Global Private Label Cosmetics Market

市场规模(十亿美元)

CAGR :

%

USD

12.28 Billion

USD

18.01 Billion

2024

2032

USD

12.28 Billion

USD

18.01 Billion

2024

2032

| 2025 –2032 | |

| USD 12.28 Billion | |

| USD 18.01 Billion | |

|

|

|

|

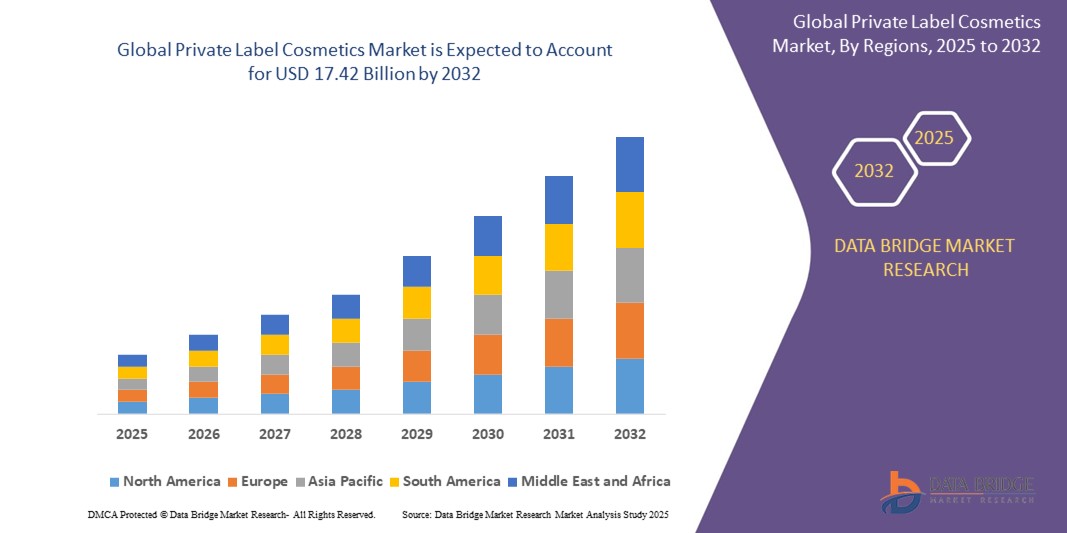

全球自有品牌化妝品市場細分,按產品(護膚品、護髮品、彩妝和香水)、類型(有機/天然、傳統/合成和其他)、最終用途(男士、女士和其他)、分銷渠道(線下、線上/電子商務和其他)進行細分 - 行業趨勢及預測(至 2032 年)

自有品牌化妝品市場規模

- 2024 年全球自有品牌化妝品市場規模為122.8 億美元 ,預計 到 2032 年將達到 180.1 億美元,預測期內 複合年增長率為 4.90%。

- 市場成長主要源自於對價格實惠且高品質美容產品的需求不斷增長,加上零售商和消費者對獨家品牌客製化化妝品的偏好日益增長

- 此外,電子商務平台的興起、配方技術的進步以及生產外包給專業製造商的增加,使零售商能夠擴大其自有品牌化妝品系列,進一步推動市場擴張

自有品牌化妝品市場分析

- 自有品牌化妝品,包括以零售商品牌名稱銷售的護膚品、護髮品、彩妝品和個人護理產品,正在全球範圍內受到青睞,因為零售商利用消費者偏好轉向高品質且經濟實惠的美容解決方案

- 自有品牌化妝品需求的不斷增長,源於消費者對零售商品牌的信任度不斷提高、對個人化和小眾美容產品的興趣日益濃厚,以及合約製造夥伴關係帶來的更快的產品創新週期

- 北美在自有品牌化妝品市場佔據主導地位,2025 年將佔據 38.7% 的最大收入份額,這得益於強大的零售基礎設施、自有美容品牌的普及以及消費者對具有清潔或天然配方的物有所值產品的日益偏好

- 由於可支配收入的增加、美容意識的增強以及中國、印度和韓國等國家現代零售和電子商務滲透率的不斷提高,預計亞太地區將成為預測期內自有品牌化妝品市場增長最快的地區

- 預計到 2025 年,護膚品將佔據自有品牌化妝品市場的主導地位,市場份額將達到 41.6%,這得益於消費者對抗衰老、保濕和天然成分產品的興趣,這些產品以實惠的價格提供優質的產品

