Us Padded Mailers Market

Market Size in USD Million

CAGR :

%

USD

650.16 Million

USD

97,532.00 Million

2024

2032

USD

650.16 Million

USD

97,532.00 Million

2024

2032

| 2025 –2032 | |

| USD 650.16 Million | |

| USD 97,532.00 Million | |

|

|

|

|

Padded Mailers Market Size

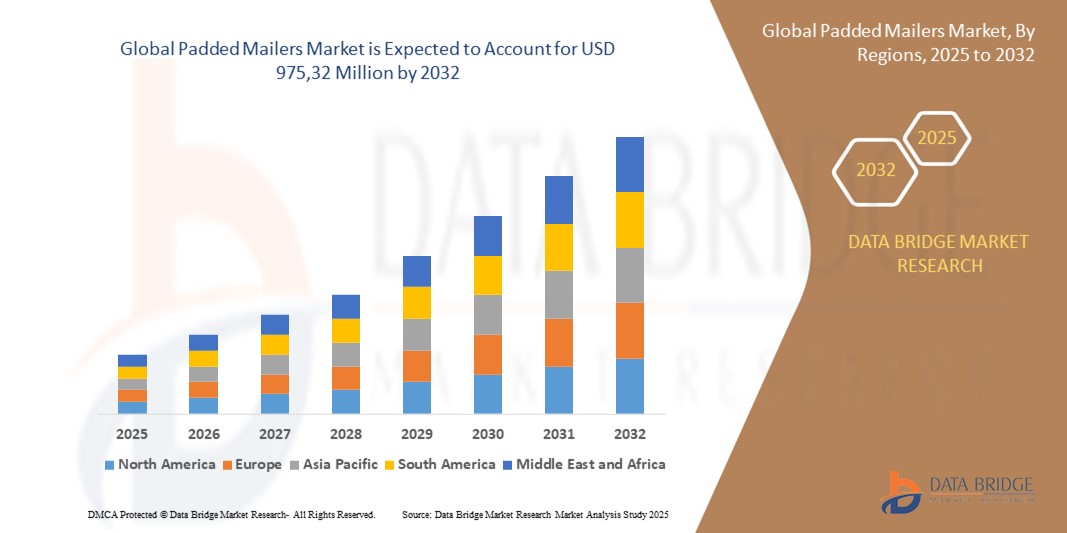

- The U.S. padded mailers market size was valued at USD 650.16 million in 2024 and is expected to reach USD 975,32 million by 2032, at a CAGR of 5.2% during the forecast period

- The market growth is largely fueled by the rapid expansion of e-commerce and the rising demand for lightweight, cost-effective, and protective packaging solutions across various industries, including retail, electronics, and healthcare

- Furthermore, increasing environmental awareness and regulatory pressure are driving the shift toward sustainable packaging alternatives, prompting manufacturers to develop recyclable and fiber-based padded mailers that align with circular economy goals, thereby accelerating market penetration

Padded Mailers Market Analysis

- Padded mailers are cushioned packaging envelopes designed to protect products during shipment while keeping shipping costs low due to their lightweight structure. They are widely used for shipping small to medium-sized items such as books, electronics, jewelry, and pharmaceuticals across both B2C and B2B channels

- The escalating demand for padded mailers in the U.S. is primarily driven by the surge in online shopping, increasing focus on product safety during transit, and the growing preference for eco-friendly, paper-based mailers over traditional plastic-based alternatives

- Self-seal segment dominated the market with a market share of 62% in 2024, due to its user-friendly application, minimal preparation time, and strong adhesive properties that ensure secure sealing. Self-seal mailers are widely adopted in both retail and logistics sectors for quick and efficient packaging workflows

Report Scope and Padded Mailers Market Segmentation

|

Attributes |

Padded Mailers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Padded Mailers Market Trends

“Rising Expansion of E-Commerce and Sustainable Packaging Innovation”

- The U.S. padded mailers market is experiencing robust growth, driven by the surge in e-commerce and the need for safe, lightweight, and cost-effective packaging for shipping a wide range of products

- For instance, companies such as Sealed Air Corporation, PAC Worldwide Corporation, and Pregis LLC are introducing eco-friendly, recyclable, and biodegradable mailers to meet rising consumer and regulatory demand for sustainable packaging solutions

- The integration of advanced materials—such as thinner yet durable kraft paper and bioplastics—is enhancing protection, reducing shipping costs, and supporting the industry’s sustainability goals

