Global Covid 19 Sample Collection Kits Market

Market Size in USD Billion

CAGR :

%

USD

7.68 Billion

USD

12.93 Billion

2025

2033

USD

7.68 Billion

USD

12.93 Billion

2025

2033

| 2026 –2033 | |

| USD 7.68 Billion | |

| USD 12.93 Billion | |

|

|

|

|

COVID-19 Sample Collection Kits Market Size

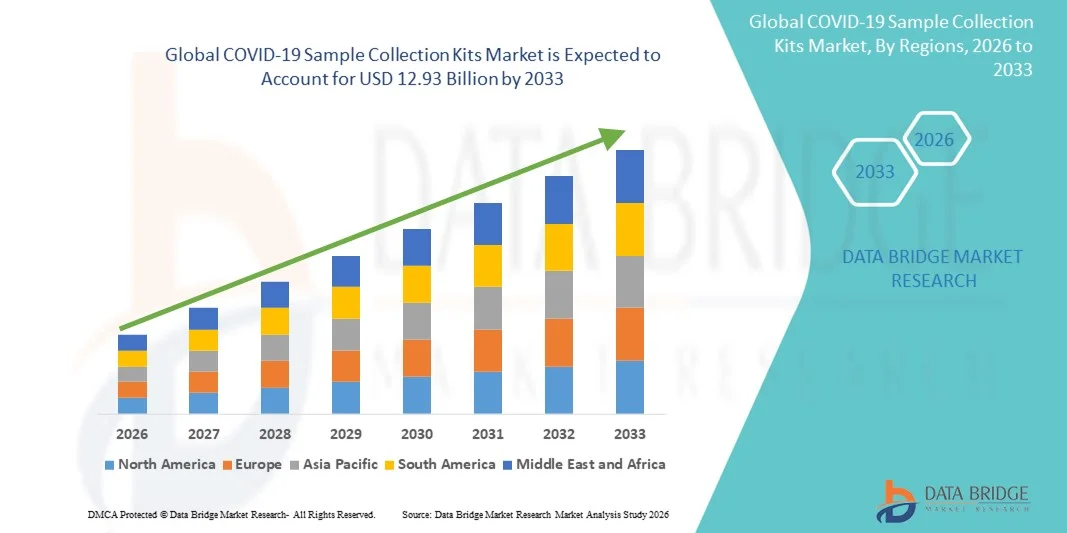

- The global COVID-19 sample collection kits market size was valued at USD 7.68 billion in 2025 and is expected to reach USD 12.93 billion by 2033, at a CAGR of 6.73% during the forecast period

- The market growth is largely fueled by the ongoing need for accurate and reliable sample collection solutions for SARS‑CoV‑2 diagnosis, sustained demand for swabs and viral transport media, and continued investment in healthcare testing infrastructure worldwide

- Furthermore, rising awareness of early detection benefits, supportive government initiatives to expand testing accessibility, and advances in specimen collection technologies are establishing improved sample collection kits as critical components in pandemic preparedness and routine diagnostics. These converging factors are supporting steady uptake of COVID‑19 sample collection products, thereby significantly boosting the industry’s growth

COVID-19 Sample Collection Kits Market Analysis

- COVID‑19 sample collection kits, including swabs, viral transport media, and specimen collection devices, are increasingly vital components of pandemic management and diagnostic workflows in both clinical and point-of-care settings due to their accuracy, ease of use, and compatibility with various testing platforms

- The escalating demand for COVID‑19 sample collection kits is primarily fueled by ongoing testing requirements, rising awareness of early detection benefits, and government initiatives to expand healthcare infrastructure and testing accessibility

- North America dominated the COVID‑19 sample collection kits market with the largest revenue share of 38.6% in 2025, characterized by robust healthcare infrastructure, strong public and private testing programs, and the presence of major kit manufacturers, with the U.S. witnessing substantial adoption across hospitals, diagnostic laboratories, and community testing centers

