北美遗传性视网膜疾病市场,按疾病类型(视网膜色素变性、斯塔加特病、全色盲、视锥杆营养不良、脉络膜缺失、莱伯先天性黑蒙、黄斑水肿等)、按类型(诊断和治疗)、最终用户(医院、专科诊所、门诊手术中心、家庭医疗保健等)、分销渠道(零售销售和直接招标)划分,行业趋势及预测至 2029 年。

市场分析和见解:北美遗传性视网膜疾病市场

遗传性视网膜疾病(IRD)是一组可能导致严重视力丧失甚至失明的疾病。每个 IRD 都由至少一个基因无法正常工作引起。IRD 会影响所有年龄段的人,进展速度不同,而且很少见。然而,许多 IRD 是退行性的,这意味着疾病的症状会随着时间的推移而恶化。常见的 IRD 类型包括莱伯先天性黑蒙 (LCA)、视网膜色素变性、脉络膜白斑、斯塔加特病和全色盲。基因治疗的目标是纠正或补偿有缺陷的基因。由于视网膜具有独特的物理构造,IRD 是基因治疗的强有力候选者。与身体的其他器官相比,眼睛很小,易于进行治疗。然而,身体的某些部位具有免疫特权,这意味着正常的免疫反应不那么活跃。这通常发生在我们身体非常重要的部位,如果出现肿胀或炎症,可能会受损。这意味着植入眼睛的任何东西(例如带有修正基因的细胞)都不太可能被排斥。

遗传性视网膜疾病的诊断和治疗包括各种技术,这些技术允许在产品获批后诊断遗传性视网膜疾病。该疾病的治疗方法最近获得批准,这支持了市场的增长。

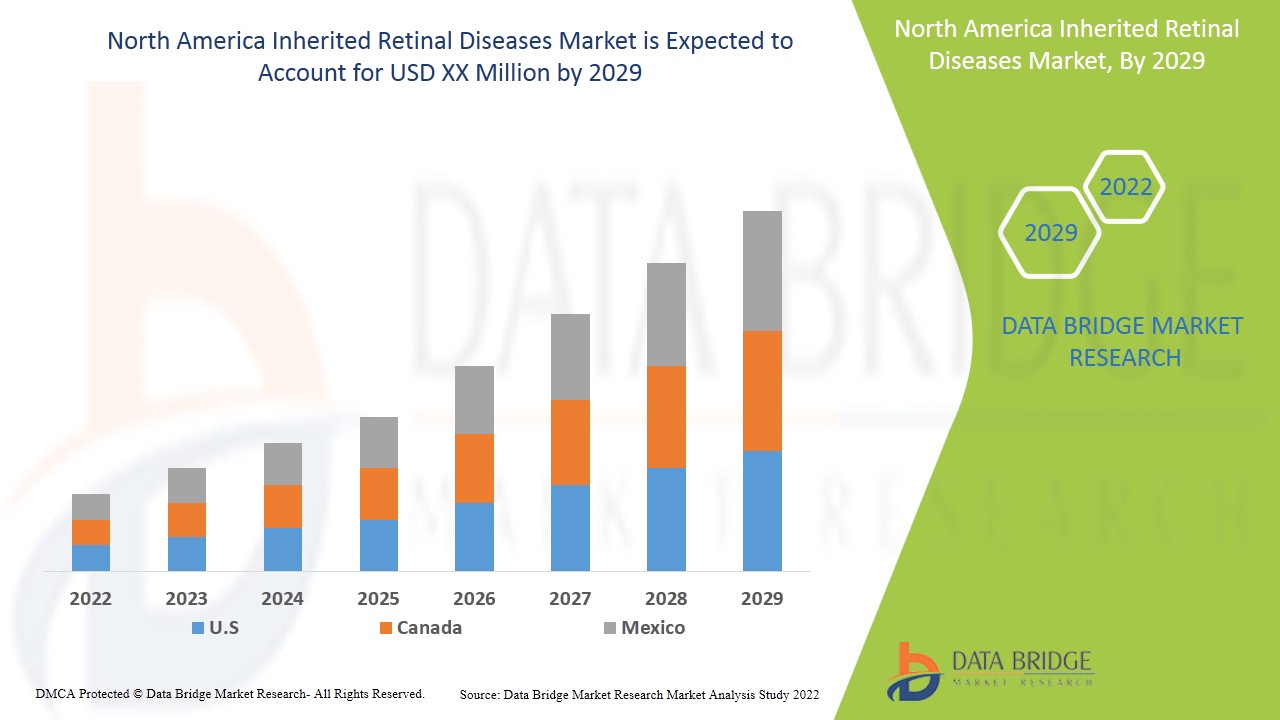

遗传性视网膜疾病具有支持作用,旨在减少疾病的进展。Data Bridge Market Research 分析,遗传性视网膜疾病市场在 2022 年至 2029 年的预测期内将以 7.6% 的复合年增长率增长。

