In October 2020, during Apple's quarterly financial call, Tim Cook (CEO of Apple), quoted that "Contactless payment has taken on a different level of adoption and I don't think we'll go back."

Mobile wallets have revolutionized the way a consumer makes the payment for goods and services. The global economies are moving towards digitization, which has fueled the demand and adoption of mobile wallets. As a result, many mobile wallet applications are introduced in the market on a daily basis. Mobile wallets allow the users to link the credit and debit cards to transfer the money online. This kind of transactional arrangement is safe and further has driven away from the possibility of hard cash theft. Mobile wallet is set to emerge as the leading point of sale platform in developing countries such as India by 2023. But still in many parts of the world, there lie some misconceptions about mobile wallets which are cleared up as below:

Fig.1 Misconceptions regarding mobile wallets

Mobile wallets can be used to make quicker and safer payments for the fast-moving consumables goods. At any shop, departmental store, retail store, or any other similar infrastructural facility, one can purchase a range of products such as shampoo using a mobile wallet. According to Data Bridge Market Research, the shampoo market is expected to be growing at a growth rate of 3.81% in the forecast period of 2021 to 2028 and is expected to reach the USD 40.58 billion by 2028. Unilever, Procter & Gamble, Church & Dwight Co., Inc., KCWW, Kao Corporation, Shiseido Company, Limited, L'Oréal, Johnson & Johnson Private Limited, The Estée Lauder Companies and Colgate-Palmolive Company are some of the major players operating in this market.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-shampoo-market

1. Mobile wallets are secure

Mobile wallets are nothing but digital cash, however, when it comes to technology, there exists ambiguity and concern for its security. Factually, mobile wallets prove to be even safer than chip-enabled swipe cards (credit, debit and ATM). Mobile wallets are based on encryption technology that protects every crucial information of the user, such as card number, PIN, etc. This indicates that misusing or even accessing the information is quite difficult for a third party. The new line of digital or e-wallets also incorporates advanced features such as biometrics and two-factor authentication, thereby improving the security and safety quotient.

2. Mobile wallets are digital versions of physical wallets

As discussed above, mobile wallets can be filled up with digital cash easily using credit and debit cards. Digital wallets are easy to use and can also store debit and loyalty cards. The payment process involves selecting the good or service to be bought/ consumed, tapping on the payment and entering the personal identification number (PIN), or using biometrics to make the payment. The phone next connects with the payment terminal wirelessly using near-field communication. Some mobile wallets also use secure magnetic transmission along with near field communication.

3. Mobile wallets aren't just limited to smartphones

Unaware people often relate mobile or digital wallets to smartphones. However, the reality says something else. Digital wallets can be used on tablets, iPad, and other gadgets. This misconception of people is generally because the major juggernauts in the mobile wallet industry, such as PayPal, Google Wallet, and Apple Pay offer digital wallets in mobile applications that can be downloaded from android, windows and iOS platforms. As technology advances daily, digital wallets will not just be restricted to these gadgets. Digital wallets in future will be accessed via wearable devices or even via the internet of things technology.

4. Proximity and remote: Digital wallets are divided into two

In continuation to the point above, the digital and mobile wallets are divided into two major groups: remote mobile wallets and proximity mobile wallets. From the name itself, it is clear that proximity wallets are the arrangements used for the authorization and processing of transactions involving the payer and the payee in proximity to each other. In the case of remote mobile wallets, the payer and the payee aren't close to each other. However, both ensure safety, security and are devoid of any complexities.

5. Digital wallets are useless without services

Mobile wallets are capable of performing various functions than just transferring money. Mobile wallets offer other services such as identification (employee ID, passport, and driving license), loyalty and coupons (gift cards), ticketing and transportation (concert tickets, air tickets), access (hotel room keys, front door keys) and much more. In combination with the contactless payment feature, these services improve the overall significance quotient of mobile wallets as they can secure all the crucial information at one secure and convenient place.

