Europe Blood Plasma And Plasma Derived Medicinal Products Market

Marktgröße in Milliarden USD

CAGR :

%

USD

7.96 Billion

USD

13.75 Billion

2024

2032

USD

7.96 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 7.96 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Marktsegmentierung für Blutplasma und aus Plasma gewonnene Arzneimittel in Europa nach Produkt ( Immunglobuline , Gerinnungsfaktoren (gegen Blutungsstörungen), Albumin (Plasmavolumenexpander), Proteaseinhibitoren (gegen genetische Defekte), monoklonale Antikörper (aus Plasmazellen gewonnen) und andere aus Plasma gewonnene Proteine), Anwendung (Immunologie, Hämatologie, Intensivmedizin, Neurologie, Pulmonologie, Hämato-Onkologie , Rheumatologie und andere Anwendungen), Verarbeitungstechnologie (Ionenaustauschchromatographie, Affinitätschromatographie, Kryopräzipitation, Ultrafiltration und Mikrofiltration), Modus (Moderne und traditionelle Plasmafraktionierung), Endverbraucher (Krankenhäuser und Kliniken, Forschungslabore, akademische Institute und andere), Vertriebskanal (Direktausschreibung, Drittanbieter und andere) – Branchentrends und Prognose bis 2032

Marktgröße für Blutplasma und aus Plasma gewonnene Arzneimittel

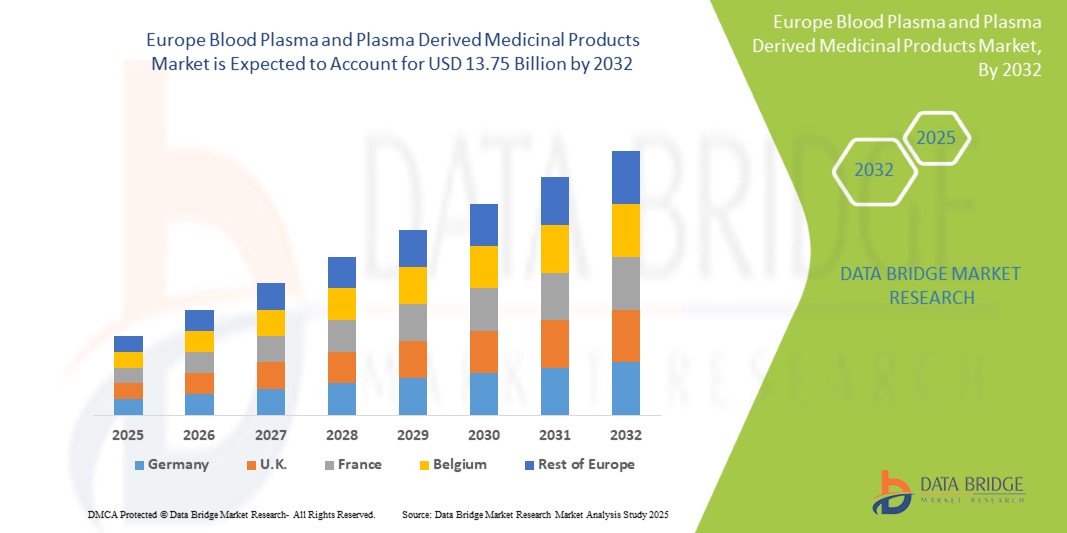

- Der europäische Markt für Blutplasma und plasmabasierte Arzneimittel wurde im Jahr 2024 auf 7,96 Milliarden US-Dollar geschätzt und dürfte im Prognosezeitraum bis 2032 13,75 Milliarden US-Dollar erreichen, bei einer CAGR von 7,11 %.

- Das Marktwachstum wird maßgeblich durch die zunehmende Verbreitung seltener und chronischer Krankheiten vorangetrieben.

- Darüber hinaus gibt es technologische Fortschritte bei der Plasmafraktionierung von Blutplasma und plasmabasierten Arzneimitteln. Diese konvergierenden Faktoren beschleunigen die Akzeptanz von Lösungen für Blutplasma und plasmabasierte Arzneimittel und fördern damit das Wachstum der Branche erheblich.