- Technology adoption is accelerating, with manufacturers incorporating features such as tamper-evident seals, waterproofing, RFID, and QR codes for better security, traceability, and supply chain analytics

- The growth of subscription box services, direct-to-consumer brands, and increased international shipping is fueling demand for padded mailers that offer both protection and branding opportunities

- In conclusion, the convergence of e-commerce growth, material innovation, and sustainability initiatives is positioning padded mailers as a critical component in the future of US packaging and logistics

Padded Mailers Market Dynamics

Driver

“Expanding E-Commerce and Direct Shipping”

- The explosive growth of online retailing and direct-to-consumer shipping is the primary driver for the U.S. padded mailers market

- For instance, companies such as Amazon, Walmart, and Shopify merchants are increasingly relying on padded mailers for efficient, protective, and cost-effective delivery of electronics, books, apparel, and small goods

- The convenience, lightweight nature, and lower shipping costs of padded mailers make them a preferred choice for both large retailers and small businesses

- The rise of personalized branding and custom packaging is encouraging brands to use padded mailers as a marketing tool, enhancing customer experience and loyalty

- The expansion of logistics networks and improvements in last-mile delivery are further boosting demand for versatile and durable mailer solutions

Restraint/Challenge

“Volatility in Raw Material Prices and Recycling Infrastructure”

- Fluctuating prices of key raw materials such as kraft paper, polyethylene, and bioplastics can impact production costs and profit margins for padded mailer manufacturers

- For instance, companies such as Intertape Polymer Group and ProAmpac Holdings Inc. face challenges in sourcing sustainable and affordable materials while maintaining product quality and performance

- Limited recycling infrastructure and inconsistent collection systems across the US can hinder the circularity of padded mailers, especially those with mixed-material construction

- Increasing regulatory pressure for eco-friendly packaging and extended producer responsibility is raising compliance costs and operational complexity for manufacturers

- Intense competition and price sensitivity in the market are making it difficult for providers to balance innovation, sustainability, and profitability

Padded Mailers Market Scope

The market is segmented on the basis of material type, type, capacity, size, distribution channel, and application.

- By Material Type

On the basis of material type, the U.S. padded mailers market is segmented into kraft paper, polyethylene, and fiber-based. The kraft paper segment dominated the market with the highest revenue share in 2024 due to its recyclability, cost-efficiency, and wide availability. Its rigid outer surface paired with a cushioning inner layer makes it a preferred choice for lightweight and non-fragile goods. Kraft paper padded mailers are increasingly favored by environmentally conscious businesses and e-commerce platforms striving to reduce plastic usage.

The fiber-based segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for sustainable and biodegradable packaging solutions. These mailers, often made from recycled paper pulp or molded fiber, offer adequate protection and are suitable for branding and customization, making them attractive to eco-focused retailers and premium product vendors.

- By Type

On the basis of type, the market is segmented into self-seal and peel and seal. The self-seal segment accounted for the largest share of 62% in 2024, driven by its user-friendly application, minimal preparation time, and strong adhesive properties that ensure secure sealing. Self-seal mailers are widely adopted in both retail and logistics sectors for quick and efficient packaging workflows.

The peel and seal segment is expected to register the fastest CAGR from 2025 to 2032, supported by its tamper-evident closure and enhanced protection against accidental openings. These features make peel and seal mailers suitable for high-value and sensitive product shipments, especially in industries such as electronics, jewelry, and pharmaceuticals.

- By Capacity

On the basis of capacity, the market is segmented into less than 300 g, 300 to 500 g, 500 to 1000 g, 1000 to 2000 g, and above 2000 g. The 300 to 500 g segment held the largest market share in 2024, as it aligns with the most common packaging needs in the e-commerce and small parcel delivery sectors. This weight range is ideal for items such as books, cosmetics, and accessories that require padded protection but do not exceed standard postal weight limits.

The 500 to 1000 g segment is anticipated to grow at the fastest pace from 2025 to 2032, due to increasing demand from online retailers shipping mid-weight products. These mailers strike a balance between protection, postage efficiency, and cost, making them attractive to growing online businesses and third-party logistics providers.

- By Size

On the basis of size, the market is segmented into 10 in. x 13 in., 9 in. x 12 in., and 6 in. x 9 in. The 10 in. x 13 in. segment dominated the market in 2024, supported by its suitability for larger documents, catalogs, apparel, and mid-sized items. This size is widely used across retail, publishing, and corporate sectors for its versatility and ample interior space.