However, mobile wallets come with their own set of disadvantages. Not everything related to mobile wallets is a smooth ride. There are many instances where hard and physical cash has the upper hand over mobile and digital wallets. Some of the major advantages and disadvantages are discussed as below:

|

ADVANTAGES

|

DISADVANTAGES

|

|

Since all of the necessary cards and other vital data are stored in an app, there is no need to maintain dozens of cards and papers in a wallet, handbag, or backpack or to waste time looking for them. Because the payment is completed in less than a minute, such an app allows retail lines to move faster. When buying online, the digital wallet eliminates the need to enter credit card information and identification because everything is already verified within the app.

|

Customers must be able to pay with digital wallets, thus businesses must invest in special hardware or software to make this possible. Companies that wish to create their digital wallet solution must hire software developers with suitable knowledge and invest both money and effort in the process.

|

|

All of the information one enters into the app is encrypted, and it is never shared with third parties. As a result, the online market where one shops will never know the specifics of the transaction. Furthermore, one must confirm transactions (fingerprint, password), and the digital card wallet is safeguarded by the device's security system (Face ID, fingerprints, passwords). It implies that getting access to the money will be difficult if the smartphone is stolen or found.

|

Security has previously been noted as a benefit of digital wallets, but there are a few more factors to consider. Because the devices back the security of the app, it is critical to ensure that the smartphone is well-protected. Otherwise, if the smartphone is lost or stolen, it will be simple to access the digital wallet account. Another important point to remember is to pay attention to the digital wallet provider; it must be reliable.

|

|

All of the transactions are saved in the app, allowing one to review them after each week or month to better regulate spending. If sticking to a budget is difficult for someone, he or she can set spending limitations for specific categories of expenses to prevent from wasting big sums of money. In order to encourage customers to utilize their apps, certain digital wallet companies provide their additional bonuses and special offers. It implies that one will be able to pay for the purchases more quickly and easily and benefit from additional benefits.

|

Owing to the requirement of capital and resources to set up the system, many merchants are resistant to their deployment and thus, don't support mobile wallets. From the consumer point of view, the adoption of mobile wallet applications depends upon the popularity of that particular application; that is, one may use Apply Pay but not any other local application.

|

|

This advantage primarily applies to businesses such as retailers that hire people to finish sales and collect money from clients. The expansion of the digital wallet market may replace the need for cashiers at checkouts, saving businesses a significant amount of money each month.

|

The use of mobile wallet via the mobile application can be a little troublesome in case the phone drops dead out of battery just before one is about to make a payment. In case of lack of a strong internet connection as well, making the payment can rise a sense of concern. In such a case, one must have hard cash or payment card with him/ her.

|

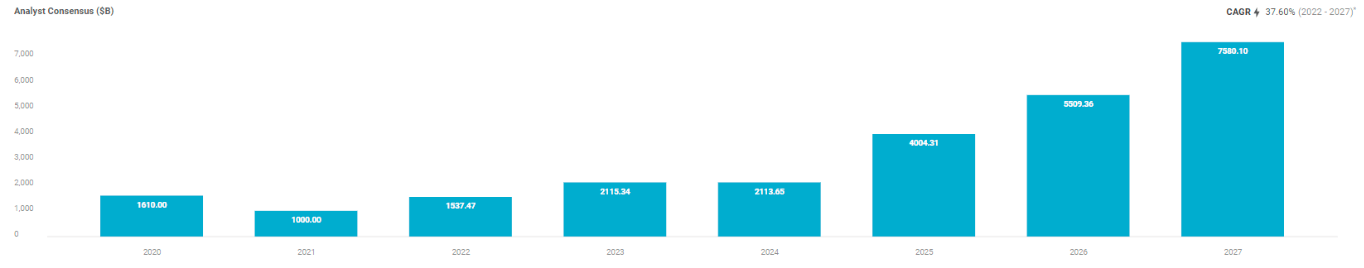

Over the last decade, the mobile wallet industry has seen a significant growth. Mobile wallets have changed the way individuals manage and spend their money along with providing additional benefits to them. Hence, the mobile wallet industry has emerged as one of the fastest growing industries globally.

