Медицинское страхование обеспечивает финансовую поддержку в случае серьезной болезни или несчастного случая. Рост расходов на медицинские услуги, связанные с операциями и пребыванием в больнице, создал новую финансовую эпидемию по всему миру. Стоимость медицинских услуг складывается из стоимости операции, гонораров врачей, стоимости пребывания в больнице, стоимости отделения неотложной помощи и стоимости диагностических исследований среди прочего.

Планы медицинского страхования покрывают множество различных видов операций и заболеваний, а также другие аспекты медицинского лечения. Медицинские расходы стремительно растут. Во многих медицинских случаях медицинская страховка покрывает расходы на скорую помощь, стоимость лекарств, плату за консультации, расходы на госпитализацию, анализы и расходы на постгоспитализацию, благодаря чему люди обеспечивают себе жизнь, оформляя полис медицинского страхования.

Доступ к полному отчету по адресу https://www.databridgemarketresearch.com/reports/global-health-insurance-market

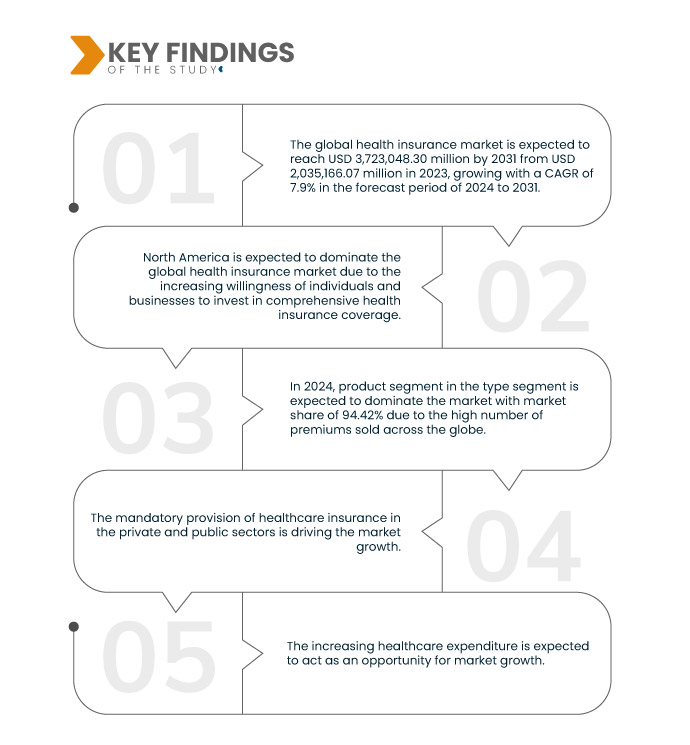

По данным исследования рынка Data Bridge, ожидается, что объем мирового рынка медицинского страхования к 2031 году достигнет 3 723 048,30 млн долларов США по сравнению с 2 035 166,07 млн долларов США в 2023 году, а среднегодовой темп роста составит 7,9% в прогнозируемый период с 2024 по 2031 год.

Основные выводы исследования

Растущее количество процедур по уходу за детьми в дневное время

Процедуры дневного ухода — это те виды медицинских процедур или хирургических операций, которые в первую очередь требуют меньшего времени пребывания в больницах. При процедуре дневного ухода пациенты должны оставаться в больнице в течение короткого периода. Большинство компаний медицинского страхования теперь покрывают процедуры дневного ухода в своих страховых планах, и для требования таких видов хирургии нет принуждения проводить 24 часа в больнице, что является минимальным пребыванием в больнице для требования страховки. Процедуры дневного ухода, которые ранее требовали длительного пребывания в больнице, завершаются менее чем за 24 часа из-за технологических достижений в медицинской отрасли. Полисы медицинского страхования ранее покрывали только те виды расходов, которые включали дорогостоящее лечение критических заболеваний, которые требовали длительного пребывания в больнице. Кроме того, страхователи могут получить требование на процедуры дневного ухода двумя способами, безналичным путем и с возмещением, в связи с чем на рынке растет все большее количество процедур дневного ухода, что стимулирует рост рынка.

