Global Animal Antibiotics Antimicrobials Market

Размер рынка в млрд долларов США

CAGR :

%

USD

5.08 Billion

USD

7.00 Billion

2024

2032

USD

5.08 Billion

USD

7.00 Billion

2024

2032

| 2025 –2032 | |

| USD 5.08 Billion | |

| USD 7.00 Billion | |

|

|

|

|

Сегментация мирового рынка противомикробных препаратов для животных по видам продукции ( тетрациклин , пенициллин, сульфонамид, макролид, цефалоспорин , фторхинолон, линкозамиды и цефалоспорины ), типу (противомикробные препараты и антибиотики), способу введения (премиксы, пероральные порошки, инъекции и другие), типу животных (крупный рогатый скот, свинина, птица, аквакультура и другие виды домашнего скота) — тенденции отрасли и прогноз до 2032 года

Антибиотики для животных Антимикробные препараты Размер рынка

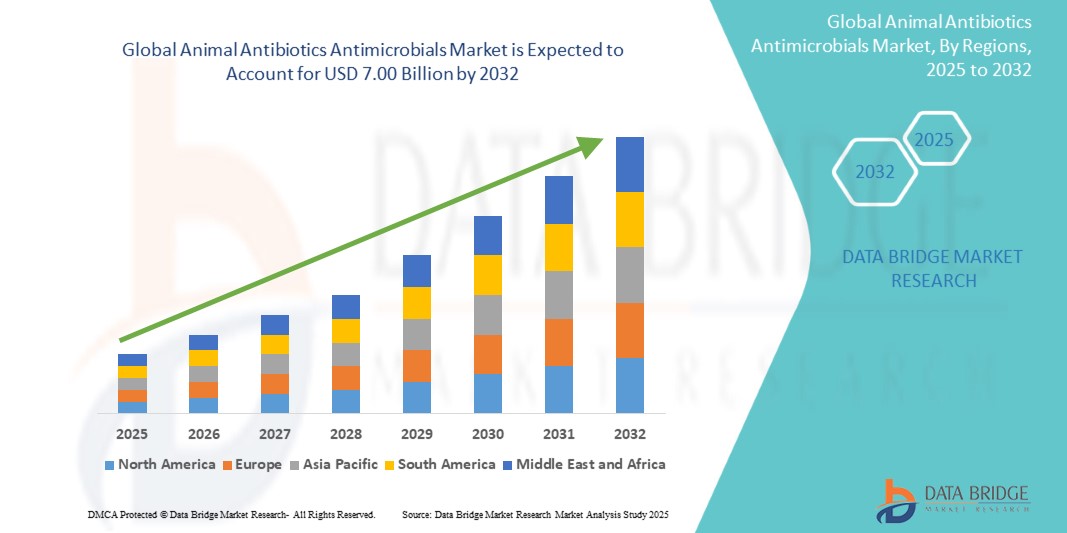

- Объем мирового рынка антибиотиков для животных и противомикробных препаратов оценивался в 5,08 млрд долларов США в 2024 году и, как ожидается, достигнет 7,00 млрд долларов США к 2032 году при среднегодовом темпе роста 4,10% в прогнозируемый период.

- Этот рост обусловлен растущей обеспокоенностью состоянием здоровья животных.

Анализ рынка антибиотиков и противомикробных препаратов для животных

- Антибиотики и противомикробные препараты для животных играют решающую роль в поддержании здоровья животных, леча и предотвращая бактериальные инфекции у скота, птицы и домашних животных, тем самым повышая общую производительность и безопасность пищевых продуктов.

- Спрос на эти продукты увеличивается из-за роста мирового потребления мяса, интенсификации животноводства и необходимости предотвращения вспышек заболеваний среди популяций животных для обеспечения устойчивости цепочек поставок продовольствия.

- Ожидается, что Северная Америка будет доминировать на рынке противомикробных препаратов для животных с самой большой долей рынка в 37,37% благодаря хорошо налаженной инфраструктуре ветеринарного здравоохранения, высокой осведомленности среди животноводов и присутствию ведущих фармацевтических компаний в регионе.

