Us And Mexico Stainless Steel Protection Film Market

Market Size in USD Million

CAGR :

%

USD

158.57 Million

USD

220.59 Million

2024

2032

USD

158.57 Million

USD

220.59 Million

2024

2032

| 2025 –2032 | |

| USD 158.57 Million | |

| USD 220.59 Million | |

|

|

|

Stainless Steel Protection Film Market Analysis

The stainless-steel protection film market is driven by the need to safeguard stainless steel surfaces during handling, transportation, and installation across industries like construction, automotive, and appliances. Growth is fueled by increasing demand for high-quality finishes and eco-friendly, residue-free protective films. Key trends include innovations in bio-based and recyclable materials and UV-resistant, anti-scratch films. While North America and Europe emphasize quality and sustainability, Asia-Pacific leads in growth due to rapid industrialization. Market players focus on advanced adhesive technologies and custom solutions to maintain competitiveness. Environmental concerns and cost pressures remain challenges in this evolving market.

Stainless Steel Protection Film Market Size

The U.S. & Mexico stainless steel protection film is expected to reach USD 220.59 million by 2032 from USD 158.57 million in 2024, growing with a substantial CAGR of 4.5% in the forecast period of 2025 to 2032.

Stainless Steel Protection Film Market Trends

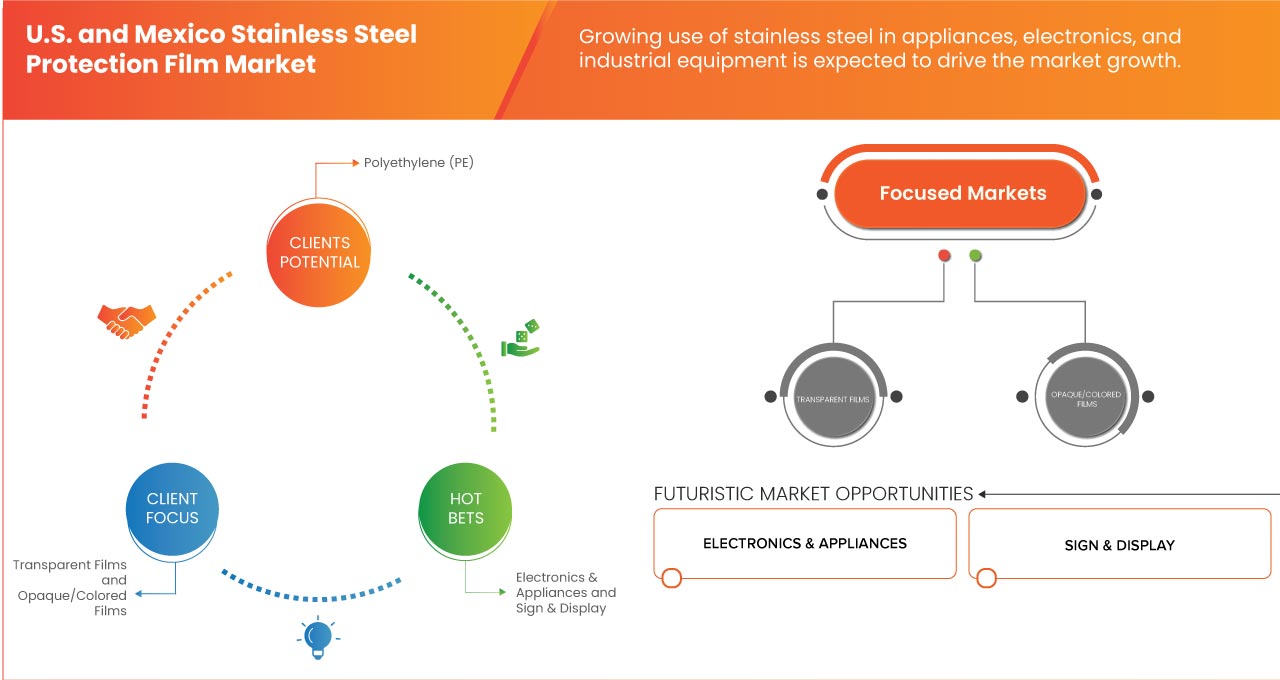

“Growing Use of Stainless Steel in Appliances, Electronics, and Industrial Equipment”

The increasing application of stainless steel in appliances, electronics, and industrial equipment is a significant driver of growth for the stainless-steel protection film market in the U.S. and Mexico. Stainless steel has become a preferred material across various sectors due to its durability, corrosion resistance, aesthetic appeal, and sustainability. Its widespread use has created a parallel demand for high-quality protective films that preserve its surface integrity during manufacturing, transportation, and installation processes.

In the appliance industry, stainless steel is widely used in products like refrigerators, ovens, dishwashers, and microwaves, owing to its sleek and modern appearance. With the growing consumer preference for premium and durable appliances, manufacturers increasingly use stainless steel to enhance product value. However, stainless steel surfaces are prone to scratches, dents, and fingerprints, which can degrade their aesthetic quality. Protection films act as a safeguard against these damages, ensuring the stainless steel maintains its pristine condition until it reaches the end-user. Similarly, in the electronics sector, stainless steel is employed in products such as smartphones, tablets, and wearables, primarily for its strength, lightweight nature, and design versatility. Protective films ensure the surface remains unblemished during the production and assembly stages, which is critical for maintaining the high standards expected in consumer electronics.

