Global Long Acting Recombinant Hormone Biosimilars Market

市场规模(十亿美元)

CAGR :

%

USD

198.00 Million

USD

421.35 Million

2025

2033

USD

198.00 Million

USD

421.35 Million

2025

2033

| 2026 –2033 | |

| USD 198.00 Million | |

| USD 421.35 Million | |

|

|

|

|

Global Long-Acting Recombinant Hormone Biosimilars Market Segmentation, By Product Type (Long-acting insulin biosimilars, Long-acting growth hormone biosimilars, and Other long-acting recombinant hormone biosimilars), Therapeutic Indication (Diabetes management, Growth hormone deficiency, and Other), Distribution Channel (Hospital pharmacies, Retail pharmacies, and Online pharmacies), End User (Hospitals and specialty clinics, Outpatient clinics, and Home healthcare)- Industry Trends and Forecast to 2033

Long-Acting Recombinant Hormone Biosimilars Market Size

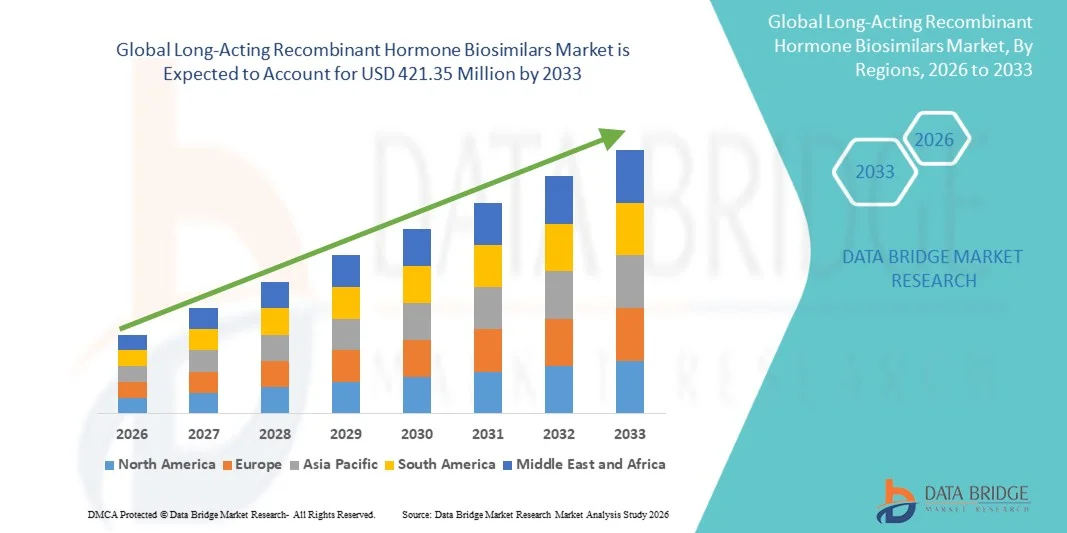

- The global long-acting recombinant hormone biosimilars market size was valued at USD 198.00 million in 2025 and is expected to reach USD 421.35 million by 2033, at a CAGR of 9.90% during the forecast period

- The market growth is largely driven by the rising prevalence of hormonal disorders such as diabetes and growth hormone deficiency, increasing investments in biosimilar development, and supportive regulatory frameworks that encourage faster approvals and lower treatment costs compared to reference biologics

- Furthermore, increasing demand for cost-effective biologic alternatives, expanding healthcare expenditure in emerging economies, and improving awareness and acceptance of biosimilars among healthcare professionals and patients are establishing long-acting recombinant hormone biosimilars as a preferred therapeutic option. These combined factors are accelerating product adoption and significantly boosting overall market growth

Long-Acting Recombinant Hormone Biosimilars Market Analysis

- Long-acting recombinant hormone biosimilars, developed to deliver prolonged therapeutic effects with fewer injections, are becoming essential in the treatment of chronic endocrine disorders such as diabetes and growth hormone deficiency, owing to their improved patient adherence, clinical comparability to originator biologics, and cost advantages

