Increased financial crimes detection efforts have intensified scrutiny on anti-money laundering (AML) measures, focusing on enhancing compliance and monitoring systems. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system Hence increased financial crimes detection efforts of the sector is expected to drive the market growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-anti-money-laundering-market

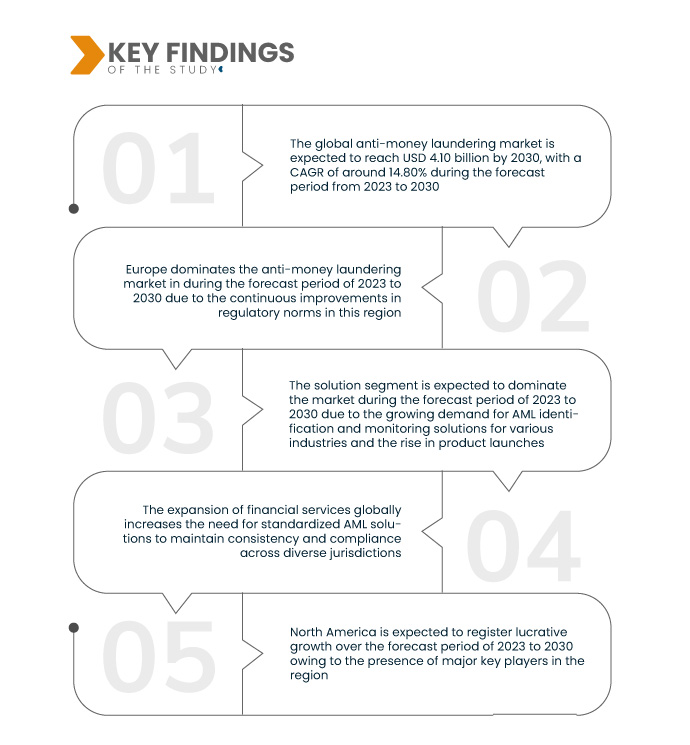

Data Bridge Market Research analyses that Global Anti-Money Laundering Market is expected to reach USD 11.81 billion by 2031 from USD 3.94 billion in 2023, growing with a CAGR of 14.8% in the forecast period of 2024 to 2031.

Increasing Stringent Regulations and Compliance Related to AML

The increasing stringent regulations and compliance related to Anti-Money Laundering (AML) drive the AML market by intensifying the need for advanced detection and reporting systems. Regulatory bodies impose stricter rules to prevent financial crimes, compelling institutions to adopt comprehensive AML solutions. These enhanced regulations increase the demand for technology and services that ensure compliance and mitigate risks. As penalties for non-compliance grow, organizations invest more in robust AML frameworks to safeguard against legal and financial repercussions. Consequently, the market for AML solutions expands to meet these heightened regulatory demands.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Billion

|

|

Segments Covered

|

Offering (Solution and Services), Function (Compliance Management, Customer Identity Management, Transaction Monitoring, Currency Transaction Reporting, and Others), Deployment (Cloud and On-Premise), Enterprise Size (Large Enterprises and Small & Medium Enterprises), End Use (Banks & Financial Institution, Insurance Providers, Government, Gaming & Gambling, and Others

|

|

Countries Covered

|

U.S., Canada, and Mexico, U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Belgium, Turkey, Luxembourg, Rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, Egypt, Israel, and Rest of Middle East and Africa

|

|

Market Players Covered

|

NICE (Israel), IBM (U.S.), sanctions.io (U.S.), Intel Corporation (U.S.), Oracle (U.S.), SAP SE (Germany), Accenture (U.S.), Experian Information Solution, Inc. (Ireland), Open Text Corporation (Canada), BAE Systems (U.K.), SAS Institute Inc (U.S.), ACI Worldwide (U.S.), Cognizant (U.S.), Trulioo (Canada), Temenos Headquarters SA (Switzerland), WorkFusion, Inc, (U.S.) and Vixio Regulatory Intelligence (England) among others.

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The global anti-money laundering market is segmented into five notable segments based on the offering, function, deployment, enterprise size, and end use.

- On the basis of offering, the global anti-money laundering market is segmented into solution and services

In 2024, the solution segment is expected to dominate the global anti-money laundering market

In 2024, the solution segment is expected to dominate the global anti-money laundering market segment with a 53.78% share due to the growing demand for AML identification and monitoring solutions for various industries and the rise in product launches.

- On the basis of function, the global anti-money laundering market is segmented into compliance management, currency transaction reporting, customer identity management, transaction monitoring, and others.

In 2024, compliance management segment is expected to dominate the global Anti-money laundering market

In 2024, compliance management segment is expected to dominate the market with a 32.64% market share due to an increase in stringent regulations and compliances for AML to strengthen the solution.

- On the basis of deployment, the global anti-money laundering market is segmented into on-premise and cloud. In 2024, the cloud segment is expected to dominate the global anti-money laundering market with a 54.37% market share.

- On the basis of enterprise size, the global anti-money laundering market is segmented into small & medium enterprises and large enterprises. In 2024, the large enterprise segment is expected to dominate the global anti-money laundering market segment with a 56.80% market share.

- On the basis of end use, the global anti-money laundering market is segmented into banks & financial institutions, insurance providers, gaming & gambling, government, and others. In 2024, banks & financial institutions segment is expected to dominate the global anti-money laundering market segment with a 33.00% market share.

