Global Data Warehouse As A Service Market

市场规模(十亿美元)

CAGR :

%

USD

11.37 Billion

USD

70.22 Billion

2024

2032

USD

11.37 Billion

USD

70.22 Billion

2024

2032

| 2025 –2032 | |

| USD 11.37 Billion | |

| USD 70.22 Billion | |

|

|

|

|

全球資料倉儲即服務市場細分,按類型(企業資料倉儲即服務和營運資料儲存)、用途(分析、報告和資料探勘)、部署模式(公有雲、私有雲和混合雲)、組織規模(中小型企業和大型企業)、應用(客戶分析、風險與合規管理、資產管理、供應鏈管理、製藥和控制管理等)、產業電信(銀行、金融服務和金融服務IT、政府和公共部門、製造業、媒體和娛樂、旅遊和酒店等)– 產業趨勢和預測到 2032 年。

資料倉儲即服務市場規模

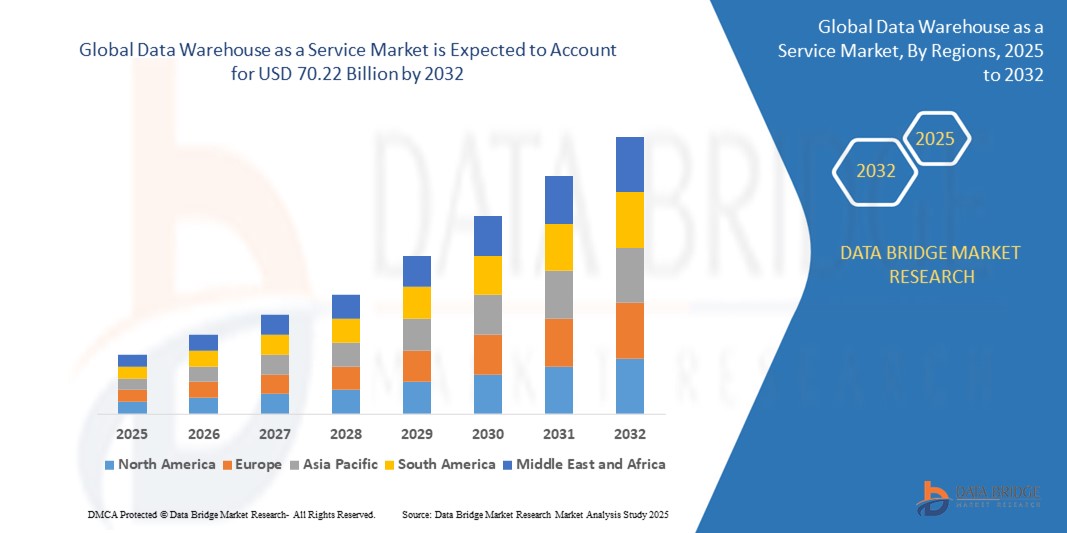

- 2024 年全球資料倉儲即服務市場規模為113.7 億美元 ,預計 到 2032 年將達到 702.2 億美元,預測期內 複合年增長率為 25.55%。

- 市場成長主要得益於雲端運算的加速採用、大數據的快速成長以及各行各業對高階分析和商業智慧日益增長的需求

- 此外,對支援數據驅動決策的可擴展、經濟高效且敏捷的數據管理解決方案的需求不斷增長,正在將 DWaaS 確立為現代企業 IT 基礎設施的基石,從而顯著促進該行業的擴張

資料倉儲即服務市場分析

- 資料倉儲即服務解決方案提供基於雲端的可擴展資料倉儲功能,使組織能夠儲存、管理和分析大量數據,而無需承擔內部基礎設施的複雜性和開銷

- 資料倉儲即服務解決方案的需求不斷增長,主要原因是雲端運算模型的快速採用、大數據的指數級增長、對高階分析和商業智慧的需求不斷增長

- 北美預計將在資料倉儲即服務市場中佔據主導地位,並佔據最大的收入份額,其特點是早期廣泛採用雲端運算、IT 基礎設施成熟,以及企業高度集中地投入資料分析和數位轉型計劃