The 6 in. x 9 in. segment is forecasted to witness the fastest growth rate from 2025 to 2032, driven by rising volumes of small electronics, accessories, and luxury items being shipped via direct-to-consumer channels. Compact padded mailers offer cost savings on shipping while providing adequate protection and reducing packaging waste.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarket/hypermarket, e-commerce, specialty stores, and others. The e-commerce segment held the largest revenue share in 2024, driven by the surge in online retail and the need for quick, convenient, and cost-effective packaging procurement. Online availability of a wide range of mailer sizes, materials, and bulk purchasing options appeals strongly to small businesses and independent sellers.

Specialty stores are expected to grow at the fastest CAGR from 2025 to 2032, fueled by rising demand for custom-branded, eco-friendly, and premium padded mailers. These stores cater to niche business segments, including artisanal brands and high-end product vendors, looking for tailored packaging solutions that align with their brand identity.

- By Application

On the basis of application, the market is segmented into manufacturing and warehousing, books and audio CDs, jewelry, gifts, frames, watches and novelties, video cassettes, and others. The books and audio CDs segment held the largest market share in 2024, driven by the ongoing popularity of physical media in educational and entertainment sectors. Publishers and retailers rely on padded mailers for cost-effective, damage-resistant packaging of these media items.

The jewelry segment is poised to register the fastest growth from 2025 to 2032, due to the increasing trend of online purchases of small, high-value items. Padded mailers provide lightweight, secure packaging for jewelry, minimizing shipping costs while ensuring a professional unboxing experience, which is critical in customer satisfaction and brand perception.

Padded Mailers Market Regional Analysis

- U.S. dominated the padded mailers market with the largest revenue share in 2024, driven by the dominance of the e-commerce sector, rising demand for lightweight and cost-efficient packaging, and the widespread shift toward sustainable materials

- Businesses across retail, electronics, and personal care are increasingly adopting padded mailers for secure last-mile delivery, while consumer preference for minimal and recyclable packaging further accelerates market growth

- The presence of established logistics networks and packaging manufacturers also supports high-volume production and innovation in material technology across the country

Padded Mailers Market Share

The padded mailers industry is primarily led by well-established companies, including:

- Vereinigte Papierwarenfabriken GmbH (Germany)

- Sealed Air (U.S.)

- Pregis LLC (U.S.)

- ProAmpac (U.S.)

- Intertape Polymer Group (Canada)

- Polycell Packaging Corp (Taiwan)

- PAC Worldwide Corporation. (U.S.)

- STOROPACK HANS REICHENECKER GMBH (Germany)

- abrisojiffy.com (Belgium)

- Bravo Pack Inc (U.S.)

- 3M (U.S.)

- LPS Industries. (U.S.)

- AP Packaging Corp. (U.S.)

- Sonoco ThermoSafe (U.S.)

- Smurfit Kappa (Ireland)

- DS Smith (U.K.)

Latest Developments in U.S. Padded Mailers Market

- In September 2024, Mondi, a global leader in sustainable packaging and paper, introduced its new recyclable Protective Mailers made entirely of paper, developed in collaboration with Amazon. This launch is expected to significantly influence the padded mailers market by accelerating the shift toward plastic-free, eco-friendly packaging alternatives. By offering a fully recyclable solution that eliminates the need for plastic bubble wrap, Mondi’s innovation aligns with rising consumer and regulatory demand for sustainable e-commerce packaging, reinforcing the market trend toward circular economy practices

- In 2023, CompanyBox launched a new era of sustainability in the padded mailers market with their 100% recyclable and compostable paper-based mailers, featuring eco-friendly water-based inks, catering to environmentally conscious consumers

- In 2021, Georgia-Pacific expanded its facilities to produce curbside recyclable paper padded mailers, aligning with the growing demand for sustainable shipping solutions in the padded mailers market

- In 2020, PREGIS LLC revolutionized the padded mailers market with the MAX-PRO 24 poly bagging system, offering enhanced productivity and reduced labor costs through automated settings, promising increased revenue and sales

- In 2020, Intertape Polymer Group addressed evolving needs by launching a new line of Social Distancing Tape with heightened durability, catering to pandemic-induced demand for safe shipping solutions in the padded mailers market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Us Padded Mailers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Us Padded Mailers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Us Padded Mailers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.