One of the trending factors that is affecting the population in general, especially the employees is the surge in pharmaceutical companies. We generally get confused between the prescription drugs and over-the-counter (OTC) drugs. The difference lies in here: Prescription drugs are prescribed by the doctor. It is FDA approved. Whereas the over the counter drugs are the ones that don’t require a prescription, it is regulated by FDA through OTC Drug monographs. Recently, there has been much buzz about the surge in prices of the prescription drugs which affected major set of population. The high cost of prescription drugs threatens the healthcare budget and limits the funding available in other areas that require public investment. In countries without universal health insurance, the high cost of prescription drugs poses an additional threat. In the work front, this increased prices of pharmaceutical drugs is taking a heavy toll on the employees. As drug costs increase, it directly impacts Medicaid, Medicare, other state-sponsored programs, and medical costs for people eligible for federal employees. Most of the costs of these health programs are covered by our employer or federal program. For decades, the real cost of medicines was unknown to the majority of people, as the out-of-pocket costs of most medicines were relatively low compared to the cost of purchasing them. This trend changed with the use of gradual out-of-pocket systems and the placement of prescriptions based on the cost of the drug and its perceived value for patient care.

There has been many questions associated with this increased surge in pharmaceutical drugs such as who are the most likely to get affected, why the prices are increasing, are employees the only section that is getting affected much and much more. There were much polls regarding the varied factors and about three in ten say that they haven’t taken their medicine as prescribed due to the high prices. Then about eight in ten across parties say that pharma profits are a major contributing factor to prescription drugs costs. Then there was another set of people who favor several actions to lower drugs. About 85% of them opinionated on the fact that placing an annual limit on out-of-pocket drug costs for people with Medicare. Around 53% of them said that allowance of Medicare plans to put more restrictions on use of certain drugs. Another half of the people said that Government should negotiate with drug companies to get a lower price on Rx drugs that would apply to both Medicare and private insurance. Then, based on 2019 polling, it was analysed that around 25% of people allowed Medicare drug plans to exclude more drugs.

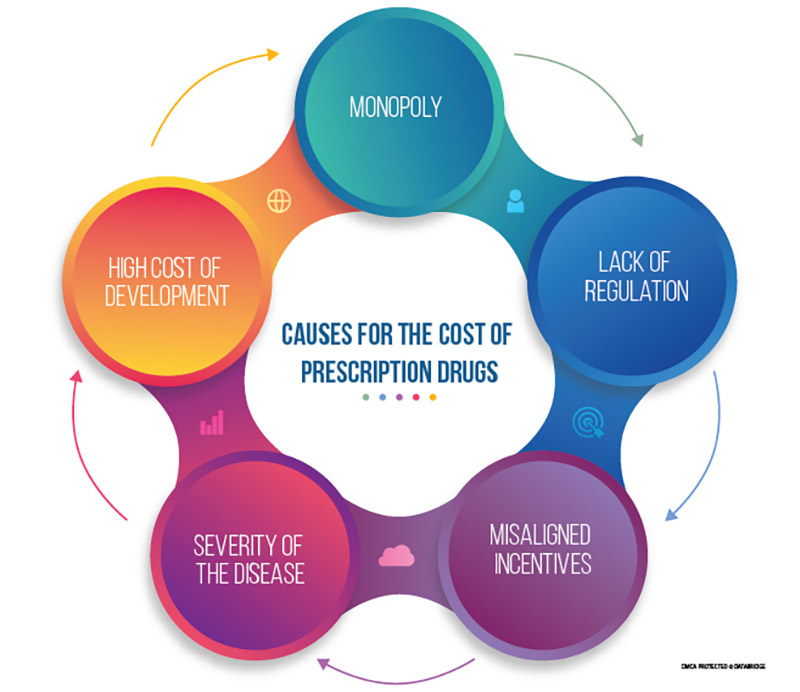

Figure 1: Schematic Representation of the categories of possible causes behind the high price of prescription drugs

- Monopoly

The main reason for the high cost of prescription drugs is the existence of a monopoly. There is no substitute for many new drugs. Patients need effective medications at some point in the course of their illness.

