The expansion of global manufacturing and industrial output is a fundamental driver shaping demand in the pallets packaging market. As production volumes increase across sectors such as automotive, consumer goods, pharmaceuticals, chemicals, and electronics, the need for reliable and standardized load-handling solutions becomes critical. Pallets serve as the backbone of industrial logistics, enabling efficient movement of raw materials, semi-finished goods, and finished products within factories and across supply chains. This sustained rise in manufacturing activity directly translates into higher pallet consumption, as producers prioritize operational efficiency, damage prevention, and streamlined distribution in increasingly complex and high-volume industrial environments.

Access Full Report @ https://test.databridgemarketresearch.com/reports/global-pallets-packaging-market

For instance,

As reported by Industry Today in December 2025, growing globalization of trade and industrial production has intensified the movement of goods across supply chains, increasing demand for standardized pallets that ensure efficient handling, safe storage, and smooth transitions from factory floors to transportation systems in modern logistics networks.

As highlighted by UNIDO’s World Manufacturing Production and Trade Quarterly Report in December 2025, global manufacturing output increased in the third quarter of 2025, with production rising by 0.7% and manufacturing exports by 1.7% quarter-on-quarter, reflecting continued industrial expansion that supports pallet usage in transporting and distributing manufactured goods across international supply chains.

According to UNIDO’s Industrial Statistics Yearbook 2025, manufacturing expanded by about 2.9% in 2024 despite geopolitical and supply chain challenges, underlining how rising industrial output fuels increased requirement for efficient pallet packaging and material handling solutions in export and domestic logistics.

In conclusion, the expansion of global manufacturing and industrial output remains a foundational force underpinning demand in the pallets packaging market. As production volumes rise and supply chains become more complex and geographically dispersed, pallets continue to serve as indispensable infrastructure for efficient material handling, storage, and transportation. Their role extends beyond simple load support to enabling standardized, scalable, and cost-effective logistics across manufacturing ecosystems. This sustained industrial growth ensures that pallet demand remains structurally linked to manufacturing performance, positioning pallets as a long-term necessity rather than a cyclical or discretionary packaging component within global supply chains.

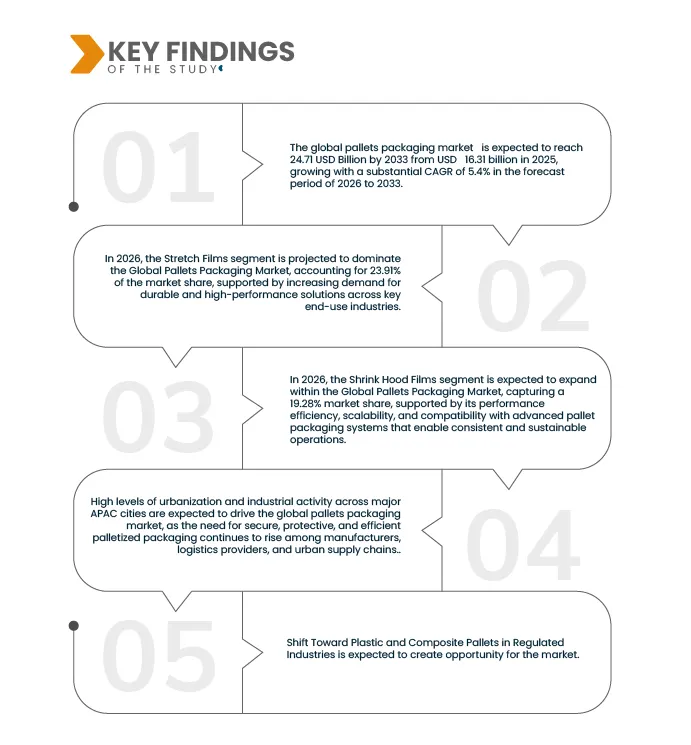

Key Findings of the Study

Growth of Organized Logistics, Warehousing, and Distribution Networks

The growth of organized logistics, warehousing, and distribution networks is playing a pivotal role in shaping demand for pallet packaging globally. As supply chains transition from fragmented storage models to centralized warehouses, large-scale distribution centers, and professionally managed third-party logistics facilities, the need for standardized material handling solutions has intensified. Pallets form the operational backbone of these organized logistics environments, enabling efficient stacking, racking, mechanized handling, and high-throughput order fulfillment. This structural shift toward modern logistics infrastructure is directly strengthening pallet adoption across industries seeking faster turnaround times, improved inventory control, and seamless movement of goods across domestic and international distribution networks.

