Vietnam Elderly Care Market

Market Size in USD Billion

CAGR :

%

USD

2.21 Billion

USD

4.79 Billion

2023

2031

USD

2.21 Billion

USD

4.79 Billion

2023

2031

| 2024 –2031 | |

| USD 2.21 Billion | |

| USD 4.79 Billion | |

|

|

|

Vietnam Elderly Care Market Analysis and Size

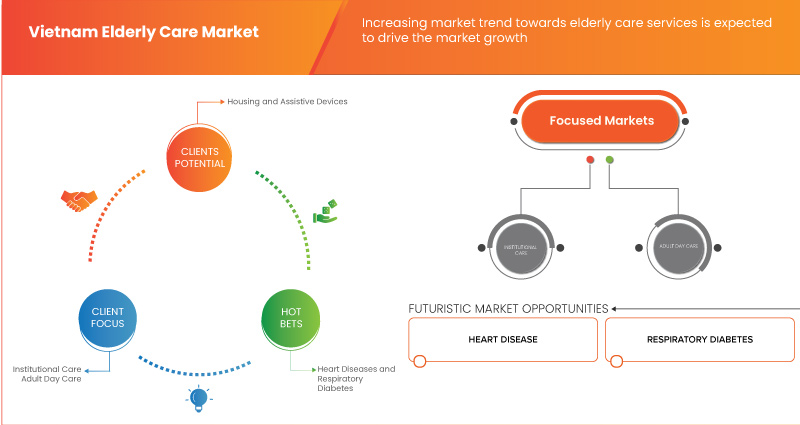

The Vietnam elderly care market is being driven by two factors: the increasing geriatric population, rising cases of chronic diseases. These platforms are the expanding application spectrum has fueled significant market growth, reflected in rising awareness and emphasis on preventive healthcare and early detection of diseases. However, a significant restraint for the market is high cost of elderly care services occur in under developed countries. Despite this challenge, there is an opportunity of continuous enhancement in technological development such as telehealth platforms, mobile apps, wearable devices, Innovations in imaging technology, molecular diagnostics, and digital health solutions have revolutionized how diseases are detected and monitored, can attract new market segments. One major challenge facing the market lack of knowledge and skilled professionals.

Data Bridge Market Research analyzes that the Vietnam elderly care market is expected to reach USD 4.79 billion by 2031 from USD 2.21 billion in 2023, growing with CAGR of 7.7% during forecast period of 2024 to 2034.

|

Report Metric |

Details |

|

Forecast Period |

2024-2034 |

|

Base Year |

2023 |

|

Historic Year |

2022 (Customizable 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Product Type (Housing and Assistive Devices and Pharmaceuticals), Service (Home Care, Institutional Care, and Adult Day Care), Application (Heart Diseases, Respiratory, Diabetes, Osteoporosis, Neurological, Cancer, Kidney Diseases, Arthritis, and Others) |

|

Country Covered |

Vietnam |

|

Market Players Covered |

Philips, Medtronic, Vinmec International Hospital, Phonak – A Sonova brand, Care Connect Vietnam and Hio JSC, Saigon Healthcare and Signia Hearing Aids, and among others |

Market Definition

Elderly care is referred to as senior care, which includes meeting all the requirements of senior citizens at different stages. It includes products and services that make the daily activities of aged people simple and easy. The need for elderly care increases with the growing age as aged people require physical as well as emotional assistance to lead a productive, healthy, and independent life. Eldercare services include assisted living, adult daycare, long-term care, short-term care, hospice, and home care.

In developed nations, elderly care services are in high demand and with growing medical science technology the developing nations are also opting for these services. Elderly care services are divided into medical and non-medical services. After surgeries or any injuries, the services offered to the elders are mainly medical. While emotional problems or neurodegenerative disease include both medical and non-medical services.