- Ожидается, что в Азиатско-Тихоокеанском регионе будут зарегистрированы самые высокие темпы роста рынка антибиотиков для животных в течение прогнозируемого периода из-за роста поголовья скота, увеличения инвестиций в ветеринарное здравоохранение и растущего спроса на животный белок в быстро урбанизирующихся странах, таких как Китай, Индия и Вьетнам.

- Ожидается, что сегмент антибиотиков будет доминировать в сегменте типов с наибольшей долей рынка в 45,44% в 2025 году, поскольку они используются для профилактики и лечения инфекционных заболеваний у животных; эти препараты применимы для различных видов животных, включая домашний скот, птицу и домашних животных.

Область применения отчета и сегментация рынка антибиотиков для животных и противомикробных препаратов

|

Атрибуты |

Антибиотики для животных Антимикробные препараты Ключевые данные о рынке |

|

Охваченные сегменты |

|

|

Страны, охваченные |

Северная Америка

Европа

Азиатско-Тихоокеанский регион

Ближний Восток и Африка

Южная Америка

|

|

Ключевые игроки рынка |

|

|

Возможности рынка |

|

|

Информационные наборы данных с добавленной стоимостью |

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают анализ импорта и экспорта, обзор производственных мощностей, анализ потребления продукции, анализ ценовых тенденций, сценарий изменения климата, анализ цепочки поставок, анализ цепочки создания стоимости, обзор сырья и расходных материалов, критерии выбора поставщиков, анализ PESTLE, анализ Портера и нормативную базу. |

Тенденции рынка антибиотиков для животных и противомикробных препаратов

«Переход к альтернативным антибиотикам и рациональному использованию противомикробных препаратов»

- Важной тенденцией на рынке антибиотиков и противомикробных препаратов для животных является растущий сдвиг в сторону альтернатив, таких как пробиотики , пребиотики, фитогенные препараты и эфирные масла , с целью снижения зависимости от традиционных антибиотиков.

- Этот переход обусловлен растущей обеспокоенностью по поводу устойчивости к противомикробным препаратам (УПП), ужесточением нормативных ограничений на использование антибиотиков в кормах для животных и давлением со стороны потребителей, требующих, чтобы мясо и молочные продукты не содержали антибиотиков.

- Эти альтернативы поддерживают здоровье кишечника и иммунитет у животных, выступая в качестве профилактических стратегий для снижения уровня инфицирования, не способствуя развитию резистентности.

- Например, в 2024 году компания DSM Animal Nutrition & Health расширила ассортимент альтернатив антибиотикам, выпустив Symphiome — новую кормовую добавку, способствующую здоровью кишечника и предназначенную для производителей птицы и свинины.

- Ожидается, что эта тенденция изменит практику управления здоровьем животных, стимулируя инновации и изменение рецептур кормов для скота в соответствии с глобальными усилиями по снижению УПП.

Динамика рынка антибиотиков и противомикробных препаратов для животных

Водитель

«Растущий уровень распространенности зоонозных заболеваний и заболеваемости скота»

- Глобальный рост зоонозных и эндемических заболеваний скота обусловливает спрос на эффективные антибиотики и противомикробные препараты для предотвращения крупномасштабных вспышек и защиты общественного здоровья.

- Болезни животных, такие как птичий грипп, чума свиней и респираторные заболевания крупного рогатого скота, продолжают оказывать негативное воздействие на популяции животных и цепочку поставок продовольствия, что обусловливает острую необходимость в профилактических мерах лечения.

- Правительства и международные организации пропагандируют ответственное использование антибиотиков для контроля вспышек заболеваний и обеспечения продовольственной безопасности.

- Например, в 2023 году компания Zoetis сообщила о резком росте спроса на антибиотики на основе линкомицина после вспышек респираторных заболеваний на птицеводческих фермах по всей Юго-Восточной Азии.

- Ожидается, что рост заболеваемости приведет к тому, что использование антибиотиков останется на переднем крае стратегий охраны здоровья животных, особенно в системах интенсивного земледелия.

Возможность

«Растущий спрос в сегментах аквакультуры и развивающегося животноводства»

- Аквакультура, один из самых быстрорастущих секторов пищевой промышленности в мире, открывает новые возможности для использования антибиотиков и противомикробных препаратов целевого назначения для борьбы с патогенами, передающимися через воду, и поддержания здоровья рыб.

