Global Packaging Foams Market

Размер рынка в млрд долларов США

CAGR :

%

USD

35.21 Billion

USD

67.63 Billion

2024

2032

USD

35.21 Billion

USD

67.63 Billion

2024

2032

| 2025 –2032 | |

| USD 35.21 Billion | |

| USD 67.63 Billion | |

|

|

|

|

Global Packaging Foams Market Segmentation, By Type (Flexible Foam, Rigid Foam), Material Type (Polyurethane Foam, Polyolefin Foam, Others), Service Type (Food Service, Protective Packaging, Others), Application (Inserts, Corner and Edge Protectors, Antistatic ESD Foam, Liners, Others), End User (Medical and Pharmaceutical, Food and Beverages, Aerospace and Defense, Automotive, Electrical and Electronics, Personal Care, Consumer Packaging, Others), - Industry Trends and Forecast to 2032

Packaging Foams Market Size

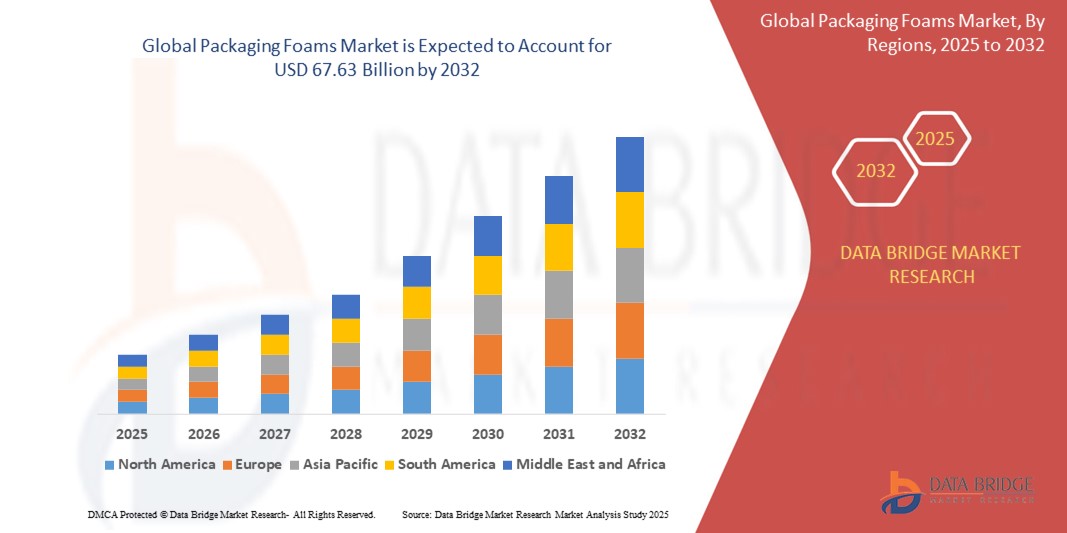

- The global Packaging Foams market size was valued atUSD 35.21 billion in 2024and is expected to reachUSD 67.63 billion by 2032, at aCAGR of 8.50%during the forecast period

- This growth is driven by factors such as the rise in the manufacturing and production of various products, increase in the need to ensure safe packaging

Packaging Foams Market Analysis

- Packaging foams are essential materials used in protecting fragile and sensitive goods during transportation and storage, offering cushioning, insulation, and shock absorption. They are widely used across industries including electronics, automotive, food, and pharmaceuticals

- The demand for packaging foams is significantly driven by the growth of e-commerce, increased global trade, and heightened awareness of protective packaging solutions to reduce product damage

- North America is expected to dominate the Packaging Foams market due to a strong logistics network, high demand from the electronics and automotive sectors, and the presence of leading packaging companies

- Asia-Pacific is expected to be the fastest growing region in the Packaging Foams market during the forecast period due to rapid industrialization, growth in manufacturing sectors, and rising e-commerce activities in countries like China and India

- Polyurethane (PU) foam segment is expected to dominate the market with a market share of 48.67% due to its superior cushioning properties, versatility, and widespread use in both flexible and rigid packaging applications

