Europe Blood Plasma And Plasma Derived Medicinal Products Market

Taille du marché en milliards USD

TCAC :

%

USD

7.96 Billion

USD

13.75 Billion

2024

2032

USD

7.96 Billion

USD

13.75 Billion

2024

2032

| 2025 –2032 | |

| USD 7.96 Billion | |

| USD 13.75 Billion | |

|

|

|

|

Segmentation du marché européen du plasma sanguin et des médicaments dérivés du plasma, par produit ( immunoglobulines , facteurs de coagulation (pour les troubles de la coagulation), albumine (expanseur de volume plasmatique), inhibiteurs de protéase (pour les déficiences génétiques), anticorps monoclonaux (dérivés des plasmocytes) et autres protéines dérivées du plasma), application (immunologie, hématologie, soins intensifs, neurologie, pneumologie, hémato-oncologie , rhumatologie et autres applications), technologie de traitement (chromatographie par échange d'ions, chromatographie d'affinité, cryoprécipitation, ultrafiltration et microfiltration), mode (fractionnement du plasma moderne et traditionnel), utilisateur final (hôpitaux et cliniques, laboratoires de recherche, instituts universitaires et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché du plasma sanguin et des médicaments dérivés du plasma

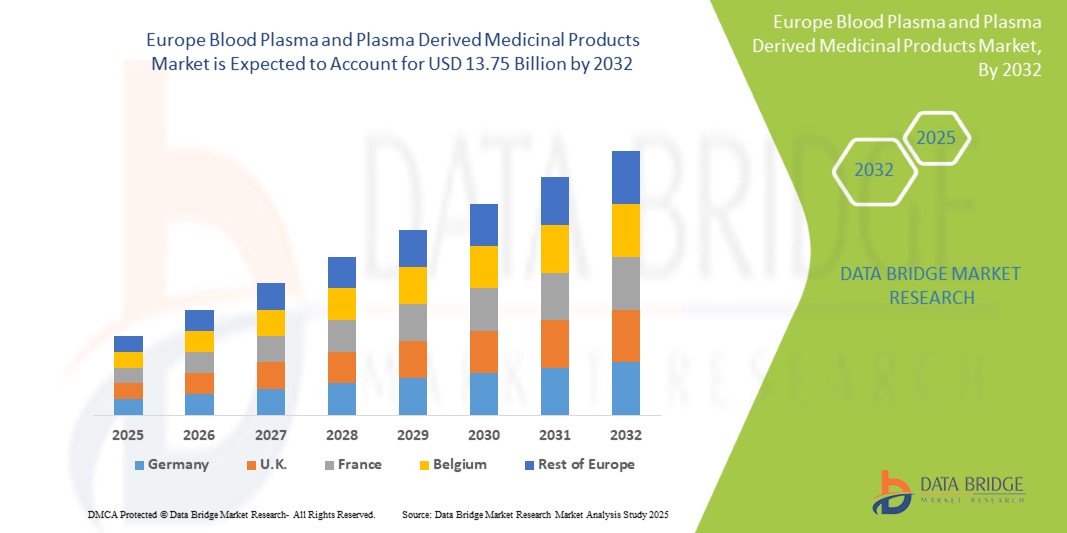

- Le marché européen du plasma sanguin et des médicaments dérivés du plasma était évalué à 7,96 milliards USD en 2024 et devrait atteindre 13,75 milliards USD d'ici 2032 , à un TCAC de 7,11 %, au cours de la période de prévision.

- La croissance du marché est largement alimentée par la prévalence croissante des maladies rares et chroniques

- De plus, les avancées technologiques en matière de fractionnement du plasma sanguin et des médicaments dérivés du plasma accélèrent l'adoption de solutions à base de plasma sanguin et de médicaments dérivés du plasma, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché du plasma sanguin et des médicaments dérivés du plasma

- Le marché est en pleine expansion en raison de la demande accrue de thérapies dérivées du plasma dans le traitement de maladies telles que l'hémophilie, les troubles d'immunodéficience et les maladies auto-immunes, soutenue par une sensibilisation croissante et des progrès en médecine transfusionnelle.

- Les progrès technologiques en matière de collecte de sang, de fractionnement et de logistique de la chaîne du froid améliorent la qualité et la durée de conservation des produits, encourageant une adoption plus large dans les hôpitaux, les centres de traumatologie et les laboratoires de diagnostic du monde entier.

