Le maltitol est un édulcorant hypocalorique qui présente de nombreux avantages pour la santé. L'obésité, directement liée aux problèmes cardiaques liés à une consommation excessive de calories, est l'un des principaux problèmes liés à la consommation de sucre. Le maltitol contribue à la prévention et au traitement de l'obésité grâce à son apport calorique inférieur, seulement 2,1 calories par gramme, à celui des autres édulcorants. La directive européenne sur l'étiquetage nutritionnel a fixé au maltitol et aux autres polyols une valeur calorique de 2,4 calories par gramme. Pour prévenir l'obésité, la faible teneur en calories du maltitol est bénéfique. De plus, il confère le même goût que le sucre classique sans augmenter la glycémie et contribue à atténuer l'augmentation de la glycémie et la réponse insulinique liée à l'absorption du glucose.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-maltitol-in-chocolate-market

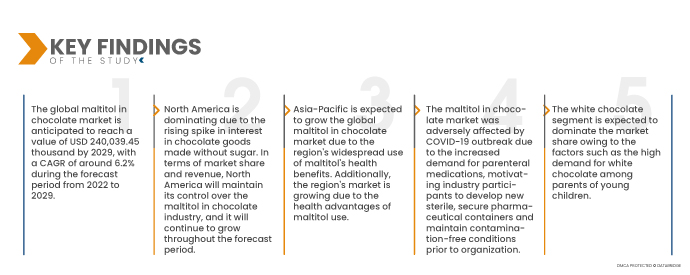

Data Bridge Market Research analyse que le marché du maltitol dans le chocolat devrait croître à un TCAC de 6,2 % au cours de la période de prévision de 2022 à 2029 et devrait atteindre 240 039,45 milliers USD d'ici 2029 contre 148 835,71 milliers USD en 2021.

Principales conclusions de l'étude

La forte demande pour les produits à base de chocolat à faible teneur en calories et sans sucre devrait stimuler le marché

Le maltitol est de plus en plus demandé dans les chocolats hypocaloriques et sans sucre à l'échelle mondiale. Cette tendance vers les aliments hypocaloriques s'explique principalement par l'augmentation du nombre de personnes soucieuses de leur santé. Plusieurs entreprises lancent également de nouveaux produits chocolatés pour répondre à la demande croissante de chocolats hypocaloriques de la part des consommateurs du monde entier. Selon Gama Compass, 15,8 % des nouveaux produits hypocaloriques commercialisés dans le monde (aliments ne contenant que 50 à 150 calories pour 100 g/ml) ont été fabriqués en Amérique latine. L'Amérique du Nord a représenté 44,4 % des lancements d'aliments hypocaloriques, tandis que l'Europe en a représenté 27,5 %. La demande croissante d'aliments hypocaloriques, comme le chocolat, devrait donc stimuler la demande.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2022 à 2029

|

Année de base

|

2021

|

Années historiques

|

2020 (personnalisable de 2014 à 2019)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en unités, prix en USD

|

Segments couverts

|

Forme (poudre cristalline et sirops), catégorie de chocolat (chocolat blanc, chocolat au lait et chocolat noir), application (boulangerie, chocolats de détail, inclusions de chocolat)

|

Pays couverts

|

États-Unis, Canada, Mexique en Amérique du Nord, Allemagne, Suède, Pologne, Danemark, Italie, Royaume-Uni, France, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Russie, Reste de l'Europe en Europe, Japon, Chine, Inde, Corée du Sud, Nouvelle-Zélande, Vietnam, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Brésil, Argentine, Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Oman, Qatar, Koweït, Afrique du Sud, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA)

|

Acteurs du marché couverts

|

Zhejiang Huakang Pharmaceutical Co. Ltd. (Chine), Roquette Frères (France), Ingredion (États-Unis), Mitsubishi Corporation Life Sciences Limited (Japon), ADM (États-Unis), Brenntag (États-Unis), Merck KGaA (Allemagne), Shandong Futaste Co. (Chine), Cargill, Incorporated (États-Unis), B Food Science Co., Ltd. (Japon), Hangzhou Verychem Science And Technology Co. Ltd (Chine), Haihang Industry (Chine), Sosa (États-Unis), Foodchem International Corporation (Chine), PT. Ecogreen Oleochemicals (France), Mitushi Biopharma (Inde), MUBY CHEMICALS (Inde), Hylen Co., Ltd (Chine) et Nutra Food Ingredients (États-Unis).