As Steven Wright rightly quoted, “I think it’s wrong that only one company makes the game monopoly”.

The question of whether a new drug is needed rarely arises only when it is needed. Even some old medicines can remain a virtual monopoly. Monopolies are usually temporary, and generic drug competition should eventually occur after the patent expires. Unfortunately, this often does not occur with cancer or chronic life-threatening illnesses. When a drug's patent expires, it is considered obsolete (planned obsolescence) and is no longer standard care. A "new and improved version" with a new patent term and exclusive protection is already in stage. For biopharmaceuticals, the tedious manufacturing and biosimilar approval process is an additional barrier that significantly limits the number of competitors that can enter the market.

- High Cost of Development

The high cost of drug development is an important issue that needs to be addressed. Development costs are inversely proportional to the incremental profits of new drugs, as larger sample sizes and more research are required to obtain regulatory approval. More importantly, the fact that the science behind most new drugs is heavily funded cannot be ignored. Therefore, the public has the legitimate right to ensure that life-saving medicines are offered at fair prices.

- Severity of the Disease

High prescription drug prices are maintained by the fact that treatment of serious illnesses is not a luxury and is needed by vulnerable patients who want to improve their quality of life or extend their lifespan. High prices are not an obstacle. When a serious illness occurs, patients and their families are willing to pay any price to save or prolong their lives.

- Misaligned Incentives

The inconsistent system of incentives between pharmaceutical companies and pharmacy benefit managers (PBMs) in health care plans makes prescription drug prices so high. The relationship between PBM and pharmaceutical companies creates a scenario where manufacturers simply raise prices so that they can give PBM even greater discounts. In this situation, manufacturer and PBM payments will increase, but plan / employee payments will also increase. Many health insurance / pharmacy plans require you to pay the full cost of the drug until the patient is eligible for the deduction, while others require you to pay joint insurance for each prescription that the patient prescribes. The problem with these plan options is that they are both based on the list price of the drug. Every time a pharmaceutical company raises a price, employees also pay more at a discount.

- Lack of Regulation

There are numerous reasons prescription drug costs are so considerable. One of the most significant reasons is the lack of regulation in this country. Countries such as Australia, Canada, and dozens of others do regulate the price of prescription drugs, unlike other consumer goods. These countries do this because prescription drugs are a good that some citizens literally can`t live without. Though this increased government regulation does come with some tradeoffs. Countries with more stringent prescription drugs often refuse to pay for drugs that they feel are not worth the price. These denials may make certain medicines sold in the United States unavailable in other countries. But that doesn't mean that all patients have access to them, as there are more medicines on the market.

Our DBMR team analysed that the market was valued at USD 1,015.63 billion in 2021 and is expected to reach USD 1,482.35 billion by 2029, registering a CAGR of 4.84% during the forecast period of 2022 to 2029. North America dominates the prescription drugs market due to the growing demand of diseases specific treatment and rising healthcare expenditure will further propel the 'market's growth rate in this region. Asia-Pacific is expected to be the fastest growing region during the forecast period of 2022-2029 due to surging level of disposable income in this region.

To know more about the study, kindly visit: https://www.databridgemarketresearch.com/reports/global-prescription-drugs-market