- The rising demand for long-acting recombinant hormone biosimilars is mainly driven by the increasing global burden of diabetes and other hormonal disorders, growing pressure to reduce biologic therapy costs, and expanding physician and patient confidence in biosimilar efficacy and safety

- North America dominated the global long-acting recombinant hormone biosimilars market with a revenue share of 46.4% in 2025, supported by a high prevalence of diabetes, advanced healthcare infrastructure, strong regulatory support for biosimilar approvals, and rapid adoption of cost-effective long-acting insulin biosimilars, with the United States accounting for the majority of regional demand due to favorable reimbursement frameworks and widespread uptake across hospital and outpatient care settings

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, driven by a rapidly expanding diabetic population, improving access to biologic therapies, rising healthcare expenditure, and growing domestic biosimilar manufacturing capabilities in countries such as China and India

- The long-acting insulin biosimilars segment dominated the market with a market share of 71.2% in 2025, fueled by strong demand for basal insulin therapies offering sustained glycemic control, increasing availability of approved biosimilar products, and continuous efforts by manufacturers to enhance affordability and long-term treatment outcomes

Report Scope and Long-Acting Recombinant Hormone Biosimilars Market Segmentation

|

Attributes |

Long-Acting Recombinant Hormone Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Long-Acting Recombinant Hormone Biosimilars Market Trends

“Shift Toward Extended-Duration Therapies to Improve Patient Adherence”

- A significant and accelerating trend in the global long-acting recombinant hormone biosimilars market is the growing shift toward extended-duration formulations that reduce dosing frequency, thereby improving patient adherence and long-term treatment outcomes in chronic endocrine disorders

- For instance, several manufacturers are advancing long-acting insulin biosimilars designed to provide stable basal glycemic control with fewer injections compared to short-acting alternatives, supporting better compliance among diabetic patients

- Innovations in drug delivery technologies, including sustained-release formulations and improved injectable devices, are enabling biosimilar developers to closely match or enhance the pharmacokinetic profiles of reference biologics

- The increasing preference for long-acting therapies among clinicians is driven by their ability to reduce treatment burden, minimize missed doses, and improve overall disease management, particularly in diabetes and growth hormone deficiency

- This trend is also encouraging pharmaceutical companies to invest in lifecycle management strategies for biosimilars, focusing on long-acting variants to differentiate products in competitive markets

- Growing collaboration between biosimilar manufacturers and device companies is facilitating the development of user-friendly delivery systems that enhance the overall treatment experience

- The rising demand for patient-centric, long-acting biosimilar hormone therapies is reshaping treatment standards and accelerating adoption across hospital, outpatient, and home-care settings

Long-Acting Recombinant Hormone Biosimilars Market Dynamics

Driver

“Rising Chronic Disease Burden and Cost Pressure on Healthcare Systems”

- The increasing prevalence of chronic endocrine disorders, particularly diabetes and growth hormone deficiencies, combined with mounting pressure to reduce biologic therapy costs, is a major driver of demand for long-acting recombinant hormone biosimilars

- For instance, healthcare systems in North America and Europe are actively promoting biosimilar adoption through favorable reimbursement policies to manage rising expenditures associated with long-term biologic treatments

- As treatment costs for originator biologics remain high, biosimilars offer a clinically comparable and more affordable alternative, encouraging wider prescription by endocrinologists and primary care providers

- Growing awareness and confidence among physicians regarding the safety, efficacy, and regulatory rigor of biosimilars are further accelerating market uptake

- The need for long-term disease management solutions that balance clinical effectiveness with economic sustainability is making long-acting biosimilar hormones an increasingly attractive option

- In addition, expanding access to biologic therapies in emerging economies is supporting broader market growth, as biosimilars help address affordability and accessibility challenges

- Government-led initiatives aimed at increasing biosimilar penetration are strengthening demand across public healthcare systems

- Rising payer and insurer support for biosimilar substitution is further accelerating adoption in both developed and emerging markets

Restraint/Challenge

“Complex Manufacturing and Regulatory Approval Barriers”

- The complex manufacturing processes required for recombinant hormone biosimilars, including stringent quality control and comparability studies, pose a significant challenge to market entry and scalability