Vietnam Elderly Care Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Geriatric Population

The rising geriatric population in Vietnam is a significant driver for the development of elderly care services. As the number of older adults continues to grow, there is an increasing demand for comprehensive and specialized care tailored to the needs of the elderly. This demographic shift highlights the necessity for a robust support system that can address various aspects of aging, including healthcare, daily living assistance, and social support. The growing elderly population underscores the urgency for innovative solutions and infrastructure to ensure that older individuals receive the care and attention they require. Further the proportion of aged people (people aged 60 and over) is increasing worldwide. The geriatric population has more health issues where home healthcare provides services to provide better treatment among patients. Thus, the increase in the geriatric population globally is helping the elderly care market to grow

For instance,

- In September 2022, according to the report published by UNFPA Viet Nam named “Population Ageing and Older Person in Viet Nam” state that from 2009 to 2019, Viet Nam's population experienced significant shifts in its age structure. The young-old population (ages 60–69) saw a substantial increase of 3.1 million people. In contrast, the middle-old population (ages 70–74) grew by a modest 200,000, while the oldest-old population (aged 74 and over) expanded by 570,000. Detailed data for the 2009–2019 period reveals notable differences in the annual growth rates across these age groups. The young-old population, especially those aged 60–64, exhibited a high growth rate of 7.5%, while the oldest-old population experienced a steady increase with a growth rate of approximately 3.6%

In conclusion, as the demographic landscape shifts towards a higher proportion of older adults, there is an expanding demand for specialized products, services, and solutions tailored to this age group. This shift not only fuels market growth but also drives innovation in sectors such as healthcare, housing, and technology. By recognizing and addressing the unique needs of the aging population, Vietnam can leverage this demographic trend to foster new business opportunities, enhance quality of life for seniors, and ensure sustainable economic growth.

- Increasing Cases of Chronic Disease

The rising prevalence of chronic diseases among the elderly in Vietnam significantly drives the demand for enhanced elderly care services. As the population ages, more seniors are experiencing long-term health conditions such as diabetes, cardiovascular diseases, and respiratory disorders. These chronic illnesses necessitate ongoing medical attention, management, and specialized care, which highlights the urgent need for robust elderly care systems. Such systems must offer comprehensive health services, including preventive care, continuous monitoring, and personalized treatment plans to manage these conditions effectively. The growing burden of chronic diseases underscores the importance of developing and expanding healthcare infrastructure and support services tailored to the unique needs of the aging population, ensuring they receive the appropriate care and support to maintain their quality of life

The burden of chronic diseases such as diabetes, cardiovascular diseases, obesity, cancer, osteoporosis, and dental diseases has increased worldwide. These diseases can be prevented with proper treatment, diet, and nutrition along with proper suggestions from doctors. But in recent times, the treatment can also be taken by sitting at home with the help of home healthcare services in which one does not need to visit hospitals.

Home healthcare provides services of both nursing homes and home care facilities. Home care is more beneficial for the elder people as it can be done at home itself; hence its demand is higher amongst the elderly population worldwide. These services are required according to the intensity of the disease and proper assessment of patients. With such multiple benefits of home healthcare such as home care, nursing care, physical therapies, and others, people are more inclined towards it, and hence increasing cases of chronic diseases amongst the geriatric population is considered as a driving factor for market to grow.

For instance,

- In September 2023, according to the article published by VietNamNet Global, The World Health Organization (WHO) reports that Vietnamese men have the fifth highest average life expectancy in Southeast Asia, while Vietnamese women rank second in the region. The overall average life expectancy for Vietnamese people is 73.7 years. However, of those years, approximately 10 are spent in poor health, which significantly impacts the quality of life and reduces the number of healthy years

- In October 2021, According to the Viet Nam Aging Survey (VNAS) Survey data on the elderly population in Viet Nam indicates that non-communicable diseases are the predominant health concerns among this demographic. The prevalence of hypertension among the elderly has notably increased, rising from 20% in 2003 to 45.6% in 2011, and further to 52.6% in 2019. Arthritis (37.6%) and cardiovascular disease (20.3%) are also common among the elderly. Other diseases, such as cancer and chronic obstructive pulmonary disease (COPD), have shown significant increases as well. Diabetes prevalence has surged, particularly among elderly women, with an increase from 5% in 2011 to 14.3% in 2019, and among elderly men from 6.8% to 8.5% over the same period. The most prevalent conditions among the elderly include diabetes (96.7%), high blood pressure (93.4%), vestibular disorders (90.7%), osteoarthritis (85.5%), and arthritis (83.1%)

