El cloruro de hidrógeno anhidro (HCl) de alta pureza es un compuesto químico muy solicitado con importantes aplicaciones en diversas industrias. Su excepcional pureza, que a menudo supera el 99,99 %, lo hace ideal para la fabricación de semiconductores, donde desempeña un papel crucial en el grabado y la limpieza de obleas de silicio. La industria electrónica también depende del HCL anhidro de alta pureza para la producción de fibras ópticas y materiales avanzados. En la síntesis química, actúa como reactivo y catalizador, facilitando la producción de productos farmacéuticos , agroquímicos y productos químicos especializados. Su forma anhidra garantiza la ausencia de agua, evitando reacciones indeseadas y manteniendo la integridad del proceso. Además, el HCL anhidro de alta pureza es esencial en la producción de polímeros y resinas de alto rendimiento. Su riguroso control de calidad y su rendimiento constante lo convierten en un recurso valioso en los laboratorios de investigación y desarrollo. En general, la demanda de cloruro de hidrógeno anhidro de alta pureza sigue creciendo debido a su papel crucial en los procesos químicos y de fabricación de alta tecnología .

Acceda al informe completo en https://www.databridgemarketresearch.com/reports/global-high-purity-anhydrous-hydrogen-chloride-hcl-gas-market

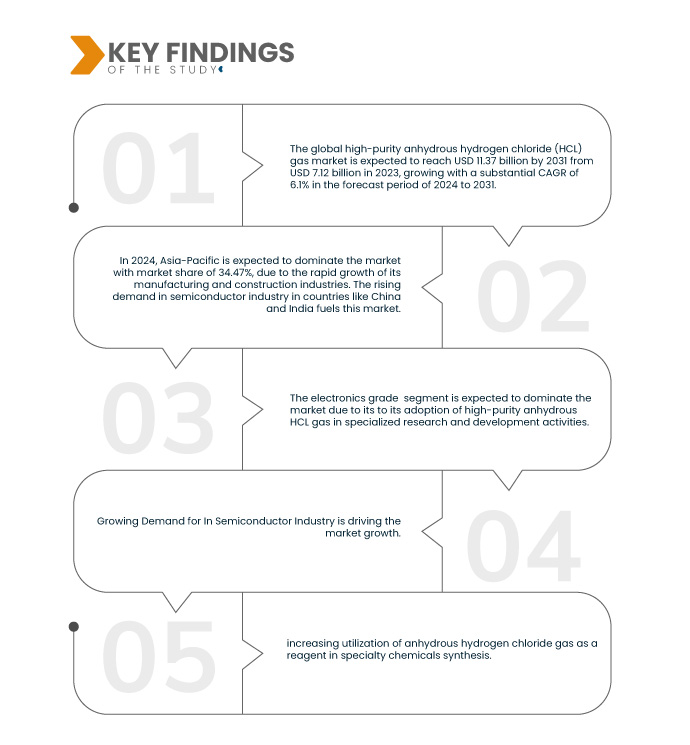

Data Bridge Market Research analiza que se espera que el mercado global de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza alcance los USD 11,37 mil millones para 2031 desde USD 7,12 mil millones en 2023, creciendo con una CAGR sustancial del 6,1% en el período de pronóstico de 2024 a 2031.

Principales hallazgos del estudio

- Aumento de la demanda en la industria de semiconductores

La industria de semiconductores está experimentando un aumento repentino de la demanda de cloruro de hidrógeno (HCl) anhidro de alta pureza, ya que es un componente esencial en el proceso de fabricación de semiconductores y desempeña un papel fundamental en el grabado de obleas de silicio y otros materiales esenciales para su fabricación. La creciente demanda de dispositivos semiconductores en diversos sectores, como la electrónica de consumo , la automoción, la sanidad y las telecomunicaciones, es un factor clave que impulsa la mayor demanda de HCl anhidro.

A medida que la tecnología avanza, existe una demanda continua de componentes semiconductores más pequeños, rápidos y eficientes, lo que genera mayores requisitos de precisión y pureza en los procesos de fabricación. El gas HCl anhidro de alta pureza garantiza que los fabricantes de semiconductores puedan alcanzar los estrictos estándares de calidad necesarios para producir dispositivos semiconductores avanzados. Además, la creciente adopción de tecnologías emergentes como el 5G, la inteligencia artificial, el Internet de las Cosas (IoT) y los vehículos eléctricos está amplificando la demanda de semiconductores en todo el mundo, lo que impulsa aún más la necesidad de gas HCl anhidro de alta pureza. Asimismo, las regulaciones ambientales y las preocupaciones por la sostenibilidad también influyen en la preferencia de la industria de semiconductores por el gas HCl anhidro de alta pureza. Los estrictos estándares ambientales exigen el uso de procesos de fabricación más limpios y respetuosos con el medio ambiente. El gas HCl anhidro se prefiere por su eficacia en la fabricación de semiconductores, a la vez que minimiza el impacto ambiental .

