Global Rfid Barcode Printer Market

Размер рынка в млрд долларов США

CAGR :

%

USD

10.30 Billion

USD

17.30 Billion

2024

2032

USD

10.30 Billion

USD

17.30 Billion

2024

2032

| 2025 –2032 | |

| USD 10.30 Billion | |

| USD 17.30 Billion | |

|

|

|

|

Global Radio Frequency Identification (RFID) and Barcode Printer Market, By Type (Barcode & RFID Printers), Printing Technology (Thermal Transfer, Direct Thermal, Inkjet), Printing Resolution (Below 300 dpi, Between 301 and 600 dpi, Above 601 dpi), Connectivity Type (Ethernet, Bluetooth, Serial and Parallel, Universal Serial Bus), Application (Manufacturing, Retail, Transportation and Logistics, Healthcare, Government, Entertainment, Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) - Industry Trends and Forecast to 2032

Radio Frequency Identification (RFID) and Barcode Printer Market Size

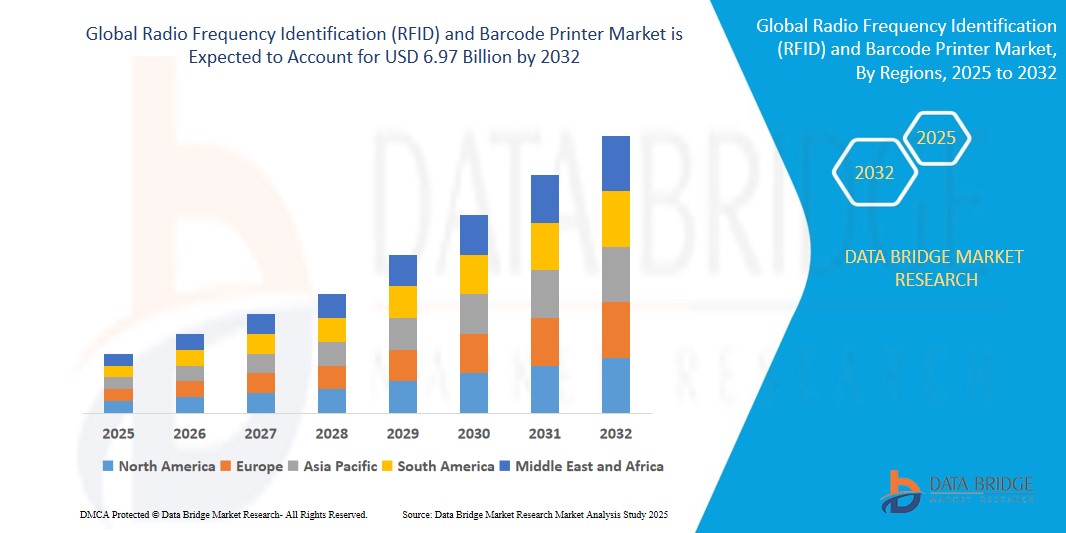

- The Global Radio Frequency Identification (RFID) and Barcode Printer Market size was valued atUSD 4.15 billion in 2024 and is expected to reachUSD 6.97 billion by 2032, at aCAGR of 6.70%during the forecast period

- This growth is driven by factors such as the increase in need for improvement in inventory management across the globe

Radio Frequency Identification (RFID) and Barcode Printer Market Analysis

- RFID and barcode printers play a pivotal role in enhancing supply chain visibility, asset tracking, inventory management, and operational efficiency across various industries including retail, healthcare, manufacturing, logistics, and transportation. These printers facilitate accurate data capture and real-time information access, thereby reducing human error and improving productivity.

- Market growth is driven by the increasing need for automated identification and data capture (AIDC), rising demand for real-time inventory tracking, growing adoption of smart labelling, and advancements in printing technologies.

- North America is expected to lead the global RFID and Barcode Printer market due to robust retail and e-commerce infrastructure, widespread implementation of warehouse automation, and early technological adoption across industries.

- The Asia Pacific region is projected to witness the fastest growth, fueled by rapid industrialization, expansion of manufacturing and logistics sectors, and increasing government focus on digitalization and smart manufacturing initiatives.

- The RFID printers segment holds the largest market share of 50.80% due to the increasing demand for RFID-printed labels in the supply chains of the retail and healthcare industries is the key factor contributing to the high growth of this segment of the market.

Report Scope and Radio Frequency Identification (RFID) and Barcode Printer Market Segmentation

|

Attributes |

Hazardous Area Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Radio Frequency Identification (RFID) and Barcode Printer Market Trends

“Integration of RFID with IoT and Cloud Platforms for Real Time Visibility”

- A key trend reshaping the RFID and barcode printer market is the integration of RFID systems with Internet of Things (IoT) and cloud platforms, enabling end to end visibility and real-time data tracking across supply chains and production environments

- These integrations enhance automation, improve asset utilization, and support predictive analytics for operations and inventory management

- For instance, in January 2025, several leading logistics companies in Germany deployed cloud-connected RFID printers integrated with IoT sensors to track shipment conditions and movement in real-time. The result was a significant reduction in inventory shrinkage and enhanced operational transparency

- The growing trend of Industry 4.0 is further accelerating demand for smart, connected printing solutions that feed live data into centralized platforms for agile decision-making.