- Аналогичным образом, использование антибиотиков расширяется в новых сегментах животноводства, таких как кролики, перепела и экзотические домашние животные, из-за растущей коммерциализации и увеличения количества владельцев домашних животных.

- Участники рынка теперь инвестируют в индивидуальные формулы и системы доставки, подходящие для водных и нетрадиционных видов.

- Например, в 2024 году компания Phibro Animal Health представила водорастворимый антибиотик на основе окситетрациклина, специально разработанный для ферм по разведению креветок и тилапии по всей Латинской Америке.

- Ожидается, что эта диверсификация в нишевые секторы сельского хозяйства откроет новые источники дохода и будет способствовать целевым инновациям в области продуктов.

Сдержанность/Вызов

«Строгая нормативно-правовая база и запреты на использование антибиотиков»

- Серьезной проблемой на рынке антибиотиков и противомикробных препаратов для животных является ужесточение глобальных правил использования антибиотиков, особенно у животных, используемых для производства продуктов питания, для борьбы с устойчивостью к противомикробным препаратам.

- Многие страны запретили использование антибиотиков в качестве стимуляторов роста и вводят более строгие стандарты контроля остатков, что делает соблюдение этих норм более строгим для производителей.

- Такое нормативное давление часто приводит к увеличению производственных затрат, изменению рецептуры продукции и ограничению доступности продукции на определенных рынках.

- Например, в 2023 году Европейский союз ввел полный запрет на использование важных с медицинской точки зрения антибиотиков для профилактического использования в животноводстве, что привело к изменению рецептур по всей цепочке поставок.

- Хотя эти меры направлены на защиту здоровья людей и животных, они создают краткосрочные препятствия для компаний, стремящихся обеспечить соответствие региональным нормам и переформулировать портфели продуктов.

Рынок антибиотиков для животных и противомикробных препаратов

Рынок сегментирован по продукту, типу, способу доставки и виду животных.

|

Сегментация |

Субсегментация |

|

По продукту |

|

|

По типу |

|

|

По способу доставки |

|

|

По типу животного |

|

Ожидается, что в 2025 году противомикробный препарат будет доминировать на рынке, занимая наибольшую долю в сегменте

Ожидается, что сегмент противомикробных препаратов будет доминировать на рынке противомикробных препаратов для животных с наибольшей долей рынка в 45,44% в 2025 году. Поскольку эти препараты используются для профилактики и лечения инфекционных заболеваний у животных, они применимы для различных видов животных, включая домашний скот, домашнюю птицу и домашних животных.

Ожидается, что в прогнозируемый период наибольшая доля в сегменте животных будет приходиться на птицу.

Ожидается, что в 2025 году сегмент птицеводства будет доминировать на рынке с наибольшей долей рынка в 41,22% из-за их использования в кормах для птиц или воде, эти вещества помогают предотвращать и лечить инфекции у кур, уток и других птиц. Они поддерживают здоровье и благополучие животных, одновременно способствуя лучшим темпам роста.

Региональный анализ рынка антибиотиков для животных и противомикробных препаратов

«Северная Америка занимает самую большую долю на рынке противомикробных препаратов для животных»

- Ожидается, что Северная Америка будет доминировать на мировом рынке противомикробных препаратов для животных с самой большой долей рынка в 37,37%, что обусловлено наличием известных производителей, передовой исследовательской инфраструктуры и надежными инвестициями в сельскохозяйственную науку и ветеринарную медицину.

- США лидируют в регионе, чему способствуют высокий спрос на продукцию для здоровья животных, существенное финансирование сельскохозяйственных исследований и хорошо развитая ветеринарная фармацевтическая промышленность.

- Ожидается, что постоянные инновации в области ветеринарной диагностики, растущее внимание к устойчивым методам ведения сельского хозяйства и стратегическое партнерство между академическими учреждениями и лидерами отрасли сохранят лидирующие позиции Северной Америки в течение всего прогнозируемого периода.