Область отчета и сегментация рынка

Отчет Метрика

|

Подробности

|

Прогнозируемый период

|

2024-2031

|

Базовый год

|

2023

|

Исторический год

|

2022 (Можно настроить на 2016–2021)

|

Количественные единицы

|

Доход в млн. долл. США

|

Охваченные сегменты

|

Тип (продукт и решения), услуги (стационарное лечение, амбулаторное лечение, медицинское страхование и другие), уровень покрытия ( бронзовый , серебряный, золотой и платиновый), поставщики услуг (поставщики государственных медицинских страховых услуг и частные поставщики медицинских страховых услуг), планы медицинского страхования (точка обслуживания (POS), эксклюзивная организация-поставщик (EPOS), предпочтительная организация-поставщик (PPO), возмещающее медицинское страхование, организация по поддержанию здоровья (HMO), сберегательный счет на здравоохранение (HSA), квалифицированные соглашения о возмещении расходов на здравоохранение для малых работодателей (QSEHRAS) и другие), демография (взрослые, несовершеннолетние и пожилые граждане), тип покрытия (пожизненное и срочное покрытие), конечный пользователь (корпорации, частные лица и другие), канал распространения (прямые продажи, финансовые учреждения, электронная коммерция , больницы, клиники и другие)

|

Страны, охваченные

|

США, Канада, Мексика, Германия, Франция, Великобритания, Италия, Россия, Испания, Турция, Бельгия, Нидерланды, Швейцария, остальные страны Европы, Китай, Япония, Индия, Южная Корея, Австралия и Новая Зеландия, Сингапур, Таиланд, Индонезия, Филиппины, Малайзия, Гонконг, Тайвань, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальные страны Южной Америки, Южная Африка, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль, Египет, а также остальные страны Ближнего Востока и Африки.

|

Охваченные участники рынка

|

Bupa (Великобритания), Now Health International (Китай), Cigna Healthcare (США), Aetna Inc. (дочерняя компания CVS Health) (США), AXA (Франция), HBF Health Limited (США), Vitality (дочерняя компания Discovery Limited) (Великобритания), Centene Corporation (США), International Medical Group, Inc. (дочерняя компания Sirius International Insurance Group Ltd.) (США), Anthem Insurance Companies, Inc. (дочерняя компания Elevance Health.) (США), Broadstone Corporate Benefits Limited (Великобритания), Allianz Care (дочерняя компания Allianz SE) (Франция), HealthCare International Global Network Ltd (Великобритания), Vhi Group (Ирландия), UnitedHealth Group (США) и Oracle (США) среди прочих

|

Данные, отраженные в отчете

|

Помимо информации о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, эпидемиологию пациентов, анализ воронки продаж, анализ ценообразования и нормативно-правовую базу.

|

Анализ сегмента

Глобальный рынок медицинского страхования разделен на девять основных сегментов в зависимости от типа, услуг, уровня покрытия, поставщиков услуг, планов медицинского страхования, демографических данных, типа покрытия, конечного пользователя и канала распространения .

- По типу рынок сегментируется на продукты и решения.

Ожидается, что в 2024 году этот сегмент продуктов будет доминировать на мировом рынке медицинского страхования.

Ожидается, что в 2024 году сегмент продуктов будет доминировать на рынке с долей рынка 94,42% за счет большого количества премий, продаваемых по всему миру.

- По видам услуг рынок сегментируется на стационарное лечение, амбулаторное лечение, медицинскую помощь и другие.

Ожидается, что в 2024 году сегмент стационарного лечения будет доминировать на мировом рынке медицинского страхования.