Alcance del informe y segmentación del mercado

Métrica del informe

|

Detalles

|

Período de pronóstico

|

2024 a 2031

|

Año base

|

2023

|

Años históricos

|

2022 (Personalizable para 2016-2021)

|

Unidades cuantitativas

|

Ingresos en miles de millones de dólares

|

Segmentos cubiertos

|

Producto (grado electrónico y grado químico), aplicación (electrónica y eléctrica, farmacéutica , química y otras), nivel de pureza (3N, 4N, 4,5N, 5N y 6N)

|

Países cubiertos

|

EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Taiwán, Singapur, Tailandia, Australia, Malasia, Indonesia, Filipinas, Nueva Zelanda, Resto de Asia-Pacífico, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Italia, Bélgica, España, Rusia, Turquía, Dinamarca, Noruega, Polonia, Finlandia, Suecia, Georgia, Resto de Europa, Brasil, Argentina, Colombia, Chile, Perú, Ecuador, Uruguay, Panamá, Venezuela, Bolivia, Paraguay, Resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel, Catar, Kuwait, Omán, Baréin, Resto de Oriente Medio y África

|

Actores del mercado cubiertos

|

AIR LIQUIDE (Francia), Linde plc. (Irlanda), SUMITOMO SEIKA CHEMICALS CO.,LTD. (Japón), Gujarat Fluorochemicals Limited (India), Niacet Corporation, Weitai Chem (EE. UU.), MATHESON TRI-GAS, INC. (EE. UU.) y Merck KGaA (Alemania), entre otros.

|

Puntos de datos cubiertos en el informe

|

Además de los conocimientos sobre escenarios de mercado como el valor de mercado, la tasa de crecimiento, la segmentación, la cobertura geográfica y los principales actores, los informes de mercado seleccionados por Data Bridge Market Research también incluyen un análisis profundo de expertos, producción y capacidad por empresa representadas geográficamente, diseños de red de distribuidores y socios, análisis detallado y actualizado de tendencias de precios y análisis deficitario de la cadena de suministro y la demanda.

|

Análisis de segmentos

El mercado global de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza está segmentado en tres segmentos notables según el producto, la aplicación y el nivel de pureza.

- En función del producto, el mercado está segmentado en grado electrónico y grado químico.

En 2024, se espera que el segmento de grado electrónico domine el mercado mundial de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza.

Se espera que en 2024, el segmento de grado electrónico domine el mercado con una participación de mercado del 65,44% debido a la adopción de gas HCL anhidro de alta pureza en actividades especializadas de investigación y desarrollo.

- Sobre la base de la aplicación, el mercado está segmentado en electrónica y electricidad, productos farmacéuticos, productos farmacéuticos, productos químicos y otros.

En 2024, se espera que el segmento de electrónica y electricidad domine el mercado mundial de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza.

Se espera que en 2024, el segmento de electrónica y electricidad domine el mercado con un 40,00 % debido a su creciente utilización de gas de cloruro de hidrógeno anhidro como reactivo en la síntesis de productos químicos especiales.

- Según el nivel de pureza, el mercado se segmenta en 3N, 4N, 4.5N, 5N y 6N. Se espera que en 2024, el segmento 3N domine el mercado con una cuota de mercado del 40,56%.

Actores principales

Data Bridge Market Research analiza a AIR LIQUIDE (Francia), Linde plc. (Irlanda), SUMITOMO SEIKA CHEMICALS CO.,LTD. (Japón), Matheson Tri-Gas, Inc, (una subsidiaria de Nippon Holdings Group) (EE. UU.), Merck KGaA (Alemania) como los principales actores del mercado en este mercado.