Major Players

Data Bridge Market Research analyzes Accenture (Ireland), ORACLE (U.S.), Cognizant (U.S.), Intel Corporation (U.S.), IBM (U.S.) as major market players in this market.

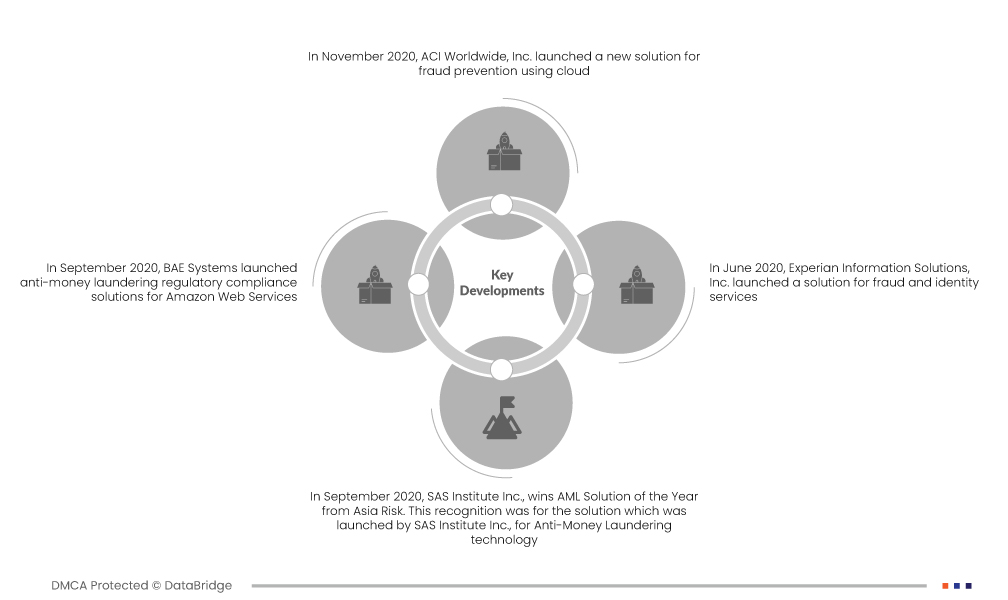

Market Development

- In September 2020, Accenture proposed a data-driven managed services model to help financial firms combat rising compliance costs and increased crime. The approach focused on enhancing Anti-Money Laundering (AML) and Know Your Customer (KYC) functions through automation, offering greater efficiency compared to temporary staffing solutions. This model benefited companies by enabling cost-effective regulatory compliance and providing strategic growth opportunities

- In April 2024, Oracle introduced the Financial Services Compliance Agent, an AI-powered cloud service designed to help banks mitigate anti-money laundering (AML) risks. This service allows banks to conduct cost-effective scenario testing to adjust controls, identify suspicious transactions, and enhance compliance. It also helps banks assess and optimize transaction monitoring systems, evaluate new product risks, and proactively address high-risk typologies. This solution aims to reduce compliance costs and improve the effectiveness of AML programs

- In April 2024, Cognizant enhanced AML measures by improving detection accuracy and efficiency, Auren Malik explored the dual-edged nature of generative AI in anti-money laundering (AML) efforts in a recent blog. while also noting its potential misuse by criminals. Cognizant’s insights emphasize their commitment to advancing AML strategies and technology to stay ahead of emerging threats

- In August 2024, Intel Corporation and F5 announced a collaboration to enhance AI inference solutions. The partnership integrated F5's NGINX Plus with Intel's OpenVINO toolkit and Infrastructure Processing Units (IPUs). This solution improved AI model performance, security, and scalability by combining traffic management and security with optimized AI inference. The benefits include superior protection, high performance, and efficient resource management for AI applications, particularly at the edge

- In February 2024, IBM collaborated with Clari5 to bring Clari5's real-time Enterprise Financial Crime Management solution to the new IBM LinuxONE 4 Express system. This partnership expanded Clari5's fraud prevention capabilities by leveraging IBM's Telum processor, enhancing AI-driven fraud detection and reducing false positives. The new system offered Clari5 clients improved scalability, security, and cost savings. By integrating Clari5 on IBM LinuxONE 4 Express, financial institutions gained a powerful platform to monitor transactions in real time, optimize AI processes, and streamline fraud prevention efforts without disrupting operations

Regional Analysis

Geographically, the countries covered in the global anti-money laundering market report are U.S., Canada, and Mexico, U.K., Germany, France, Italy, Spain, Russia, Netherlands, Switzerland, Belgium, Turkey, Luxembourg, rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Saudi Arabia, Egypt, Israel, and rest of Middle East and Africa.

As per Data Bridge Market Research analysis:

Europe region is expected to dominate and fastest growing region in the global anti-money laundering market

Europe is expected to dominate and fastest growing region in the global anti-money laundering market due to highest demand for transaction monitoring systems that assess financial crime patterns and the maximum number of industries such as financial, banking, insurance, among others where these technologies can be deployed which subsequently increases the need for anti-money laundering solutions.

For more detailed information about global Anti-Money Laundering Market report, click here – https://www.databridgemarketresearch.com/reports/global-anti-money-laundering-market