Report Scope and Packaging Foams Market Segmentation

|

Attributes |

Packaging Foams KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• BASF SE (Germany) • Atlas Molded Products (U.S.) • ARMACELL LLC (Germany) • Sealed Air (U.S.) • KANEKA CORPORATION (Japan) • Borealis AG (Austria) • Recticel NV/SA (Belgium) • Rogers Corporation (U.S.) • Synthos (Poland) • Total (France) • Zotefoams plc (U.K.) • Foamcraft, Inc. (U.S.) • Hanwha Advanced Materials America (U.S.) • BEWiSynbra Group (Sweden) • Tosoh Corporation (Japan) • UFP Technologies, Inc. (U.S.) • Dow (U.S.) • RAJAPACK Ltd (U.K.) • JSP (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Packaging Foams Market Trends

“Sustainability and Innovation in Packaging Foam Materials”

- One prominent trend in the packaging foams market is the increasing focus on sustainability, with companies developing biodegradable, recyclable, and eco-friendly foam materials to reduce environmental impact.

- These innovations help meet the rising demand for sustainable packaging solutions while adhering to regulatory pressures for reducing plastic waste.

- For instance, bio-based foams and foams made from recycled materials are gaining traction, offering similar performance characteristics to conventional foams but with a significantly lower carbon footprint.

- These advancements are reshaping the packaging industry by aligning with global sustainability goals, offering a competitive edge for companies adopting eco-conscious production practices.

Packaging Foams Market Dynamics

Driver

“Growing Need Due to Surge in E-commerce and Packaging Demands”

- The rapid growth of e-commerce is significantly contributing to the increased demand for packaging foams, as online shopping increases the need for protective packaging to ensure safe delivery of fragile goods.

- As more people purchase items online, there is a greater reliance on packaging solutions that offer both protection and cost-effectiveness for shipping a wide variety of products.

- This trend is particularly pronounced in industries such as electronics, automotive, and consumer goods, where the risk of damage during transit is higher.

For instance,

- In December 2023, the global e-commerce market saw a surge in demand for innovative packaging solutions, with packaging foam materials being identified as one of the most effective methods for protecting products during shipping. The demand for packaging foam is expected to rise in parallel with the e-commerce boom.

- As a result of this demand, packaging foam manufacturers are being pushed to develop better, more efficient, and environmentally friendly solutions to cater to the growing e-commerce market

Opportunity

“Advancements in Eco-Friendly and Sustainable Foam Materials”

- Companies are focusing on developing biodegradable, recyclable, and renewable foam materials to meet the rising demand for sustainable packaging solutions.

- With increased environmental awareness and stricter regulations regarding plastic waste, the development of sustainable packaging foams offers a major opportunity for market growth.

- Innovations such as plant-based foams and foams made from recycled content provide an alternative to traditional petroleum-based foams, aligning with global sustainability goals

For instance,

- In January 2024, companies like BASF SE and Dow announced new initiatives to produce foam materials from renewable resources, significantly reducing the carbon footprint of their products and offering a more sustainable option for the packaging industry.

- The growing preference for eco-friendly products presents an opportunity for packaging foam manufacturers to expand their market share by providing greener alternatives that appeal to environmentally conscious consumers..

Restraint/Challenge

“Cost and Supply Chain Challenges for Raw Materials”

- the cost of raw materials used in the production of packaging foams can be a significant challenge for manufacturers, especially as global supply chain disruptions affect the availability and pricing of these materials.

- Rising costs of petroleum-based products, used in many types of foam, and fluctuations in the availability of biodegradable alternatives can hinder the growth of the packaging foams market.

- Additionally, transportation costs and labor shortages in certain regions can further impact manufacturing and distribution, leading to potential delays and higher production costs.

For instance,

- In November 2023, supply chain disruptions caused by global events led to an increase in raw material costs, directly impacting the price of packaging foams. Companies in North America and Europe reported challenges in meeting demand due to shortages of key materials.

- These challenges can lead to higher prices for packaging foams, which may deter small and medium-sized businesses from adopting high-quality foam solutions, thereby limiting market penetration.

Packaging Foams Market Scope

The market is segmented on the basis Type, Material Type, Service Type, Application, end user,

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material Type |

|

|

By Service Type |

|

|

By Application

|

|

|

By end user |

|

In 2025, theflexible foam is projected to dominate the market with the largest share in the Type segment

The flexible foam segment is expected to dominate the Packaging Foams market with the largest share of 56.22% in 2025 due to its superior cushioning, adaptability, and lightweight characteristics. Flexible foams are widely used across various industries, especially in protective packaging for electronics, consumer goods, and automotive parts. The continued rise in e-commerce and increasing demand for reliable product protection are driving the segment’s dominance. Innovations in sustainable flexible foam materials further strengthen its market position.

