Asia Pacific Blood Plasma And Plasma Derived Medicinal Products Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

11.61 Billion

USD

5.96 Billion

2024

2032

USD

11.61 Billion

USD

5.96 Billion

2024

2032

| 2025 –2032 | |

| USD 11.61 Billion | |

| USD 5.96 Billion | |

|

|

|

|

Segmentación del mercado de plasma sanguíneo y medicamentos derivados del plasma en Asia-Pacífico, por producto ( inmunoglobulinas , factores de coagulación (para trastornos hemorrágicos), albúmina (expansor del volumen plasmático), inhibidores de la proteasa (para deficiencias genéticas), anticuerpos monoclonales (derivados de células plasmáticas) y otras proteínas plasmáticas), aplicación (inmunología, hematología, cuidados intensivos, neurología, neumología, hematooncología , reumatología y otras aplicaciones), tecnología de procesamiento (cromatografía de intercambio iónico, cromatografía de afinidad, crioprecipitación, ultrafiltración y microfiltración), modo (fraccionamiento de plasma moderno y tradicional), usuario final (hospitales y clínicas, laboratorios de investigación, institutos académicos y otros), canal de distribución (licitación directa, distribuidores externos y otros) - Tendencias de la industria y pronóstico hasta 2032

Tamaño del mercado de plasma sanguíneo y medicamentos derivados del plasma

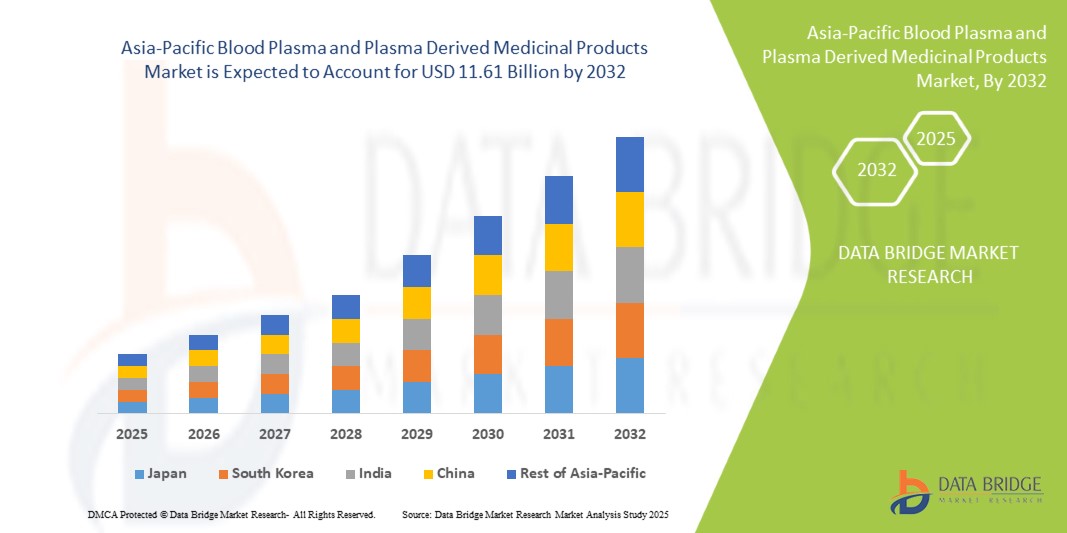

- El mercado de plasma sanguíneo y productos medicinales derivados del plasma de Asia-Pacífico se valoró en USD 5.96 mil millones en 2024 y se espera que alcance los USD 11.61 mil millones para 2032 con una CAGR del 8,73%, durante el período de pronóstico.

- El crecimiento del mercado está impulsado en gran medida por la creciente prevalencia de enfermedades raras y crónicas.

- Además, los avances tecnológicos en el fraccionamiento del plasma sanguíneo y sus derivados están acelerando la adopción de soluciones de plasma sanguíneo y sus derivados, impulsando así significativamente el crecimiento de la industria.

Análisis del mercado de plasma sanguíneo y medicamentos derivados del plasma

- El mercado se está expandiendo debido a la mayor demanda de terapias derivadas del plasma para tratar afecciones como la hemofilia, los trastornos de inmunodeficiencia y las enfermedades autoinmunes, respaldadas por la creciente conciencia y los avances en la medicina transfusional.