- L'Allemagne devrait dominer le marché du plasma sanguin et des médicaments dérivés du plasma avec une part de 18,16 % en 2025 en raison de l'amélioration des infrastructures de santé, de la demande croissante de thérapies plasmatiques, du soutien accru du gouvernement et de la prévalence croissante des maladies chroniques et infectieuses.

- L'Allemagne devrait être la région connaissant la croissance la plus rapide sur le marché du plasma sanguin et des médicaments dérivés du plasma en raison de l'augmentation des investissements dans les soins de santé, de la prévalence croissante des maladies chroniques et infectieuses, de l'amélioration des installations de diagnostic, de la sensibilisation croissante à la sécurité du sang et des initiatives gouvernementales visant à améliorer l'accessibilité et l'infrastructure de la thérapie plasmatique.

- Le segment des immunoglobulines devrait dominer le marché du plasma sanguin et des médicaments dérivés du plasma avec une part de 42,20 % en 2025 en raison de la demande croissante de thérapies ciblées, de l'amélioration des technologies de purification et de la prévalence croissante des troubles liés au système immunitaire.

Portée du rapport et segmentation du marché du plasma sanguin et des médicaments dérivés du plasma

|

Attributs |

Informations clés sur le marché du plasma sanguin et des médicaments dérivés du plasma |

|

Segments couverts |

|

|

Pays couverts |

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research incluent également une analyse approfondie des experts, une épidémiologie des patients, une analyse du pipeline, une analyse des prix et un cadre réglementaire. |

Tendances du marché du plasma sanguin et des médicaments dérivés du plasma

« Prévalence croissante des maladies rares et chroniques »

- L’un des principaux moteurs du marché du plasma sanguin et des médicaments dérivés du plasma est la prévalence croissante des maladies rares et chroniques à l’échelle mondiale, alimentée par les progrès des technologies de diagnostic et une sensibilisation accrue des prestataires de soins de santé et des patients.

- Par exemple, en avril 2025, les données des CDC ont révélé que 76,4 % des adultes américains souffraient d'au moins une maladie chronique et que 51,4 % souffraient de plusieurs maladies. Cette tendance à la hausse, également observée chez les jeunes adultes, a intensifié la demande de soins à vie, notamment pour des maladies comme l'hémophilie, les déficits immunitaires primaires et la maladie de von Willebrand.

- Les traitements dérivés du plasma, tels que les immunoglobulines, les facteurs de coagulation et l'albumine, sont essentiels à la prise en charge de ces affections chroniques. Les patients atteints d'immunodéficience primaire dépendent des IgIV pour leur soutien immunitaire, tandis que les patients hémophiles nécessitent des perfusions régulières de facteurs de coagulation pour prévenir les épisodes hémorragiques.

- Le vieillissement de la population mondiale accentue encore cette tendance, les personnes âgées étant de plus en plus touchées par des maladies telles que la cirrhose du foie, le myélome multiple et les maladies inflammatoires, qui nécessitent toutes des interventions dérivées du plasma.

- En mars 2025, une étude publiée dans PMC a mis en lumière l'immense fardeau mondial des maladies rares, notamment chez les enfants. Malgré les progrès de la médecine génomique et du développement de médicaments orphelins, les retards diagnostiques et les options thérapeutiques limitées persistent, soulignant la nécessité d'une prise en charge multidisciplinaire et soutenue.

- La demande croissante de thérapies dérivées du plasma sûres, efficaces et de haute qualité est un facteur essentiel qui stimule le marché du plasma sanguin et des médicaments dérivés du plasma, car ces produits jouent un rôle crucial dans la gestion des maladies chroniques et dans la réponse aux besoins médicaux non satisfaits en Europe.

Dynamique du marché du plasma sanguin et des médicaments dérivés du plasma

Conducteur

« Population gériatrique en expansion »

- La demande croissante de plasma sanguin et de produits médicaux dérivés du plasma est fortement motivée par le vieillissement de la population mondiale, qui est plus sujette aux maladies chroniques et dégénératives telles que les troubles du système immunitaire, les maladies neurologiques, les complications hépatiques et les problèmes liés au sang qui nécessitent des thérapies à base de plasma, notamment des immunoglobulines, de l'albumine et des facteurs de coagulation.

- Par exemple, en mars 2025, une étude publiée dans PMC analysant les données de l'échantillon national de patients hospitalisés (NIS) des États-Unis de 2010 à 2024 a révélé que la croissance rapide de la population âgée a entraîné une hausse substantielle des admissions à l'hôpital, des séjours hospitaliers plus longs et des taux de réadmission plus élevés. Cette tendance, largement due aux maladies chroniques et à la multimorbidité, met en évidence la pression croissante sur les systèmes de santé et la demande correspondante de traitements dérivés du plasma.