Report Scope and Stainless-Steel Protection Film Market Segmentation

|

Attributes |

Stainless Steel Protection Film Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S. and Mexico |

|

Key Market Players |

Chargeurs (France), NITTO DENKO CORPORATION (Japan), Polifilm (Germany), Ecoplast Ltd (India), Surface Armor (U.S.), Rust-X (U.S.), LAMATEK, Inc. (U.S.), Tilak Polypack (India), Presto Tape (U.S.), TapeManBlue (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Stainless Steel Protection Film Market Definition

Stainless steel protection film is a specialized adhesive film designed to safeguard stainless steel surfaces from damage, such as scratches, stains, abrasions, and contamination, during manufacturing, handling, transportation, and installation processes. These films are made from materials like polyethylene (PE) or polypropylene (PP) and feature adhesives that securely bond to the surface without leaving residue upon removal. They provide temporary protection, preserving the aesthetic and functional quality of the stainless steel, and are widely used in industries such as construction, automotive, appliances, and manufacturing.

Stainless Steel Protection Film Market Dynamics

Drivers

- Growing Use of Stainless Steel In Appliances, Electronics, and Industrial Equipment

The increasing application of stainless steel in appliances, electronics, and industrial equipment is a significant driver of growth for the stainless steel protection film market in the U.S. and Mexico. Stainless steel has become a preferred material across various sectors due to its durability, corrosion resistance, aesthetic appeal, and sustainability. Its widespread use has created a parallel demand for high-quality protective films that preserve its surface integrity during manufacturing, transportation, and installation processes.

In the appliance industry, stainless steel is widely used in products like refrigerators, ovens, dishwashers, and microwaves, owing to its sleek and modern appearance. With the growing consumer preference for premium and durable appliances, manufacturers increasingly use stainless steel to enhance product value. However, stainless steel surfaces are prone to scratches, dents, and fingerprints, which can degrade their aesthetic quality. Protection films act as a safeguard against these damages, ensuring the stainless steel maintains its pristine condition until it reaches the end-user. Similarly, in the electronics sector, stainless steel is employed in products such as smartphones, tablets, and wearables, primarily for its strength, lightweight nature, and design versatility. Protective films ensure the surface remains unblemished during the production and assembly stages, which is critical for maintaining the high standards expected in consumer electronics.

For instance,

- The extensive use of stainless steel in appliances like refrigerators, dishwashers, and ovens by major manufacturers such as Whirlpool directly drives the demand for stainless steel protection films in the U.S. and Mexico. These films are essential for safeguarding surfaces during production, transportation, and installation, ensuring the durability and aesthetic appeal of the products. With the growing consumer preference for modern, high-quality appliances, the need for protective films is set to expand, fueling market growth in both countries. This highlights the vital role of protective solutions in maintaining product integrity and meeting consumer expectations

- Stainless steel bars and wires play a critical role in electronics, being used in connectors, springs, and structural components due to their excellent conductivity, durability, and corrosion resistance, as highlighted in the ISSF report. The precision and aesthetic requirements of electronic components demand pristine stainless steel surfaces, driving the adoption of protection films during manufacturing and transportation. As the electronics industry continues to grow in the U.S. and Mexico, fueled by increasing consumer demand for advanced devices, the need for stainless steel protection films is set to rise significantly

Increased Construction Activities in Both Residential and Commercial Sectors

The surge in construction activities across residential and commercial sectors in the U.S. and Mexico is significantly driving the demand for stainless steel protection films. Stainless steel is a widely used material in construction due to its durability, corrosion resistance, and aesthetic appeal. Its applications range from kitchen fixtures, elevators, and decorative panels to building facades, railings, and structural components. The increase in construction projects has, in turn, escalated the need for high-quality protective films to safeguard stainless steel surfaces during installation and transportation.

In the residential construction sector, stainless steel is a popular choice for modern kitchens and bathrooms. Stainless steel appliances, countertops, sinks, and decorative trims are highly sought after for their sleek, contemporary appearance and resistance to wear and tear. Protective films are essential to prevent scratches, dents, and stains on these surfaces during construction and renovation processes, ensuring a flawless finish upon project completion. With the rise in single-family housing starts and luxury residential developments in the U.S., the demand for stainless steel protection films is experiencing steady growth. Similarly, the commercial construction sector is witnessing significant activity, with projects such as office buildings, shopping malls, airports, and hospitals incorporating stainless steel for its strength and aesthetic versatility. For example, elevators, escalators, and cladding in commercial spaces rely heavily on stainless steel for their durability and visual appeal. Protective films play a critical role in maintaining the pristine condition of these stainless steel components as they are transported and installed in high-traffic areas. In addition to above in Mexico, government-led infrastructure initiatives, such as urban renewal projects and industrial park developments, are further boosting the construction of commercial spaces. This growth in infrastructure development is contributing to increased use of stainless steel and a parallel demand for protective films.