- 由於各行業數位化進程加快、雲端基礎設施投資增加,亞太地區預計將成為預測期內資料倉儲即服務市場成長最快的地區

- 預計到 2024 年,公有雲部署模式將佔據資料倉儲即服務市場主導地位,市場份額將達到 39.7%,這得益於其無與倫比的可擴展性、成本效益和易於部署的特點,使其成為尋求敏捷靈活的資料倉儲解決方案且無需大量前期資本支出的各種規模的組織的首選。

報告範圍和資料倉儲即服務市場細分

|

屬性 |

資料倉儲即服務關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了市場價值、成長率、市場區隔、地理覆蓋範圍、市場參與者和市場情景等市場洞察之外,Data Bridge 市場研究團隊策劃的市場報告還包括深入的專家分析、進出口分析、定價分析、生產消費分析和 pestle 分析。 |

資料倉儲即服務市場趨勢

“雲端原生架構和即時分析需求推動採用加速”

- A prominent and rapidly expanding trend in the global data warehouse as a service market is the escalating adoption fueled by the pervasive shift towards cloud-native architectures and the growing imperative for real-time data analytics

- For instance, solutions such as Snowflake's Data Cloud seamlessly integrate with various cloud platforms (AWS, Azure, Google Cloud), allowing businesses to leverage its scalable architecture for diverse analytical workloads. Similarly, Google BigQuery provides a serverless and highly scalable data warehouse that supports real-time analytics for vast datasets

- The emphasis on real-time data analytics in data warehouse as a service market solutions enables features such as immediate ingestion and processing of streaming data, providing up-to-the-minute insights for operational decision-making

- The seamless integration of data warehouse as a service market with other cloud services, such as data lakes, machine learning platforms, and business intelligence tools, facilitates a comprehensive and agile data ecosystem

- This trend towards more agile, scalable, and interconnected data warehousing solutions is fundamentally reshaping how enterprises approach data management and business intelligence

- The demand for data warehouse as a service market solutions that offer seamless integration with cloud-native environments and cater to real-time analytics needs is growing rapidly across various industries, as organizations increasingly prioritize data-driven decision-making and operational efficiency

Data Warehouse as a Service Market Dynamics

Driver

“Growing Need Due to Rising Security Concerns and Smart Home Adoption”

- The increasing prevalence of security concerns among homeowners and businesses, coupled with the accelerating adoption of smart home ecosystems, is a significant driver for the heightened demand for Data Warehouse as a Services

- For instance, in April 2024, Onity, Inc. (Honeywell International, Inc.) announced an advancement in IoT-based self-storage security, looking forward to integrating state-of-the-art sensors into the Passport locking solution. Such strategies by key companies are expected to drive the data warehouse as a services industry growth in the forecast period

- As consumers become more aware of potential security threats and seek enhanced protection for their properties, data warehouse as a services offer advanced features such as remote monitoring, activity logs, and tamper alerts, providing a compelling upgrade over traditional mechanical locks

- Furthermore, the growing popularity of smart home devices and the desire for interconnected living spaces are making data warehouse as a services an integral component of these systems, offering seamless integration with other smart devices and platforms

- The convenience of keyless entry, remote access control for family members or service providers, and the ability to manage access through smartphone applications are key factors propelling the adoption of data warehouse as a services in both residential and commercial sectors

Restraint/Challenge

“Data Security and Compliance Concerns, Alongside Vendor Lock-in Risks”

- Concerns surrounding data security, privacy, and compliance regulations, coupled with the potential for vendor lock-in, pose significant challenges to broader market penetration for data warehouse as a services

- For instance, high-profile data breaches in cloud environments have made some businesses hesitant to migrate their critical data to data warehouse as a services platforms, raising anxieties among potential consumers about data governance and control. Adhering to stringent compliance frameworks such as GDPR, HIPAA, or CCPA can also be complex when data resides with a third-party provider

- Addressing these data security and compliance concerns through robust encryption, comprehensive access controls, regular security audits, and clear service level agreements is crucial for building consumer trust. Data warehouse as a services providers often highlight their certifications and compliance features in their marketing to reassure potential buyers

- In addition, the challenge of vendor lock-in, where businesses become heavily reliant on a single data warehouse as a services provider's ecosystem, can be a barrier to adoption for organizations seeking flexibility and multi-cloud strategies

- Overcoming these challenges through enhanced data security measures, transparent compliance frameworks, consumer education on shared responsibility models, and the development of open standards or interoperable data warehouse as a services solutions will be vital for sustained market growth

Data Warehouse as a Service Market Scope

The market is segmented on the basis of type, usage, deployment model, organization size, end-user industry, and application.

