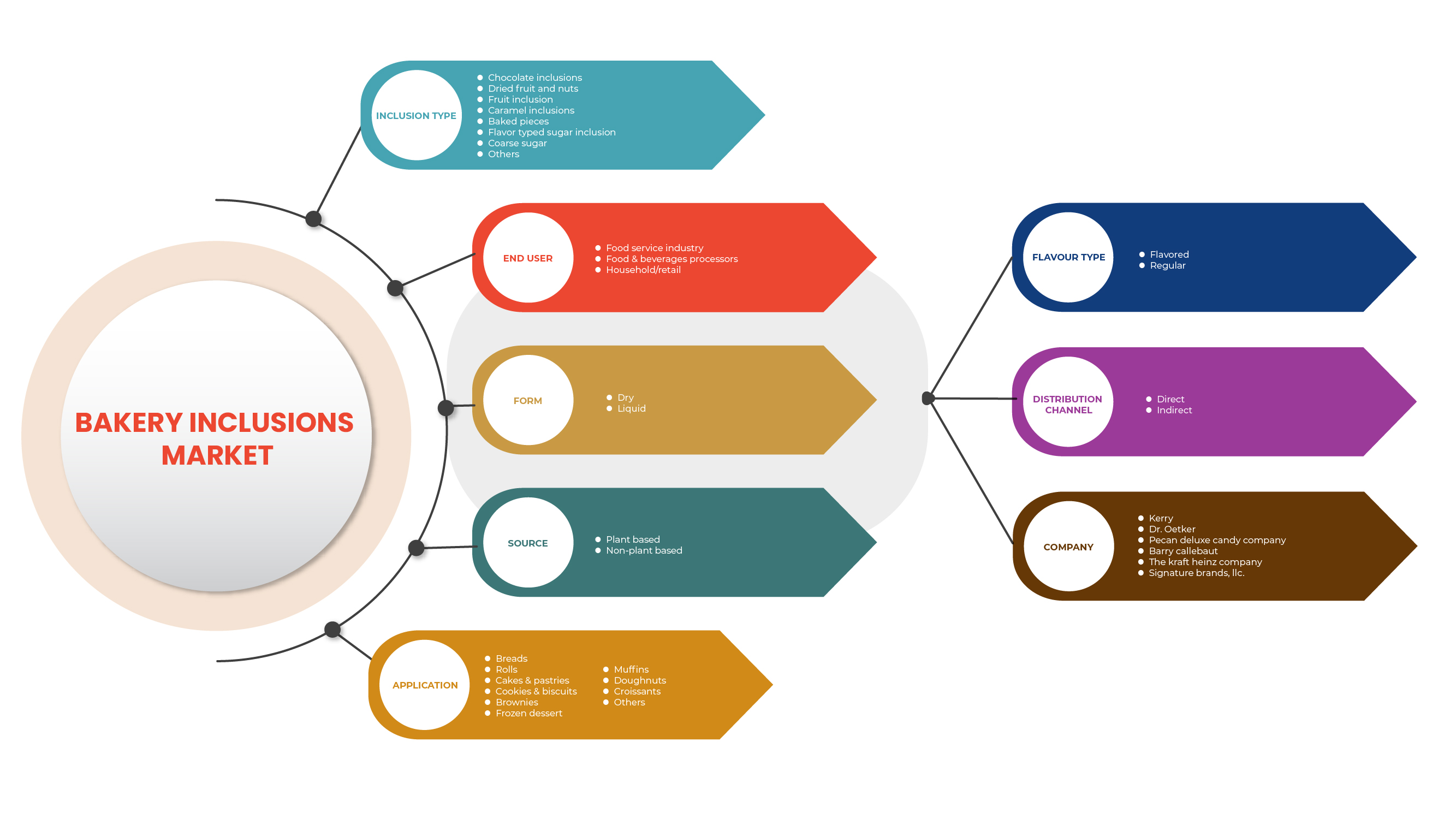

Mercado europeo de inclusiones de panadería, por tipo de inclusión ( inclusiones de chocolate , inclusiones de caramelo , frutos secos y nueces, azúcar grueso, piezas horneadas, inclusiones de frutas , inclusiones de azúcar con sabor y otros), usuario final (procesadores de alimentos y bebidas, industria de servicios de alimentos y hogar/venta minorista), forma (seca y líquida), fuente ( de origen vegetal y no vegetal), aplicación (panes, muffins, donas, croissants, panecillos, tortas y pasteles, galletas y bizcochos y otros), sabor (saborizado y regular), canal de distribución (directo e indirecto) - Tendencias de la industria y pronóstico hasta 2029.