For instance,

- In November 2024, according to an article published Construct Connect the U.S. construction industry is projected to experience significant growth in 2025, with total construction starts expected to increase by 8.5%. This expansion is driven by positive economic conditions, robust government spending, and declining interest rates, which are anticipated to boost both residential and nonresidential building sectors. Residential construction is forecasted to rebound with a 12% increase, while nonresidential building activity is expected to rise by 8%. This growth indicates a strong recovery from previous declines and suggests a promising outlook for the U.S. construction industry in the coming year

Opportunities

- Shifting Inclination Towards Use of Eco-Friendly, Recyclable Protection Films

As sustainability becomes a key focus in industries, there is a growing shift towards the adoption of eco-friendly and recyclable protection films in the U.S. and Mexico. Consumers and manufacturers are increasingly recognizing the environmental impact of traditional non-biodegradable materials, prompting a move towards greener alternatives. This trend is particularly significant in markets like stainless steel protection films, which are widely used in industries such as automotive, construction, and manufacturing. The demand for environmentally friendly films is being driven by stricter regulations surrounding waste management, recyclability, and sustainability. Both the U.S. and Mexico are witnessing increasing government initiatives promoting the reduction of plastic waste, encouraging companies to adopt materials that are biodegradable or recyclable. Additionally, eco-conscious consumers and businesses are prioritizing products that align with their environmental values, which is creating a competitive advantage for manufacturers that offer sustainable protection film solutions.

For instance,

- In September 2023, according to an article published by Industrial Polythene Ltd., Biodegradable films, made from plant-based materials, decompose naturally, offering a sustainable alternative to plastic. They reduce carbon emissions, are non-toxic, and contribute to less environmental pollution. These films break down within 3 to 6 months, making them ideal for packaging, hygiene products, agriculture, and other eco-friendly applications

Innovations in Adhesive Technologies and Multilayer Films

Innovations in these areas are enabling the development of high-performance films that provide enhanced protection for stainless steel surfaces during transportation, handling, and installation processes. Traditional protection films often used adhesives that could leave residue or damage the stainless steel surface upon removal. However, new advancements in adhesive formulations have led to the development of low-tack, residue-free adhesives. These innovations allow for easy removal of the film without compromising the quality of the stainless steel surface underneath, addressing a key concern for manufacturers and end-users. Additionally, more durable and temperature-resistant adhesives are being introduced, enabling protection films to withstand various environmental conditions during transit and storage.

For instance,

- In January 2021, according to an article published by John Wiley & Sons, Inc, this study explored the delamination mechanism of multilayer flexible packaging films (MFPFs) using carboxylic acids. A model based on Fick's law and dissolution kinetics was tested under various conditions (temperature, acid concentration, and solid/liquid ratios). The model successfully predicted delamination times, with high solid/liquid ratios essential for process scalability

Restraints/Challenges

- Fluctuating Prices Affect Production and Profitability

Fluctuating raw material prices, especially those for stainless steel and petroleum-based components used in the production of protection films, represent a significant restraint for the U.S. & Mexico stainless steel protection film market. The cost of key materials, such as polyethylene, polypropylene, and other polymers used in film production, often experiences volatility due to shifts in global supply and demand, geopolitical instability, or changes in trade policies. This unpredictability in raw material prices poses a challenge for manufacturers in both countries, impacting their cost structures and profit margins.

Increased raw material costs directly affect the price of the final protection films, making it difficult for manufacturers to maintain competitive pricing without sacrificing profitability. As the prices of stainless steel and the chemicals used in producing these films rise, manufacturers may be forced to pass on these costs to consumers, which could reduce demand, particularly in price-sensitive sectors such as construction and appliance manufacturing. Furthermore, this cost pressure can deter potential customers from adopting premium protection films, particularly smaller businesses that are more vulnerable to cost fluctuations. Again fluctuations in the price of oil can impact the cost of petroleum-based polymers, which are essential components of heat-shrinkable and adhesive protection films. Similarly, changes in the price of stainless steel, a core material in many industries, also influence the demand for protective films designed for stainless steel surfaces. If manufacturers are unable to accurately predict and adjust to these fluctuations, they risk facing reduced production volumes or financial instability.

For instance,

- In November 2024, Fastmarkets Global Limited the implementation of tariffs on steel by the U.S. under Section 232 caused significant price volatility. Initially, steel prices surged due to restricted imports, but by 2019 they declined sharply due to weak market fundamentals and the COVID-19 pandemic. This disruption led to higher price fluctuations, especially in the HR coil market, and while some U.S. steelmakers benefitted from improved margins, the overall market volatility increased due to ongoing capacity utilization and supply chain challenges

Increasing Restrictions on Non-Biodegradable Materials

The growing concerns about environmental sustainability have led to increasing restrictions on the use of non-biodegradable materials, which pose a significant restraint to the U.S. and Mexico stainless steel protection film market. Governments in both regions are implementing stricter regulations aimed at reducing plastic waste, encouraging recycling, and promoting the use of biodegradable and eco-friendly materials. As a result, manufacturers of protection films face pressure to comply with these evolving standards, which can complicate production processes and increase costs.

A significant portion of stainless steel protection films is made from plastic-based polymers such as polyethylene and polypropylene, which, despite their effectiveness, are non-biodegradable. As environmental concerns rise, policymakers are pushing for the reduction of plastic waste, which has resulted in more stringent regulations regarding the use of such materials. For instance, several U.S. states have already implemented or are considering bans on single-use plastics and non-recyclable packaging materials, which could extend to protective films used in industries like construction, automotive, and appliances.

These restrictions can affect the availability and cost of traditional protection films. Manufacturers may be forced to invest in research and development of alternative materials that are biodegradable or recyclable, which can increase production costs. Moreover, transitioning to sustainable alternatives may require modifications to manufacturing processes, further adding to operational expenses. In addition to it, consumer demand for eco-friendly solutions is pushing businesses to seek more sustainable packaging and protective solutions. This shift is likely to continue as environmentally-conscious consumers and businesses increasingly prioritize sustainability. Failure to meet these demands could potentially harm the market's growth, as industries may seek alternative solutions that align better with their sustainability goals.

