Global Autoimmune Biosimilar Drug Market

Taille du marché en milliards USD

TCAC :

%

USD

415.80 Million

USD

879.70 Million

2025

2033

USD

415.80 Million

USD

879.70 Million

2025

2033

| 2026 –2033 | |

| USD 415.80 Million | |

| USD 879.70 Million | |

|

|

|

|

Global Autoimmune Biosimilar Drug Market Segmentation, By Drug Class (Monoclonal Antibodies, Recombinant Proteins, Peptides, and Other Biosimilar Molecules), Disease (Rheumatoid Arthritis, Psoriasis, Inflammatory Bowel Disease, Ankylosing Spondylitis, and Other Autoimmune Conditions), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), End User (Hospitals & Clinics, Specialty Pharmacies, Home Healthcare, and Other End Users)- Industry Trends and Forecast to 2033

Autoimmune Biosimilar Drug Market Size

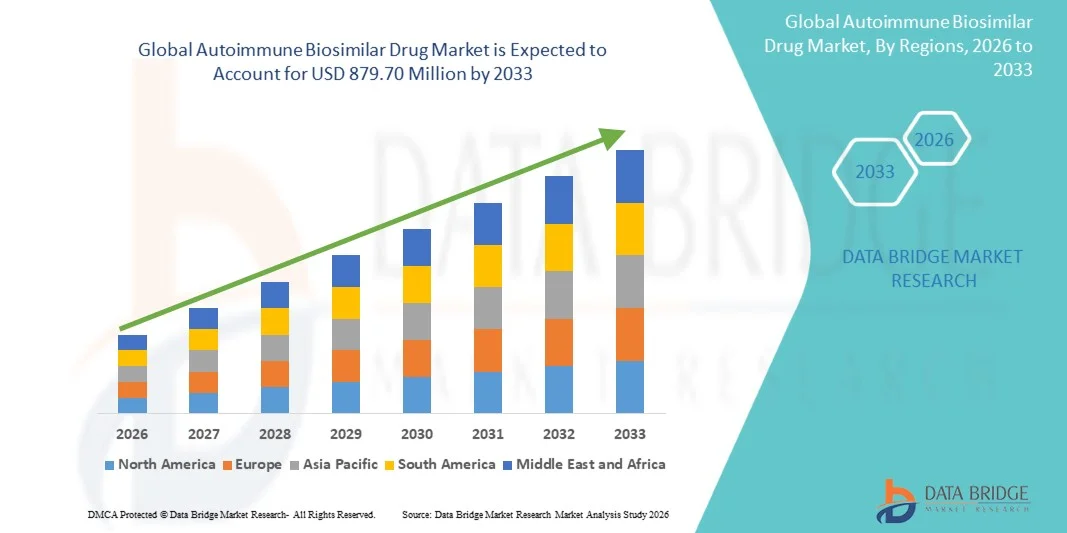

- The global autoimmune biosimilar drug market size was valued at USD 415.80 million in 2025 and is expected to reach USD 879.70 million by 2033, at a CAGR of 9.80% during the forecast period

- The market growth is largely fueled by the increasing demand for cost-effective alternatives to originator biologic therapies used in the treatment of autoimmune diseases, along with expanding regulatory approvals and broader clinical acceptance of biosimilars across major healthcare systems

- Furthermore, the rising prevalence of autoimmune disorders worldwide, combined with growing physician confidence, improved patient access, and supportive government policies promoting biosimilar adoption, is accelerating the uptake of autoimmune biosimilar drugs and significantly boosting overall market growth

Autoimmune Biosimilar Drug Market Analysis

- Autoimmune biosimilar drugs, developed as cost-effective alternatives to reference biologics for treating chronic autoimmune disorders, are increasingly vital components of modern immunology treatment protocols across hospitals and specialty clinics due to their comparable efficacy, safety, and improved affordability

- The escalating demand for autoimmune biosimilars is primarily fueled by the rising global prevalence of autoimmune diseases, the high cost burden of originator biologics, and supportive regulatory policies aimed at expanding access to affordable biologic therapies

