Asia Pacific Japanese Restaurant Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

7.79 Billion

USD

10.36 Billion

2024

2032

USD

7.79 Billion

USD

10.36 Billion

2024

2032

| 2025 –2032 | |

| USD 7.79 Billion | |

| USD 10.36 Billion | |

|

|

|

Segmentación del mercado de restaurantes japoneses en Asia-Pacífico por tipo de cocina (cocina japonesa tradicional, cocina japonesa especializada y cocina japonesa moderna), tipo de servicio (restaurantes de servicio rápido (QSR), restaurantes de servicio completo y mostradores/puntos de venta de comida para llevar), categoría de restaurante (restaurantes independientes y modelos de cadena/franquicia), modelo de restaurante (comida para llevar, entrega a domicilio y servicio en el lugar), canal de venta (puntos de venta físicos y restaurantes de entrega en línea/ cocinas fantasma ): tendencias de la industria y pronóstico hasta 2031

Análisis del mercado de restaurantes japoneses en Asia-Pacífico

La creciente conciencia de los beneficios para la salud relacionados con la comida japonesa está impulsando el crecimiento del mercado. La innovación en las ofertas de menús ofrece oportunidades en el mercado. Además, el aumento de la popularidad del plato sushi está impulsando el crecimiento del mercado.

Tamaño del mercado de restaurantes japoneses en Asia-Pacífico

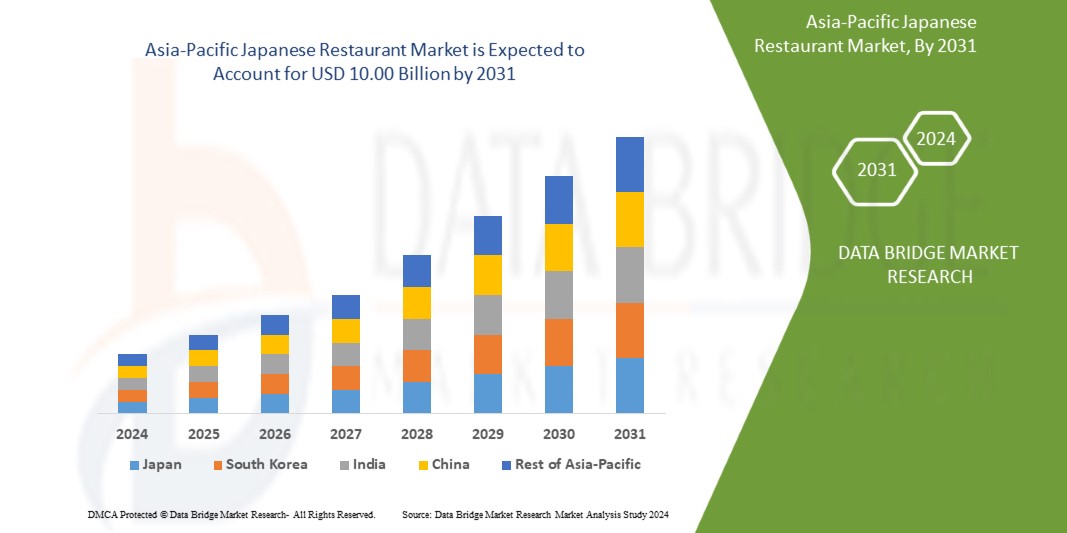

Se espera que el mercado de restaurantes japoneses en Asia-Pacífico alcance los USD 10.000 millones en 2031, desde los USD 7.550 millones en 2023, creciendo a una CAGR sustancial del 3,62 % en el período previsto de 2024 a 2031.

Tendencias del mercado de Asia y el Pacífico

“La creciente conciencia sobre los beneficios para la salud relacionados con la comida japonesa impulsa el mercado de restaurantes japoneses en Asia y el Pacífico”

El mercado de restaurantes japoneses de Asia-Pacífico está experimentando un crecimiento significativo, impulsado por la creciente conciencia de los beneficios para la salud asociados con la cocina japonesa. La cocina japonesa, famosa por su énfasis en ingredientes frescos y de alta calidad y nutrición equilibrada, se alinea bien con el creciente enfoque de Asia-Pacífico en la salud y el bienestar. Los platos tradicionales como el sushi, el sashimi y la sopa de miso no solo son sabrosos, sino que también son bajos en grasas y ricos en nutrientes esenciales. El sushi, por ejemplo, presenta proteínas magras como pescado y verduras ricas en nutrientes, mientras que la sopa de miso proporciona probióticos beneficiosos para la salud digestiva. Los beneficios para la salud de estos alimentos son cada vez más reconocidos, lo que lleva a un aumento en el interés de los consumidores. La creciente conciencia de los beneficios para la salud de la cocina japonesa también contribuye a su atractivo en diversos mercados. Los consumidores de varias regiones están explorando la comida japonesa no solo por su sabor, sino también por su impacto positivo en la salud general. Este cambio es particularmente evidente en regiones donde hay una tendencia creciente de hábitos alimentarios orientados a la salud, como América del Norte y Europa. Los restaurantes japoneses en estas áreas están viendo un aumento de patrocinio a medida que atienden la demanda de opciones gastronómicas más saludables.

A medida que más personas se preocupan por su salud, buscan cada vez más opciones gastronómicas que se ajusten a sus objetivos de bienestar. Los restaurantes japoneses están aprovechando esta tendencia al destacar las ventajas nutricionales de sus menús. Muchos establecimientos como Sushi Gen Enterprises, Sushi Nozawa Group RE&S y otros ahora enfatizan el uso de ingredientes frescos y naturales y métodos de cocina tradicionales que conservan el máximo valor nutricional de los alimentos. Este enfoque en la salud no se limita solo a los platos tradicionales, sino que se extiende a interpretaciones modernas y cocinas de fusión que integran los principios japoneses con otras tradiciones culinarias saludables .