For instance,

- According to an article published by U.S. Department of the Interior the U.S. government is implementing increasing restrictions on non-biodegradable materials, particularly single-use plastics, in an effort to reduce environmental pollution. The Department of the Interior has been actively promoting sustainable practices, focusing on reducing plastic waste in national parks and other public lands. These measures include a shift towards more eco-friendly materials and better waste management systems, highlighting the need for businesses and individuals to adapt to new policies aimed at protecting the environment

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

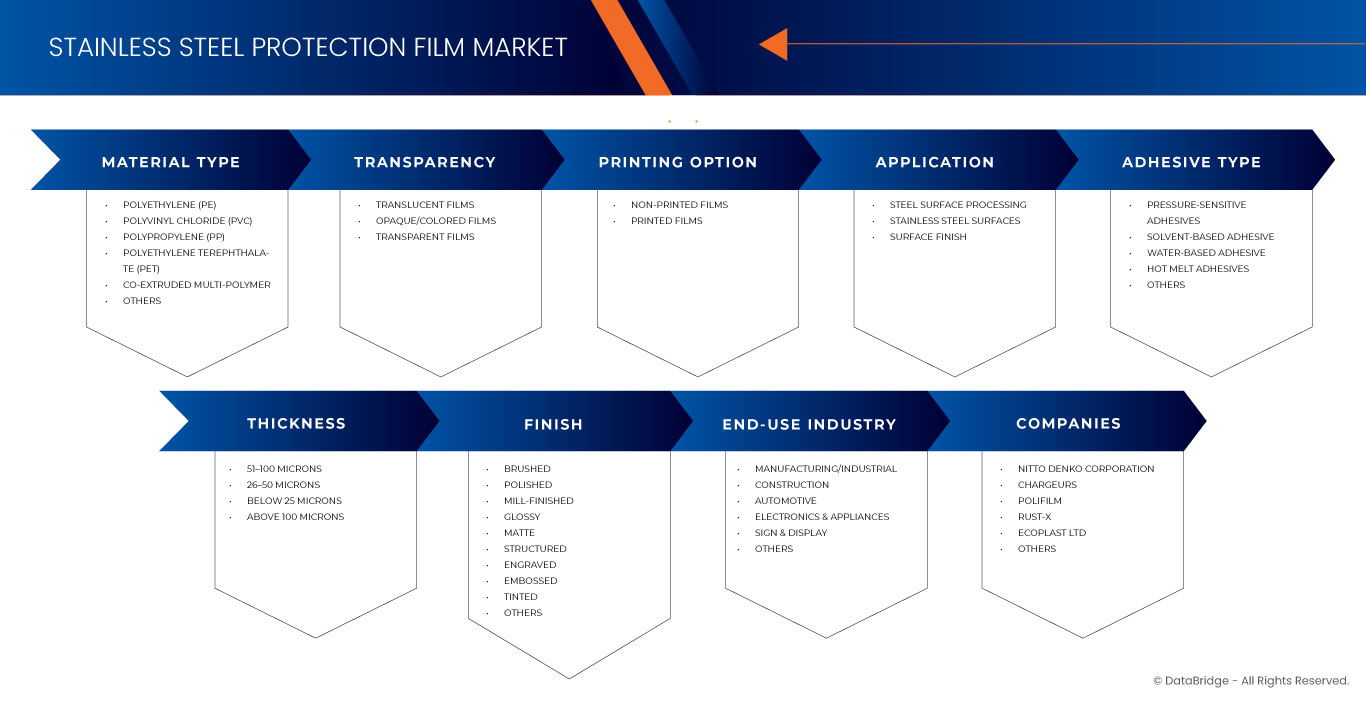

Industrial Machine Vision Market Scope

The market is segmented on the basis of material type, adhesive type, transparency, thickness, printing option, finish, application, and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Material Type

- Polyethylene (PE)

- Polyethylene (PE), BY TYPE

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene (PE), BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Polyethylene (PE), BY TYPE

- Polyvinyl Chloride (PVC)

- Polyvinyl Chloride (PVC), BY TYPE

- Flexible PVC

- Rigid PVC

- Polyvinyl Chloride (PVC), BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Polyvinyl Chloride (PVC), BY TYPE

- Polypropylene (PP)

- Polypropylene (PP), BY TYPE

- Biaxially Oriented Polypropylene (BOPP)

- Cast Polypropylene (CPP)

- Polypropylene (PP), BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Polypropylene (PP), BY TYPE

- Polyethylene Terephthalate (PET)

- Polyethylene Terephthalate (PET), BY TYPE

- Non-Metalized PET

- Metalized PET

- Polyethylene Terephthalate (PET), BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Polyethylene Terephthalate (PET), BY TYPE

- Co-Extruded Multi-Polymer

- Co-Extruded Multi-Polymer, BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Co-Extruded Multi-Polymer, BY Transparency

