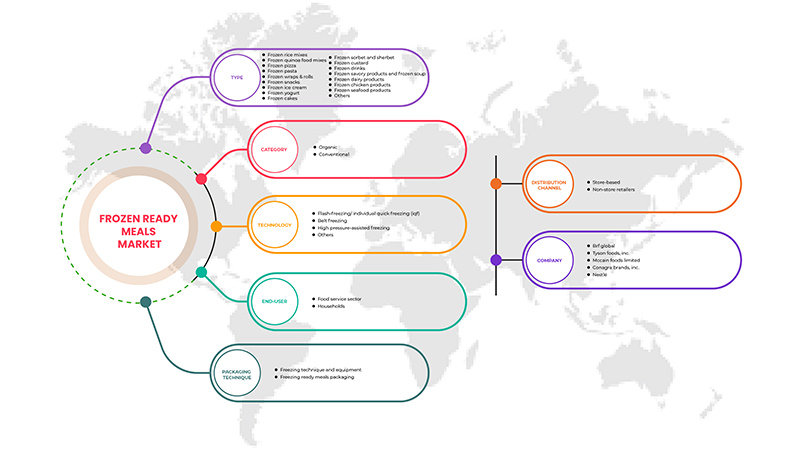

北美冷冻即食食品市场,按类型(冷冻米饭混合物、冷冻藜麦食品混合物、冷冻比萨、冷冻意大利面、冷冻卷饼和面包卷、冷冻零食冷冻冰淇淋、冷冻酸奶、冷冻蛋糕、冷冻冰糕和果子露、冷冻蛋奶冻、冷冻饮料、冷冻咸味产品和冷冻汤、冷冻乳制品、冷冻鸡肉产品、冷冻海鲜产品等)、类别(有机和传统)、技术(速冻/单独速冻 (IQF)、带式冷冻、高压辅助冷冻等)、最终用户(食品服务业和家庭)、包装技术(冷冻技术和设备以及冷冻即食食品包装和分销渠道(基于商店和非商店零售商) - 行业趋势和预测到 2029 年。

北美冷冻即食食品市场分析和见解。

由于消费者的生活方式繁忙,北美冷冻即食食品市场增长更快。越来越多的人改变饮食习惯,选择均衡的营养饮食和积极的生活方式,这是推动冷冻即食食品行业增长的主要因素。世界各地的人们生活忙碌,因此更喜欢即食食品以节省精力和时间,这有利于市场的增长。然而,冷冻即食食品的高价格可能会阻碍市场的增长。