Alcance del informe y segmentación del mercado

|

Atributos |

Perspectivas clave del mercado de Asia y el Pacífico |

|

Segmentación |

Por tipo de cocina: cocina tradicional japonesa, cocina japonesa especializada y cocina japonesa moderna Por tipo de servicio: restaurantes de servicio rápido (QSR), restaurantes de servicio completo y puntos de venta de comida para llevar Por categoría de restaurante: Restaurantes independientes y modelos de cadena/franquicia Por modelo de restaurante: comida para llevar, entrega a domicilio y servicio de comedor Por canal de venta: puntos de venta físicos y entrega a domicilio Restaurantes en línea/Cocinas fantasma |

|

Países cubiertos |

China, Japón, India, Corea del Sur, Singapur, Indonesia, Tailandia, Filipinas, Australia y Nueva Zelanda, Malasia y el resto de Asia-Pacífico |

|

Actores clave del mercado |

Katsu-Ya Group, Inc (EE.UU.), Wokcano Asian Restaurant & Bar.(EE.UU.), 893 Ryōtei Berlin (Alemania), Chiba Japanese Restaurant (EE.UU.), Tsujita Artisan Noodle (Japón), Sushi Den (EE.UU.), Florilège (Japón), Kaiten Zushi (EE.UU.), Kura Sushi USA (EE.UU.), Narisawa (Japón), RE&S (Singapur), Sazenka (Japón), Sushi A Go (EE.UU.), Sushi Gen Enterprises (EE.UU.), Sushi Nozawa Group (EE.UU.), Sushiya (India), Takami Sushi & Robata Restaurant (EE.UU.), Tatsu Ramen LLC (EE.UU.), Yamashiro Hollywood (EE.UU.), entre otros |

|

Oportunidades de mercado |

|

|

Conjuntos de información de datos de valor añadido |

Además de la información sobre escenarios de mercado como valor de mercado, tasa de crecimiento, segmentación, cobertura geográfica y actores principales, los informes de mercado seleccionados por Data Bridge Market Research también incluyen análisis de expertos en profundidad, análisis de precios, análisis de participación de marca, encuesta de consumidores, análisis demográfico, análisis de la cadena de suministro, análisis de la cadena de valor, descripción general de materias primas/consumibles, criterios de selección de proveedores, análisis PESTLE, análisis de Porter y marco regulatorio. |

Definición del mercado de restaurantes japoneses en Asia y el Pacífico

Un restaurante japonés es un establecimiento que se especializa en servir cocina tradicional japonesa, que se caracteriza por su énfasis en ingredientes frescos y de alta calidad y técnicas de preparación meticulosas. El menú generalmente presenta una variedad de platos, que incluyen sushi, sashimi, tempura, ramen y otros elementos que reflejan la diversa herencia culinaria de Japón. Los restaurantes japoneses a menudo priorizan la autenticidad, incorporando métodos de cocción tradicionales y estilos de presentación, como rollos de sushi y cajas de bento, para brindar una experiencia gastronómica genuina. El ambiente de estos restaurantes a menudo refleja la estética japonesa, con un enfoque en la simplicidad, la elegancia y la atención al detalle. El servicio en los restaurantes japoneses es generalmente atento y respetuoso, con el objetivo de mejorar la experiencia gastronómica en general. En los últimos años, muchos restaurantes japoneses también han adoptado innovaciones modernas, como pedidos en línea y prácticas sustentables, para satisfacer las preferencias cambiantes de los consumidores de Asia y el Pacífico.

Dinámica del mercado de restaurantes japoneses en Asia y el Pacífico

Conductores

- El aumento de la popularidad del plato sushi

La creciente popularidad del sushi es un factor importante para el mercado de restaurantes japoneses de Asia-Pacífico, que influye en las preferencias de los consumidores y amplía el alcance del mercado. El sushi, un alimento básico de la cocina japonesa, ha experimentado un aumento de popularidad en Asia-Pacífico debido a su alineamiento con las tendencias de salud, versatilidad e integración en la cultura alimentaria dominante. Uno de los principales factores que impulsan esta tendencia es la reputación del sushi como una opción de comida saludable y conveniente. Con su énfasis en el pescado fresco, las verduras y el arroz, el sushi a menudo se percibe como una opción nutritiva. La creciente conciencia de la salud y el bienestar ha llevado a muchos consumidores a buscar alternativas más saludables a la comida rápida tradicional. El perfil bajo en calorías, alto en proteínas y rico en omega-3 del sushi se alinea bien con estas preferencias dietéticas, lo que lo convierte en una opción atractiva para los comensales conscientes de la salud. Como resultado, el sushi se ha convertido en un elemento esencial en muchas dietas en todo el mundo, lo que impulsa una mayor demanda de restaurantes japoneses. Junto con ello, el aumento de la popularidad del sushi también está respaldado por su versatilidad y adaptabilidad. El sushi se puede personalizar para adaptarse a distintos gustos y necesidades dietéticas, incluidas opciones vegetarianas y sin gluten. Esta flexibilidad permite que el sushi satisfaga una amplia gama de preferencias de los consumidores, lo que aumenta aún más su atractivo. La introducción de innovadores rollos de sushi y creaciones de fusión también ha ayudado a atraer a un público diverso, desde tradicionalistas hasta quienes buscan experiencias culinarias novedosas. Esta adaptabilidad ha facilitado la expansión de las ofertas de sushi tanto en los restaurantes japoneses tradicionales como en los nuevos establecimientos de comida contemporánea. Además, la aceptación generalizada del sushi también ha desempeñado un papel crucial en su influencia en el mercado. El sushi se ha convertido en un elemento habitual en ciudades de todo el mundo, desde Nueva York y Londres hasta Sídney y Tokio. Su presencia en los medios populares, incluidos programas de televisión, redes sociales y blogs de comida, ha elevado al sushi a una posición destacada en la cultura alimentaria de Asia y el Pacífico. Esta mayor visibilidad ha llevado a una aceptación más amplia del sushi como una opción gastronómica convencional, atrayendo a clientes que tal vez antes no hubieran considerado la cocina japonesa.