報告範圍和自有品牌化妝品市場細分

|

屬性 |

自有品牌化妝品關鍵市場洞察 |

|

涵蓋的領域 |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Private Label Cosmetics Market Trends

“Rising Demand for Clean Beauty and Personalized Solutions”

- A significant and accelerating trend in the global private label cosmetics market is the growing consumer preference for clean, natural, and organic beauty products that avoid harmful chemicals, reflecting increased health and environmental awareness

- For instance, many private label brands are now offering formulations free from parabens, sulfates, and synthetic fragrances, appealing to eco-conscious and sensitive-skin consumers. Brands such as Beauty counter and Herbivore Botanicals have inspired retailers to incorporate similar clean-label standards in their private lines

- Personalization is also reshaping the market, with consumers demanding customized skincare and makeup products tailored to their unique skin types and concerns. Technologies such as AI-driven skin analysis apps and online quizzes are enabling private label manufacturers to offer bespoke formulations

- For instance, Function of Beauty’s personalized haircare model is influencing cosmetic retailers to explore tailored private label offerings

- The rise of influencer collaborations and social media-driven product launches accelerates trend adoption and consumer engagement. Many retailers partner with influencers to co-create limited edition private label collections, driving rapid growth and brand visibility

- In addition, the expansion of direct-to-consumer e-commerce platforms is allowing private label brands to bypass traditional retail constraints, offering convenience, competitive pricing, and deeper consumer data insights to fuel innovation

- This trend towards clean, personalized, and digitally-enabled private label cosmetics is fundamentally transforming consumer expectations, prompting retailers and manufacturers to invest in research, technology, and sustainable practices to stay competitive

Private Label Cosmetics Market Dynamics

Driver

“Increasing Consumer Demand for Affordable, High-Quality, and Customized Beauty Products”

- The rising preference among consumers for affordable yet high-quality cosmetics is a significant driver fueling the growth of the private label cosmetics market globally.

- For instance, in March 2024, Sephora launched several exclusive private label skincare lines aimed at providing premium formulations at competitive prices, highlighting a growing trend among major retailers to expand private label offerings.

- Consumers are increasingly seeking personalized and niche beauty products that cater to individual skin types, tones, and preferences, encouraging retailers to collaborate with specialized manufacturers to develop customized private label products.

- In addition, the surge in online beauty shopping and the expansion of direct-to-consumer channels enable private label brands to reach wider audiences, improving accessibility and consumer engagement.

- The trend toward clean, vegan, and cruelty-free formulations within private label cosmetics further drives demand as consumers become more conscious of product ingredients and ethical considerations.

- Retailers benefit from enhanced profit margins and stronger brand loyalty by offering unique private label products that differentiate them in a highly competitive market, propelling continued investment and innovation in this space.

Restraint/Challenge

“Intense Market Competition and Quality Control Concerns”

- The highly competitive nature of the cosmetics industry, with numerous established brands and new entrants, poses a significant challenge for private label cosmetics manufacturers and retailers striving to differentiate their offerings

- For instance, many private label brands face skepticism from consumers regarding product efficacy and safety compared to well-known branded cosmetics, which can limit market acceptance and growth

- Maintaining consistent quality and compliance with increasingly stringent regulatory standards across different regions is a complex and costly process for private label manufacturers. Incidents of product recalls or negative consumer feedback can severely impact brand reputation

- In addition, supply chain disruptions and variability in raw material availability—especially for natural and organic ingredients—can affect production timelines and product consistency, adding operational challenges

- Price sensitivity among consumers, especially in developing markets, also limits the extent to which private label brands can invest in premium ingredients or innovative formulations without increasing product costs

- Overcoming these challenges requires investment in quality assurance, transparent ingredient sourcing, strong regulatory compliance, and effective marketing to build consumer trust and brand loyalty

Private Label Cosmetics Market Scope

The market is segmented on the basis product, type, end use, and distribution channel.