For instance,

As highlighted by Knight Frank India data in March 2025, warehousing demand in key logistics hubs such as Mumbai, Bengaluru, and Kolkata reached record levels, with take-up exceeding 51 million sq ft and robust activity from manufacturing and third-party logistics operators, demonstrating how expanding organised warehousing networks are supporting improved material handling and pallet usage across supply chains.

As reported by The Times of India in August 2025, ColdStar Logistics opened a new distribution hub in Visakhapatnam with a storage capacity for over 3,500 pallets, reflecting the growth of organised distribution infrastructure to support last-mile and sector-specific logistics needs.

As highlighted by Logistics Outlook in 2025, the rise of organised warehousing and distribution centres driven by e-commerce and 3PL operations has significantly increased the use of pallets, as these platforms enable easier consolidation, movement, and storage of goods within mechanised warehouses and fulfilment hubs.

In conclusion, the growth of organized logistics, warehousing, and distribution networks is structurally strengthening demand for pallet packaging across global supply chains. As industries increasingly rely on centralized warehouses, large-scale distribution centers, and professionally managed third-party logistics facilities, pallets remain essential for enabling standardized storage, mechanized handling, and high-throughput operations. This continued expansion of modern logistics infrastructure reinforces pallets as a foundational asset within warehousing and distribution ecosystems, ensuring sustained and predictable demand as supply chains prioritize efficiency, scalability, and operational control.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2018-2024 (Customizable)

|

|

Quantitative Units

|

Revenue in USD billion

|

|

Segments Covered

|

Product Type (Stretch Films, Shrink Hood Films, Euro Pallet, Pallet Boxes, Pallet Lids & Caps, Slip Sheets & Tier Sheets, Stretch Wrappers, Stretch Hooders and Pallet Netting), Machine Type (Fully Automatic and Semi‑Automatic), Function Type (Wrapping, Strapping, Protection & Cushioning, Hooding and Others), Application (Food & Beverages, Retail & E-commerce, Consumer Packaged Goods (CPG), Pharmaceuticals, Chemicals, Agriculture & Horticulture, Industrial Manufacturing, Automotive, Electronics & Appliances and Others), End Use (Logistics & 3PL Providers, Manufacturing Plants, Retail Distribution Centers, Cold Chain Operators and Others), Distribution Channel (Direct and Indirect)

|

|

Countries Covered

|

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Market Players Covered

|

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global pallet packaging products market is segmented into six notable segments based on the product type, machine type, function type, application, end use, distribution channel.

- On the basis of Product Type, the market is segmented into Stretch Films, Shrink Hood Films, Euro Pallets, Pallet Boxes, Pallet Lids & Caps, Slip Sheets & Tier Sheets, Stretch Wrappers, Stretch Hooders, and Pallet Netting.

In 2026, the Stretch Films segment is expected to dominate the market

In 2026, the Stretch Films segment is projected to dominate the Global Pallets Packaging Market with the largest market share of 23.91%, due to their superior load stability, high stretchability, puncture resistance, and cost-effectiveness in securing palletized goods during storage and transportation. Stretch films are extensively used across food & beverage, pharmaceuticals, chemicals, and consumer goods industries to prevent load shifting, moisture ingress, and contamination. Additionally, their compatibility with both manual and automated pallet wrapping systems, along with growing demand for recyclable and downgauged films, further supports segment growth.

- On the basis of Machine Type, the Global Pallet Packaging Products Market is segmented into Fully Automatic and Semi-Automatic systems.

In 2026, the Fully Automatic segment is expected to dominate the market

In 2026, the Fully Automatic segment is projected to dominate the Global Pallets Packaging Market with a market share of 65.40%, due to its ability to handle high-throughput palletizing operations with consistent wrapping quality, reduced labour dependency, and enhanced operational efficiency. Fully automatic pallet packaging systems are widely adopted in large-scale manufacturing and distribution facilities to minimize downtime, improve worker safety, and ensure uniform load containment. Integration with conveyor systems, robotics, PLC controls, and Industry 4.0-enabled monitoring further accelerates adoption among high-volume end users.

- On the basis of Function Type, the Global Pallet Packaging Products Market is segmented into Wrapping, Strapping, Protection & Cushioning, Hooding, and Others.