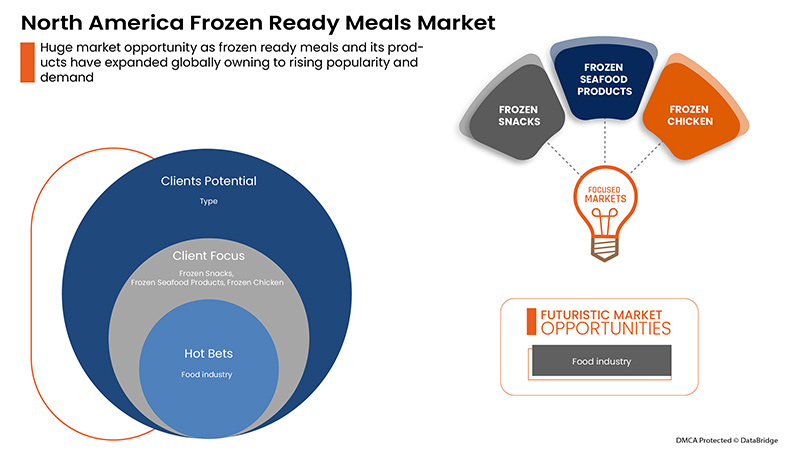

冷冻鸡肉、牛肉和海鲜消费量的增加将为全球市场带来新的机遇。相反,市场参与者之间的竞争可能会对市场的增长构成挑战。

各家公司都在做出战略决策,例如推出创新型速冻即食食品,以及收购其他公司以提高市场份额。因此,全球速冻即食食品市场正在快速增长。

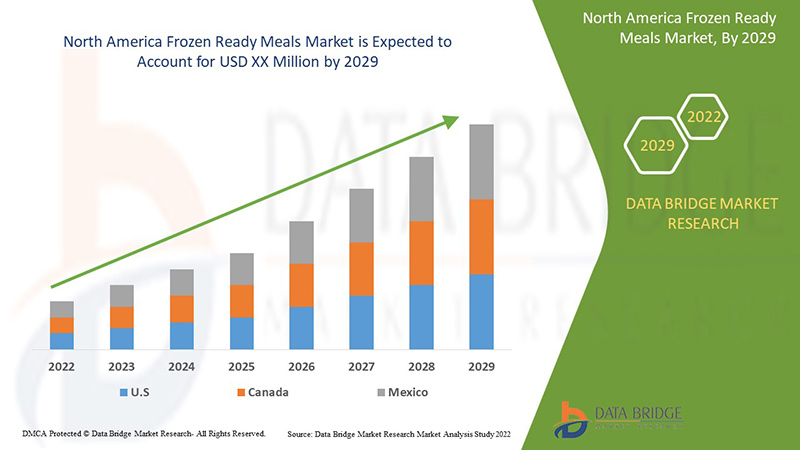

Data Bridge Market Research 分析称,2022 年至 2029 年的预测期内,北美冷冻即食食品市场将以 5.0% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2015) |

|

定量单位 |

收入(百万美元) |

|

涵盖的领域 |

按类型(冷冻米粉、冷冻藜麦食品混合物、冷冻比萨、冷冻意大利面、冷冻卷饼和面包卷、冷冻小吃、冷冻冰淇淋、冷冻酸奶、冷冻蛋糕、冷冻冰糕和果子露、冷冻蛋奶冻、冷冻饮料、冷冻咸味产品和冷冻汤、冷冻乳制品、冷冻鸡肉产品、冷冻海鲜产品等)、类别(有机和传统)技术(速冻/单独速冻(IQF)、带式冷冻、高压辅助冷冻等)、最终用户(食品服务业和家庭)、包装技术(冷冻技术和设备以及冷冻即食食品包装和分销渠道(商店和非商店零售商) |

|

覆盖国家 |

美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

麦凯恩食品有限公司、卡夫食品、家乐氏公司、泰森食品公司、Nomad Foods、Grupo Virto、味之素株式会社、Gulf West Company、Sidco Foods Trading LLC、Al Kabeer Group ME、JBS Foods、Mosaic Foods、AdvancePierre、Wawona、雀巢、通用磨坊公司、康尼格拉品牌公司、Amy's Kitchen 公司、Safco International Gen. Trading Co. LLC、Hakan Agro DMCC、Dr. Oetker |

市场定义

速冻即食食品通常在工厂内烹制和包装。该过程包括加热食材并将其包装到容器中。一旦食品准备好并放入冰箱冷却,它们便会受到消费者的欢迎,因为它们提供了多样化的菜单并且易于准备。速冻食品可能包含肉类主菜、蔬菜和淀粉类食物,例如面食和酱汁。一些速冻食品是专门为素食者或有特定饮食需求的人准备的。制造这种产品需要食品加工商的细心照料。

北美冷冻即食食品市场动态

驱动程序

- 即食有机食品的受欢迎程度日益提高

近年来,即食食品已成为全球即食食品业务中最多样化的部分之一。便利模式的增长和对有机食品需求的增加导致对有机冷冻包装食品的需求不断增长。有机冷冻食品和饮料行业是忙碌消费者的另一个选择,提供从冷冻糖果到开胃菜和餐点的各种食品。有机冷冻即食食品因没有微生物和真菌污染而受到消费者的欢迎。此外,有机冷冻即食食品提供的营养和健康益处也导致了市场需求的增长。因此,为了吸引更多追求健康和风味的消费者,冷冻包装食品制造商也将营养益处与口味相结合,从而推动了全球冷冻即食食品市场的增长。消费者对植物性纯素产品的偏好正在发生变化,为有机、方便食品铺平了道路,导致全球市场对冷冻即食食品的需求增加。

例如,

- 2021 年 12 月,Organic Prairie 推出的新款有机碎牛肉采用全有机调味料预先调味,缩短了一些美国最受欢迎的家常菜的准备时间。由于推出了新款有机调味碎牛肉,家庭厨师现在可以选择快速轻松准备的优质蛋白质。顾客可以“随手拿走”,肉在大约 8 分钟内就完全煮熟了

