تشهد منطقة آسيا والمحيط الهادئ زيادةً حادةً في أمراض القلب والأوعية الدموية، نتيجةً لتغيرات نمط الحياة، والتحضر، وتزايد أعداد كبار السن. يساهم تزايد السلوكيات الخاملة، وسوء التغذية، والتدخين، وتعاطي الكحول، والتوتر في ارتفاع معدلات السمنة، بالإضافة إلى حالاتٍ مثل ارتفاع ضغط الدم، وداء السكري، وخلل شحميات الدم، وكلها عوامل تزيد من خطر الإصابة بأمراض القلب والأوعية الدموية. إضافةً إلى ذلك، ومع تزايد أعداد كبار السن في العالم، أصبحت عوامل الخطر المرتبطة بالعمر أكثر شيوعًا لأمراض القلب. تُحدث هذه الاتجاهات تحولًا في احتياجات الرعاية الصحية، وتزيد الطلب على طب القلب التداخلي وأجهزة الأوعية الدموية لإدارة أمراض القلب والأوعية الدموية وعلاجها بفعالية.

من المتوقع أن يُسهم التفاعل بين تغيرات نمط الحياة، وشيخوخة السكان، وزيادة الوعي، والابتكارات التكنولوجية في دعم الطلب على الأجهزة التداخلية وتعزيزه. ومع استمرار مقدمي الرعاية الصحية في إعطاء الأولوية لصحة القلب والأوعية الدموية والاستثمار في حلول العلاج المتقدمة، من المتوقع أن يشهد سوق أجهزة أمراض القلب التداخلية والأوعية الدموية الطرفية نموًا كبيرًا، مما يُلبي احتياجات الرعاية الصحية المُلحة التي يُمثلها العبء المتزايد لأمراض القلب والأوعية الدموية في المنطقة.

يمكنك الوصول إلى التقرير الكامل على الرابط التالي: https://www.databridgemarketresearch.com/reports/asia-pacific-interventional-cardiology-peripheral-vascular-devices-market

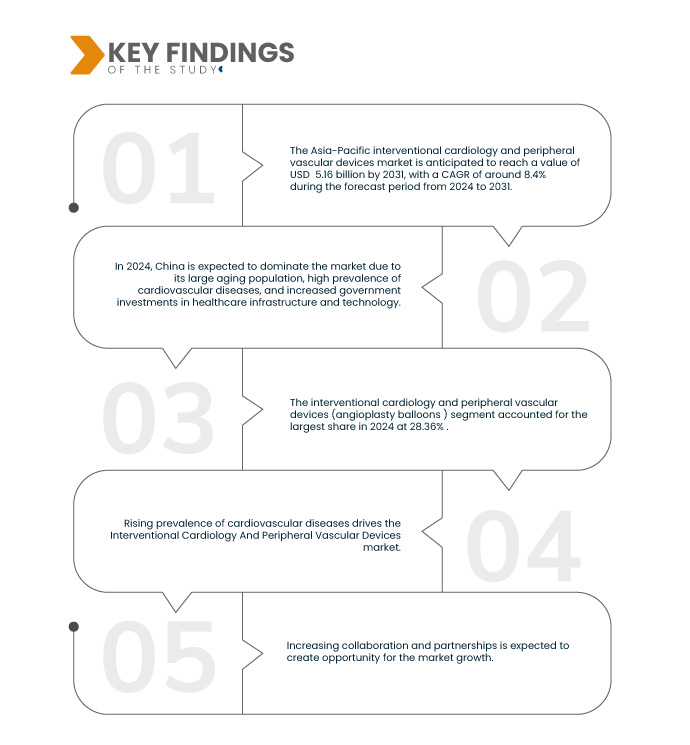

تحلل شركة Data Bridge Market Research أن سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ من المتوقع أن ينمو بمعدل نمو سنوي مركب قدره 8.4٪ في الفترة المتوقعة من 2024 إلى 2031 ومن المتوقع أن يصل إلى 5.16 مليار دولار أمريكي بحلول عام 2031.

النتائج الرئيسية للدراسة

تزايد عدد السكان المسنين

يُعدّ النمو السكاني لكبار السن في منطقة آسيا والمحيط الهادئ محركًا رئيسيًا لسوق أجهزة أمراض القلب التداخلية والأوعية الدموية الطرفية. ومع تقدم كبار السن في السن، يرتفع معدل انتشار أمراض القلب والأوعية الدموية، مما يستلزم أجهزة طبية متخصصة لتلبية احتياجاتهم الخاصة. يُعدّ كبار السن أكثر عرضة لأمراض القلب والأوعية الدموية بسبب التغيرات المرتبطة بالعمر وعوامل الخطر مثل ارتفاع ضغط الدم والسكري وفرط شحميات الدم، مما يزيد الطلب على الأجهزة التداخلية مثل الدعامات والقسطرة. علاوة على ذلك، يؤدي نمو كبار السن إلى زيادة الطلب على الإجراءات الجراحية واتباع نهج استباقي لصحة القلب والأوعية الدموية، مما يعزز استخدام الأجهزة التشخيصية والعلاجية ويدفع بتوسع السوق.