- Avec l'âge, le système immunitaire s'affaiblit, augmentant la vulnérabilité aux infections et aux maladies auto-immunes. Les traitements par immunoglobulines sont fréquemment utilisés dans la prise en charge de pathologies telles que la polyneuropathie inflammatoire démyélinisante chronique (PIDC), tandis que l'albumine est essentielle à la gestion de l'équilibre hydrique lors des interventions chirurgicales et des soins intensifs chez les patients âgés.

- Les pays où la proportion de personnes âgées est élevée connaissent une augmentation soutenue de la consommation de plasma de référence. Cette tendance démographique exerce une pression considérable sur les systèmes de santé nationaux, qui doivent garantir la continuité des chaînes d'approvisionnement et une collecte adéquate de plasma.

- L'augmentation prévue de la population mondiale âgée de 60 ans et plus – de 1,1 milliard en 2023 à 2,1 milliards en 2050, selon les estimations de l'OMS – souligne encore davantage le rôle crucial des soins gériatriques. Cette évolution démographique non seulement amplifie le besoin d'accompagnement thérapeutique à long terme, mais positionne également la population âgée comme un segment de marché clé et durable pour les PDMP en Europe.

Retenue/Défi

« Processus de fabrication complexe et coûteux »

- Le coût élevé et la complexité de la fabrication du plasma sanguin et des médicaments dérivés du plasma constituent un obstacle majeur à l'expansion du marché. Ce processus nécessite des protocoles rigoureux de collecte de plasma, un dépistage approfondi des agents pathogènes et un fractionnement en plusieurs étapes dans des environnements stériles et conformes aux BPF, ce qui rend la production très gourmande en ressources et chronophage.

- Par exemple, une analyse détaillée d'Aykon Biosciences a souligné que la fabrication de produits biologiques complexes, tels que les thérapies dérivées du plasma, est confrontée à une pression croissante sur les coûts en raison du coût élevé des matières premières, des exigences en matière de main-d'œuvre qualifiée et des exigences réglementaires de plus en plus strictes. L'évolution vers des thérapies spécialisées et personnalisées accroît encore les coûts, nécessitant des technologies de pointe et des systèmes d'assurance qualité rigoureux.

- De plus, le cycle de fabrication des PDMP peut s'étendre jusqu'à 12 mois, ce qui nécessite une logistique de la chaîne du froid pour le stockage et le transport tout au long du processus. Ces facteurs augmentent considérablement les dépenses d'investissement et d'exploitation, limitant l'évolutivité et dissuadant les petits acteurs et les économies en développement de participer efficacement au marché.

- Le caractère coûteux de la production contribue également à la cherté du produit final, ce qui réduit son accessibilité et son coût, notamment dans les pays à revenu faible ou intermédiaire où les budgets de santé sont limités. Ce fardeau financier complique la satisfaction de la demande mondiale croissante, freinant ainsi l'adoption des médicaments de prévention et de traitement à l'échelle mondiale.

- Si l'innovation technologique en cours peut progressivement améliorer la rentabilité, les coûts élevés actuels de production et de transformation demeurent un frein majeur. Relever ces défis grâce à des technologies de fabrication améliorées, à un renforcement des infrastructures des donateurs et à un financement de santé publique favorable sera crucial pour élargir l'accès au marché et assurer une couverture thérapeutique équitable.

Blood Plasma & Plasma Derived Medicinal Products Market Scope

The market is segmented on the basis of product, application, processing technology, mode, end user, and distribution channel.

- By Product

On the basis of product, the market is segmented into immunoglobulins, coagulation factors (for bleeding disorders), albumin (plasma volume expander), protease inhibitors (for genetic deficiencies), monoclonal antibodies (derived from plasma cells), and other plasma derived proteins. In 2025, the immunoglobulins segment is expected to dominate the market with a market share of 42.20% in 2025, driven by its rising immunodeficiency diagnoses, autoimmune diseases, and increasing intravenous immunoglobulin (IVIG) use.

The coagulation factors (for bleeding disorders) segment is anticipated to witness the fastest growth rate of 7.27% from 2025 to 2032, fueled by rising hemophilia cases, improved diagnostic access, government support, and expanding use of recombinant and plasma-derived therapies.

- By Application

On the basis of application, the market is segmented into immunology, hematology, critical care, neurology, pulmonology, haemato-oncology, rheumatology, and other applications. The immunology segment held the largest market revenue share in 2025, driven by its widespread use in treating primary immunodeficiencies, autoimmune disorders, and rising global demand for intravenous immunoglobulin (IVIG).