- Asia-Pacific is expected to be the fastest-growing region in the COVID‑19 sample collection kits market during the forecast period due to increasing investments in healthcare infrastructure, rising population awareness, and expanding production capacities for diagnostic consumables

- Swab segment dominated the COVID‑19 sample collection kits market with a market share of 45.2% in 2025, driven by its essential role in accurate specimen collection and compatibility with a wide range of molecular and antigen-based testing methods

Report Scope and COVID-19 Sample Collection Kits Market Segmentation

|

Attributes |

COVID-19 Sample Collection Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

COVID-19 Sample Collection Kits Market Trends

Advancements in Rapid and At-Home Testing Technologies

- A significant and accelerating trend in the global COVID-19 sample collection kits market is the development of rapid, at-home, and self-collection kits, enabling faster and more convenient testing outside traditional clinical settings

- For instance, the Lucira COVID-19 All-in-One Test Kit allows users to collect nasal samples and obtain results within 30 minutes at home, providing a convenient alternative to laboratory-based testing. Similarly, Everlywell offers self-collection kits for COVID-19 and other infectious diseases, which can be mailed to laboratories for analysis

- Integration with digital platforms and mobile apps is enhancing usability, allowing patients to track their test results, receive guidance, and share results with healthcare providers seamlessly. For instance, some Abbott BinaxNOW kits now include app-based instructions and result reporting features to improve accuracy and compliance

- The seamless connection of collection kits with telehealth and public health monitoring platforms facilitates real-time reporting of test results, enabling faster outbreak response and centralized health data management

- This trend toward user-friendly, rapid, and digitally connected collection kits is fundamentally reshaping consumer expectations for pandemic diagnostics. Consequently, companies such as Cue Health are innovating app-connected at-home testing solutions with guided collection steps and integrated result reporting

- The demand for self-collection and rapid testing kits is growing rapidly across both residential and institutional sectors, as consumers and healthcare providers increasingly prioritize convenience, speed, and reliable disease monitoring

- Expansion of multi-disease panels in collection kits, enabling simultaneous testing for COVID-19 and other respiratory pathogens, is becoming an emerging trend, improving diagnostic efficiency

- Partnerships between kit manufacturers and logistics providers to enhance sample transport and cold-chain management are enabling wider distribution and faster result turnaround, further boosting adoption

COVID-19 Sample Collection Kits Market Dynamics

Driver

Increasing Demand Due to Ongoing Testing and Health Awareness

- The continued requirement for mass testing, early detection, and monitoring of COVID-19 infections, coupled with growing public health awareness, is a significant driver for the heightened demand for sample collection kits

- For instance, in March 2025, Thermo Fisher Scientific launched expanded production of their TaqPath COVID-19 collection kits to support large-scale testing initiatives in North America and Europe. Such strategic moves by key companies are expected to propel market growth during the forecast period

- As governments and healthcare organizations emphasize frequent testing for outbreak management, sample collection kits offer reliable and standardized tools for safe specimen handling, making them indispensable for both clinical and at-home testing

- Furthermore, the rising adoption of telehealth services and decentralized diagnostics is making sample collection kits integral to testing workflows, supporting seamless specimen collection and result submission

- Ease of use, rapid collection processes, and the ability to send samples to certified laboratories or obtain point-of-care results are key factors driving adoption across residential, commercial, and institutional settings

- Increasing investment in healthcare infrastructure and public-private partnerships to expand testing networks further stimulates demand for high-quality sample collection kits

- Growing awareness and preparedness for potential future pandemics encourage governments and institutions to maintain stockpiles of reliable sample collection kits, supporting sustained market growth

Restraint/Challenge

Supply Chain Constraints and Regulatory Compliance Hurdles

- Challenges in global supply chains, including shortages of swabs, viral transport media, and transport logistics, pose significant hurdles to the consistent availability of COVID-19 sample collection kits

- For instance, during peak testing periods, several manufacturers reported delays in kit distribution due to high demand for raw materials and shipping bottlenecks, affecting testing programs in multiple regions