مع تزايد عدد كبار السن، يزداد انتشار أمراض القلب والأوعية الدموية، مما يؤدي إلى زيادة الطلب على الأجهزة الطبية المتخصصة والإجراءات التدخلية. ومع التركيز على الرعاية الصحية الوقائية والابتكارات التكنولوجية المستمرة، من المتوقع أن يشهد السوق نموًا كبيرًا، مما يُلبي بفعالية الاحتياجات الصحية الفريدة لكبار السن، ويُحسّن نتائج رعاية مرضى القلب والأوعية الدموية.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

سنة تاريخية

|

2022 (قابلة للتخصيص 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

المنتج (بالونات قسطرة الأوعية الدموية، الدعامات، القسطرة، منتجات إصلاح تمدد الأوعية الدموية، وغيرها والملحقات)، النوع (تقليدي وقياسي)، الإجراء (قسطرة الأوعية الدموية الطرفية، التدخل الحرقفي، التدخلات الظنبوبية (تحت الركبة)، استئصال الخثرة الشريانية، استئصال اللويحات الطرفية، والتدخلات الفخذية الرضفية)، المؤشرات ( مرض الشرايين الطرفية والتدخل التاجي)، الفئة العمرية (كبار السن، والبالغين، والأطفال) المستخدم النهائي (المستشفيات، مراكز الجراحة الخارجية ، مرافق التمريض، العيادات وغيرها)، قناة التوزيع (الموزعون الخارجيون، العطاء المباشر، وغيرها)

|

الدول المغطاة

|

الصين، الهند، اليابان، كوريا الجنوبية، أستراليا، سنغافورة، إندونيسيا، تايلاند، ماليزيا، الفلبين، وبقية دول آسيا والمحيط الهادئ

|

الجهات الفاعلة في السوق المغطاة

|

Abbott (الولايات المتحدة)، Boston Scientific Corporation (الولايات المتحدة)، BD (الولايات المتحدة)، Medtronic (الولايات المتحدة)، Terumo Corporation (اليابان)، B.Braun SE (ألمانيا)، ENDOCOR GmbH & CO. KG (ألمانيا)، Teleflex Incorporated (الولايات المتحدة)، Lepu Medical Technology (بكين) المحدودة (الصين)، MicroPort Scientific Corporation (الصين)، Koninklijke Philips NV (هولندا)، Biotronik (ألمانيا)، SMT (الصين)، OrbusNeich Medical Group Holdings Limited (الصين)، Biosensors International Group, Ltd. (سنغافورة)، Edwards Lifesciences Corporation (الولايات المتحدة)، AngioDynamics (الولايات المتحدة)، Alvimedica (تركيا)، Cook (الولايات المتحدة)، Cordis (الولايات المتحدة)، Palex (إسبانيا)، و WL Gore & Associates (الولايات المتحدة)، Inc.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research تتضمن أيضًا تحليلًا متعمقًا من الخبراء وعلم الأوبئة للمرضى وتحليل خطوط الأنابيب وتحليل التسعير والإطار التنظيمي.

|

تحليل القطاعات

يتم تقسيم سوق أجهزة القلب والأوعية الدموية الطرفية التدخلية في منطقة آسيا والمحيط الهادئ إلى سبعة قطاعات بارزة تعتمد على المنتج والنوع والإجراء والمؤشر والفئة العمرية والمستخدم النهائي وقناة التوزيع.

- على أساس المنتج، يتم تقسيم السوق إلى بالونات قسطرة الأوعية الدموية ، والدعامات، والقسطرة، ومنتجات إصلاح تمدد الأوعية الدموية، وغيرها من الملحقات

في عام 2024، من المتوقع أن تهيمن شريحة بالونات قسطرة الشرايين على السوق

من المتوقع أن تهيمن شريحة بالونات توسيع الأوعية الدموية على سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ في عام 2024 بحصة سوقية تبلغ 28.36٪ بسبب زيادة حالات أمراض الشرايين الطرفية، وزيادة خطر نمط الحياة المستقرة، والتشخيص المبكر، والكشف عن أمراض الشرايين الطرفية بواسطة أجهزة الأوعية الدموية الطرفية، وارتفاع التمويل الحكومي ووجود سياسات السداد في الرعاية الصحية.