The immunology segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing prevalence of autoimmune diseases, rising aging population, and expanding clinical applications of immunoglobulin therapies.

- By Processing Technology

On the basis of processing technology, the market is segmented into ion exchange chromatography, affinity chromatography, cryoprecipitation, ultrafiltration, and microfiltration. The ion exchange chromatography segment held the largest market revenue share in 2025, driven by high efficiency, scalability, and effectiveness in purifying plasma proteins like immunoglobulins, albumin, and coagulation factors.

The affinity chromatography segment is expected to witness the fastest CAGR from 2025 to 2032, favored for its high specificity, ability to isolate target proteins, and growing adoption in advanced biologics purification.

- By Mode

On the basis of mode, the market is segmented into modern and traditional plasma fractionation. The modern segment accounted for the largest market revenue share in 2025, driven advanced processing technologies, higher product purity, improved safety profiles, and increased adoption of recombinant and high-yield plasma-derived therapies.

The modern segment is expected to witness the fastest CAGR from 2025 to 2032, driven innovation in purification techniques, rising demand for safer biologics, and growing investments in next-generation plasma processing technologies.

- By End User

En fonction de l'utilisateur final, le marché est segmenté en hôpitaux et cliniques, laboratoires de recherche, instituts universitaires, etc. En 2025, ce segment représentait la plus grande part de chiffre d'affaires du marché, grâce à son volume élevé de patients, à la disponibilité de soins spécialisés, à l'augmentation du nombre de traitements contre les maladies chroniques et à l'accès aux thérapies avancées dérivées du plasma.

Le segment des hôpitaux et des cliniques devrait également connaître le TCAC le plus rapide de 2025 à 2032, propulsé par l'expansion des infrastructures de santé, l'augmentation des admissions de patients hospitalisés et le recours croissant aux thérapies plasmatiques pour les affections complexes.

- Par canal de distribution

En fonction du canal de distribution, le marché est segmenté en appels d'offres directs, distributeurs tiers et autres. Le segment des appels d'offres directs représentait la plus grande part de chiffre d'affaires du marché en 2025, grâce aux achats groupés des organismes gouvernementaux, à la rentabilité, à la sécurité des chaînes d'approvisionnement et à l'augmentation des investissements du secteur public dans les médicaments dérivés du plasma.

Le segment des appels d'offres directs devrait également connaître le TCAC le plus rapide de 2025 à 2032, propulsé par l'expansion des programmes de santé gouvernementaux, les politiques d'approvisionnement centralisées et la demande croissante de distribution de thérapies plasmatiques rentables et à grande échelle.

Analyse régionale du marché du plasma sanguin et des médicaments dérivés du plasma

- L'Allemagne domine le marché du plasma sanguin et des médicaments dérivés du plasma avec la plus grande part de revenus de 18,16 % et devrait connaître le TCAC le plus rapide de 7,56 % en 2025, grâce à une infrastructure de soins de santé avancée, des taux de diagnostic accrus de maladies rares et chroniques et des dépenses de santé élevées par habitant.

- Le cadre réglementaire solide du pays, ses systèmes de remboursement robustes et la présence d'acteurs majeurs du marché tels que Grifols, CSL Behring et Takeda contribuent au leadership européen en matière de collecte de plasma et de distribution de thérapies.

- Les principales économies investissent massivement dans la R&D biopharmaceutique, étendent les réseaux de collecte de plasma et améliorent l'accès aux thérapies dérivées du plasma pour l'immunologie, l'hématologie et la neurologie.

Aperçu du marché français du plasma sanguin et des médicaments dérivés du plasma

La France devrait connaître une forte croissance en Europe entre 2025 et 2032, grâce à son écosystème de santé bien établi, à la croissance de son bassin de patients atteints de maladies rares et chroniques, et à de solides initiatives gouvernementales en faveur du don de plasma. Le grand nombre de centres de collecte de plasma et l'accélération des approbations des médicaments de substitution améliorent l'accessibilité aux traitements et stimulent l'expansion du marché.

Aperçu du marché britannique du plasma sanguin et des médicaments dérivés du plasma

Le Royaume-Uni devrait enregistrer un TCAC important dans la région entre 2025 et 2032, grâce à son système de santé universel, à la sensibilisation croissante aux maladies rares et aux investissements publics dans le développement des capacités nationales de collecte de plasma. Les partenariats stratégiques et les avancées dans la fabrication de produits biologiques renforcent sa présence dans le paysage des médicaments de pointe.