Therefore, for treatment of above listed chronic diseases especially in the geriatric population, home healthcare is found to be a better solution as it provides several services for patients which include nursing home care and home care facility. Such facilities provided by organizations to the patient help the market to grow. Hence, increasing cases of chronic diseases where home healthcare can be used for better treatment of senior citizen acts as a major driving factor for the growth of the market.

Opportunity

- Increasing Market Trend and the Government Approval Towards Elderly Care Services

The increasing elderly population acts as a driving force for elderly care services. Change in the economy and social environment increased the demand for care business. A growing number of the elderly population puts pressure on the young generation to take care of elderly family members along with work. This as result creates the need for elderly care services. It is divided into short-term services and long-term services. Short-term services help in performing the daily basic activities, while long-term services focus on the residential facilities. Long-term service requires medical assistance and daycare.

For instance,

- In February 2024, according to an article published by Sadie G. Mays Health & Rehabilitation Center, automation is emerging as a key trend in senior care technology, streamlining processes and reducing costs by utilizing cloud-based systems for patient data management and big data analytics to identify patterns in patient behavior. This trend justifies the increasing market demand for elderly care services and presents a significant opportunity for the elderly care market by enhancing efficiency, reducing operational costs, and improving patient outcomes

- In August 2024, according to the article published by Vietnam investment review, The Ministry of Health has issued Decision 403/QD-BYT for the Action Plan for Elderly Health Care by 2030. This decision lays out a framework for monitoring and evaluating progress in managing Vietnam’s aging population. The Law on the Elderly, approved by the National Assembly in 2009, also recognizes the role and protection of legal rights for older persons

As the aging population is increasing, the options for better service assistance are also increasing. For elder care, services such as long-term care and short term, nursing, and residential facility are available. Thus, increasing the elderly population, continuous involvement towards the advancement by the companies creates more opportunities for service providers to offer better care services to older people which in the result is acting as an opportunity to market.

Restraint/Challenge

- Lack of Knowledge and Skilled Professionals

The growing demand for elderly care services underscores the need for a workforce that is both well-trained and experienced in geriatric care. However, the sector faces a notable deficit in professionals who possess specialized knowledge and skills required to address the complex needs of the elderly. This gap not only hampers the quality of care provided but also affects the development of comprehensive and effective care programs. The lack of advanced training and education in geriatric care limits the ability to implement best practices and innovations that can improve the overall standard of elderly care. As the elderly population continues to expand, the shortage of qualified professionals presents a substantial obstacle to enhancing care quality and ensuring that older individuals receive the attention and support they deserve in chronic diseases such as Diabetes, Alzheimer’s and Dementia, monitoring and caring is very important for patient treatment. So for better treatment, staff needs to be well trained in handling the patient with new technologies.

If the service provider is not well trained or not aware of the updated technology then it becomes difficult for the patient to handle which automatically leads to a longer recovery time. It has also been seen that the service-providing companies have received complaints from the patients regarding the inefficient service provider.

For instance,

- In June 2021, according to the article published by UNFPA (United Nations Population Fund), Vietnam is experiencing a critical shortage of nurses and caregivers specialized in elderly care due to the rising demand for these services. This shortfall is compounded by the competition for skilled labor from labor exports. As the global population ages, the need for elderly care services and professionals has surged in both developed and developing countries. Many of these countries face overwhelmed primary care units due to an increasing number of elderly and sick individuals, which in turn has heightened the demand for imported nurses and caregivers

- According to NCBI, the current status of the occupation of community care for older adults stresses the need to establish the occupation as a profession. The need for such a transformation is derived from two main challenges that characterize the lack of professionalism inherited in the care of older adults at present: first, the lack of differentiation between the work of a traditionally paid care worker and that of a community care worker; and second, the need for marketing the role of the community care worker

