The global hop water market is gaining momentum as consumers increasingly shift toward low-calorie, sugar-free, and non-alcoholic beverages driven by health, wellness, and moderation trends. Rising awareness of lifestyle-related health risks and the growth of the “sober-curious” movement, particularly among millennials and Gen Z, are reducing consumption of sugary and alcoholic drinks and boosting demand for flavorful yet health-conscious alternatives. Hop water’s zero-calorie, alcohol-free, and clean-label positioning—combined with the craft and functional appeal of hops—allows it to bridge the gap between sparkling water and beer, making it a socially acceptable and lifestyle-oriented choice. Supported by expanded retail presence and wellness-focused brand positioning from major players, hop water is emerging as a resilient and integral category within the rapidly expanding non-alcoholic beverage market.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-hop-water-market

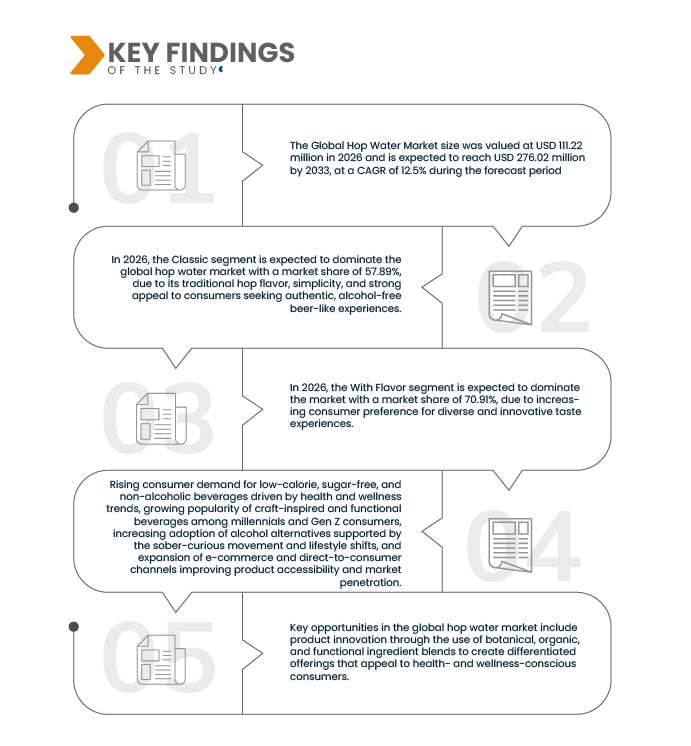

Data Bridge Market Research projects that the Global Hop Water Market will grow from USD 111.22 million in 2025 to USD 276.02 million by 2033, registering a CAGR of 12.5%.

Key Findings of the Study

Growing popularity of craft-inspired and functional beverages, particularly among millennials and gen z consumers

The global hop water market is being driven by Millennials and Gen Z, who prioritize craft-inspired, functional, and health-focused beverages over traditional sugary or alcoholic drinks. These younger consumers seek unique flavors, artisanal quality, and wellness benefits, aligning perfectly with hop water’s botanical infusion, non-alcoholic positioning, and experiential appeal. Trends such as reduced alcohol consumption, “mindful drinking,” and demand for functional beverages that support hydration, mood, or digestion further reinforce its popularity. Industry moves—like PepsiCo’s acquisition of functional soda brand Poppi—and data showing declines in young adults’ alcohol use highlight this shift, positioning hop water as a flavorful, health-aligned, and socially relevant choice for experience-driven, wellness-conscious younger audiences.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2026 to 2033

|

|

Base Year

|

2025

|

|

Historic Years

|

2024 (Customizable from 2018-2024)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

By Product Type (Classic and Blended), By Flavor (With Flavor and Without Flavor), By Carbonation Level (Low Carbonated, Medium Carbonated and Highly Carbonated), By Packaging (Aluminum Cans, Bottles, Kegs/Barrel, Pouches, Others), By Price (2–5 USD, Up to 2 USD and 5–10 USD, Above 10 USD), By Application (Fitness & Wellness, Mixers for Alcoholic Beverages, Culinary Use, Medical & Therapeutic Use and Others), By End User (Household/Residential, Commercial and Institutional), By Distribution Channel (Store Based and Non-Store Based)

|

|

Market Players Covered

|

HOP WTR, H2OPS Sparkling Hop Water, Hoplark, Athletic Brewing Company LLC, Sierra Nevada Brewing Co., Lagunitas Brewing Company, Deschutes Brewery, Founders Brewing Co., John I. Haas, Abita Brewing Company, Surly Brewery, Pelican Brewing Company, Dr Hops, Wooden Hill Brewing Company, Burlington Beer Company, Untitled Art, Fieldwork Brewing Co, Griffin Claw Brewing Company, Denver Beer Co

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

|

Segment Analysis

The global hop water market is segmented into eight notable segments based on the product type, flavor, carbonation level, packaging, price, application, end user and distribution channel.

On the basis of product type, the global hop water market is segmented into classic and blended.

In 2026, the Classic segment is expected to dominate the market

In 2026, the Classic segment is expected to dominate the market with a market share of 57.89%, due to its traditional hop flavor, simplicity, and strong appeal to consumers seeking authentic, alcohol-free beer-like experiences. Its established presence in the market, coupled with greater brand recognition from leading companies, drives higher demand compared to Blended variants. Additionally, Classic hop water is often perceived as a healthier, low-calorie alternative, further strengthening its market position.

