Global Zero Friction Coatings Market

市场规模(十亿美元)

CAGR :

%

USD

915.00 Million

USD

1,470.00 Million

2024

2032

USD

915.00 Million

USD

1,470.00 Million

2024

2032

| 2025 –2032 | |

| USD 915.00 Million | |

| USD 1,470.00 Million | |

|

|

|

|

全球零摩擦塗層市場按類型(PTFE 基低摩擦塗層和 MOS2 基低摩擦塗層)、最終用戶(汽車和運輸工業、航空航天工業、通用工程、食品和醫療保健、能源、石油和天然氣、電力等)細分 - 行業趨勢和預測至 2032 年

零摩擦塗料市場規模

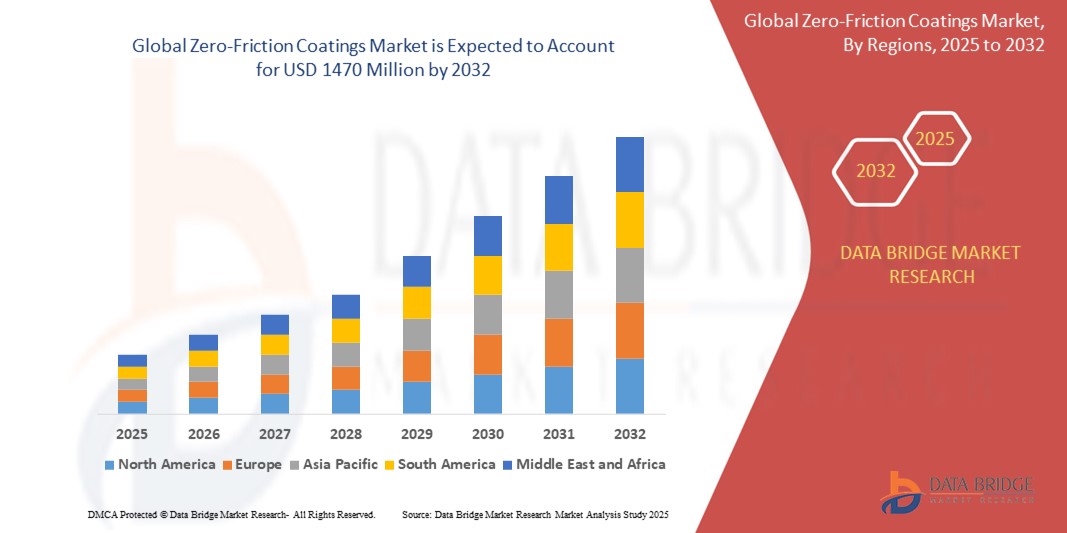

- 2024 年全球零摩擦塗層市場規模為9.156 億美元 ,預計 到 2032 年將達到 14.7 億美元,預測期內 複合年增長率為 5.4%。

- 市場成長主要得益於對節能解決方案的需求不斷增長、汽車和航空航太產量不斷增長、低摩擦塗層技術的進步、促進環保材料的嚴格環境法規以及全球工業機械、電子和可再生能源領域的應用不斷擴大。

- 此外,永續發展意識的不斷增強、政府對綠色技術的激勵以及塗層材料的不斷創新提高了塗層的耐用性和性能,推動了零摩擦塗層在製造業、運輸業和電子業等不同行業的廣泛應用,從而加速了整體市場的擴張。

零摩擦塗料市場分析

- 隨著工業自動化程度的提高、對設備效率的需求以及降低能耗的需求,零摩擦塗層市場正在迅速擴張。 PTFE 和 MoS₂ 等先進材料可提高汽車、航空航太和製造業的性能、耐用性和環保合規性。

- 亞太地區的工業繁榮和北美的技術創新推動了區域成長。嚴格的環境法規和永續發展目標推動了環保塗料的普及。然而,高昂的生產成本和原材料價格波動帶來了挑戰,促使人們持續研究開發經濟高效的高性能塗料解決方案。

- 亞太地區 (APAC) 將在 2025 年佔據零摩擦塗料市場的主導地位,收入份額為 36%,這得益於快速的工業化、不斷擴大的汽車和航空航天行業、不斷增長的製造活動、政府支持可持續技術的舉措以及中國和印度等主要經濟體對節能、高性能塗料解決方案日益增長的需求。

- 此外,研發投入的增加、PTFE 和 MoS₂ 等先進材料的採用、可再生能源項目的擴大以及環境法規意識的提高進一步推動了亞太地區對零摩擦塗層的需求,鞏固了其在全球市場的領導地位。