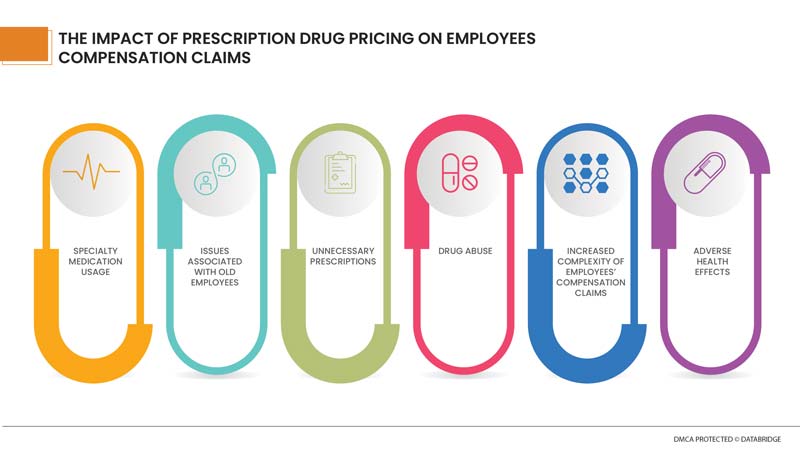

The Impact of Prescription Drug Pricing on Employees Compensation Claims

Increased use of prescription drugs poses unique challenges to worker compensation programs. Drug prices continue to rise, but overall consumption is declining. As mentioned above, these are the several factors that are leading on to this trend. There are, however, several negative trends that continue to drive the increased cost of prescription drugs.

Specialty medicines make up the majority of medical costs associated with treating work-related injuries. Specialty medicines are expensive prescription drugs used to treat complex or chronic conditions and injuries. Specialty medicines make up the majority of medical costs associated with treating work-related injuries. Specialty medicines are expensive prescription drugs used to treat complex or chronic conditions and injuries. Due to the high cost of specialty medicines, special care should be taken when administering these medicines to injured workers, up to the usage review process.

Older workers have a higher opioid dispensing rate than younger workers. High prescription drug costs related to physician dispensing, opioid abuse and the extended recovery time for work injuries are widely believed to be exacerbated as people become older. Moreover, older workers are more likely than younger workers to sustain higher cost permanent injuries. For instance, older workers are more likely to have higher cost rotator cuff and knee injuries while younger workers are more likely to have lower cost back strains. Further, older workers experience more incidents of strains and sprains in moderate and high manual labor jobs. As a result, occupational accidents tend to be more expensive for older workers. The cost of prescription drugs plays an important role, as the proportion of medical costs for complaints tends to increase as the duration of the complaint increases. This is because pain relief may be more important than healing an injury.

Another worrying issue is compound interest. A licensed pharmacist or licensed physician combines, mixes, or modifies the ingredients of the drug to create a drug tailored to the needs of the individual patient. Complex drugs may be considered medically necessary to treat an injured worker. However, the compound has not been tested and approved by the US Food and Drug Administration (FDA), which has determined that such drugs pose a potential health risk. Still, the cost per prescription of a compound is much higher than other treatments. In addition, injured workers taking such combinations often require continuous clinical monitoring and increased support and guidance from pharmacists or other caregivers, resulting in worker accident compensation claims.

Thousands of people die each year from drug overdose. As Jim Morrison correctly said, “Drugs are a bet with the mind”.

All countries have prescription drug laws, and many states have specific laws dealing with prescription drugs for employee accident compensation. Drugs are commonly prescribed in occupational accident claims for three reasons: Surgical treatment injuries that require immediate pain management; and general pain control. Injuries in many workplaces cause chronic pain and continue to use opioids to relieve the pain.

Chronic opioid use can pose a risk of opioid-related adverse events, potential additional comorbidities, depression, anxiety, and exaggeration. Employers must take action in employees’ accident compensation programs to tackle the opioid crisis head-on to reduce the risk of abuse and the potential for addiction. Employers should endeavor to provide safer alternative treatments to consider for injured workers, as opposed to drug use. Providing injured workers at the right time, for the right time, and with the right treatment can help reduce overall claims for employees' compensation and improve results.

Our DBMR team has analyzed a report of anxiety disorder and it has been shown that North America dominates the market share due to increased investment by pharmaceutical industries for the advancement in the treatment and favourable reimbursement scenario. Asia-Pacific is expected to account for the largest market share over coming years for the Anxiety disorder market due to rapidly improving health care infrastructure in the region.