Por ejemplo,

- En 2024, según World Metrics, el mercado de sushi de Asia-Pacífico ha experimentado un crecimiento sustancial, con una industria valorada en más de 27 mil millones de dólares. Este aumento pone de relieve la creciente popularidad del sushi, que impulsa un aumento significativo del número de restaurantes japoneses y contribuye a la expansión de las experiencias gastronómicas japonesas en todo el mundo.

El reconocimiento de la cocina japonesa como Patrimonio Cultural Inmaterial de la UNESCO

La designación de la cocina japonesa como patrimonio cultural inmaterial de la UNESCO pone de relieve sus prácticas tradicionales, sus métodos de preparación únicos y su importancia cultural. Este reconocimiento no solo eleva el perfil de la comida japonesa, sino que también genera un mayor interés en la región de Asia y el Pacífico. Los consumidores se sienten cada vez más atraídos por la cocina japonesa debido a su rica historia, su autenticidad y la artesanía asociada a su preparación. Como resultado, existe una creciente demanda de experiencias gastronómicas japonesas auténticas, lo que beneficia directamente a los restaurantes japoneses en todo el mundo.

El reconocimiento de la UNESCO también realza el atractivo de la cocina japonesa en Asia-Pacífico al posicionarla como un símbolo de sofisticación cultural y excelencia culinaria. Este estatus atrae a entusiastas de la comida y turistas culturales que buscan experimentar los sabores auténticos y las técnicas tradicionales que ahora se celebran internacionalmente. Por lo tanto, los restaurantes japoneses se benefician del aumento del tráfico peatonal y del interés de los consumidores impulsado por este prestigioso reconocimiento. Además, el enfoque de Asia-Pacífico en la preservación del patrimonio cultural intangible se alinea con tendencias más amplias en el turismo cultural y la gastronomía experiencial. A medida que los viajeros se interesan más en sumergirse en las tradiciones y prácticas culturales locales, el estatus de la cocina japonesa en la UNESCO la convierte en una opción atractiva. Los restaurantes que ofrecen platos japoneses tradicionales y enfatizan su conexión con el patrimonio probablemente atraigan tanto a turistas internacionales como a consumidores locales que están ansiosos por participar en experiencias culinarias culturalmente significativas.

Por ejemplo,

- En febrero de 2024, según un artículo publicado por Star Advertiser, el interés de Asia y el Pacífico por la cocina tradicional japonesa, reconocida como patrimonio cultural inmaterial de la UNESCO, sigue aumentando. El reconocimiento de la cocina japonesa por parte de la UNESCO mejora su prestigio y atractivo, alentando a más comensales a explorar y apreciar su importancia cultural e histórica, lo que a su vez impulsa el crecimiento y la popularidad de los establecimientos gastronómicos japoneses en todo el mundo.

Oportunidades

- Innovación en la oferta de menús

La innovación en la oferta de menús representa una oportunidad importante para el mercado de restaurantes japoneses de Asia y el Pacífico, ya que está creciendo y captando nuevos segmentos de clientes. A medida que evoluciona el panorama gastronómico, los restaurantes japoneses tienen la oportunidad de diferenciarse adoptando opciones de menú creativas y diversas que atraigan a los consumidores modernos. Una de las oportunidades clave radica en la adaptación de los platos tradicionales japoneses a los gustos y preferencias dietéticas contemporáneos. Por ejemplo, el sushi, que tradicionalmente consistía en pescado crudo y arroz, ha evolucionado para incluir una variedad de ingredientes y estilos, como rollos vegetarianos, creaciones de fusión e incluso burritos de sushi. Esta innovación permite a los restaurantes japoneses atender a un público más amplio, incluidos aquellos con restricciones dietéticas o una preferencia por combinaciones de sabores únicas. Al ofrecer elementos de menú diversos e innovadores, los restaurantes pueden atraer a una gama más amplia de clientes y aumentar su atractivo en el mercado.

Otra oportunidad para la innovación en los menús es la integración de las tendencias culinarias de Asia-Pacífico con la cocina japonesa. Los restaurantes japoneses incorporan cada vez más elementos de otras tradiciones culinarias, lo que da como resultado nuevos y atractivos platos que combinan sabores y técnicas. Por ejemplo, la fusión de ingredientes japoneses y mediterráneos puede crear platos únicos como el sushi con hummus o el cordero glaseado con miso. Estas innovaciones interculturales no solo atraen a comensales aventureros, sino que también posicionan a los restaurantes japoneses como creadores de tendencias en la escena gastronómica de Asia-Pacífico.

Por ejemplo,

- En 2018, según el Economic Times, el mercado de la restauración japonés experimentó una innovación significativa con la introducción de los donuts y burritos de sushi. Estas novedosas creaciones, que combinan ingredientes tradicionales del sushi con nuevos formatos, como un sushi en forma de donut o un wrap estilo burrito, reflejan una tendencia creciente hacia ofertas de menús innovadoras.

Colaboración con eventos culturales y festivales locales

La colaboración con eventos y festivales culturales locales representa una oportunidad importante para el mercado de restaurantes japoneses de Asia-Pacífico, ya que fomenta el crecimiento y amplía el alcance del mercado. Estas colaboraciones permiten a los restaurantes japoneses mejorar su visibilidad, interactuar con públicos diversos y fortalecer la presencia de su marca tanto en mercados establecidos como emergentes.