Marktanalyse für Blutplasma und aus Plasma gewonnene Arzneimittel

- Der Markt wächst aufgrund der steigenden Nachfrage nach Plasmatherapien zur Behandlung von Erkrankungen wie Hämophilie, Immunschwäche und Autoimmunerkrankungen, unterstützt durch ein steigendes Bewusstsein und Fortschritte in der Transfusionsmedizin.

- Technologische Fortschritte bei der Blutentnahme, Fraktionierung und Kühlkettenlogistik verbessern die Produktqualität und Haltbarkeit und fördern eine breitere Akzeptanz in Krankenhäusern, Traumazentren und Diagnoselabors weltweit.

- Es wird erwartet, dass Deutschland den Markt für Blutplasma und plasmabasierte Arzneimittel im Jahr 2025 mit einem Anteil von 18,16 % dominieren wird. Grund dafür sind die verbesserte Gesundheitsinfrastruktur, die steigende Nachfrage nach Plasmatherapien, verstärkte staatliche Unterstützung und die zunehmende Verbreitung chronischer und infektiöser Krankheiten.

- Deutschland dürfte die am schnellsten wachsende Region im Markt für Blutplasma und plasmabasierte Arzneimittel sein. Grund dafür sind steigende Investitionen im Gesundheitswesen, die zunehmende Verbreitung chronischer und infektiöser Krankheiten, verbesserte Diagnosemöglichkeiten, ein wachsendes Bewusstsein für die Blutsicherheit sowie staatliche Initiativen zur Verbesserung der Zugänglichkeit und Infrastruktur der Plasmatherapie.

- Es wird erwartet, dass das Segment Immunglobuline den Markt für Blutplasma und daraus gewonnene Arzneimittel mit einem Anteil von 42,20 % im Jahr 2025 dominieren wird, aufgrund der steigenden Nachfrage nach zielgerichteten Therapien, verbesserten Reinigungstechnologien und der zunehmenden Prävalenz immunbedingter Erkrankungen

Berichtsumfang und Marktsegmentierung für Blutplasma und aus Plasma gewonnene Arzneimittel

|

Eigenschaften |

Wichtige Markteinblicke zu Blutplasma und aus Plasma gewonnenen Arzneimitteln |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure umfassen die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, Patientenepidemiologie, Pipeline-Analysen, Preisanalysen und regulatorische Rahmenbedingungen. |

Markttrends für Blutplasma und aus Plasma gewonnene Arzneimittel

„Steigende Prävalenz seltener und chronischer Krankheiten“

- Eine wichtige Triebkraft für den Markt für Blutplasma und aus Plasma gewonnene Arzneimittel ist die weltweit zunehmende Verbreitung seltener und chronischer Krankheiten, die durch Fortschritte in der Diagnosetechnologie und ein gestiegenes Bewusstsein bei Gesundheitsdienstleistern und Patienten vorangetrieben wird.

- So zeigten CDC-Daten im April 2025, dass 76,4 % der Erwachsenen in den USA mindestens eine chronische Erkrankung hatten und 51,4 % mehrere. Dieser steigende Trend – auch bei jüngeren Erwachsenen zu beobachten – hat die Nachfrage nach lebenslanger Pflege verstärkt, insbesondere bei Erkrankungen wie Hämophilie, primären Immundefizienzerkrankungen und der Von-Willebrand-Krankheit.

- Plasmabasierte Therapien wie Immunglobuline, Gerinnungsfaktoren und Albumin sind für die Behandlung dieser lebenslangen Erkrankungen von entscheidender Bedeutung. Patienten mit primärer Immundefizienz sind auf IVIG zur Unterstützung des Immunsystems angewiesen, während Hämophiliepatienten regelmäßige Gerinnungsfaktor-Infusionen benötigen, um Blutungen vorzubeugen.

- Die weltweite Alterung der Bevölkerung verstärkt diesen Trend zusätzlich. Ältere Menschen sind zunehmend von Erkrankungen wie Leberzirrhose, multiplem Myelom und entzündlichen Erkrankungen betroffen, die alle auf plasmabasierte Interventionen angewiesen sind.

