Global Continuous Bioprocessing Consumables And Reagents Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.81 Billion

USD

3.52 Billion

2025

2033

USD

1.81 Billion

USD

3.52 Billion

2025

2033

| 2026 –2033 | |

| USD 1.81 Billion | |

| USD 3.52 Billion | |

|

|

|

|

Global Continuous Bioprocessing Consumables & Reagents Market Segmentation, By Product (Single-use assemblies & bags, Tubing, fittings & connectors, Filtration consumables, Membranes & cartridges, Chromatography resins & single-use columns, Single-use sensors & probes, Sampling & aseptic transfer consumables, Media & buffer consumables, and Ancillary disposables), Process Stage (Upstream processing, Downstream processing, and Integrated continuous processing), Application (Monoclonal antibodies, Recombinant proteins, Vaccines, Gene therapy, and Biosimilars), End User (Pharmaceutical & biopharmaceutical companies, Contract Manufacturing Organizations (CMOs), Academic & research institutes, and Equipment OEMs)- Industry Trends and Forecast to 2033

Continuous Bioprocessing Consumables & Reagents Market Size

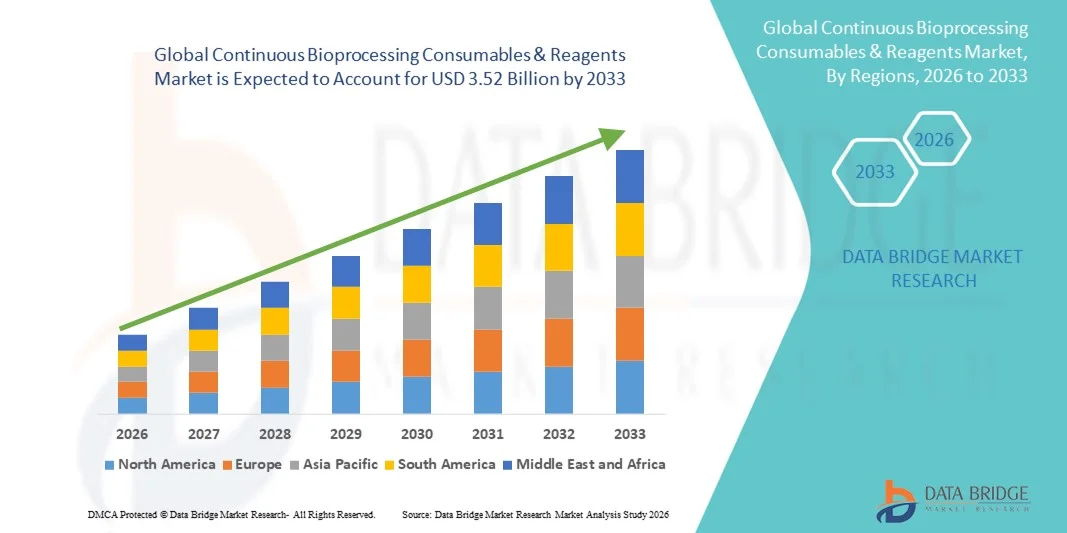

- The global continuous bioprocessing consumables & reagents market size was valued at USD 1.81 billion in 2025 and is expected to reach USD 3.52 billion by 2033, at a CAGR of 8.70% during the forecast period

- The market growth is largely driven by the increasing adoption of continuous biomanufacturing technologies across the biopharmaceutical industry, along with rising demand for single-use consumables, reagents, and process-specific materials that enhance productivity, scalability, and cost efficiency

- Furthermore, growing focus on process intensification, reduced manufacturing downtime, and improved product consistency is accelerating the shift from traditional batch processing to continuous workflows. These factors are strengthening demand for specialized consumables and reagents, thereby significantly supporting the overall market growth

Continuous Bioprocessing Consumables & Reagents Market Analysis

- Continuous bioprocessing consumables and reagents, including single-use assemblies & bags, filtration consumables, membranes, chromatography resins, media & buffers, and sensors, are essential for enabling uninterrupted upstream and downstream biomanufacturing workflows, supporting enhanced process control, sterility, and product consistency in biologics production