La participación en eventos y festivales culturales permite a los restaurantes japoneses presentar su cocina a nuevos segmentos de clientes. Los eventos como festivales de comida, ferias culturales y celebraciones comunitarias atraen a un público amplio y variado, lo que proporciona una plataforma para que los restaurantes muestren sus ofertas. Por ejemplo, un restaurante japonés que instala un stand en un festival de comida multicultural puede llegar a los asistentes que pueden no estar familiarizados con la cocina japonesa. Al ofrecer platos de muestra o menús especiales para eventos, los restaurantes pueden atraer clientes potenciales, generar interés y alentarlos a visitar el restaurante para disfrutar de una experiencia gastronómica completa. Estas colaboraciones ayudan a los restaurantes japoneses a generar reconocimiento de marca y establecer una reputación positiva dentro de la comunidad. Cuando los restaurantes se alinean con eventos locales populares, se benefician de los esfuerzos promocionales del evento, incluidos los materiales de marketing, las menciones en las redes sociales y la cobertura de los medios locales. Esta asociación puede aumentar la visibilidad y la credibilidad del restaurante, lo que genera un mayor interés y tráfico peatonal. Por ejemplo, un restaurante japonés que se asocia con un festival cultural local destacado puede aparecer en los anuncios del evento y recibir menciones en los medios de comunicación locales, lo que aumenta su perfil entre los posibles comensales.

Restricciones/Desafíos

- Alto costo de los ingredientes de la cocina japonesa

La cocina japonesa, conocida por su énfasis en los ingredientes frescos y de alta calidad, a menudo depende de artículos especializados, como pescado de primera calidad para sushi, verduras raras y condimentos importados. Por ejemplo, los ingredientes como el atún rojo, utilizado en el sushi de alta gama, y los artículos de temporada como los hongos Matsutake, no solo son caros, sino que también están sujetos a fluctuaciones en la disponibilidad y el precio. El alto costo de estos ingredientes afecta la estructura general de costos de los restaurantes japoneses, lo que lleva a un aumento de los precios del menú y una posible reducción de la demanda de los consumidores. Los altos costos de los ingredientes pueden afectar especialmente a los restaurantes japoneses más pequeños o independientes. Estos establecimientos pueden tener dificultades para absorber los aumentos de costos sin aumentar significativamente los precios del menú, lo que podría desanimar a los clientes conscientes del presupuesto. Además, la volatilidad de los precios de los ingredientes puede dar lugar a precios y disponibilidad inconsistentes en el menú. Por ejemplo, las fluctuaciones en el mercado de mariscos de Asia y el Pacífico debido a la sobrepesca, los cambios ambientales o las interrupciones de la cadena de suministro pueden causar aumentos repentinos de los costos.

El impacto de los altos costos de los ingredientes se extiende más allá del nivel del restaurante y afecta las percepciones y el comportamiento de los consumidores. Cuando los precios del menú aumentan debido al aumento de los costos de los ingredientes, los consumidores pueden percibir el restaurante como menos asequible o con una mejor relación calidad-precio. Esta percepción puede conducir a una disminución del apoyo y a una reducción de las ventas generales. Además, el alto costo de los ingredientes japoneses auténticos puede limitar la capacidad de los restaurantes para ofrecer un menú variado, lo que podría reducir su atractivo para un público más amplio.

- Intensa competencia entre la cocina italiana y la china

El mercado de restaurantes japoneses de Asia-Pacífico enfrenta desafíos significativos debido a la intensa competencia de las cocinas italiana y china. Tanto las opciones de restaurantes italianos como los chinos están profundamente arraigadas en la cultura gastronómica de Asia-Pacífico, lo que presenta formidables rivales para los restaurantes japoneses en su lucha por la atención del consumidor y la participación en el mercado. Un desafío principal es la saturación de las cocinas italiana y china en el mercado de restaurantes de Asia-Pacífico. La cocina italiana, con su diversa gama de platos como pasta, pizza y risotto, y la cocina china, conocida por su amplia variedad que incluye dim sum, fideos y salteados, están ampliamente disponibles y profundamente arraigadas en muchos países. Esta disponibilidad generalizada crea un alto nivel de competencia para los restaurantes japoneses, que deben diferenciarse

Los restaurantes japoneses se esfuerzan por captar el interés del consumidor. La prevalencia de estas cocinas significa que los restaurantes japoneses enfrentan la dificultad de destacarse en un mercado abarrotado donde predominan las opciones conocidas y populares.

Además, el costo de entrada y los desafíos operativos asociados con el mantenimiento de un restaurante japonés pueden ser un desafío significativo. Los restaurantes italianos y chinos a menudo se benefician de las economías de escala debido a su mayor presencia y cadenas de suministro establecidas. Por el contrario, los restaurantes japoneses pueden enfrentar costos más altos para obtener ingredientes auténticos y equipos especializados, lo que puede afectar su precio y rentabilidad. Por ejemplo, el pescado de alta calidad para sushi y las salsas de soja premium son caros y requieren un manejo cuidadoso que puede aumentar los costos operativos. Esta disparidad en la eficiencia operativa puede dificultar a los restaurantes japoneses

Los restaurantes compiten en precios, especialmente en mercados donde el costo es una consideración clave para los consumidores.

Impacto y situación actual del mercado ante la escasez de materias primas y retrasos en los envíos

Data Bridge Market Research ofrece un análisis de alto nivel del mercado y brinda información teniendo en cuenta el impacto y el entorno actual del mercado en relación con la escasez de materias primas y los retrasos en los envíos. Esto se traduce en la evaluación de posibilidades estratégicas, la creación de planes de acción efectivos y la asistencia a las empresas para tomar decisiones importantes.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Asia-Pacific Japanese Restaurant Market Scope

The market is segmented into five notable segments based on cusine type, service type, restaurant category, restaurant model, and sales channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Traditional Japanese Cuisine

- Traditional Japanese cuisine, By Cuisine Type

- Sushi

- Sushi, By Type

- Conveyor Belt

- Without Conveyor

- Sushi, By Chain

- Local Restaurants

- International Chain

- Sushi, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Sushi, By Type

- Ramen

- Ramen, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Ramen, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Ramen, By Restaurant Mode

