The Braze Alloys Market offers a wide array of applications, including automotive, aerospace, electronics, and HVAC systems. However, the dominating segment is in the automotive industry, where braze alloys are extensively used for joining components, such as radiators, heat exchangers, and engine parts. This is due to the alloys' exceptional strength, corrosion resistance, and ability to withstand high temperatures, ensuring reliable performance in demanding automotive environments. With the growing demand for lightweight materials and increased vehicle production, the automotive sector remains the primary driver of the Braze Alloys market's growth.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-braze-alloys-market

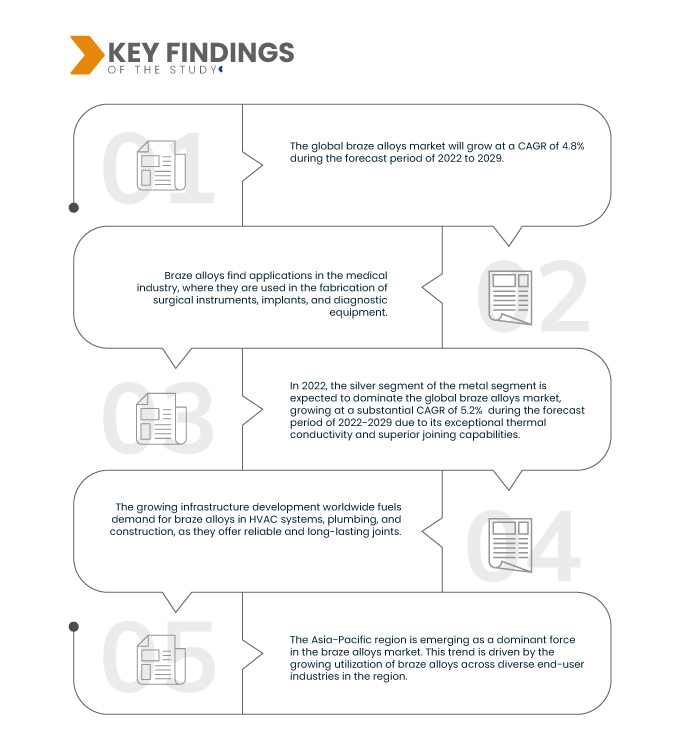

Data Bridge Market Research analyses that the Global Braze Alloys Market will grow at a CAGR of 4.8% during the forecast period of 2022 to 2029. Environmental concerns and regulations are pushing industries to adopt more efficient and eco-friendly materials, with braze alloys being a viable choice due to their sustainability and recyclability.

Key Findings of the Study

Innovations in material science are expected to drive the market's growth rate

Continuous advancements in the formulation and manufacturing of braze alloys lead to improved performance and increased versatility. These innovations enable braze alloys to offer enhanced strength, durability, and resistance to extreme conditions. Consequently, they find wider applications across industries, including automotive, aerospace, and electronics. This expanding scope and improved performance drive market growth as businesses increasingly rely on these alloys for reliable and efficient joining solutions in various demanding environments.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 20142019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Tons, Pricing in USD

|

|

Segments Covered

|

Metal (Nickel, Cobalt, Silver, Gold, Aluminum, Copper, Steel, Iron, Magnesium, Titanium, and Others), Filler Material (Braze Powder, Braze Paste, Braze Tape, Braze Preform, Braze Foil and Braze Rod and Wire), Technology (Torch Brazing, Furnace Brazing, Induction Brazing, Dip Brazing, Resistance Brazing, Infrared Brazing, Exothermic Brazing, Blanket Brazing, Electron Beam/Laser Brazing, Braze Welding, Dissociated Ammonia, Vacuum Brazing, Hydrogen Brazing, Fuel Gas Brazing and Others), Form (Pipe, Tube, Sheet, Strip, Plate, Round Bar, Flat, Bar, Wire, and Others), Production Temperature (Less than 900 °C, 901 °C to 1000 °C, 1001 °C to 1200 °C and Above 1200 °C), End Use (Aerospace and Defense, Electronics and Electrical, Automotive, Marine, Chemicals, Building and Construction and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, (Germany), France, U.K., Netherlands, (Switzerland), (Belgium), Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, (India), South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Johnson Matthey (U.K.), OC Oerlikon Management AG (Switzerland), Sulzer Ltd (Switzerland), Belmont Metals (U.S.), Harris Products Group (U.S.), Morgan Advanced Materials and its affiliates (U.K.), Aimtek, Inc. (U.S.), Prince Izant Compan (U.S.), LucasMilhaupt, Inc. (U.S.), Esprix Technologies (U.S.), Indium Corporation (U.S.), AMETEK, Inc. (U.S.), TSI Technologies (U.S.), ESAB (U.S.), Umicore (Belgium), (India)n Solder and Brazing Alloys (India), SAXONIA Edelmetalle GmbH (Germany), Saru Silver Alloy Private Limited (India), Cupro Alloys Corporation (India), KRANTI METALLURGY PVT LTD. (India), S. K. METAL (India)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global braze alloys market is segmented into metal, filler material, technology, form, production temperature, and end use.