Análisis y perspectivas del mercado

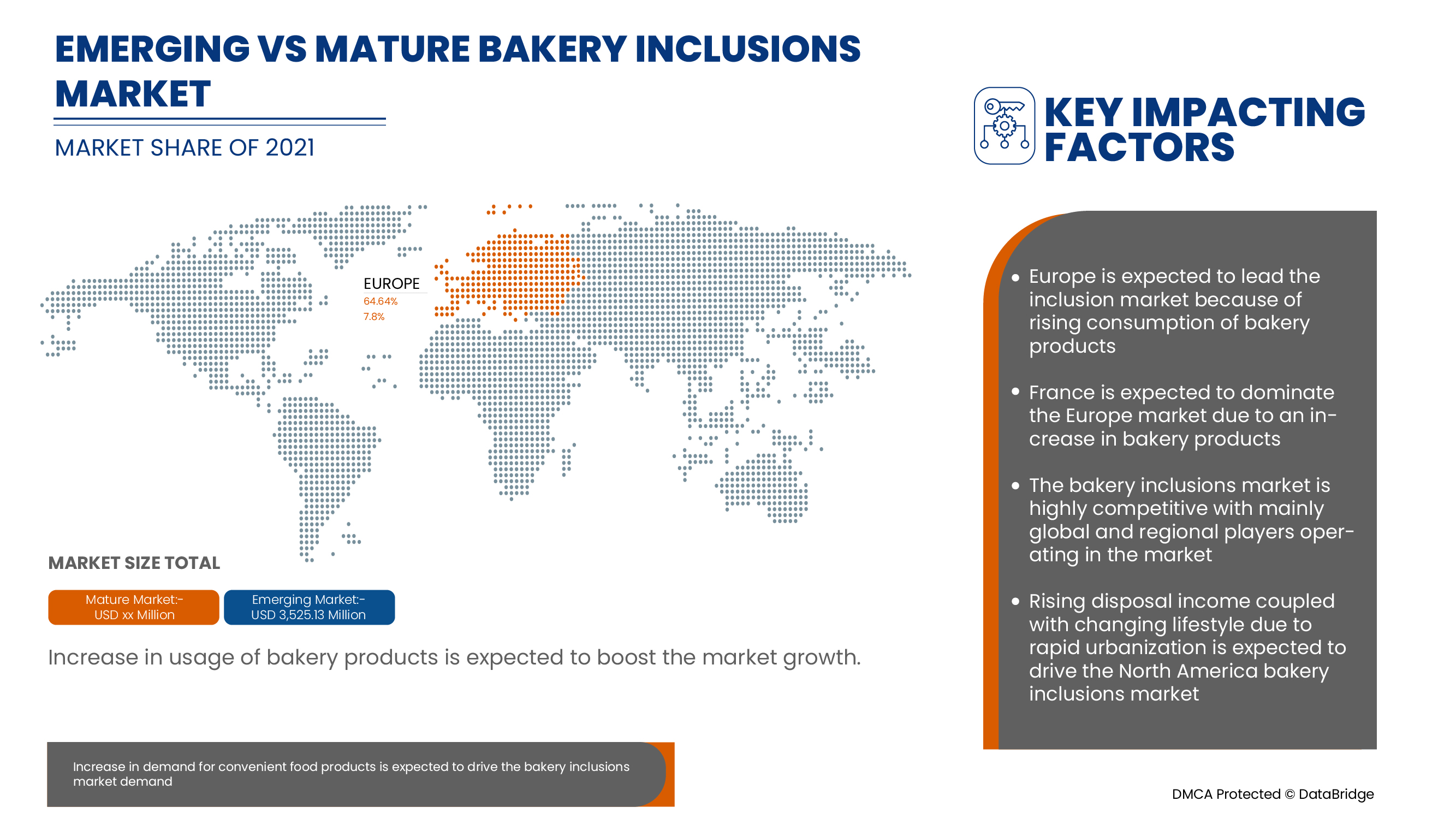

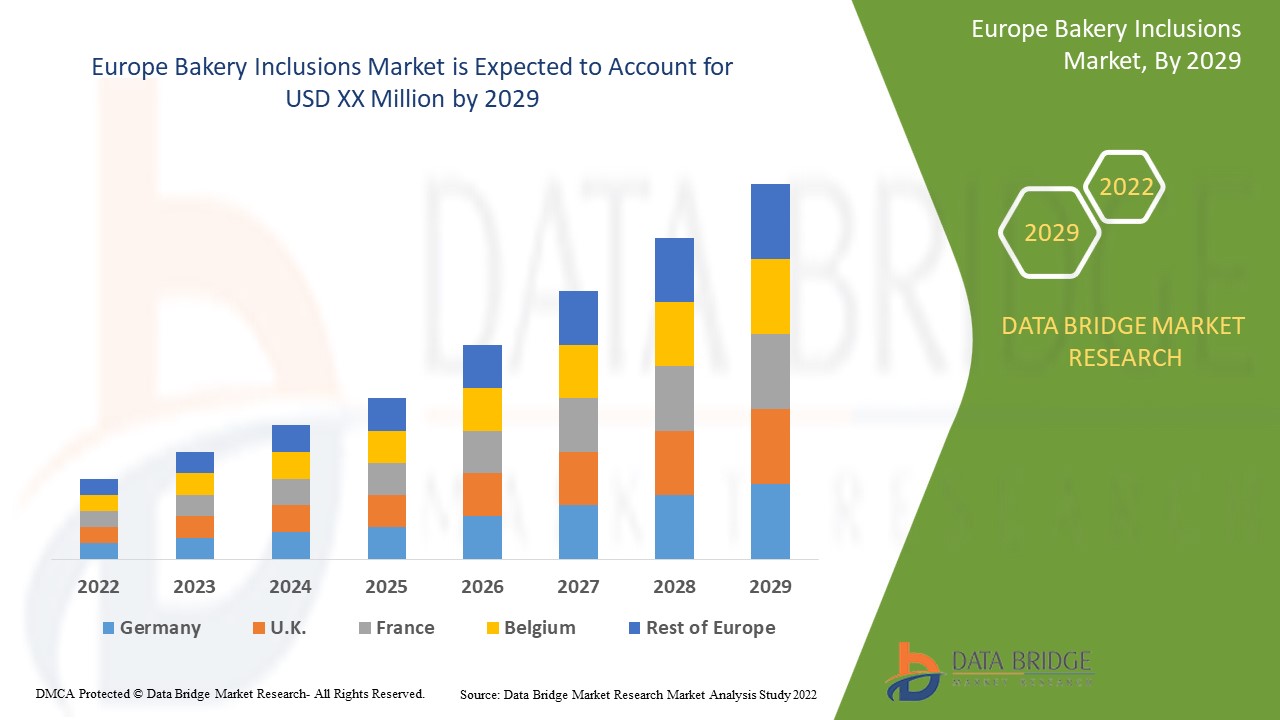

El principal factor de crecimiento en el mercado de inclusiones de panadería es el rápido cambio de estilo de vida, así como el aumento de la población activa. El factor principal que impulsa la demanda de inclusiones de panadería es la creciente demanda de alimentos procesados con algún tipo de valor añadido. Además, el aumento de los ingresos disponibles, la rápida urbanización y la creciente demanda de snacks y dulces de conveniencia también están aumentando la demanda general del mercado de inclusiones de panadería durante el período de pronóstico. Además, las diversas propiedades funcionales que ofrecen las inclusiones y la creciente demanda de productos de panadería y confitería también sirven como los principales impulsores del aumento de la demanda del mercado de inclusiones de panadería. Además, la presencia de una gran cantidad de aplicaciones en el sector de alimentos y bebidas también está impulsando el crecimiento del mercado de inclusiones de panadería. Data Bridge Market Research analiza que el mercado de inclusiones de panadería de Europa crecerá a una CAGR del 7,8% durante el período de pronóstico de 2022 a 2029.