|

报告指标 |

细节 |

|

预测期 |

2022 至 2029 年 |

|

基准年 |

2021 |

|

历史岁月 |

2020(可定制至 2019 - 2014) |

|

定量单位 |

收入(百万美元)、销量(单位)、定价(美元) |

|

涵盖的领域 |

疾病类型(视网膜色素变性、斯塔加特病、全色盲、视锥细胞-视杆细胞营养不良、脉络膜缺失、莱伯先天性黑蒙、黄斑水肿等)、按类型(诊断和治疗)、最终用户(医院、专科诊所、门诊手术中心、家庭医疗保健等)、分销渠道(零售和直接招标) |

|

覆盖国家 |

北美的美国、加拿大和墨西哥 |

|

涵盖的市场参与者 |

Spark Therapeutics、诺华公司、Okuvision、Nidek Co. Ltd.、Invitae Corporation、Carl Zeiss Meditech AG、Optos(尼康公司旗下子公司)、Neurosoft、PIXIUM VISION、LKC TECHNOLOGIES, INC.、Renurone、安斯泰来制药、REGENXBIO Inc.、Ionis Pharmaceutics、Sparing Vision、Ocugen Inc、强生公司、IVERIC bio、Second Sight、Coave Therapeutics、MeiraGTx Limited、Gensight Biologics、ProQR Therapeutics、Bionic Vision Technologies |

遗传性视网膜疾病市场动态

驱动程序

- 遗传性视网膜疾病患病率上升

遗传性致突变位点的日益流行和不断发现有望成为市场增长的驱动力。单基因IRD 的流行率约为 1/2000,影响 200 万在线用户。

- 管道产品不断增加

随着临床试验活动上升到新的水平,该领域似乎有望在 IRD 研究和患者护理方面取得快速而重要的进展。这些只是一些常见的试验,因此,在这个市场运营的公司不断进行临床试验,并将他们的候选人纳入临床试验。这有望创造机会并推动北美遗传性视网膜疾病市场的发展。遗传病患病率高

此外,米勒-迪克综合征、沃克-沃堡综合征等一些遗传病发病率的上升将进一步促进遗传性视网膜疾病市场的增长。

此外,主要参与者的战略举措增多、医疗技术的进步、IRD 产品审批的增加、公共和私人组织提高认识的举措增多以及政府资金的增加都是扩大遗传性视网膜疾病市场的因素。其他因素,如对有效疗法的需求增加和早期遗传咨询的采用率上升,将对遗传性视网膜疾病市场的增长率产生积极影响。此外,高可支配收入、各种视网膜疾病病例数的增加将导致遗传性视网膜疾病市场的扩大。

机会

- 政府针对遗传性视网膜疾病的治疗举措增多。

此外,认知度和治疗寻求率的提高以及新兴的治疗报销政策将为市场增长率带来新的机会。

此外,有效疗法的推出和持续的临床试验将为 2022-2029 年预测期内的遗传性视网膜疾病市场提供有利的机会。此外,当前治疗的巨大未满足需求和医疗技术的发展将在未来提高遗传性视网膜疾病市场的增长率。

限制/挑战

然而,低收入国家治疗费用高昂,基础设施缺乏,这些因素将阻碍遗传性视网膜疾病市场的增长。此外,缺乏足够的合格专业人员,以及疾病并发症也将阻碍遗传性视网膜疾病市场的增长。

这份遗传性视网膜疾病市场报告详细介绍了最新发展、贸易法规、进出口分析、生产分析、价值链优化、市场份额、国内和本地市场参与者的影响,分析了新兴收入领域的机会、市场法规的变化、战略市场增长分析、市场规模、类别市场增长、应用领域和主导地位、产品批准、产品发布、地域扩展、市场技术创新。如需了解有关遗传性视网膜疾病市场的更多信息,请联系 Data Bridge Market Research 获取分析师简报,我们的团队将帮助您做出明智的市场决策,实现市场增长。