- Tempura

- Tempura, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Tempura, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Tempura, By Restaurant Mode

- Sashimi

- Sashimi, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Sashimi, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Sashimi, By Restaurant Mode

- Kaiseki

- Kaiseki, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Kaiseki, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Kaiseki, By Restaurant Mode

- Udon/Soba

- Udon/Soba, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Udon/Soba, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Udon/Soba, By Restaurant Mode

- Others

- Others, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Others, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Others, By Restaurant Mode

- Sushi

Specialty Japanese Cuisine

- Specialty Japanese Cuisine, By Type

- Yakitori

- Teppanyaki

- Others

- Specialty Japanese Cuisine, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Specialty Japanese Cuisine, By Restaurant Mode

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

- Modern Japanese Cuisine

- Modern Japanese cuisine, By Type

- Fusion Japanese

- Contemporary Japanese Dishes

- Modern Japanese cuisine, By Type

- Modern Japanese cuisine, By Restaurant Mode

- Takeaway

- Home Delivery

- Dine-In

- Modern Japanese cuisine, By Establishment

- Quick-Service

- Full-Service Restaurants

- Take-Out Counters/Outlets

Service Type

- Quick Service Restaurants (QSR)

- Full Service Restaurants

- Take-Out Counters/Outlets

Restaurant Category

- Standalone Restaurants

- Chain/Franchise Model

Restaurant Model

- Takeaway

- Home Delivery

- Dine-In

Sales Channel

- Physical Outlets

- Delivery Online Restaurants/Ghost Kitchen

Asia-Pacific Market Regional Analysis

The market is segmented into five notable segments based on cusine type, service type, restaurant category, restaurant model, and sales channel.

The countries covered in the market are China, Japan, India, South Korea, Singapore, Indonesia, Thailand, Philippines, Australia and New Zealand, Malaysia, and rest of Asia-Pacific.

Japan is expected to dominate and fastest growing country in the market due to its well-established infrastructure, advanced processing technology, and higher levels of investment in the sector compared to other regions are expected to further fuel the market's growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Asia-Pacific Market Leaders Operating in the Market Are:

- Katsu-Ya Group, Inc (U.S.)

- Wokcano Asian Restaurant & Bar.(U.S.),

- 893 Ryōtei Berlin (Germany),

- Chiba Japanese Restaurant (U.S.)

- Tsujita Artisan Noodle (Japan)

- Sushi Den (U.S.)

- Florilège (Japan)

- Kaiten Zushi (U.S.)

- Kura Sushi USA (U.S.)

- Narisawa (Japan)

- RE&S (Singapore)

- Sazenka (Japan)

- Sushi A Go Go (U.S.)

- Sushi Gen Enterprises (U.S.)

- Sushi Nozawa Group (U.S.)

- Sushiya (India)

- Takami Sushi & Robata Restaurant (U.S.)

- Tatsu Ramen LLC (U.S.)

- Yamashiro Hollywood (U.S.)

Latest Developments in Asia-Pacific Japanese Restaurant Market

- In May 2024, Sushi Den has announced the relaunch of its highly anticipated lunch service. In addition, OTOTO, a latest addition to the Sushi Den and Izakaya Den, has launched a delightful Sunday Brunch starting from 11:00 AM to 2:00 PM. The company look forward to sharing this new chapter with their customer’s and enjoying the season’s fresh offerings together

- En mayo de 2024, Kura Sushi USA lanzó una promoción Bikkura Pon con temática de Dragon Ball Super del 1 de mayo al 30 de junio de 2024. La colaboración incluyó premios exclusivos de Dragon Ball Super, incluidos llaveros de acrílico de edición limitada y pines esmaltados. Un llavero raro de Goku que brilla en la oscuridad estuvo disponible en cantidades limitadas. Del 5 al 9 de junio, los miembros del programa Rewards recibieron una camiseta gráfica de Dragon Ball Super con una compra de $70 en el restaurante. Un juego de botellas de Dragon Ball Super con pajita y cordón estuvo disponible por $16.00 a partir del 1 de junio. El sistema de premios Bikkura Pon premió a los comensales con premios con temática de Dragon Ball Super por cada 15 platos disfrutados.

- En diciembre de 2023, Kura Sushi USA, Inc. presentó ecopon, la primera cápsula de papel biodegradable y sin plástico del mundo, para sus premios Bikkura Pon. Desarrolladas por K2 Station Co., Ltd., Rengo Co., Ltd. y Daiho Industrial Co., Ltd., las cápsulas ecopon están hechas de almidón y pulpa de papel, lo que reduce las emisiones de CO2 en un tercio en comparación con el polipropileno. Las nuevas cápsulas debutarán con una colaboración de Peanuts® Bikkura Pon desde el 1 de diciembre de 2024 hasta el 31 de enero de 2025. Esta iniciativa refleja el compromiso de Kura Sushi con la sostenibilidad, luego de su transición a pajitas de papel y otras prácticas ecológicas. Para obtener más información, visite kurasushi.com/sustainability

- En octubre de 2023, Kura Sushi USA, Inc. se ha asociado con Peanuts Worldwide LLC para una promoción especial de Bikkura Pon que se extenderá desde el 1 de diciembre de 2024 hasta el 31 de enero de 2025. Los comensales pueden disfrutar de premios exclusivos con la temática de Peanuts, que incluyen llaveros con figuras, insignias para latas y paños de microfibra con personajes como Snoopy y Charlie Brown. Por cada 15 platos de sushi, los invitados recibirán un premio Peanuts x Kura Sushi, con un raro llavero con figura de Snoopy disponible solo a través del sistema de premios. Los miembros de Rewards que gasten $70 del 3 al 7 de enero de 2024 recibirán un juego de vasos inspirado en Peanuts. Kura Sushi también está utilizando las cápsulas biodegradables de ecopon para esta promoción.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SUPPLY CHAIN ANALYSIS