|

Métrica del informe |

Detalles |

|

Período de pronóstico |

2022 a 2029 |

|

Año base |

2021 |

|

Años históricos |

2020 (Personalizable para 2020 - 2014) |

|

Unidades cuantitativas |

Ingresos en millones de USD, precios en USD |

|

Segmentos cubiertos |

Por tipo de inclusión ( inclusiones de chocolate , inclusiones de caramelo , frutos secos y nueces, azúcar grueso, piezas horneadas, inclusiones de frutas , inclusiones de azúcar con sabor y otros), usuario final (procesadores de alimentos y bebidas, industria de servicios de alimentos y hogares/venta minorista), forma (seca y líquida), fuente ( de origen vegetal y no vegetal), aplicación (panes, muffins, donas, croissants, panecillos, tortas y pasteles, galletas y bizcochos y otros), sabor (saborizado y regular), canal de distribución (directo e indirecto) |

|

Países cubiertos |

Francia, Alemania, Italia, Reino Unido, España, Bélgica, Países Bajos, Suiza, Rusia, Turquía, Luxemburgo y resto de Europa. |

|

Actores del mercado cubiertos |

Kerry, Dr. Oetker, Pecan Deluxe Candy Company, Hanns G. Werner GmbH + Co. KG, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Nimbus Foods Ltd, Cacau Foods do Brasil., Britannia Superfine, Shantou Hehe Technology Co., Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, GÜNTHART & Co. KG, entre otros. |

Definición de mercado:

Las inclusiones son el tipo de pequeñas variedades que se agregan a los alimentos y las fórmulas de panadería para impartir sabores, texturas y colores únicos junto con otras propiedades deseables. Están disponibles en rodajas, hojuelas, pepitas, bolitas u otras formas. Las inclusiones se agregan a los productos horneados por varias razones. Las inclusiones como nueces, dulces y frutas secas pueden mejorar la textura. Las inclusiones como especias, brillo y hojuelas de purpurina mejoran la estética y las propiedades sensoriales. Las inclusiones como trozos de chocolate y nueces de macadamia agregan indulgencia al producto final. Las inclusiones también ayudan a aumentar el valor nutricional de los productos de panadería. Las inclusiones pueden brindar altas concentraciones de proteínas, fibra, vitaminas y ácidos grasos esenciales, entre otros, a los productos de panadería.

Dinámica del mercado de inclusiones de panadería en Europa

Conductores

- Aumento del consumo de productos de panadería

Los productos de panadería incluyen pan de molde con levadura, pan de molde, pan plano, galletas, pasteles, muffins, galletas, bollos, hojaldres y tortillas de harina. Se fabrican a partir de diferentes harinas, como harina de trigo, harina de sorgo y muchas mezclas de diferentes harinas, con diferentes composiciones de mezcladores, emulsionantes, potenciadores del sabor, conservantes y muchos más ingredientes para mejorar la textura, el color, el sabor y los aromas deseados. Se utilizan diferentes inclusiones en productos de panadería, como inclusiones de chocolate, inclusiones de caramelo, frutos secos y nueces, azúcar grueso, piezas horneadas, inclusiones de frutas e inclusiones de azúcar saborizado, entre otros. Estas inclusiones brindan sabor y textura a los productos de panadería.

- Beneficios para la salud combinados con sabor en inclusiones de panadería a base de frutas y nueces

Las inclusiones de frutas secas son las preferidas a nivel mundial debido al aumento de la demanda de productos con menos azúcar, ya que existe una prevalencia creciente de la obesidad. Estas inclusiones de frutas aportan dulzura natural a los productos. Las inclusiones de frutas más comunes que se utilizan en el mercado son manzana, albaricoque, plátano, cereza, grosella negra, arándano, uva, mango, piña y melocotón, entre otras.

Las inclusiones de frutas aportan beneficios para la salud, como antioxidantes, vitaminas, minerales y otros beneficios funcionales para la salud. Además, debido a la tendencia en evolución de la utilización de fuentes naturales de azúcar en inclusiones y al abandono del azúcar procesado, la demanda de inclusiones de frutas está impulsando también la atención de los consumidores preocupados por la salud en todo el mundo.