By Product

On the basis of product, the private label cosmetics market is segmented into skincare, haircare, color cosmetics, and fragrance. The skincare segment dominates the largest market revenue share in 2025, driven by increasing consumer focus on skin health, anti-aging, and personalized skincare solutions. Products such as moisturizers, serums, and sunscreens are key contributors to this segment’s growth.

The haircare segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising demand for natural and damage-repair products, along with innovations in formulations targeting diverse hair types and concerns. Shampoos, conditioners, and styling products under private labels are increasingly gaining consumer preference.

• By Type

On the basis of type, the market is segmented into organic/natural, conventional/synthetic, and other types. The organic/natural segment holds the largest market revenue share in 2025, reflecting growing consumer awareness about clean beauty and preference for eco-friendly, chemical-free ingredients. This segment benefits from trends toward sustainability and health-conscious consumption.

The conventional/synthetic segment is expected to witness steady growth due to the availability of a wider variety of formulations and cost-effective manufacturing processes. Conventional products continue to appeal to consumers seeking high-performance and innovative cosmetic solutions.

• By End Use

On the basis of end use, the market is segmented into men, women, and others. The women’s segment accounted for the largest market revenue share in 2024, driven by extensive product offerings, evolving beauty trends, and strong marketing campaigns targeting female consumers across age groups. Skincare and color cosmetics are particularly popular in this segment.

The men’s segment is expected to witness the fastest CAGR from 2025 to 2032, supported by rising awareness about personal grooming, increasing availability of men-specific private label products, and growing acceptance of cosmetics among male consumers globally.

•By Distribution Channel

On the basis of distribution channel, the market is segmented into offline, online/e-commerce, and others. The offline segment held the largest market revenue share in 2025, supported by well-established retail networks such as department stores, specialty beauty stores, and supermarkets offering private label cosmetics with direct consumer interaction.

The online/e-commerce segment is expected to witness the fastest growth due to the rising popularity of digital shopping platforms, convenience of home delivery, and enhanced consumer access to a wide range of private label cosmetic products, boosted further by social media marketing and influencer endorsements.

Private Label Cosmetics Market Regional Analysis

- North America dominates the private label cosmetics market with the largest revenue share of 38.7% in 2024, driven by strong consumer demand for innovative and personalized beauty products alongside widespread adoption of clean and sustainable cosmetics

- Consumers in the region prioritize quality, brand transparency, and product efficacy, with a growing preference for private label offerings from major retailers and e-commerce platforms that provide value without compromising on performance

- This dominance is further supported by high disposable incomes, advanced retail infrastructure, and robust online sales channels, enabling seamless access to a diverse range of private label cosmetic products across skincare, haircare, and color cosmetics categories

U.S. Private Label Cosmetics Market Insight

The U.S. private label cosmetics market captured the largest revenue share of 82% within North America in 2024, fueled by increasing consumer preference for personalized and clean beauty products. Growing awareness around organic and natural ingredients, combined with the expansion of major retail chains and e-commerce platforms offering private label cosmetics, is driving market growth. Moreover, rising demand for affordable yet high-quality cosmetics in categories such as skincare and color cosmetics is significantly boosting adoption.

Europe Private Label Cosmetics Market Insight

The European private label cosmetics market is projected to expand at a substantial CAGR throughout the forecast period, driven by the rising demand for natural and organic products alongside strict regulatory frameworks promoting product safety. Increasing urbanization and sustainability concerns among consumers are fostering the growth of private label cosmetics. The region sees strong demand across skincare and haircare segments, with private labels gaining traction in both established retail outlets and online channels.

U.K. Private Label Cosmetics Market Insight

The U.K. private label cosmetics market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by rising consumer inclination toward value-for-money products with high quality and natural ingredients. The expanding influence of beauty influencers and social media campaigns promoting private label brands is enhancing market penetration. Additionally, the U.K.’s well-developed retail and e-commerce infrastructure further accelerates market growth.

Germany Private Label Cosmetics Market Insight

The German private label cosmetics market is expected to expand at a considerable CAGR during the forecast period, fueled by growing consumer awareness of sustainable and cruelty-free beauty products. Germany’s emphasis on eco-friendly practices and innovation promotes the adoption of organic and natural private label cosmetics. The integration of private label products in both drugstores and specialty retail outlets supports steady market growth.