- North America dominated the autoimmune biosimilar drug market with the largest revenue share of 43.7% in 2025, driven by strong biologics usage, increasing FDA approvals of biosimilars, favorable payer acceptance, and widespread adoption across the U.S., particularly for rheumatoid arthritis, psoriasis, and inflammatory bowel disease treatments

- Asia-Pacific is expected to be the fastest growing region during the forecast period, supported by large patient pools, improving healthcare infrastructure, growing physician confidence in biosimilars, and expanding domestic biosimilar manufacturing in countries such as China, India, and South Korea

- Monoclonal Antibodies segment dominated the autoimmune biosimilar drug market with a share of 49.2% in 2025, owing to their extensive clinical use in major autoimmune indications and the patent expiration of several high-revenue biologic therapies

Report Scope and Autoimmune Biosimilar Drug Market Segmentation

|

Attributes |

Autoimmune Biosimilar Drug Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Autoimmune Biosimilar Drug Market Trends

“Accelerated Adoption Driven by Regulatory Support and Cost Optimization”

- A significant and accelerating trend in the global autoimmune biosimilar drug market is the increasing regulatory acceptance and policy-level support for biosimilars, particularly in cost-sensitive healthcare systems aiming to reduce long-term expenditure on biologic therapies

- For instance, regulatory agencies in the U.S. and Europe have streamlined approval pathways and expanded guidance on biosimilar interchangeability, enabling faster market entry and broader physician confidence in prescribing autoimmune biosimilars

- Growing payer and insurer endorsement of biosimilars is further reinforcing this trend, as reimbursement frameworks increasingly favor lower-cost biosimilar alternatives over originator biologics for chronic autoimmune disease management

- The expanding clinical evidence base demonstrating comparable efficacy, safety, and immunogenicity to reference products is encouraging wider adoption across hospitals and specialty clinics treating rheumatoid arthritis, psoriasis, and inflammatory bowel disease

- This trend toward normalization of biosimilars in routine autoimmune care is reshaping treatment paradigms, prompting pharmaceutical companies to invest heavily in lifecycle management, expanded indications, and post-marketing surveillance programs

- As a result, demand for autoimmune biosimilars is rising steadily across both developed and emerging markets, positioning them as a cornerstone of sustainable immunology treatment strategies

- The growing role of real-world evidence and long-term outcome studies is further enhancing physician trust and supporting broader therapeutic substitution with autoimmune biosimilars

Autoimmune Biosimilar Drug Market Dynamics

Driver

“Rising Cost Burden of Biologic Therapies and Expanding Autoimmune Patient Pool”

- The growing economic burden associated with long-term biologic therapy for autoimmune diseases, combined with the rising global prevalence of conditions such as rheumatoid arthritis and inflammatory bowel disease, is a major driver of autoimmune biosimilar market growth

- For instance, healthcare systems in North America and Europe are increasingly encouraging biosimilar prescriptions to control escalating biologics spending while maintaining treatment continuity for chronic patients

- As awareness of biosimilar clinical equivalence increases among physicians and patients, confidence in switching from originator biologics to biosimilars is improving, supporting higher adoption rates

- Furthermore, favorable reimbursement policies and formulary inclusions are accelerating biosimilar uptake across hospital networks and specialty pharmacies

- The need to expand patient access to advanced autoimmune treatments in resource-constrained settings is further strengthening demand for cost-effective biosimilar options

- Collectively, these factors are driving sustained growth in the autoimmune biosimilar drug market across both public and private healthcare sectors

- Expanding biologic patent expirations in autoimmune indications are creating continuous opportunities for new biosimilar launches and market entry

- Increasing pressure on healthcare budgets from aging populations is further reinforcing the shift toward biosimilars as a long-term cost-containment strategy

Restraint/Challenge

“Physician Hesitancy and Interchangeability Perception Barrier”

- Persistent concerns regarding interchangeability, immunogenicity, and long-term real-world outcomes remain a key challenge limiting faster adoption of autoimmune biosimilars in certain markets

