Global Ear Nasal Packing Market

Taille du marché en milliards USD

TCAC :

%

USD

257.26 Million

USD

410.03 Million

2024

2032

USD

257.26 Million

USD

410.03 Million

2024

2032

| 2025 –2032 | |

| USD 257.26 Million | |

| USD 410.03 Million | |

|

|

|

|

Global Ear and Nasal Packing Market Segmentation, By Type (Nasal packingand Ear packing), Material (Bio Absorbable and Non-Absorbable), Distribution Channel (Direct Tender and OTC), End User (Hospitals, Clinics, Ambulatory Centres, and Others) - Industry Trends and Forecast to 2032

Ear and Nasal Packing Market Size

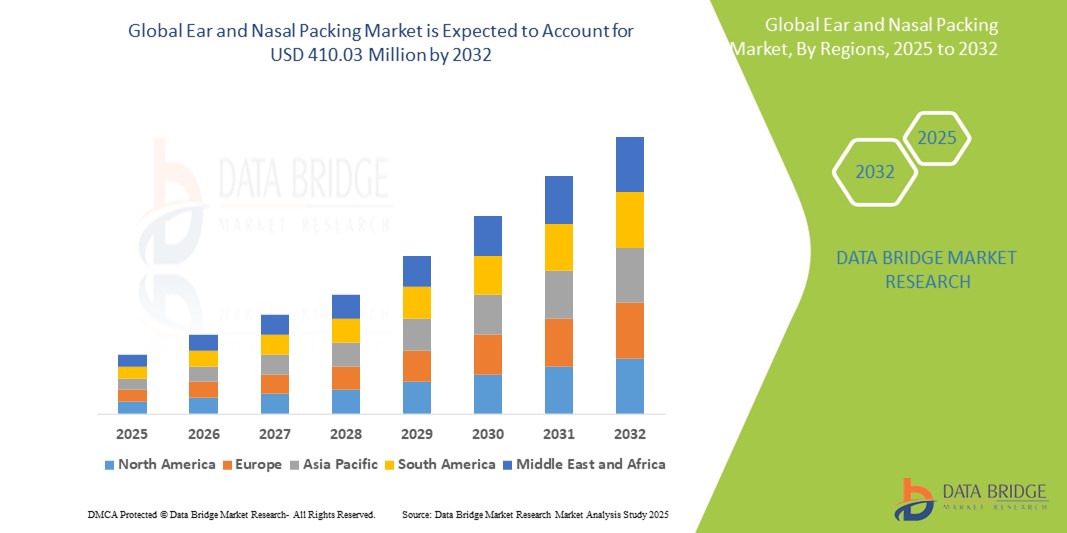

- The global ear and nasal packing market size was valued atUSD 257.26 million in 2024and is expected to reachUSD 410.03 million by 2032, at aCAGR of 6.00%during the forecast period

- This growth is driven by factors such as the rising prevalence of ENT disorders, increasing adoption of minimally invasive surgeries, and advancements in bioresorbable nasal and ear packing materials

Ear and Nasal Packing Market Analysis

- Ear and nasal packing products are used in medical procedures to control bleeding, support tissue healing, and stabilize nasal and ear structures during and after surgeries

- The demand for these packing materials is primarily driven by the rising incidence of ENT disorders, increased preference for minimally invasive surgeries, and technological advancements in packing materials

- North America is expected to dominate the ear and nasal packings market with a market share of 38.5%, due to high prevalence of ent disorders, increasing number of ENT surgeries, and widespread adoption of advanced packing materials such as bioresorbable and drug-eluting types

- Asia-Pacific is expected to be the fastest growing region in the ear and nasal packing market with a market share of 22.5%, during the forecast period due to rapid healthcare infrastructure development, increasing ENT surgical volumes, and growing awareness about modern treatment solutions

- Non-Absorbable segment is expected to dominate the market with a market share of 55.2% due to its durability and long-lasting performance. Non-absorbable packing materials are preferred in cases where long-term support and stability are required, particularly in more complex surgeries.