- Navigating regulatory approvals and compliance with evolving standards in different countries is also crucial, as delays or mismatched guidelines can slow kit deployment and adoption. For instance, some kits require FDA EUA or CE marking to be used in clinical settings, and regulatory updates can create uncertainty for manufacturers and healthcare providers

- The relatively high cost of certain advanced or at-home collection kits compared to traditional laboratory collection methods can limit adoption among budget-conscious consumers or in developing regions

- Addressing these challenges through supply chain optimization, streamlined regulatory approvals, and cost-effective kit development will be critical for sustained market growth and broader accessibility

- Variability in sample collection quality and user errors in at-home kits can impact test accuracy, creating potential hurdles for wider consumer confidence and adoption

- Limited cold-chain infrastructure in remote or rural regions restricts kit distribution and timely sample delivery, particularly in emerging markets, posing a significant market challenge

COVID-19 Sample Collection Kits Market Scope

The market is segmented on the basis of product, application, and site of collection.

- By Product

On the basis of product, the COVID-19 sample collection kits market is segmented into swabs, viral transport media (VTM), blood collection kits, and other consumables. The swabs segment dominated the market with the largest revenue share of 45.2% in 2025, driven by their essential role in accurate specimen collection and compatibility with various molecular and antigen-based tests. Swabs are preferred due to their simplicity, ease of use, and reliability in collecting nasal or throat samples, making them indispensable for both clinical and at-home testing. Strong demand is fueled by high testing volumes across hospitals, laboratories, and home-testing programs globally. Technological innovations such as flocked swabs and 3D-printed swabs are improving collection efficiency, patient comfort, and test accuracy. The segment also benefits from ongoing public health initiatives that emphasize frequent and widespread testing.

The blood collection kits segment is anticipated to witness the fastest growth rate of 12% from 2026 to 2033, driven by their increasing use in serology testing and monitoring of antibodies against SARS-CoV-2. Blood collection kits are essential for research, vaccine efficacy studies, and post-infection immunity assessment, supporting growing demand in both diagnostics and research applications. Advancements in minimally invasive kits and micro-sampling methods contribute to easier self-collection and home testing adoption. Rising investments in clinical studies and longitudinal research programs are also fueling segment growth. The segment’s expansion is further supported by collaborations between kit manufacturers and hospitals, research labs, and biotech companies.

- By Application

On the basis of application, the COVID-19 sample collection kits market is segmented into diagnostics and research. The diagnostics segment dominated the market in 2025, accounting for the majority of revenue due to the persistent need for clinical COVID-19 testing in hospitals, clinics, and testing centers worldwide. Diagnostic applications require high accuracy, rapid turnaround times, and safe sample handling, driving demand for reliable swabs, VTMs, and blood collection kits. The segment is further supported by government-led mass testing programs, corporate testing initiatives, and home-testing adoption. High demand in diagnostics is also reinforced by routine screening in workplaces, schools, and travel hubs. Continuous improvements in kit performance, sensitivity, and ease of use further strengthen the segment’s market position.

The research segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing investments in vaccine development, clinical trials, and epidemiological studies. Research applications often require specialized kits to maintain sample integrity and reproducibility across labs. Rising focus on variants, immunity studies, and long-term effects of COVID-19 is boosting demand for blood and other consumables designed for research purposes. Technological innovations in sample preservation and transportation enhance usability in research. Partnerships between research institutions and kit manufacturers are also driving segment growth.

- By Site of Collection

On the basis of site of collection, the COVID-19 sample collection kits market is segmented into hospitals and clinics, and home test. The hospitals and clinics segment dominated the market in 2025, driven by centralized testing infrastructure, higher test volumes, and professional administration of specimen collection. Hospitals and clinics are preferred for accurate sample handling, proper storage, and immediate laboratory processing. High demand is reinforced by institutional testing policies, occupational screening, and public health programs. Continuous adoption of standardized protocols and trained staff ensures reliable results, supporting segment dominance. Strong partnerships between hospitals, labs, and kit suppliers maintain consistent supply and availability.