Therefore, regular training programs should be conducted by the organizations for the service providers to make them aware of the diseases and latest technologies developed for elderly care. Skilled people may provide better treatment with the latest technology which further may lead to the growth of the market

Recent Developments

- In May 2023, Medtronic to acquire wearable insulin patch maker EOFlow, announced company has entered into a set of definitive agreements to acquire EOFlow Co. Ltd. manufacturer of the EOPatch device — a tubeless, wearable and fully disposable insulin delivery device. The addition of EOFlow, together with Medtronic's Meal Detection Technology algorithm and next-generation continuous glucose monitor (CGM), is expected to expand the company's ability to address the needs of more individuals with diabetes

- In July 2024, Philips and Narayana Institute of Cardiac Sciences collaborate together with successful first year of their ELiTE Program, having trained over 200 clinicians. This milestone underscores the program's impact in advancing cardiac care through specialized training and education. The collaboration highlights a commitment to enhancing clinical skills and improving patient outcomes in the cardiology field

- In June 2024, Signia was honored with a silver award in the “Achievements in Customer Service Excellence” category at the 2024 Awards for Customer Excellence. This recognition highlighted Signia's commitment to exceptional customer service and followed their earlier win at the 2024 Excellence in Customer Service Awards from the Business Intelligence Group. The Globe Awards celebrated organizations that demonstrated outstanding dedication to delivering superior customer experiences, with other winners including Bank of America, Pfizer, and IBM

- In March 2024, Signia expanded its Integrated Xperience (IX) platform with the addition of the Styletto IX and Insio IX hearing aids. Styletto IX is the slimmest Slim-RIC, and Insio IX is the smallest CIC and IIC available. These new models enhance speech clarity and reduce the stigma associated with hearing aids, offering sleek designs and advanced technology for improved conversation and connectivity

- In August 2022, Medtronic completes acquisition of Affera, announced that it has completed the acquisition of Affera, Inc. This acquisition expands the company's cardiac ablation portfolio to include its first-ever cardiac mapping and navigation platform that encompasses a differentiated, fully integrated diagnostic, focal pulsed field and radiofrequency ablation solution

Vietnam Elderly Care Market Scope

The Vietnam elderly care market is segmented into three notable segments based on basis of product type, service, and application.

Product Type

- Housing and Assistive Disease

- Pharmaceuticals

On the basis of product type, the market is segmented into housing and assistive devices and pharmaceuticals.

Service

- Homecare

- Institutional Care

- Adult Day Care

On the basis of service, the market is segmented into homecare, institutional care, and adult day care.

Application

- Heart Diseases

- Respiratory

- Diabetes

- Osteoporosis

- Neurological

- Cancer

- Kidney Diseases

- Arthritis

- Others

On the basis of application, the market is segmented into heart diseases, respiratory, diabetes, osteoporosis, neurological, cancer, kidney diseases, arthritis, and others.

Vietnam Elderly Care Market Regional Analysis/Insights

Vietnam elderly care market is analyzed and market size insights and trends are provided based on the product type, service, and application as referenced above.

The country covered in this market report is Vietnam.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, Porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Vietnam Elderly Care Market Share Analysis

Vietnam elderly care market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites, and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Vietnam elderly care market. Some of the major players operating in the Vietnam elderly care market are Philips, Medtronic, Vinmec International Hospital, Phonak – A Sonova brand, and among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE VIETNAM ELDERLY CARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 MULTIVARIATE MODELLING