- For instance, some clinicians continue to exercise caution when switching stable patients from originator biologics to biosimilars, particularly in complex or severe autoimmune cases

- Variability in interchangeability regulations across regions further complicates prescribing decisions and limits automatic substitution in several countries

- In addition, extensive patient education and pharmacovigilance requirements increase commercialization complexity and post-launch costs for biosimilar manufacturers

- Market penetration can also be constrained by aggressive pricing strategies and contracting practices employed by originator biologic manufacturers to retain market share

- Overcoming these challenges through expanded clinical data generation, physician education initiatives, and harmonized regulatory frameworks will be essential for sustained long-term growth of the autoimmune biosimilar drug market

- Limited biosimilar awareness among patients in certain regions continues to slow acceptance and delays treatment switching decisions

- Complex manufacturing requirements and high initial development costs pose entry barriers for smaller players seeking to compete in the autoimmune biosimilar landscape

Autoimmune Biosimilar Drug Market Scope

The market is segmented on the basis of drug class, disease, distribution channel, and end user.

- By Drug Class

On the basis of drug class, the global autoimmune biosimilar drug market is segmented into monoclonal antibodies, recombinant proteins, peptides, and other biosimilar molecules. The monoclonal antibodies segment dominated the market with the largest revenue share of 49.2% in 2025, driven by their extensive use in the treatment of major autoimmune diseases such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease. These biosimilars closely replicate high-revenue biologics whose patents have expired, enabling rapid market uptake. Strong clinical evidence supporting comparable efficacy and safety has further increased physician confidence in monoclonal antibody biosimilars. In addition, favorable reimbursement policies and higher prescribing volumes in hospitals have reinforced their dominant position. The high cost-saving potential compared to originator biologics continues to accelerate adoption across developed healthcare systems.

The recombinant proteins segment is expected to witness the fastest growth during the forecast period, supported by expanding research pipelines and increasing approvals for autoimmune indications. Advances in protein engineering and manufacturing technologies are improving yield efficiency and reducing production costs. Growing demand for affordable long-term autoimmune therapies is encouraging wider clinical use of recombinant protein biosimilars. Emerging markets are also contributing to growth due to improving access and local manufacturing capabilities. Increased physician familiarity and expanding indications are further supporting rapid segment expansion.

- By Disease

On the basis of disease, the market is segmented into rheumatoid arthritis, psoriasis, inflammatory bowel disease, ankylosing spondylitis, and other autoimmune conditions. The rheumatoid arthritis segment dominated the market in 2025, owing to the high global prevalence of the disease and long-term dependence on biologic therapies. Rheumatoid arthritis patients often require continuous treatment, making cost-effective biosimilars an attractive option for healthcare systems. The availability of multiple approved biosimilars targeting TNF inhibitors has significantly increased competition and adoption. Strong clinical guidelines supporting biosimilar use in rheumatoid arthritis further reinforce market dominance. In addition, high treatment volumes in hospital and specialty clinic settings contribute to sustained revenue generation.

The inflammatory bowel disease segment is anticipated to grow at the fastest rate during the forecast period, driven by rising incidence rates of Crohn’s disease and ulcerative colitis worldwide. Increasing diagnosis rates and improved access to biologic therapies are expanding the patient pool. Biosimilars offer a viable solution to reduce the high cost burden associated with long-term IBD management. Growing physician confidence in switching stable patients to biosimilars is also supporting rapid uptake. Expanding reimbursement coverage and real-world evidence are expected to further accelerate growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment dominated the market in 2025, driven by the fact that most autoimmune biosimilars are administered under clinical supervision. Hospitals play a central role in initiating biologic and biosimilar therapies, particularly for moderate to severe autoimmune conditions. Strong formulary control and bulk purchasing agreements favor biosimilar adoption within hospital systems. In addition, physician-led treatment decisions and infusion-based administration support higher sales through hospital pharmacies. The concentration of specialty care services further strengthens this segment’s dominance.