Ожидается, что в 2024 году сегмент стационарного лечения будет доминировать на рынке с долей рынка 53,88%, поскольку большинство премиальных планов используются только при стационарном лечении.

- На основе уровня охвата рынок сегментирован на бронзу, серебро, золото и платину. Ожидается, что в 2024 году бронзовый сегмент будет доминировать на рынке с долей рынка 43,42%

- На основе поставщиков услуг рынок сегментирован на частных поставщиков медицинского страхования и поставщиков государственного медицинского страхования. Ожидается, что в 2024 году сегмент государственного медицинского страхования будет доминировать на рынке с долей рынка 56,56%

- На основе планов медицинского страхования рынок сегментирован на точки обслуживания (POS), эксклюзивные организации поставщиков (EPOS), возмещающее медицинское страхование, счета медицинских сбережений (HSA), квалифицированные соглашения о возмещении расходов на здравоохранение для малых работодателей (QSEHRAS), предпочтительные организации поставщиков (PPO), организации по поддержанию здоровья (HMO) и другие. Ожидается, что в 2024 году сегмент точек обслуживания (POS) будет доминировать на рынке с долей рынка 36,69%.

- На основе демографических данных рынок сегментирован на взрослых, несовершеннолетних и пожилых граждан. Ожидается, что в 2024 году сегмент взрослых будет доминировать на рынке с долей рынка 49,57%

- На основе типа покрытия рынок сегментируется на пожизненное покрытие и срочное покрытие. Ожидается, что в 2024 году сегмент пожизненного покрытия будет доминировать на рынке с долей рынка 63,82%

- На основе конечного пользователя рынок сегментируется на корпорации, частные лица и др. Ожидается, что в 2024 году сегмент корпораций будет доминировать на рынке с долей рынка 52,67%.

- На основе канала сбыта рынок сегментируется на прямые продажи, финансовые учреждения, электронную коммерцию, больницы, клиники и др. Ожидается, что в 2024 году сегмент прямых продаж будет доминировать на рынке с долей рынка 53,46%.

Основные игроки

Data Bridge Market Research анализирует Cigna Healthcare (США), Centene Corporation (США), Allianz Care (дочерняя компания Allianz) (Франция), Aetna Inc. (дочерняя компания CVS Health) (США), Anthem Insurance Companies, Inc. (дочерняя компания Elevance Health) (США) как основных игроков на мировом рынке медицинского страхования.