- 消费者生活方式和饮食习惯的改变

在快节奏的忙碌世界中,一半的人口更喜欢方便食品,这有助于消费者节省准备饭菜的时间和精力。由于生活节奏快、忙碌,消费者的消费模式从生食转向方便食品。此外,快速的城市化和人们生活方式的变化也增加了对冷冻即食食品的需求。由于消费者消费模式的不断演变,由于消费者健康意识的增强和城市生活方式的不断增加,方便食品在全球范围内大幅增长。与此同时,由于时间更少、工作量更大,消费者正转向快速发展的企业模式,使他们的饮食模式多样化。冷冻即食食品易于烹饪、随时可用、价格实惠且方便食用,使其成为满足消费者日常营养需求的明智解决方案。消费者健康和保健意识的增强正在加速人们养成健康的生活方式,提高人们对积极生活方式的接受度,而食用保存了营养的健康冷冻食品正在推动冷冻即食食品市场向前发展。

机会

-

冷冻即食食品制造商采取了越来越多的举措

冷冻即食食品制造商采取的举措越来越多,例如产品发布、扩张、筹集资金等,将为全球冷冻即食食品市场的增长创造巨大的机会。由于日程繁忙、可支配收入增加以及对即食食品的需求不断增长以节省烹饪时间,消费者对冷冻即食食品的需求正在增加。消费者对冷冻即食食品的需求不断增加,使制造商能够向市场推出新产品、扩大生产设施并增加投资,为不同的最终用户生产不同的冷冻即食食品。

例如,

- 2021年11月,Mosaic Foods在由Gather Ventures领投的种子轮融资中筹集了600万美元。他们计划借助这笔资金扩大直销业务、开发新产品并拓展线下渠道

限制/挑战

- 冷冻食品保质期有限

食品加工和冷冻技术限制了冷冻食品的保质期。冷冻食品可以避免变质并保持风味。然而,这也使某些冷冻食品的保质期有限。超过冷冻保质期的食品通常不安全,因为解冻后,它们会缺乏风味、营养或两者兼而有之,或者质地奇怪。这就是为什么包装好的冷冻食品(如肉类、蔬菜或完全煮熟的主菜)通常都有保质期。由于这些物品已经过了保质期,因此它们不再合法出售。

冷冻食品的保质期取决于原材料的质量、冷冻速度、储存温度和定期维护以及零售商和消费者对产品的处理方式。微生物检测的适用性有限。然而,化学检测可以直接测量保质期。

后 COVID-19 对北美冷冻即食食品市场的影响

新冠疫情对消费者行为产生了重大影响。消费者正在囤积保质期较长的食品,例如冷冻即食食品。囤货行为导致 2020 年全球冷冻零食和食品市场价值大幅上涨,由于冷冻食品保质期较长且易于储存,疫情结束后,这一情况将恢复正常。

最新动态

- 2020 年 11 月,雀巢旗下子公司 Gerber Products Co. 推出了 Freshful Start 碗装和冷冻零食。这些经美国农业部认证的有机、清洁标签产品由全谷物和蔬菜制成,非常适合 12 个月及以上的幼儿,几分钟内即可加热食用

北美冷冻即食食品市场范围

北美冷冻即食食品市场根据类型、类别、技术、最终用户、包装技术和分销渠道分为六个显著的细分市场。这些细分市场之间的增长将帮助您分析行业中的主要增长细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

类型

- 冷冻零食

- 冷冻比萨

- 冰冻冰淇淋

- 冷冻海鲜产品

- 冷冻鸡肉产品

- 冷冻酸奶

- 冷冻乳制品

- 冷冻意大利面

- 冷冻饮品

- 冷冻素食

- 冷冻雪糕和果子露

- 冷冻蛋糕

- 冷冻卷饼和面包卷

- 冷冻蛋奶冻

- 冷冻汤

- 冷冻藜麦食品混合物

- 冷冻米饭

- 其他的

根据类型,北美冷冻即食食品市场分为冷冻米饭混合物、冷冻藜麦食品混合物、冷冻比萨、冷冻意大利面、冷冻卷饼和面包卷、冷冻小吃、冷冻冰淇淋、冷冻酸奶、冷冻蛋糕、冷冻冰糕和果子露、冷冻蛋奶冻、冷冻饮料、冷冻咸味产品和冷冻汤、冷冻乳制品、冷冻鸡肉产品、冷冻海鲜产品等。