The online pharmacies segment is expected to register the fastest growth during the forecast period, supported by increasing digitalization of healthcare services. Growing acceptance of e-pharmacies, particularly for subcutaneous and self-administered biosimilars, is improving patient access. Convenience, home delivery, and competitive pricing are key factors driving adoption. Expansion of telemedicine services and electronic prescriptions is further enabling growth. Regulatory improvements supporting online pharmaceutical distribution are also contributing to segment expansion.

- By End User

On the basis of end user, the market is segmented into hospitals & clinics, specialty pharmacies, home healthcare, and other end users. The hospitals & clinics segment dominated the market in 2025 due to the high reliance on institutional settings for autoimmune disease diagnosis and treatment initiation. Most biosimilars are prescribed and administered under specialist supervision, particularly during early treatment stages. Hospitals benefit from structured treatment protocols and reimbursement systems that encourage biosimilar use. The availability of infusion facilities and multidisciplinary care teams further supports dominance. High patient footfall and long-term treatment regimens contribute to sustained demand.

The home healthcare segment is projected to grow at the fastest rate over the forecast period, driven by increasing preference for self-administration and home-based care. Advances in drug delivery systems have enabled easier administration of biosimilars outside clinical settings. Patients with stable autoimmune conditions increasingly prefer home treatment for convenience and reduced hospital visits. Cost savings for both patients and healthcare systems are further accelerating adoption. Growing support services and remote patient monitoring are expected to strengthen this segment’s growth trajectory

Autoimmune Biosimilar Drug Market Regional Analysis

- North America dominated the autoimmune biosimilar drug market with the largest revenue share of 43.7% in 2025, driven by strong biologics usage, increasing FDA approvals of biosimilars, favorable payer acceptance, and widespread adoption across the U.S., particularly for rheumatoid arthritis, psoriasis, and inflammatory bowel disease treatments

- Healthcare providers and payers in the region place strong emphasis on cost-effective treatment alternatives, with autoimmune biosimilars offering comparable efficacy and safety while significantly lowering long-term therapy expenses

- This widespread adoption is further supported by well-established healthcare infrastructure, growing physician confidence in biosimilar interchangeability, favorable reimbursement frameworks, and the increasing prevalence of chronic autoimmune diseases across the U.S. and Canada

U.S. Autoimmune Biosimilar Drug Market Insight

The U.S. autoimmune biosimilar drug market captured the largest revenue share within North America in 2025, driven by high utilization of biologic therapies and increasing FDA approvals of biosimilars for autoimmune indications. Healthcare payers and providers are increasingly prioritizing cost containment, encouraging the adoption of biosimilars as alternatives to high-cost originator biologics. Growing physician confidence in biosimilar efficacy and safety, supported by robust clinical data, is further accelerating market penetration. Moreover, expanding interchangeability designations and favorable reimbursement policies are significantly contributing to market growth across hospital and specialty care settings.

Europe Autoimmune Biosimilar Drug Market Insight

The Europe autoimmune biosimilar drug market is projected to expand at a strong CAGR during the forecast period, primarily driven by well-established regulatory frameworks and proactive government policies promoting biosimilar use. Cost-containment measures across public healthcare systems are fostering widespread adoption of biosimilars in autoimmune disease treatment. European countries demonstrate high acceptance of biosimilar substitution, particularly within hospital formularies. The region continues to witness strong uptake across rheumatoid arthritis, inflammatory bowel disease, and psoriasis therapies, supported by mature reimbursement structures.

U.K. Autoimmune Biosimilar Drug Market Insight

The U.K. autoimmune biosimilar drug market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the National Health Service’s strong emphasis on biosimilar adoption to reduce biologics spending. Structured switching programs and physician-led initiatives are accelerating biosimilar uptake across autoimmune indications. Increasing prevalence of chronic autoimmune diseases and strong clinical guideline support further drive demand. The U.K.’s centralized healthcare procurement system also enables rapid and large-scale biosimilar penetration.