Desarrollos del mercado

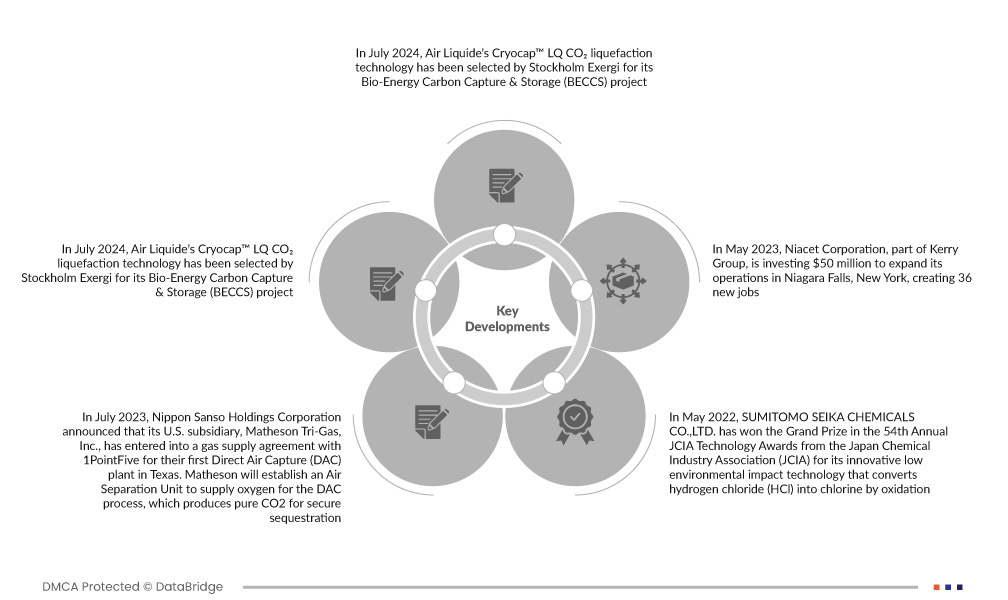

- En julio de 2024, la tecnología de licuefacción de CO₂ Cryocap™ LQ de Air Liquide fue seleccionada por Stockholm Exergi para su proyecto de Captura y Almacenamiento de Carbono en Bioenergía (BECCS). El acuerdo permitirá a Air Liquide suministrar equipos para una unidad de licuefacción de CO₂ a gran escala, una de las mayores del mundo, con una capacidad de 3500 toneladas diarias, en la planta de biocogeneración de Estocolmo. La instalación BECCS tiene como objetivo almacenar alrededor de ocho millones de toneladas de CO₂ biogénico durante la próxima década, con el apoyo del Fondo Europeo de Innovación.

- En mayo de 2024, Linde PLC firmó un acuerdo a largo plazo con H2 Green Steel para suministrar gases industriales a la primera planta de producción de acero verde a gran escala del mundo. Además, Linde suministrará a Celanese dióxido de carbono capturado en sus instalaciones de Clear Lake, Texas, para su uso en la producción de metanol con menor intensidad de carbono en Fairway Methanol LLC. Esto amplía el suministro actual de Linde de monóxido de carbono, oxígeno y nitrógeno a Celanese, apoyando sus esfuerzos para reducir la huella de carbono de la producción de metanol.

- En julio de 2023, Nippon Sanso Holdings Corporation anunció que su filial estadounidense, Matheson Tri-Gas, Inc., firmó un acuerdo de suministro de gas con 1PointFive para su primera planta de Captura Directa de Aire (DAC) en Texas. Matheson instalará una Unidad de Separación de Aire para suministrar oxígeno al proceso de DAC, que produce CO2 puro para su secuestro seguro. La planta Stratos, cuya entrada en funcionamiento está prevista para mediados de 2025, aspira a capturar hasta 500.000 toneladas de CO2 al año, convirtiéndola en la planta de DAC más grande del mundo. Este desarrollo fortalecerá significativamente la posición de Matheson en el mercado, demostrando su capacidad para impulsar proyectos de captura de carbono a gran escala, alineándose así con las tendencias globales de sostenibilidad.

- En mayo de 2022, SUMITOMO SEIKA CHEMICALS CO.,LTD. ganó el Gran Premio de la 54.ª edición de los Premios Anuales de Tecnología JCIA, otorgados por la Asociación de la Industria Química de Japón (JCIA), por su innovadora tecnología de bajo impacto ambiental que convierte el cloruro de hidrógeno (HCl) en cloro por oxidación. Esta tecnología, desarrollada y comercializada por Sumitomo Chemical, es reconocida por su importante contribución al avance de la sostenibilidad de la industria química y la mejora de los resultados ambientales.

- En mayo de 2023, Niacet Corporation, parte de Kerry Group, invertirá 50 millones de dólares para expandir sus operaciones en Niagara Falls, Nueva York, lo que generará 36 nuevos empleos. La planta producirá cloruro de hidrógeno anhidro (AHCL) de ultraalta pureza, esencial para la fabricación de semiconductores, impulsando el crecimiento de Nueva York como centro de fabricación de chips.

Análisis regional

Geográficamente, las regiones cubiertas en el mercado global de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza son EE. UU., Canadá, México, China, Japón, India, Corea del Sur, Taiwán, Singapur, Tailandia, Australia, Malasia, Indonesia, Filipinas, Nueva Zelanda, resto de Asia-Pacífico, Alemania, Francia, Reino Unido, Países Bajos, Suiza, Italia, Bélgica, España, Rusia, Turquía, Dinamarca, Noruega, Polonia, Finlandia, Suecia, Georgia, resto de Europa, Brasil, Argentina, Colombia, Chile, Perú, Ecuador, Uruguay, Panamá, Venezuela, Bolivia, Paraguay, resto de Sudamérica, Sudáfrica, Arabia Saudita, Emiratos Árabes Unidos, Egipto, Israel, Qatar, Kuwait, Omán, Baréin y resto de Medio Oriente y África.

Según el análisis de investigación de mercado de Data Bridge:

Se espera que Asia-Pacífico domine y sea la región de más rápido crecimiento en el mercado global de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza.

Se espera que Asia-Pacífico domine el mercado debido al rápido crecimiento de sus industrias manufactureras y de construcción. La creciente demanda de la industria de semiconductores en países como China e India impulsa este mercado.

Para obtener información más detallada sobre el informe de mercado global de gas de cloruro de hidrógeno anhidro (HCL) de alta pureza, haga clic aquí: https://www.databridgemarketresearch.com/reports/global-high-purity-anhydrous-hydrogen-chloride-hcl-gas-market