- For instance, demonstrating long-term safety, immunogenicity, and therapeutic equivalence to reference biologics often requires extensive clinical trials, increasing development time and costs

- Regulatory requirements for biosimilars vary across regions, creating additional hurdles for global market expansion and delaying product launches in certain countries

- High initial investment requirements for advanced biomanufacturing infrastructure can limit participation to well-capitalized pharmaceutical companies, restricting competition

- Differences in physician perception and limited awareness of long-acting biosimilars in certain regions can slow prescribing rates

- Supply chain complexity and cold-chain storage requirements add operational challenges, particularly in emerging markets

- Overcoming these challenges through harmonized regulatory frameworks, advancements in bioprocessing technologies, and streamlined approval pathways will be critical for sustained growth of the long-acting recombinant hormone biosimilars market

Long-Acting Recombinant Hormone Biosimilars Market Scope

The market is segmented on the basis of product type, therapeutic indication, distribution channel, and end user.

- By Product Type

On the basis of product type, the market is segmented into long-acting insulin biosimilars, long-acting growth hormone biosimilars, and other long-acting recombinant hormone biosimilars. The long-acting insulin biosimilars segment dominated the market in 2025 with a market share of 71.2%, driven by the high global prevalence of diabetes and the widespread clinical reliance on basal insulin therapies for long-term glycemic control. These products offer comparable efficacy to reference biologics at a lower cost, making them highly attractive to healthcare systems and payers. Strong physician familiarity with insulin therapy, coupled with favorable reimbursement policies in major markets, further supports dominance. In addition, frequent product approvals and increasing interchangeability designations are accelerating adoption. The chronic nature of diabetes ensures sustained and recurring demand for long-acting insulin biosimilars.

The long-acting growth hormone biosimilars segment is expected to witness the fastest growth during the forecast period, supported by rising diagnosis rates of growth hormone deficiency in both pediatric and adult populations. Advancements in formulation technologies enabling extended dosing intervals are improving patient adherence and driving preference for long-acting options. Increasing awareness and screening for hormonal disorders are expanding the addressable patient pool. Moreover, growing acceptance of biosimilars in endocrinology practices is supporting uptake. Emerging markets are also contributing to growth due to improved access to biologic therapies. These factors collectively position growth hormone biosimilars as a high-growth segment.

- By Therapeutic Indication

On the basis of therapeutic indication, the market is categorized into diabetes management, growth hormone deficiency, and other indications. The diabetes management segment accounted for the largest market share in 2025, owing to the massive global diabetic population and the long-term nature of insulin therapy. Long-acting insulin biosimilars are widely prescribed to maintain stable blood glucose levels, making them a cornerstone of diabetes treatment. Healthcare systems increasingly favor biosimilars to reduce the financial burden of lifelong diabetes care. Strong clinical guidelines supporting basal insulin use further reinforce dominance. In addition, expanding screening programs and earlier diagnosis continue to increase treatment volumes.

The growth hormone deficiency segment is projected to grow at the fastest rate over the forecast period, driven by improved diagnostic capabilities and rising awareness among healthcare providers. Long-acting growth hormone biosimilars reduce injection frequency, significantly enhancing patient compliance, especially in pediatric cases. Increasing healthcare expenditure and better reimbursement coverage are also encouraging treatment initiation. The entry of new biosimilar products is intensifying competition and improving affordability. Furthermore, unmet needs in adult growth hormone deficiency are opening new growth avenues. These trends are accelerating expansion within this indication.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2025, primarily due to the specialized nature of biosimilar hormone therapies and the need for physician supervision during treatment initiation. Hospitals serve as key centers for diagnosis, prescription, and early-stage therapy management, particularly for insulin and growth hormone treatments. Strong procurement volumes and established cold-chain infrastructure support dominance. In addition, hospital-based reimbursement mechanisms favor biosimilar utilization. The presence of endocrinology specialists further strengthens hospital pharmacy demand.

The online pharmacies segment is expected to register the fastest growth during the forecast period, driven by increasing patient preference for convenience and home delivery of chronic therapies. Digital health adoption and the expansion of e-pharmacy platforms are improving access to biosimilars, particularly for long-term maintenance therapy. Online channels also offer competitive pricing and refill convenience, enhancing adherence. Growth in telemedicine and e-prescriptions is further supporting this trend. Emerging economies are witnessing rapid digital pharmacy expansion. These factors position online pharmacies as a high-growth distribution channel.