Oportunidad

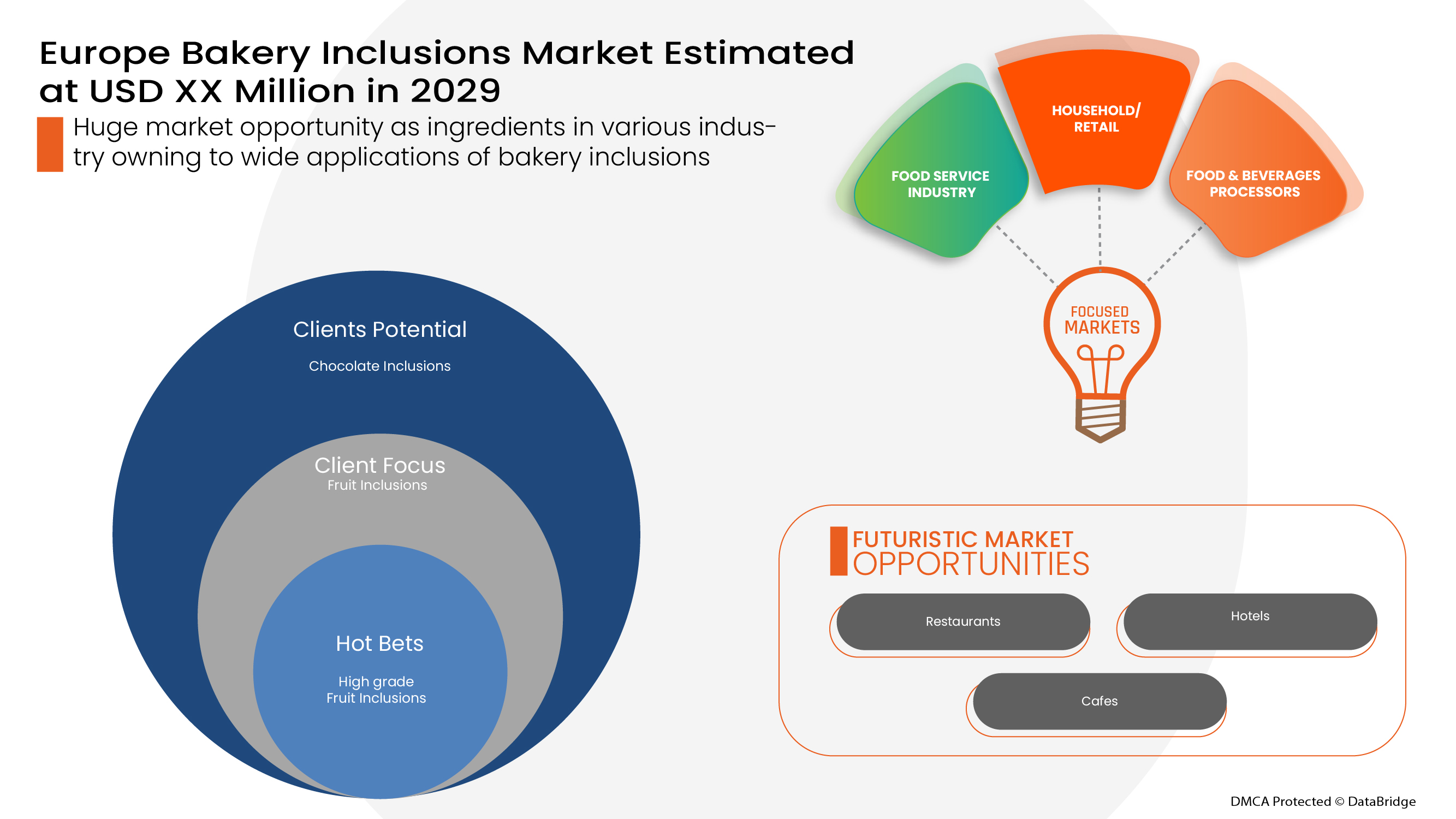

- Aumento de la demanda de productos alimenticios convenientes

La demanda de soluciones para la hora de la cena por parte de los clientes actuales está creciendo rápidamente, ya que el comportamiento de consumo de comidas entre los clientes está cambiando notablemente. Si bien las personas carecen cada vez más del tiempo y la habilidad para preparar comida para sus hogares, muchos consumidores están dispuestos a gastar dinero en el mercado de alimentos listos para comer. Este factor ha aumentado la demanda del mercado minorista de alimentos preparados.

La pandemia del coronavirus está cambiando el estilo de vida de los consumidores hacia el consumo de alimentos reconfortantes, ya que la mayoría de los países se ven obligados a restringir el movimiento y cerrar sus fronteras. La necesidad de alimentos preparados es primordial en este período, especialmente en los EE. UU., donde la pandemia está golpeando al país con fuerza.

Restricción/Desafío

- Vida útil limitada de los productos de panadería

La principal preocupación de los productos de panadería es mantener su frescura en términos de sabor, textura y aroma. Los productos de panadería tienen una vida útil limitada. Varias enzimas se modifican genéticamente para mejorar la frescura de los productos de panadería manteniendo la textura, la estabilidad, la frescura, el volumen y el aroma adecuados de los productos de panadería. Estas enzimas tienen efectos nocivos para la salud humana, lo que se espera que frene el mercado de productos de panadería.

Impacto posterior al COVID-19 en el mercado europeo de productos de panadería

La COVID-19 ha afectado en cierta medida al mercado europeo de inclusiones de panadería. Debido al confinamiento, el proceso de fabricación se detuvo y la demanda de los usuarios finales también disminuyó, lo que ha afectado al mercado. Después de la COVID-19, la demanda de inclusiones de panadería aumentó debido a los cambios en los patrones de compra de los consumidores y a un cambio gradual hacia el aumento de la demanda de inclusiones de panadería entre varios usuarios finales, como la automoción, la industria aeroespacial y de defensa, la electrónica y la electricidad, la construcción y edificación, entre otros.

Acontecimientos recientes

- En enero de 2022, Pecan Deluxe Candy Company recibió el premio a la gran empresa Food Quality and Safety Award 2021. Este premio ha ayudado a la empresa a atraer más clientes.

- En abril de 2021, Pecan Deluxe Candy Company lanzó Popping Boba. Este lanzamiento de producto ha ayudado a la empresa a ampliar su cartera de productos.

- En septiembre de 2021, Dr. Oetker adquirió Kuppies, una empresa de investigación y desarrollo de productos farmacéuticos. Esta adquisición ha ayudado a la empresa a ampliar su presencia y su cartera de productos.

- En abril de 2021, Pecan Deluxe Candy Company lanzó Popping Boba. Este lanzamiento de producto ha ayudado a la empresa a ampliar su cartera de productos.

- En septiembre de 2021, Nimbus Foods Ltd. firmó una asociación estratégica con Herza. Herza es un productor líder de chocolate funcional y compuestos para su uso en la fabricación de alimentos. Esta asociación ha ayudado a la empresa a ampliar su gama de productos.

Alcance del mercado de inclusiones de panadería en Europa

El mercado europeo de inclusiones para panadería está segmentado por tipo de inclusión, sabor, forma, usuario final, origen, aplicación y canal de distribución. El crecimiento entre estos segmentos le ayudará a analizar los escasos segmentos de crecimiento de las industrias y brindará a los usuarios una valiosa descripción general del mercado y conocimientos del mercado para tomar decisiones estratégicas para identificar las principales aplicaciones del mercado.

TIPO DE INCLUSIÓN

- Inclusiones de chocolate

- Frutos secos y nueces

- inclusión de frutas

- Inclusiones de caramelo

- Trozos horneados

- Inclusión de azúcar tipificada por sabor

- Azúcar grueso

- Otros

Sobre la base del tipo de inclusión, el mercado europeo de inclusiones de panadería está segmentado en inclusiones de chocolate, inclusiones de caramelo, frutos secos y nueces, azúcar grueso, piezas horneadas, inclusiones de frutas, inclusiones de azúcar saborizada y otros.

USUARIO FINAL

- Industria de servicios de alimentación

- Procesadores de alimentos y bebidas

- Hogar/venta al por menor

Sobre la base del usuario final, el mercado europeo de inclusiones de panadería está segmentado en procesadores de alimentos y bebidas, industria de servicios de alimentos y hogares/venta minorista.

FORMA

- Seco

- Líquido

En función de la forma, el mercado europeo de inclusiones de panadería se segmenta en secos y líquidos.

FUENTE

- A base de plantas

- No basado en plantas

Según la fuente, el mercado europeo de inclusiones de panadería está segmentado en productos de origen vegetal y productos no vegetales.

