Global Carbon Fibre Tape Market

Размер рынка в млрд долларов США

CAGR :

%

USD

3.11 Billion

USD

7.23 Billion

2024

2032

USD

3.11 Billion

USD

7.23 Billion

2024

2032

| 2025 –2032 | |

| USD 3.11 Billion | |

| USD 7.23 Billion | |

|

|

|

|

Global Carbon Fibre Tape Market Segmentation, By Resin (Epoxy, PolyamideBismaleimide Resin, Thermoplastic Resin, and Other Resins), Form (Prepreg Tape and Dry Tape), Manufacturing Process (Hot Melt Process and Solvent Dip Process), End-user (Aerospace, Marine, Pipe and Tank, Sporting Goods, Construction and Infrastructure, and Others)- Industry Trends and Forecast to 2032

Carbon Fibre Tape Market Analysis

The carbon fiber tape market is experiencing significant growth due to its wide application across industries such as automotive, aerospace, construction, and sports equipment. Carbon fiber tape, known for its lightweight, high-strength, and durable properties, is increasingly used to replace traditional materials such as metals in applications requiring strength-to-weight ratio improvement. The growing demand for fuel-efficient vehicles, particularly in the automotive and aerospace sectors, is driving the adoption of carbon fiber tape as a material for lightweight components, such as body panels, seat frames, and aircraft interiors.

Recent advancements in carbon fiber tape technology have further fueled market growth. Innovations such as thermoplastic carbon fiber tapes, which offer enhanced processability and recyclability, are attracting attention from industries looking for cost-effective and eco-friendly solutions. For instance, Teijin Carbon Europe introduced a polyphenylene sulfide (PPS)-based carbon fiber thermoplastic tape that combines performance with sustainability. Additionally, developments in automated manufacturing techniques, such as continuous fiber reinforcement and adhesive bonding processes, are improving the efficiency and quality of carbon fiber tape production.

As demand for lightweight, high-performance materials grows and new applications emerge, the carbon fiber tape market is expected to expand rapidly, with technological advancements continuing to drive innovation and market adoption.

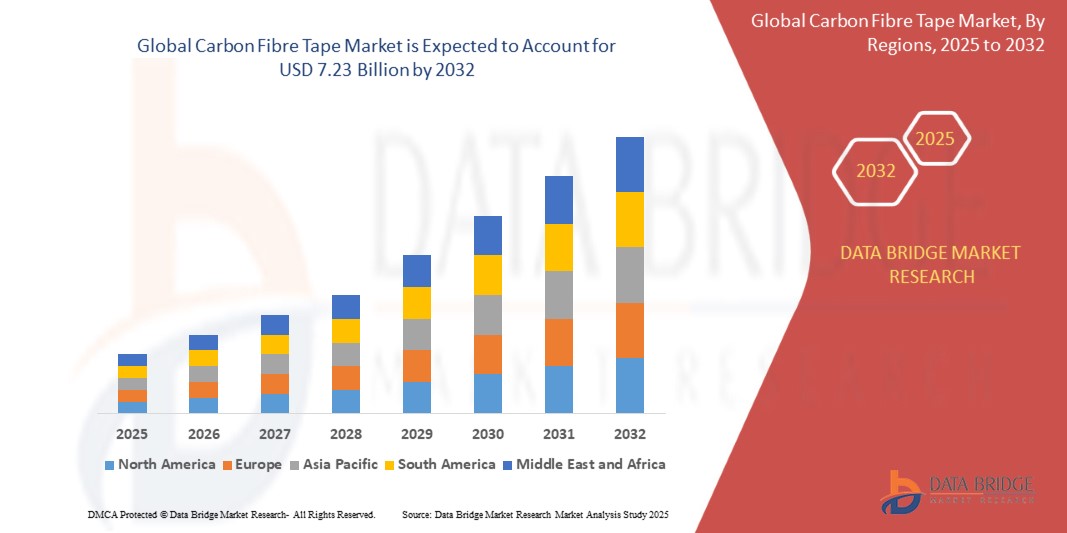

Carbon Fibre Tape Market Size

The global carbon fibre tape market size was valued at USD 3.11 billion in 2024 and is projected to reach USD 7.23 billion by 2032, with a CAGR of 11.12% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Carbon Fibre Tape Market Trends