Part de marché du plasma sanguin et des médicaments dérivés du plasma

L'industrie du plasma sanguin et des médicaments dérivés du plasma est principalement dirigée par des entreprises bien établies, notamment :

- CSL (Australie)

- Takeda Pharmaceutical Company Limited (Japon)

- Grifols, SA (Espagne)

- Octapharma AG (Suisse)

- Kedrion (Italie)

- Sérums Bharat (Inde)

- Biotest AG (Allemagne)

- Fresenius Kabi AG (Allemagne)

- Intas Pharmaceuticals Ltd. (Inde)

- Kamada Pharmaceuticals (Israël)

- KM Biologics (Japon)

- LFB (États-Unis)

- Reliance Life Sciences (Inde)

- SK Plasma (Corée du Sud)

- Synthaverse SA (Pologne)

- VIRCHOW BIOTECH (Inde)

Dernières évolutions du marché du plasma sanguin et des médicaments dérivés du plasma

- En novembre 2024, CSL Plasma a étendu l'adoption du système avancé de don de plasma Rika à six centres de don américains situés près de Denver, au Colorado. Ces nouveaux dispositifs, développés conjointement avec Terumo Blood & Cell Technologies, ont permis de réduire les délais de collecte d'environ 30 % tout en améliorant le confort, la sécurité et l'efficacité des donneurs.

- En décembre 2022, CSL a inauguré sa nouvelle usine de fractionnement du plasma de Broadmeadows, dans l'État de Victoria, en Australie. Il s'agit du plus grand site de traitement de grains de plasma de l'hémisphère sud. D'une capacité de traitement de 9,2 millions de litres d'équivalent plasma par an, cette installation de 900 millions de dollars américains répond à la demande mondiale de thérapies à base de plasma pour le traitement des déficits immunitaires, des troubles neurologiques et des affections graves comme les greffes et les brûlures.

- En juin 2024, Takeda a annoncé une extension de 30 millions de dollars US de son usine de fractionnement du plasma de Los Angeles, leader mondial en termes de capacité. Cette modernisation devrait permettre d'augmenter le volume de production jusqu'à 2 millions de litres par an, contribuant ainsi à répondre à la demande mondiale croissante de thérapies dérivées du plasma utilisées dans le traitement des déficits immunitaires et des troubles de la coagulation.

- En 2023, Takeda a investi environ 765 millions de dollars dans la construction d'une nouvelle usine de fabrication de thérapies dérivées du plasma à Osaka, au Japon, quintuplant ainsi la capacité de son site actuel de Narita. Cette usine devrait être pleinement opérationnelle d'ici 2030 et desservira les marchés japonais et internationaux.

- En mars 2025, Grifols s'est associé à Inpeco pour intégrer la robotique d'automatisation avancée (FlexLab X), les diagnostics et les réactifs, créant ainsi des « laboratoires du futur » pour des tests sanguins et plasmatiques à haut débit, plus sûrs et traçables dans les laboratoires de médecine transfusionnelle. Les laboratoires analysent des échantillons biologiques pour diagnostiquer, surveiller et rechercher des maladies.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INDUSTRY RIVALRY

4.3 SUPPLY CHAIN IMPACT ON THE EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET

4.3.1 OVERVIEW

4.3.2 RAW MATERIAL AVAILABILITY

4.3.3 MANUFACTURING CAPACITY

4.3.4 LOGISTICS AND LAST-MILE HURDLES

4.3.5 PRICING MODELS AND MARKET POSITIONING

4.4 INNOVATION STRATEGIES

4.4.1 KEY INNOVATION STRATEGIES

4.4.2 EMERGING DELIVERY TECHNIQUES

4.4.3 STRATEGIC IMPLICATIONS

4.4.4 CONCLUSION

4.5 RISK AND MITIGATION

4.6 VENDOR SELECTION DYNAMICS

4.6.1 PRODUCT QUALITY AND REGULATORY COMPLIANCE

4.6.2 SUPPLY CHAIN CAPABILITIES AND RELIABILITY

4.6.3 CLINICAL EFFICACY AND INNOVATION

4.6.4 COST COMPETITIVENESS AND REIMBURSEMENT COMPATIBILITY

4.6.5 LOCAL MARKET PRESENCE AND SUPPORT INFRASTRUCTURE

4.6.6 ETHICAL SOURCING, ESG COMPLIANCE, AND TRANSPARENCY

4.6.7 CONCLUSION

4.7 TARIFFS AND THEIR IMPACT ON MARKET

4.7.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.7.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.7.3 VENDOR SELECTION CRITERIA DYNAMICS

