Rapid diagnostic tests are preferred over standard diagnostic tests since they can boost the aetiologic analysis of infections in several situations (for instance, sepsis, respiratory tract infections, and meningitis). The elucidation of the currently available rapid diagnostic tests is not always upfront, and therefore, they cannot yet replace conventional tests. There are three types of rapid diagnostic tests. The rapid immunoassay test strips or cassettes are used to measure the concentration of a chemical. Test strips are most often used to test the pH level of a liquid in a sample, but some types of test strips serve other purposes, such as detecting the presence of a contaminant. The immunochromatographic assays are easy and convenient; the rapid tests show a suitable alternative to the conventional subculture method for the primary identification of pathogens. The Reverse Transcriptase (RT) Polymerase Chain Reaction (PCR) is used to test the genetic material present in the sample. The strengths of rapid diagnostic tests include ease of use, minimum training requirements, rapid results, and limited instrumentation. However, the weaknesses noticed are the subjective interpretation of readout, less rate of biological data being delivered, and less sensitivity relative to reference tests.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-rapid-diagnostic-tests-rdt-market

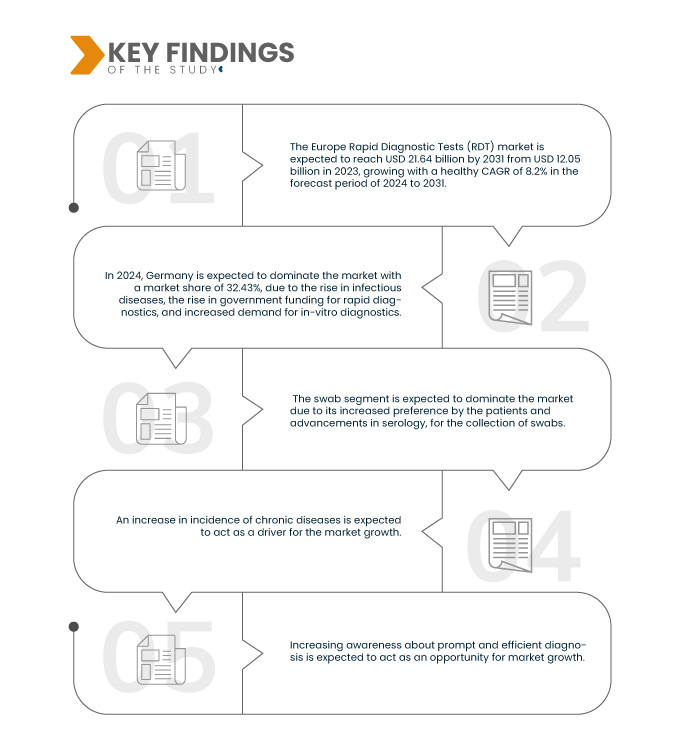

Data Bridge Market Research analyses that the Europe Rapid Diagnostic Tests (RDT) Market is expected to reach USD 21.64 billion by 2031 from USD 12.05 billion in 2023, growing with a healthy CAGR of 8.2% in the forecast period of 2024 to 2031.

Key Findings of the Study

- Increase in the Incidence of Chronic Diseases

The driving factors responsible for the growth of the Europe Rapid Diagnostic Test (RDT) market are the increase in the incidence of chronic diseases, the rise in the geriatric population, technological developments in rapid diagnostic tests, and the rise in product launches. However, the factors that are expected to restrain the market are the rise in the cost of rapid diagnostics, product recalls faced in rapid diagnostic tests, and lack of awareness about the use of rapid diagnostics. Moreover, the strategic initiatives by market players and the rise in healthcare expenditure bolster the market growth. However, the need for skilled labor for sample collection and the late approval associated with product launches are the challenges that can hinder the market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Product Type (Consumables and Kits, Instruments, and Others), Mode (Professional and Over-The-Counter [OTC]), Technology (PCR-Based, Flow-Through Assays, Lateral Flow Immunochromatographic Assays, Agglutination Assay, Microfluidics, Substrate Technology, and Others), Modality (Laboratory Based Test and Non-Laboratory Based Test), Age Group (Adult and Pediatric), Test Type (Determining Confirmation, Serological Testing and Viral Sequencing), Approach (In-Vitro Diagnostic and Molecular Diagnostic), Specimen (Swab, Blood, Urine, Saliva, Sputum, and Others), Application (Infectious Disease Testing, Glucose Monitoring, Cardiology Testing, Oncology Testing, Cardiometabolic Testing, Drugs-of-Abuse Testing, Pregnancy & Fertility Testing, Toxicology Testing, and Others), End User (Hospital & Clinic, Diagnostic Laboratory, Home Care Setting, Research and Academic Institutes, and Others), Distribution Channel (Direct Tender and Retail Sales)