“Growing Adoption of Thermoplastic Carbon Fiber Tapes”

One of the key trends driving the carbon fiber tape market is the growing adoption of thermoplastic carbon fiber tapes, which offer improved processability, recyclability, and cost-effectiveness. These advanced tapes, such as Teijin's Tenax TPUD, are gaining traction due to their ability to maintain the high strength and lightweight properties of traditional carbon fiber while providing easier handling during manufacturing. The ability to store and ship these tapes at room temperature, coupled with their flame-retardant and low smoke emission characteristics, makes them ideal for industries such as aerospace and automotive, where lightweight and safe materials are crucial. The demand for such tapes is rising in applications such as aircraft interiors and automotive body parts, where reducing weight is essential for fuel efficiency and performance. As sustainability continues to be a top priority, the recyclability of thermoplastic carbon fiber tapes aligns with the increasing emphasis on eco-friendly manufacturing processes, presenting a major opportunity for market expansion.

Report Scope and Carbon Fibre Tape Market Segmentation

|

Attributes |

Carbon Fibre Tape Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Hexcel Corporation (U.S.), Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Japan), SABIC (Saudi Arabia), TEIJIN LIMITED. (Japan), Solvay (Belgium), Zoltek Corporation (U.S.), SGL Carbon (Germany), Evonik Industries AG (Germany), Plastic Reinforcement Fabrics (U.K.), TCR Composites, Inc. (U.S.), Chomarat NA (U.S.), Celanese Corporation (U.S.), Cristex Composite Materials (U.K.), and Eurocarbon B.V. (Netherlands) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Carbon Fibre Tape Market Definition

Carbon fiber tape is a type of high-performance material made from continuous carbon fibers that are woven into a tape format, often coated with resin for added strength and durability. It is known for its lightweight, high-strength, and stiffness properties. Carbon fiber tape is especially valued in applications that require high tensile strength, flexibility, and resistance to temperature extremes, moisture, and chemicals. The material can be used in both composite manufacturing and as a standalone reinforcement solution, offering superior performance in demanding environments.

Carbon Fibre Tape Market Dynamics

Drivers

- Increasing Demand for Lightweight Materials

The increasing demand for lightweight materials is a major driver of the carbon fiber tape market, especially in sectors such as automotive, aerospace, and construction. As industries seek ways to improve fuel efficiency, reduce emissions, and enhance performance, carbon fiber tape offers an ideal solution due to its excellent strength-to-weight ratio. For instance, in the automotive industry, car manufacturers such as BMW use carbon fiber tape in the production of lightweight components such as body panels and chassis to reduce vehicle weight, which directly improves fuel efficiency and overall performance. Similarly, in aerospace, carbon fiber tape is used to manufacture lighter, more fuel-efficient aircraft parts, helping airlines reduce operational costs and meet sustainability goals. As the push for energy-efficient and high-performance materials intensifies, carbon fiber tape’s ability to meet these demands positions it as a key material in the ongoing transformation of these industries, further fueling its market growth.

- Increasing Demand for Fuel efficiency and sustainability

Fuel efficiency and sustainability are becoming central concerns across industries, driving the growing demand for carbon fiber tape. As manufacturers strive to reduce carbon footprints and enhance energy efficiency, carbon fiber tape’s lightweight and durable properties offer significant advantages in producing fuel-efficient vehicles and aircraft. For instance, Boeing uses carbon fiber tape in its aircraft components to reduce weight, which contributes to lower fuel consumption and reduced emissions, helping meet sustainability goals. Similarly, in the automotive sector, companies such as Ford are adopting carbon fiber tape in vehicle manufacturing to decrease weight and improve fuel efficiency, aligning with growing consumer and regulatory demands for greener solutions. Moreover, the recyclability of carbon fiber tape makes it an even more attractive choice, as companies can reuse materials, reducing waste and promoting circular manufacturing. As the emphasis on sustainability increases across sectors, carbon fiber tape is becoming a crucial material, driving market growth as industries prioritize environmentally responsible solutions.