TheFood & Beverage is expected to account for the largest share during the forecast period in the End-Use Industry segment

In 2025, the Food & Beverage segment is expected to dominate the market with the largest market share of 51.31% due to the high demand for insulated and hygienic packaging to preserve food quality and extend shelf life. Packaging foams offer excellent thermal insulation and shock absorption, making them ideal for transporting perishable goods. The growing focus on food safety, coupled with the expansion of food delivery services and cold chain logistics, contributes significantly to the dominance of this segment.

Packaging Foams Market Regional Analysis

“North America Holds the Largest Share in the Packaging Foams Market”

- North America dominates the Packaging Foams market, driven by a strong presence of e-commerce, advanced manufacturing sectors, and high demand for protective and insulating packaging solutions across industries such as electronics, automotive, and healthcare

- The U.S. holds a significant share due to the presence of major packaging foam manufacturers, rapid technological advancements in foam materials, and a robust distribution network supporting diverse end-use industries

- Favorable regulatory policies supporting sustainable packaging and growing consumer preference for convenience and safe delivery are accelerating market demand

- In addition, rising demand for temperature-sensitive packaging in the pharmaceutical and food & beverage sectors is boosting the adoption of packaging foams across the region

“Asia-Pacific is Projected to Register the HighestCAGR in the Packaging Foams Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the Packaging Foams market, driven by expanding industrialization, growing e-commerce activity, and increasing consumption of packaged goods

- Countries such as China, India, and Japan are emerging as key markets due to rapid urbanization, rising middle-class income, and growing demand for protective packaging in sectors like electronics and consumer goods

- Japan, with its focus on innovation and high standards in manufacturing, continues to adopt advanced foam technologies for precision packaging in high-value industries

- China and India, with their vast consumer bases and growing export industries, are seeing a surge in demand for efficient, lightweight, and cost-effective foam packaging solutions. Government initiatives supporting industrial growth and improved logistics infrastructure further support market expansion in the region

Packaging Foams Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Type dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Arkema (France)

- BASF SE (Germany)Atlas Molded Products (U.S.)

- ARMACELL LLC (Germany)

- Sealed Air (U.S.)

- KANEKA CORPORATION (Japan)

- Borealis AG (Austria)

- Recticel NV/SA (Belgium)

- Rogers Corporation (U.S.)

- Synthos (Poland)

- Total (France)

- Zotefoams plc (U.K.)

- Foamcraft, Inc. (U.S.)

- Hanwha Advanced Materials America (U.S.)

- BEWiSynbra Group (Sweden)

- Tosoh Corporation (Japan)

- UFP Technologies, Inc. (U.S.)

- Dow (U.S.)

- RAJAPACK Ltd (U.K.)

- JSP (Japan)

Latest Developments in Global Packaging Foams Market

- In March 2025, Sealed Air Corporation announced the launch of its new EcoPure foam packaging line, made with over 60% post-consumer recycled content. This new product is designed to meet increasing regulatory and consumer demands for sustainable packaging while maintaining the same high-performance protection standards. EcoPure is targeted toward electronics, appliances, and e-commerce packaging applications, aligning with Sealed Air’s sustainability roadmap to achieve 100% recyclable or reusable packaging by 2025.

- In January 2025, BASF SE revealed the expansion of its Styroflex plant in Ludwigshafen, Germany, to meet growing global demand for flexible packaging foams. The expansion will increase production capacity by 30%, allowing BASF to serve customers more efficiently in key markets such as food packaging, medical insulation, and protective packaging. Styroflex is a key component in lightweight, flexible foams offering excellent mechanical properties and environmental compatibility.

- In December 2024, Zotefoams plc introduced its latest high-performance closed-cell foam series, ZOTEK F HT, engineered specifically for high-temperature packaging applications. These foams are ideal for electronics and aerospace components requiring superior thermal insulation and chemical resistance. The product line is also fully recyclable and supports Zotefoams’ initiative toward circular economy packaging solutions.

- In October 2024, Armacell LLC partnered with a major Asian electronics manufacturer to co-develop customized anti-static polyethylene foam packaging solutions. These foams are tailored for precision electronic components, providing advanced ESD protection and form-fitting designs to reduce damage during transit. The partnership aims to expand Armacell’s footprint in the Asia-Pacific region, where demand for electronics packaging continues to grow rapidly.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.