Fig.2 Mobile Wallets market growth over the time

Source: Research Report

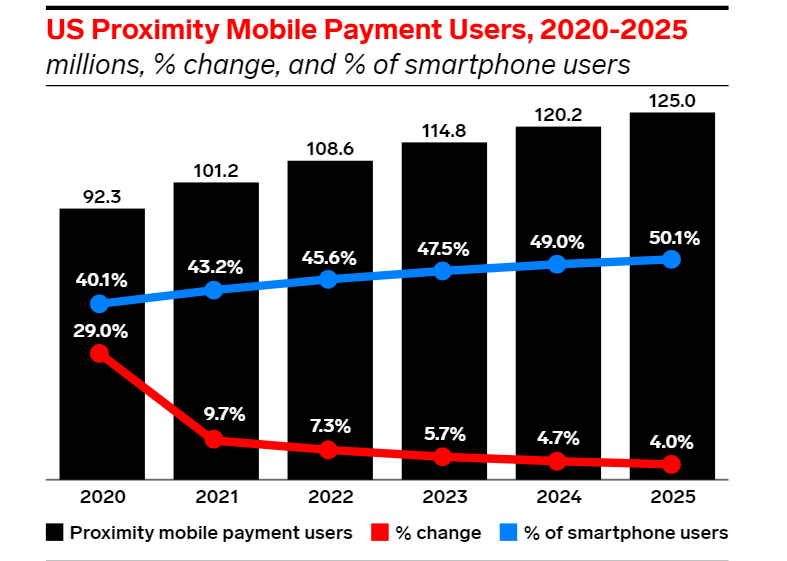

In recent years, mobile wallets have been a defining trend in the payments sector. Consumers around the world are adopting mobile wallets like Google Pay and Apple Pay, in which a customer registers their bank card information to a smartphone, which is then tokenized to create a simple and secure payment method stored within the device, as an alternative to traditional card payments for both online and in-store purchases. According to a recent report, the use of mobile wallets in the United States increased by 29% in 2020, to 40% of all smartphone users over the age of 14. More over half of American consumers use contactless payment methods, such as contactless credit and debit cards, suggesting a deeper need for more seamless payment experiences.

Fig.3 U.S. proximity mobile payment users (2020-2025)

Source: eMarketer

A proximity mobile payment is a point of sale transaction that involves using a mobile phone as a payment method. The point of sale mobile wallet payments and point of sale mobile contactless payments are other terms for the same thing. Includes scanning, tapping, or swiping a mobile phone at a point of sale to make a transaction; excludes purchases of digital goods on mobile phones, purchases made remotely on mobile phones that are delivered later, and tablet transactions. Google Pay, Samsung Pay, Apple Pay, and the Starbucks mobile app are just a few examples. In 2021, the number of Americans 14 and older who use in-store mobile payment apps will reach 101.2 million. This follows a year-over-year (YoY) increase of 29.0 percent in 2020. By 2025, half of all smartphone users will have used the device.

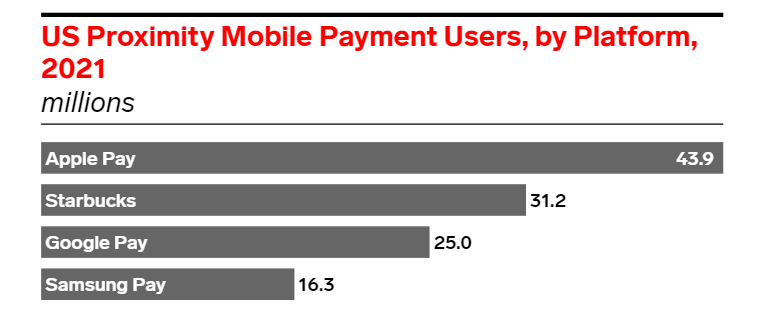

Fig.4 U.S. proximity mobile payment users (2021)

Source: eMarketer

With 43.9 million users in 2021, Apple Pay is the market leader. It will add 14.4 million users between 2020 and 2025, far more than its competitors. This will give it a more significant lead over Starbucks, which is now in second place. By the conclusion of the projection period, Google Pay will have gained 10.2 million customers. Between 2020 and 2025, Samsung Pay's growth is flat, with only 2 million new users.