To know more about the study, kindly visit: https://www.databridgemarketresearch.com/reports/global-anxiety-disorder-market

Prescription drugs are a necessary part of employees’ compensation program. Employees’ injured with long-term opioid prescriptions (at least once in the first 3 months and then at least 3 times in 6-12 months after injury) were not given drugs for similar injuries. A prescription that caused a temporary disability that was more than three times longer than similar workers. By closely monitoring and controlling provider behavior, educating and cooperating with employees, and making informed decisions about prescription drug programs, employers manage these costs and are better overall.

The health insurance portion of a claim can last for years or even the life of an injured employee. Over the years, prescription drugs have become a major part of medical costs. This is especially true if the injured employee is dependent on or addicted to opioid medications for pain management. Opioids have many side effects, including constipation, gastrointestinal upset, and erectile dysfunction. Long-term use of drugs can also cause serious cardiac side effects, including slow heart rate, hypotension, rapid arrhythmias, and myocardial dysfunction that can lead to heart failure, stroke, or heart attack. Treatment should always consider aspects of the health of the injured worker beyond the injuries themselves, in order to avoid unnecessary harm from prescription drugs.

Our DBMR team has analyzed and investigated on the opioid market and found that North America is the dominating region due to rise in government initiatives to combat the crisis in the U.S. Asia-Pacific region is expected to expand at a significant growth rate in the forecast period of 2022 to 2029 because of the rapid shift in the focus of the major companies towards this region with an aim to strengthen their position. The opioids drug market is expected to gain growth at a potential rate of 5.04% in the forecast period of 2022 to 2029.

For more information on the study, kindly visit: https://www.databridgemarketresearch.com/reports/global-opioids-drug-market

Now, the next bigger question comes that even though the prices of the prescription drugs are rising high, can employers do a little in changing the scenario so that employees will feel less burdensome. Much attention has been paid to the actions of potential Medicare or the Food and Drug Administration (FDA), but less attention has been paid to the role of private payers in solving problems. Health insurance-sponsored employers are not bound by the same legal restrictions that apply to Medicare, but with less restrictions, can determine the amount of coverage and the cost that an employee will pay for each benefit. However, employers are sensitive to changes in medical benefits that can affect the employment of their employees.

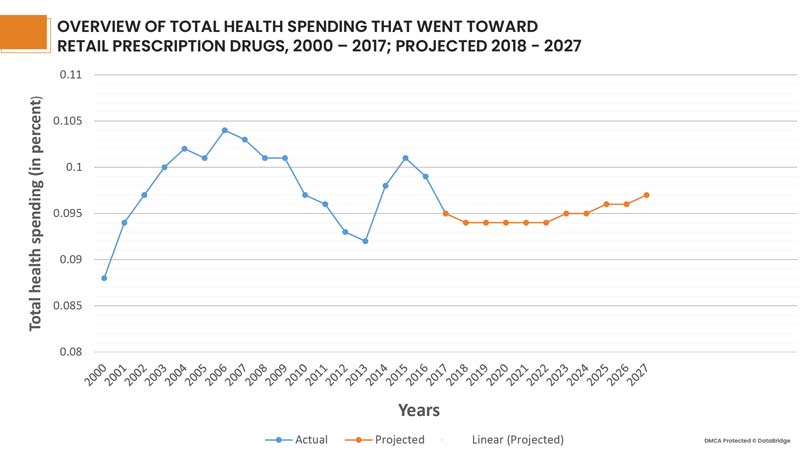

Issue Associated With Launch Price

There is evidence that the above programs have affected the cost of non-specialized medicines. However, specialty medicines accounted for 32% of total drug spending in 2014, and their costs are rising faster than any other product or service in the economy. In 2017, per capita prescription drug spending slightly decreased (down 0.3%) for the first time since 2012. In 2015, pharmaceutical spending grew 8.1% on a per capita basis and in 2014 these costs had grown 11.5%, particularly because new specialty drugs came to market. It is expected that growth in per capita drug spending will be moderate through 2027. In addition to this, there was also seen a trend of retail prescription drugs. Prescription drugs had represented a shrinking trend of total health spending through 2013, but increased in 2014 and 2015 with the introduction of some high cost specialty drugs. In 2017, drug spending did not grow as much as spending on other services, however, it is expected that drug spending as a portion of overall health spending will remain consistent over time.

