Global Dermatology Drugs Market

Taille du marché en milliards USD

TCAC :

%

USD

27.86 Billion

USD

60.81 Billion

2024

2032

USD

27.86 Billion

USD

60.81 Billion

2024

2032

| 2025 –2032 | |

| USD 27.86 Billion | |

| USD 60.81 Billion | |

|

|

|

|

Global Dermatology Drugs Market Segmentation, By Dermatological Diseases (Acne,DermatitisPsoriasis, Skin Cancer, and Others), Prescription mode (Prescription Based Drugs and Over Counter Drugs), Drug Classification (Corticosteroids, Astringents, Anti-Inflammatory & Antipruritic Drugs, Anti-Infective/Antibacterial Drugs, andAntifungal Drugs), Route Of Administration (Topical, Oral and Parenteral Administration), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), End User (Hospitals, Speciality Clinics, andCosmetic Centres) - Industry Trends and Forecast to 2032

Dermatology Drugs Market Size

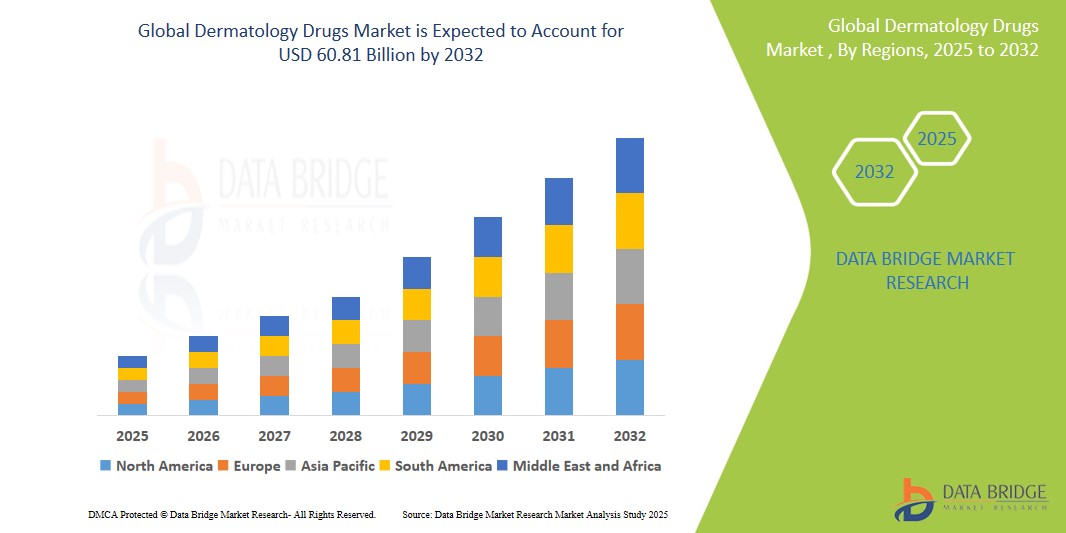

- The global Dermatology Drugs market size was valued at USD 27.86 billion in 2024 and is expected to reach USD 60.81 billion by 2032, at a CAGR of 10.25% during the forecast period

- This growth is driven by rise in clinical studies

Dermatology Drugs Market Analysis

- Dermatology drugs are essential in treating a variety of skin conditions, ranging from common conditions such as eczema and psoriasis to more complex diseases such as skin cancer, thereby significantly improving patients' quality of life

- The increasing prevalence of skin diseases, coupled with advancements inbiotechnology and pharmaceuticals, is driving the demand for dermatology drugs. The growing awareness of dermatological conditions and new drug formulations are expected to fuel market growth

- North America is expected to dominate the dermatology drugs market with the largest market share of 39.04%, due to the presence of leading pharmaceutical companies, high healthcare expenditure, and robust research and development capabilities in the region

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the dermatology drugs market during the forecast period, supported by expanding healthcare infrastructure, increasing awareness of dermatological conditions, and rising investments in medical diagnostics in the region