类别

- 传统的

- 有机的

根据类别,北美冷冻即食食品市场分为有机食品和传统食品

技术

- 速冻/单独速冻(IQF)

- 带式冷冻

- 高压辅助冷冻

- 其他的

根据技术,北美冷冻即食食品市场分为速冻/个体速冻(IQF)、带式冷冻、高压辅助冷冻等。

最终用户

- 食品服务业

- 家庭/零售业

根据最终用户,北美冷冻即食食品市场分为食品服务和家庭/零售部门。

封装技术

- 冷冻技术与设备

- 冷冻即食食品包装

根据包装技术,北美冷冻即食食品市场细分为冷冻技术和设备以及冷冻即食食品包装

分销渠道

- 商店零售商

- 无店铺零售商

根据分销渠道,北美冷冻即食食品市场分为商店零售商和非商店零售商。

北美冷冻即食食品市场区域分析/洞察

对北美冷冻即食食品市场进行了分析,并根据上述参考提供了市场规模洞察和趋势。

北美冷冻即食食品市场报告涵盖的国家包括美国、墨西哥和加拿大。

就市场份额和市场收入而言,美国预计将在北美冷冻即食食品市场占据主导地位。由于北美食品服务和酒店业的需求不断增长,预计美国将在预测期内保持主导地位。

报告的区域部分还提供了影响单个市场因素和市场法规变化,这些因素和变化会影响市场的当前和未来趋势。新车和替代车销售、国家人口统计、疾病流行病学和进出口关税等数据点是预测单个国家市场情景的一些主要指标。此外,在对国家数据进行预测分析时,还考虑了北美品牌的存在和可用性、它们因来自本地和国内品牌的激烈竞争而面临的挑战以及销售渠道的影响。

竞争格局和北美冷冻即食食品市场份额分析

竞争激烈的北美冷冻即食食品市场提供了有关竞争对手的详细信息。详细信息包括公司概况、公司财务状况、收入、市场潜力、研发投资、新市场计划、北美业务、生产基地和设施、生产能力、公司优势和劣势、产品发布、产品宽度和广度以及应用主导地位。以上数据点仅与公司对北美冷冻即食食品市场的关注有关。

北美冷冻即食食品市场的一些主要参与者包括麦凯恩食品有限公司、卡夫食品、家乐氏公司、泰森食品公司、Nomad Foods、Grupo Virto、味之素株式会社、Gulf West Company、Sidco Foods Trading LLC、Al Kabeer Group ME、JBS Foods、Mosaic Foods、AdvancePierre、Wawona、雀巢、通用磨坊公司、康尼格拉品牌公司、Amy's Kitchen, Inc.、Safco International Gen. Trading Co. LLC、Hakan Agro DMCC 和 Dr. Oetker 等。

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区以及供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA FROZEN READY MEALS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPARATIVE ANALYSIS