Развитие рынка

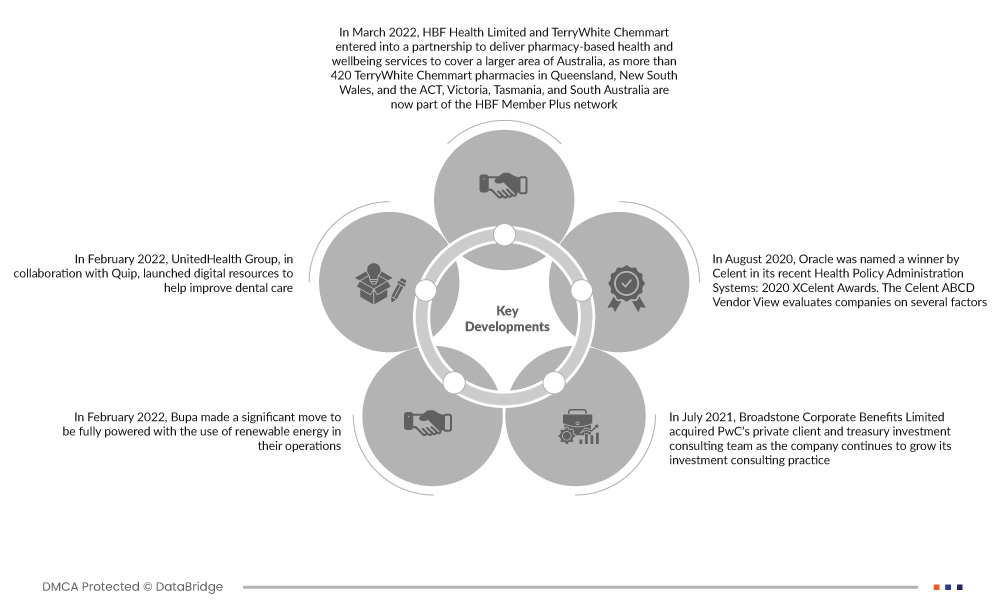

- В марте 2022 года HBF Health Limited и TerryWhite Chemmart заключили партнерство с целью предоставления услуг в области здравоохранения и благополучия на базе аптек для охвата большей территории Австралии, поскольку более 420 аптек TerryWhite Chemmart в Квинсленде, Новом Южном Уэльсе, а также в столичной территории, Виктории, Тасмании и Южной Австралии теперь являются частью сети HBF Member Plus. Это помогло компании расширить свое присутствие в других регионах

- В феврале 2022 года UnitedHealth Group в сотрудничестве с Quip запустила цифровые ресурсы для улучшения стоматологической помощи. Последнее предложение расширяет доступ к круглосуточным виртуальным стоматологическим визитам, чтобы помочь участникам встретиться с лицензированным стоматологом по телефону или видео, предоставляя соответствующим участникам многих планов стоматологической помощи UnitedHealthcare два виртуальных стоматологических визита без разделения затрат. Эта разработка поможет компании привлечь клиентов, заинтересованных в стоматологических планах

- В феврале 2022 года Bupa сделала значительный шаг к полному переходу на возобновляемую энергию в своей деятельности. Для этого бизнес Bupa в Австралии заключил партнерство с производителем возобновляемой энергии Pacific Hydro Australia, чтобы перейти на чистую энергию в стране. Это позволит компании здравоохранения сделать важный шаг вперед на пути к тому, чтобы стать компанией Net Zero к 2040 году.

- В июле 2021 года Broadstone Corporate Benefits Limited приобрела команду PwC по инвестиционному консалтингу для частных клиентов и казначейства, поскольку компания продолжает расширять свою практику инвестиционного консалтинга. Это большой стратегический шаг компании по расширению ее инвестиционного консалтингового бизнеса

- В августе 2020 года компания Celent назвала Oracle победителем в своей недавней премии Health Policy Administration Systems: 2020 XCelent Awards. Celent ABCD Vendor View оценивает компании по нескольким факторам. Среди 22 рассмотренных систем администрирования медицинского страхования и страхования медицинских продуктов Oracle Health Insurance получила награду за самую широкую функциональность. Эта разработка принесла компании мировое признание и улучшила имидж бренда

Региональный анализ

Географически в отчете о мировом рынке медицинского страхования рассматриваются следующие страны: США, Канада, Мексика, Германия, Франция, Великобритания, Италия, Россия, Испания, Турция, Бельгия, Нидерланды, Швейцария, остальные страны Европы, Китай, Япония, Индия, Южная Корея, Австралия и Новая Зеландия, Сингапур, Таиланд, Индонезия, Филиппины, Малайзия, Гонконг, Тайвань, остальные страны Азиатско-Тихоокеанского региона, Бразилия, Аргентина, остальные страны Южной Америки, Южная Африка, Саудовская Аравия, Объединенные Арабские Эмираты, Израиль, Египет и остальные страны Ближнего Востока и Африки.

Ожидается, что Северная Америка будет доминировать и, по оценкам, станет самым быстрорастущим регионом на мировом рынке медицинского страхования.

Ожидается, что Северная Америка будет доминировать и станет самым быстрорастущим регионом на рынке из-за растущей готовности частных лиц и предприятий инвестировать в комплексное медицинское страхование.

Более подробную информацию об отчете о мировом рынке медицинского страхования можно получить здесь – https://www.databridgemarketresearch.com/reports/global-health-insurance-market