축산업은 아시아 농업 발전에 필수적인 요소입니다. 최근 수십 년 동안 괄목할 만한 성장을 거듭하며 급증하는 축산물 수요를 충족하는 데 기여해 왔습니다. 가금류, 돼지, 소와 같은 가축은 아시아 국가에서 중요한 경제적, 사회적 역할을 담당합니다. 급속한 경제 성장으로 인해 아시아, 특히 인도, 말레이시아, 중국, 태국에서 육류 단백질에 대한 수요가 크게 증가했습니다. 이는 가축의 주요 영양 공급원인 동물 사료 수요 증가로 이어졌습니다. 아시아 태평양 동물 사료 시장은 고품질의 영양가 높은 사료 수요를 충족할 수 있는 기업들에게 성장하는 기회입니다.

https://www.databridgemarketresearch.com/reports/asia-pacific-animal-feed-market 에서 전체 보고서를 확인하세요.

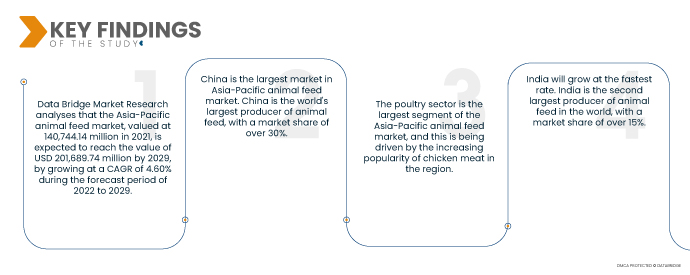

Data Bridge Market Research에 따르면 , 2021년 1,407억 4,414만 달러 규모였던 아시아 태평양 동물 사료 시장은 2022년부터 2029년까지 연평균 성장률 4.60%로 성장하여 2029년에는 2,016억 8,974만 달러 규모에 이를 것으로 전망됩니다. 이 지역의 성장은 소득 증가, 육류 소비 증가, 육류 생산 증가에 기인합니다. 중국, 베트남, 말레이시아, 인도, 인도네시아는 이 지역의 최대 복합 사료 소비국입니다. 중국과 인도는 이 지역에서 가장 큰 시장으로 수요 증가에 크게 기여하고 있습니다. 중국은 세계 최대 복합 사료 생산국 중 하나로, 이 지역 생산량의 절반을 차지합니다. 동물 복지에 대한 관심 증가와 정부 이니셔티브가 이 시장을 견인하고 있습니다.

동물성 단백질에 대한 수요 증가 로 시장 성장률이 높아질 것으로 예상 됩니다.

아시아 태평양 동물 사료 시장의 주요 성장 동력 중 하나는 동물성 단백질 수요 증가입니다. 이 지역의 소득이 지속적으로 증가함에 따라 사람들은 육류, 가금류, 생선을 더 많이 섭취하고 있습니다. 이는 가축의 주요 영양 공급원인 동물 사료에 대한 수요를 견인하고 있습니다. 아시아 인구는 2020년 45억 명에서 2050년 53억 명으로 증가할 것으로 예상됩니다. 이러한 인구 증가는 육류, 가금류, 생선을 포함한 식량 수요 증가로 이어질 것입니다. 아시아에서는 일반적으로 육류 소비량이 높은 서구식 식단으로의 전환 추세가 증가하고 있습니다. 이는 도시화, 가공식품의 접근성 증가, 서구 언론의 영향 등 여러 요인에 의해 주도되고 있습니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2022년부터 2029년까지

|

기준 연도

|

2021

|

역사적인 해

|

2020 (2014-2019년으로 맞춤 설정 가능)

|

양적 단위

|

매출(백만 달러), 볼륨(단위), 가격(달러)

|

다루는 세그먼트

|

유형( 아미노산 , 미네랄, 비타민, 산성화제, 미코톡신 해독제, 효소, 인산염, 카로티노이드, 항산화제, 향료 및 감미료 , 항생제, 비단백질 질소 및 기타), 가축(돼지, 가금류, 반추동물, 수생 동물 및 기타), 형태(건조 및 액체)

|

포함 국가

|

일본, 중국, 인도, 한국, 뉴질랜드, 베트남, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 아시아 태평양(APAC)의 나머지 아시아 태평양(APAC)

|

시장 참여자 포함

|

CHR. Hansen Holdings A/S(덴마크), Lallemand Inc.(캐나다), Novus International(미국), DSM(네덜란드), BASF SE(독일), Alltech(미국), ADM(미국), Charoen Popkphand Foods PCL(태국), Associated British Foods Plc(영국), Cargill Incorporated(미국), Purina Animal Nutrition LLC(미국), Zinpro Corp(미국), Dallas Keith(영국), Balchem Inc.(미국), Kemin Industries, Inc.(미국)

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 업체와 같은 시장 시나리오에 대한 통찰력 외에도 심층적인 전문가 분석, 지리적으로 대표되는 회사별 생산 및 용량, 유통업체 및 파트너의 네트워크 레이아웃, 상세하고 업데이트된 가격 추세 분석 및 공급망 및 수요의 적자 분석이 포함됩니다.

|

세그먼트 분석:

아시아 태평양 동물사료 시장은 유형, 가축 및 형태에 따라 5개의 주요 부문으로 구분됩니다.