- Im März 2025 verdeutlichte eine im PMC veröffentlichte Studie die enorme globale Belastung durch seltene Krankheiten, insbesondere bei Kindern. Trotz Fortschritten in der Genommedizin und der Entwicklung von Orphan-Medikamenten kommt es weiterhin zu Verzögerungen bei der Diagnose und eingeschränkten Behandlungsmöglichkeiten. Dies unterstreicht die Notwendigkeit einer multidisziplinären und nachhaltigen Versorgung.

- Die wachsende Nachfrage nach sicheren, wirksamen und hochwertigen Therapien auf Plasmabasis ist ein entscheidender Faktor für den Markt für Blutplasma und Arzneimittel auf Plasmabasis, da diese Produkte eine entscheidende Rolle bei der Behandlung lebenslanger Krankheiten und der Deckung des ungedeckten medizinischen Bedarfs in Europa spielen.

Marktdynamik für Blutplasma und aus Plasma gewonnene Arzneimittel

Treiber

„Wachsende geriatrische Bevölkerung“

- Die steigende Nachfrage nach Blutplasma und daraus gewonnenen Arzneimitteln wird maßgeblich durch die alternde Weltbevölkerung getrieben, die anfälliger für chronische und degenerative Erkrankungen wie Störungen des Immunsystems, neurologische Erkrankungen, Leberkomplikationen und Blutprobleme ist, die plasmabasierte Therapien wie Immunglobuline, Albumin und Gerinnungsfaktoren erfordern.

- So zeigte beispielsweise eine im März 2025 in PMC veröffentlichte Studie, die Daten der US-amerikanischen National Inpatient Sample (NIS) von 2010 bis 2024 analysierte, dass die schnell wachsende ältere Bevölkerung zu einem deutlichen Anstieg der Krankenhauseinweisungen, längeren Krankenhausaufenthalten und höheren Wiedereinweisungsraten geführt hat. Dieser Trend, der hauptsächlich auf chronische Erkrankungen und Multimorbidität zurückzuführen ist, verdeutlicht die zunehmende Belastung der Gesundheitssysteme und die entsprechende Nachfrage nach plasmabasierten Behandlungen.

- Mit zunehmendem Alter schwächt sich das Immunsystem ab, was die Anfälligkeit für Infektionen und Autoimmunerkrankungen erhöht. Immunglobulintherapien werden häufig bei Erkrankungen wie der chronisch inflammatorischen demyelinisierenden Polyneuropathie (CIDP) eingesetzt, während Albumin für die Regulierung des Flüssigkeitshaushalts bei chirurgischen Eingriffen und in der Intensivpflege älterer Patienten von entscheidender Bedeutung ist.

- Länder mit einem hohen Anteil älterer Erwachsener verzeichnen einen anhaltenden Anstieg des PDMP-Verbrauchs. Dieser demografische Trend setzt die nationalen Gesundheitssysteme unter enormen Druck, unterbrechungsfreie Lieferketten und eine ausreichende Plasmagewinnung sicherzustellen.

- Der prognostizierte Anstieg der Weltbevölkerung ab 60 Jahren – von 1,1 Milliarden im Jahr 2023 auf 2,1 Milliarden im Jahr 2050, laut WHO-Schätzungen – unterstreicht die entscheidende Rolle der Altenpflege. Dieser demografische Wandel verstärkt nicht nur den Bedarf an langfristiger therapeutischer Unterstützung, sondern positioniert die ältere Bevölkerung auch als wichtiges, dauerhaftes Marktsegment für PDMPs in Europa.

Einschränkung/Herausforderung

„ Hoher Preis und komplexer Herstellungsprozess “

- Die hohen Kosten und die Komplexität der Herstellung von Blutplasma und plasmabasierten Arzneimitteln stellen ein erhebliches Hindernis für die Marktexpansion dar. Der Prozess erfordert strenge Plasmasammelprotokolle, ein umfassendes Pathogen-Screening und eine mehrstufige Fraktionierung unter sterilen, GMP-konformen Bedingungen – was die Produktion äußerst ressourcenintensiv und zeitaufwändig macht.

- Eine detaillierte Analyse von Aykon Biosciences zeigte beispielsweise, dass die Herstellung komplexer Biologika, wie beispielsweise plasmabasierter Therapien, aufgrund teurer Rohstoffe, des Bedarfs an Fachkräften und zunehmend strengerer regulatorischer Anforderungen einem steigenden Kostendruck ausgesetzt ist. Der Trend zu spezialisierten und personalisierten Therapien treibt die Kosten weiter in die Höhe und erfordert fortschrittliche Technologien und strenge Qualitätssicherungssysteme.