Report Scope and Ear and Nasal Packing Market Segmentation

|

Attributes |

Ear and Nasal Packing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ear and Nasal Packing Market Trends

“Advancements in Bioresorbable Materials & Minimally Invasive Technique”

- A prominent trend in the ear and nasal packing market is the increasing adoption of bioresorbable materials, which eliminate the need for removal after use, enhancing patient comfort and reducing recovery time

- These materials are designed to gradually dissolve in the body, offering both effective support and reduced complications associated with traditional non-absorbable packing

- For instance, bioresorbable nasal packs are gaining popularity in surgeries such as septoplasty and rhinoplasty due to their ability to minimize the risk of infection and promote faster healing

- This trend is driving the demand for advanced packing solutions that align with the shift towards minimally invasive ENT procedures, improving surgical outcomes and reducing post-operative care requirements

Ear and Nasal Packing Market Dynamics

Driver

“Increasing Incidence of ENT Disorders and Surgical Interventions”

- The rising prevalence of ENT (ear, nose, and throat) disorders such as chronicsinusitis, epistaxis(nosebleeds),nasal polyps, and otitis media is significantly driving the demand for ear and nasal packing products

- With growing environmental pollution, allergen exposure, and lifestyle changes, more individuals are developing ENT conditions that often require surgical treatment and post-operative care involving packing materials

- The demand is further boosted by the increasing number of ENT procedures, both in hospitals andambulatory surgical centers, requiring effective bleeding control and structural support

For instance,

- According to the World Health Organization (WHO), an estimated 430 million people worldwide require treatment for disabling hearing loss, while millions undergo sinus and nasal surgeries annually, creating a sustained need for high-performance packing solutions

- As the burden of ENT diseases continues to rise globally, the market for effective, patient-friendly ear and nasal packing solutions is expected to grow steadily

Opportunity

“Innovation in Bioresorbable and Drug-Eluting Packing Materials”

- Technological advancements in the development of bioresorbable and drug-eluting ear and nasal packing materials are creating significant growth opportunities in the market. These materials not only provide structural support but also dissolve naturally, reducing the need for painful removal and improving patient comfort

- Drug-eluting packs can deliver localized therapies—such as antibiotics or anti-inflammatory agents—directly to surgical sites, which helps reduce post-operative infections, inflammation, and healing time

- The combination of controlled drug release and patient-friendly material design is gaining traction among healthcare providers seeking safer and more effective post-operative solutions

For instance,

- In 2024 study published in the International Journal of Otolaryngology highlighted that drug-eluting nasal packs significantly reduced post-operative pain and infection rates in sinus surgery patients, improving overall clinical outcomes and satisfaction

- These innovations are transforming post-surgical care in ENT procedures, presenting an opportunity for manufacturers to develop differentiated, value-added products that cater to the growing demand for advanced and minimally invasive ENT treatments

Restraint/Challenge

“Limited Accessibility and High Cost of Advanced Packing Materials”

- The high cost of advanced ear and nasal packing materials, especially bioresorbable and drug-eluting types, presents a significant challenge to widespread adoption, particularly in low- and middle-income countries

- These premium products are often priced significantly higher than conventional non-absorbable options, making them less accessible to smaller healthcare facilities and clinics with constrained budgets

- The cost factor not only limits market penetration but also leads to continued reliance on older, less effective packing materials, which may cause discomfort or require manual removal

For instance,

- According to a 2023 report by Allied Market Research, healthcare providers in cost-sensitive markets often prefer traditional, affordable packing products, citing financial constraints and limited insurance coverage for newer technologies as major barriers to adoption

- Consequently, despite their clinical benefits, the use of innovative packing solutions remains restricted, which may hinder the overall advancement of ENT post-surgical care and restrain market growth

Ear and Nasal Packing Market Scope

The market is segmented on the basis of type, material, distribution channel, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Material |

|

|

By Distribution Channel |

|

|

By End User

|

|

In 2025, the non-absorbable is projected to dominate the market with a largest share in material segment

The non-absorbable segment is expected to dominate the ear and nasal packing market with the largest share of 55.2% in 2024 due to its durability and long-lasting performance. Non-absorbable packing materials are preferred in cases where long-term support and stability are required, particularly in more complex surgeries. In addition, these materials are highly effective in controlling bleeding and maintaining structural integrity during the healing process, making them a favored choice for many surgical procedures

The nasal packing is expected to account for the largest share during the forecast period in type market

In 2025, the nasal packing segment is expected to dominate the market with the largest market share of 65.5% due to its critical role in managing post-operative bleeding and stabilizing nasal structures after surgeries such as septoplasty and rhinoplasty. The growing preference for advanced, bioresorbable nasal packing materials, which minimize discomfort and reduce the need for removal, is also driving this segment’s growth. In addition, the increasing number of nasal surgeries globally contributes to the segment's dominant position.