SOLICITUD

- Panes

- Rollos

- Tortas y pasteles

- Galletas y bizcochos

- Brownies

- Postre helado

- Muffins

- Donas

- Croissants

- Otros

Sobre la base de la aplicación, el mercado europeo de inclusiones de panadería está segmentado en panes, muffins, donas, croissants, panecillos, tortas y pasteles, galletas y bizcochos, y otros.

TIPO DE SABOR

- Sazonado

- Regular

En función del sabor, el mercado europeo de inclusiones de panadería se segmenta en sabor y regular.

CANAL DE DISTRIBUCIÓN

- Directo

- Indirecto

Sobre la base del canal de distribución, el mercado europeo de inclusiones de panadería está segmentado en directo e indirecto.

Análisis y perspectivas regionales del mercado de inclusiones de panadería en Europa

Se analiza el mercado de inclusiones de panadería de Europa y se proporcionan información y tendencias sobre el tamaño del mercado por tipo de inclusión, sabor, forma, usuario final, fuente, aplicación y canal de distribución.

Las regiones cubiertas en el informe del mercado de inclusión de panadería de Europa son Francia, Alemania, Italia, Reino Unido, España, Bélgica, Países Bajos, Suiza, Rusia, Turquía, Luxemburgo y el resto de Europa.

Se espera que Francia domine el mercado europeo de inclusiones de panadería durante el período de pronóstico debido a un aumento en el uso de productos de panadería.

La sección de países del informe también proporciona factores de impacto de mercado individuales y cambios en las regulaciones del mercado que afectan las tendencias actuales y futuras del mercado. Los puntos de datos, como las ventas de productos nuevos y de reemplazo, la demografía del país, la epidemiología de las enfermedades y los aranceles de importación y exportación, son algunos de los principales indicadores utilizados para pronosticar el escenario del mercado para países individuales. Además, se consideran la presencia y disponibilidad de marcas globales y los desafíos que enfrentan debido a la alta competencia de las marcas locales y nacionales y el impacto de los canales de venta al proporcionar un análisis de pronóstico de los datos del país.

Análisis del panorama competitivo y de la cuota de mercado de la panadería en Europa

El panorama competitivo del mercado de inclusiones de panadería en Europa proporciona detalles de los competidores. Los detalles incluidos son una descripción general de la empresa, las finanzas de la empresa, los ingresos generados, el potencial de mercado, la inversión en investigación y desarrollo, las nuevas iniciativas de mercado, la presencia en Europa, los sitios e instalaciones de producción, las capacidades de producción, las fortalezas y debilidades de la empresa, el lanzamiento de productos, la amplitud y variedad de productos y el dominio de la aplicación. Los puntos de datos anteriores proporcionados solo están relacionados con el enfoque de las empresas en el mercado de inclusiones de panadería en Europa.

Algunos de los principales actores que operan en el mercado de inclusiones de panadería son Kerry, Dr. Oetker, Pecan Deluxe Candy Company, Hanns G. Werner GmbH + Co. KG, AMERICAN SPRINKLE COMPANY, Girrbach Süßwarendekor GmbH, Nimbus Foods Ltd, Cacau Foods do Brasil., Britannia Superfine, Shantou Hehe Technology Co.,Ltd, Barry Callebaut, The Kraft Heinz Company, Cape Foods, GÜNTHART & Co. KG, entre otros.

Metodología de la investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. Los datos del mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Aparte de esto, los modelos de datos incluyen la cuadrícula de posicionamiento de proveedores, el análisis de la línea de tiempo del mercado, la descripción general y la guía del mercado, la cuadrícula de posicionamiento de la empresa, el análisis de la participación de mercado de la empresa, los estándares de medición, Europa frente a la región y el análisis de la participación de los proveedores. Solicite una llamada de un analista en caso de tener más consultas.

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Tabla de contenido

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE BAKERY INCLUSIONS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 BRAND COMPETITIVE ANALYSIS