- The rising demand for these consumables is primarily driven by the industry-wide shift toward continuous bioprocessing technologies, increasing production of monoclonal antibodies and recombinant proteins, and growing adoption of single-use systems that reduce contamination risks and operational costs

- North America dominated the continuous bioprocessing consumables & reagents market in 2025 with the largest revenue share of 40.6%, supported by a mature biomanufacturing ecosystem, strong presence of pharmaceutical and biopharmaceutical companies, and early adoption of continuous processing platforms, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region during the forecast period due to expanding biologics manufacturing capacity, increasing investments in advanced bioprocessing infrastructure, and rising activity from contract manufacturing organizations (CMOs) across emerging economies

- Upstream processing segment dominated the market with a 46.7% share in 2025, driven by high demand for media and buffer consumables, filtration materials, tubing, and single-use components used in continuous cell culture and perfusion-based bioprocessing systems

Report Scope and Continuous Bioprocessing Consumables & Reagents Market Segmentation

|

Attributes |

Continuous Bioprocessing Consumables & Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Continuous Bioprocessing Consumables & Reagents Market Trends

Rising Adoption of Single-Use and Integrated Continuous Consumables

- A significant and accelerating trend in the global continuous bioprocessing consumables & reagents market is the increasing reliance on single-use and integrated consumable solutions that support uninterrupted upstream and downstream biomanufacturing workflows

- For instance, biopharmaceutical manufacturers are increasingly adopting pre-assembled single-use tubing sets, filtration units, and chromatography columns to enable faster changeovers and reduced contamination risk in continuous processing lines

- The use of advanced consumables such as single-use sensors, membranes, and real-time monitoring reagents enables improved process control, consistent product quality, and reduced manual intervention across continuous operations

- For instance, the growing deployment of perfusion-based cell culture systems is driving demand for high-performance media, buffer consumables, and filtration components designed specifically for long-duration continuous runs

- The integration of consumables across upstream and downstream stages supports end-to-end continuous bioprocessing, allowing manufacturers to minimize downtime, reduce validation complexity, and improve overall manufacturing efficiency

- This shift toward standardized, disposable, and interoperable consumables is reshaping manufacturing strategies, with suppliers increasingly focusing on scalable consumable platforms tailored for continuous biologics production

- Growing emphasis on sustainability is encouraging the development of consumables with reduced material usage, improved recyclability, and lower environmental impact without compromising process performance

Continuous Bioprocessing Consumables & Reagents Market Dynamics

Driver

Growing Biologics Production and Shift Toward Continuous Manufacturing

- The increasing global demand for biologics, including monoclonal antibodies, recombinant proteins, and biosimilars, coupled with the industry’s transition from batch to continuous manufacturing, is a key driver of the consumables & reagents market

- For instance, pharmaceutical and biopharmaceutical companies are expanding continuous upstream and downstream facilities to improve yield, reduce production costs, and accelerate time-to-market for complex biologics

- Continuous manufacturing requires a steady and reliable supply of specialized consumables such as media, buffers, filtration materials, and chromatography resins, resulting in recurring demand throughout the production lifecycle

- Furthermore, the adoption of single-use technologies in continuous processes is driving higher consumption volumes of disposable assemblies, tubing, and aseptic transfer consumables

- The growing role of contract manufacturing organizations (CMOs) in biologics production is further supporting market growth, as CMOs increasingly invest in flexible continuous platforms that rely heavily on consumables and reagents

- Collectively, these factors are accelerating the uptake of continuous bioprocessing consumables and reagents across both commercial-scale manufacturing and clinical-stage production

- Rising regulatory encouragement for continuous manufacturing from health authorities is further motivating biopharmaceutical companies to transition toward continuous workflows

- Increasing investment in advanced biologics pipelines, including gene therapies and complex proteins, is expanding the addressable market for high-value, process-specific consumables and reagents

Restraint/Challenge

High Qualification Requirements and Supply Chain Complexity

- The need for extensive validation, qualification, and regulatory compliance of consumables and reagents used in continuous bioprocessing poses a significant challenge to market growth

- For instance, changes in consumable materials or suppliers often require re-validation of continuous processes, increasing time, cost, and operational complexity for manufacturers

- Supply chain disruptions or shortages of critical consumables such as filtration membranes, media, or chromatography resins can directly impact continuous production, where interruptions are more costly than in batch processing