- Los avances tecnológicos en la recolección de sangre, el fraccionamiento y la logística de la cadena de frío están mejorando la calidad y la vida útil de los productos, lo que fomenta una adopción más amplia en hospitales, centros de trauma y laboratorios de diagnóstico en Asia-Pacífico.

- Se espera que China domine el mercado de plasma sanguíneo y productos medicinales derivados del plasma con una participación del 24,89 % en 2025 debido a la mejora de la infraestructura de atención médica, la creciente demanda de terapias de plasma, el mayor apoyo gubernamental y la creciente prevalencia de enfermedades crónicas e infecciosas.

- Se espera que China sea la región de más rápido crecimiento en el mercado debido al aumento de las inversiones en atención médica, la creciente prevalencia de enfermedades crónicas e infecciosas, las mejores instalaciones de diagnóstico, la creciente conciencia sobre la seguridad de la sangre y las iniciativas gubernamentales para impulsar la accesibilidad y la infraestructura de la terapia con plasma.

- Se espera que el segmento de inmunoglobulinas domine el mercado con una participación del 41,42 % en 2025 debido a la creciente demanda de terapias dirigidas, tecnologías de purificación mejoradas y una prevalencia creciente de trastornos relacionados con el sistema inmunitario.

Alcance del informe y segmentación del mercado de plasma sanguíneo y medicamentos derivados del plasma

|

Atributos |

Información clave del mercado sobre plasma sanguíneo y medicamentos derivados del plasma |

|

Segmentos cubiertos |

|

|

Países cubiertos |

|

|

Actores clave del mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de los conocimientos sobre escenarios de mercado, como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, epidemiología de pacientes, análisis de la cartera de productos, análisis de precios y marco regulatorio. |

Tendencias del mercado del plasma sanguíneo y de los medicamentos derivados del plasma

Aumento de la prevalencia de enfermedades raras y crónicas

- Una de las principales fuerzas impulsoras del mercado de plasma sanguíneo y productos medicinales derivados del plasma es la creciente prevalencia de enfermedades raras y crónicas en Asia-Pacífico, impulsada por los avances en las tecnologías de diagnóstico y una mayor conciencia entre los proveedores de atención médica y los pacientes.

- Por ejemplo, en abril de 2025, los datos de los CDC revelaron que el 76,4 % de los adultos estadounidenses padecía al menos una enfermedad crónica y el 51,4 % tenía múltiples enfermedades. Esta tendencia al alza, observada también entre los adultos más jóvenes, ha intensificado la demanda de atención de por vida, en particular para enfermedades como la hemofilia, las inmunodeficiencias primarias y la enfermedad de von Willebrand.

- Las terapias derivadas del plasma, como las inmunoglobulinas, los factores de coagulación y la albúmina, son cruciales para el manejo de estas afecciones crónicas. Los pacientes con inmunodeficiencia primaria dependen de la inmunoglobulina intravenosa (IVIG) para el apoyo inmunitario, mientras que los pacientes con hemofilia requieren infusiones regulares de factores de coagulación para prevenir episodios hemorrágicos.

- El envejecimiento de la población mundial impulsa aún más esta tendencia, y los adultos mayores se ven cada vez más afectados por afecciones como cirrosis hepática, mieloma múltiple y enfermedades inflamatorias, todas las cuales requieren intervenciones derivadas del plasma.

- En marzo de 2025, una investigación publicada en PMC destacó la enorme carga mundial de enfermedades raras, especialmente en la población pediátrica. A pesar de los avances en medicina genómica y el desarrollo de fármacos huérfanos, persisten los retrasos en el diagnóstico y las limitadas opciones de tratamiento, lo que subraya la necesidad de una atención multidisciplinaria y sostenida.

- La creciente demanda de terapias derivadas del plasma seguras, eficaces y de alta calidad es un factor fundamental que impulsa el mercado del plasma sanguíneo y los productos medicinales derivados del plasma, ya que estos productos desempeñan un papel crucial en el manejo de enfermedades crónicas y en la atención de necesidades médicas no satisfechas en Asia-Pacífico.