- على أساس النوع، يتم تقسيم السوق إلى تقليدي وقياسي

في عام 2024، من المتوقع أن يهيمن القطاع التقليدي على السوق

ومن المتوقع أن تهيمن الشريحة التقليدية على السوق في عام 2024 بحصة سوقية تبلغ 56.44% بسبب ارتفاع معدل انتشار أمراض القلب والأوعية الدموية مثل أمراض الشريان التاجي وأمراض الشريان السباتي وأمراض القلب الإقفارية والتشوهات الخلقية في القلب وغيرها.

- بناءً على الإجراءات، يُقسّم السوق إلى قسطرة محيطية، وتدخلات الشريان الحرقفي، وتدخلات الظنبوب (تحت الركبة)، واستئصال الخثرة الشريانية، واستئصال اللويحات الشريانية المحيطية، وتدخلات الفخذ المأبضي. في عام 2024، من المتوقع أن يهيمن قطاع قسطرة الأوعية الدموية المحيطية على سوق أجهزة القلب والأوعية الدموية المحيطية التداخلية في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ 30%.

- بناءً على المؤشرات، يُقسّم السوق إلى قسمين: أمراض الشرايين الطرفية والتدخلات التاجية. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع أمراض الشرايين الطرفية على سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ ٦٤.٩٤٪.

- بناءً على الفئات العمرية، يُقسّم السوق إلى فئات عمرية: كبار السن، والبالغين، والأطفال. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع كبار السن على سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ ٧٥.٤٦٪.

- بناءً على المستخدم النهائي، يُقسّم السوق إلى مستشفيات، ومراكز جراحة خارجية، ومرافق تمريض، وعيادات، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع المستشفيات على سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ ٥٩.٦٥٪.

- بناءً على قنوات التوزيع، يُقسّم السوق إلى موزعين خارجيين، وعطاءات مباشرة، وغيرها. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع العطاءات المباشرة على سوق أجهزة القلب التداخلية والأوعية الدموية الطرفية في منطقة آسيا والمحيط الهادئ بحصة سوقية تبلغ ٦٥.٩٨٪.

اللاعبون الرئيسيون

تقوم شركة Data Bridge Market Research بتحليل شركات Abbott (الولايات المتحدة)، وBoston Scientific Corporation (الولايات المتحدة)، وBD (الولايات المتحدة)، وMedtronic (الولايات المتحدة)، وTerumo Corporation (اليابان) باعتبارها اللاعبين الرئيسيين في السوق.

تطوير السوق

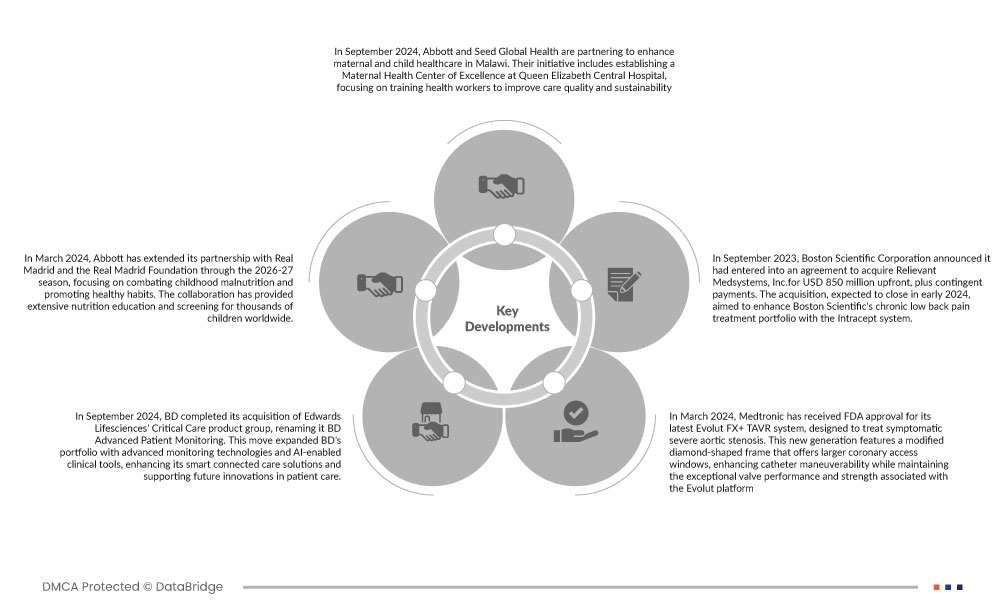

- في سبتمبر 2024، تتعاون شركة أبوت مع منظمة سيد جلوبال هيلث لتحسين رعاية الأمومة والطفولة في ملاوي. تتضمن مبادرتهما إنشاء مركز متميز لصحة الأمومة في مستشفى الملكة إليزابيث المركزي، مع التركيز على تدريب العاملين الصحيين لتحسين جودة الرعاية واستدامتها.