Radio Frequency Identification (RFID) and Barcode Printer Market Dynamics

Driver

“Surge in Demand for Accurate Inventory and Asset Management Across Industries”

- Increasing demand for real-time inventory tracking, asset monitoring, and error-free labeling in industries such as retail, healthcare, and manufacturing is driving the adoption of RFID and barcode printers.

- The need for operational efficiency, reduced labor costs, and improved customer satisfaction is pushing businesses toward automated printing and tagging solutions.

- For instance, In March 2025, a global retail chain upgraded its warehouse management system by deploying high speed barcode printers across 50 locations. This allowed faster product labeling and improved inventory accuracy, resulting in a 20% boost in order fulfillment efficiency.

- As digital transformation becomes a priority, RFID and barcode printers are becoming core components in modern logistics and production ecosystems.

Opportunity

“Expansion of RFID in Emerging Economies and Smart Manufacturing”

- The increasing penetration of RFID technology in emerging markets, driven by government digitalization initiatives and investments in smart manufacturing, presents a significant growth opportunity

- Small and medium enterprises (SMEs) are also beginning to adopt cost-effective RFID and barcode printing solutions to enhance traceability and meet global compliance standards.

- For instance, In February 2025, India’s Ministry of Commerce partnered with technology firms to implement RFID-based tracking systems in the country’s textile export sector. RFID printers were deployed to label and monitor goods through the entire export cycle, improving traceability and reducing fraud.

- The growing adoption of Industry 4.0 and government-backed smart factory programs is expected to fuel demand for advanced RFID printing technologies in Asia-Pacific and Latin America.

Restraint/Challenge

“High Initial Cost and Integration Complexity in Legacy Systems”

- One of the key challenges hampering market growth is the high upfront cost of RFID systems and printers, particularly for small businesses and budget constrained organizations.

- Additionally, integrating modern RFID and barcode printers into legacy IT infrastructure can be complex, requiring significant time, expertise, and system compatibility checks.

- For Instance, In 2024, a mid sized logistics firm in South Africa reported project delays and cost overruns while integrating RFID printers with their outdated warehouse management system. Lack of software compatibility and staff training extended the implementation timeline by four months.

- While these barriers do not halt adoption, they require tailored implementation strategies, vendor support, and long-term ROI planning to overcome.

Radio Frequency Identification (RFID) and Barcode Printer Market Scope

The market is segmented on the basis, product and industry.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Printing Technology |

|

|

By Printing Resolution |

|

|

By Connectivity Type |

|

|

By Application |

|

In 2025, RFID printers are projected to dominate the market, holding the largest share within the type segment.

The increasing demand for RFID printed labels in the supply chains of the retail and healthcare industries is the key factor contributing to the high growth of this segment of the market. RFID printed labels and tags are used in various industries such as transportation and logistics, healthcare, and transportation to track and assess information related to the assets using radiofrequency in real time.

The retail industry is expected to account for the largest share in the application segment during the forecast period.

RFID and barcode labels or tags help retailers in handling retail printing requirements. POS printers are designed to provide printing solutions for tasks at the front and back of stores, along with catering to the requirements of online/e-commerce retail applications.Retailers use labels or tags for improving operational efficiency and customer satisfaction through the timely delivery of products, as well as with improved management of assets in stores.

Radio Frequency Identification (RFID) and Barcode Printer Market Regional Analysis

“North America Holds the Largest Share in the Radio Frequency Identification (RFID) and Barcode Printer Market”

- North America dominates the global RFID and barcode printer market, driven by advanced industrial infrastructure, widespread adoption of automation technologies, and high demand for real-time tracking across key sectors such as retail, logistics, healthcare, and manufacturing.

- The U.S. leads the region due to its mature e-commerce ecosystem, extensive supply chain networks, and strong presence of major technology providers offering integrated RFID and barcode solutions.

“Asia-Pacific is Projected to Register the Highest CAGR in the Radio Frequency Identification (RFID) and Barcode Printer Market”

- The Asia-Pacific region is expected to witness the fastest growth in the global RFID and barcode printer market, supported by rapid industrialization, expansion of manufacturing hubs, and increasing adoption of digital identification technologies across emerging economies.

- Countries like China, India, Japan, and South Korea are leading the charge, with growing investments in smart factories, logistics automation, and digital supply chain systems. In particular, China’s aggressive push toward Industry 4.0 and India’s initiatives like “Digital India” and Make in India are significantly boosting the adoption of RFID and barcode printing technologies

- The booming e-commerce sector in the region, coupled with the need for accurate product labeling, order fulfillment, and inventory management, is driving demand for high-speed, cost-effective printers.