Dinámica del mercado del plasma sanguíneo y de los medicamentos derivados del plasma

Conductor

“Expansión de la población geriátrica”

- La creciente demanda de plasma sanguíneo y productos médicos derivados del plasma está impulsada significativamente por el envejecimiento de la población mundial, que es más propensa a enfermedades crónicas y degenerativas como trastornos del sistema inmunológico, enfermedades neurológicas, complicaciones hepáticas y problemas relacionados con la sangre que requieren terapias basadas en plasma, incluidas inmunoglobulinas, albúmina y factores de coagulación.

- Por ejemplo, en marzo de 2025, una investigación publicada en PMC que analizaba los datos de la Muestra Nacional de Pacientes Hospitalizados (NIS) de EE. UU. entre 2010 y 2024 reveló que el rápido crecimiento de la población de edad avanzada ha provocado un aumento sustancial de los ingresos hospitalarios, estancias hospitalarias más prolongadas y tasas de reingreso más altas. Esta tendencia, impulsada en gran medida por las enfermedades crónicas y la multimorbilidad, pone de relieve la creciente presión sobre los sistemas de salud y la consiguiente demanda de tratamientos derivados del plasma.

- Con la edad, el sistema inmunitario se debilita, lo que aumenta la susceptibilidad a infecciones y trastornos autoinmunes. Las terapias con inmunoglobulinas se utilizan con frecuencia para el tratamiento de afecciones como la polineuropatía desmielinizante inflamatoria crónica (PDIC), mientras que la albúmina es vital para el control del equilibrio hídrico durante procedimientos quirúrgicos y cuidados intensivos en pacientes de edad avanzada.

- Países como Japón, Alemania, Italia y Estados Unidos, con una alta proporción de adultos mayores, están experimentando un aumento sostenido en el consumo de PDMP. Esta tendencia demográfica ejerce una enorme presión sobre los sistemas nacionales de salud para garantizar cadenas de suministro ininterrumpidas y una recolección adecuada de plasma.

- El aumento proyectado de la población mundial de 60 años o más —de 1100 millones en 2023 a 2100 millones en 2050, según estimaciones de la OMS— subraya aún más el papel crucial de la atención geriátrica. Este cambio demográfico no solo intensifica la necesidad de apoyo terapéutico a largo plazo, sino que también posiciona a la población de edad avanzada como un segmento de mercado clave y duradero para los PDMP en Asia-Pacífico.

Restricción/Desafío

“ Proceso de fabricación complejo y de alto costo ”

- El alto costo y la complejidad asociados con la fabricación de plasma sanguíneo y medicamentos derivados del plasma representan una barrera significativa para la expansión del mercado. El proceso requiere estrictos protocolos de recolección de plasma, un exhaustivo cribado de patógenos y un fraccionamiento en múltiples etapas en entornos estériles que cumplen con las normas GMP, lo que hace que la producción requiera muchos recursos y tiempo.

- Por ejemplo, un análisis detallado de Aykon Biosciences destacó que la fabricación de productos biológicos complejos, como las terapias derivadas del plasma, se enfrenta a una creciente presión de costos debido al alto coste de las materias primas, la necesidad de mano de obra cualificada y las exigencias cada vez más estrictas del cumplimiento normativo. La transición hacia terapias especializadas y personalizadas eleva aún más los costos, lo que requiere tecnologías avanzadas y rigurosos sistemas de control de calidad.

- Además, el ciclo de fabricación de los PDMP puede extenderse hasta 12 meses, lo que requiere logística de cadena de frío para el almacenamiento y el transporte durante todo el proceso. Estos factores incrementan significativamente los gastos de capital y operativos, lo que limita la escalabilidad y disuade a las pequeñas empresas y a las economías en desarrollo de participar eficazmente en el mercado.

- El alto costo de la producción también contribuye a los altos precios del producto final, lo que reduce la accesibilidad y la asequibilidad, especialmente en países de ingresos bajos y medios donde los presupuestos de salud son limitados. Esta carga financiera dificulta la satisfacción de la creciente demanda mundial, lo que frena una adopción más amplia de los PDMP a nivel mundial.