- By End User

On the basis of end user, the market is segmented into hospitals and specialty clinics, outpatient clinics, and home healthcare. The hospitals and specialty clinics segment held the largest revenue share in 2025, driven by the centralized management of complex endocrine conditions. These settings are preferred for initiating biosimilar therapies, monitoring patient response, and managing dose adjustments. Availability of specialized healthcare professionals supports biosimilar confidence and adoption. In addition, hospitals benefit from bulk purchasing agreements and structured reimbursement pathways. The growing focus on cost containment is further encouraging biosimilar use in institutional settings.

The home healthcare segment is anticipated to grow at the fastest rate during the forecast period, supported by the increasing shift toward self-administration of long-acting therapies. Advances in injection devices and patient education are enabling safe and effective home use. Rising preference for reduced hospital visits, particularly among chronic disease patients, is accelerating this trend. Cost savings associated with home-based care further support adoption. Aging populations and long-term disease prevalence are also contributing to growth. As a result, home healthcare is emerging as a key growth area in the market.

Long-Acting Recombinant Hormone Biosimilars Market Regional Analysis

- North America dominated the global long-acting recombinant hormone biosimilars market with a revenue share of 46.4% in 2025, supported by a high prevalence of diabetes, advanced healthcare infrastructure, strong regulatory support for biosimilar approvals, and rapid adoption of cost-effective long-acting insulin biosimilars

- Healthcare providers in the region place significant emphasis on clinically proven, long-acting treatment options that improve patient adherence and reduce long-term therapy costs, supporting widespread uptake of long-acting insulin and growth hormone biosimilars

- This strong market position is further reinforced by advanced healthcare infrastructure, favorable regulatory and reimbursement frameworks for biosimilars, and high awareness and acceptance among physicians and patients, establishing North America as a key hub for biosimilar adoption in both hospital and outpatient care settings

U.S. Long-Acting Recombinant Hormone Biosimilars Market Insight

The U.S. long-acting recombinant hormone biosimilars market captured the largest revenue share within North America in 2025, driven by the high prevalence of diabetes and other endocrine disorders, along with strong demand for cost-effective biologic alternatives. Healthcare providers are increasingly adopting long-acting insulin biosimilars to reduce long-term treatment costs while maintaining clinical efficacy. Favorable FDA regulatory pathways, growing confidence in biosimilar interchangeability, and supportive reimbursement policies are further accelerating adoption. Moreover, the strong presence of major biosimilar manufacturers and advanced healthcare infrastructure continues to support sustained market growth across hospital and outpatient settings.

Europe Long-Acting Recombinant Hormone Biosimilars Market Insight

The Europe long-acting recombinant hormone biosimilars market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by well-established biosimilar regulatory frameworks and strong government support for cost-containment in healthcare. Increasing burden of chronic diseases and widespread physician acceptance of biosimilars are fostering market growth. European healthcare systems actively promote biosimilar substitution to reduce biologic spending, supporting demand across diabetes and endocrinology care. Growth is evident across hospital and retail pharmacy channels, with biosimilars being integrated into standard treatment protocols.

U.K. Long-Acting Recombinant Hormone Biosimilars Market Insight

The U.K. long-acting recombinant hormone biosimilars market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong National Health Service initiatives encouraging biosimilar adoption. Rising prevalence of diabetes and increasing focus on value-based healthcare are driving demand for long-acting biosimilar therapies. Clinicians in the U.K. demonstrate high confidence in prescribing biosimilars, aided by clear clinical guidelines and reimbursement support. In addition, growing patient awareness and acceptance are contributing to sustained market expansion.

Germany Long-Acting Recombinant Hormone Biosimilars Market Insight

The Germany long-acting recombinant hormone biosimilars market is expected to expand at a considerable CAGR, fueled by a robust healthcare system and early adoption of biosimilar therapies. Germany’s strong emphasis on cost efficiency and high-quality clinical outcomes supports widespread use of long-acting insulin and growth hormone biosimilars. Favorable pricing policies and mandatory substitution incentives are encouraging uptake across hospital and outpatient settings. The country’s strong biopharmaceutical manufacturing base further strengthens market growth.