- Darüber hinaus kann sich der Herstellungszyklus von PDMPs bis zu 12 Monate erstrecken, was eine Kühlkettenlogistik für Lagerung und Transport während des gesamten Prozesses erfordert. Diese Faktoren erhöhen die Investitions- und Betriebskosten erheblich, schränken die Skalierbarkeit ein und halten kleinere Akteure und Entwicklungsländer von einer effektiven Marktteilnahme ab.

- Die kostenintensive Produktion trägt zudem zu hohen Endproduktpreisen bei, was die Zugänglichkeit und Erschwinglichkeit einschränkt – insbesondere in Ländern mit niedrigem und mittlerem Einkommen, in denen die Gesundheitsbudgets begrenzt sind. Diese finanzielle Belastung stellt eine Herausforderung bei der Deckung der wachsenden globalen Nachfrage dar und behindert somit die weltweite Verbreitung von PDMPs.

- Während technologische Innovationen die Kosteneffizienz schrittweise verbessern können, bleiben die derzeit hohen Produktions- und Verarbeitungskosten ein zentrales Hindernis. Die Bewältigung dieser Herausforderungen durch verbesserte Fertigungstechnologien, eine erweiterte Geberinfrastruktur und eine unterstützende Finanzierung des öffentlichen Gesundheitswesens ist entscheidend für einen breiteren Marktzugang und eine gerechte therapeutische Abdeckung.

Marktumfang für Blutplasma und aus Plasma gewonnene Arzneimittel

Der Markt ist nach Produkt, Anwendung, Verarbeitungstechnologie, Modus, Endbenutzer und Vertriebskanal segmentiert.

- Nach Produkt

Der Markt ist produktbezogen in Immunglobuline, Gerinnungsfaktoren (bei Blutgerinnungsstörungen), Albumin (Plasmavolumenexpander), Proteaseinhibitoren (bei genetischen Defekten), monoklonale Antikörper (aus Plasmazellen) und andere Plasmaproteine segmentiert. Im Jahr 2025 wird das Segment Immunglobuline voraussichtlich mit einem Marktanteil von 42,20 % den Markt dominieren, was auf die steigende Zahl von Immundefizienzdiagnosen, Autoimmunerkrankungen und die zunehmende Verwendung intravenöser Immunglobuline (IVIG) zurückzuführen ist.

Das Segment der Gerinnungsfaktoren (für Blutungsstörungen) dürfte zwischen 2025 und 2032 mit einer Rate von 7,27 % die höchste Wachstumsrate aufweisen. Grund hierfür sind die steigende Zahl der Hämophiliefälle, ein verbesserter Zugang zu Diagnoseverfahren, staatliche Unterstützung und die zunehmende Verwendung rekombinanter und plasmabasierter Therapien.

- Nach Anwendung

Der Markt ist nach Anwendungsgebieten in Immunologie, Hämatologie, Intensivmedizin, Neurologie, Pulmonologie, Hämato-Onkologie, Rheumatologie und weitere Anwendungsgebiete unterteilt. Das Segment Immunologie hatte 2025 den größten Marktanteil, was auf die weit verbreitete Anwendung bei der Behandlung primärer Immundefekte und Autoimmunerkrankungen sowie die weltweit steigende Nachfrage nach intravenösen Immunglobulinen (IVIG) zurückzuführen ist.

Im Segment Immunologie wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) verzeichnet, was auf die zunehmende Verbreitung von Autoimmunerkrankungen, die zunehmende Alterung der Bevölkerung und die zunehmende klinische Anwendung von Immunglobulintherapien zurückzuführen ist.

- Nach Verarbeitungstechnologie

Basierend auf der Verarbeitungstechnologie ist der Markt in Ionenaustauschchromatographie, Affinitätschromatographie, Kryopräzipitation, Ultrafiltration und Mikrofiltration segmentiert. Das Segment Ionenaustauschchromatographie hatte im Jahr 2025 den größten Marktanteil, getrieben durch hohe Effizienz, Skalierbarkeit und Effektivität bei der Reinigung von Plasmaproteinen wie Immunglobulinen, Albumin und Gerinnungsfaktoren.