4.1.1 RAW MATERIAL SOURCING

4.1.2 PROCESSING & PACKAGING

4.1.3 LOGISTICS & DISTRIBUTION

4.1.4 RESTAURANT OPERATIONS

4.1.5 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS FOR THE ASIA-PACIFIC JAPANESE RESTAURANT MARKET

4.2 VENDOR SELECTION CRITERIA

4.2.1 INGREDIENT QUALITY AND AUTHENTICITY

4.2.2 RELIABILITY AND SUPPLY CHAIN EFFICIENCY

4.2.3 COMPLIANCE WITH FOOD SAFETY AND REGULATORY STANDARDS

4.2.4 COST COMPETITIVENESS AND PRICING STABILITY

4.2.5 SUSTAINABILITY AND ETHICAL SOURCING PRACTICES

4.2.6 TECHNOLOGICAL INTEGRATION AND ORDERING EFFICIENCY

4.3 FACTORS INFLUENCING PURCHASING DECISION OF END USERS IN THE ASIA-PACIFIC JAPANESE RESTAURANT MARKET

4.3.1 AUTHENTICITY AND CULTURAL EXPERIENCE

4.3.2 QUALITY AND FRESHNESS OF INGREDIENTS

4.3.3 MENU VARIETY AND DIETARY PREFERENCES

4.3.4 PRICING AND VALUE FOR MONEY

4.3.5 AMBIENCE AND RESTAURANT DESIGN

4.3.6 BRAND REPUTATION AND REVIEWS

4.3.7 CONVENIENCE AND ACCESSIBILITY

4.3.8 CUSTOMER SERVICE AND HOSPITALITY

4.3.9 HEALTH AND SAFETY CONCERNS

4.3.10 CULTURAL TRENDS AND POPULARITY

4.3.11 CONCLUSION

4.4 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS IN THE ASIA-PACIFIC JAPANESE RESTAURANT MARKET

4.4.1 EXPANSION THROUGH FRANCHISING

4.4.2 MENU INNOVATION AND DIVERSIFICATION

4.4.3 DIGITAL TRANSFORMATION AND ONLINE PRESENCE

4.4.4 STRATEGIC PARTNERSHIPS AND COLLABORATIONS

4.4.5 SUSTAINABLE PRACTICES AND ETHICAL SOURCING

4.4.6 PREMIUMIZATION AND FINE DINING CONCEPTS

4.4.7 GEOGRAPHIC EXPANSION INTO EMERGING MARKETS

4.4.8 LOYALTY PROGRAMS AND CUSTOMER ENGAGEMENT

4.4.9 TECHNOLOGY-DRIVEN EFFICIENCY

4.4.10 HEALTH AND WELLNESS-FOCUSED OFFERINGS

4.4.11 CONCLUSION

4.5 INDUSTRY TRENDS AND FUTURE PERSPECTIVE OF THE ASIA-PACIFIC JAPANESE RESTAURANT MARKET

4.5.1 RISING POPULARITY OF AUTHENTIC AND REGIONAL JAPANESE CUISINE

4.5.2 GROWTH OF FAST-CASUAL AND TAKEAWAY CONCEPTS

4.5.3 INCREASED FOCUS ON SUSTAINABILITY AND ETHICAL SOURCING

4.5.4 DIGITAL TRANSFORMATION AND SMART RESTAURANT TECHNOLOGY

4.5.5 EXPANSION INTO EMERGING MARKETS

4.5.6 HEALTH AND WELLNESS-DRIVEN MENUS

4.5.7 INFLUENCE OF JAPANESE POP CULTURE ON FOOD TRENDS

4.5.8 PERSONALIZATION AND CUSTOMIZATION

4.5.9 ALCOHOL PAIRING AND SAKE CULTURE EXPANSION

4.5.10 FUTURE OUTLOOK: THE EVOLUTION OF THE JAPANESE RESTAURANT MARKET

4.5.11 CONCLUSION

4.6 TECHNOLOGICAL ADVANCEMENT OF THE ASIA-PACIFIC JAPANESE RESTAURANT MARKET

4.6.1 AUTOMATION AND ROBOTICS

4.6.2 AI AND SMART ORDERING SYSTEMS

4.6.3 DIGITAL PAYMENT AND CONTACTLESS SOLUTIONS

4.6.4 SMART KITCHENS AND IOT INTEGRATION

4.6.5 SUSTAINABLE AND ECO-FRIENDLY INNOVATIONS

4.6.6 CONCLUSION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING AWARENESS OF HEALTH BENEFITS

6.1.2 THE INCREASE IN POPULARITY OF THE DISH SUSHI

6.1.3 JAPANESE CUISINE, RECOGNIZED AS A UNESCO INTANGIBLE CULTURAL HERITAGE, INCREASES THE ASIA-PACIFIC CONSUMER INTEREST FOR JAPANESE CUISINE

