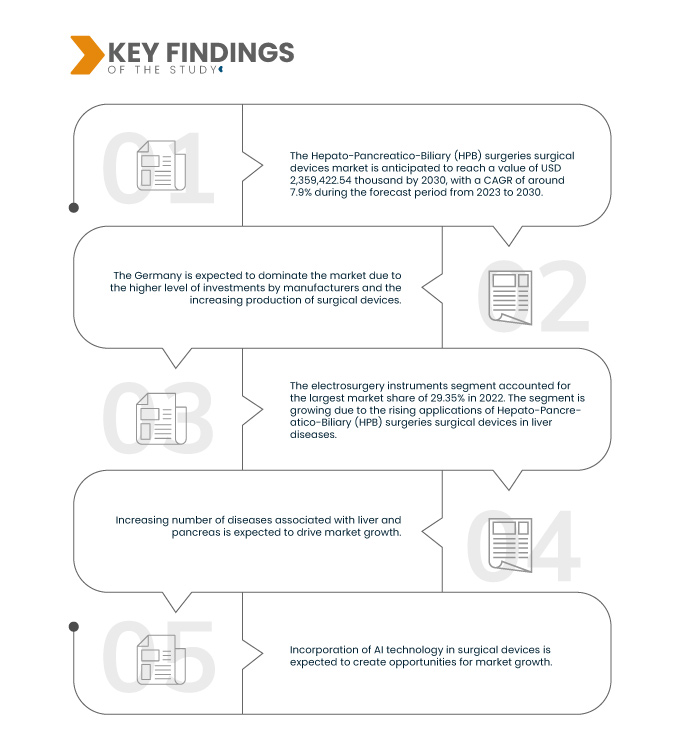

The escalating prevalence of diseases linked to the liver and pancreas has emerged as a pivotal factor propelling the market growth. In recent years, the healthcare landscape has witnessed a notable surge in conditions such as liver cirrhosis, hepatocellular carcinoma, pancreatic cancer, and chronic pancreatitis among others. This surge in diseases affecting the liver and pancreas has created a substantial demand for advanced surgical interventions and innovative medical devices. The healthcare industry is witnessing a surge in the number of HPB surgeries performed as these hepato-pancreatic conditions become more prevalent globally. These surgical procedures necessitate a range of specialized devices and instruments designed to facilitate complex surgeries, minimize risks, and improve patient outcomes.

Consequently, the increasing demand for HPB surgeries and the corresponding need for surgical devices have propelled market growth. This trend is likely to persist as healthcare professionals and medical device manufacturers continue to innovate and improve surgical techniques and devices for better patient care. Thus, the rising incidence of liver and pancreas-related diseases is expected to drive market growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-hepato-pancreatico-biliary-hpb-surgeries-surgical-devices-market

Data Bridge Market Research analyzes that the Europe Hepato-Pancreatico-Biliary (HPB) Surgeries Surgical Devices Market is expected to grow with a CAGR of 7.9% in the forecast period of 2023 to 2030 and is expected to reach USD 2,359,422.54 thousand by 2030. The product segment is projected to propel the market growth due to increasing number of diseases associated with liver and pancreas.

Key Findings of the Study

Incorporation of AI Technology in Surgical Devices

Incorporating AI (Artificial Intelligence) technology into surgical devices presents a remarkable opportunity for market growth. AI has the potential to revolutionize the field of HPB surgery by enhancing precision, improving patient outcomes, and reducing the overall complexity of these intricate procedures. AI can assist surgeons in several ways, such as image analysis for better preoperative planning and intraoperative guidance. Machine learning algorithms can process vast amounts of medical data, enabling more accurate diagnoses and surgical strategies tailored to each patient's unique anatomy. During surgery, AI-powered surgical devices can provide real-time feedback and assistance to surgeons, helping them make more informed decisions and execute precise movements.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Product (Electrosurgery Instruments, Endoscope, Visualization and Robotic Surgical System, Hand Instruments, Access Instruments, Surgical Suture and Stapler Devices, Energy/Vessel Sealing Devices, Fluid Management Systems, Stents, and Others), Indication (Liver Cancer, Pancreatic Cancer, Bile Duct Cancer, Gall Stones, Pancreatitis, Cirrhosis, Cholesystitis, and Others), Type of Surgery (Open Surgery and Minimally-Invasive Surgery), Age Group (Pediatric, Adults, and Geriatric), End User (Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Trauma Centers, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others)

|

|

Countries Covered

|

Germany, France, U.K., Hungary, Lithuania, Austria, Ireland, Norway, Poland, Italy, Spain, Russia, Turkey, Netherlands, Switzerland, and Rest of Europe

|

|

Market Players Covered

|

Medtronic (Ireland), Cook (U.S.), B. Braun SE (Germany), BD (U.S.), and Johnson & Johnson Services, Inc. (U.S.) Cook (U.S.), Olympus Corporation (Japan), B. Braun SE (Germany), Boston Scientific Corporation (U.S.), CONMED Corporation (U.S.), COMEPA (France), CooperSurgical Inc (U.S.), KARL STORZ (Germany), Terumo Europe NV (Belgium), , STERIS (U.S.), Medi-Globe GmbH (Germany), TeleMed Systems Inc (U.S.), and FUJIFILM Corporation (Japan) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market is segmented into six notable segments based on product, indication, type of surgery, age group, end user, and distribution channel.

- On the basis of product, the market is segmented into electrosurgery instruments, endoscope, visualization and robotic surgical system, hand instruments, access instruments, surgical suture and stapler devices, energy/vessel sealing devices, fluid management systems, stents, and others.

In 2023, the electrosurgery instruments segment is expected to dominate the Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market

In 2023, the electrosurgery instruments segment is expected to dominate the market with 29.58% market share due to being the most preferred product by healthcare professionals.