患者流行病学分析

遗传性视网膜疾病是一种相对少见且发病率不明的遗传性疾病。根据一项关于遗传性视网膜疾病的研究,IRD 的发病率为 1/3000。

视网膜色素变性是其他疾病中最常见的一种。视网膜色素变性是一组相关的眼部疾病,由影响视网膜的 60 个基因变异引起。IRD 是一组异质性孤儿眼部疾病,患病率估计在 0.06% 至 0.2% 之间,北美 IRD 病例数在 500 万至 1000 万人之间。

遗传性视网膜疾病市场还为您提供详细的市场分析,包括患者分析、预后和治疗。患病率、发病率、死亡率、依从率是报告中提供的一些数据变量。分析流行病学对市场增长的直接或间接影响,以创建更稳健、更全面的多元统计模型,用于预测增长期的市场。

COVID-19 对遗传性视网膜疾病市场的影响

COVID-19 对市场产生了负面影响。疫情期间的封锁和隔离使疾病管理和药物依从性变得复杂。无法获得医疗设施进行常规治疗和药物管理将进一步影响市场。社会隔离会增加压力、绝望和社会支持,所有这些都可能导致疫情期间抗惊厥药物依从性的降低。

近期发展

- 2022年1月,致力于寻找治疗和治愈致盲视网膜疾病方法的全球领先组织宣布启动戴安娜戴维斯斯宾塞基金会增强转化研究加速计划。

北美遗传性视网膜疾病市场范围

遗传性视网膜疾病市场细分为疾病类型、类型、最终用户和分销渠道。这些细分市场之间的增长将帮助您分析行业中增长微弱的细分市场,并为用户提供有价值的市场概览和市场洞察,以便做出战略决策,确定核心市场应用。

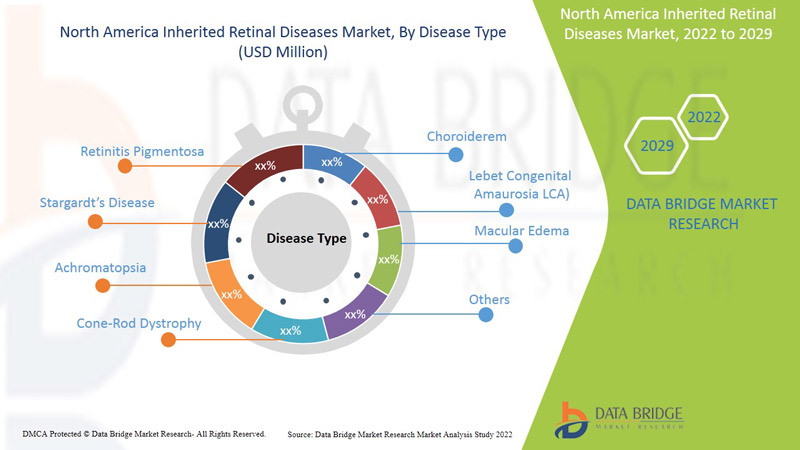

疾病类型

- 视网膜色素变性

- 斯塔加特病

- 色盲

- 视锥细胞-视杆细胞营养不良

- 无脉络膜症

- 莱伯先天性黑蒙 (LCA)

- 黄斑水肿

- 其他的

根据类型,遗传性视网膜疾病市场细分为以下疾病类型(视网膜色素变性、斯塔格特氏病、全色盲、视锥细胞营养不良、脉络膜缺失、莱伯先天性黑蒙、黄斑水肿等)

类型

- 诊断

- 治疗

根据类型,遗传性视网膜疾病市场细分为诊断和治疗。诊断部分细分为基因治疗、视网膜假体、神经保护剂等。神经保护剂进一步细分为维生素 A 棕榈酸酯、二十二碳六烯酸 (DHA)、叶黄素等。诊断部分细分为临床诊断和基因诊断。临床诊断进一步细分为视网膜成像、电生理测试、视野测试和临床眼科检查。视网膜成像进一步细分为光学相干断层扫描 (OCT)、眼底自发荧光成像 (FAF)、扫描激光检眼镜 (SLO)、自适应光学 (AO) 成像和传统彩色眼底成像。电生理测试进一步细分为全视野视网膜电图 (ERG) 和暗适应测量 (DA)。视野测试进一步细分为计算机化视野测试和手动视野测试。临床眼科检查分为裂隙灯检查、间接检眼镜检查、屈光检查、散瞳检查