Opportunities

- Increasing Advancements in Manufacturing Technology

Advancements in manufacturing technology, particularly the development of thermoplastic carbon fiber tapes, are creating a significant market opportunity by improving both the cost-effectiveness and ease of use of carbon fiber materials. These innovations enable manufacturers to produce high-performance components more efficiently and at a lower cost, broadening the potential applications of carbon fiber tape. For instance, Teijin Carbon Europe's Tenax TPUD, a thermoplastic carbon fiber tape, offers enhanced recyclability, flame-retardant properties, and easier handling, making it an attractive choice for industries such as automotive and aerospace. These advancements have made carbon fiber tapes more accessible to companies that may have previously found the material cost-prohibitive, thus driving adoption across a range of industries seeking lightweight, durable, and sustainable solutions. As a result, the increasing accessibility of advanced carbon fiber tape technologies is opening up new opportunities for market growth, particularly in sectors looking to reduce weight and enhance performance while maintaining cost efficiency.

- Growing Automotive and Aerospace Sectors

The growth in the automotive and aerospace sectors presents a significant market opportunity for carbon fiber tape, as both industries increasingly rely on high-performance materials to enhance performance, safety, and durability. Carbon fiber tape’s strength-to-weight ratio makes it an ideal solution for critical components such as body panels, seat frames, and aircraft interiors, where reducing weight is crucial for improving fuel efficiency and overall performance. For instance, Boeing and Airbus have incorporated carbon fiber tape into their aircraft designs to reduce weight and enhance fuel efficiency while maintaining structural integrity. Similarly, in the automotive sector, companies such as Tesla use carbon fiber tape in electric vehicle (EV) components to reduce weight, improving both energy efficiency and acceleration. As the demand for lightweight, fuel-efficient, and high-performance vehicles and aircraft continues to rise, carbon fiber tape is well-positioned to capture significant market share, driving innovation and adoption in these key sectors. This growing trend presents a substantial opportunity for manufacturers to expand their use of carbon fiber tape in various applications.

Restraints/Challenges

- High Production Costs

High production costs represent a significant market challenge for the carbon fiber tape industry, primarily driven by the expensive raw materials, such as carbon fibers, and the advanced manufacturing technologies required to produce high-quality tapes. The production of carbon fiber itself is energy-intensive and involves complex processes such as spinning and curing, which increase costs. For instance, carbon fiber production can cost several hundred dollars per kilogram, whereas alternatives such as fiberglass or steel are considerably less expensive. This price disparity makes carbon fiber tape less accessible for industries with tight budgets, such as automotive and construction. For instance, in the automotive sector, manufacturers are increasingly using carbon fiber for lightweight parts to improve fuel efficiency and performance. However, the high production costs of carbon fiber tape limit its widespread adoption in mass-market vehicles, as automakers need to balance performance with production cost constraints. As a result, carbon fiber tape’s high manufacturing costs restrict its use to high-end or niche products, keeping it out of more cost-sensitive industries and limiting its market penetration. This cost barrier directly links to the broader challenge of scaling up carbon fiber tape adoption across industries, preventing its full market potential from being realized.

- Competition from Alternative Materials

Competition from alternative materials is a significant market challenge for the carbon fiber tape industry, as materials such as fiberglass, aramid fibers (such as Kevlar), and thermoplastic composites offer comparable performance in many applications but at a lower cost and with easier processing. For instance, fiberglass is often used in automotive and construction industries as a lightweight, durable material, and it is significantly less expensive than carbon fiber tape. While carbon fiber offers superior strength-to-weight ratio and stiffness, the higher costs associated with its production make it less attractive for industries where budget constraints are tight. Aramid fibers, on the other hand, are known for their toughness and impact resistance, making them a popular choice for applications such as protective clothing and body armor, areas where carbon fiber might not be cost-effective. Additionally, thermoplastic composites are increasingly used due to their ease of processing, lower weight, and recyclability, posing a challenge to carbon fiber tape in industries focused on sustainability. As a result, these alternative materials limit carbon fiber tape’s market share in sectors where cost, manufacturing efficiency, and ease of use are prioritized over the superior performance offered by carbon fiber, making competition from these materials a key challenge in the market.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Carbon Fibre Tape Market Scope