COVID-19 Impact on the Mobile Wallets Market

Almost no industry has escaped the impact of the COVID-19 epidemic, which has triggered a tidal wave of changes. The fintech and payments industries have not been spared by the effects of the coronavirus, which has resulted in a clear move to contactless payment solutions. With the rise of contactless payments, it begs the question of whether new consumer behaviors will persist long after the threat of the coronavirus has passed. It's a complicated subject because for the past few years, leading mobile wallets such as Apple Pay, Google Pay, and Samsung Pay have been fighting for market share not just with each other, but also with other popular payment options. Is this the time for the digital wallet to take off?

COVID-19 pandemic brought about havoc all around the globe. The demand for sample collection kits was on the rise on a daily basis. Numerous resources were purchased to meet the emergencies' demands, and it was made sure to undertake contactless payments for the supplies. Therefore, Data Bridge Market Research prepared a detailed report on the global COVID-19 sample collection kits market. According to Data Bridge Market Research, the COVID-19 sample collection kits market is expected to grow in the forecast period of 2021 to 2028. Data Bridge Market Research analyses the market to account for USD 2,988.55 million by 2028 growing at a CAGR of 5.32% in the forecast period. COVID-19 Sample Collection Kits market is segmented on the basis of product, application, and site of collection.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-covid-19-sample-collection-kits-market

In the United States itself, contactless cards and mobile payments have increased significantly throughout the coronavirus pandemic. According to one report, about one-third of U.S. consumers became first-time contactless payment users during the pandemic. After the dust has settled on the COVID-19, the majority of individuals expect to continue utilizing contactless payment methods. In fact, contactless card payments are expected to grow eight-fold in the United States between now and 2024, with mobile proximity payments growing even faster. In contrast, transaction volume for credit and debit cards fell dramatically from early March to early April in 2020, representing a 30% and 25% year-over-year reduction.

Mobile wallets have become an essential component of the Southeast Asian consumer space, allowing millions of previously unbanked people to access financial services. Wallets saw a rise in newly registered users as online spending skyrocketed during the COVID-19 pandemic. In the region's growing markets, the adoption of this convenient technology has far outpaced that of credit cards, reviving the payments ecosystem.

Because of the rising penetration of smartphones in the Philippines, internet adoption was quick. The same thing is happening with e-wallets/ digital wallets/ mobile wallets: their function has expanded beyond only payments. The way people use the app has grown incredibly innovative and personalized. Mainly during COVID-19, it has been observed that the retailers use it to accept payments from clients, pay invoices, and obtain credit or loans. It's no surprise to watch how people across the region are responding to these advances. Mobile wallet has emerged as a digital life hack quickly evolving into a financial-wellness platform.

While credit cards remain the most popular payment method in the United States, alternative payment methods such as digital wallets are likely to overtake credit cards in terms of E-commerce sales during the next two years. Mobile wallets are rapidly being utilized for online and in-store purchases. According to a poll conducted by the Economist Intelligence Unit (EIU) in January/February 2020, 60% of respondents stated they would like to utilize digital payments instead of cash for daily transactions.

Mobile wallet services are designed to make life easier. Education and awareness were major roadblocks. And when there arises another roadblock such as COVID-19, people understand how superior it is. Trust goes hand in hand with education and awareness. And once an individual has broken through that trust barrier, it's there to stay. People have learned that this solves actual problems. Payments via mobile wallets are quite localized. Mobile wallets have traditionally been urban-centric, but there is so much expansion in smaller cities beyond the usual centers that this is where future growth will be found.

In the Asia-Pacific (APAC) region, mobile wallet acceptance and usage are expected to skyrocket in the coming years, displacing traditional payment methods such as cash and cards. The COVID-19 pandemic has aggravated the trend because mobile payment has emerged as one of the few areas in the whole payments industry that has witnessed a positive impact from the pandemic.