«Прогнозируется, что в Азиатско-Тихоокеанском регионе будет зарегистрирован самый высокий среднегодовой темп роста на рынке антибиотиков для животных»

- Ожидается, что в Азиатско-Тихоокеанском регионе будут зарегистрированы самые высокие совокупные годовые темпы роста (CAGR) на рынке противомикробных препаратов для животных, что обусловлено расширением инфраструктуры здравоохранения, повышением спроса на продукцию для здоровья животных и ростом инвестиций в ветеринарную помощь.

- Такие страны, как Китай, Индия и Япония, вносят ключевой вклад, а такие национальные инициативы, как «Сделано в Китае 2025» и индийская «Аюшман Бхарат», способствуют развитию местных инноваций и производства в сфере ветеринарии, включая антибиотики и противомикробные препараты.

- Быстрая модернизация сельскохозяйственных методов в Китае и Индии в сочетании с растущим внедрением передовых диагностических технологий позиционирует Азиатско-Тихоокеанский регион как регион со значительным ростом производства ветеринарной продукции.

Антибиотики для животных Антимикробные препараты Доля рынка

Конкурентная среда рынка содержит сведения о конкурентах. Включены сведения о компании, ее финансах, полученном доходе, рыночном потенциале, инвестициях в исследования и разработки, новых рыночных инициативах, глобальном присутствии, производственных площадках и объектах, производственных мощностях, сильных и слабых сторонах компании, запуске продукта, широте и широте продукта, доминировании приложений. Приведенные выше данные касаются только фокуса компаний на рынке.

Основными лидерами рынка, работающими на рынке, являются:

- Берингер Ингельхайм Интернешнл ГмбХ (Германия)

- Zoetis Services LLC (США)

- Эланко (США)

- Merck & Co. Inc. (США)

- Корпорация Phibro Animal Health (США)

- Вирбак (Франция)

- Ветохинол (Франция)

- HIPRA (Испания)

- Сева (Франция)

- Дехра (Великобритания)

- Kyoritsuseiyaku Seiyaku Corporation (Япония)

- Китайская группа животноводства (Китай)

- Endovac Animal Health (США)

- Группа Zydus (Индия)

- Indian Immunologicals Ltd (Индия)

- UCBVET - Saúde Animal (США)

- American Reagent Inc. (США)

- Корпорация Neogen (США)

- Huvepharma (США)

- Ashish Life Science (Индия)

- Inovet (Бельгия)

- Лютим Фарма Прайвет Лимитед (Индия)

- ECO - Animal Health Ltd (США)

Последние разработки на мировом рынке противомикробных препаратов для животных

- В мае 2023 года Bayer AG представила новый антибиотик, цефтиофур, цефалоспорин третьего поколения, предназначенный для лечения множественных инфекций животных, таких как респираторные, мочевыводящие пути и кожные инфекции. Ожидается, что этот запуск укрепит позиции Bayer в сегменте ветеринарных антибиотиков

- В апреле 2023 года Elanco Animal Health объявила о запуске Draxxin, инъекционного антибиотика для однократного ежедневного применения, разработанного для борьбы с серьезными грамотрицательными бактериальными инфекциями, включая E. coli и Klebsiella pneumoniae. Продукт расширяет портфолио Elanco для лечения опасных для жизни инфекций у скота

- В марте 2023 года Virbac выпустила Synulox — антибиотик широкого спектра действия, предназначенный для лечения респираторных, мочеполовых и кожных инфекций у животных. Этот продукт призван поддержать рост компании в сегментах лечения домашних и сельскохозяйственных животных.

- В феврале 2023 года компания Boehringer Ingelheim GmbH представила препарат Клавамокс — комбинированный антибиотик, содержащий амоксициллин и клавулановую кислоту, предназначенный для широкого спектра инфекций животных. Добавление препарата Клавамокс расширяет возможности антибиотикотерапии для ветеринаров от Boehringer Ingelheim

- В январе 2023 года Ceva Santé Animale выпустила Энрофлоксацин — антибиотик широкого спектра действия, предназначенный для лечения респираторных, мочеполовых и кожных инфекций у животных. Этот продукт подтверждает приверженность Ceva предложению эффективных антимикробных решений для здоровья животных.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.