4.2 CONSUMER DISPOSABLE INCOME DYNAMICS/SPEND DYNAMICS

4.2.1 OVERVIEW

4.2.2 SOCIAL FACTORS

4.2.3 CULTURAL FACTORS

4.2.4 PSYCHOLOGICAL FACTORS

4.2.5 PERSONAL FACTORS

4.2.6 ECONOMIC FACTORS

4.2.7 PRODUCT TRAITS

4.2.8 MARKET ATTRIBUTES

4.2.9 CONSUMERS DISPOSABLE INCOME/SPEND DYNAMICS

4.2.10 CONCLUSION

4.3 CONSUMER TYPE AND THEIR BUYING PERCEPTIONS

4.3.1 OVERVIEW

4.3.2 MILLENNIALS

4.3.3 GEN X

4.3.4 BABY BOOMERS

4.4 FACTORS INFLUENCING PURCHASE DECISION

4.4.1 PRICING OF FROZEN READY MEALS PRODUCTS

4.4.2 CERTIFIED FROZEN READY MEALS PRODUCTS

4.4.3 QUALITY OF READY MEAL PRODUCTS

4.5 PRICING ANALYSIS FOR FROZEN READY MEALS MARKET

4.6 EXPORT & IMPORT ANALYSIS

4.7 LABELING AND CLAIMS

4.7.1 UNITED NATIONS ENVIRONMENT PROGRAMME SALE OF FROZEN FOODS REGULATIONS

4.7.2 DIRECTIVE 89/108/EEC ON QUICK-FROZEN FOODSTUFFS FOR HUMAN CONSUMPTION

4.7.3 FOOD CLAIMS ON LABELS – THE EUROPEAN PERSPECTIVE

4.8 LIST OF TOP EXPORTING COMPANIES OF NORTH AMERICA FROZEN READY MEALS MARKET

4.9 LIST OF TOP IMPORTING COMPANIES FOR FROZEN READY MEALS MARKET

4.1 MARKET TRENDS

4.11 NEW PRODUCT LAUNCH STRATEGY

4.11.1 OVERVIEW

4.11.2 NUMBER OF PRODUCT LAUNCHES

4.11.2.1 LINE EXTENSION

4.11.2.2 NEW PACKAGING

4.11.2.3 RELAUNCHED

4.11.2.4 NEW FORMULATION

4.11.3 DIFFERENTIAL PRODUCT OFFERING

4.11.4 MEETING CONSUMER REQUIREMENT

4.11.5 PACKAGE DESIGNING

4.11.6 PRICING ANALYSIS

4.11.7 PRODUCT POSITIONING

4.11.8 CONCLUSION

4.12 BRAND LABEL

4.13 PROMOTIONAL ACTIVITIES

4.14 SHOPPING BEHAVIOUR AND DYNAMICS

4.14.1 RECOMMENDATIONS FROM FAMILY & FRIENDS-

4.14.2 RESEARCH

4.14.3 IMPULSIVE

4.14.4 ADVERTISEMENT

4.14.5 TELEVISION ADVERTISEMENT

4.14.6 ONLINE ADVERTISEMENT

4.14.7 IN-STORE ADVERTISEMENT

4.14.8 OUTDOOR ADVERTISEMENT

4.15 SUPPLY CHAIN ANALYSIS

4.15.1 RAW MATERIAL PROCUREMENT

4.15.2 MANUFACTURING PROCESS

4.15.3 INDIVIDUAL QUICK FREEZER

4.15.4 INSPECTION OF FROZEN FOOD

4.15.5 PACKING OF FROZEN FOOD

4.15.6 AUTOMATIC PACKAGING UNIT

4.15.7 MARKETING AND DISTRIBUTION

4.15.8 END-USERS

5 REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY

6.1.2 RISING PREFERENCE FOR READY-TO-EAT ORGANIC FOODS

6.1.3 EXPANSIONS OF CONVENIENCE STORES

6.1.4 CHANGE IN LIFESTYLE AND EATING PATTERN OF CONSUMERS

6.2 RESTRAINTS

6.2.1 PRESENCE OF FATS IN FROZEN READY MEALS

6.2.2 LACK OF COLD CHAIN INFRASTRUCTURE

6.2.3 LIMITED SELF-LIFE OF FROZEN FOOD

6.3 OPPORTUNITIES

6.3.1 DIGITALIZATION OF THE RETAIL INDUSTRY

6.3.2 INCREASING NUMBER OF INITIATIVES TAKEN BY FROZEN READY MEALS MANUFACTURERS

6.4 CHALLENGES

6.4.1 HIGH COMPETITION AMONG THE MARKET PLAYERS

6.4.2 RISING PREFERENCE FOR FRESH AND NATURAL FOOD PRODUCTS

7 NORTH AMERICA FROZEN READY MEALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FROZEN SNACKS

7.2.1 FRENCH FRIES

7.2.2 NUGGETS

7.2.3 BITES