6.2 RESTRAINTS

6.2.1 FOOD CONTAMINATION, RISKING THE SAFETY, AND QUALITY OF THE PRODUCT

6.2.2 HIGH COSTS OF INGREDIENTS FOR JAPANESE CUISINE

6.3 OPPORTUNITIES

6.3.1 INNOVATION IN MENU OFFERINGS

6.3.2 COLLABORATION WITH LOCAL CULTURAL EVENTS AND FESTIVALS

6.4 CHALLENGES

6.4.1 INTENSE COMPETITION FROM ITALIAN AND CHINESE CUISINES

6.4.2 MAINTAINING AUTHENTICITY AND LABOR SHORTAGES

7 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY CUISINE TYPE

7.1 OVERVIEW

7.2 TRADITIONAL JAPANESE CUISINE

7.2.1 SUSHI

7.2.2 RAMEN

7.2.3 TEMPURA

7.2.4 SASHIMI

7.2.5 KAISEKI

7.2.6 UDON/SOBA

7.2.7 OTHERS

7.3 SPECIALTY JAPANESE CUISINE

7.4 MODERN JAPANESE CUISINE

8 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SERVICE TYPE

8.1 OVERVIEW

8.2 QUICK SERVICE RESTAURANTS (QSR)

8.3 FULL SERVICE RESTAURANTS

8.4 TAKE-OUT COUNTERS/OUTLETS

9 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY

9.1 OVERVIEW

9.2 STANDALONE RESTAURANT

9.3 CHAIN/FRANCHISE MODEL

10 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL

10.1 OVERVIEW

10.2 TAKEAWAY

10.3 HOME DELIVERY

10.4 DINE-IN

11 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 PHYSICAL OUTLETS

11.3 DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN

12 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 SOUTH KOREA

12.1.4 THAILAND

12.1.5 INDONESIA

12.1.6 PHILIPPINES

12.1.7 AUSTRALIA AND NEW ZEALAND

12.1.8 MALAYSIA

12.1.9 INDIA

12.1.10 SINGAPORE

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC JAPANESE RESTAURANT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 KATSU-YA GROUP, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 WOKCANO ASIAN RESTAURANT & BAR.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 893 RYŌTEI BERLIN

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 CHIBA JAPANESE RESTAURANT

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 TSUJITA ARTISAN NOODLE.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 FLORILÈGE

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 KAITEN ZUSHI

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 KURA SUSHI USA

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENTS

15.9 MY CONCIERGE JAPAN

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 NARISAWA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 RE&S

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 BRAND PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 SAZENKA

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 SEZZANE

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT NEWS

15.14 SUSHI A GO GO

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 SUSHI DEN

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 SUSHI GEN ENTERPRISES

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 SUSHI NOZAWA GROUP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SUSHIYA

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 TAKAMI SUSHI & ROBATA RESTAURANT

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 TATSU RAMEN LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 YAMASHIRO HOLLYWOOD