- Si bien la innovación tecnológica continua puede mejorar gradualmente la rentabilidad, los elevados costos actuales de producción y procesamiento siguen siendo una limitación fundamental. Abordar estos desafíos mediante tecnologías de fabricación mejoradas, una mayor infraestructura de donantes y una financiación de apoyo a la salud pública será crucial para lograr un mayor acceso al mercado y una cobertura terapéutica equitativa.

Alcance del mercado del plasma sanguíneo y de los medicamentos derivados del plasma

El mercado está segmentado según el producto, la aplicación, la tecnología de procesamiento, el modo, el usuario final y el canal de distribución.

- Por producto

Según el producto, el mercado se segmenta en inmunoglobulinas, factores de coagulación (para trastornos hemorrágicos), albúmina (expansor del volumen plasmático), inhibidores de la proteasa (para deficiencias genéticas), anticuerpos monoclonales (derivados de células plasmáticas) y otras proteínas plasmáticas. En 2025, se prevé que el segmento de inmunoglobulinas domine el mercado con una cuota de mercado del 41,42 %, impulsado por el aumento de los diagnósticos de inmunodeficiencias, enfermedades autoinmunes y el creciente uso de inmunoglobulina intravenosa (IVIG).

Se anticipa que el segmento de factores de coagulación (para trastornos hemorrágicos) experimentará la tasa de crecimiento más rápida del 8,94 % entre 2025 y 2032, impulsada por el aumento de casos de hemofilia, un mejor acceso al diagnóstico, el apoyo del gobierno y la expansión del uso de terapias recombinantes y derivadas del plasma.

- Por aplicación

Según su aplicación, el mercado se segmenta en inmunología, hematología, cuidados intensivos, neurología, neumología, hematooncología, reumatología y otras aplicaciones. El segmento de inmunología obtuvo la mayor cuota de mercado en 2025, impulsado por su uso generalizado en el tratamiento de inmunodeficiencias primarias, enfermedades autoinmunes y la creciente demanda mundial de inmunoglobulina intravenosa (IVIG).

Se espera que el segmento de inmunología experimente la CAGR más rápida entre 2025 y 2032, impulsada por la creciente prevalencia de enfermedades autoinmunes, el creciente envejecimiento de la población y la expansión de las aplicaciones clínicas de las terapias de inmunoglobulina.

- Por tecnología de procesamiento

Según la tecnología de procesamiento, el mercado se segmenta en cromatografía de intercambio iónico, cromatografía de afinidad, crioprecipitación, ultrafiltración y microfiltración. El segmento de cromatografía de intercambio iónico obtuvo la mayor participación en los ingresos del mercado en 2025, gracias a su alta eficiencia, escalabilidad y eficacia en la purificación de proteínas plasmáticas como inmunoglobulinas, albúmina y factores de coagulación.

Se espera que el segmento de cromatografía de afinidad sea testigo de la CAGR más rápida entre 2025 y 2032, favorecido por su alta especificidad, capacidad para aislar proteínas objetivo y creciente adopción en la purificación de productos biológicos avanzados.

- Por modo

Según el modelo, el mercado se segmenta en fraccionamiento de plasma moderno y tradicional. El segmento moderno representó la mayor cuota de mercado en 2025, impulsado por tecnologías de procesamiento avanzadas, mayor pureza del producto, mejores perfiles de seguridad y una mayor adopción de terapias recombinantes y de alto rendimiento derivadas del plasma.

Se espera que el segmento moderno sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por la innovación en técnicas de purificación, la creciente demanda de productos biológicos más seguros y las crecientes inversiones en tecnologías de procesamiento de plasma de próxima generación.

- Por el usuario final

En función del usuario final, el mercado se segmenta en hospitales y clínicas, laboratorios de investigación, institutos académicos y otros. El segmento de hospitales y clínicas representó la mayor cuota de mercado en 2025, impulsado por su alto volumen de pacientes, la disponibilidad de atención especializada, el aumento de los tratamientos para enfermedades crónicas y el acceso a terapias avanzadas derivadas del plasma.