最终用户

- 医院

- 专科诊所

- 门诊手术中心

- 家庭医疗保健

- 其他的

根据最终用户,遗传性视网膜疾病市场细分为医院、专科诊所、门诊手术中心、家庭医疗保健和其他

分销渠道

- 零售销售

- 直接招标

遗传性视网膜疾病市场还根据分销渠道细分为零售、直接招标。

管道分析

遗传性视网膜疾病药物的管道分析包括各种管道疗法,例如NCT05244304,NCT00999609,NCT05176717,NCT05158296,NCT04850118。Belite Bio, Inc,Spark Therapeutics,ProQR Therapeutics,Applied Genetic Technologies Corp,Biogen,MeiraGTx Ltd 参与了用于改善癫痫治疗的潜在药物的开发。

遗传性视网膜疾病市场区域分析/见解

对遗传性视网膜疾病市场进行了分析,并按国家、疾病类型、类型、最终用户和分销渠道提供了市场规模洞察和趋势。

The countries covered in the inherited retinal diseases market report are U.S., Canada and Mexico in North America.

U.S. dominates the inherited retinal diseases market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and well-developed healthcare infrastructure in this region.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of North America brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Inherited Retinal Diseases Market Share Analysis

The inherited retinal diseases market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on inherited retinal diseases market.

Some of the major players operating in the inherited retinal diseases market are Spark Therapeutics, Novartis AG, Okuvision, Nidek Co. Ltd., Invitae Corporation, Carl Zeiss Meditech AG, Optos (A Subdidiary of Nikon Corporation, Neurosoft, PIXIUM VISION, LKC TECHNOLOGIES, INC., Renurone, Astellas Pharma, REGENXBIO Inc., Ionis Pharmaceutics, Sparing Vision, Ocugen Inc, Johnson & Johnson, IVERIC bio, Second Sight, Coave Therapeutics, MeiraGTx Limited, Gensight Biologics, ProQR Therapeutics, Bionic Vision Technologies among others.

Research Methodology: North America Inherited Retinal Diseases Market

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。DBMR 研究团队使用的关键研究方法是数据三角测量,涉及数据挖掘、数据变量对市场影响的分析以及主要(行业专家)验证。除此之外,数据模型还包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、公司市场份额分析、测量标准、北美与地区和供应商份额分析。如有进一步询问,请要求分析师致电。

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

目录

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PIPELINE ANALYSIS FOR NORTH AMERICA INHERITED RETINAL DISEASES MARKET

5 REGULATORY FRAMEWORK

6 PREMIUM INSIGHTS

6.1 PESTEL ANALYSIS

6.2 POTER’S FIVE FORCES MODEL

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES

7.1.2 INCREASE IN PIPELINE PRODUCTS

7.1.3 INCREASING PRODUCT APPROVAL FOR INHERITED RETINAL DISEASES

7.1.4 INCREASE IN STRATEGIC INITIATIVE BY KEY PLAYER

7.2 RESTRAINTS

7.2.1 HIGH COST OF TREATMENT AND PROCEDURES

7.2.2 LACK OF ENOUGH QUALIFIED PROFESSIONALS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN GOVERNMENT INITIATIVES TOWARDS INHERITED RETINAL DISEASES(IRDS)