In 2026, the Wrapping segment is expected to dominate the market

In 2026, the Wrapping segment is projected to dominate the Global Pallets Packaging Market with a market share of 46.97%, driven by its critical role in stabilizing pallet loads, protecting goods from dust, moisture, and mechanical damage, and enabling safe long-distance transportation. Wrapping solutions such as stretch and shrink wrapping are widely used across logistics, food & beverage, and industrial manufacturing due to their versatility, ease of application, and compatibility with various pallet sizes. Increasing emphasis on supply chain efficiency and damage reduction further contributes to the segment’s expansion.

- On the basis of Application, the Global Pallet Packaging Products Market is segmented into Food & Beverages, Retail & E-commerce, Consumer Packaged Goods (CPG), Pharmaceuticals, Chemicals, Agriculture & Horticulture, Industrial Manufacturing, Automotive, Electronics & Appliances, and Others.

In 2026, the Food & Beverages segment is expected to dominate the market

In 2026, the Food & Beverages segment is projected to dominate the Global Pallets Packaging Market with the largest market share of 22.41%, owing to the high volume of palletized movement of packaged foods, beverages, and bulk consumables requiring secure, hygienic, and damage-resistant packaging solutions. Pallet packaging ensures product integrity during cold chain storage, warehousing, and long-haul transportation. The rising demand for packaged and ready-to-consume food products, along with stringent food safety and handling regulations, continues to drive adoption within this segment.

- On the basis of End Use, the Global Pallet Packaging Products Market is segmented into Logistics & 3PL Providers, Manufacturing Plants, Retail Distribution Centers, Cold Chain Operators, and Others.

In 2026, the Logistics & 3PL Provider’s segment is expected to dominate the market

In 2026, the Logistics & 3PL Providers segment is projected to dominate the Global Pallets Packaging Market with the largest market share of 40.52%, due to the extensive handling, consolidation, and redistribution of palletized goods across multiple industries. Logistics providers rely heavily on pallet packaging solutions to ensure load stability, reduce transit damage, and improve warehouse efficiency. The rapid growth of e-commerce, cross-border trade, and third-party warehousing services further increases demand for reliable and scalable pallet packaging products.

- On the basis of Distribution Channel, the Global Pallet Packaging Products Market is classified into Direct and Indirect channels. The Direct channel is further segmented into Company Sales Teams, Direct OEM Contracts, and Company-Owned Websites, while the Indirect channel is further segmented into Wholesalers/Distributors, Industrial Supply Stores, and Third-Party E-commerce.

In 2026, the Direct segment is expected to dominate the market

In 2026, the Direct segment is expected to dominate the Global Pallets Packaging Market with a market share of 58.83%, due to strong preference among large industrial buyers for direct procurement from manufacturers to ensure customized solutions, bulk pricing advantages, and technical support. Direct channels enable end users to access tailored pallet packaging systems, long-term supply contracts, and after-sales services. Additionally, growing adoption of direct OEM relationships and manufacturer-led digital sales platforms strengthens the dominance of this segment.

Major Players

Sigma Plastics Group (U.S.), IPL Schoeller (Austria), Novolex (U.S.), Craemer GmbH (Germany) and PalletOne (U.S.) and others.