- By Type

On the basis of type, the data warehouse as a service market is segmented into enterprise data warehouse as a service and operational data storage. The enterprise data warehouse as a service segment is expected to hold the largest market revenue share in 2024, driven by the increasing need for integrated, comprehensive data analytics across large organizations. This segment caters to complex analytical requirements, supporting strategic decision-making and leveraging diverse data sources. Enterprises prioritize this type for its ability to handle vast data volumes and provide a single source of truth for business intelligence.

The operational data storage segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the rising demand for real-time data processing and analytics for operational insights. This segment focuses on supporting day-to-day business operations with immediate access to current data, enabling faster decision-making and improved operational efficiency, particularly in sectors requiring instant data feedback.

- By Usage

On the basis of usage, the data warehouse as a service market is segmented into analytics, reporting, and data mining. The analytics segment held the largest market revenue share in 2024, driven by the pervasive need for in-depth data analysis to uncover trends, predict outcomes, and support strategic business initiatives. Organizations are increasingly leveraging data warehouse as a service for advanced analytics to gain competitive advantages and enhance decision-making.

The data mining segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing interest in extracting valuable patterns and insights from large datasets. Data mining applications, often leveraging machine learning, are becoming critical for identifying hidden correlations and predictive models, making data warehouse as a service an ideal platform for these computationally intensive tasks.

- By Deployment Model

On the basis of deployment model, the data warehouse as a service market is segmented into public cloud, private cloud, and hybrid cloud. The public cloud segment held the largest market revenue share of 39.7% in 2024, driven by its scalability, cost-effectiveness, and ease of deployment. Public cloud data warehouse as a service solutions appeal to a broad range of businesses due to their flexibility and ability to handle varying data workloads without significant upfront infrastructure investments.

The hybrid cloud segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by organizations seeking a balance between public cloud flexibility and the control/security offered by private infrastructure. Hybrid models allow businesses to keep sensitive data on-premises while leveraging public cloud for analytical workloads, providing a tailored approach to data residency and performance.

- By Organization Size

On the basis of organization size, the data warehouse as a service market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The large enterprises segment held the largest market revenue share in 2024, driven by their extensive data generation, complex analytical needs, and significant budgets for advanced data management solutions. Large organizations require robust and scalable data warehouse as a service platforms to consolidate and analyze massive datasets for strategic insights.

The small and medium-sized enterprises segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the growing awareness among SMEs about the benefits of data analytics and the affordability of data warehouse as a service solutions. Data warehouse as a service provides SMEs with access to enterprise-grade data warehousing capabilities without the need for large capital expenditures or specialized IT staff, enabling them to compete more effectively with larger players.

- By End-user Industry

On the basis of end-user industry, the data warehouse as a service market is segmented into BFSI, IT & telecom, retail & e-commerce, manufacturing, government & public sector, healthcare & life sciences, media & entertainment, travel & hospitality, and others. The IT & telecom segment accounted for the largest market revenue share in 2024, driven by the massive volume of data generated by network operations, customer interactions, and service usage, necessitating advanced data warehouse as a service solutions for performance monitoring, customer analytics, and fraud detection.

The BFSI (Banking, Financial Services, and Insurance) segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing need for real-time fraud detection, risk management, regulatory compliance, and personalized customer experiences. Data warehouse as a service enables BFSI institutions to analyze vast transactional data efficiently and securely.

- By Application

On the basis of application, the data warehouse as a service market is segmented into customer analytics, risk and compliance management, asset management, supply chain management, fraud detection & threat management, business intelligence, predictive analytics, and data modernization. The business intelligence segment held the largest market revenue share in 2024, driven by the fundamental need across all industries to transform raw data into actionable insights for operational and strategic decision-making. Data warehouse as a service serves as the backbone for modern BI platforms.