4.7.4 IMPACT ON SUPPLY CHAIN

4.7.5 IMPACT ON PRICES

4.7.6 REGULATORY INCLINATION

4.7.6.1 GCC TRADE ALIGNMENT & FTAS

4.7.6.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.7.6.3 LOCAL SUBSIDY & POLICY RESPONSE

4.7.6.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF RARE AND CHRONIC DISEASES

6.1.2 EXPANDING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN PLASMA FRACTIONATION

6.1.4 GOVERNMENT AND INSTITUTIONAL SUPPORT

6.2 RESTRAINTS

6.2.1 HIGH COST AND COMPLEX MANUFACTURING PROCESS

6.2.2 LACK OF PLASMA SUPPLY AND DONOR

6.3 OPPORTUNITIES

6.3.1 ADVANCEMENTS IN PLASMA PROCESSING TECHNOLOGIES TO ENHANCE YIELD AND REDUCE COSTS

6.3.2 REIMBURSEMENT FRAMEWORKS AND INCREASED GOVERNMENTAL FOCUS ON RARE DISEASE TREATMENT

6.3.3 STRATEGIC ALLIANCES, MERGERS, AND ACQUISITIONS TO STRENGTHEN EUROPE MARKET PENETRATION

6.4 CHALLENGES

6.4.1 COMPETITIVE PRESSURE FROM RECOMBINANT AND ALTERNATIVE BIOLOGICAL THERAPIES

6.4.2 INFRASTRUCTURE LIMITATIONS IN COLD CHAIN LOGISTICS IMPACTING PRODUCT DISTRIBUTION

7 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 IMMUNOGLOBULINS

7.3 COAGULATION FACTORS (FOR BLEEDING DISORDERS)

7.4 ALBUMIN (PLASMA VOLUME EXPANDER)

7.5 PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)

7.6 MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS)

7.7 OTHER PLASMA DERIVED PROTEINS

8 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 IMMUNOLOGY

8.3 HEMATOLOGY

8.4 CRITICAL CARE

8.5 NEUROLOGY

8.6 PULMONOLOGY

8.7 HAEMATO-ONCOLOGY

8.8 RHEUMATOLOGY

8.9 OTHER APPLICATIONS

9 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ION EXCHANGE CHROMATOGRAPHY

9.3 AFFINITY CHROMATOGRAPHY

9.4 CRYOPRECIPITATION

9.5 ULTRAFILTRATION

9.6 MICROFILTRATION

10 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE

10.1 OVERVIEW

10.2 MODERN

10.3 TRADITIONAL PLASMA FRACTIONATION

11 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER

11.1 OVERVIEW

11.2 HOSPITALS & CLINICS

11.3 RESEARCH LABS

11.4 ACADEMIC INSTITUTES

11.5 OTHERS

12 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDERS

12.3 THIRD PARTY DISTRIBUTORS

12.4 OTHERS

13 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION

13.1 EUROPE

13.1.1 GERMANY

13.1.2 FRANCE

13.1.3 U.K

13.1.4 ITALY

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 TURKEY

13.1.8 NETHERLANDS

13.1.9 SWITZERLAND

13.1.10 POLAND

13.1.11 DENMARK

13.1.12 SWEDEN

13.1.13 BELGIUM

13.1.14 IRELAND

13.1.15 NORWAY

13.1.16 FINLAND

13.1.17 REST OF EUROPE

14 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 CSL

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENTS

16.3 GRIFOLS, S.A.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT DEVELOPMENTS

16.4 OCTAPHARMA AG

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 KEDRION

16.5.1 COMPANY SNAPSHOT

16.5.2 COMPANY SHARE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENT

16.6 ADMA BIOLOGICS, INC

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENT

16.7 AEGROS

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT DEVELOPMENT

16.8 BHARAT SERUMS

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENT

16.9 BIOTEST AG.

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 FRESENIUS KABI AG

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENT

16.11 GC BIOPHARMA CORPORATE

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENT

16.12 ICHOR

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 INTAS PHARMACEUTICALS LTD.

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 KAMADA PHARMACEUTICALS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KM BIOLOGICS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LFB

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 PLASMAGEN BIOSCIENCES PVT. LTD.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 PROLIANT HEALTH & BIOLOGICALS

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENT

16.19 PROMEA

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 RELIANCE LIFE SCIENCES

16.20.1 COMPANY SNAPSHOT

16.20.2 BUSINESS PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SICHUAN YUANDA SHYUANG PHARMACEUTICAL CO., LTD.

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENT

16.22 SK PLASMA

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SYNTHAVERSE S. A.