4.2 BRAND LEVEL VS PRIVATE LABEL

4.3 FUTURE TRENDS

4.3.1 TASTE

4.3.2 LOW SUGAR, LOW CALORIE, AND CLEAN LABEL DEMAND

4.4 HOW FLAVORS ARE DELIVERED TO BAKERY PRODUCERS

4.4.1 INTERNAL FLAVORING

4.4.2 FILLINGS AND ICING

4.5 IMPORT & EXPORT ANALYSIS OF EUROPE BAKERY INCLUSION MARKET

4.5.1 IMPORT-EXPORT ANALYSIS OF CHOCOLATE

4.5.2 IMPORT-EXPORT ANALYSIS OF EDIBLE FRUIT AND NUTS

4.6 MARKETING STRATEGIES

4.7 PATENT ANALYSIS OF EUROPE BAKERY INCLUSIONS MARKET

4.7.1 DBMR ANALYSIS

4.7.2 COUNTRY-LEVEL ANALYSIS

4.7.3 YEARWISE ANALYSIS

4.8 EUROPE BAKERY INCLUSION MARKET PRODUCTION AND CONSUMPTION

5 SUPPLY CHAIN OF EUROPE BAKERY INCLUSIONS MARKET

5.1 RAW MATERIAL PROCUREMENT

5.2 MANUFACTURING

5.3 PROCESSED INCLUSIONS:

5.4 MARKETING AND DISTRIBUTION

5.5 END USERS

6 EUROPE BAKERY INCLUSION MARKET: REGULATIONS

6.1 COMMISSION REGULATION (EU)

6.2 EUROPEAN UNION

6.3 REGULATIONS BY USFDA

6.4 GOVERNMENT OF CANADA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMPTION OF BAKERY PRODUCTS

7.1.2 HEALTH BENEFITS COMBINED WITH TASTE IN FRUIT- AND NUT-BASED BAKERY INCLUSIONS

7.1.3 QUALITY CLAIMS AND CERTIFICATIONS FOR INCLUSIONS LEND CREDIBILITY TO END PRODUCTS

7.1.4 RISING DISPOSABLE INCOME COUPLED WITH CHANGING LIFESTYLES DUE TO RAPID URBANIZATION

7.2 RESTRAINTS

7.2.1 LIMITED SHELF LIFE OF BAKERY PRODUCTS

7.2.2 DECREASE IN ADOPTION OF BAKERY PRODUCTS DUE TO INCREASED HEALTH CONSCIOUSNESS

7.3 OPPORTUNITIES

7.3.1 INCREASE IN DEMAND FOR CONVENIENT FOOD PRODUCTS

7.3.2 GROW IN DEMAND FOR VEGAN AND PLANT-BASED BAKERY PRODUCTS

7.3.3 TECHNOLOGY INTERVENTION IN INCLUSIONS PROPELLING UTILIZATION IN DIFFERENT APPLICATIONS

7.4 CHALLENGES

7.4.1 DISTURBANCE IN SUPPLY CHAIN DUE TO COVID-19 PANDEMIC

7.4.2 STRINGENT GOVERNMENT REGULATIONS

8 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE

8.1 OVERVIEW

8.2 CHOCOLATE INCLUSIONS

8.2.1 CHOCOLATE CHUNKS

8.2.1.1 DARK

8.2.1.2 MILK

8.2.1.3 WHITE

8.2.2 CHOCOLATE FLAKES

8.2.2.1 DARK

8.2.2.2 MILK

8.2.2.3 WHITE

8.2.3 CHOCOLATE SYRUPS

8.2.3.1 DARK

8.2.3.2 MILK

8.2.3.3 WHITE

8.2.4 OTHERS

8.2.4.1 DARK

8.2.4.2 MILK

8.2.4.3 WHITE

8.3 DRIED FRUITS AND NUTS

8.3.1 ALMOND

8.3.2 WALNUTS

8.3.3 HAZELNUTS

8.3.4 CASHEW

8.3.5 CHESTNUTS

8.3.6 BRAZIL NUTS

8.3.7 MACADAMIA NUTS

8.3.8 HICKORY NUTS

8.3.9 RESINS

8.3.10 OTHERS

8.4 FRUIT INCLUSION

8.4.1 BERRIES

8.4.1.1 STRAWBERRY

8.4.1.2 BLACKBERRY

8.4.1.3 CRANBERRY

8.4.1.4 BLUEBERRY

8.4.1.5 RASPBERRY

8.4.1.6 OTHERS

8.4.2 CHERRY

8.4.3 APPLE

8.4.4 BANANA

8.4.5 CITRUS FRUITS

8.4.5.1 LEMON

8.4.5.2 LIME

8.4.5.3 ORANGE

8.4.5.4 GRAPE FRUIT

8.4.5.5 OTHERS

8.4.6 BLACKCURRANT

8.4.7 MANGO

8.4.8 APRICOT

8.4.9 PINEAPPLE

8.4.10 PEACH

8.4.11 GRAPE

8.4.12 RIG

8.4.13 OTHERS

8.5 CARAMEL INCLUSIONS

8.5.1 NUTS SABLAGE

8.5.2 CARAMEL CRISPY BITES

8.5.3 CARAMEL CRUNCHES

8.6 BAKED PIECES

8.7 FLAVOR TYPED SUGAR INCLUSION

8.8 COARSE SUGAR

8.9 OTHERS

9 EUROPE BAKERY INCLUSIONS MARKET, BY END USER

9.1 OVERVIEW

9.2 FOOD SERVICE INDUSTRY

9.2.1 RESTAURANTS

9.2.2 HOTELS

9.2.3 CAFES

9.2.4 SHAKES AND SMOOTHIES PARLORS

9.2.5 OTHERS

9.3 FOOD & BEVERAGES PROCESSORS

9.4 HOUSEHOLD/RETAIL

10 EUROPE BAKERY INCLUSIONS MARKET, BY FORM

10.1 OVERVIEW

10.2 DRY

10.2.1 FLAKES & CRUNCHES

10.2.2 CHIPS & NIBS

10.2.3 POWDER

10.2.4 CUBES/PIECES

10.2.5 GRANULES

10.3 LIQUID

10.3.1 CONCENTRATES

10.3.2 PUREE

11 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 PLANT BASED

11.3 NON-PLANT BASED

12 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 BREADS

12.3 ROLLS

12.4 CAKES & PASTRIES

12.5 COOKIES & BISCUITS

12.6 BROWNIES

12.7 FROZEN DESSERT

12.8 MUFFINS

12.9 DOUGHNUTS

12.1 CROISSANTS

12.11 OTHERS

13 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE

13.1 OVERVIEW

13.2 FLAVORED

13.2.1 CARAMEL

13.2.2 BUTTERSCOTCH

13.2.3 STRAWBERRY

13.2.4 VANILLA

13.2.5 BLUEBERRY

13.2.6 MOCHA

13.2.7 BANANA

13.2.8 CHERRY

13.2.9 PEPPERMINT

13.2.10 OTHERS

13.3 REGULAR

14 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 INDIRECT

14.2.1 STORE-BASED RETAILING

14.2.1.1 SUPERMARKETS/HYPERMARKETS

14.2.1.2 SPECIALTY STORES

14.2.1.3 CONVENIENCE STORES

14.2.1.4 WHOLESALERS

14.2.1.5 GROCERY STORES

14.2.1.6 OTHERS

14.2.2 NON-STORE RETAILING

14.2.2.1 ONLINE

14.2.2.2 VENDING

14.3 DIRECT

15 EUROPE BAKERY INCLUSIONS MARKET

15.1 EUROPE

15.1.1 FRANCE

15.1.2 GERMANY

15.1.3 ITALY

15.1.4 U.K.

15.1.5 SPAIN

15.1.6 BELGIUM

15.1.7 NETHERLAND

15.1.8 SWITZERLAND

15.1.9 RUSSIA

15.1.10 TURKEY

15.1.11 LUXEMBOURG

15.1.12 REST OF EUROPE

16 COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: EUROPE

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 DR. OETKER

18.1.1 COMPANY SNAPSHOT

18.1.2 PRODUCT PORTFOLIO

18.1.3 RECENT DEVELOPMENT

18.1.4 SWOT ANALYSIS

18.2 KERRY

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUS ANALYSIS

18.2.3 PRODUCT PORTFOLIO

18.2.4 RECENT DEVELOPMENTS

18.2.5 SWOT ANALYSIS

18.3 BARRY CALLEBAUT

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUS ANALYSIS

18.3.3 PRODUCT PORTFOLIO

18.3.4 RECENT DEVELOPMENT

18.3.5 SWOT ANALYSIS

18.4 THE KRAFT HEINZ COMPANY

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUS ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENT