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 SECONDARY SOURCES

2.9 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATORY SCENARIO

5.1 REGULATORY BODIES

5.1.1 MINISTRY OF HEALTH (MOH)

5.1.2 MINISTRY OF LABOR, INVALIDS AND SOCIAL AFFAIRS (MOLISA)

5.1.3 DEPARTMENT OF SOCIAL PROTECTION (UNDER MOLISA)

5.1.4 VIETNAM ASSOCIATION OF THE ELDERLY (VAE)

5.1.5 LOCAL HEALTH DEPARTMENTS

5.2 KEY REGULATIONS AND POLICIES

5.2.1 LAW ON ELDERLY PEOPLE (2009)

5.2.2 LAW ON SOCIAL INSURANCE (2014)

5.2.3 DECREE NO. 136/2013/ND-CP ON SOCIAL ASSISTANCE POLICIES

5.2.4 CIRCULAR NO. 21/2016/TT-BLDTBXH ON REGULATIONS FOR ELDERLY CARE FACILITIES

5.2.5 DECISION NO. 102/2016/QD-TTG ON SUPPORT POLICIES FOR THE ELDERLY

5.2.6 CIRCULAR NO. 14/2021/TT-BYT ON HEALTH CARE SERVICES FOR THE ELDERLY

5.3 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING GERIATRIC POPULATION

6.1.2 INCREASING CASES OF CHRONIC DISEASE

6.1.3 RISING AWARENESS OF HOME HEALTH CARE SERVICES

6.2 RESTRAINTS

6.2.1 HIGH COST OF ELDERLY CARE SERVICES

6.2.2 LOW PENETRATION RATE FOR ELDERLY CARE SERVICES

6.3 OPPORTUNITIES

6.3.1 INCREASING MARKET TREND AND THE GOVERNMENT APPROVAL TOWARDS ELDERLY CARE SERVICES

6.3.2 CONTINUOUS ENHANCEMENT IN TECHNOLOGICAL DEVELOPMENT

6.4 CHALLENGES

6.4.1 LACK OF KNOWLEDGE AND SKILLED PROFESSIONALS

6.4.2 GAP IN DEMAND AND SUPPLY

7 VIETNAM ELDERLY CARE MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 HOUSING AND ASSISTIVE DEVICES

7.2.1 MEDICAL WEARABLES

7.2.2 HEARING AIDS

7.2.3 ALERT DEVICES

7.2.4 MOBILITY DEVICES

7.2.5 OTHERS

7.3 PHARMACEUTICALS

8 VIETNAM ELDERLY CARE MARKET, BY SERVICE

8.1 OVERVIEW

8.2 HOMECARE

8.2.1 HEALTHCARE

8.2.1.1 MEDICAL CARE

8.2.1.2 PHYSIOTHERAPY SERVICES

8.2.1.3 TELEHEALTH

8.2.1.4 PALLIATIVE CARE

8.2.1.5 HOSPICE CARE

8.2.2 NON-MEDICAL CARE

8.2.2.1 PERSONAL CARE

8.2.2.2 REHABILITATION

8.2.2.3 OTHERS

8.3 INSTITUTIONAL CARE

8.3.1 NURSING HOME

8.3.2 HOSPITAL BASED

8.3.3 INDEPENDENT SENIOR LIVING

8.3.4 ASSISTED LIVING

8.4 ADULT DAY CARE

9 VIETNAM ELDERLY CARE MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HEART DISEASES

9.3 RESPIRATORY

9.4 DIABETES

9.5 OSTEOPOROSIS

9.6 NEUROLOGICAL

9.7 CANCER

9.8 KIDNEY DISEASES

9.9 ARTHRITIS

9.1 OTHERS

10 VIETNAM ELDERLY CARE MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: VIETNAM

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 MEDTRONIC

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT DEVELOPMENT

12.2 PHILIPS

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENT

12.3 VINMEC INTERNATIONAL HOSPITAL

12.3.1 COMPANY SNAPSHOT

12.3.2 PRODUCT PORTFOLIO

12.3.3 RECENT DEVELOPMENT

12.4 PHONAK – A SONOVA BRAND

12.4.1 COMPANY SNAPSHOT

12.4.2 PRODUCT PORTFOLIO

12.4.3 RECENT UPDATES

12.5 CARE CONNECT VIETNAM INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 PRODUCT PORTFOLIO

12.5.3 RECENT UPDATES

12.6 HIO CARE

12.6.1 COMPANY SNAPSHOT

12.6.2 SERVICES PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 SAIGON HEALTHCARE

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATES

12.8 SIGNIA HEARING AIDS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 LEVELS AND RATES OF INCREASE/DECREASE OF OLDER POPULATION BY AGE GROUP