- 預計到 2025 年,PTFE 基低摩擦塗料領域將在零摩擦塗料市場佔據主導地位,佔有約 38% 的份額,這得益於其出色的耐化學性、低摩擦係數、廣泛的工業應用以及對耐用、節能塗料日益增長的需求。

報告範圍和零摩擦塗料市場細分

|

屬性 |

零摩擦塗層關鍵市場洞察 |

|

涵蓋的領域 |

|

|

覆蓋國家 |

北美洲

歐洲

亞太

中東和非洲

南美洲

|

|

主要市場參與者 |

|

|

市場機會 |

|

|

加值資料資訊集 |

除了對市場價值、成長率、細分、地理覆蓋範圍和主要參與者等市場情景的洞察之外,Data Bridge Market Research 策劃的市場報告還包括深入的專家分析、定價分析、品牌份額分析、消費者調查、人口統計分析、供應鏈分析、價值鏈分析、原材料/消耗品概述、供應商選擇標準、PESTLE 分析、波特分析和監管框架。 |

零摩擦塗料市場趨勢

“可持續、低摩擦塗層在汽車和工業應用中的應用日益廣泛”

- 日益嚴格的環境法規正在推動汽車製造商使用可持續的低摩擦塗層,提高燃油效率並減少排放,同時滿足全球嚴格的環保汽車生產標準。

- 工業部門正在採用低摩擦塗層來延長機械壽命、降低維護成本並提高營運效率,透過最大限度地減少能源消耗和資源浪費為永續發展目標做出貢獻。

- Advances in coating technologies enable development of bio-based and waterborne low-friction coatings, attracting industries aiming to reduce their carbon footprint and comply with increasing environmental compliance requirements worldwide.

- Automotive and aerospace industries prefer low-friction coatings for critical components to reduce wear and friction, resulting in improved performance, lower energy consumption, and extended equipment life, supporting long-term sustainability.

- Increasing awareness among manufacturers about the benefits of low-friction coatings, such as reduced downtime and improved equipment reliability, drives higher adoption rates in industrial applications seeking sustainable and cost-effective solutions.

Zero-Friction Coatings Market Dynamics

Driver

“Rising automotive production increases demand for sustainable friction-reducing coatings”

- Rapid growth in global automotive manufacturing drives the need for advanced low-friction coatings that improve fuel efficiency, reduce emissions, and meet stringent environmental regulations, promoting widespread adoption of sustainable coating solutions in vehicle components.

- Increasing production of electric vehicles (EVs) emphasizes the use of friction-reducing coatings to enhance battery performance, extend component life, and optimize energy efficiency, accelerating demand for sustainable coatings in the automotive sector.

- Automotive OEMs focus on lightweight materials and advanced surface treatments, including sustainable friction-reducing coatings, to improve overall vehicle performance, durability, and compliance with global emission standards, stimulating market growth.

- Expansion of automotive supply chains in emerging economies boosts demand for cost-effective, eco-friendly coatings that support local manufacturers’ sustainability goals and meet international quality benchmarks.

- Rising consumer preference for environmentally responsible vehicles encourages manufacturers to integrate sustainable coatings that reduce energy loss and wear, aligning product development with global sustainability trends and regulatory frameworks.

Restraint/Challenge

“High production costs limit widespread adoption of zero-friction coatings”

- Expensive raw materials and complex manufacturing processes increase overall costs, making zero-friction coatings less affordable for small and medium-sized enterprises, limiting their market penetration and adoption across various industries.

- High production expenses discourage price-sensitive customers from switching to zero-friction coatings, especially in cost-competitive sectors where cheaper alternatives may be preferred despite lower performance benefits

- The need for specialized equipment and skilled labor to apply advanced coatings adds to operational costs, posing a barrier to large-scale implementation in emerging markets and developing economies.

- Research and development investments required to improve coating formulations and reduce costs can be substantial, limiting the pace of innovation and the availability of cost-effective zero-friction coating options.

- Price volatility of key raw materials such as PTFE and MoS₂ further escalates production costs, making it challenging for manufacturers to maintain stable pricing and profitability in a competitive market environment.

Zero-Friction Coatings Market Scope

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the Zero-Friction Coatings market is segmented into PTFE-Based Low Friction Coatings and MOS2 Based Low Friction Coatings. The PTFE-Based Low Friction Coatings segment dominates the largest market revenue share of approximately 38% in 2025, driven by its excellent chemical resistance, low friction properties, wide industrial applications, durability under extreme conditions, and growing demand from automotive, aerospace, and manufacturing sectors globally.

The PTFE-Based Low Friction Coatings segment is anticipated to witness the fastest growth rate of around 6.5% CAGR from 2025 to 2032, fueled by increasing adoption in automotive and aerospace industries, superior performance in reducing wear, and rising demand for energy-efficient, sustainable coating solutions.