The home test segment is expected to witness the fastest growth from 2026 to 2033, fueled by convenience, ease of self-collection, and increasing adoption of at-home rapid testing kits. Home testing enables early detection, reduces exposure risk in crowded clinical settings, and integrates with telehealth platforms for result reporting. Growing awareness, regulatory approvals, and online distribution channels are expanding access to home kits. Technological advancements in user-friendly kit designs improve accuracy and compliance for self-testing. Partnerships between manufacturers and e-commerce providers are accelerating growth in this segment

COVID-19 Sample Collection Kits Market Regional Analysis

- North America dominated the COVID‑19 sample collection kits market with the largest revenue share of 38.6% in 2025, characterized by robust healthcare infrastructure, strong public and private testing programs, and the presence of major kit manufacturers, with the U.S. witnessing substantial adoption across hospitals, diagnostic laboratories, and community testing centers

- Healthcare providers and consumers in the region highly value the accuracy, reliability, and ease of use offered by modern sample collection kits, including swabs, viral transport media, and at-home rapid test kits, which support efficient diagnosis and monitoring

- This widespread adoption is further supported by government initiatives to expand testing accessibility, strong public-private collaborations, and the presence of leading kit manufacturers, establishing North America as a key hub for COVID-19 testing and research

U.S. COVID-19 Sample Collection Kits Market Insight

The U.S. COVID-19 sample collection kits market captured the largest revenue share of 80% in 2025 within North America, driven by widespread testing infrastructure and strong public awareness of early detection benefits. Hospitals, diagnostic laboratories, and home-testing programs are rapidly adopting swabs, viral transport media, and at-home kits. The growing trend of self-testing and telehealth integration, combined with demand for rapid and accurate results, is further propelling the market. Government-led initiatives to expand testing accessibility and partnerships with private manufacturers are contributing significantly to market growth. The presence of leading kit manufacturers and advanced R&D facilities also strengthens the adoption of innovative collection solutions.

Europe COVID-19 Sample Collection Kits Market Insight

The Europe COVID-19 sample collection kits market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations and growing emphasis on pandemic preparedness. Increased urbanization, rising awareness of early diagnosis, and adoption of advanced diagnostics are fostering market growth. European countries are investing heavily in hospitals, laboratories, and community testing programs, supporting the demand for high-quality swabs, viral transport media, and blood collection kits. The market is witnessing strong growth across clinical, research, and at-home testing applications. Innovations in kit design, user-friendliness, and integrated digital reporting systems are also enhancing adoption.

U.K. COVID-19 Sample Collection Kits Market Insight

The U.K. COVID-19 sample collection kits market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by large-scale testing programs and rising health awareness among consumers. The increasing adoption of at-home testing kits, coupled with telehealth and digital result reporting, is driving demand. Government support, regulatory approvals, and efficient logistics networks facilitate widespread kit distribution across residential and clinical settings. Growing concerns regarding new variants and workplace testing mandates are also boosting market growth. The U.K.’s established healthcare infrastructure and focus on early detection support consistent adoption of reliable collection kits.

Germany COVID-19 Sample Collection Kits Market Insight

The Germany COVID-19 sample collection kits market is expected to expand at a considerable CAGR during the forecast period, driven by robust healthcare infrastructure and a strong emphasis on public health and safety. Rising awareness of accurate specimen collection, coupled with ongoing testing programs in hospitals, clinics, and research institutions, supports market growth. Technologically advanced collection kits, including swabs, viral transport media, and blood collection kits, are increasingly adopted for both clinical and research purposes. Government initiatives, efficient regulatory frameworks, and innovation in at-home testing kits further encourage market penetration. The demand for safe, reliable, and eco-conscious sample collection solutions aligns with local consumer expectations and sustainability trends.

Asia-Pacific COVID-19 Sample Collection Kits Market Insight

The Asia-Pacific COVID-19 sample collection kits market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by increasing urbanization, rising disposable incomes, and expanding healthcare infrastructure in countries such as China, Japan, and India. Growing awareness of early detection, government initiatives for mass testing, and investments in diagnostic facilities are driving adoption. The region is also witnessing the expansion of domestic manufacturers producing cost-effective kits, increasing accessibility to both clinical and at-home testing solutions. Technological advancements in rapid and easy-to-use kits further support market growth. Rising demand across residential, institutional, and research applications is contributing to APAC’s leading growth trajectory.