- The psoriasis segment is expected to dominate the dermatological diseases segment with the largest market share of 51.15% in 2025, due to growing awareness of the disease and a rising demand for effective treatment options. Increased recognition of psoriasis has played a significant role in driving the need for accurate diagnosis and advanced therapies

Report Scope and Dermatology Drugs Market Segmentation

|

Attributes |

Dermatology Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dermatology Drugs Market Trends

“Increasing Demand for Topical Dermatology Treatments”

- A growing trend in the dermatology drugs market is the rising preference for topical treatments for skin conditions such as eczema, psoriasis, and acne due to their targeted application and reduced systemic side effects

- The demand for non-invasive, localized treatments is increasing as patients and healthcare providers prioritize options with fewer side effects and quicker recovery times

- This trend is aligned with the increasing awareness about the benefits of topical therapies, which are becoming first-line treatments for many dermatological conditions

- For instance, in 2024, Johnson & Johnson introduced a new topical treatment for psoriasis that promises faster results with minimal skin irritation

- The continued rise in the adoption of topical dermatology drugs is expected to further expand their role in managing chronic dermatological conditions, driving market growth

Dermatology Drugs Market Dynamics

Driver

“Rising Prevalence of Dermatological Conditions”

- The increasing incidence of skin diseases, such as psoriasis, acne, eczema, and skin cancer, is driving the demand for dermatology drugs globally

- Growing environmental factors, such as pollution and UV radiation, are contributing to the higher occurrence of these conditions

- Patients are increasingly seeking medical treatment for these conditions due to improved awareness and the availability of advanced treatment options

- For instance, in 2023, a report by the American Academy of Dermatology found that over 50 million people in the U.S. suffer from some form of skin disease, further increasing the demand for dermatology drugs

- This rise in prevalence is expected to drive market growth, with more patients seeking early treatments and effective management options

Opportunity

“Expanding Role of Telemedicine in Dermatology”

- The integration of telemedicine in dermatology presents a significant opportunity for the market, allowing patients to consult with dermatologists remotely for diagnosis and prescription of dermatology drugs

- This shift is particularly beneficial in underserved areas where access to dermatologists is limited, improving overall access to dermatology care

- Telemedicine platforms are increasingly offering virtual consultations, dermatology drug prescriptions, and even follow-up treatments

- For instance, in 2024, Teladoc Health announced a partnership with leading dermatology pharmaceutical companies to offer remote dermatology consultations and treatment plans

- The increasing adoption of telemedicine is expected to enhance accessibility and streamline the distribution of dermatology drugs, providing opportunities for growth in global markets

Restraint/Challenge

“High Cost of Advanced Dermatology Drugs”

- One of the main challenges facing the dermatology drugs market is the high cost of advanced treatments, particularly biologics and specialty drugs, which are often out of reach for many patients, especially in low-income regions

- These drugs can require ongoing treatment, placing a financial burden on patients and healthcare systems

- In addition, the high cost of research, development, and manufacturing of innovative dermatology drugs contributes to their expensive price tags

- For instance, in 2023, Dupixent, a biologic treatment for eczema, faced criticism due to its high costs, making it less accessible to a significant portion of the patient population

- Addressing the cost challenge through pricing reforms, insurance coverage, and generic options will be crucial for expanding access and increasing the adoption of dermatology drugs

Dermatology Drugs Market Scope

The market is segmented on the basis of dermatological diseases, prescription mode, drug classification, route of administration, distribution channel, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Dermatological Diseases |

|

|

By Prescription Mode |

|

|

By Drug Classification |

|

|

By Route of Administration |

|

|

By Distribution Channel |

|

|

By End-User

|

|

In 2025, the psoriasis is projected to dominate the market with a largest share in dermatological diseases segment

The psoriasis segment is expected to dominate the dermatology drugs market with the largest market share of 51.15% in 2025, due to growing awareness of the disease and a rising demand for effective treatment options. Increased recognition of psoriasis has played a significant role in driving the need for accurate diagnosis and advanced therapies.