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 TAIBANG BIO GROUP CO., LTD

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENT

16.25 VIRCHOW BIOTECH

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK AND GUIDELINES

TABLE 2 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 3 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 4 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 5 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 6 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 7 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 8 EUROPE COAGULATION FACTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 9 EUROPE FACTOR IX IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 10 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 11 EUROPE FACTOR VIII IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 12 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 13 EUROPE FIBRINOGEN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 14 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 15 EUROPE VON WILLEBRAND FACTOR (VWF) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 16 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 17 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 18 IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 19 EUROPE ALBUMIN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 20 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES)IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 21 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 22 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 23 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 24 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS )IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 25 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 26 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 27 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 28 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2025-2032 (USD THOUSAND)

TABLE 29 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2025-2032 (USD THOUSAND)

TABLE 30 EUROPE IMMUNOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 31 EUROPE HEMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 32 EUROPE CRITICAL CARE IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 33 EUROPE NEUROLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 34 EUROPE PULMONOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 35 EUROPE HEMATOLOGY -ONCOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 36 EUROPE RHEUMATOLOGY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 37 EUROPE OTHER APPLICATIONS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 38 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

TABLE 39 EUROPE ION EXCHANGE CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 40 EUROPE AFFINITY CHROMATOGRAPHY IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 41 EUROPE CRYOPRECIPITATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 42 EUROPE ULTRAFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 43 EUROPE MICROFILTRATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 44 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2025-2032 (USD THOUSAND)

TABLE 45 EUROPE MODERN IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 46 EUROPE TRADITIONAL PLASMA FRACTIONATION IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 47 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2025-2032 (USD THOUSAND)

TABLE 48 EUROPE HOSPITALS & CLINICS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 49 EUROPE RESEARCH LABS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 50 EUROPE ACADEMIC INSTITUTES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 51 EUROPE OTHERS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 52 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

TABLE 53 EUROPE DIRECT TENDERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 54 EUROPE THIRD PARTY DISTRIBUTORS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 55 EUROPE OTHERS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY REGION, 2025-2032 (USD THOUSAND)