- In addition, the higher upfront cost of specialized continuous-use consumables compared to conventional batch consumables can deter adoption among smaller biopharmaceutical companies and research institutes

- Overcoming these challenges will require robust supplier qualification strategies, improved supply chain resilience, and closer collaboration between consumable manufacturers and biopharmaceutical producers

- Limited availability of standardized consumables across suppliers can restrict interoperability and flexibility in multi-vendor continuous bioprocessing setups

- Managing long-term supply agreements and ensuring consistent quality across high-volume consumable usage remain critical challenges for sustained continuous manufacturing operations

Continuous Bioprocessing Consumables & Reagents Market Scope

The market is segmented on the basis of product, process stage, application, and end user.

- By Product

On the basis of product, the continuous bioprocessing consumables & reagents market is segmented into single-use assemblies & bags, tubing, fittings & connectors, filtration consumables, membranes & cartridges, chromatography resins & single-use columns, single-use sensors & probes, sampling & aseptic transfer consumables, media & buffer consumables, and ancillary disposables. The media & buffer consumables segment dominated the market in 2025, driven by their continuous and high-volume usage in perfusion-based upstream processing and integrated continuous workflows. Media and buffers are consumed consistently throughout production cycles, making them indispensable for maintaining cell viability, productivity, and product quality. Their recurring nature results in stable and predictable demand across both commercial and clinical manufacturing. In addition, increasing biologics complexity has led to higher customization of media formulations, further strengthening this segment’s dominance.

The chromatography resins & single-use columns segment is expected to witness the fastest growth during the forecast period, supported by the expanding adoption of continuous downstream purification technologies. Continuous chromatography techniques such as multicolumn chromatography require specialized resins optimized for high throughput and extended operational lifetimes. Growing production of monoclonal antibodies and biosimilars is accelerating demand for advanced resins that offer higher binding capacity and process efficiency. Furthermore, the transition toward single-use columns reduces cleaning validation requirements, making them increasingly attractive to manufacturers.

- By Process Stage

On the basis of process stage, the market is segmented into upstream processing, downstream processing, and integrated continuous processing. The upstream processing segment dominated the market in 2025 with a market share of 46.7%, primarily due to the widespread adoption of continuous cell culture and perfusion-based bioreactor systems. Upstream operations require large volumes of consumables such as media, buffers, filtration components, tubing, and sensors to support sustained cell growth and productivity. Continuous upstream processes operate for extended durations, resulting in significantly higher consumable usage compared to batch processes. The growing emphasis on improving yields and reducing facility footprint further reinforces the dominance of this segment.

The integrated continuous processing segment is projected to grow at the fastest rate over the forecast period, driven by the industry’s push toward end-to-end continuous biomanufacturing. Integrated systems combine upstream and downstream operations into a seamless workflow, increasing reliance on interoperable consumables and reagents. This approach minimizes hold steps, reduces process variability, and improves overall efficiency. As regulatory confidence in fully continuous manufacturing increases, adoption of integrated systems is expected to accelerate, driving rapid growth in this segment.

- By Application

On the basis of application, the continuous bioprocessing consumables & reagents market is segmented into monoclonal antibodies, recombinant proteins, vaccines, gene therapy, and biosimilars. The monoclonal antibodies segment accounted for the largest market share in 2025, owing to their dominant position in the global biologics pipeline and commercial production landscape. Continuous manufacturing of monoclonal antibodies requires extensive use of consumables across both upstream and downstream stages, including media, chromatography resins, filtration systems, and single-use assemblies. The high production volumes and long-term commercial demand for mAbs ensure sustained consumable consumption. In addition, ongoing innovation in antibody formats continues to support this segment’s leadership.

The gene therapy segment is expected to be the fastest growing during the forecast period, driven by rapid expansion of viral vector–based therapies and increased clinical and commercial activity. Gene therapy manufacturing requires highly specialized consumables tailored for sensitive and complex biological materials. Continuous processing offers advantages in consistency and scalability, making it increasingly attractive for gene therapy developers. As more gene therapies progress toward commercialization, demand for application-specific consumables and reagents is expected to rise sharply.