También se espera que el segmento de hospitales y clínicas sea testigo de la CAGR más rápida entre 2025 y 2032, impulsada por la expansión de la infraestructura de atención médica, el aumento de las admisiones de pacientes hospitalizados y la creciente dependencia de las terapias con plasma para afecciones complejas.

- Por canal de distribución

Según el canal de distribución, el mercado se segmenta en licitación directa, distribuidores externos y otros. El segmento de licitación directa representó la mayor cuota de mercado en 2025, impulsado por las compras a gran escala por parte de organismos gubernamentales, la rentabilidad, la seguridad en las cadenas de suministro y el aumento de la inversión pública en medicamentos derivados del plasma.

También se espera que el segmento de licitación directa sea testigo de la CAGR más rápida entre 2025 y 2032, impulsado por la expansión de los programas de atención médica del gobierno, las políticas de adquisiciones centralizadas y la creciente demanda de una distribución de terapia de plasma a gran escala y rentable.

Análisis regional del mercado de plasma sanguíneo y medicamentos derivados del plasma

- China domina el mercado de plasma sanguíneo y productos médicos derivados del plasma con la mayor participación en los ingresos del 24,89% y se proyecta que crezca a la CAGR más rápida del 9,95% en 2025, impulsada por una infraestructura de atención médica avanzada, mayores tasas de diagnóstico de enfermedades raras y crónicas y un alto gasto de atención médica per cápita.

- El sólido marco regulatorio del país, los robustos sistemas de reembolso y la presencia de importantes actores del mercado como Grifols, CSL Behring y Takeda contribuyen al liderazgo de Asia-Pacífico en la recolección de plasma y la distribución de terapias.

- Las principales economías como China, Japón e India están invirtiendo fuertemente en I+D biofarmacéutica, expandiendo las redes de recolección de plasma y mejorando el acceso a terapias derivadas del plasma para inmunología, hematología y neurología.

Análisis del mercado japonés de plasma sanguíneo y medicamentos derivados del plasma

Se proyecta que Japón experimentará un sólido crecimiento entre 2025 y 2032 en la región Asia-Pacífico, gracias a su consolidado ecosistema sanitario, la creciente base de pacientes con enfermedades raras y crónicas, y las sólidas iniciativas gubernamentales que promueven la donación de plasma. El gran número de centros de recolección de plasma del país y la rápida aprobación de los PDMP mejoran la accesibilidad al tratamiento e impulsan la expansión del mercado.

Análisis del mercado de plasma sanguíneo y medicamentos derivados del plasma en Corea del Sur

Se espera que Corea del Sur registre una tasa de crecimiento anual compuesta (TCAC) significativa en la región entre 2025 y 2032, impulsada por su sistema de salud universal, la creciente concienciación sobre las enfermedades raras y las inversiones gubernamentales para ampliar la capacidad nacional de recolección de plasma. Las alianzas estratégicas y los avances en la fabricación de productos biológicos están fortaleciendo la presencia de Canadá en el panorama de los PDMP.

Cuota de mercado del plasma sanguíneo y de los medicamentos derivados del plasma

La industria del plasma sanguíneo y de los productos medicinales derivados del plasma está liderada principalmente por empresas bien establecidas, entre las que se incluyen:

- CSL (Australia)

- Takeda Pharmaceutical Company Limited (Japón)

- Grifols, SA (España)

- Octapharma AG (Suiza)

- Kedrion (Italia)

- Aegros (Australia)

- Sueros Bharat (India)

- Biotest AG (Alemania)

- Fresenius Kabi AG (Alemania)

- Corporación GC Biopharma (Corea del Sur)

- ICHOR (India)

- Intas Pharmaceuticals Ltd. (India)

- Kamada Pharmaceuticals (Israel)

- KM Biologics (Japón)

- PlasmaGen BioSciences Pvt. Ltd. (India)

- Proliant Health & Biologicals (EE. UU.)