TABLE 56 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 57 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 58 EUROPE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 EUROPE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 EUROPE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 EUROPE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 EUROPE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 EUROPE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 EUROPE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 EUROPE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 EUROPE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 EUROPE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 EUROPE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 EUROPE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 EUROPE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 EUROPE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 EUROPE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 EUROPE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 EUROPE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 EUROPE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 EUROPE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 EUROPE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 80 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 81 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 82 EUROPE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 83 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 84 GERMANY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 GERMANY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 GERMANY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 GERMANY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 GERMANY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 GERMANY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 GERMANY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 GERMANY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 GERMANY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 GERMANY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 GERMANY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 GERMANY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 GERMANY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 GERMANY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 GERMANY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 GERMANY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 GERMANY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 GERMANY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 GERMANY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 105 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 106 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 107 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 108 GERMANY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 109 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 110 FRANCE IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 FRANCE INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 FRANCE INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 FRANCE COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 FRANCE FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 FRANCE RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 FRANCE FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 FRANCE RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 FRANCE FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 FRANCE PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 FRANCE VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 FRANCE FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 GERMANY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 FRANCE FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 FRANCE ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 FRANCE PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 FRANCE ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 FRANCE C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 FRANCE MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 FRANCE OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 FRANCE ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 132 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 133 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 134 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 135 FRANCE BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 136 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 137 U.K. IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 U.K. INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 U.K. INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 U.K. COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 U.K. FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 U.K. RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 U.K. FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.K. RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 U.K. FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.K. PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 U.K. VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 U.K. FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 U.K. FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 U.K. ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 U.K. PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 U.K. ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 U.K. C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 U.K. MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 U.K. OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.K. ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 158 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 159 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 160 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 161 U.K. BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 162 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 163 ITALY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 ITALY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 ITALY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 ITALY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 ITALY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 ITALY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 ITALY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 ITALY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 ITALY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 ITALY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 ITALY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 ITALY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 ITALY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 ITALY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 ITALY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 ITALY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 ITALY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 ITALY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 ITALY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 ITALY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 184 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 185 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 186 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 187 ITALY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 188 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 189 SPAIN IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 SPAIN INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 SPAIN INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SPAIN COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 SPAIN FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 SPAIN RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 SPAIN FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SPAIN RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 SPAIN FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 SPAIN PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 SPAIN VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 200 SPAIN FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 SPAIN FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 SPAIN ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 SPAIN PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SPAIN ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 SPAIN C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 SPAIN MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 207 SPAIN OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SPAIN ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 209 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 210 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 211 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 212 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 213 SPAIN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 214 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 215 RUSSIA IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 RUSSIA INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 217 RUSSIA INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 218 RUSSIA COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 219 RUSSIA FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 220 RUSSIA RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 221 RUSSIA FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 222 RUSSIA RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 223 RUSSIA FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 224 RUSSIA PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 225 RUSSIA VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 226 RUSSIA FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 227 RUSSIA FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 RUSSIA ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 229 RUSSIA PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 230 RUSSIA ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 231 RUSSIA C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 RUSSIA MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 233 RUSSIA OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 234 RUSSIA ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 235 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 236 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 237 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 238 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 239 RUSSIA BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 240 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 241 TURKEY IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 242 TURKEY INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 243 TURKEY INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 TURKEY COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 245 TURKEY FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 246 TURKEY RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 247 TURKEY FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 248 TURKEY RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 249 TURKEY FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 250 TURKEY PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 251 TURKEY VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 TURKEY FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 253 TURKEY FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 254 TURKEY ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 255 TURKEY PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 256 TURKEY ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 257 TURKEY C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 258 TURKEY MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 259 TURKEY OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 260 TURKEY ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 261 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 262 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 263 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 264 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 265 TURKEY BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 266 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 267 NETHERLANDS IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 NETHERLANDS INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 269 NETHERLANDS INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 270 NETHERLANDS COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 271 NETHERLANDS FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 272 NETHERLANDS RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 273 NETHERLANDS FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 274 NETHERLANDS RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 275 NETHERLANDS FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 NETHERLANDS PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 277 NETHERLANDS VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 278 NETHERLANDS FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 279 NETHERLANDS FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 NETHERLANDS ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 281 NETHERLANDS PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 282 NETHERLANDS ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 283 NETHERLANDS C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 284 NETHERLANDS MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 285 NETHERLANDS OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 286 NETHERLANDS ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 287 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 288 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 289 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 290 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 291 NETHERLANDS BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 292 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 293 SWITZERLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 294 SWITZERLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 295 SWITZERLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 296 SWITZERLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 297 SWITZERLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 298 SWITZERLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 299 SWITZERLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 300 SWITZERLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 301 SWITZERLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 302 SWITZERLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 303 SWITZERLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 304 SWITZERLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 305 SWITZERLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 306 SWITZERLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 307 SWITZERLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 308 SWITZERLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 309 SWITZERLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 310 SWITZERLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 311 SWITZERLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 312 SWITZERLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 313 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 314 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PROCESSING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 315 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY MODE, 2018-2032 (USD THOUSAND)

TABLE 316 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 317 SWITZERLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 318 POLAND BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 319 POLAND IMMUNOGLOBULINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 320 POLAND INTRAVENOUS IMMUNOGLOBULINS (IVIGS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 321 POLAND INTRAMUSCULAR IMMUNOGLOBULINS (IMIG) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 322 POLAND COAGULATION FACTORS (FOR BLEEDING DISORDERS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 323 POLAND FACTOR IX PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 324 POLAND RECOMBINANT FACTOR IX (RFIX) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 325 POLAND FACTOR VIII PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 326 POLAND RECOMBINANT FACTOR VIII (RFVIII) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 327 POLAND FIBRINOGEN CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 328 POLAND PROTHROMBIN COMPLEX CONCENTRATES (PCCS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 329 POLAND VON WILLEBRAND FACTOR (VWF) PRODUCTS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 330 POLAND FACTOR XIII CONCENTRATES IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 331 POLAND FACTOR VIIA IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 332 POLAND ALBUMIN (PLASMA VOLUME EXPANDER) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 333 POLAND PROTEASE INHIBITORS (FOR GENETIC DEFICIENCIES) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 334 POLAND ALPHA 1 ANTITRYPSIN (AAT) (FOR AAT DEFICIENCY) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 335 POLAND C1 ESTERASE INHIBITOR (C1 INH) (FOR HAE) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 336 POLAND MONOCLONAL ANTIBODIES (DERIVED FROM PLASMA CELLS) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 337 POLAND OTHER PLASMA DERIVED PROTEINS IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 338 POLAND ANTITHROMBIN III (AT III) (FOR THROMBOSIS PREVENTION) IN BLOOD PLASMA & PLASMA DERIVED MEDICINAL PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)