Germany Autoimmune Biosimilar Drug Market Insight

The Germany autoimmune biosimilar drug market is expected to expand at a considerable CAGR, fueled by early regulatory acceptance and strong physician confidence in biosimilars. Germany has been a pioneer in biosimilar adoption, supported by favorable pricing policies and reference pricing systems. High awareness among healthcare professionals and patients encourages switching from originator biologics. The country’s advanced healthcare infrastructure and strong hospital-based prescribing patterns continue to support sustained market growth.

Asia-Pacific Autoimmune Biosimilar Drug Market Insight

The Asia-Pacific autoimmune biosimilar drug market is expected to grow at the fastest CAGR during the forecast period, driven by a rapidly expanding patient population and increasing access to biologic therapies. Improving healthcare infrastructure and rising awareness of biosimilars are supporting adoption across emerging economies. Governments in the region are promoting biosimilar use to address affordability challenges associated with autoimmune disease treatment. In addition, the presence of strong domestic biosimilar manufacturers is improving supply availability and cost competitiveness.

Japan Autoimmune Biosimilar Drug Market Insight

The Japan autoimmune biosimilar drug market is gaining momentum due to rising healthcare expenditure pressures and increasing regulatory support for biosimilars. The country’s aging population is contributing to a higher prevalence of autoimmune disorders, driving demand for long-term, cost-effective treatment options. Growing physician familiarity with biosimilar prescribing is improving acceptance across hospital settings. Japan’s emphasis on quality, safety, and post-marketing surveillance further supports steady market expansion.

India Autoimmune Biosimilar Drug Market Insight

The India autoimmune biosimilar drug market accounted for the largest revenue share in Asia Pacific in 2025, supported by a strong domestic biosimilar manufacturing base and high demand for affordable therapies. Increasing prevalence of autoimmune diseases and improving diagnostic capabilities are expanding the patient pool. Government initiatives to enhance access to biologics and biosimilars are accelerating market growth. Competitive pricing, rising healthcare awareness, and growing adoption across public and private hospitals continue to position India as a key growth market.

Autoimmune Biosimilar Drug Market Share

The Autoimmune Biosimilar Drug industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Amgen Inc. (U.S.)

- Sandoz Group AG (Switzerland)

- Novartis AG (Switzerland)

- Samsung Bioepis (South Korea)

- Celltrion, Inc. (South Korea)

- Biocon Biologics Limited (India)

- Alvotech (Iceland)

- Fresenius Kabi AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Zydus Lifesciences Limited (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Torrent Pharmaceuticals Ltd. (India)

- Reliance Life Sciences Pvt. Ltd. (India)

- Innovent Biologics, Inc. (China)

- Bio-Thera Solutions, Ltd. (China)

- Zhejiang Hisun Pharmaceutical Co., Ltd. (China)

- LG Chem, Ltd. (South Korea)

What are the Recent Developments in Global Autoimmune Biosimilar Drug Market?

- In November 2025, the European Commission granted approval for Remsima™ IV liquid formulation, the world’s first ready-to-use liquid version of an infliximab biosimilar, designed to simplify preparation and reduce hospital workload in treating autoimmune conditions such as rheumatoid arthritis and Crohn’s disease

- In September 2025, the U.S. FDA approved adalimumab-atto (Amjevita), a biosimilar to Humira, for multiple autoimmune indications including rheumatoid arthritis, Crohn’s disease, and psoriasis, expanding affordable treatment options in the U.S. market

- In January 2025, Celltrion’s SteQeyma, an ustekinumab biosimilar, was launched across five major European countries (France, Italy, Spain, UK, Germany) for treating chronic inflammatory autoimmune diseases, marking a major regional rollout

- In October 2024, the U.S. FDA approved Imuldosa (ustekinumab-srlf), the fifth biosimilar referencing Stelara, for treatment of autoimmune diseases such as plaque psoriasis, psoriatic arthritis, and inflammatory bowel disease, signaling continued biosimilar expansion in the U.S. market

- In March 2024, the U.S. FDA approved tocilizumab-aazg (Tyenne), a biosimilar of Actemra, for various autoimmune and inflammatory conditions with both intravenous and subcutaneous formulations the first with dual administration options enhancing treatment flexibility

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.