- By End-User

On the basis of end-user, the Zero-Friction Coatings market is segmented in to automobile and transportation industry, aerospace industry, general engineering, food and healthcare, energy, oil and gas, power and others. The automobile and transportation industry segment drives the Zero-Friction Coatings market due to increasing demand for fuel-efficient vehicles, stringent emission regulations, need for lightweight components, and growing adoption of electric vehicles, which require advanced low-friction coatings to enhance performance and reduce energy consumption.

The automobile and transportation industry segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising electric vehicle production, stringent emission norms, demand for improved fuel efficiency, and increasing use of lightweight materials requiring advanced zero-friction coatings.

Zero-Friction Coatings Market Regional Analysis

- Asia-Pacific (APAC) dominates the Zero-Friction Coatings market with a 36% revenue share in 2025, driven by rapid industrialization, expanding automotive and aerospace sectors, increasing manufacturing activities, government initiatives supporting sustainable technologies, and growing demand for energy-efficient, high-performance coating solutions across key economies like China and India.

- Strong government support for sustainable technologies and environmental regulations, coupled with rising demand for energy-efficient and durable coating solutions, further accelerate market expansion across Asia-Pacific, making it the fastest-growing region for zero-friction coatings globally.

- Increasing investments in research and development within Asia-Pacific are driving innovation in zero-friction coatings, enabling the creation of cost-effective, eco-friendly, and high-performance products that meet stringent environmental standards, further strengthening the region’s dominance and fueling robust market growth through 2025 and beyond.

China Zero-Friction Coatings Market Insight

The China Zero-Friction Coatings market captured the largest revenue share of approximately 42% within Asia-Pacific (APAC) in 2025, driven by its extensive manufacturing base, strong automotive and industrial machinery sectors, and growing demand for high-performance coatings to reduce energy losses and enhance equipment durability.

North America Zero-Friction Coatings Market Insight

The North America market is projected to expand at a substantial CAGR due to increasing demand from the automotive and aerospace sectors, rising focus on energy efficiency, technological advancements in coating materials, and growing investments in research and development for durable, high-performance surface solutions.

U.S. Zero-Friction Coatings Market Insight

The U.S. market is driven by robust industrial infrastructure, high demand from automotive and aerospace sectors, advancements in coating technologies, stringent environmental regulations promoting low-friction solutions, and increased investment in R&D. These factors collectively support the growing adoption of zero-friction coatings across various applications.

Zero-Friction Coatings Market Share

The Zero-Friction Coatings industry is primarily led by well-established companies, including:

- AkzoNobel N.V. (Netherlands)

- The Chemours Company (United States)

- Solvay S.A. (Belgium)

- PPG Industries, Inc. (United States)

- BASF SE (Germany)

- Mankiewicz Gebr. & Co. GmbH (Germany)

- Henkel AG & Co. KGaA (Germany)

- RPM International Inc. (United States)

- Saint-Gobain (France)

- CIE Automotive (Spain)

- Zhejiang Jiashan Coating Co., Ltd. (China)

- Jiangsu Yoke Industrial Co., Ltd. (China)

- Coventya GmbH (Germany)

- NanoTech Coatings (United Kingdom)

- Süd-Chemie AG (Germany)

Latest Developments in Global Zero-Friction Coatings Market

- In September 2024, DuPont launched an advanced zero-friction coating designed for extreme industrial conditions. This product significantly increases component lifespan and efficiency in high-stress environments, such as automotive and aerospace applications. It aligns with growing industry demand for energy-saving, wear-resistant coating technologies.

- In April 2022, PPG Industries acquired Arsonsisi's powder coatings division to enhance its zero-friction coating portfolio. The acquisition strengthens PPG’s market presence across Europe and supports innovation in sustainable, low-emission coating solutions tailored for automotive, electronics, and heavy machinery sectors seeking performance and regulatory compliance.

- 2022年6月,福斯集團收購瑞典Gleitmo Technik AB公司,擴大潤滑油和塗料產品線。此舉鞏固了福斯在歐洲市場的地位,使其能夠獲得先進的零摩擦塗層技術,從而提升機械性能並降低能耗。

- 2023年,3M推出了專為汽車產業設計的全新零摩擦塗層系列。這些塗層有助於減少機械能量損失,提高燃油效率,並支持減排目標,滿足了全球對永續性和高性能汽車工程日益增長的關注。

- 2023年,杜邦公司推出了新一代低摩擦塗層,旨在提供更長的耐用性和更低的環境影響。這些塗層專為工業和運輸應用而設計,滿足了日益增長的環保材料需求,同時在高溫、高壓等極端操作條件下也能保持優異的性能。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。