On the basis of flavor, the global hop water market is segmented into with flavor and without flavor.

In 2026, the With Flavor segment is expected to dominate the market

In 2026, the With Flavor segment is expected to dominate the market with a market share of 70.91%, due to increasing consumer preference for diverse and innovative taste experiences. Flavored hop waters appeal to health-conscious and adventurous consumers seeking unique, low-calorie, alcohol-free beverages. Additionally, leading companies are actively introducing new flavor variants, enhancing product differentiation and driving higher demand for flavored options.

On the basis of carbonation level, the global hop water market is segmented into low carbonated, medium carbonated, and highly carbonated.

In 2026, the Low Carbonated segment is expected to dominate the market

In 2026, the Low Carbonated segment is expected to dominate the market with a share of 46.16%, due to increasing consumer preference for mild, easy-to-drink beverages, greater suitability for health-conscious consumers, and its widespread acceptance among mainstream and craft beverage audiences.

On the basis of packaging, the global hop water market is segmented into aluminium cans, bottles, kegs/barrels, pouches, and others.

In 2026, the Aluminium Cans segment is expected to dominate the market with a market

In 2026, the Aluminium Cans segment is expected to dominate the market with a market share of 65.46%, due to their superior convenience, lightweight nature, and recyclability. Consumers prefer cans for on-the-go consumption, and brands favor them for longer shelf life and better preservation of flavor. Additionally, growing environmental awareness is boosting demand for recyclable packaging options.

On the basis of price, the global hop water market is segmented into 2–5 USD, up to 2 USD, 5–10 USD, above 10 USD.

In 2026, the 2–5 USD segment is expected to dominate the market

In 2026, the 2–5 USD segment is expected to dominate the market with a market share of 43.02%, due to its affordability while still offering perceived premium quality. This price range attracts the largest number of consumers seeking a balance between cost and taste, making it the most preferred choice for everyday consumption.

On the basis of application, the global hop water market is segmented into fitness & wellness, mixers for alcoholic beverages, culinary use, medical & therapeutic use, and others.

In 2026, the Fitness & Wellness segment is expected to dominate the market

In 2026, the Fitness & Wellness segment is expected to dominate the market with a market share of 39.23%, due to increasing consumer focus on health, hydration, and functional beverages. Its use for pre-workout hydration, post-workout recovery, and detoxification makes it highly popular among fitness enthusiasts. Growing awareness of low-calorie, natural alternatives to traditional drinks is further driving demand in this segment.

On the basis of end user, the global hop water market is segmented into household/residential, commercial, and institutional.

In 2026, the Household/Residential segment is expected to dominate the market

In 2026, the Household/Residential segment is expected to dominate the market with a market share of 73.29%, due to increasing consumer preference for healthy, non-alcoholic beverages at home. The growing awareness of the health benefits of hop water, along with its versatility and refreshing taste, makes it a popular choice for everyday hydration. Additionally, the convenience of having it available in residential settings is driving its adoption.

On the basis of distribution channel, the global hop water market is segmented into store-based and non-store based.

In 2026, the Store-Based segment is expected to dominate the market

In 2026, the Store-Based segment is expected to dominate the market with a market share of 72.40%, due to the widespread availability and convenience of purchasing from physical retail locations. Supermarkets, health & wellness stores, and specialty beverage stores provide easy access to hop water, allowing consumers to make spontaneous purchases. Additionally, the in-store shopping experience, with product visibility and promotional offers, is expected to drive higher sales.

Major Players

Data Bridge Market Research analyzes HOP WTR, H2OPS Sparkling Hop Water, Hoplark, Athletic Brewing Company LLC, Sierra Nevada Brewing Co., Lagunitas Brewing Company, Deschutes Brewery, Founders Brewing Co., John I. Haas, Abita Brewing Company, Surly Brewery, Pelican Brewing Company, Dr Hops, Wooden Hill Brewing Company, Burlington Beer Company, Untitled Art, Fieldwork Brewing Co, Griffin Claw Brewing Company, Denver Beer Co

Market Developments

- In September 2025, Sierra Nevada published an in‑depth blog on the journey behind its non‑alcoholic Trail Pass brews, covering brewing innovation and product development for its non‑alcoholic lineup.

- In December 2024, Hoplark announced a seasonal mocktail collaboration with non-alcoholic beverage brand For Bitter for Worse, introducing **The Spruce Katoon**, a holiday-inspired, alcohol-free mocktail combining Hoplark’s hop-brewed flavors with botanical and fruit-forward elements to deliver a refined, festive drinking experience.

- In April 2025, HOP WTR published multiple community and news blog posts discussing benefits of ingredients like Vitamin C and L‑Theanine, and promoting hop water as a refreshing beer alternative and seasonal companion to events.

- In June 2024, Deschutes Brewery, in collaboration with Patagonia Provisions, launched certified organic non-alcoholic and alcoholic beers brewed with Kernza® perennial grain, reinforcing its commitment to regenerative agriculture and sustainable brewing practices.

- In December 2025, Founders Brewing Co. released its first non-alcoholic beer family, Nonetheless, beginning with Nonetheless Golden, a crisp, balanced golden ale brewed like traditional Founders beers and aimed at expanding its portfolio into the growing NA category.

As per Data Bridge Market Research analysis:

For more detailed information about Hop Water Market click here – https://www.databridgemarketresearch.com/reports/global-hop-water-market