- 아시아 태평양 동물 사료 시장은 아미노산, 미네랄, 비타민 , 산성화제, 미코톡신 해독제, 효소, 인산염, 카로티노이드 , 항산화제, 향료 및 감미료, 항생제 , 비단백질 질소 등으로 세분화됩니다. 아미노산 부문은 아시아 태평양 동물 사료 시장에서 30.92%의 가장 큰 점유율을 차지하며 시장을 주도할 것으로 예상됩니다. 아미노산은 동물의 조직과 우유 단백질을 구성하는 주요 구성 요소이며, 아미노산 결핍은 면역 반응을 저해하고 동물의 생산을 감소시킵니다.

- 아시아 태평양 동물사료 시장은 가축을 기준으로 돼지, 가금류, 반추동물, 수생동물 및 기타로 구분됩니다.

돼지가 아시아 태평양 동물사료 시장을 장악할 것으로 예상

아시아 태평양 지역 동물 사료 시장에서는 돼지 부문이 35.83%의 가장 큰 시장 점유율을 차지하며 시장을 주도할 것으로 예상됩니다. 아시아 태평양 지역 국가들의 육류 및 육류 기반 단백질에 대한 수요와 소비 증가로 인해 돼지는 아시아 태평양 지역 동물 사료 시장에서 가장 큰 비중을 차지하는 가축 부문으로 자리매김했습니다.

- 아시아 태평양 동물사료 시장은 형태를 기준으로 건조사료와 액상사료로 구분됩니다.

건조 부문이 아시아 태평양 동물사료 시장을 지배할 것으로 예상됩니다.

건사료 부문은 높은 GDP 규모를 갖춘 최대 가축 시장으로 인해 75.96%의 시장 점유율을 기록하며 시장을 주도할 것으로 예상됩니다. 그러나 사료 부문의 지배적인 부문은 취급 용이성, 영양소 안정성, 다양한 사료 공급 시스템에 대한 적합성 등의 요인에 따라 달라질 수 있습니다. 시장 동향, 기술 발전, 그리고 특정 제품 배합은 아시아 태평양 지역 동물 사료 시장의 지배적인 사료 부문을 결정하는 데 중요한 역할을 합니다.

주요 플레이어

Data Bridge Market Research는 다음 회사를 주요 시장 참여자로 인식합니다.CHR.Hansen Holdings A/S(덴마크), Lallemand Inc.(캐나다), Novus International(미국), DSM(네덜란드), BASF SE(독일), Alltech(미국), ADM(미국), Charoen Popkphand Foods PCL(태국), Associated British Foods Plc(영국), Cargill Incorporated(미국), Purina Animal Nutrition LLC(미국), Zinpro Corp(미국), Dallas Keith(영국), Balchem Inc.(미국), Kemin Industries, Inc.(미국).

시장 개발

- 2022년, 동물 영양 분야의 글로벌 리더인 ADM Animal Nutrition은 5월 사우스 코타바토주 폴로몰록에 위치한 South Sunrays Milling Corporation의 사료 공장을 인수했습니다. 이번 인수는 혁신적이고 고품질의 동물 사료 솔루션에 대한 아시아 시장의 수요에 부응하는 다양하고 최첨단 제품을 제공하는 데 있어 한 걸음 더 나아간 것입니다.

- ADM은 2021년 10월 중국 저장성 핑후시에 최첨단 완전 자동화 향료 생산 시설인 ADM 푸드 테크놀로지(핑후)를 개소하며 전 세계 영양 공급 역량을 강화했습니다. 핑후에 새롭게 들어서는 최첨단 향료 공장은 아시아 태평양 지역에서 ADM의 향료 공급 허브 역할을 할 것이며, ADM은 지식과 최첨단 기술을 활용하여 고객 니즈를 충족하고 성장 목표를 달성할 수 있을 것입니다.

지역 분석

지리적으로 시장 보고서에서 다루는 국가는 일본, 중국, 인도, 한국, 뉴질랜드, 베트남, 호주, 싱가포르, 말레이시아, 태국, 인도네시아, 필리핀, 아시아 태평양(APAC)의 기타 국가입니다.

Data Bridge Market Research 분석에 따르면:

중국은 2022-2029년 예측 기간 동안 아시아 태평양 동물사료 시장 에서 지배적인 지역입니다.

중국은 아시아 태평양 지역 동물 사료 시장에서 가장 큰 시장입니다. 중국은 세계 최대 동물 사료 생산국으로 시장 점유율이 30%가 넘습니다. 중국 동물 사료 시장은 증가하는 인구와 더불어 증가하는 경제 성장에 힘입어 성장하고 있습니다.

인도는 2022-2029년 예측 기간 동안 아시아 태평양 동물사료 시장 에서 가장 빠르게 성장하는 지역으로 추산됩니다.

인도는 가장 빠른 속도로 성장할 것입니다. 인도는 세계 2위의 가축 사료 생산국으로, 시장 점유율이 15%가 넘습니다. 인도 정부는 경제 성장 촉진과 일자리 창출을 위해 축산업 발전을 장려하고 있습니다.

아시아 태평양 동물 사료 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/asia-pacific-animal-feed-market