18.4.5 SWOT ANALYSIS

18.5 PECAN DELUXE CANDY COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 PRODUCT PORTFOLIO

18.5.3 RECENT DEVELOPMENTS

18.5.4 SWOT ANALYSIS

18.6 AMERICAN SPRINKLE COMPANY

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENT

18.7 BRITANNIA SUPERFINE

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENTS

18.8 CACAU FOODS DO BRASIL.

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 CAPE FOODS

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENTS

18.1 GIRRBACH SÜßWARENDEKOR GMBH

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENTS

18.11 GÜNTHART & CO. KG

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 HANNS G. WERNER GMBH + CO. KG

18.12.1 COMPANY SNAPSHOT

18.12.2 PRODUCT PORTFOLIO

18.12.3 RECENT DEVELOPMENTS

18.13 NIMBUS FOODS LTD

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 PAULAUR CORPORATION

18.14.1 COMPANY SNAPSHOT

18.14.2 PRODUCT PORTFOLIO

18.14.3 RECENT DEVELOPMENT

18.15 SHANTOU HEHE TECHNOLOGY CO.,LTD

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENTS

18.16 SIGNATURE BRANDS, LLC.

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Lista de Tablas

TABLE 1 IMPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 2 EXPORT DATA OF PRODUCT: CHOCOLATE (USD THOUSAND)

TABLE 3 IMPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 4 EXPORT DATA OF PRODUCT: EDIBLE FRUIT AND NUTS (USD THOUSAND)

TABLE 5 CANADA'S BAKERY PRODUCTS, MARKET SIZE BY RETAIL VALUE SALES

TABLE 6 PRODUCTION AND CONSUMPTION OF BREAD 2020

TABLE 7 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 EUROPE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 13 EUROPE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE BERRIES INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 19 EUROPE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 EUROPE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 21 EUROPE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 22 EUROPE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 23 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 26 EUROPE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 27 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 28 EUROPE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 EUROPE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 EUROPE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 EUROPE BAKERY INCLUSIONS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 33 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 34 EUROPE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 35 EUROPE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 37 EUROPE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 42 EUROPE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 44 EUROPE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 45 EUROPE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 46 EUROPE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 47 EUROPE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 48 EUROPE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 49 EUROPE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 50 EUROPE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 51 EUROPE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 52 EUROPE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 EUROPE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 EUROPE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 55 EUROPE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 FRANCE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 57 FRANCE CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 FRANCE CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 FRANCE CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 60 FRANCE CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 61 FRANCE OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 FRANCE CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 63 FRANCE DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 FRANCE FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 65 FRANCE BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 66 FRANCE CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 67 FRANCE BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 FRANCE FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 FRANCE BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 70 FRANCE DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 71 FRANCE LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 72 FRANCE BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 73 FRANCE BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 74 FRANCE BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 75 FRANCE FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 76 FRANCE BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 77 FRANCE INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 FRANCE STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 79 FRANCE NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 GERMANY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 81 GERMANY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 GERMANY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 GERMANY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 GERMANY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 GERMANY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 GERMANY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 GERMANY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 GERMANY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 GERMANY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 90 GERMANY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 GERMANY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 92 GERMANY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 93 GERMANY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 94 GERMANY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 95 GERMANY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 96 GERMANY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 97 GERMANY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 GERMANY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 99 GERMANY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 100 GERMANY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 GERMANY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 102 GERMANY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 103 GERMANY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 104 ITALY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 105 ITALY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 ITALY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 107 ITALY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 ITALY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 ITALY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 ITALY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 ITALY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 ITALY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 ITALY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 ITALY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 ITALY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 116 ITALY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 117 ITALY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 118 ITALY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 119 ITALY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 120 ITALY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 ITALY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 122 ITALY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 123 ITALY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 124 ITALY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 ITALY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 ITALY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 127 ITALY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 128 U.K. BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 129 U.K. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 130 U.K. CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 131 U.K. CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 132 U.K. CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 U.K. OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 135 U.K. DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 U.K. FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 141 U.K. BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 142 U.K. DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 143 U.K. LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 144 U.K. BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 145 U.K. BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 146 U.K. BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 147 U.K. FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 148 U.K. BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 149 U.K. INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 150 U.K. STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 151 U.K. NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 152 SPAIN BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 153 SPAIN CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 154 SPAIN CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 SPAIN CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 SPAIN CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 157 SPAIN OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 158 SPAIN CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 159 SPAIN DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 160 SPAIN FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 161 SPAIN BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 SPAIN CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 SPAIN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 164 SPAIN FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 165 SPAIN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 166 SPAIN DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 167 SPAIN LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 168 SPAIN BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 169 SPAIN BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 170 SPAIN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 171 SPAIN FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 172 SPAIN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 173 SPAIN INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 SPAIN STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 175 SPAIN NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 BELGIUM BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 177 BELGIUM CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 BELGIUM CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 BELGIUM CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 BELGIUM CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 BELGIUM OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 182 BELGIUM CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 BELGIUM DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 BELGIUM FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 185 BELGIUM BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 186 BELGIUM CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 187 BELGIUM BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 188 BELGIUM FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 189 BELGIUM BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 190 BELGIUM DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 191 BELGIUM LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 192 BELGIUM BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 193 BELGIUM BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 BELGIUM BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 195 BELGIUM FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 196 BELGIUM BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 197 BELGIUM INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 198 BELGIUM STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 199 BELGIUM NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 200 NETHERLAND BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 NETHERLAND CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 202 NETHERLAND CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 203 NETHERLAND CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 NETHERLAND CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 205 NETHERLAND OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 206 NETHERLAND CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 207 NETHERLAND DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 208 NETHERLAND FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 NETHERLAND BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 210 NETHERLAND CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 NETHERLAND BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 212 NETHERLAND FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 213 NETHERLAND BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 214 NETHERLAND DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 215 NETHERLAND LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 216 NETHERLAND BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 217 NETHERLAND BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 218 NETHERLAND BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 219 NETHERLAND FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 220 NETHERLAND BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 221 NETHERLAND INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 NETHERLAND STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 223 NETHERLAND NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 224 SWITZERLAND BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWITZERLAND CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWITZERLAND CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 227 SWITZERLAND CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 228 SWITZERLAND CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWITZERLAND OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 230 SWITZERLAND CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 231 SWITZERLAND DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 SWITZERLAND FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 233 SWITZERLAND BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 234 SWITZERLAND CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 235 SWITZERLAND BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 236 SWITZERLAND FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 237 SWITZERLAND BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 238 SWITZERLAND DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 239 SWITZERLAND LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 240 SWITZERLAND BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 241 SWITZERLAND BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 242 SWITZERLAND BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 243 SWITZERLAND FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 244 SWITZERLAND BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 245 SWITZERLAND INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 246 SWITZERLAND STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 247 SWITZERLAND NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 248 RUSSIA BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 249 RUSSIA CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 250 RUSSIA CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 RUSSIA CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 252 RUSSIA CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 RUSSIA OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 RUSSIA CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 255 RUSSIA DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 256 RUSSIA FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 257 RUSSIA BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 258 RUSSIA CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 259 RUSSIA BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 260 RUSSIA FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 261 RUSSIA BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 262 RUSSIA DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 263 RUSSIA LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 264 RUSSIA BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 265 RUSSIA BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 266 RUSSIA BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 267 RUSSIA FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 268 RUSSIA BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 269 RUSSIA INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 270 RUSSIA STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 271 RUSSIA NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 272 TURKEY BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 273 TURKEY CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 TURKEY CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 275 TURKEY CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 276 TURKEY CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 277 TURKEY OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 278 TURKEY CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 TURKEY DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 280 TURKEY FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 TURKEY BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 TURKEY CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 283 TURKEY BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 284 TURKEY FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 285 TURKEY BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 286 TURKEY DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 287 TURKEY LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 288 TURKEY BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 289 TURKEY BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 290 TURKEY BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 291 TURKEY FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 292 TURKEY BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 293 TURKEY INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 294 TURKEY STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 295 TURKEY NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 296 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