Das Segment der Affinitätschromatographie dürfte zwischen 2025 und 2032 die höchste durchschnittliche jährliche Wachstumsrate aufweisen und wird aufgrund seiner hohen Spezifität, der Fähigkeit zur Isolierung von Zielproteinen und der zunehmenden Anwendung bei der Reinigung fortschrittlicher Biologika bevorzugt.

- Nach Modus

Der Markt wird nach der Art der Plasmafraktionierung in moderne und traditionelle Verfahren unterteilt. Das moderne Segment erzielte 2025 den größten Marktanteil und trieb fortschrittliche Verarbeitungstechnologien, höhere Produktreinheit, verbesserte Sicherheitsprofile und die zunehmende Nutzung rekombinanter und ertragreicher Plasmatherapien voran.

Im modernen Segment wird von 2025 bis 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) zu verzeichnen sein, angetrieben durch Innovationen bei Reinigungstechniken, eine steigende Nachfrage nach sichereren Biologika und wachsende Investitionen in Plasmaverarbeitungstechnologien der nächsten Generation.

- Nach Endbenutzer

Der Markt ist nach Endverbrauchern segmentiert: Krankenhäuser und Kliniken, Forschungslabore, akademische Institute und weitere. Das Segment Krankenhäuser und Kliniken hatte im Jahr 2025 den größten Marktanteil, bedingt durch das hohe Patientenaufkommen, die Verfügbarkeit spezialisierter Versorgung, die zunehmende Behandlung chronischer Krankheiten und den Zugang zu fortschrittlichen plasmabasierten Therapien.

Auch im Bereich Krankenhäuser und Kliniken wird von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate erwartet, angetrieben durch den Ausbau der Gesundheitsinfrastruktur, steigende stationäre Aufnahmen und die zunehmende Nutzung von Plasmatherapien bei komplexen Erkrankungen.

- Nach Vertriebskanal

Basierend auf den Vertriebskanälen ist der Markt in Direktausschreibungen, Drittanbieter und andere segmentiert. Das Segment Direktausschreibungen hatte im Jahr 2025 den größten Marktanteil, getrieben durch Großeinkäufe staatlicher Stellen, Kosteneffizienz, gesicherte Lieferketten und steigende öffentliche Investitionen in plasmabasierte Arzneimittel.

Auch im Segment der Direktausschreibungen wird von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate erwartet, angetrieben durch die Ausweitung staatlicher Gesundheitsprogramme, zentralisierte Beschaffungsrichtlinien und die steigende Nachfrage nach kostengünstiger, groß angelegter Verteilung von Plasmatherapien.

Regionale Marktanalyse für Blutplasma und aus Plasma gewonnene Arzneimittel

- Deutschland dominiert den Markt für Blutplasma und plasmabasierte Arzneimittel mit dem größten Umsatzanteil von 18,16 % und wird voraussichtlich im Jahr 2025 mit einer CAGR von 7,56 % das schnellste Wachstum verzeichnen. Dies ist auf eine fortschrittliche Gesundheitsinfrastruktur, erhöhte Diagnoseraten seltener und chronischer Krankheiten sowie hohe Gesundheitsausgaben pro Kopf zurückzuführen.

- Der starke regulatorische Rahmen des Landes, die robusten Erstattungssysteme und die Präsenz wichtiger Marktteilnehmer wie Grifols, CSL Behring und Takeda tragen zur Führungsrolle Europas bei der Plasmagewinnung und Therapieverteilung bei.

- Große Volkswirtschaften investieren massiv in biopharmazeutische Forschung und Entwicklung, erweitern Plasmasammelnetzwerke und verbessern den Zugang zu plasmabasierten Therapien für Immunologie, Hämatologie und Neurologie.

Markteinblick in Blutplasma und plasmabasierte Arzneimittel in Frankreich

Für Frankreich wird in der Region Europa von 2025 bis 2032 ein starkes Wachstum prognostiziert. Dies ist auf das gut etablierte Gesundheitssystem, den wachsenden Patientenpool für seltene und chronische Erkrankungen sowie die starken staatlichen Initiativen zur Förderung der Plasmaspende zurückzuführen. Die große Anzahl an Plasmasammelzentren und die beschleunigten Zulassungen für PDMPs verbessern den Zugang zu Behandlungen und treiben die Marktexpansion voran.