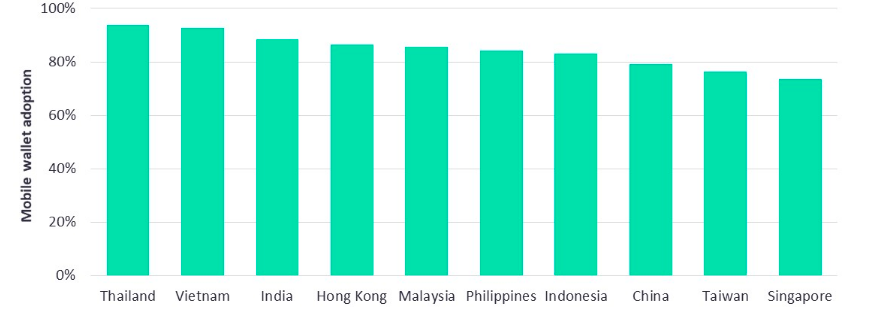

Mobile wallets have been vigorously promoted in APAC regions such as China and India, putting them much ahead of their Western counterparts. Other markets in the region are also catching up, with Thailand and Vietnam ranking as the world's top adopters of mobile wallets.

Fig.5 Mobile wallet adoption in APAC (2021)

Source: Global Data Banking and Payments Intelligence Center

Thailand ranked first in the world regarding mobile wallet adoption, with 93.7 percent of poll respondents saying they have used a mobile wallet in a store in the previous 12 months. Other Asian markets such as Vietnam, India, and China follow Thailand. Despite substantial smartphone usage in these countries, the region's adoption rate is much greater than that of several established markets such as the United States and the United Kingdom, where adoption rates are just 42.8 percent and 36.5 percent, respectively.

The widespread use of QR code-based payments in the region has been a major driver of mobile wallet use. While consumers appreciate the convenience and pricing benefits (cashback/discounts), merchants value the 'cost-effectiveness' of mobile wallet acceptance because the costs associated with setting up infrastructure (such as QR code sticker) and transaction fees are significantly lower than those associated with traditional card-based payment systems.

Instant payments are likely to increase the use of mobile wallets in the region. Instant payments, which were originally designed to allow for real-time financial transfers between bank accounts, are currently being expanded to include merchant payments. Mobile devices serve as the major form factor.

The Future of Mobile Wallets

Consumers worried about privacy should be aware of what personal information is provided back to the merchant by the mobile wallet, especially if it is shared unintentionally. The speed of digitization is picking up in all areas, boosting no-contact transactions and increasing demand for digital banking services. Digital banking has grown in popularity among consumers as all small and large businesses and e-commerce businesses are eager to accept digital payments. Digital wallets are apps that are directly linked to consumers' accounts and allow them to transact using their smartphones or laptops, such as receiving or making payments. In this pandemic era, digital wallets are the most extensively used options. Individuals want to shop online for all of their day-to-day requirements in this "cashless" era, looking for choices that are convenient and secure and resilient. One of the tried-and-true foundations in this function is digital wallets. Consumers are looking for quick banking services, and digital banking has emerged as a popular option in recent years. Here are some facts that demonstrate the importance of digital banking in today's technological age:

- According to a poll conducted by the Global FinTech Index Report, 96 percent of clients have used online fintech services to transact at least once

- According to Statista research, non-traditional financial firms dominate digital wallets and mobile payments, with 66.7 percent of senior banking professionals agreeing

- According to Worldpay's Global Payments Report, by 2023, more than half of all e-commerce transactions will be conducted using a digital wallet

All sectors have benefited from digitalization, and banking was one of the first to experience this. In recent years, many advancements have been made, and digitization has greatly aided the banking sector. With customers increasingly using mobile devices and e-commerce to conduct their everyday financial activities, the digital wallet has emerged as one of the most popular and convenient payment options. As a result of the circumstance, all firms, large and small, were forced to adapt in order to stay up with this contactless mode of operation digitally. As a result, most businesses use online banking services to make electronic payments. Below are some points in discussion as to how mobile wallets are the future of digital banking:

1. Sales and Client Database

Because digital wallets make the checkout process faster, more customers are drawn to them. Apps for digital wallets feature a simple registration and login process, and users may easily create an account with no hidden fees. This increases client interest in digital banking and aids in the development of client databases. This also aids the financial institution's data-driven decision-making by allowing them to gather client demand and experiences more systematically and productively.