- Promea (India)

- Reliance Life Sciences (India)

- Sichuan Yuanda Shyuang Pharmaceutical Co., Ltd. (China)

- SK Plasma (Corea del Sur)

- Synthaverse SA (Polonia)

- Taibang Bio Group Co., Ltd (China)

- VIRCHOW BIOTECH (India)

Últimos avances en el mercado del plasma sanguíneo y sus derivados

- En noviembre de 2024, CSL Plasma amplió la adopción del avanzado Sistema de Donación de Plasma Rika en seis centros de donación de plasma de EE. UU. cerca de Denver, Colorado. Estos nuevos dispositivos, desarrollados en colaboración con Terumo Blood & Cell Technologies, redujeron los tiempos de recolección en aproximadamente un 30 %, a la vez que mejoraron la comodidad, la seguridad y la eficiencia del donante.

- En diciembre de 2022, CSL inauguró su nueva Planta de Fraccionamiento de Plasma Broadmeadows en Victoria, Australia, la mayor planta de procesamiento de granos de plasma del hemisferio sur. Con capacidad para procesar 9,2 millones de litros equivalentes de plasma al año, esta planta de 900 millones de dólares estadounidenses satisface la demanda mundial de terapias basadas en plasma para tratar inmunodeficiencias, trastornos neurológicos y afecciones críticas como trasplantes y quemaduras.

- En junio de 2024, Takeda anunció una ampliación de 30 millones de dólares estadounidenses de su planta de fraccionamiento de plasma en Los Ángeles, líder mundial en capacidad. Se espera que esta modernización aumente el volumen de producción hasta 2 millones de litros anuales, lo que ayudará a satisfacer la creciente demanda mundial de terapias derivadas del plasma para el tratamiento de inmunodeficiencias y trastornos hemorrágicos.

- En 2023, Takeda destinó aproximadamente 765 millones de dólares a la construcción de una nueva planta de fabricación de terapias derivadas del plasma en Osaka, Japón, lo que prácticamente quintuplicaría la capacidad de su planta actual de Narita. Se prevé que esta planta esté plenamente operativa para 2030 y prestará servicios tanto al mercado japonés como al mundial.

- En marzo de 2025, Grifols se asoció con Inpeco para integrar robótica de automatización avanzada (FlexLab X), diagnósticos y reactivos, creando "laboratorios del futuro" para pruebas de sangre y plasma de alto rendimiento, más seguras y trazables en transfusiones. Los laboratorios de medicina analizan muestras biológicas para diagnosticar, monitorear e investigar enfermedades.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 SUPPLY CHAIN IMPACT ON THE ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL AVAILABILITY

4.3.3 MANUFACTURING CAPACITY

4.3.4 LOGISTICS AND LAST-MILE HURDLES

4.3.5 PRICING MODELS AND MARKET POSITIONING

4.4 INNOVATION STRATEGIES

4.4.1 KEY INNOVATION STRATEGIES

4.4.2 EMERGING DELIVERY TECHNIQUES

4.4.3 STRATEGIC IMPLICATIONS

4.4.4 CONCLUSION

4.5 RISK AND MITIGATION

4.6 VENDOR SELECTION DYNAMICS

4.6.1 PRODUCT QUALITY AND REGULATORY COMPLIANCE

4.6.2 SUPPLY CHAIN CAPABILITIES AND RELIABILITY

4.6.3 CLINICAL EFFICACY AND INNOVATION

4.6.4 COST COMPETITIVENESS AND REIMBURSEMENT COMPATIBILITY

4.6.5 LOCAL MARKET PRESENCE AND SUPPORT INFRASTRUCTURE

4.6.6 ETHICAL SOURCING, ESG COMPLIANCE, AND TRANSPARENCY

4.6.7 CONCLUSION

4.7 TARIFFS AND THEIR IMPACT ON MARKET

4.7.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.7.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.7.3 VENDOR SELECTION CRITERIA DYNAMICS

4.7.4 IMPACT ON SUPPLY CHAIN

4.7.5 IMPACT ON PRICES

4.7.6 REGULATORY INCLINATION

4.7.6.1 GCC TRADE ALIGNMENT & FTAS

4.7.6.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.7.6.3 LOCAL SUBSIDY & POLICY RESPONSE

4.7.6.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF RARE AND CHRONIC DISEASES