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments :

Le marché du maltitol dans le chocolat est segmenté en trois segments notables qui sont basés sur la forme, la catégorie de chocolat et l'application.

- Sur la base de la forme, le maltitol dans le marché du chocolat est segmenté en cristal, poudre et sirop.

Le segment des sirops devrait dominer le marché du maltitol dans le chocolat

Le segment du sirop devrait dominer la part de marché en raison de facteurs tels que le faible coût du sirop par rapport aux autres formes.

- Le marché du maltitol est segmenté en chocolat blanc, chocolat au lait et chocolat noir par catégorie de chocolat. Le chocolat blanc devrait dominer le marché en raison de la forte demande des parents de jeunes enfants.

- Sur la base de l'application, le marché du maltitol dans le chocolat est segmenté en boulangerie, chocolats de détail et inclusions de chocolat.

Le segment des chocolats de détail devrait dominer le marché du maltitol dans le chocolat

Le segment des chocolats de détail devrait dominer le marché en raison de la forte demande de produits chocolatés à faible teneur en calories.

Acteurs majeurs

Data Bridge Market Research identifie les entreprises suivantes comme les principaux acteurs du marché des films de protection de peinture sur le marché du maltitol dans le chocolat : Zhejiang Huakang Pharmaceutical Co. Ltd. (Chine), Roquette Frères (France), Ingredion (États-Unis), Mitsubishi Corporation Life Sciences Limited (Japon), ADM (États-Unis), Brenntag (États-Unis), Merck KGaA (Allemagne), Shandong Futaste Co. (Chine), Cargill, Incorporated (États-Unis), B Food Science Co., Ltd. (Japon), Hangzhou Verychem Science And Technology Co. Ltd (Chine), Haihang Industry (Chine), Sosa (États-Unis), Foodchem International Corporation (Chine), PT. Ecogreen Oleochemicals (France), Mitushi Biopharma (Inde), MUBY CHEMICALS (Inde), Hylen Co., Ltd (Chine) et Nutra Food Ingredients (États-Unis).