- On the basis of metal, the global braze alloys market is segmented into silver, copper, nickel, gold, titanium, steel, aluminum, cobalt, iron, magnesium, and other. In 2022, the silver segment is expected to dominate the global braze alloys market, growing at a substantial CAGR of 5.2% during the forecast period of 2022-2029 due to its exceptional thermal conductivity and superior joining capabilities.

In 2022, the silver segment of the metal segment is expected to dominate the global braze alloys market during the forecast period of 2022-2029

In 2022, the silver segment is expected to dominate the global braze alloys market, growing at a substantial CAGR of 5.2% during the forecast period of 2022-2029 due to its exceptional thermal conductivity and superior joining capabilities. These qualities make silver-based braze alloys a preferred choice for critical applications in industries such as aerospace, electronics, and automotive, ensuring its leading position in the market.

- On the basis of filler material, the global braze alloys market is segmented into braze paste, braze rod and wire, braze powder, braze preform, braze foil, and braze tape. In 2022, the braze paste segment is projected to establish supremacy in the global braze alloys market, growing at a substantial CAGR of 5.0% during the forecast period of 2022-2029 due to its ease of application and ability to provide precise, controlled bonding in various industries.

In 2022, the braze paste segment of the filler material segment is expected to dominate the global braze alloys market during the forecast period of 2022-2029

In 2022, the braze paste segment is projected to establish supremacy in the global braze alloys market, growing at a substantial CAGR of 5.0% during the forecast period of 2022-2029 due to its ease of application and ability to provide precise, controlled bonding in various industries, including electronics, medical devices, and automotive. Its adaptability and efficiency make it a preferred choice for complex assembly and joining applications.

- On the basis of technology, the global braze alloys market is segmented into torch brazing, furnace brazing, resistance brazing, induction brazing, dip brazing, infrared brazing, vacuum brazing, electron beam/laser brazing, exothermic brazing, braze welding, hydrogen brazing, blanket brazing, dissociated ammonia, fuel gas brazing, and others. In 2022, torch brazing is set to dominate the global braze alloys market, growing at a substantial CAGR of 6.1% during the forecast period of 2022-2029 due to its widespread use in various industries. Its versatility and cost-effectiveness make it a preferred method for achieving strong, reliable joints.

- On the basis of form, the global braze alloys market is segmented into wire, strip, bar, pipe, tube, flat, sheet, plate, round bar, and others. In 2022, the wire segment is poised for dominance in the global braze alloys market, growing at a substantial CAGR of 5.7% during the forecast period of 2022-2029 due to its convenient handling and precise application, making it a preferred choice for industries requiring accurate and efficient joining solutions.

- On the basis of production temperature, the global braze alloys market is segmented into 1001°C to 1200°C, less than 900°C, 901°C to 1000°C, and above 1200°C. In 2022, the 1001°C to 1200°C temperature range segment is expected to lead the global braze alloys market, growing at a substantial CAGR of 5.3% during the forecast period of 2022-2029 due to its suitability for a wide range of industrial applications requiring elevated melting points and robust bonding capabilities.

- On the basis of end use, the global braze alloy market is segmented into automotive, aerospace and defense, electronics and electrical, building and construction, chemicals, marine, and others. In 2022, the automotive segment is anticipated to dominate the global braze alloys market, growing at a substantial CAGR of 5.0% during the forecast period of 2022-2029 because of its extensive use in manufacturing critical components such as radiators and heat exchangers, ensuring robust demand within the industry.