6.1.2 EXPANDING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN PLASMA FRACTIONATION

6.1.4 GOVERNMENT AND INSTITUTIONAL SUPPORT

6.2 RESTRAINTS

6.2.1 HIGH COST AND COMPLEX MANUFACTURING PROCESS

6.2.2 LACK OF PLASMA SUPPLY AND DONOR

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN PLASMA PROCESSING TECHNOLOGIES TO ENHANCE YIELD AND REDUCE COSTS

6.3.2 REIMBURSEMENT FRAMEWORKS AND INCREASED GOVERNMENTAL FOCUS ON RARE DISEASE TREATMENT

6.3.3 STRATEGIC ALLIANCES, MERGERS, AND ACQUISITIONS TO STRENGTHEN ASIA-PACIFIC MARKET PENETRATION

6.4 CHALLENGES

6.4.1 COMPETITIVE PRESSURE FROM RECOMBINANT AND ALTERNATIVE BIOLOGICAL THERAPIES

6.4.2 INFRASTRUCTURE LIMITATIONS IN COLD CHAIN LOGISTICS IMPACTING PRODUCT DISTRIBUTION

7 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 IMMUNOGLOBULINS

7.3 COAGULATION FACTORS (FOR BLEEDING DISORDERS)

7.4 ALBUMIN (PLASMA VOLUME EXPANDER)

7.5 PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)

7.6 MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS)

7.7 OTHER PLASMA DERIVED PROTEINS

8 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IMMUNOLOGY

8.3 HEMATOLOGY

8.4 CRITICAL CARE

8.5 NEUROLOGY

8.6 PULMONOLOGY

8.7 HAEMATO-ONCOLOGY

8.8 RHEUMATOLOGY

8.9 OTHER APPLICATIONS

9 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ION EXCHANGE CHROMATOGRAPHY

9.3 AFFINITY CHROMATOGRAPHY

9.4 CRYOPRECIPITATION

9.5 ULTRAFILTRATION

9.6 MICROFILTRATION

10 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE

10.1 OVERVIEW

10.2 MODERN

10.3 TRADITIONAL PLASMA FRACTIONATION

11 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 RESEARCH LABS

11.4 ACADEMIC INSTITUTES

11.5 OTHERS

12 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

12.4 OTHERS

13 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION

13.1 ASIA-PACIFIC

13.1.1 CHINA

13.1.2 JAPAN

13.1.3 SOUTH KOREA

13.1.4 AUSTRALIA

13.1.5 INDIA

13.1.6 MALAYSIA

13.1.7 THAILAND

13.1.8 SINGAPORE

13.1.9 PHILIPPINES

13.1.10 INDONESIA

13.1.11 NEW ZEALAND

13.1.12 VIETNAM

13.1.13 TAIWAN

13.1.14 REST OF ASIA-PACIFIC

14 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CSL

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GRIFOLS, S.A.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 OCTAPHARMA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KEDRION

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ADMA BIOLOGICS, INC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AEGROS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BHARAT SERUMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIOTEST AG.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FRESENIUS KABI AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GC BIOPHARMA CORPORATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ICHOR

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTAS PHARMACEUTICALS LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KAMADA PHARMACEUTICALS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KM BIOLOGICS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LFB

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PLASMAGEN BIOSCIENCES PVT. LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PROLIANT HEALTH & BIOLOGICALS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PROMEA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 RELIANCE LIFE SCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 BUSINESS PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SICHUAN YUANDA SHYUANG PHARMACEUTICAL CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SK PLASMA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SYNTHAVERSE S. A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TAIBANG BIO GROUP CO., LTD