7.2.4 WEDGES

7.2.5 OTHERS

7.3 FROZEN PIZZA

7.3.1 FROZEN VEG PIZZA

7.3.1.1 WITH CHEESE

7.3.1.2 WITHOUT CHEESE

7.3.2 FROZEN NON-VEG PIZZA

7.3.2.1 FROZEN NON-VEG PIZZA, BY MEAT TYPE

7.3.2.1.1 PEPPERONI PIZZA

7.3.2.1.2 CHICKEN PIZZA

7.3.2.1.3 BEEF PIZZA

7.3.2.1.4 OTHERS

7.3.2.2 FROZEN NON-VEG PIZZA, BY BASE TYPE

7.3.2.2.1 WITH CHEESE

7.3.2.2.2 WITHOUT CHEESE

7.4 FROZEN ICE CREAM

7.4.1 FROZEN SOFT SERVE

7.4.2 FROZEN GELATO

7.4.3 OTHERS

7.5 FROZEN SEAFOOD PRODUCTS

7.5.1 FROZEN FISH FILLETS

7.5.2 FROZEN SHRIMP POPCORN

7.5.3 FROZEN FISH NUGGETS

7.5.4 FROZEN FISH BITES

7.5.5 OTHERS

7.6 FROZEN CHICKEN PRODUCTS

7.6.1 FROZEN CHICKEN NUGGETS

7.6.2 FROZEN CHICKEN STRIPS

7.6.3 FROZEN CHICKEN BITES

7.6.4 FROZEN CHICKEN WINGS

7.6.5 FROZEN CHICKEN POPCORN

7.6.6 OTHERS

7.7 FROZEN YOGHURT

7.7.1 LOW FAT

7.7.2 FAT FREE

7.7.3 FULL FAT

7.8 FROZEN DAIRY PRODUCTS

7.8.1 FROZEN DAIRY PRODUCTS, BY SOURCE

7.8.1.1 ANIMAL-BASED DAIRY

7.8.1.2 PLANT-BASED DAIRY

7.8.1.2.1 ALMOND MILK

7.8.1.2.2 SOY MILK

7.8.1.2.3 COCONUT MILK

7.8.1.2.4 OAT MILK

7.8.1.2.5 OTHERS

7.8.2 FROZEN DAIRY PRODUCTS, BY FLAVOR

7.8.2.1 REGULAR

7.8.2.2 FLAVOR

7.8.2.2.1 CHOCOLATES

7.8.2.2.2 VANILLA

7.8.2.2.3 STRAWBERRY

7.8.2.2.4 CARAMEL

7.8.2.2.5 BLACKBERRY

7.8.2.2.6 NUTS

7.8.2.2.7 BUTTERSCOTCH

7.8.2.2.8 PEPPERMINT

7.8.2.2.9 MOCHA

7.8.2.2.10 BLUEBERRY

7.8.2.2.11 BANANA

7.8.2.2.12 CHERRY

7.8.2.2.13 PEACH

7.8.2.2.14 AMARETTO

7.8.2.2.15 POMEGRANATE

7.8.2.2.16 PUMPKIN

7.8.2.2.17 COTTON CANDY

7.8.2.2.18 ORCHARD CHERRY

7.8.2.2.19 COCONUT

7.8.2.2.20 HONEY

7.8.2.2.21 HERBAL

7.8.2.2.22 OTHERS

7.9 FROZEN PASTA

7.9.1 SPAGHETTI

7.9.2 PENNE

7.9.3 RAVIOLI

7.9.4 MACARONI / MACCHERONI / ELBOW

7.9.5 LASAGNA

7.9.6 FETTUCCINE

7.9.7 GNOCCHI

7.9.8 OTHERS

7.1 FROZEN DRINKS

7.11 FROZEN VEGETARIAN MEALS

7.11.1 POWER BOWL

7.11.2 BUDDHA BOWL

7.11.3 SOUP BOWL

7.11.4 CURRY BOWL

7.12 FROZEN SORBET AND SHERBET

7.13 FROZEN CAKES

7.13.1 FLAVORED CAKES

7.13.2 PLUM CAKES

7.13.3 SPONGE CAKES

7.13.4 CHEESE CAKES

7.13.5 CUP CAKES

7.13.6 OTHERS

7.14 FROZEN WRAPS & ROLLS

7.14.1 FROZEN VEG WRAPS & ROLLS

7.14.2 FROZEN NON-VEG WRAPS & ROLLS

7.15 FROZEN CUSTARD

7.16 FROZEN SOUP

7.17 FROZEN QUINOA FOOD MIXES

7.17.1 QUINOA WITH VEGETABLES

7.17.2 QUINOA WITH CHICKEN

7.17.3 QUINOA WITH PORK

7.17.4 QUINOA WITH SEAFOOD

7.17.5 OTHERS

7.18 FROZEN RICE MIXES

7.18.1 FROZEN RICE MIXES, BY TYPE

7.18.1.1 WHITE RICE

7.18.1.2 BROWN RICE

7.18.1.3 BLACK RICE

7.18.1.4 WILD RICE

7.18.1.5 OTHERS

7.18.2 FROZEN RICE MIXES, BY RICE MIX CATEGORY

7.18.2.1 RICE WITH CHICKEN

7.18.2.1.1 WHITE RICE

7.18.2.1.2 BROWN RICE

7.18.2.1.3 BLACK RICE

7.18.2.1.4 WILD RICE

7.18.2.1.5 OTHERS

7.18.2.2 RICE WITH BEEF

7.18.2.2.1 WHITE RICE

7.18.2.2.2 BROWN RICE

7.18.2.2.3 BLACK RICE