The market is segmented on the basis of resin, form, manufacturing process, and end-user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Resin

- Epoxy

- Polyamide

- Bismaleimide Resin

- Thermoplastic Resin

- Other Resins

Form

- Prepreg Tape

- Dry Tape

Manufacturing process

- Hot Melt Process

- Solvent Dip Process

End-user

- Aerospace

- Marine

- Pipe and Tank

- Sporting Goods

- Construction and Infrastructure

- Others

Carbon Fibre Tape Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, resin, form, manufacturing process, and end-user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the market, primarily driven by the significant market share of the U.S. in the carbon fiber tape industry. This growth is fueled by the increasing demand for lightweight materials across various sectors, including automotive, aerospace, and sports equipment. Additionally, the availability of favorable conditions, such as low interest rates on carbon fiber materials, has further boosted the adoption of these advanced materials. As industries continue to prioritize performance, fuel efficiency, and sustainability, the U.S. remains a key player in the expanding carbon fiber tape market.

European market is anticipated to experience the fastest compound annual growth rate (CAGR), driven by strong demand for advanced materials such as carbon fiber tape across industries such as automotive, aerospace, and construction. The region’s focus on sustainability, innovation, and the shift towards lightweight, high-performance materials is fueling this growth. Additionally, government regulations promoting eco-friendly manufacturing practices are encouraging the adoption of carbon fiber solutions. With ongoing advancements in technology and a growing emphasis on reducing carbon footprints, Europe is poised for significant expansion in the carbon fiber tape market.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Carbon Fibre Tape Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Carbon Fibre Tape Market Leaders Operating in the Market Are:

- Hexcel Corporation (U.S.)

- Mitsubishi Chemical Carbon Fiber and Composites, Inc. (Japan)

- SABIC (Saudi Arabia)

- TEIJIN LIMITED. (Japan)

- Solvay (Belgium)

- Zoltek Corporation (U.S.)

- SGL Carbon (Germany)

- Evonik Industries AG (Germany)

- Plastic Reinforcement Fabrics (U.K.)

- TCR Composites, Inc. (U.S.)

- Chomarat NA (U.S.)

- Celanese Corporation (U.S.)

- Cristex Composite Materials (U.K.)

- Eurocarbon B.V. (Netherlands)

Latest Developments in Carbon Fibre Tape Market

- In January 2022, TORAY INDUSTRIES INC. introduced a new analytical technique designed to assess multi-material structures using unidirectional adhesive tape, providing enhanced precision in material analysis and applications

- In November 2021, Solvay and 9T Labs AG entered into a partnership to advance the development of carbon fiber-reinforced materials, including polyetheretherketone (CF/PEEK), bio-based high-performance polyamides, and polyphenylene sulfide (CF/PPS) composites. This collaboration significantly broadens 9T Labs' portfolio of carbon fiber-reinforced materials, offering customers a wider range of advanced solutions

- In May 2021, Teijin Carbon Europe launched a new polyphenylene sulfide (PPS)-based carbon fiber thermoplastic unidirectional pre-impregnated tape (TPUD). The Tenax TPUD with PPS matrix offers access to cost-sensitive markets while maintaining key benefits such as chemical resistance, low flammability, room-temperature storage, and recyclability. Its flame-retardant properties make it ideal for applications such as aircraft interiors and rail carriages

- In September 2020, Jiangsu Hansu introduced a new line of unidirectional composite tapes made from continuous carbon fiber and SABIC's ULTEM 1000F3SP powder. These tapes, designed for high-performance aerospace applications such as seat frames and baggage compartments, provide a lightweight, sustainable alternative to metals, supporting goals for reduced weight and increased fuel efficiency in the aviation industry

- In January 2020, Hexcel collaborated with Madshus, a leader in cross-country skiing innovation, to supply three different Hi Tape products for the design of various ski types. Hexcel's HiTape dry carbon tapes enhance the performance, manufacturing efficiency, and surface finish of Madshus skis, advancing the technology used in high-performance skiing equipment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.