Japan COVID-19 Sample Collection Kits Market Insight

The Japan COVID-19 sample collection kits market is gaining momentum due to the country’s advanced healthcare system, technological adoption, and public health awareness. The increasing number of smart hospitals, telehealth programs, and at-home testing solutions are driving growth. Integration of kits with digital platforms for real-time reporting and efficient sample management is becoming prevalent. Government support for testing initiatives, coupled with widespread adoption of self-testing kits, contributes to market expansion. Japan’s focus on high-quality, reliable, and easy-to-use collection solutions supports consistent growth across residential and clinical settings.

India COVID-19 Sample Collection Kits Market Insight

The India COVID-19 sample collection kits market accounted for the largest revenue share in Asia Pacific in 2025, attributed to rapid urbanization, increasing healthcare awareness, and government-led testing programs. India is one of the largest markets for at-home and institutional COVID-19 testing kits, including swabs, viral transport media, and blood collection kits. Rising investments in diagnostic infrastructure, telehealth integration, and domestic manufacturing capabilities are key factors driving market growth. Affordable kit options and partnerships with logistics providers enhance accessibility across urban and semi-urban regions. Increasing demand from hospitals, research institutions, and residential users is further propelling the market in India.

COVID-19 Sample Collection Kits Market Share

The COVID-19 Sample Collection Kits industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Labcorp (U.S.)

- Bio Rad Laboratories Inc. (U.S.)

- COPAN Diagnostics (U.S.)

- HiMedia Laboratories (India)

- Medline Industries, Inc. (U.S.)

- Vircell, S.L. (Spain)

- Hardy Diagnostics (U.S.)

- Cepheid (U.S.)

- QIAGEN (Netherlands)

- Hologic (U.S.)

- Cardinal Health (U.S.)

- Greiner Bio One (Austria)

- Siemens Healthineers AG (Germany)

- PerkinElmer (U.S.)

- 3M (U.S.)

- Puritan Medical Products (U.S.)

What are the Recent Developments in Global COVID-19 Sample Collection Kits Market?

- In June 2025, the Delhi High Court in India urged the central government to update policies on COVID‑19 sample collection processes, including the operation of collection centres and transportation guidelines, underscoring the continuing public health focus on efficient sample acquisition amid continuing community transmission

- In April 2023, the FDA reported that hundreds of molecular tests and sample collection devices were authorized for COVID‑19 under EUAs, including multiple home collection options, reflecting continued regulatory support and diversification of collection kit formats to meet evolving testing demands; this summary included at least 300 molecular test and sample collection device authorizations by that time, signaling sustained market innovation and regulatory activity

- In March 2023, Quest Diagnostics’ COVID‑19 Nucleic Acid Test Collection Kit received Emergency Use Authorization (EUA) from the U.S. Food and Drug Administration (FDA), enabling self‑collection of anterior nasal swab specimens at home or in supervised settings as part of COVID‑19 testing programs; this authorization expanded testing accessibility across ages and supported broader community‑based specimen collection efforts by utilizing designated laboratories for molecular SARS‑CoV‑2 testing

- In March 2023, Quest Diagnostics’ home‑collection kit authorization supported collection of over 37,000 unobserved self‑collected nasal swab specimens, demonstrating that nearly all participants could collect adequate samples without professional supervision, which underscored growing confidence in self‑collection kit performance and usability for large‑scale testing programs across diverse populations

- In July 2021, the Everlywell COVID‑19 & Flu Test Home Collection Kit was updated under its EUA to clarify age‑related usage guidelines and support self‑collection of anterior nasal swab specimens for combined COVID‑19 and influenza testing; this update helped streamline home sampling processes for broader populations, including minors with adult supervision, strengthening dual‑pathogen testing utility during respiratory virus seasons

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.