Markteinblick in Blutplasma und plasmabasierte Arzneimittel in Großbritannien

Großbritannien wird voraussichtlich von 2025 bis 2032 eine signifikante jährliche Wachstumsrate in der Region verzeichnen. Dies ist auf das universelle Gesundheitssystem, das steigende Bewusstsein für seltene Erkrankungen und staatliche Investitionen in den Ausbau der inländischen Plasmagewinnungskapazitäten zurückzuführen. Strategische Partnerschaften und Fortschritte in der Biologika-Produktion stärken die Präsenz in der PDMP-Landschaft.

Marktanteil von Blutplasma und aus Plasma gewonnenen Arzneimitteln

Die Branche für Blutplasma und aus Plasma gewonnene Arzneimittel wird hauptsächlich von etablierten Unternehmen geführt, darunter:

- CSL (Australien)

- Takeda Pharmaceutical Company Limited (Japan)

- Grifols, SA (Spanien)

- Octapharma AG (Schweiz)

- Kedrion (Italien)

- Bharat Serums (Indien)

- Biotest AG (Deutschland)

- Fresenius Kabi AG (Deutschland)

- Intas Pharmaceuticals Ltd. (Indien)

- Kamada Pharmaceuticals (Israel)

- KM Biologics (Japan)

- LFB (USA)

- Reliance Life Sciences (Indien)

- SK Plasma (Südkorea)

- Synthaverse SA (Polen)

- VIRCHOW BIOTECH (Indien)

Neueste Entwicklungen auf dem Markt für Blutplasma und aus Plasma gewonnene Arzneimittel

- Im November 2024 erweiterte CSL Plasma die Einführung des fortschrittlichen Rika Plasmaspendesystems auf sechs US-Spendezentren in der Nähe von Denver, Colorado. Diese neuen Geräte, die gemeinsam mit Terumo Blood & Cell Technologies entwickelt wurden, verkürzen die Entnahmezeiten um ca. 30 % und verbessern gleichzeitig den Komfort, die Sicherheit und die Effizienz der Spender.

- Im Dezember 2022 eröffnete CSL seine neue Broadmeadows Plasmafraktionierungsanlage in Victoria, Australien – die größte Plasmakornverarbeitungsanlage der südlichen Hemisphäre. Mit einer Kapazität von 9,2 Millionen Litern Plasmaäquivalent pro Jahr deckt diese 900 Millionen US-Dollar teure Anlage die weltweite Nachfrage nach plasmabasierten Therapien zur Behandlung von Immundefekten, neurologischen Erkrankungen und kritischen Erkrankungen wie Transplantationen und Verbrennungen.

- Im Juni 2024 kündigte Takeda eine 30 Millionen US-Dollar teure Erweiterung seiner Plasmafraktionierungsanlage in Los Angeles an, seiner weltweit führenden Anlage nach Kapazität. Diese Modernisierung soll das Produktionsvolumen auf bis zu 2 Millionen Liter pro Jahr steigern und dazu beitragen, die steigende weltweite Nachfrage nach plasmabasierten Therapien zur Behandlung von Immundefekten und Blutgerinnungsstörungen zu decken.

- Takeda investierte 2023 rund 765 Millionen US-Dollar in den Bau einer neuen Produktionsanlage für plasmabasierte Therapeutika in Osaka, Japan. Damit würde sich die Kapazität des bestehenden Standorts Narita nahezu verfünffachen. Die Anlage soll bis 2030 voll betriebsbereit sein und sowohl den japanischen als auch den globalen Markt bedienen.