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 VIRCHOW BIOTECH

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC COAGULATION FACTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC FACTOR IX IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FACTOR VIII IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC FIBRINOGEN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC VON WILLEBRAND FACTOR (VWF) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 18 IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC ALBUMIN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS )IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC IMMUNOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HEMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC CRITICAL CARE IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC NEUROLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC PULMONOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC HEMATOLOGY -ONCOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC RHEUMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC OTHER APPLICATIONS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ION EXCHANGE CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC AFFINITY CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC CRYOPRECIPITATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC ULTRAFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC MICROFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2025-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC MODERN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC TRADITIONAL PLASMA FRACTIONATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2025-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC HOSPITALS & CLINICS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC RESEARCH LABS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC ACADEMIC INSTITUTES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC OTHERS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC DIRECT TENDERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC THIRD PARTY DISTRIBUTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC OTHERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 80 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 81 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 ASIA-PACIFIC BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CHINA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CHINA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CHINA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CHINA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CHINA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CHINA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CHINA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 106 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 107 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 CHINA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 JAPAN IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 JAPAN INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 JAPAN INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 JAPAN COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 JAPAN FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 JAPAN RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 JAPAN FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 JAPAN RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 JAPAN FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 JAPAN PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 JAPAN VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 JAPAN FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 JAPAN FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 JAPAN ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 JAPAN PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 JAPAN ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 JAPAN C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 JAPAN MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 JAPAN OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 JAPAN ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 131 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 132 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 133 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 134 JAPAN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 SOUTH KOREA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SOUTH KOREA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SOUTH KOREA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH KOREA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH KOREA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH KOREA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SOUTH KOREA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH KOREA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH KOREA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH KOREA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH KOREA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH KOREA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH KOREA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH KOREA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 157 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 158 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 159 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 160 SOUTH KOREA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 161 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 162 AUSTRALIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 AUSTRALIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 AUSTRALIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 AUSTRALIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 AUSTRALIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 AUSTRALIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 AUSTRALIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 AUSTRALIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 AUSTRALIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 AUSTRALIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 AUSTRALIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 AUSTRALIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 AUSTRALIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 AUSTRALIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 AUSTRALIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 AUSTRALIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 AUSTRALIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 AUSTRALIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 AUSTRALIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 AUSTRALIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 183 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 184 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 185 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 AUSTRALIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 188 INDIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 INDIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 INDIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 INDIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 INDIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 INDIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 INDIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 INDIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 INDIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 INDIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 INDIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 INDIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 INDIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 INDIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 INDIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 INDIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 INDIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 INDIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 INDIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 INDIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 209 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 210 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 211 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 212 INDIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 213 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 214 MALAYSIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 MALAYSIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 MALAYSIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 MALAYSIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 MALAYSIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 MALAYSIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 MALAYSIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 MALAYSIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 MALAYSIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 MALAYSIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 MALAYSIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 MALAYSIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 MALAYSIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 MALAYSIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 MALAYSIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 MALAYSIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 MALAYSIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 MALAYSIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 MALAYSIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 MALAYSIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 235 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 236 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 237 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 238 MALAYSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 239 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 240 THAILAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 THAILAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 THAILAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 THAILAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 THAILAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 THAILAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 THAILAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 THAILAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 THAILAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 THAILAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 THAILAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 THAILAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 THAILAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 THAILAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 THAILAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 THAILAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 THAILAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 THAILAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 THAILAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 THAILAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 261 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 262 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 263 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 264 THAILAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 265 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 266 SINGAPORE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 267 SINGAPORE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 SINGAPORE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 SINGAPORE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 SINGAPORE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 SINGAPORE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 SINGAPORE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 SINGAPORE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 SINGAPORE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 SINGAPORE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 SINGAPORE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 SINGAPORE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 SINGAPORE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 SINGAPORE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 SINGAPORE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 SINGAPORE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 SINGAPORE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 SINGAPORE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 SINGAPORE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 SINGAPORE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 287 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 288 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 289 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 290 SINGAPORE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 291 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 292 PHILIPPINES IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 PHILIPPINES INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 PHILIPPINES INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 PHILIPPINES COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 PHILIPPINES FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 PHILIPPINES RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 PHILIPPINES FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 PHILIPPINES RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 PHILIPPINES FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 PHILIPPINES PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 PHILIPPINES VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 PHILIPPINES FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 PHILIPPINES FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 PHILIPPINES ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 PHILIPPINES PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 PHILIPPINES ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 PHILIPPINES C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 PHILIPPINES MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 PHILIPPINES OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 PHILIPPINES ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 313 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 314 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 315 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 316 PHILIPPINES BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 317 INDONESIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 318 INDONESIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 319 INDONESIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 INDONESIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 INDONESIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 INDONESIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 INDONESIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 INDONESIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 INDONESIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 INDONESIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 INDONESIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 INDONESIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)