- Others

- Others, BY Transparency

- Translucent Films

- Transparent Films

- Opaque/Colored Films

- Others, BY Transparency

By Adhesive Type

- Pressure-Sensitive Adhesives

- Pressure-Sensitive Adhesives, By Type

- Silicone-Based Adhesives

- Non-Silicone Adhesives

- Pressure-Sensitive Adhesives, By Type

- Solvent-Based Adhesive

- Solvent-Based Adhesive, By Type

- Acrylic Solvent Adhesives

- Rubber Solvent Adhesives

- Solvent-Based Adhesive, By Type

- Water-Based Adhesive

- Water-Based Adhesives, By Type

- Acrylic Water-Based Adhesives

- Starch-Based Adhesives

- Water-Based Adhesives, By Type

- Hot Melt Adhesives

- Hot Melt Adhesives, By Type

- EVA (Ethylene Vinyl Acetate) Based

- Polyamide-Based

- Hot Melt Adhesives, By Type

- Others

By Transparency

- Translucent Films

- Opaque/Colored Films

- Opaque/Colored Films, By Type

- Blue

- Black

- Black and White

- White

- Others

- Opaque/Colored Films, By Type

- Transparent Films

By Thickness

- 51–100 Microns

- 26–50 Microns

- Below 25 Microns

- Above 100 Microns

By Printing Options

- Non-Printed Films

- Printed Films

By Finish

- Brushed

- Polished

- Mill-Finished

- Glossy

- Matte

- Structured

- Engraved

- Embossed

- Tinted

- Others

By Application

- Steel Surface Processing

- Steel Surface Processing, By Type

- Laser Cutting

- Fiber Laser

- CO2 Laser

- Polishing

- Automotive Panels

- Kitchen Sinks

- Welding

- Tig Welding

- Mig Welding

- Deep Drawing

- Satin Polishing

- Mirror Polishing

- Laser Cutting

- Steel Surface Processing, By Type

- Stainless Steel Surfaces

- Stainless Steel Surfaces, By Type

- Coils

- Sheets

- Tubes

- Panels

- Stainless Steel Surfaces, By Type

- Surface Finish

By End-Use Industry

- Manufacturing/Industrial

- Manufacturing/Industrial, Category

- Tanks and Silos

- Machinery and Equipment

- Processing Units

- Others

- Manufacturing/Industrial, Category

- Construction

- Construction, By Category

- Curtain Walls

- Exterior Cladding

- Elevator Doors and Panels

- Railings and Balustrades

- Others

- Construction, By Vertical

- Commercial

- Infrastructure

- Residential

- Construction, By Category

- Automotive

- Automotive, By Category

- Exhaust Systems

- Chassis Components

- Trim and Decorative Parts

- Others

- Automotive, By Vertical

- Commercial

- Passenger

- Automotive, By Category

- Electronics & Appliances

- Electronics & Appliances, By Category

- Kitchen Appliances

- Refrigerators

- Dishwashers

- Others

- Cooking Appliances

- Ovens

- Microwaves

- Others

- Laundry Equipment

- Washing Machines

- Dryers

- Others

- Others

- Kitchen Appliances

- Electronics & Appliances, By Vertical

- Residential

- Commercial

- Infrastructure

- Electronics & Appliances, By Category

- Sign & Display

- Others

Stainless Steel Protection Film Market Regional Analysis

The market is analyzed and market size insights and trends are provided by material type, adhesive type, transparency, thickness, printing option, finish, application, and end-use industry.

The countries covered in the market are U.S. and Mexico.

U.S. dominates the stainless-steel protection film market. This is due to its well-established industries such as construction, automotive, and appliances, which have a high demand for stainless steel and protective films. The U.S. also has a strong focus on innovation, quality standards, and the adoption of advanced protective film technologies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North-America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Stainless Steel Protection Film Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North-America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Stainless Steel Protection Film Market Leaders Operating in the Market Are:

- Chargeurs (France)

- NITTO DENKO CORPORATION (Japan)

- Polifilm (Germany)

- Ecoplast Ltd (India)

- Surface Armor (U.S.)