- Im März 2025 ging Grifols eine Partnerschaft mit Inpeco ein, um fortschrittliche Automatisierungsrobotik (FlexLab X), Diagnostik und Reagenzien zu integrieren und so „Labore der Zukunft“ für hochdurchsatzfähige, sicherere und rückverfolgbare Blut- und Plasmatests bei Transfusionen zu schaffen. Medizinische Labore analysieren biologische Proben, um Krankheiten zu diagnostizieren, zu überwachen und zu erforschen.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Inhaltsverzeichnis

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 SUPPLY CHAIN IMPACT ON THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL AVAILABILITY

4.3.3 MANUFACTURING CAPACITY

4.3.4 LOGISTICS AND LAST-MILE HURDLES

4.3.5 PRICING MODELS AND MARKET POSITIONING

4.4 INNOVATION STRATEGIES

4.4.1 KEY INNOVATION STRATEGIES

4.4.2 EMERGING DELIVERY TECHNIQUES

4.4.3 STRATEGIC IMPLICATIONS

4.4.4 CONCLUSION

4.5 RISK AND MITIGATION

4.6 VENDOR SELECTION DYNAMICS

4.6.1 PRODUCT QUALITY AND REGULATORY COMPLIANCE

4.6.2 SUPPLY CHAIN CAPABILITIES AND RELIABILITY

4.6.3 CLINICAL EFFICACY AND INNOVATION

4.6.4 COST COMPETITIVENESS AND REIMBURSEMENT COMPATIBILITY

4.6.5 LOCAL MARKET PRESENCE AND SUPPORT INFRASTRUCTURE

4.6.6 ETHICAL SOURCING, ESG COMPLIANCE, AND TRANSPARENCY

4.6.7 CONCLUSION

4.7 TARIFFS AND THEIR IMPACT ON MARKET

4.7.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.7.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.7.3 VENDOR SELECTION CRITERIA DYNAMICS

4.7.4 IMPACT ON SUPPLY CHAIN

4.7.5 IMPACT ON PRICES

4.7.6 REGULATORY INCLINATION

4.7.6.1 GCC TRADE ALIGNMENT & FTAS

4.7.6.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.7.6.3 LOCAL SUBSIDY & POLICY RESPONSE

4.7.6.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF RARE AND CHRONIC DISEASES

6.1.2 EXPANDING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN PLASMA FRACTIONATION

6.1.4 GOVERNMENT AND INSTITUTIONAL SUPPORT

6.2 RESTRAINTS

6.2.1 HIGH COST AND COMPLEX MANUFACTURING PROCESS

6.2.2 LACK OF PLASMA SUPPLY AND DONOR

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN PLASMA PROCESSING TECHNOLOGIES TO ENHANCE YIELD AND REDUCE COSTS

6.3.2 REIMBURSEMENT FRAMEWORKS AND INCREASED GOVERNMENTAL FOCUS ON RARE DISEASE TREATMENT

6.3.3 STRATEGIC ALLIANCES, MERGERS, AND ACQUISITIONS TO STRENGTHEN EUROPE MARKET PENETRATION

6.4 CHALLENGES

6.4.1 COMPETITIVE PRESSURE FROM RECOMBINANT AND ALTERNATIVE BIOLOGICAL THERAPIES

6.4.2 INFRASTRUCTURE LIMITATIONS IN COLD CHAIN LOGISTICS IMPACTING PRODUCT DISTRIBUTION

7 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 IMMUNOGLOBULINS

7.3 COAGULATION FACTORS (FOR BLEEDING DISORDERS)

7.4 ALBUMIN (PLASMA VOLUME EXPANDER)

7.5 PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)

7.6 MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS)

7.7 OTHER PLASMA DERIVED PROTEINS

8 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IMMUNOLOGY

8.3 HEMATOLOGY

8.4 CRITICAL CARE

8.5 NEUROLOGY

8.6 PULMONOLOGY

8.7 HAEMATO-ONCOLOGY

8.8 RHEUMATOLOGY

8.9 OTHER APPLICATIONS

9 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ION EXCHANGE CHROMATOGRAPHY

9.3 AFFINITY CHROMATOGRAPHY

9.4 CRYOPRECIPITATION

9.5 ULTRAFILTRATION

9.6 MICROFILTRATION

10 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE

10.1 OVERVIEW

10.2 MODERN

10.3 TRADITIONAL PLASMA FRACTIONATION

11 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 RESEARCH LABS

11.4 ACADEMIC INSTITUTES

11.5 OTHERS

12 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

12.4 OTHERS

13 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 POLAND

13.1.11 DENMARK

13.1.12 SWEDEN

13.1.13 BELGIUM

13.1.14 IRELAND

13.1.15 NORWAY

13.1.16 FINLAND

13.1.17 REST OF EUROPE

14 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CSL

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GRIFOLS, S.A.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 OCTAPHARMA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KEDRION