Radio Frequency Identification (RFID) and Barcode Printer Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zebra Technologies Corp. (US)

- SATO Holdings Corporation (Japan)

- Honeywell International (US)

- Seiko Epson Corp. (Japan)

- AVERY DENNISON CORPORATION (US)

- BIXOLON (South Korea)

- GoDEX International (Taiwan)

- Toshiba Tec Corporation (Japan)

- Star Micronics (US)

- Printronix (US)

- Primera Technology (US

- Postek Electronics (China)

- Wasp Barcode Technologies (US)

- Brother International Corporation (US)

Latest Developments in Global Radio Frequency Identification (RFID) and Barcode Printer Market

- In March 2025, Zebra Technologies introduced the Zebra ZT620R Plus, a next generation RFID enabled industrial printer designed for high-volume and high speed printing in manufacturing and logistics environments. The product features improved encoding accuracy, rugged design for harsh environments, and native integration with enterprise IoT platforms. This launch addresses growing demand for smart automation in supply chain management, offering increased throughput and precision in real-time item tracking and inventory control.

- In February 2025, Honeywell announced the acquisition of SATO America's RFID printing division for USD 280 million, marking a strategic move to strengthen its position in the AIDC (Automatic Identification and Data Capture) market. The acquisition allows Honeywell to expand its product line with advanced RFID label printers and integrate SATO’s patented encoding technologies into its existing hardware ecosystem. This move aims to boost Honeywell’s market share in retail, healthcare, and manufacturing sectors where RFID adoption is surging.

- In January 2025, TSC Printronix Auto ID entered into a strategic partnership with Microsoft Azure to develop a cloud enabled print management platform for barcode and RFID printers. The collaboration enables users to monitor, configure, and manage printers remotely via secure cloud connections, ideal for multi-site retail, logistics, and healthcare operations. The partnership aligns with growing demand for centralized, IoT-enabled device management in enterprise environments

- In December 2024, Brother International launched the RJ 4250WB, a rugged, lightweight mobile barcode printer equipped with Bluetooth 5.0 and Wi-Fi Direct connectivity. Designed for field service and mobile workforce applications, the device allows high speed thermal printing of labels and receipts in real time. This innovation targets last mile delivery, law enforcement, and retail sectors, supporting growing trends in mobile and on the go operations.

- In November 2024, Chinese RFID printer manufacturer Postek formed a strategic collaboration with Alibaba Group to deploy RFID and barcode printing systems across Alibaba’s smart warehouses. The initiative integrates Postek’s RFID printers with Alibaba’s AI and warehouse robotics systems to streamline inventory tracking and reduce operational delays. This partnership highlights the role of RFID printing in supporting large-scale, AI-driven logistics infrastructures across e-commerce and fulfillment centers in Asia.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Интерактивная панель анализа данных

- Панель анализа компании для возможностей с высоким потенциалом роста

- Доступ аналитика-исследователя для настройки и запросов

- Анализ конкурентов с помощью интерактивной панели

- Последние новости, обновления и анализ тенденций

- Используйте возможности сравнительного анализа для комплексного отслеживания конкурентов

Методология исследования

Сбор данных и анализ базового года выполняются с использованием модулей сбора данных с большими размерами выборки. Этап включает получение рыночной информации или связанных данных из различных источников и стратегий. Он включает изучение и планирование всех данных, полученных из прошлого заранее. Он также охватывает изучение несоответствий информации, наблюдаемых в различных источниках информации. Рыночные данные анализируются и оцениваются с использованием статистических и последовательных моделей рынка. Кроме того, анализ доли рынка и анализ ключевых тенденций являются основными факторами успеха в отчете о рынке. Чтобы узнать больше, пожалуйста, запросите звонок аналитика или оставьте свой запрос.

Ключевой методологией исследования, используемой исследовательской группой DBMR, является триангуляция данных, которая включает в себя интеллектуальный анализ данных, анализ влияния переменных данных на рынок и первичную (отраслевую экспертную) проверку. Модели данных включают сетку позиционирования поставщиков, анализ временной линии рынка, обзор рынка и руководство, сетку позиционирования компании, патентный анализ, анализ цен, анализ доли рынка компании, стандарты измерения, глобальный и региональный анализ и анализ доли поставщика. Чтобы узнать больше о методологии исследования, отправьте запрос, чтобы поговорить с нашими отраслевыми экспертами.

Доступна настройка

Data Bridge Market Research является лидером в области передовых формативных исследований. Мы гордимся тем, что предоставляем нашим существующим и новым клиентам данные и анализ, которые соответствуют и подходят их целям. Отчет можно настроить, включив в него анализ ценовых тенденций целевых брендов, понимание рынка для дополнительных стран (запросите список стран), данные о результатах клинических испытаний, обзор литературы, обновленный анализ рынка и продуктовой базы. Анализ рынка целевых конкурентов можно проанализировать от анализа на основе технологий до стратегий портфеля рынка. Мы можем добавить столько конкурентов, о которых вам нужны данные в нужном вам формате и стиле данных. Наша команда аналитиков также может предоставить вам данные в сырых файлах Excel, сводных таблицах (книга фактов) или помочь вам в создании презентаций из наборов данных, доступных в отчете.