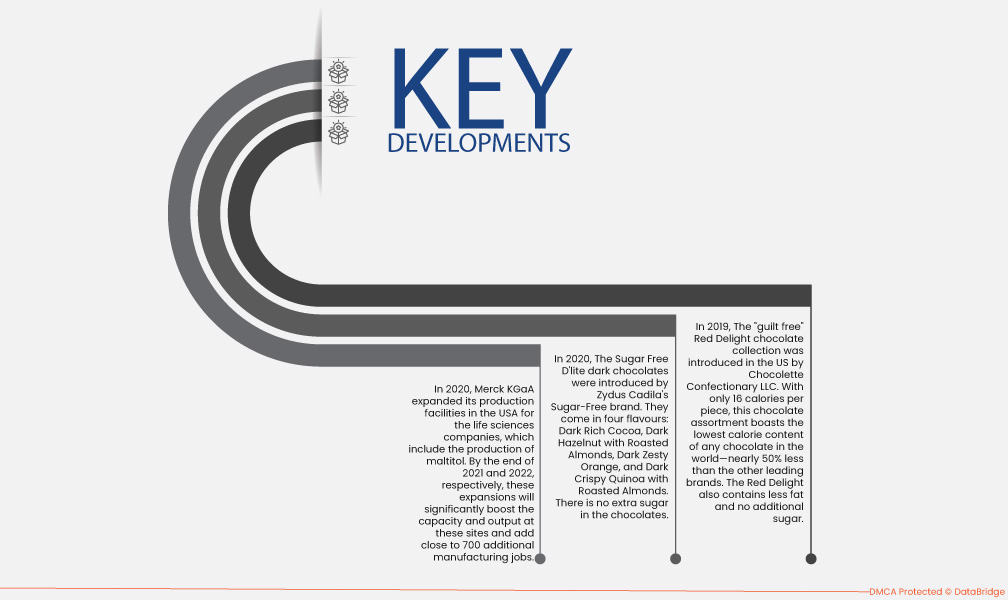

Développement du marché

- En 2020, Merck KGaA a agrandi ses sites de production aux États-Unis pour les entreprises du secteur des sciences de la vie, notamment pour la production de maltitol. D'ici fin 2021 et fin 2022, respectivement, ces extensions augmenteront considérablement la capacité et la production de ces sites et créeront près de 700 emplois supplémentaires dans le secteur manufacturier. Cette expansion a permis d'accroître la portée géographique de l'entreprise.

- En 2020, la marque Sugar-Free de Zydus Cadila a lancé les chocolats noirs D'lite sans sucre. Ils sont disponibles en quatre saveurs : Noir Cacao Riche, Noir Noisette aux Amandes Grillées, Noir Orange Zestée et Noir Quinoa Croustillant aux Amandes Grillées. Ces chocolats ne contiennent aucun sucre ajouté.

- En 2019, Chocolette Confectionary LLC a lancé aux États-Unis sa collection de chocolats « sans culpabilité ». Avec seulement 16 calories par pièce, cet assortiment de chocolats affiche la plus faible teneur en calories au monde : près de 50 % de moins que les autres grandes marques. Le Red Delight contient également moins de matières grasses et aucun sucre ajouté.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché des films de protection de peinture sont les suivants : États-Unis, Canada, Mexique en Amérique du Nord, Allemagne, Suède, Pologne, Danemark, Italie, Royaume-Uni, France, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Russie, Reste de l'Europe en Europe, Japon, Chine, Inde, Corée du Sud, Nouvelle-Zélande, Vietnam, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Brésil, Argentine, Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Oman, Qatar, Koweït, Afrique du Sud, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA)

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord est la région dominante sur le marché du maltitol dans le chocolat au cours de la période de prévision 2022-2029

L'Amérique du Nord domine le marché grâce à l'intérêt croissant pour les produits chocolatés sans sucre. En termes de parts de marché et de chiffre d'affaires, l'Amérique du Nord conservera sa domination sur le maltitol dans l'industrie du chocolat et poursuivra sa croissance tout au long de la période de prévision. Cela s'explique par la forte demande de produits chocolatés hypocaloriques dans la région.

L'Asie-Pacifique devrait être la région connaissant la croissance la plus rapide sur le marché du maltitol dans le chocolat au cours de la période de prévision 2022-2029.

La région Asie-Pacifique devrait connaître une croissance du marché mondial du maltitol dans le chocolat, grâce à l'utilisation répandue du maltitol et à ses bienfaits pour la santé. De plus, le marché régional est en pleine croissance grâce aux bienfaits du maltitol pour la santé.

Analyse d'impact de la COVID-19

L'épidémie exceptionnelle de COVID-19 a accru la demande de médicaments parentéraux, incitant les acteurs du secteur à développer de nouveaux contenants pharmaceutiques stériles et sécurisés, et à maintenir des conditions exemptes de contamination avant leur mise en marché. Cela accélérera le marché du maltitol dans le chocolat pendant la pandémie. En revanche, l'épidémie de COVID-19 a fortement réduit la production et affecté la chaîne d'approvisionnement de l'usine de fabrication.

Pour plus d'informations sur le rapport sur le marché du maltitol dans le chocolat, cliquez ici : https://www.databridgemarketresearch.com/reports/global-maltitol-in-chocolate-market