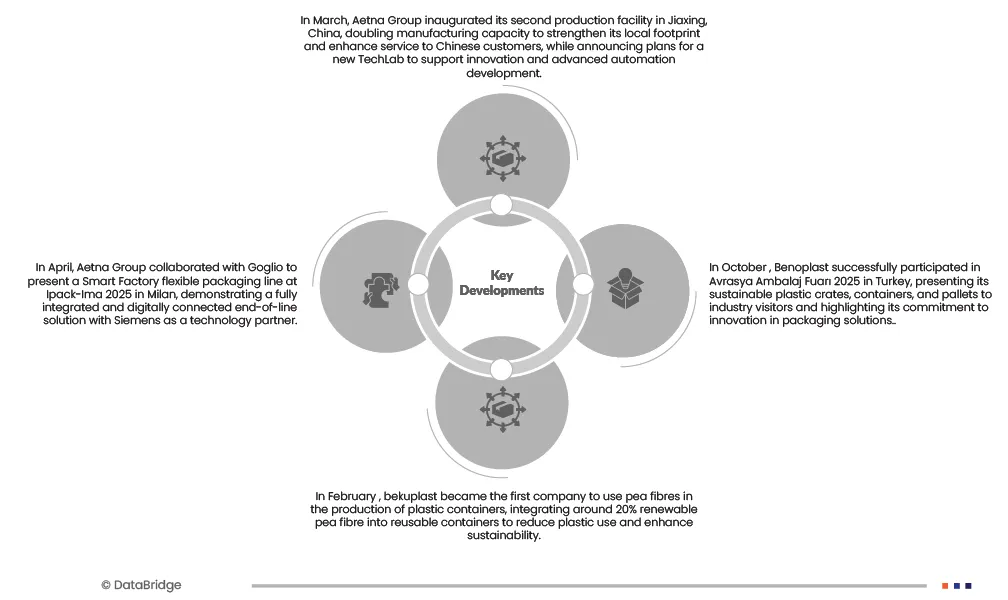

Latest Developments in Global Pallets Packaging Market

- In December, 2025 – Lantech introduced its next-generation semi-automatic stretch wrappers, the SL400 and SL400LT, designed to address labor shortages and improve pallet wrapping efficiency. These machines feature advanced automation, reduced operator touchpoints, and enhanced load-stability technologies.

- In February 2025, Sigma Plastics Group, along with its affiliate Mercury Plastics, acquired the assets of California-based Sun Plastics, Inc., marking Sigma’s 43rd acquisition and expanding its global operations to 49 locations. Sun Plastics, founded in 1979, specializes in high-quality, custom, 100% recyclable LDPE bags and films for diverse sectors including food, medical, electronics, and industrial markets. The acquisition strengthens Sigma’s presence in North America and enhances its capabilities in value-added, sustainable packaging solutions. This strategic move will provide Sigma with expanded market reach, advanced production expertise, and new growth opportunities.

- In May 2025, Transoplast Group and Schoeller Allibert launched a Platinum Partnership, with Transoplast becoming the main distributor for Schoeller Allibert products. This collaboration aims to deliver innovative, sustainable logistics solutions across industries, enhancing efficiency and supply chain performance. Transoplast will expand its inventory at a 25,000 m² logistics center, enabling faster delivery, customisation, and access to high-quality Schoeller Allibert products even for small orders. The partnership strengthens customer-centric solutions through personalised and scalable packaging options.

- In October 2025, the European Commission granted a full exemption for pallet wrapping and straps from the 100% reuse targets under Articles 29(2) and (3) of the Packaging and Packaging Waste Regulation (PPWR). However, the 40% reuse target for cross-border transport packaging under Article 29(1) is still under consideration. This exemption allows companies like Trioworld to continue producing and supplying high-performance pallet films without immediate regulatory changes, ensuring operational stability and supporting ongoing innovation in sustainable packaging solutions

As per Data Bridge Market Research analysis:

Geographically, the countries covered in the global pallets packaging market report are North America, Europe, Asia-Pacific, Middle East and Africa, South America. North America is further segmented into U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Netherlands, Belgium, Switzerland, Sweden, Turkey, Russia, Denmark, Finland, Norway, Rest of Europe, China, Japan, India, South Korea, Indonesia, Thailand, Australia, Taiwan, Malaysia, Singapore, Hong Kong, Philippines, New Zealand, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Qatar, Kuwait, Oman, Bahrain, Rest of Middle East and Africa, Brazil, Argentina, Colombia, Peru, Chile, Ecuador, Venezuela, Bolivia, Paraguay, Uruguay, and Rest of South America.

Asia-Pacific is the dominating region in Global Pallets Packaging Market

Asia-Pacific dominates the Global Pallets Packaging Market, driven by rapid industrialization, expanding manufacturing output, and strong growth in food & beverage, chemicals, pharmaceuticals, and consumer goods industries across the region. Countries such as China, India, Japan, and South Korea have a large concentration of production facilities and export-oriented industries, resulting in high demand for pallets, stretch films, pallet boxes, and automated pallet packaging solutions. The presence of a vast manufacturing base, cost-efficient operations, and increasing adoption of automated pallet wrapping and load stabilization systems further reinforce Asia-Pacific’s leadership in the global market.

Asia-Pacific is expected to be the fastest growing region in Global Pallets Packaging Market

Asia-Pacific is projected to witness the fastest growth in the Global Pallets Packaging Market during the forecast period, supported by rising intra-regional and cross-border trade, rapid expansion of e-commerce logistics, and increasing reliance on palletized goods movement. Growing investments in modern warehousing, cold chain infrastructure, and automated logistics facilities are driving demand for advanced pallet packaging products. Additionally, the shift toward standardized pallets, sustainable packaging materials, and automation upgrades by manufacturers and logistics providers across emerging economies continues to accelerate regional market growth.

For more detailed information about the Global Pallets Packaging Market report, click here – https://test.databridgemarketresearch.com/reports/global-pallets-packaging-market