Asia-Pacific Private Label Cosmetics Market Insight

The Asia-Pacific private label cosmetics market is poised to grow at the fastest CAGR of over 22% in 2024, driven by rising disposable incomes, urbanization, and increasing demand for personalized and affordable beauty products in countries such as China, India, Japan, and South Korea. Government initiatives promoting domestic manufacturing and digital retail channels are boosting market accessibility. Additionally, the region’s growing beauty-conscious population and evolving consumer preferences toward natural and organic cosmetics are key growth factors.

Japan Private Label Cosmetics Market Insight

The Japan private label cosmetics market is gaining momentum due to the country’s sophisticated beauty culture and demand for high-quality skincare and anti-aging products. Japanese consumers prioritize product efficacy and safety, driving demand for innovative private label cosmetics incorporating natural ingredients and advanced formulations. The growth of e-commerce platforms and collaborations with local retailers further support market expansion.

China Private Label Cosmetics Market Insight

The China private label cosmetics market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a rising middle-class population, and increasing beauty awareness. China is witnessing growing demand for clean, organic, and customized private label products. The expansion of online sales channels, social media marketing, and government support for local manufacturing are significant factors accelerating market growth in China.

Private Label Cosmetics Market Share

The private label cosmetics industry is primarily led by well-established companies, including:

- Cosmax Inc. (South Korea)

- Intercos Group (Italy)

- Kolmar Korea Co., Ltd. (South Korea)

- Fareva (France)

- Schwan-STABILO Cosmetics GmbH & Co. KG (Germany)

- HCT Group (South Korea)

- Coptis (France)

- Cosmetic Solutions (U.S.)

- Manucurist (France)

- Garcoa Laboratories (U.S.)

- MakeUp Cosmetics (India)

- Vee Pak Inc. (U.S.)

- Anjac Health & Beauty (U.S.)

- HCP Packaging (China)

- BPI Labs (U.S.)

Latest Developments in Global Private Label Cosmetics Market

- In March 2025, Chromavis Fareva unveiled Dynaverse, a groundbreaking makeup line that seamlessly integrates skincare benefits. Presented at the Cosmoprof trade fair in Bologna, this innovative collection redefines the interaction between makeup and light, offering coverage while maintaining transparency. The formulations within Dynaverse work intuitively with the skin, enhancing natural beauty through hybridized technologies. Chromavis also won the Cosmopack Award for its Sheer Dream Creamy Remover, a vegan nail polish remover stick featuring a 100% natural formula

- In February 2025, Kolmar Korea introduced the Packaged Product Service (PPS), a streamlined solution designed to accelerate cosmetic product development. PPS provides predeveloped formulations and packaging options, significantly reducing the time required to launch new products—cutting the typical timeline from 9–12 months to just 3–6 months. By integrating advanced stability testing and leveraging its subsidiary Yenu, Kolmar Korea enhances efficiency while maintaining high-quality standards. This initiative strengthens K-beauty’s global competitiveness and supports emerging brands entering the market

- In September 2024, Cosmewax, a leading Spanish private-label cosmetics manufacturer, announced the construction of a new production facility in Puzol, Valencia. This expansion is dedicated to skincare products and is expected to boost the company’s production capacity by 50%. The state-of-the-art factory will integrate advanced technology and sustainable solutions, including solar energy systems, to enhance efficiency and environmental responsibility. This strategic move aligns with Cosmewax’s commitment to innovation and eco-friendly manufacturing

- In April 2024, Intercos S.p.A. entered into a new commercial agreement with The Estée Lauder Companies, strengthening their long-standing partnership of over 40 years. Under this agreement, Estée Lauder will transition the majority of its U.S.-based cosmetic powder production to Intercos America Inc., reinforcing Intercos’s expertise in the cosmetic powders segment. This strategic move highlights Intercos’s leadership in innovation and manufacturing, further expanding its global presence in beauty product development

- In August 2024, Walgreens Boots Alliance introduced an eco-friendly private-label cosmetics line, emphasizing sustainability and cruelty-free formulations. This new range aligns with the company’s commitment to responsible beauty, offering high-quality skincare and makeup products free from parabens, sulfates, and phthalates. Designed to meet growing consumer demand for ethical and environmentally conscious beauty solutions, the collection integrates sustainable packaging and clean ingredients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。