- Rust-X (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF SUBSTITUTES

4.2.2 BARGAINING POWER OF BUYERS

4.2.3 BARGAINING POWER OF SUPPLIERS

4.2.4 COMPETITIVE RIVALRY

4.3 IMPORT EXPORT SCENARIO

4.4 PRICE INDEX

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 SUPPLY CHAIN ANALYSIS

4.6.1 KEY PLAYERS IN THE SUPPLY CHAIN

4.6.2 KEY STAKEHOLDERS IN THE SUPPLY CHAIN

4.6.2.1 Suppliers of Raw Materials

4.6.2.2 Surface Protective Film Manufacturers

4.6.2.3 Converters of Plastic Films

4.6.2.4 Stainless Steel Manufacturers

4.6.2.5 OEMs (Original Equipment Manufacturers):

4.6.3 CHALLENGES FACED BY KEY STAKEHOLDERS

4.6.3.1 Raw Material Volatility

4.6.3.2 Regulatory Environment

4.6.3.3 Rising Demand for Sustainability

4.6.4 INTERDEPENDENCE OF STAKEHOLDERS

4.6.5 PRICING DYNAMICS

4.6.6 ADDITIONAL FACTORS IMPACTING THE SUPPLY CHAIN

4.6.7 OUTLOOK FOR THE SUPPLY CHAIN

4.7 VENDOR SELECTION CRITERIA

4.7.1 PRODUCT QUALITY AND PERFORMANCE

4.7.2 COST AND PRICING

4.7.3 SUPPLY CHAIN RELIABILITY

4.7.4 CUSTOMER SERVICE AND SUPPORT

4.7.5 REPUTATION AND EXPERIENCE

4.7.6 INNOVATIVE CAPABILITIES

4.7.7 COMPLIANCE WITH REGULATORY STANDARDS

4.7.8 FINANCIAL STABILITY

4.7.9 ENVIRONMENTAL AND SUSTAINABILITY INITIATIVES

4.8 CLIMATE CHANGE SCENARIO

4.8.1 IMPACT OF CLIMATE CHANGE ON PRODUCTION PROCESSES

4.8.2 DEMAND DRIVERS IN THE U.S. AND MEXICO

4.8.3 REGIONAL MARKET TRENDS

4.9 LIST OF POTENTIAL CUSTOMERS

4.1 RAW MATERIAL PRODUCTION COVERAGE

4.10.1 POLYETHYLENE (PE)

4.10.2 POLYPROPYLENE (PP)

4.10.3 SHIFT TOWARD SUSTAINABLE MATERIALS

4.10.4 IMPORTANCE OF ADHESIVE FORMULATIONS

4.10.5 PVC (POLYVINYL CHLORIDE)

4.10.6 PET (POLYETHYLENE TEREPHTHALATE)

4.10.7 CO-EXTRUDED MULTI-POLYMER FILMS

4.11 TECHNOLOGY ADVANCEMENTS BY MANUFACTURERS

4.11.1 HIGH-PERFORMANCE POLYMER TECHNOLOGIES

4.11.2 MULTI-LAYER EXTRUSION TECHNIQUES

4.11.3 SUSTAINABLE SOLUTIONS

4.11.4 DIGITALIZATION AND SMART PRODUCTION

4.12 VALUE CHAIN ANALYSIS

4.12.1 RAW MATERIAL PROCUREMENT

4.12.2 MANUFACTURING OF PROTECTIVE FILMS

4.12.3 DISTRIBUTION AND LOGISTICS

4.12.4 END-USE APPLICATIONS

4.12.5 END-OF-LIFE RECYCLING AND SUSTAINABILITY

4.12.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING USE OF STAINLESS STEEL IN APPLIANCES, ELECTRONICS, AND INDUSTRIAL EQUIPMENT