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tablas

TABLE 1 REGULATORY COVERAGE

TABLE 2 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MODERN JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC QUICK SERVICE RESTAURANTS (QSR) IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC FULL SERVICE IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC TAKE-OUT COUNTERS/OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC STANDALONE RESTAURANT IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC CHAIN/FRANCHISE MODEL IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC TAKEAWAY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC HOME DELIVERY IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC DINE-IN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC PHYSICAL OUTLETS IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC DELIVERY ONLINE RESTAURANTS/GHOST KITCHEN IN JAPANESE RESTAURANT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 57 ASIA-PACIFIC KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 59 ASIA-PACIFIC UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 72 JAPAN JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 JAPAN TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 JAPAN SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 JAPAN SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 76 JAPAN SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 77 JAPAN SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 78 JAPAN RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 79 JAPAN RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 80 JAPAN TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 81 JAPAN TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 82 JAPAN SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 83 JAPAN SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 84 JAPAN KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 85 JAPAN KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 86 JAPAN UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 87 JAPAN UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 88 JAPAN OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 89 JAPAN OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 90 JAPAN SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 JAPAN SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 92 JAPAN SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 93 JAPAN MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 JAPAN MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 95 JAPAN MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 96 JAPAN JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 JAPAN JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 98 JAPAN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 99 JAPAN JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 100 CHINA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CHINA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CHINA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CHINA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 104 CHINA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 105 CHINA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 106 CHINA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 107 CHINA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 108 CHINA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 109 CHINA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 110 CHINA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 111 CHINA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 112 CHINA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 113 CHINA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 114 CHINA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 115 CHINA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 116 CHINA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 117 CHINA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 118 CHINA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CHINA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 120 CHINA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 121 CHINA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 CHINA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 123 CHINA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 124 CHINA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 CHINA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 126 CHINA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 127 CHINA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 128 SOUTH KOREA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 SOUTH KOREA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 SOUTH KOREA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 SOUTH KOREA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 132 SOUTH KOREA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 133 SOUTH KOREA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 134 SOUTH KOREA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 135 SOUTH KOREA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 136 SOUTH KOREA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 137 SOUTH KOREA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 138 SOUTH KOREA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 139 SOUTH KOREA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 140 SOUTH KOREA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 141 SOUTH KOREA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 142 SOUTH KOREA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 143 SOUTH KOREA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 144 SOUTH KOREA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 145 SOUTH KOREA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 146 SOUTH KOREA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SOUTH KOREA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 148 SOUTH KOREA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 149 SOUTH KOREA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SOUTH KOREA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 151 SOUTH KOREA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 152 SOUTH KOREA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SOUTH KOREA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 154 SOUTH KOREA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 155 SOUTH KOREA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 156 THAILAND JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 THAILAND TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 THAILAND SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 THAILAND SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 160 THAILAND SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 161 THAILAND SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 162 THAILAND RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 163 THAILAND RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 164 THAILAND TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 165 THAILAND TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 166 THAILAND SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 167 THAILAND SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 168 THAILAND KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 169 THAILAND KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 170 THAILAND UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 171 THAILAND UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 172 THAILAND OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 173 THAILAND OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 174 THAILAND SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 THAILAND SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 176 THAILAND SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 177 THAILAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 THAILAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 179 THAILAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 180 THAILAND JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 THAILAND JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 182 THAILAND JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 183 THAILAND JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 184 INDONESIA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 185 INDONESIA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 INDONESIA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 187 INDONESIA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 188 INDONESIA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 189 INDONESIA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 190 INDONESIA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 191 INDONESIA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 192 INDONESIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 193 INDONESIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 194 INDONESIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 195 INDONESIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 196 INDONESIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 197 INDONESIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 198 INDONESIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 199 INDONESIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 200 INDONESIA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 201 INDONESIA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 202 INDONESIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 INDONESIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 204 INDONESIA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 205 INDONESIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 INDONESIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 207 INDONESIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 208 INDONESIA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 INDONESIA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 210 INDONESIA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 211 INDONESIA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 212 PHILIPPINES JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 213 PHILIPPINES TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 214 PHILIPPINES SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 215 PHILIPPINES SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 216 PHILIPPINES SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 217 PHILIPPINES SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 218 PHILIPPINES RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 219 PHILIPPINES RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 220 PHILIPPINES TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 221 PHILIPPINES TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 222 PHILIPPINES SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 223 PHILIPPINES SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 224 PHILIPPINES KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 225 PHILIPPINES KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 226 PHILIPPINES UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 227 PHILIPPINES UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 228 PHILIPPINES OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 229 PHILIPPINES OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 230 PHILIPPINES SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 PHILIPPINES SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 232 PHILIPPINES SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 233 PHILIPPINES MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 PHILIPPINES MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 235 PHILIPPINES MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 236 PHILIPPINES JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 237 PHILIPPINES JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 238 PHILIPPINES JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 239 PHILIPPINES JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 240 AUSTRALIA AND NEW ZEALAND JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 241 AUSTRALIA AND NEW ZEALAND TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 AUSTRALIA AND NEW ZEALAND SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 AUSTRALIA AND NEW ZEALAND SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 244 AUSTRALIA AND NEW ZEALAND SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 245 AUSTRALIA AND NEW ZEALAND SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 246 AUSTRALIA AND NEW ZEALAND RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 247 AUSTRALIA AND NEW ZEALAND RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 248 AUSTRALIA AND NEW ZEALAND TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 249 AUSTRALIA AND NEW ZEALAND TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 250 AUSTRALIA AND NEW ZEALAND SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 251 AUSTRALIA AND NEW ZEALAND SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 252 AUSTRALIA AND NEW ZEALAND KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 253 AUSTRALIA AND NEW ZEALAND KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 254 AUSTRALIA AND NEW ZEALAND UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 255 AUSTRALIA AND NEW ZEALAND UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 256 AUSTRALIA AND NEW ZEALAND OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 257 AUSTRALIA AND NEW ZEALAND OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 258 AUSTRALIA AND NEW ZEALAND SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 AUSTRALIA AND NEW ZEALAND SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 260 AUSTRALIA AND NEW ZEALAND SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 261 AUSTRALIA AND NEW ZEALAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 262 AUSTRALIA AND NEW ZEALAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 263 AUSTRALIA AND NEW ZEALAND MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 264 AUSTRALIA AND NEW ZEALAND JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 265 AUSTRALIA AND NEW ZEALAND JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 266 AUSTRALIA AND NEW ZEALAND JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 267 AUSTRALIA AND NEW ZEALAND JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 268 MALAYSIA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 MALAYSIA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 MALAYSIA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 MALAYSIA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 272 MALAYSIA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 273 MALAYSIA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 274 MALAYSIA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 275 MALAYSIA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 276 MALAYSIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 277 MALAYSIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 278 MALAYSIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 279 MALAYSIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 280 MALAYSIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 281 MALAYSIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 282 MALAYSIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 283 MALAYSIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 284 MALAYSIA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 285 MALAYSIA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 286 MALAYSIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 MALAYSIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 288 MALAYSIA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 289 MALAYSIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 290 MALAYSIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 291 MALAYSIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 292 MALAYSIA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 293 MALAYSIA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 294 MALAYSIA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 295 MALAYSIA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 296 INDIA JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 INDIA TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 INDIA SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 INDIA SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 300 INDIA SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 301 INDIA SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 302 INDIA RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 303 INDIA RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 304 INDIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 305 INDIA TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 306 INDIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 307 INDIA SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 308 INDIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 309 INDIA KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 310 INDIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 311 INDIA UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 312 INDIA OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 313 INDIA OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 314 INDIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 315 INDIA SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 316 INDIA SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 317 INDIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 318 INDIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 319 INDIA MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 320 INDIA JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 INDIA JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 322 INDIA JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)

TABLE 323 INDIA JAPANESE RESTAURANT MARKET, BY SALES CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 324 SINGAPORE JAPANESE RESTAURANT MARKET, BY CUISINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 SINGAPORE TRADITIONAL JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 SINGAPORE SUSHI IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 SINGAPORE SUSHI IN JAPANESE RESTAURANT MARKET, BY CHAIN, 2018-2032 (USD THOUSAND)

TABLE 328 SINGAPORE SUSHI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 329 SINGAPORE SUSHI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 330 SINGAPORE RAMEN IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 331 SINGAPORE RAMEN IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 332 SINGAPORE TEMPURA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 333 SINGAPORE TEMPURA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 334 SINGAPORE SASHIMI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 335 SINGAPORE SASHIMI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 336 SINGAPORE KAISEKI IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 337 SINGAPORE KAISEKI IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 338 SINGAPORE UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 339 SINGAPORE UDON/SOBA IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 340 SINGAPORE OTHERS IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 341 SINGAPORE OTHERS IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 342 SINGAPORE SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 343 SINGAPORE SPECIALTY JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 344 SINGAPORE SPECIALTY JAPANESE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 345 SINGAPORE MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 346 SINGAPORE MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY RESTAURANT MODE, 2018-2032 (USD THOUSAND)

TABLE 347 SINGAPORE MODERN JAPANESE CUISINE IN JAPANESE RESTAURANT MARKET, BY ESTABLISHMENT, 2018-2032 (USD THOUSAND)

TABLE 348 SINGAPORE JAPANESE RESTAURANT MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 349 SINGAPORE JAPANESE RESTAURANT MARKET, BY RESTAURANT CATEGORY, 2018-2032 (USD THOUSAND)

TABLE 350 SINGAPORE JAPANESE RESTAURANT MARKET, BY RESTAURANT MODEL, 2018-2032 (USD THOUSAND)