cargill Inc. partnered with Starpro, Thailand’s leading food-grade tapioca starch producer, to expand its specialty tapioca starch offerings across the Asia Pacific region. The collaboration covers a full range of locally manufactured modified tapioca starches, supporting the processing needs of food manufacturers and meeting the sensory expectations of Asian consumers. This move aligns with Cargill’s strategy to strengthen its regional presence by leveraging local manufacturing, technical expertise, and cost optimization, while promoting the use of non-GMO, texturally versatile starches in diverse applications—from noodles and snacks to beverages and sauces

- In January 2021, Tate & Lyle expanded its tapioca-based starch portfolio with the launch of REZISTA® MAX thickening starches and BRIOGEL® gelling starches. These innovative ingredients were developed to meet the evolving needs of food and beverage manufacturers, offering enhanced process tolerance, mouthfeel, and texture across applications such as dairy desserts, soups, sauces, dressings, and confectionery. The REZISTA® MAX line delivers superior stability under extreme processing conditions, while BRIOGEL® starches provide soft gel textures ideal for processed cheese and gummy candies. This expansion followed Tate & Lyle’s acquisition of Thailand-based Chaodee Modified Starch Co., Ltd., reinforcing its commitment to plant-based, label-friendly solutions

- In March 2022, Ingredion introduced two new clean-label rice starches—NOVATION® Lumina 8300 and 8600—designed to enhance color and flavor release in food applications, particularly in white or delicately flavored products. These functional native starches offer a smooth, creamy texture with hypoallergenic properties, high digestibility, and low viscosity development, making them ideal for a wide range of clean-label formulations. The launch reflects the industry’s growing emphasis on natural, minimally processed ingredients that meet evolving consumer expectations for transparency and simplicity in food labelling

- In November 2021, Ingredion launched FILMKOTE® 2030, a sustainable barrier starch designed to deliver high-performance oil and grease resistance for food service packaging in the U.S. and Canada. Derived from corn, this plant-based starch offers an eco-friendly alternative to fluorochemicals (PFAS), which are commonly used in fast-food packaging but raise environmental and health concerns. FILMKOTE 2030 is suitable for a wide range of applications—including wraps, bags, and boxes—and features shear-thinning rheology for improved runnability and film formation. The launch supports Ingredion’s commitment to sustainable innovation and helps manufacturers meet their corporate social responsibility goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Turkey Starch Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Turkey Starch Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Turkey Starch Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.