TABLE 297 LUXEMBOURG CHOCOLATE INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 298 LUXEMBOURG CHOCOLATE CHUNKS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 299 LUXEMBOURG CHOCOLATE FLAKES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 300 LUXEMBOURG CHOCOLATE SYRUPS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 301 LUXEMBOURG OTHERS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 302 LUXEMBOURG CARAMEL INCLUSIONS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 303 LUXEMBOURG DRIED FRUITS AND NUTS IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 304 LUXEMBOURG FRUIT INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 305 LUXEMBOURG BERRIES IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 306 LUXEMBOURG CITRUS FRUITS INCLUSION IN BAKERY INCLUSIONS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 307 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 308 LUXEMBOURG FOOD SERVICE INDUSTRY IN BAKERY INCLUSIONS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 309 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 310 LUXEMBOURG DRY IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 311 LUXEMBOURG LIQUID IN BAKERY INCLUSIONS MARKET, BY FORM, 2020-2029 (USD MILLION)

TABLE 312 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 313 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 314 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 315 LUXEMBOURG FLAVORED IN BAKERY INCLUSIONS MARKET, BY FLAVOR TYPE, 2020-2029 (USD MILLION)

TABLE 316 LUXEMBOURG BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 317 LUXEMBOURG INDIRECT IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 318 LUXEMBOURG STORE-BASED RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 319 LUXEMBOURG NON-STORE RETAILING IN BAKERY INCLUSIONS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 320 REST OF EUROPE BAKERY INCLUSIONS MARKET, BY INCLUSION TYPE, 2020-2029 (USD MILLION)

Lista de figuras

FIGURE 1 EUROPE BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 2 EUROPE BAKERY INCLUSIONS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE BAKERY INCLUSIONS MARKET : DROC ANALYSIS

FIGURE 4 EUROPE BAKERY INCLUSIONS MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 EUROPE BAKERY INCLUSIONS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE BAKERY INCLUSIONS MARKET : INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE BAKERY INCLUSIONS MARKET : DBMR MARKET POSITION GRID

FIGURE 8 EUROPE BAKERY INCLUSIONS MARKET : VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE BAKERY INCLUSIONS MARKET: SEGMENTATION

FIGURE 10 INCREASING DEMAND OF BAKERY PRODUCTS AND INCREASE IN DEMAND OF READY TO EAT PRODUCTS ARE LEADING THE GROWTH OF THE EUROPE BAKERY INCLUSIONS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCLUSION TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE BAKERY INCLUSIONS MARKETIN 2022 & 2029

FIGURE 12 PATENT REGISTERED FOR BAKERY INCLUSIONS, BY COUNTRY

FIGURE 13 PATENT REGISTERED YEAR (2018 - 2022)

FIGURE 14 SUPPLY CHAIN OF EUROPE BAKERY INCLUSIONS MARKET

FIGURE 15 VALUE CHAIN OF EUROPE BAKERY INCLUSIONS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE BAKERY INCLUSIONS MARKET

FIGURE 17 AVERAGE ANNUAL EXPENDITURE BY BAKERY PRODUCTS (2017-2020)

FIGURE 18 WORLDWIDE GDP PER CAPITA INCOME (2015-2020)

FIGURE 19 U.S. BAKERY PRODUCTS SALES SHARED IN 2021

FIGURE 20 GLOBAL NUMBER OF PEOPLE SIGNING TO 'VEGANUARY' CAMPAIGN, (2014-2019)

FIGURE 21 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE, 2021

FIGURE 22 EUROPE BAKERY INCLUSIONS MARKET: BY END USER, 2021

FIGURE 23 EUROPE BAKERY INCLUSIONS MARKET: BY FORM, 2021

FIGURE 24 EUROPE BAKERY INCLUSIONS MARKET: BY SOURCE, 2021

FIGURE 25 EUROPE BAKERY INCLUSIONS MARKET: BY APPLICATION, 2021

FIGURE 26 EUROPE BAKERY INCLUSIONS MARKET: BY FLAVOR TYPE, 2021

FIGURE 27 EUROPE BAKERY INCLUSIONS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 28 EUROPE BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 29 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 30 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029

FIGURE 31 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 32 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 33 EUROPE BAKERY INCLUSIONS MARKET: SNAPSHOT (2021)

FIGURE 34 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021)

FIGURE 35 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 36 EUROPE BAKERY INCLUSIONS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 37 EUROPE BAKERY INCLUSIONS MARKET: BY INCLUSION TYPE (2022-2029)

FIGURE 38 EUROPE BAKERY INCLUSIONS MARKET: COMPANY SHARE 2021 (%)

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.