TABLE 2 VIETNAM ELDERLY CARE MARKET, BY PRODUCT TYPE, 2022-2034 (USD MILLION)

TABLE 3 VIETNAM HOUSING AND ASSISTIVE DEVICES IN ELDERLY CARE MARKET, BY PRODUCT TYPE, 2022-2034 (USD MILLION)

TABLE 4 VIETNAM ELDERLY CARE MARKET, BY SERVICE, 2022-2034 (USD MILLION)

TABLE 5 VIETNAM HOMECARE IN ELDERLY CARE MARKET, BY TYPE, 2022-2034 (USD MILLION)

TABLE 6 VIETNAM HEALTHCARE IN ELDERLY CARE MARKET, BY TYPE, 2022-2034 (USD MILLION)

TABLE 7 VIETNAM NON-MEDICAL CARE IN ELDERLY CARE MARKET, BY TYPE, 2022-2034 (USD MILLION)

TABLE 8 VIETNAM INSTITUTIONAL CARE IN ELDERLY CARE MARKET, BY SERVICE TYPE, 2022-2034 (USD MILLION)

TABLE 9 VIETNAM ELDERLY CARE MARKET, BY APPLICATION, 2022-2034 (USD MILLION)

List of Figure

FIGURE 1 VIETNAM ELDERLY CARE MARKET: SEGMENTATION

FIGURE 2 VIETNAM ELDERLY CARE MARKET: DATA TRIANGULATION

FIGURE 3 VIETNAM ELDERLY CARE MARKET: DROC ANALYSIS

FIGURE 4 VIETNAM ELDERLY CARE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 VIETNAM ELDERLY CARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 VIETNAM ELDERLY CARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 VIETNAM ELDERLY CARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 VIETNAM ELDERLY CARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 VIETNAM ELDERLY CARE MARKET: SEGMENTATION

FIGURE 10 STRATEGIC DECISIONS

FIGURE 11 TWO SEGMENTS COMPRISE THE VIETNAM ELDERLY CARE MARKET, BY PRODUCT TYPE

FIGURE 12 RISING CASES OF CHRONIC DISEASES IS DRIVING THE GROWTH OF THE VIETNAM ELDERLY CARE MARKET FROM 2024 TO 2034

FIGURE 13 THE HOUSING AND ASSISTIVE DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE VIETNAM ELDERLY CARE MARKET IN 2024 AND 2034

FIGURE 14 DROC ANALYSIS

FIGURE 15 LEVELS AND RATES OF INCREASE/DECREASE OF OLDER POPULATION BY AGE GROUP

FIGURE 16 VIETNAM ELDERLY CARE MARKET: BY PRODUCT TYPE, 2023

FIGURE 17 VIETNAM ELDERLY CARE MARKET: BY PRODUCT TYPE, 2024-2034 (USD MILLION)

FIGURE 18 VIETNAM ELDERLY CARE MARKET: BY PRODUCT TYPE, CAGR (2024-2034)

FIGURE 19 VIETNAM ELDERLY CARE MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 20 VIETNAM ELDERLY CARE MARKET: BY SERVICE, 2023

FIGURE 21 VIETNAM ELDERLY CARE MARKET: BY SERVICE, 2024-2034 (USD MILLION)

FIGURE 22 VIETNAM ELDERLY CARE MARKET: BY SERVICE, CAGR (2024-2034)

FIGURE 23 VIETNAM ELDERLY CARE MARKET: BY SERVICE, LIFELINE CURVE

FIGURE 24 VIETNAM ELDERLY CARE MARKET: BY APPLICATION, 2023

FIGURE 25 VIETNAM ELDERLY CARE MARKET: BY APPLICATION, 2024-2034 (USD MILLION)

FIGURE 26 VIETNAM ELDERLY CARE MARKET: BY APPLICATION, CAGR (2024-2034)

FIGURE 27 VIETNAM ELDERLY CARE MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 VIETNAM ELDERLY CARE MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.