7.18.2.2.4 WILD RICE

7.18.2.2.5 OTHERS

7.18.2.3 RICE WITH PORK

7.18.2.3.1 WHITE RICE

7.18.2.3.2 BROWN RICE

7.18.2.3.3 BLACK RICE

7.18.2.3.4 WILD RICE

7.18.2.3.5 OTHERS

7.18.2.4 RICE WITH SEAFOOD

7.18.2.4.1 WHITE RICE

7.18.2.4.2 BROWN RICE

7.18.2.4.3 BLACK RICE

7.18.2.4.4 WILD RICE

7.18.2.4.5 OTHERS

7.18.2.5 RICE WITH VEGETABLES

7.18.2.5.1 WHITE RICE

7.18.2.5.2 BROWN RICE

7.18.2.5.3 BLACK RICE

7.18.2.5.4 WILD RICE

7.18.2.5.5 OTHERS

7.18.2.6 OTHERS

7.19 OTHERS

8 NORTH AMERICA FROZEN READY MEALS MARKET, BY CATEGORY

8.1 OVERVIEW

8.2 ORGANIC

8.3 CONVENTIONAL

9 NORTH AMERICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

9.1 OVERVIEW

9.2 FROZEN READY MEALS PACKAGING

9.2.1 FROZEN READY MEALS PACKAGING, BY TYPE

9.2.1.1 OXYGEN SCAVENGERS

9.2.1.2 MOISTURE CONTROL

9.2.1.3 ANTIMICROBIALS

9.2.1.4 TIME TEMPERATURE INDICATORS

9.2.1.5 EDIBLE FILMS

9.3 FREEZING TECHNIQUE & EQUIPMENT

9.3.1 FREEZING TECHNIQUE & EQUIPMENT, BY TYPE

9.3.1.1 AIR BLAST FREEZERS

9.3.1.2 TUNNEL FREEZERS

9.3.1.3 BELT FREEZERS

9.3.1.4 CONTACT FREEZERS

10 NORTH AMERICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

10.1 OVERVIEW

10.2 FLASH-FREEZING/ INDIVIDUAL QUICK FREEZING (IQF)

10.3 BELT FREEZING

10.4 HIGH PRESSURE-ASSISTED FREEZING

10.5 OTHERS

11 NORTH AMERICA FROZEN READY MEALS MARKET, BY END-USER

11.1 OVERVIEW

11.2 HOUSEHOLD/RETAIL SECTOR

11.3 FOOD SERVICE SECTOR

11.3.1 RESTAURANTS

11.3.2 QUICK SERVICE RESTAURANTS

11.3.3 DINING RESTAURANTS

11.3.4 GHOST RESTAURANTS (DELIVERY ONLY RESTAURANTS)

11.3.5 OTHERS

11.3.6 CAFES

11.3.7 HOTEL

11.3.8 OTHERS

12 NORTH AMERICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 STORE BASED RETAILERS

12.2.1 GROCERY RETAILERS

12.2.2 SUPERMARKETS/HYPERMARKETS

12.2.3 FROZEN DAIRY PRODUCTS SHOPS/PARLORS

12.2.4 CONVENIENCE STORES

12.2.5 SPECIALTY STORES

12.2.6 WHOLESALERS

12.2.7 OTHERS

12.3 NON- STORE BASED RETAILERS

12.3.1 ONLINE RETAILERS

12.3.2 COMPANY WEBSITE

13 NORTH AMERICA FROZEN READY MEALS MARKET BY GEOGRAPHY

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 BRF NORTH AMERICA

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TYSON FOODS, INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 MCCAIN FOODS LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 CONAGRA BRANDS, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT DEVELOPMENTS

16.5 NESTLÉ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ADVANCE PIERRE

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENT

16.7 AJINOMOTO CO., INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 AL KABEER GROUP ME

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 AMY’S KITCHEN

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DR. OETKER

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GENERAL MILLS INC.