Asia-Pacific Long-Acting Recombinant Hormone Biosimilars Market Insight

The Asia-Pacific long-acting recombinant hormone biosimilars market is poised to grow at the fastest CAGR during the forecast period, driven by a rapidly expanding diabetic population, improving healthcare access, and rising healthcare expenditure. Increasing government support for biosimilar development and local manufacturing in countries such as China and India is boosting affordability and availability. Growing awareness of biosimilar safety and efficacy among healthcare professionals is further accelerating adoption. The region’s large patient pool and unmet treatment needs present significant growth opportunities.

Japan Long-Acting Recombinant Hormone Biosimilars Market Insight

The Japan long-acting recombinant hormone biosimilars market is gaining momentum due to the country’s aging population and rising incidence of chronic endocrine disorders. Japan’s stringent regulatory standards and gradual acceptance of biosimilars are supporting steady market growth. Long-acting therapies are particularly favored for improving adherence among elderly patients requiring long-term treatment. In addition, increasing efforts to control healthcare spending are encouraging the use of biosimilar alternatives in clinical practice.

India Long-Acting Recombinant Hormone Biosimilars Market Insight

The India long-acting recombinant hormone biosimilars market accounted for a significant revenue share in Asia-Pacific in 2025, driven by a large diabetic population, expanding middle class, and improving access to biologic therapies. Strong domestic biosimilar manufacturing capabilities and competitive pricing are making long-acting hormone biosimilars more accessible. Government initiatives to expand healthcare coverage and promote affordable medicines are further supporting market growth. Increasing diagnosis rates and awareness of chronic hormonal disorders are also contributing to rising demand across urban and semi-urban regions.

Long-Acting Recombinant Hormone Biosimilars Market Share

The Long-Acting Recombinant Hormone Biosimilars industry is primarily led by well-established companies, including:

- Viatris Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- Samsung Bioepis Co., Ltd. (South Korea)

- Biocon Limited (India)

- Intas Pharmaceuticals Ltd. (India)

- Alvotech hf. (Iceland)

- Fresenius Kabi AG (Germany)

- Celltrion Healthcare Co., Ltd. (South Korea)

- Amgen Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- LG Chem, Ltd. (South Korea)

- GEROPHARM JSC (Russia)

- Paras Biopharmaceuticals Ltd. (India)

- GC Pharma (South Korea)

- Wockhardt Ltd. (India)

- Merck & Co., Inc. (U.S.)

- Biogen Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Genentech, Inc. (U.S.)

What are the Recent Developments in Global Long-Acting Recombinant Hormone Biosimilars Market?

- In February 2025, the U.S. Food and Drug Administration (FDA) approved Merilog (insulin-aspart-szjj) a biosimilar to NovoLog for treatment of diabetes, marking increased biosimilar competition in insulin therapies alongside long-acting products and potentially improving access to diabetes care

- In June 2023, Somatrogon (Ngenla) a long-acting human growth hormone analog—was approved for medical use in the United States after prior EU and Australian approvals, offering once-weekly treatment for growth hormone deficiency and influencing treatment expectations in long-acting recombinant hormone therapies

- In November 2022, Eli Lilly’s Rezvoglar (insulin glargine-aglr) a long-acting insulin glargine biosimilar originally approved in December 2021 received an interchangeability designation from the FDA, allowing pharmacists to substitute it for the reference Lantus without prescriber intervention, boosting accessibility

- In August 2021, lonapegsomatropin-tcgd (Skytrofa) was approved by the FDA for pediatric growth hormone deficiency, representing a shift toward long-acting growth hormone formulations that reduce injection frequency and improving patient adherence in GHD treatment

- In July 2021, the FDA approved Semglee (insulin glargine-yfgn) as the first interchangeable biosimilar insulin product for long-acting insulin therapy (basal insulin) in diabetes treatment, enabling pharmacy-level substitution and expanded patient access

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。