- في سبتمبر 2024، استحوذت شركة BD على مجموعة منتجات الرعاية الحرجة التابعة لشركة Edwards Lifesciences، وأعادت تسميتها إلى BD Advanced Patient Monitoring. وسّعت هذه الخطوة محفظة BD بتقنيات مراقبة متقدمة وأدوات سريرية مدعومة بالذكاء الاصطناعي، مما عزز حلول الرعاية الذكية المتصلة، ودعم الابتكارات المستقبلية في رعاية المرضى.

- في مارس 2024، حصلت شركة ميدترونيك على موافقة إدارة الغذاء والدواء الأمريكية (FDA) على أحدث نظام Evolut FX+ TAVR، المصمم لعلاج تضيق الأبهر الشديد المصحوب بأعراض. يتميز هذا الجيل الجديد بإطار مُعدّل على شكل ماسة يوفر نوافذ وصول تاجية أكبر، مما يُحسّن من سهولة استخدام القسطرة مع الحفاظ على أداء الصمام الاستثنائي ومتانته المرتبطة بمنصة Evolut.

- في مارس 2024، مددت شركة أبوت شراكتها مع ريال مدريد ومؤسسة ريال مدريد حتى موسم 2026-2027، مع التركيز على مكافحة سوء التغذية لدى الأطفال وتعزيز العادات الصحية. وقد وفّر هذا التعاون تثقيفًا وفحوصات غذائية مكثفة لملايين الأطفال حول العالم.

- في نوفمبر 2023، استحوذت شركة بوسطن ساينتفك على شركة ريليفانت ميدسيستمز في 17 نوفمبر 2023، مضيفةً بذلك نظام إنتراسبت لعلاج العصب داخل العظم إلى محفظة علاج الألم المزمن. يُوسّع هذا الاستحواذ، الذي تبلغ تكلفته 850 مليون دولار أمريكي مقدمًا بالإضافة إلى مدفوعات مشروطة، نطاق الوصول إلى علاج آلام الفقرات من خلال تغطية وطنية، مما يعود بالنفع على أكثر من 150 مليون شخص.

- في نوفمبر 2023، وقّعت شركة BD وشركة Bio Farma مذكرة تفاهم لمكافحة مرض السل في إندونيسيا من خلال توفير إمكانية الوصول إلى تشخيصات السل التي تُقدّمها BD. يهدف هذا التعاون إلى تحسين سلسلة التوريد وتعزيز تشخيص السل، بما يتماشى مع هدف إندونيسيا بالقضاء على المرض بحلول عام 2030.

- في سبتمبر 2023، أعلنت شركة بوسطن ساينتفك عن إبرامها اتفاقية للاستحواذ على شركة ريليفانت ميدسيستمز مقابل 850 مليون دولار أمريكي مقدمًا، بالإضافة إلى دفعات مشروطة. وكان الهدف من عملية الاستحواذ، التي من المتوقع إتمامها في أوائل عام 2024، تعزيز محفظة بوسطن ساينتفك لعلاج آلام أسفل الظهر المزمنة من خلال نظام إنتراسيبت.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ هي الصين والهند واليابان وكوريا الجنوبية وأستراليا وسنغافورة وإندونيسيا وتايلاند وماليزيا والفلبين وبقية دول آسيا والمحيط الهادئ.

وفقًا لتحليل Data Bridge Market Research:

الصين هي الدولة المهيمنة في سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ خلال الفترة المتوقعة من 2024 إلى 2031

ومن المتوقع أن تهيمن الصين على السوق بسبب ارتفاع عدد سكانها المسنين، وانتشار أمراض القلب والأوعية الدموية، وزيادة الاستثمارات الحكومية في البنية التحتية للرعاية الصحية والتكنولوجيا.

للحصول على معلومات أكثر تفصيلاً حول تقرير سوق أجهزة القلب والأوعية الدموية الطرفية التداخلية في منطقة آسيا والمحيط الهادئ، انقر هنا - https://www.databridgemarketresearch.com/reports/asia-pacific-interventional-cardiology-peripheral-vascular-devices-market