Ear and Nasal Packing Market Regional Analysis

“North America Holds the Largest Share in the Ear and Nasal Packing Market”

- North America dominates the ear and nasal packing market with a market share of estimated 38.5%, driven, by a high prevalence of ENT disorders, increasing number of ENT surgeries, and widespread adoption of advanced packing materials such as bioresorbable and drug-eluting types

- U.S. holds a market share of 43.6%, due to robust healthcare infrastructure, strong presence of leading medical device manufacturers, and well-established reimbursement systems

- In addition, a growing geriatric population prone to ENT conditions and strong government initiatives aimed at improving healthcare delivery continue to bolster market growth in the region

- High awareness among healthcare professionals and patients about minimally invasive procedures and post-operative care further accelerates the adoption of premium packing solutions

“Asia-Pacific is Projected to Register the Highest CAGR in the Ear and Nasal Packing Market”

- Asia-Pacific is expected to witness the highest growth rate in the Ear and Nasal Packing market with a market share of 22.5%, driven by rapid healthcare infrastructure development, increasing ENT surgical volumes, and growing awareness about modern treatment solutions

- Countries such as China, India, and South Korea are emerging as major contributors due to rising pollution levels, increasing allergic rhinitis and sinusitis cases, and expanding access to healthcare facilities

- As healthcare spending rises and more ENT procedures are performed in both urban and rural settings, the demand for effective and patient-friendly packing materials is expected to grow significantly across the region

- India is expected to register the highest CAGR, supported by a large patient base, increasing ENT surgeon availability, and growing investments in medical device innovation and accessibility

Ear and Nasal Packing Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- BD(U.S.)

- Medtronic(Ireland)

- Stryker(U.S.)

- Smith+Nephew(U.K.)

- Olympus Corporation(Japan)

- Richard Wolf GmbH (Germany)

- MED-EL Medical Electronics (Austria)

- Sonova (Switzerland)

- FUJIFILM Corporation (Japan)

- ZHEJIANG NUROTRON BIOTECHNOLOGY CO., LTD. (China)

- DCC plc (Ireland)

- Danaher (U.S.)

- Summit Health (U.S.)

- Network Medical Products Ltd. (U.S.)

- Boston Scientific Corporation (U.S.)

- AptarGroup, Inc. (U.S.)

- L&R Group (Germany)

- Aegis Lifesciences (India)

- Meril Life Sciences Pvt Ltd. (India)

Latest Developments in Global Ear and Nasal Packing Market

- In October 2024, Aptar Pharma acquired SipNose Nasal Delivery Systems' device technology assets, strengthening its position in the intranasal drug delivery market. SipNose’s devices, designed for targeted delivery within the nasal cavity, will enhance Aptar Pharma's patent portfolio and aid in developing new drug delivery products

- In September 2024, Phillips Medisize, a Molex subsidiary, announced its agreement to acquire Vectura Group, a UK-based CDMO specializing in inhalation drug delivery devices. Vectura's expertise includes the development of dry powder inhalers and metered dose inhalers, enhancing Phillips Medisize’s capabilities in inhalation drug delivery

- In April 2024, Aptar Pharma announced plans to expand its manufacturing facility in Congers, New York, with completion expected by the end of 2024. The expansion will enhance the production of Unidose nasal spray systems by adding moulds and assembly lines in cleanroom environments. The facility is set to be operational by 2025

- In March 2024, Enzymatica’s mouth spray ColdZyme secured CE-certification of Class III from Eurofins, a European-approved notified body for medical devices. The new EU medical device regulation (MDR) aims to improve patient safety by introducing more stringent methods of assessment and market surveillance. However, it has been questioned if the extensive technical documentation requirements of the MDR are suppressing opportunities for early device development

- In June 2024- CHAMPS Group Purchasing (GPO) will distribute the exclusive nosebleed devices developed by CoagCo LLC. CHAMPS GPO will incorporate the Coag it NP7 device within its member contracts

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.