6.1.2 INCREASED CONSTRUCTION ACTIVITIES IN BOTH RESIDENTIAL AND COMMERCIAL SECTORS

6.1.3 RISING CONSUMER EXPECTATIONS FOR FLAWLESS STAINLESS STEEL SURFACES IN ARCHITECTURAL DESIGNS AND CONSUMER GOODS

6.1.4 INCREASES DEMAND FOR STAINLESS STEEL PROTECTION FILMS

6.2 RESTRAINTS

6.2.1 FLUCTUATING PRICES AFFECT PRODUCTION AND PROFITABILITY

6.2.2 INCREASING RESTRICTIONS ON NON-BIODEGRADABLE MATERIALS

6.3 OPPORTUNITIES

6.3.1 SHIFTING INCLINATION TOWARDS USE OF ECO-FRIENDLY, RECYCLABLE PROTECTION FILMS

6.3.2 INNOVATIONS IN ADHESIVE TECHNOLOGIES AND MULTILAYER FILMS

6.3.3 INCREASING USE OF STAINLESS STEEL IN AUTOMOTIVE COMPONENTS OFFERS GROWTH POTENTIAL FOR PROTECTIVE FILMS

6.4 CHALLENGES

6.4.1 ADVANCES IN ALTERNATIVE SURFACE PROTECTION METHOD

6.4.2 ISSUES REGARDING PROPER DISPOSAL AND RECYCLING OF USED PROTECTION FILMS

7 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE

7.1 OVERVIEW

7.2 POLYETHYLENE (PE)

7.2.1 POLYETHYLENE (PE), BY TYPE

7.2.2 POLYETHYLENE (PE), BY TRANSPARENCY

7.3 POLYVINYL CHLORIDE (PVC)

7.3.1 POLYVINYL CHLORIDE (PVC), BY TYPE

7.3.2 POLYVINYL CHLORIDE (PVC), BY TRANSPERANCY

7.4 POLYPROPYLENE (PP)

7.4.1 POLYPROPYLENE (PP), BY TYPE

7.4.2 POLYPROPYLENE (PP), BY TRANSPARENCY

7.5 POLYETHYLENE TEREPHTHALATE (PET)

7.5.1 POLYETHYLENE TEREPHTHALATE (PET), BY TYPE

7.5.2 POLYETHYLENE TEREPHTHALATE (PET), BY TRANSPARENCY

7.6 CO-EXTRUDED MULTI-POLYMER

7.6.1 CO-EXTRUDED MULTI-POLYMER, BY TRANSPARENCY

7.7 OTHERS

7.7.1 OTHERS, BY TRANSPARENCY

8 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY ADHESIVE TYPE

8.1 OVERVIEW

8.2 PRESSURE-SENSITIVE ADHESIVES

8.2.1 PRESSURE-SENSITIVE ADHESIVES, BY TYPE

8.3 SOLVENT-BASED ADHESIVE

8.3.1 SOLVENT-BASED ADHESIVE, BY TYPE

8.4 WATER-BASED ADHESIVE

8.4.1 WATER-BASED ADHESIVE, BY TYPE

8.5 HOT MELT ADHESIVES

8.5.1 HOT MELT ADHESIVES, BY TYPE

8.6 OTHERS

9 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY

9.1 OVERVIEW

9.2 TRANSLUCENT FILMS

9.3 OPAQUE/COLORED FILMS

9.3.1 OPAQUE/COLORED FILMS, BY TYPE

9.4 TRANSPARENT FILMS

10 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY THICKNESS

10.1 OVERVIEW

10.2 51–100 MICRONS

10.3 26–50 MICRONS

10.4 BELOW 25 MICRONS

10.5 ABOVE 100 MICRONS

11 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY PRINTING OPTIONS

11.1 OVERVIEW

11.2 NON-PRINTED FILMS

11.3 PRINTED FILMS

12 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY FINISH

12.1 OVERVIEW

12.2 BRUSHED

12.3 POLISHED

12.4 MILL-FINISHED

12.5 GLOSSY

12.6 MATTE

12.7 STRUCTURED

12.8 ENGRAVED

12.9 EMBOSSED

12.1 TINTED

12.11 OTHERS

13 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 STEEL SURFACE PROCESSING

13.2.1 STEEL SURFACE PROCESSING, BY TYPE

13.2.1.1 LASER CUTTING, BY TYPE

13.2.1.2 POLISHING, BY TYPE

13.2.1.3 WELDING, BY TYPE

13.2.1.4 DEEP DRAWING, BY TYPE

13.3 STAINLESS STEEL SURFACES

13.3.1 STAINLESS STEEL SURFACES, BY TYPE

13.4 SURFACE FINISH

14 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY END-USE INDUSTRY

14.1 OVERVIEW

14.2 MANUFACTURING/INDUSTRIAL

14.2.1 MANUFACTURING/INDUSTRIAL, BY CATEGORY

14.3 CONSTRUCTION

14.3.1 CONSTRUCTION, BY CATEGORY

14.3.2 CONSTRUCTION, BY VERTICAL

14.4 AUTOMOTIVE

14.4.1 AUTOMOTIVE, BY CATEGORY

14.4.2 AUTOMOTIVE, BY VERTICAL

14.5 ELECTRONICS & APPLIANCES

14.5.1 ELECTRONICS & APPLIANCES, BY CATEGORY

14.5.1.1 KITCHEN APPLIANCES, BY TYPE

14.5.1.2 COOKING APPLIANCES, BY TYPE

14.5.1.3 LAUNDRY EQUIPMENT, BY TYPE

14.5.2 ELECTRONICS & APPLIANCES, BY VERTICAL

15 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY COUNTRY

15.1 U.S.

15.2 MEXICO

16 US & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: U.S. & MEXICO

16.2 COMPANY SHARE ANALYSIS: U.S.

16.3 COMPANY SHARE ANALYSIS: MEXICO

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 NITTO DENKO CORPORATION

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 PRODUCT PORTFOLIO

18.1.4 RECENT DEVELOPMENT

18.2 CHARGEURS

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENT

18.3 POLIFILM

18.3.1 COMPANY SNAPSHOT

18.3.2 PRODUCT PORTFOLIO

18.3.3 RECENT DEVELOPMENT

18.4 RUST-X

18.4.1 COMPANY SNAPSHOT

18.4.2 PRODUCT PORTFOLIO

18.4.3 RECENT DEVELOPMENT

18.5 ECOPLAST LTD.

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 PRODUCT PORTFOLIO

18.5.4 RECENT DEVELOPMENT

18.6 LAMATEK, INC.

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 PRESTO TAPE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 SURFACE ARMOR

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 TAPEMANBLUE

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 TILAK POLYPACK

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

List of Table

TABLE 1 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 3 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD/KG)

TABLE 4 U.S. & MEXICO POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 U.S. & MEXICO POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 6 U.S. & MEXICO POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET: BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.S. & MEXICO POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET: BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 8 U.S. & MEXICO POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.S. & MEXICO POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 10 U.S. & MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 11 U.S. & MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 12 U.S. & MEXICO CO-EXTRUDED MULTI-POLYMER IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 13 U.S. & MEXICO OTHERS IN STAINLESS STEEL PROTECTION FILM MARKET: BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 14 U.S. & MEXICO TRASH BAG MARKET, BY ADHESIVE TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 U.S. & MEXICO PRESSURE-SENSITIVE ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 U.S. & MEXICO SOLVENT-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 U.S. & MEXICO WATER-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 18 U.S. & MEXICO HOT MELT ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 20 U.S. & MEXICO OPAQUE/COLORED FILMS IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 21 U.S. & MEXICO TRASH BAG MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 22 U.S. & MEXICO TRASH BAG MARKET, BY PRINTING OPTIONS, 2018-2032 (USD THOUSAND)

TABLE 23 U.S. & MEXICO TRASH BAG MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 24 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 25 U.S. & MEXICO STEEL SURFACE PROCESSING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 U.S. & MEXICO LASER CUTTING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 U.S. & MEXICO POLISHING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 U.S. & MEXICO WELDING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 U.S. & MEXICO DEEP DRAWING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 U.S. & MEXICO STAINLESS STEEL SURFACES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 32 U.S. & MEXICO MANUFACTURING/INDUSTRIAL IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 33 U.S. & MEXICO CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 U.S. & MEXICO CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 35 U.S. & MEXICO AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 36 U.S. & MEXICO AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 37 U.S. & MEXICO ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET: BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 38 U.S. & MEXICO KITCHEN APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 U.S. & MEXICO COOKING APPLIANCES, IN STAINLESS STEEL PROTECTION FILM MARKET: BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 U.S. & MEXICO LAUNDRY EQUIPMENT IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 U.S. & MEXICO ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 44 U.S. POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 U.S. POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 50 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. CO-EXTRUDED MULTI-POLYMER IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. OTHERS IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY ADHESIVE TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. PRESSURE-SENSITIVE ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. SOLVENT-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. WATER-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. HOT MELT ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. OPAQUE/COLORED FILMS IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 62 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY PRINTING OPTIONS, 2018-2032 (USD THOUSAND)