|

|

Countries Covered

|

Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and Rest of Europe

|

|

Market Players Covered

|

Abbott (U.S.), Danaher (U.S.), Cellex (U.S.), Fujirebio (Japan), Access Bio (U.S.), Cardinal Health (U.S.), Bio-Rad Laboratories, Inc. (U.S.), BD (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), bioMérieux SA (France), InBios International, Inc (U.S.), Luminex Corporation (U.S.), Gnomegen LLC (U.S.), QIAGEN (Netherland), Quidel Corporation (U.S.), Sysmex Europe GMBH (Germany), Cardinal Health (U.S.), Siemens Healthcare Gmbh (A Subsidiary Siemens Healthineers AG) (Germany), MEGACOR DIAGNOSTIKGMBH (Germany), PerkinElmer Inc. (U.S.), Sekisui Diagnostics (U.S.), PTS Diagnostics (U.S.), werfen (Spain), Nova Biomedical (U.S.), and Trinity Biotech (Ireland), among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis

The Europe Rapid Diagnostic Tests (RDT) market is categorized into eleven notable segments based on product type, mode, technology, modality, age group, test type, approach, specimen, application, end user, and distribution channel.

- On the basis of product type, the market is segmented into consumables and kits, instruments, and others

In 2024, the consumables and kits segment is expected to dominate the Europe Rapid Diagnostic Tests (RDT) market

In 2024, the consumables and kits segment is expected to dominate the market with a market share of 55.54% due to the ease of use, availability of test kits, and faster delivery of results.

- On the basis of mode, the market is segmented into professional and Over-The-Counter [OTC]

In 2024, the professional segment is expected to dominate the Europe Rapid Diagnostic Tests (RDT) market

In 2024, the professional rapid diagnostic test product segment is expected to dominate the market with a market share of 76.11% due to accuracy and increased use in points of care, such as homes.

- On the basis of technology, the market is segmented into PCR-based, flow-through assays, lateral flow immunochromatographic assays, agglutination assay, microfluidics, substrate technology, and others. In 2024, the PCR-based segment is expected to dominate the market with a market share of 37.51%

- On the basis of modality, the market is segmented into laboratory based test and non-laboratory based test. In 2024, the laboratory based test segment is expected to dominate the market with a market share of 71.68%

- On the basis of age group, the market is segmented into adult and pediatric. In 2024, the adult segment is expected to dominate the market with a market share of 84.94%

- On the basis of test type, the market is segmented into determining confirmation, serological testing, and viral sequencing. In 2024, the determining confirmation segment is expected to dominate the market with a market share of 43.27%

- On the basis of approach, the market is segmented into in-vitro diagnostic and molecular diagnostic. In 2024, the in-vitro diagnostic segment is expected to dominate the market with a market share of 73.88%

- On the basis of specimen, the market is segmented into swab, blood, urine, saliva, sputum, and others. In 2024, the swab segment is expected to dominate the Europe rapid diagnostic tests (RDT) market with a market share of 45.04%

- On the basis of application, the market is segmented into infectious disease testing, glucose monitoring, cardiology testing, oncology testing, cardiometabolic testing, drugs-of-abuse testing, pregnancy & fertility testing, toxicology testing, and others. In 2024, the infectious disease testing segment is expected to dominate the market with a market share of 33.74%

- On the basis of end user, the market is segmented into hospital & clinic, diagnostic laboratory, home care setting, research and academic institutes, and others. In 2024, the hospital and clinic segment is expected to dominate the market with a market share of 55.10%

- On the basis of distribution channel, the market is segmented into direct tender and retail sales. In 2024, the direct tender segment is expected to dominate the market with a market share of 61.53%

Major Players

Data Bridge Market Research analyzes Abbott (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Siemens Healthcare Gmbh (A Subsidiary Siemens Healthineers AG) (Germany), Danaher (U.S.), Cardinal Health (U.S.) as major market players of Europe Rapid Diagnostic Tests (RDT) market.