The predictive analytics segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing desire among organizations to forecast future trends, identify potential risks, and optimize strategies proactively. Data warehouse as a service provides the scalable infrastructure and processing power required for complex predictive modeling and machine learning applications.

Data Warehouse as a Service Market Regional Analysis

- North America dominates the data warehouse as a service market with the largest revenue share in 2024, driven by a high concentration of technology companies, early adoption of cloud-based solutions, and significant investments in digital transformation

- The region benefits from a mature IT infrastructure, a strong focus on data-driven decision-making across various industries, and the presence of major cloud service providers

- This widespread adoption is further supported by a skilled workforce, robust regulatory frameworks promoting data analytics, and the increasing preference for scalable and cost-effective data management solutions

U.S. Data Warehouse as a Service Market Insight

The U.S. data warehouse as a service (DWaaS) market is a dominant force within North America, projected to grow at a substantial CAGR from 2025 to 2032. This growth is primarily fueled by the rapid adoption of cloud-based solutions across various industries and the increasing demand for real-time data analytics. U.S. businesses are heavily investing in DWaaS to achieve faster, more precise outcomes, automate data preparation, and leverage AI and machine learning for enhanced data quality, regulatory adherence, and information security. The robust IT infrastructure, presence of major cloud providers (such as AWS, Microsoft Azure, and Google Cloud), and strong governmental support for digital transformation initiatives further propel the DWaaS industry. Companies are increasingly recognizing the cost-effectiveness and scalability benefits of DWaaS, leading to widespread migration from traditional on-premise data warehouses.

Europe Data Warehouse as a Service Market Insight

The Europe data warehouse as a service market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the region's strong emphasis on digital transformation, increasing adoption of cloud technologies, and the growing need for sophisticated data management solutions across diverse sectors. Stringent data privacy regulations such as GDPR are also influencing the demand for DWaaS platforms that offer robust security and compliance features. European businesses are increasingly leveraging DWaaS for enhanced business intelligence, operational efficiency, and data-driven decision-making. The increase in cloud infrastructure investments and the desire for greater agility and flexibility in data processing are fostering the adoption of DWaaS in both established and emerging markets across Europe.

U.K. Data Warehouse as a Service Market Insight

The U.K. data warehouse as a service market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by its mature IT sector, increasing adoption of cloud platforms, and the escalating need for agile data solutions. The U.K.'s robust digital economy and the continuous efforts to establish comprehensive data governance frameworks are supplementing the demand for DWaaS. Concerns regarding data security and compliance, especially post-Brexit, are encouraging businesses to adopt DWaaS solutions that offer enhanced audit trails, data masking, and breach prevention tools. The U.K.'s embrace of cloud-native architectures and machine learning-driven analytics further stimulates market growth, with a growing number of enterprises seeking to leverage DWaaS for advanced insights and competitive advantage.

Germany Data Warehouse as a Service Market Insight

The Germany data warehouse as a service market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of data-driven insights, a strong focus on industrial digitalization (Industry 4.0), and the demand for highly secure and compliant cloud solutions. Germany's well-developed infrastructure and its emphasis on innovation and data protection promote the adoption of DWaaS, particularly in manufacturing, automotive, and financial sectors. The integration of DWaaS with existing enterprise resource planning (ERP) systems and the strong preference for secure, privacy-focused solutions align with local consumer and business expectations. The market sees significant growth in applications such as customer analytics and business intelligence, driven by the need for deeper insights into operational efficiency and market trends.

Asia-Pacific Data Warehouse as a Service Market Insight

The Asia-Pacific data warehouse as a service market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing digitalization initiatives, rapid cloud adoption, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region's growing inclination towards data-driven decision-making, supported by government initiatives promoting smart cities and digital economies, is driving the adoption of DWaaS. Furthermore, as APAC emerges as a global hub for technological innovation and cloud infrastructure development, the affordability and accessibility of DWaaS solutions are expanding to a wider consumer and business base, from large enterprises to burgeoning SMEs.