TABLE 63 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 64 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 U.S. STEEL SURFACE PROCESSING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.S. LASER CUTTING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 U.S. POLISHING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 U.S. WELDING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.S. DEEP DRAWING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.S. STAINLESS STEEL SURFACES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.S. STAINLESS STEEL PROTECTION FILM MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 72 U.S. MANUFACTURING/INDUSTRIAL IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. KITCHEN APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. COOKING APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. LAUNDRY EQUIPMENT IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 82 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE, 2018-2032 (TONS)

TABLE 84 MEXICO POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 MEXICO POLYETHYLENE (PE) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 86 MEXICO POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 MEXICO POLYVINYL CHLORIDE (PVC) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 88 MEXICO POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 MEXICO POLYPROPYLENE (PP) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 90 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 MEXICO POLYETHYLENE TEREPHTHALATE (PET) IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 92 MEXICO CO-EXTRUDED MULTI-POLYMER IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 93 MEXICO OTHERS IN STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 94 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY ADHESIVE TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 MEXICO PRESSURE-SENSITIVE ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MEXICO SOLVENT-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 MEXICO WATER-BASED ADHESIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 MEXICO HOT MELT ADHESIVES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY TRANSPARENCY, 2018-2032 (USD THOUSAND)

TABLE 100 MEXICO OPAQUE/COLORED FILMS IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 102 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY PRINTING OPTIONS, 2018-2032 (USD THOUSAND)

TABLE 103 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY FINISH, 2018-2032 (USD THOUSAND)

TABLE 104 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 MEXICO STEEL SURFACE PROCESSING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 MEXICO LASER CUTTING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 MEXICO POLISHING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 MEXICO WELDING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 MEXICO DEEP DRAWING IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 MEXICO STAINLESS STEEL SURFACES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 112 MEXICO MANUFACTURING/INDUSTRIAL IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 113 MEXICO CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 114 MEXICO CONSTRUCTION IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 115 MEXICO AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 116 MEXICO AUTOMOTIVE IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

TABLE 117 MEXICO ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 118 MEXICO KITCHEN APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 MEXICO COOKING APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 MEXICO LAUNDRY EQUIPMENT IN STAINLESS STEEL PROTECTION FILM MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO ELECTRONICS & APPLIANCES IN STAINLESS STEEL PROTECTION FILM MARKET, BY VERTICAL, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET

FIGURE 2 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: DATA TRIANGULATION

FIGURE 3 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM: DROC ANALYSIS

FIGURE 4 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM: REGIONAL MARKET ANALYSIS

FIGURE 5 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM: MULTIVARIATE MODELLING

FIGURE 7 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.S. AND MEXICO STAINLESS STEEL PROTECTION FILM MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.S. AND MEXICO STAINLESS STEEL PROTECTION FILM MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET:-APPLICATION COVERAGE GRID

FIGURE 11 U.S. AND MEXICO STAINLESS STEEL PROTECTION FILM MARKET: SEGMENTATION

FIGURE 12 SIX SEGMENTS COMPRISE THE U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET, BY MATERIAL TYPE (2024)

FIGURE 13 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET EXECUTIVE SUMMARY

FIGURE 14 GROWING USE OF STAINLESS STEEL IN APPLIANCES, ELECTRONICS, AND INDUSTRIAL EQUIPMENT IS EXPECTED TO DRIVE THE U.S. AND MEXICO STAINLESS STEEL PROTECTION FILM MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE POLYETHYLENE (PE) SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. AND MEXICO STAINLESS STEEL PROTECTION FILM MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 U.S. & MEXICO STAINLESS STEEL MARKET, 2024-2031, AVERAGE SELLING PRICE (USD/KG)

FIGURE 19 PRODUCTION CONSUMPTION ANALYSIS

FIGURE 20 SUPPLY CHAIN ANALYSIS

FIGURE 21 VENDOR SELECTION CRITERIA

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET

FIGURE 23 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY TYPE, 2024

FIGURE 24 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY ADHESIVE TYPE, 2024

FIGURE 25 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY TRANSPARENCY, 2024

FIGURE 26 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY THICKNESS, 2024

FIGURE 27 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY PRINTING OPTIONS, 2024

FIGURE 28 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY FINISH, 2024

FIGURE 29 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: BY APPLICATION, 2024

FIGURE 30 U.S. & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: END USE INDUSTRY, 2024

FIGURE 31 US & MEXICO STAINLESS STEEL PROTECTION FILM MARKET: COMPANY SHARE 2024 (%)

FIGURE 32 U.S. STAINLESS STEEL PROTECTION FILM MARKET: COMPANY SHARE 2024 (%)

FIGURE 33 MEXICO STAINLESS STEEL PROTECTION FILM MARKET: COMPANY SHARE 2024 (%)

Us And Mexico Stainless Steel Protection Film Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us And Mexico Stainless Steel Protection Film Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us And Mexico Stainless Steel Protection Film Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.