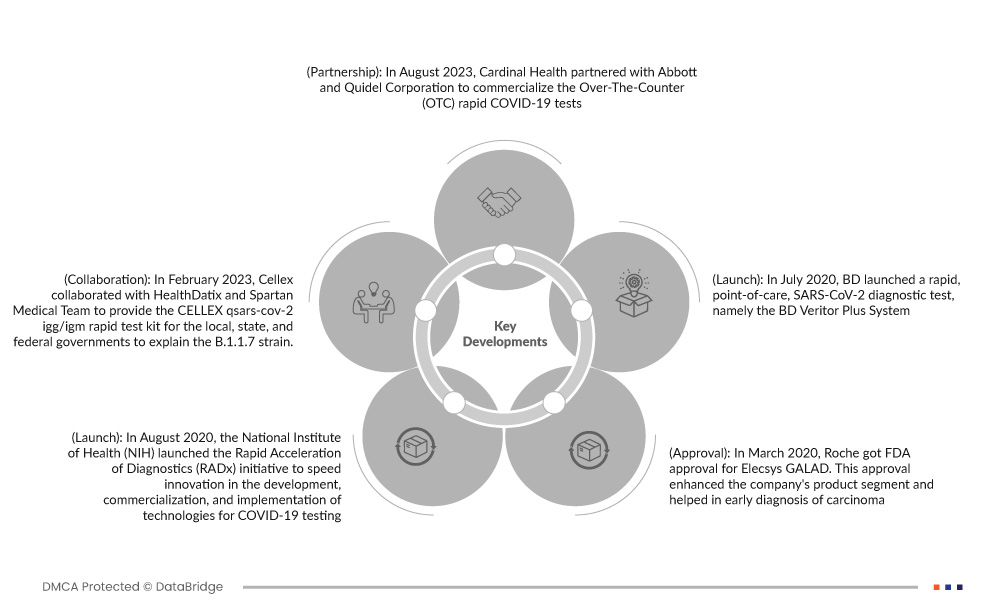

Market Developments

- In May 2020, according to a report by WHO, it has been estimated that chronic disease will be responsible for three-quarters of deaths across the globe. The number of people developing diseases such as type 2 disease, and lung cancer will reach 228 million in 2025 from 80 million. The rapid increase in chronic disease with the lifestyle change pattern leads to an increase in the obesity rate of the world, which is highly preventable by early diagnosis

- In April 2020, In August, Cardinal Health partnered with Abbott and Quidel Corporation to commercialize the Over-The-Counter (OTC) rapid COVID-19 tests. The partnership would allow Cardinal Health to expand Cardinal Health's COVID-19 testing and surveillance offerings and be able to access Quidel's QuickVue At-Home OTC COVID-19 Test and Abbott's BinaxNOW COVID-19 Antigen Self-Test, which allow the patients to perform tests without prescription easily

- In August 2020, the National Institute of Health (NIH) launched the Rapid Acceleration of Diagnostics (RADx) initiative to speed innovation in the development, commercialization, and implementation of technologies for COVID-19 testing. The rapid diagnostic test delivers accurate and optimum results

- In March 2020, Roche got FDA approval for Elecsys GALAD. This approval enhanced the company's product segment and helped in early diagnosis of carcinoma. This approval also enhanced the financials of the company

- In July 2020, BD launched a rapid, point-of-care, SARS-CoV-2 diagnostic test, namely the BD Veritor Plus System. These new assays can deliver results in 15 minutes, are easy to use, and are a highly portable instrument that is critical for improving access to COVID-19 diagnosis. This new product launch has diversified the company's product portfolios

Regional Analysis

Geographically, the countries covered in the market report are Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, and rest of Europe.

As per Data Bridge Market Research analysis:

Germany is expected to be dominant and fastest growing country in Europe Rapid Diagnostic Tests (RDT) Market

Germany is expected to dominate the market due to the rising of the infectious disease with the aging population.

For more detailed information about the Europe Rapid Diagnostic Tests (RDT) Market Report, click here – https://www.databridgemarketresearch.com/reports/europe-rapid-diagnostic-tests-rdt-market