Japan Data Warehouse as a Service Market Insight

The Japan data warehouse as a service market is gaining momentum due to the country’s high-tech culture, rapid digitalization, and increasing demand for efficient data management. The Japanese market places a significant emphasis on data quality, security, and the adoption of DWaaS is driven by the growing need for advanced analytics and business intelligence across industries such as manufacturing, healthcare, and finance. The integration of DWaaS with other IoT devices and AI platforms is fueling growth, enabling organizations to derive deeper insights from their vast datasets. Moreover, Japan's focus on digital transformation and optimizing operational efficiencies is such as demand for scalable, secure, and user-friendly DWaaS solutions in both large corporations and smaller businesses.

China Data Warehouse as a Service Market Insight

The China data warehouse as a service market accounted for a significant market revenue share in Asia Pacific in 2024, attributed to the country's rapid economic growth, massive data generation, and high rates of cloud technology adoption. China stands as one of the largest and fastest-growing markets for cloud services globally, and DWaaS is becoming increasingly popular across diverse sectors, including e-commerce, manufacturing, and telecommunications. The strong government push towards cloud-first strategies, coupled with the availability of robust and affordable DWaaS options from domestic and international providers, are key factors propelling the market in China. The demand for real-time analytics and big data processing capabilities further fuels the expansion of DWaaS in the country.

Data Warehouse as a Service Market Share

The data warehouse as a service industry is primarily led by well-established companies, including:

- Google (U.S.)

- IBM Corporation (U.S.)

- Amazon.com, Inc. (U.S.)

- Microsoft (U.S.)

- VMware, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc (U.S.)

- Huawei Technologies Co., Ltd. (China)

- FUJITSU (Japan)

- Nutanix (U.S.)

- NetApp (U.S.)

- Quantum Corporation (U.S.)

- Scale Computing (U.S.)

- DataCore Software (U.S.)

- Maxta (U.S.)

Latest Developments in Global Data Warehouse as a Service Market

- In October 2023, mParticle, Inc. introduced ComposeID, an identity resolution service designed for seamless integration with cloud data warehousing environments. Built upon IDSync, ComposeID enables teams to implement diverse identity strategies across various data architectures. Such as traditional identity solutions, ComposeID offers flexibility, transparency, and unlimited identity types while ensuring compliance with privacy regulations. By leveraging existing data warehouse investments, it enhances customer insights, personalization, and marketing strategies. This innovation empowers organizations to create unified customer views, optimize engagement, and improve regulatory adherence

- In July 2023, IBM unveiled significant enhancements to its Db2 Warehouse, introducing cloud object storage with advanced caching capabilities. This next-generation update enables organizations to achieve four times faster query performance while reducing storage costs by 34%. By leveraging cloud-native architecture, Db2 Warehouse optimizes data management, enhances analytics efficiency, and supports mission-critical workloads. The integration of advanced caching ensures seamless data retrieval, improving overall system responsiveness. These improvements empower businesses to maximize their data investments while maintaining cost-effectiveness

- In March 2023, SAP SE launched SAP Datasphere, a next-generation cloud-based data warehouse solution aimed at simplifying metadata management and organization. Built on SAP Business Technology Platform, it enhances data quality through efficient data modeling, lineage analysis, and impact assessment. SAP Datasphere enables businesses to access mission-critical data seamlessly while preserving business context and logic. By integrating data governance, cataloging, and virtualization, it supports advanced analytics and compliance needs. This innovation reflects SAP’s commitment to scalable, unified data management

- In May 2022, Dell Technologies partnered with Snowflake Inc. to enhance access to on-premises data by integrating Snowflake Data Cloud's tools with Dell's storage solutions. This collaboration enables organizations to leverage Snowflake’s advanced analytics and data-sharing capabilities while maintaining their data locally. By bridging on-premises object storage with cloud-based insights, businesses can optimize data management, improve compliance, and streamline operations in multi-cloud environments. The partnership aims to provide greater flexibility and efficiency in handling enterprise data

- In January 2022, Firebolt, a cloud data warehouse startup, secured $100 million in Series C funding, reaching a USD 1.4 billion valuation. The investment aimed to accelerate Firebolt’s technological advancements, expand business development, and strengthen its team to address growing demands in the data warehousing market. Firebolt focuses on delivering faster and more cost-effective analytics for large-scale data sets, competing with industry leaders such as Google’s BigQuery and Snowflake. The funding supports its mission to enhance performance, scalability, and efficiency in cloud-based data processing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。