Fig 3: Graphical Overview of Prescription drugs over the years 2000 - 2027, representing a similar portion of overall health spending over time

Options to Lower the Launch Price of Prescription Drugs

In the absence of supply and demand or government pricing, employers need to establish a model that associates price with value. Recently, an approach has been developed that changes depending on the outcome of drug prices achieved. This is called value-based payment. Several initiatives are underway, but there is reason to believe that this model has a limited impact on overall drug prices. Results Measurements have proven to be extremely difficult to develop, and acceptable metrics may only apply to selected drugs. A variant of this approach, which is likely to have significant short-term implications, is indication-based pricing, where drug prices vary based on evidence of efficacy in different conditions. In other words, a drug that is known to have a particular effect on a particular type of cancer is given an introduction price set by the pharmaceutical company, but if the drug is used under conditions that worked. There is another approach of lowering the launch prices of prescription drugs. Drugs may be excluded from the formula list unless the price meets the specified ratio of values. Healthcare researchers have developed a way to compare the effectiveness of interventions. Most commonly, we use the concept of cost per quality-adjusted life year (QALY).

Coping Mechanism

Management by HR:

Managing the cost of a prescription program is difficult and requires specialized knowledge. Many large employers choose to separate these programs from general health insurance so that pharmacy benefit managers (PBMs) or other advisors can closely monitor and manage their spending. More and more companies continue to expand their specialty drug programs to offer them with the support of specialty pharmacies, specialty PBMs, and other providers. HR professionals who have contracts with insurance companies to operate healthcare plans, including prescription services, have fewer options. However, we can put pressure on carriers by asking what steps they are taking to keep costs down. Another way to gain greater influence in the pharmaceutical market is to join a regional healthcare procurement alliance. This can lead to opportunities to create these benefits for closer control.

Consider Design Options

Most benefit managers have already redesigned their prescribing plans to provide financial incentives for employees to choose the cheapest product. A common way to do this is to provide different levels of coverage for different drugs. Similarly, another layer of specialized biologics (complex drugs made in biological systems such as plants and animal cells) provides higher levels of coverage for patients with lower cost biosimilars. Subsequent stages continue, with increased out-of-pocket or co-insurance based on various factors such as the proven efficacy of the drug and the type of condition being treated. However, care must be taken not to complicate this structure.

Managing Care

Traditional medicines are usually provided in the form of tablets, capsules, or liquids prescribed by a healthcare provider and are most often taken with little supervision except to provide basic instructions and information on possible side effect. On the other hand, specialty medicines are more complicated. They are generally given intravenously, but these are difficult to administer and may require professional assistance. In addition, proper follow-up care is needed to determine the effectiveness of the drug and whether the person taking it can adhere to the regimen without experiencing debilitating side effects. Those who cannot tolerate certain drugs are a real concern and can be a significant source of waste. For this reason, it is necessary to carefully control the amount of drug dispensed, especially when someone is prescribing for the first time. Working with the suppliers to reduce their initial order from 90 days to 30 days, minimizing the cost of drug discontinuation.

Keeping a Tab on the Plan

For managing the high price launch of the prescription drugs, a closer management of the prescription plans is essential. For instance, one should know how these rebates function and these refunds actually drive up costs, as PBM uses more of certain products than others to maximize discounts. Be aware of outliers when reviewing the entire planning data. It is important to note the sudden increase in drug costs due to the number of prescriptions issued.

If you have any concerns, you may be able to move alternative medicines to priority status and encourage their use instead of the more expensive medicines. In addition, changing usage standards may limit the coverage of expensive medicines. If HR is making this type of prescription change, we recommend that you notify your patient and healthcare provider 60 days in advance so that you are ready to switch to a new drug.