Major Players

Data Bridge Market Research recognizes the following companies as the global braze alloys market players in global braze alloys market are Johnson Matthey (U.K.), OC Oerlikon Management AG (Switzerland), Sulzer Ltd (Switzerland), Belmont Metals (U.S.), Harris Products Group (U.S.), Morgan Advanced Materials and its affiliates (U.K.), Aimtek, Inc. (U.S.), Prince Izant Compan (U.S.).

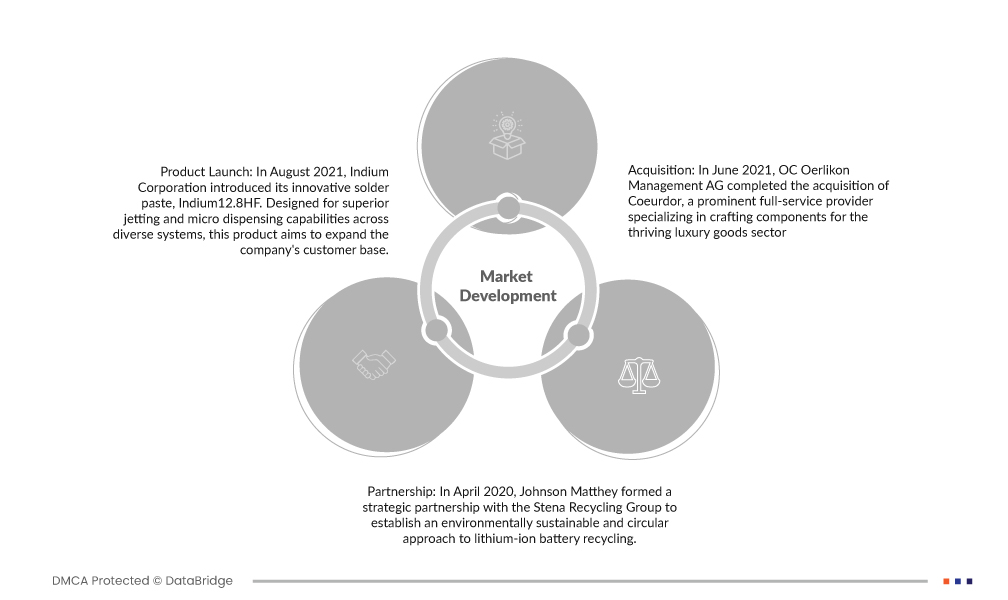

Market Developments

- In August 2021, Indium Corporation introduced its innovative solder paste, Indium12.8HF. Designed for superior jetting and micro dispensing capabilities across diverse systems, this product aims to expand the company's customer base. With its versatility and precision, Indium12.8HF meets the evolving demands of electronics manufacturing, providing reliable solutions and solidifying Indium Corporation's position as a leader in solder materials, ultimately fostering business growth and customer satisfaction.

- In June 2021, OC Oerlikon Management AG completed the acquisition of Coeurdor, a prominent full-service provider specializing in crafting components for the thriving luxury goods sector. Coeurdor is recognized for its expertise in designing, manufacturing, and coating metallic components for renowned luxury brands, providing OC Oerlikon with a strategic entry point into the luxury goods market. This acquisition is expected to contribute significantly to the company's revenue growth.

- In April 2020, Johnson Matthey formed a strategic partnership with the Stena Recycling Group to establish an environmentally sustainable and circular approach to lithium-ion battery recycling. Their collaborative effort aims to build an effective value chain for recycling lithium-ion batteries and materials used in cell manufacturing. This initiative is poised to fuel significant growth for the company in the years ahead.

Regional Analysis

Geographically, the countries covered in the global braze alloys market report are U.S., Canada and Mexico in North America, (Germany), France, U.K., Netherlands, (Switzerland), (Belgium), Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, (India), South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the global braze alloys market during the forecast period 2022-2029

The Asia-Pacific region is emerging as a dominant force in the braze alloys market. This trend is driven by the growing utilization of braze alloys across diverse end user industries in the region. Industries such as automotive, aerospace, electronics, and more are increasingly relying on braze alloys for joining and manufacturing applications, boosting demand. Asia-Pacific's robust industrial growth and manufacturing activities contribute to its dominance in the global braze alloys market during the forecast period.

For more detailed information about the global braze alloys market report, click here – https://www.databridgemarketresearch.com/reports/global-braze-alloys-market