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 NORTH AMERICA FOOD INDUSTRIES LLC

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 VIRTO GROUP

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GULF WEST COMPANY

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT DEVELOPMENT

16.15 HAKAN AGRO DMCC

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 JBS S/A

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 KELLOGG CO. (2021)

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MOSAIC FOODS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 NOMAD FOODS

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 SAFCO INTERNATIONAL GEN. TRADING CO. L.L.C.

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SCHWAN'S HOME DELIVERY

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SIDCO FOODS TRADING L.L.C.

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 THE KRAFT HEINZ COMPANY

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 WAWONA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE:

18 RELATED REPORTS

表格列表

TABLE 1 NORTH AMERICA AVERAGE SELLING PRICES OF FROZEN READY MEALS:

TABLE 2 IMPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 3 EXPORT OF FROZEN MEAT OF BOVINE ANIMALS (USD THOUSANDS)

TABLE 4 IMPORT OF CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 5 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SWINE (USD THOUSANDS)

TABLE 6 IMPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 7 EXPORT OF FRESH, CHILLED OR FROZEN MEAT OF SHEEP OR GOATS (USD THOUSANDS)

TABLE 8 IMPORT OF FROZEN CRABS (2020)

TABLE 9 EXPORT OF FROZEN CRABS (2020)

TABLE 10 IMPORT OF FROZEN VEGETABLES (2020)

TABLE 11 EXPORT OF FROZEN VEGETABLES (2020)

TABLE 12 IMPORT OF FROZEN EELS, WHOLE (2020)

TABLE 13 EXPORT OF FROZEN EELS, WHOLE (2020)

TABLE 14 IMPORT OF FROZEN FISH FILLETS (2020)

TABLE 15 EXPORT OF FROZEN FISH FILLETS (2020)

图片列表

FIGURE 1 NORTH AMERICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA FROZEN READY MEALS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA FROZEN READY MEALS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA FROZEN READY MEALS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA FROZEN READY MEALS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA FROZEN READY MEALS FOOD MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA FROZEN READY MEALS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA FROZEN READY MEALS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA FROZEN READY MEALS MARKET: SEGMENTATION

FIGURE 10 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA FROZEN READY MEALS MARKET AND GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 11 INCREASED USE OF FROZEN FOOD IN THE FOOD SERVICE INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA FROZEN READY MEALS MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA FROZEN READY MEALS MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA FROZEN READY MEALS MARKET: FACTORS AFFECTING DISPOSABLE INCOME OR SPEND DYNAMICS OF THE CONSUMERS

FIGURE 14 NORTH AMERICA FROZEN READY MEALS MARKET: FACTORS AFFECTING NEW PRODUCT LAUNCHES STRATEGY

FIGURE 15 SUPPLY CHAIN ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA FROZEN READY MEALS MARKET

FIGURE 17 NORTH AMERICA FROZEN READY MEALS MARKET, BY TYPE

FIGURE 18 NORTH AMERICA FROZEN READY MEALS MARKET, BY CATEGORY

FIGURE 19 NORTH AMERICA FROZEN READY MEALS MARKET, BY PACKAGING TECHNIQUE

FIGURE 20 NORTH AMERICA FROZEN READY MEALS MARKET, BY TECHNOLOGY

FIGURE 21 NORTH AMERICA FROZEN READY MEALS MARKET, BY END USER

FIGURE 22 NORTH AMERICA FROZEN READY MEALS MARKET, BY DISTRIBUTION CHANNEL

FIGURE 23 NORTH AMERICA FROZEN READY MEALS MARKET: SNAPSHOT (2021)

FIGURE 24 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2021)

FIGURE 25 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 NORTH AMERICA FROZEN READY MEALS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 NORTH AMERICA FROZEN READY MEALS MARKET: BY TYPE (2022 & 2029)

FIGURE 28 NORTH AMERICA FROZEN READY MEALS MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。