- By End User

On the basis of end user, the market is segmented into pharmaceutical & biopharmaceutical companies, contract manufacturing organizations (CMOs), academic & research institutes, and equipment OEMs. The pharmaceutical & biopharmaceutical companies segment dominated the market in 2025, supported by large-scale investments in continuous manufacturing infrastructure and in-house biologics production capabilities. These companies consume high volumes of consumables and reagents for commercial manufacturing, process development, and lifecycle management activities. Their focus on cost efficiency, scalability, and regulatory compliance further drives consistent demand for validated consumables.

The contract manufacturing organizations (CMOs) segment is anticipated to witness the fastest growth rate over the forecast period, driven by increased outsourcing of biologics production by both large pharmaceutical companies and emerging biotech firms. CMOs are rapidly adopting continuous bioprocessing to offer flexible, multi-product manufacturing services. This model relies heavily on standardized, high-throughput consumables and reagents to support multiple clients and products. The growing role of CMOs in advanced biologics manufacturing is expected to significantly accelerate consumables demand within this segment.

Continuous Bioprocessing Consumables & Reagents Market Regional Analysis

- North America dominated the continuous bioprocessing consumables & reagents market in 2025 with the largest revenue share of 40.6%, supported by a mature biomanufacturing ecosystem, strong presence of pharmaceutical and biopharmaceutical companies, and early adoption of continuous processing platforms, particularly in the U.S.

- Manufacturers in the region place high value on process efficiency, product consistency, and regulatory compliance, leading to increased use of specialized consumables and reagents across continuous upstream and downstream operations

- This widespread adoption is further supported by significant R&D investments, the presence of leading pharmaceutical and biopharmaceutical companies, and growing implementation of continuous manufacturing platforms, positioning North America as the leading regional market for continuous bioprocessing consumables and reagents

U.S. Continuous Bioprocessing Consumables & Reagents Market Insight

The U.S. continuous bioprocessing consumables & reagents market captured the largest revenue share within North America in 2025, supported by the country’s advanced biopharmaceutical manufacturing ecosystem and early adoption of continuous production technologies. Biopharmaceutical companies in the U.S. are increasingly shifting toward continuous upstream and downstream processes to improve efficiency, reduce costs, and enhance product consistency. Strong investment in biologics R&D, coupled with regulatory support for advanced manufacturing approaches, continues to drive sustained demand for high-quality consumables and reagents across commercial and clinical production facilities.

Europe Continuous Bioprocessing Consumables & Reagents Market Insight

The Europe continuous bioprocessing consumables & reagents market is projected to expand at a steady CAGR during the forecast period, primarily driven by increasing adoption of advanced biomanufacturing technologies and stringent regulatory standards for biologics production. The region’s focus on process optimization, quality assurance, and sustainability is encouraging manufacturers to adopt continuous processing solutions. Growth is observed across pharmaceutical companies and CMOs, with consumables demand rising in both commercial manufacturing and process development activities across Western and Northern Europe.

U.K. Continuous Bioprocessing Consumables & Reagents Market Insight

The U.K. continuous bioprocessing consumables & reagents market is expected to grow at a notable CAGR during the forecast period, driven by strong government support for life sciences, expanding biologics pipelines, and increasing investment in advanced manufacturing infrastructure. The presence of leading research institutes and growing collaboration between academia and industry are supporting adoption of continuous processing. These factors are driving consistent demand for specialized consumables and reagents used in upstream and downstream bioprocessing.

Germany Continuous Bioprocessing Consumables & Reagents Market Insight

The Germany continuous bioprocessing consumables & reagents market is anticipated to expand at a considerable CAGR, fueled by the country’s strong emphasis on innovation, precision manufacturing, and regulatory compliance. Germany’s well-established pharmaceutical and biotechnology sector is increasingly adopting continuous bioprocessing to enhance efficiency and scalability. The growing focus on high-quality biologics production and process automation is supporting demand for advanced consumables, particularly in downstream purification and integrated processing workflows.