7.3.2 INCREASE IN AWARENESS AND TREATMENT-SEEKING RATE

7.3.3 EMERGING REIMBURSEMENT POLICIES FOR THE TREATMENT

7.4 CHALLENGES

7.4.1 RISKS ASSOCIATED WITH IRD SPECIFIC GENE THERAPY

7.4.2 LIMITED ACCESS TO TREATMENT

8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE

8.1 OVERVIEW

8.2 RETINITIS PIGMENTOSA

8.3 STARGARDT’S DISEASE

8.4 ACHROMATOPSIA

8.5 CONE-ROD DYSTROPHY

8.6 CHOROIDEREMIA

8.7 LEBER CONGENITAL AMAUROSIS (LCA)

8.8 MACULAR EDEMA

8.9 OTHERS

9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE

9.1 OVERVIEW

9.2 DIAGNOSIS

9.2.1 CLINICAL DIAGNOSIS

9.2.1.1 RETINAL IMAGING

9.2.1.1.1 OPTICAL COHERENCE TOMOGRAPHY (OCT)

9.2.1.1.2 FUNDUS AUTOFLUORESCENCE IMAGING (FAF)

9.2.1.1.3 SCANNING LASER OPHTHALMOSCOPY (SLO)

9.2.1.1.4 ADAPTIVE OPTICS (AO) IMAGING

9.2.1.1.5 CONVENTIONAL COLOR FUNDUS IMAGING

9.2.1.2 ELECTROPHYSIOLOGICAL TESTS

9.2.1.2.1 FULL-FIELD ELECTRORETINOGRAM (ERG)

9.2.1.2.2 DARK ADAPTOMETRY (DA)

9.2.1.3 VISUAL FIELD TEST

9.2.1.3.1 COMPUTERIZED VISUAL FIELD TESTS

9.2.1.3.2 MANUAL FIELD TEST

9.2.1.4 CLINICAL EYE EXAMINATION

9.2.1.4.1 SLIT LAMP

9.2.1.4.2 INDIRECT OPHTHALMOSCOPY

9.2.1.4.3 REFRACTION TEST

9.2.1.4.4 DILATION EXAM

9.2.1.5 OTHERS

9.2.2 GENETIC DIAGNOSIS

9.3 THERAPY

9.3.1 GENE THERAPY

9.3.2 RETINAL PROSTHETIC

9.3.3 NEUROPROTECTIVE AGENTS

9.3.3.1 VITAMIN A PALMITATE

9.3.3.2 DOCOSAHEXAENOIC ACID

9.3.3.3 LUTEIN

9.3.3.4 OTHERS

9.3.4 OTHERS

10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER

10.1 OVERVIEW

10.2 HOSPITALS

10.3 SPECIALTY CLINICS

10.4 AMBULATORY SURGICAL CENTERS

10.5 HOME HEALTHCARE

10.6 OTHERS

11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 HOSPITAL PHARMACIES

11.2.2 RETAIL PHARMACIES

11.2.3 OTHERS

11.3 DIRECT TENDER

12 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 SPARK THERAPEUTICS, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.1.4.1 PROGRAM LAUNCH

15.1.4.2 ACQUISITIONS

15.2 NOVARTIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.2.5.1 AGREEMENT

15.3 OKUVISION

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.3.4.1 EXPANSION

15.3.4.2 EVENTS

15.3.4.3 APPROVAL

15.4 NIDEK CO., LTD

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.4.4.1 PRODUCT LAUNCH

15.4.4.2 PRODUCT LAUNCH

15.5 INVITAE CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.5.5.1 PROGRAM LAUNCH

15.5.5.2 ACQUISITION

15.6 ZEISS INTERNATIONAL

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.6.4.1 EVENTS

15.6.4.2 SOCIAL INVOLVEMENT

15.7 OPTOS (A SUBSIDIARY OF NIKON CORPORATION)

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 NEUROSOFT

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ASTELLAS PHARMA INC.

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 BIONIC VISION TECHNOLOGIES

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.10.3.1 AWARD

15.11 COAVE THERAPEUTICS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.11.3.1 AGREEMENT

15.12 GENSIGHT BIOLOGICS

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.12.4.1 EVENT

15.12.4.2 AWARD

15.13 IONIS PHARMACEUTICALS

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.13.4.1 EVENT

15.14 IVERIC BIO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JOHNSON &JOHNSON SERVICES, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.15.4.1 COLLABORATION

15.16 LKC TECHNOLOGIES, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.16.3.1 PRODUCT LAUNCH

15.17 MEIRAGTX LIMITED

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.17.3.1 EVENTS

15.17.3.2 AWARD

15.17.3.3 COLLABORATION

15.18 OCUGEN INC.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.18.3.1 INVESTMENT

15.18.3.2 CLINICAL TRIAL

15.19 PIXIUM VISION

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.19.4.1 AWARD

15.2 PROQR THERAPEUTICS

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.20.3.1 EVENT

15.21 SECOND SIGHT

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.21.3.1 PRODUCT LAUNCH

15.22 SPARING VISION

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.22.3.1 ACQUISITION

15.23 REGENXBIO INC.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.23.3.1 EVENT

15.23.3.2 COLLABORATION

15.23.3.3 CERTIFICATION

15.24 RENEURON GROUP PLC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.24.3.1 STRATEGIC INITIATIVE

16 QUESTIONNAIRE

17 RELATED REPORTS

表格列表

TABLE 1 PIPELINE ANALYSIS FOR INHERITED RETINAL DISEASES:

TABLE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA RETINITIS PIGMENTOSA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA STARGARDT’S DISEASE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA ACHROMATOPSIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CONE-ROD DYSTROPHY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHOROIDERMIA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA LEBER CONGENITAL AMAUROSIS (LCA) IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA MACULAR EDEMA IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA ELECTROPHYSIOLOGICAL TETS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA HOSPITALS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA SPECIALTY CLINICS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOME HEALTHCARE IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA DIRECT TENDER IN INHERITED RETINAL DISEASES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 46 U.S. INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 47 U.S. INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 48 U.S. THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 49 U.S. NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 U.S. DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 51 U.S. CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 52 U.S. RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 53 U.S. ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 U.S. VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.S. INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 57 U.S. INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 58 U.S. RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 59 CANADA INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CANADA INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 CANADA THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 CANADA NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 CANADA DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 CANADA CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 CANADA RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 CANADA ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 CANADA VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 68 CANADA CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 CANADA INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CANADA INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 CANADA RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 72 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISEASE TYPE, 2020-2029 (USD MILLION)

TABLE 73 MEXICO INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 MEXICO THERAPY IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 75 MEXICO NEUROPROTECTIVE AGENTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 MEXICO DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 MEXICO CLINICAL DIAGNOSIS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 MEXICO RETINAL IMAGING IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 MEXICO ELECTROPHYSIOLOGICAL TESTS IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 MEXICO VISUAL FIELD TEST IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 MEXICO CLINICAL EYE EXAMINATION IN INHERITED RETINAL DISEASES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 MEXICO INHERITED RETINAL DISEASES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 83 MEXICO INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO RETAIL SALES IN INHERITED RETINAL DISEASES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

图片列表

FIGURE 1 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: MARKET END USER COVERAGE GRID

FIGURE 10 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND EUROPE IS GROWING AT THE FASTEST PACE IN NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 INCREASE IN THE PREVALENCE OF INHERITED RETINAL DISEASES AND INCREASE IN PIPELINE PRODUCTS ARE DRIVING THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 RETINITIS PIGMENTOSA SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA INHERITED RETINAL DISEASES MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA INHERITED RETINAL DISEASES MARKET

FIGURE 16 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2021

FIGURE 17 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, 2020-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2021

FIGURE 21 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2021

FIGURE 25 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, 2020-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY END USER, LIFELINE CURVE

FIGURE 28 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 29 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 32 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: SNAPSHOT (2021)

FIGURE 33 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021)

FIGURE 34 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 35 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 36 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: BY DISEASE TYPE (2022-2029)

FIGURE 37 NORTH AMERICA INHERITED RETINAL DISEASES MARKET: COMPANY SHARE 2021 (%)

研究方法

数据收集和基准年分析是使用具有大样本量的数据收集模块完成的。该阶段包括通过各种来源和策略获取市场信息或相关数据。它包括提前检查和规划从过去获得的所有数据。它同样包括检查不同信息源中出现的信息不一致。使用市场统计和连贯模型分析和估计市场数据。此外,市场份额分析和关键趋势分析是市场报告中的主要成功因素。要了解更多信息,请请求分析师致电或下拉您的询问。

DBMR 研究团队使用的关键研究方法是数据三角测量,其中包括数据挖掘、数据变量对市场影响的分析和主要(行业专家)验证。数据模型包括供应商定位网格、市场时间线分析、市场概览和指南、公司定位网格、专利分析、定价分析、公司市场份额分析、测量标准、全球与区域和供应商份额分析。要了解有关研究方法的更多信息,请向我们的行业专家咨询。

可定制

Data Bridge Market Research 是高级形成性研究领域的领导者。我们为向现有和新客户提供符合其目标的数据和分析而感到自豪。报告可定制,包括目标品牌的价格趋势分析、了解其他国家的市场(索取国家列表)、临床试验结果数据、文献综述、翻新市场和产品基础分析。目标竞争对手的市场分析可以从基于技术的分析到市场组合策略进行分析。我们可以按照您所需的格式和数据样式添加您需要的任意数量的竞争对手数据。我们的分析师团队还可以为您提供原始 Excel 文件数据透视表(事实手册)中的数据,或者可以帮助您根据报告中的数据集创建演示文稿。