2. Brand Value Improvement and Customer Loyalty

Customers can keep in touch with a brand via a digital wallet. As a result, it assists banks in increasing consumer brand loyalty. Digital banking has grown in popularity as mobile wallets have made it easier to check account balances, move money between accounts, pay bills, and purchase online. Customers are not constrained by their usual banking procedures. They are, in fact, more receptive to new financial ties. Consumers can now pick how they interact with their banks based on their brand values. Because a digital wallet provides a more secure and safe method of digital banking, it aids in increasing consumer loyalty. In the banking industry, loyalty is the most crucial component. Banks are focusing more on creative solutions and assisting their consumers in providing additional security measures to alleviate stress. As a result, digital wallets play a significant role because they include various security features.

3. Convenient and Timeless Solution

Traveling to the bank to transfer dollars was a challenge once, but now, digital banks have emerged as a blessing. Working-class, elderly, and physically challenged persons found digital wallet software to be an easy way to handle all their banking from their cellphones. People currently choose digital wallets since they provide a one-click solution. Digital wallets offer a frictionless consumer experience by allowing for seamless payment alternatives throughout. Temporal limits do not restrict Customers because a digital wallet is a timeless solution. They only have to register once and can use digital wallet apps for the rest of their lives. With digital wallet apps, there are no time limits or renewal policies. Further, as timeless solutions, mobile or digital wallets can be used at any time (24*7) and from anywhere around the world, thereby improving the flexibility quotient.

4. Rural Development

Rural communities have significantly benefited from digital banking. Rural residents no longer have to worry about traveling long distances to reach the nearest bank, especially in the event of a financial emergency. The rural people has expressed strong interest because they can do the most basic banking transactions with just one tap of their smartphones. Digital wallets help to break down barriers and give an integrated solution in even the most remote locations.

5. Digital and Paperless Transactional Services

Traditional banking entailed making regular trips to the bank for each transaction and keeping track of the account history via printed statements. You may now go paperless and access all of your transaction history on your smartphone. Digital wallets allow users to store credit and debit card information, which can be useful for making money transactions at any time. As a result, mobile wallets make it easier for consumers to manage their finances by aggregating all of their card information into a single, secure location.

Customers continue to seek easy solutions, so digital banking is a popular choice in today's world. With all of the above features and benefits in mind, we can conclude that a mobile or digital wallet can significantly enhance the customer experience and assist banking services in retaining existing customers, increasing brand awareness, attracting new customers, and improving the ways they interact with their audience. Mobile/ digital wallets are becoming increasingly popular among people of all generations since they make it simple to transact, simplify and speed up the purchasing process, and promote contactless payment choices.

Growing awareness among the individuals pertaining to the benefits of consuming organic food and beverage items will promote the growth rate of the organic food and beverages market. Further, surging improvement in the IT infrastructure in combination with an increasing rate of digitization is promoting the use of online payment methods such as mobile wallets. Recognizing this opportunity, Data Bridge Market Research prepared an investigative report on the global organic food and beverages market. Data Bridge Market Research analyses that the global organic food and beverages market will project a CAGR of 16.37% for the forecast period of 2021-2028. Increasing personal disposable income, increasing number of chronic diseases such as cardiac issues, cancer, diabetes, and others, growth in the adoption of eco-friendly farming techniques especially in the developing economies, rising initiatives by the government to promote organic farming over traditional farming practices, increasing awareness regarding the health and environmental benefits of organic food and growing awareness about the benefits of organic food and beverages are the major factors attributable to the growth of organic food and beverages market.

To know more about the study, visit: https://www.databridgemarketresearch.com/reports/global-organic-food-beverages-market