Asia-Pacific Continuous Bioprocessing Consumables & Reagents Market Insight

The Asia-Pacific continuous bioprocessing consumables & reagents market is expected to grow at the fastest CAGR during the forecast period, driven by rapid expansion of biopharmaceutical manufacturing capacity, increasing investments in biologics, and supportive government initiatives. Countries such as China, Japan, South Korea, and India are witnessing rising adoption of continuous manufacturing technologies. The region’s growing role as a global biologics production hub is significantly increasing demand for consumables and reagents across both commercial and contract manufacturing operations.

Japan Continuous Bioprocessing Consumables & Reagents Market Insight

The Japan continuous bioprocessing consumables & reagents market is gaining momentum due to the country’s advanced technological capabilities, strong focus on quality, and increasing biologics development activities. Japanese manufacturers emphasize process consistency and efficiency, making continuous bioprocessing an attractive approach. The integration of advanced automation and monitoring technologies is further driving demand for high-performance consumables and reagents across upstream and downstream operations.

India Continuous Bioprocessing Consumables & Reagents Market Insight

The India continuous bioprocessing consumables & reagents market accounted for a significant share within Asia Pacific in 2025, supported by rapid growth in the domestic biopharmaceutical industry and increasing investment in biologics and biosimilars manufacturing. India’s expanding role as a global supplier of affordable biologics is encouraging adoption of cost-efficient continuous processing platforms. The presence of a growing number of CMOs, coupled with government initiatives supporting biotechnology and pharmaceutical manufacturing, is driving rising consumption of bioprocessing consumables and reagents across the country.

Continuous Bioprocessing Consumables & Reagents Market Share

The Continuous Bioprocessing Consumables & Reagents industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc. (U.S.)

- Sartorius AG (Germany)

- Merck KGaA (Germany)

- Danaher (U.S.)

- Pall Corporation (U.S.)

- Repligen Corporation (U.S.)

- Eppendorf AG (Germany)

- Corning Incorporated (U.S.)

- Meissner Filtration Products, Inc. (U.S.)

- Avantor, Inc. (U.S.)

- Saint-Gobain Life Sciences (France)

- Entegris, Inc. (U.S.)

- PBS Biotech, Inc. (U.S.)

- Lonza Group AG (Switzerland)

- FUJIFILM Diosynth Biotechnologies (Japan)

- Asahi Kasei Corporation (Japan)

- 3M (U.S.)

- Getinge AB (Sweden)

- Samsung Biologics Co., Ltd. (South Korea)

- Applikon Biotechnology B.V. (Netherlands)

What are the Recent Developments in Global Continuous Bioprocessing Consumables & Reagents Market?

- In December 2025, Thermo Fisher Scientific expanded its bioprocessing capabilities across Asia by establishing and enlarging Bioprocess Design Centers in Hyderabad (India), Incheon (Korea), and Singapore, offering tailored support and advanced technologies to local biopharma innovators these centers facilitate access to continuous bioprocessing consumables expertise and accelerate localized manufacturing adoption

- In September 2025, Thermo Fisher Scientific completed the acquisition of Solventum’s Purification & Filtration business, integrating advanced filtration technologies into its Life Sciences Solutions segment to better serve biopharmaceutical customers and enhance end-to-end bioprocessing offerings this deal accelerates Thermo Fisher’s position in consumables and reagents supporting continuous bioprocessing

- In February 2025, Thermo Fisher Scientific announced a definitive agreement to acquire Solventum’s Purification & Filtration business for approximately USD 4.1 billion, expanding its bioprocessing filtration and membrane solutions portfolio to strengthen upstream and downstream workflows relevant to continuous bioprocessing consumables and reagents this acquisition broadens Thermo Fisher’s capabilities in filtration technologies used across bioprocess manufacturing

- In November 2023, WuXi Biologics announced it completed end-to-end downstream manufacture at pilot scale using its patented ultra-high productivity continuous bioprocessing platform (WuXiUP) at its non-GMP pilot plant in Shanghai, and will scale it to GMP manufacturing globally demonstrating real application and scaling of continuous bioprocessing technologies that directly drive demand for related consumables and reagents

- In June 2023, Waters Corporation and Sartorius AG announced a collaboration to integrate analytical solutions for downstream biomanufacturing, combining Sartorius’ chromatography platform with Waters’ process analysis systems to provide enhanced data and efficiency for continuous downstream operations this partnership drives innovation in consumables use and process analytics essential to continuous workflows

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.