- On the basis of indication, the market is segmented into liver cancer, pancreatic cancer, gall stones, bile duct cancer, cirrhosis, pancreatitis, cholesystitis, and others.

In 2023, the liver cancer segment is expected to dominate the Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market

In 2023, the liver cancer segment is expected to dominate the market with 28.34% market share due to changes in lifestyle and increasing alcohol consumption.

- On the basis of type of surgery, the market is segmented into open surgery and minimally-invasive surgery. In 2023, the open surgery segment is expected to dominate the market with 71.84% market share.

- On the basis of age group, the market is segmented into adults, geriatrics, and pediatric. In 2023, the adults segment is expected to dominate the market with 61.98% market share.

- On the basis of end user, the market is segmented into hospitals, specialty clinics, trauma centers, ambulatory surgical centers, and others. In 2023, the hospitals segment is expected to dominate the market with 73.71% market share.

- On the basis of distribution channel, the market is segmented into direct tenders, retail sales, and others. In 2023, the direct tenders segment is expected to dominate the market with 71.58% market share.

Major Players

Data Bridge Market Research analyzes Medtronic (Ireland), Cook (U.S.), B. Braun SE (Germany), BD (U.S.), and Johnson & Johnson Services, Inc. (U.S.) as the major players of the market.

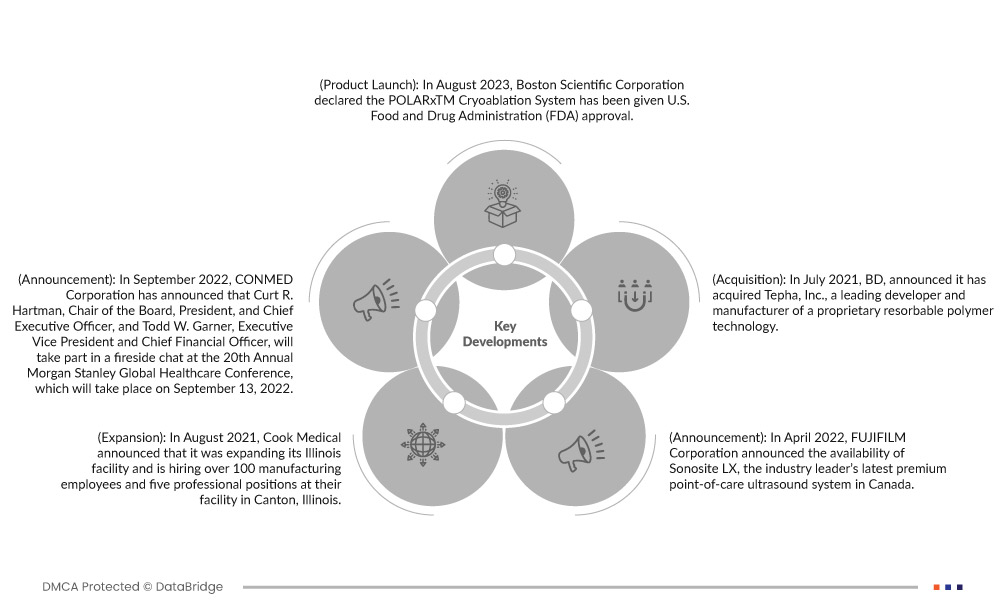

Market Development

- In August 2023, Boston Scientific Corporation declared the POLARxTM Cryoablation System has been given the U.S. Food and Drug Administration (FDA) approval. The new system uses the POLARx FIT Cryoablation Balloon Catheter, a device with the unusual ability to enable two balloon sizes—28 and 31mm—in one catheter. This catheter is indicated for the treatment of patients with paroxysmal Atrial Fibrillation (AF). This approval of newly launched products will help the companygain more brand value and customer reliability.

- In September 2022, CONMED Corporation announced that Curt R. Hartman, Chair of the Board, President, and Chief Executive Officer, and Todd W. Garner, Executive Vice President and Chief Financial Officer, will take part in a fireside chat at the 20th Annual Morgan Stanley Europe Healthcare Conference, which will take place on September 13, 2022. This participation has helped the company gain more recognition among competitors and customers.

- In April 2022, FUJIFILM Corporation announced the availability of Sonosite LX, the industry leader’s latest premium point-of-care ultrasound system in Canada. This helped the company to expand its product portfolio.

- In August 2021, Cook Medical announced that it was expanding its Illinois facility and is hiring over 100 manufacturing employees and five professional positions at its facility in Canton, Illinois. The expanded manufacturing capabilities will help Cook meet patient and customer demand for its medical devices.

- In July 2021, BD announced it had acquired Tepha, Inc., a leading developer and manufacturer of a proprietary resorbable polymer technology. This strategic acquisition advances BD's category leadership in surgical mesh and enables future innovations to provide new solutions to physicians and their patients.

Regional Analysis

Geographically, the countries covered in the market report are Germany, France, U.K., Hungary, Lithuania, Austria, Ireland, Norway, Poland, Italy, Spain, Russia, Turkey, Netherlands, Switzerland, and Rest of Europe.

As per Data Bridge Market Research analysis:

Germany is the dominant country in Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market

Germany is expected to dominate the market with the highest market share due to the higher level of investments by manufacturers and technological advancements in electrosurgery instruments.

Germany is estimated to be the fastest growing country in Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market during the forecast period 2023-2030

Germany is expected to be the fastest-growing country in the market as electrosurgery instruments, driven by the rapid technological advancements within the region.

For more detailed information about the Europe Hepato-Pancreatico-Biliary (HPB) surgery surgical devices market report, click here – https://www.databridgemarketresearch.com/reports/europe-hepato-pancreatico-biliary-hpb-surgeries-surgical-devices-market