The prescription based drugs is expected to account for the largest share during the forecast period in prescription mode segment

In 2025, the prescription based drugs segment is expected to dominate the market with the largest market share of 62.34% due to the increasing prevalence of skin conditions such as psoriasis and eczema, prompting more patients to seek medical attention and undergo treatment.

Dermatology Drugs Market Regional Analysis

“North America Holds the Largest Share in the Dermatology Drugs Market”

- North America is expected to dominate the global dermatology drugs market with the largest market share of 39.04%, driven by the presence of major pharmaceutical companies, robust healthcare infrastructure, and significant investments in R&D

- The U.S. leads the region due to high consumer awareness of skin conditions, strong healthcare spending, and a well-established dermatology pharmaceutical industry

- Ongoing advancements in biologic treatments, increasing emphasis on personalized dermatology, and collaborations between healthcare providers and pharmaceutical companies are expected to sustain North America’s leadership throughout the forecast period

“Asia-Pacific is Projected to Register the Highest CAGR in the Dermatology Drugs Market”

- Asia-Pacific is expected to witness the highest compound annual growth rate (CAGR) in the dermatology drugs market, driven by increasing prevalence of skin infections and the expanding pipeline of clinical studies are driving demand for effective treatments. Skin conditions, especially acne, have heightened the need for advanced therapeutic solutions

- China, India, and Japan are key contributors, with initiatives such as rising awareness of skin health and available therapies is prompting patients to seek medical care and treatments, including topical retinoids, corticosteroids, and isotretinoin

- Rapid development of healthcare infrastructure, including molecular diagnostics and imaging technologies, is improving the accuracy and early diagnosis of skin conditions, which supports the development and availability of new dermatological drugs

Dermatology Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- LUPIN (India)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Amgen inc. (U.S.)

- Lilly (U.S.)

- AstraZeneca (U.K.)

- AbbVie Inc (U.S.)

- Johnson & Johnson Services Inc. (U.S.)

- LEO Pharma A/S (Denmark)

- Merck & Co., Inc (U.S.)

- Bausch Health Companies Inc (Canada)

- Bristol-Myers Squibb Company (U.S.)

Latest Developments in Global Dermatology Drugs Market

- In August 2024, Sun Pharmaceutical Industries Ltd. introduced STARIZO, an antibacterial treatment aimed at addressing Acute Bacterial Skin and Skin Structure Infections caused by drug-resistant bacteria such as MRSA in India. This medication offers the convenience of once-daily dosing for six days, simplifying the treatment regimen compared to traditional therapies that require more frequent dosing. This launch is expected to significantly improve patient compliance and treatment outcomes

- In January 2024, Pfizer Inc. formed a partnership with Glenmark Pharmaceuticals to introduce abrocitinib, marketed as CIBINQO, an oral medication for treating atopic dermatitis in India. This treatment offers rapid relief from itching and provides sustained control of the disease, enhancing the quality of life for patients suffering from this chronic skin condition. This collaboration strengthens both companies' positions in the dermatology space

- In August 2023, Arcutis Biotherapeutics, Inc. and Hangzhou Zhongmei Huadong Pharmaceutical Co., a wholly owned subsidiary of Huadong Medicine Co., Ltd., announced a strategic partnership and licensing agreement to develop, produce, and commercialize a topical solution named roflumilast in Greater China and Southeast Asia. This agreement marks a significant step in expanding access to advanced dermatological treatments in these rapidly growing markets

- In June 2023, Eli Lilly and Company revealed its decision to acquire DICE Therapeutics, Inc., aiming to enhance its immunology pipeline. This acquisition is expected to bolster Eli Lilly’s capabilities in developing novel treatments for dermatological and immunological conditions, driving future innovation in the dermatology drugs market

- In April 2023, Novartis AG received marketing authorization from the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency for Cosentyx (secukinumab) to treat adults suffering from active moderate-to-severe Hidradenitis Suppurativa (HS). This approval marks a key milestone in offering effective treatment options for patients with this challenging dermatological condition

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.