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ADMA BIOLOGICS, INC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AEGROS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BHARAT SERUMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIOTEST AG.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FRESENIUS KABI AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GC BIOPHARMA CORPORATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ICHOR

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTAS PHARMACEUTICALS LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KAMADA PHARMACEUTICALS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KM BIOLOGICS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LFB

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PLASMAGEN BIOSCIENCES PVT. LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PROLIANT HEALTH & BIOLOGICALS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PROMEA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 RELIANCE LIFE SCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 BUSINESS PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SICHUAN YUANDA SHYUANG PHARMACEUTICAL CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SK PLASMA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SYNTHAVERSE S. A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TAIBANG BIO GROUP CO., LTD

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 VIRCHOW BIOTECH

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Tabellenverzeichnis

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 3 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 4 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 5 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 6 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 7 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 8 EUROPE COAGULATION FACTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 9 EUROPE FACTOR IX IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 10 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 11 EUROPE FACTOR VIII IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 13 EUROPE FIBRINOGEN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 14 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE VON WILLEBRAND FACTOR (VWF) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 16 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 17 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 18 IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 19 EUROPE ALBUMIN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 20 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS )IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE IMMUNOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE HEMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE CRITICAL CARE IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE NEUROLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE PULMONOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 35 EUROPE HEMATOLOGY -ONCOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 36 EUROPE RHEUMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 37 EUROPE OTHER APPLICATIONS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 38 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

TABLE 39 EUROPE ION EXCHANGE CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 40 EUROPE AFFINITY CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 41 EUROPE CRYOPRECIPITATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 42 EUROPE ULTRAFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 43 EUROPE MICROFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 44 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2025-2032 (USD THOUSAND)

TABLE 45 EUROPE MODERN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 46 EUROPE TRADITIONAL PLASMA FRACTIONATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 47 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2025-2032 (USD THOUSAND)

TABLE 48 EUROPE HOSPITALS & CLINICS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 49 EUROPE RESEARCH LABS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 50 EUROPE ACADEMIC INSTITUTES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 51 EUROPE OTHERS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 52 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 53 EUROPE DIRECT TENDERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 54 EUROPE THIRD PARTY DISTRIBUTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 56 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 FRANCE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 FRANCE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 FRANCE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.K. ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 160 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 ITALY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ITALY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ITALY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ITALY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 ITALY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 ITALY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 ITALY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 ITALY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ITALY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 ITALY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 ITALY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 ITALY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 188 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 SPAIN IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SPAIN INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SPAIN COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SPAIN RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SPAIN RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SPAIN FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RUSSIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RUSSIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RUSSIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 RUSSIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 RUSSIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 RUSSIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 RUSSIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 RUSSIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 RUSSIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 RUSSIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 RUSSIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 236 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 238 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 240 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 TURKEY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 TURKEY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 TURKEY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 TURKEY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 TURKEY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 TURKEY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 TURKEY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 TURKEY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 TURKEY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 TURKEY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 TURKEY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 TURKEY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 TURKEY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 TURKEY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 TURKEY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 TURKEY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 TURKEY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 TURKEY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 TURKEY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 TURKEY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 262 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 264 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 266 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 267 NETHERLANDS IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 NETHERLANDS INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 NETHERLANDS INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 NETHERLANDS COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 NETHERLANDS FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 NETHERLANDS RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 NETHERLANDS FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 NETHERLANDS RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 NETHERLANDS FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 NETHERLANDS PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 NETHERLANDS VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 NETHERLANDS FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 NETHERLANDS FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 NETHERLANDS ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 NETHERLANDS PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 NETHERLANDS ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 NETHERLANDS C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 NETHERLANDS MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 NETHERLANDS OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 NETHERLANDS ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 288 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 289 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 290 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 292 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 293 SWITZERLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 POLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 POLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 POLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 POLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 POLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 POLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 POLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 POLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 POLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 POLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 POLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 339 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 340 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 341 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 342 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)