Working on Contracts Regularly

In a constantly changing pharmacy environment, long-term contracts with PBMs and other providers are not always in the employer's best interests. For PBM contracts, shorter cycles may be justified. If manufacturers increase discounts or retail or specialized pharmacy networks offer better discounts, conditional long-term contracts may prevent plan sponsors from sharing those discounts. Shortening these cycles will ensure you get the latest prices. Rather than offering the entire program as a separate contract, some employers are beginning to offer each component of the prescription drug program (retail, mail order, specialty pharmacies, planning management) for bidding. Contracts are opaque and can sometimes be overwhelmed with incentives that cause providers to act against health insurance and the best interests of consumers.

Our DBMR team has analysed on the health insurance market and found that increasing costs for medical services and the growing number of day care procedures are some of the drivers boosting health insurance demand in the market. The market is expected to reach the value of USD 2,541.78 Billion by the year 2029, at a CAGR of 4.6% during the forecast period. Although with the onset of COVID-19 pandemic, the demand for health insurance has increased tremendously. Also, the fear of pandemic and the increased cost for medical services helped the health insurance market grow during pandemic. In addition, health insurance companies introduced packages and solutions for covering the medical costs for treating covid19 infected insurers.

For more information on the study, kindly visit: https://www.databridgemarketresearch.com/reports/global-health-insurance-market

Proper Communication with the Employees

Whatever the company do to keep costs down and manage utilization, it must be clearly explained to the employees. It is very important for employers to educate their employees about the need to limit spending while ensuring effective care through strategies such as pre-approval, phased treatment, and volume and supply limits. People need to understand that these programs aren't designed to deny access. The company should know if there is an appeal process that they and their providers can use to discuss the medical needs of a particular drug. The goal is to consume more evidence-based, less marketing-based prescription medications, or seek one or another medication. Employers need to better educate their employees on how to best use prescription drug plans.

Exploring Alternatives

The majority of us assume that employee medical services offer the highest prices available for medicines. And nearly 86% of people with health insurance say that health insurance is the cheapest way to get prescription drugs. But when it comes to buying prescriptions, shopping can save a lot of money to employees. Educating the employees about the benefits of expanding drug shopping options, including online pharmacies, renowned retailers, independent pharmacies, grocery stores can save a lot in this regard. Employees may also consider meeting with their general practitioners or pharmacist to learn more about possible alternatives such as cheaper over-the-counter products and similarly effective generics.

Importance of Planning

The most unplanned thing an employee can do is wait until an emergency occurs to see their health options. Employers need to encourage employees to secure funding for emergencies and help find local emergency rooms and networked emergency medical facilities to avoid significant financial burdens in the future. Considering the updated technologies and educated environment, today's employers have the opportunity to better educate themselves and provide security to their employee networks as they deal with this year's prescription price increases and health care plans. Finding and implementing strategies to reduce health care costs will prove rewarding for both your business and the people who maintain it.

Conclusion:

The cost of prescription drugs is taking a heavy toll on the employees and thus in a way it is hampering the market growth of pharmaceutical drugs. The minimization measures should be adopted as soon as possible so that the negative factors donot overpower the overall market growth of the prescription drugs. The high cost of prescription drugs threatens the healthcare budget and limits the funding available in other areas that require public investment. Pharmaceutical companies cite high drug prices as important to sustaining innovation. However, the ability to charge high prices for new drugs can slow the pace of innovation. Employees and their families sometimes compel to leave the prescription at the cash register simply because they do not expect higher costs. Several measures can be taken to minimize the negative trend associated with the increased market price. Employees can be guided to online resources that make searching for prescription discounts quick and easy. There are numerous online resources available that allow customers to track the value in their prescription medicines at close by pharmacies. Employers have to inspire their personnel to set apart budget to fall returned on withinside the occasion of an emergency even as assisting them become aware of their nearby emergency room and in-community urgent-care centers to keep away from enormous economic burdens withinside the future. Then, adjusting for an estimate of rebates lowers the proportion of spending in corporation plans for drugs.