Les différentes espèces d'agave utilisées, qui contiennent une large gamme de composés terpéniques, la capacité d'utiliser les feuilles d'agave dans la fermentation du mezcal, les variations dans le stade de maturation de l'agave, la cuisson de l'agave qui peut être effectuée dans des trous au sol avec du bois brûlant et des pierres chauffées qui produisent des furanes et des substances volatiles fumées et sont retenues dans l'agave, et certaines herbes ou autres matières naturelles (comme les vers) peuvent tous contribuer aux variations de saveur entre le mezcal.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-mezcal-market

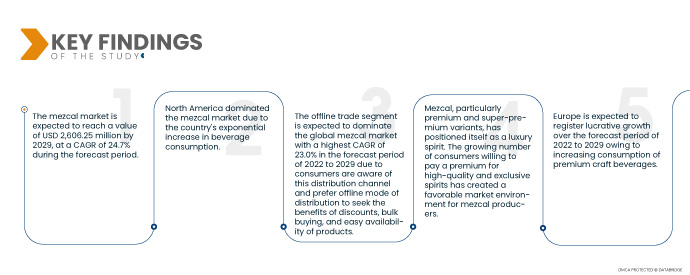

Selon Data Bridge Market Research, le marché du mezcal devrait atteindre 2 606,25 millions de dollars américains d'ici 2029, avec un TCAC de 24,7 % sur la période de prévision. Le marché du mezcal évolue vers des offres haut de gamme et met l'accent sur l'expérience client globale. Grâce à la disponibilité de variantes de mezcal de haute qualité et d'expressions uniques, les consommateurs sont prêts à explorer et à investir dans des marques de mezcal haut de gamme offrant une expérience de dégustation unique et mémorable.

La notoriété et l'appréciation croissantes des spiritueux à base d'agave devraient stimuler le taux de croissance du marché.

À mesure que les consommateurs se familiarisent avec les différents spiritueux, leur appréciation pour les boissons à base d'agave comme le mezcal s'est accrue. La saveur unique du mezcal, issue de la plante d'agave, a gagné en popularité et en popularité auprès des consommateurs du monde entier. Cela a suscité un intérêt croissant pour le mezcal, une alternative originale et savoureuse à d'autres spiritueux comme la vodka ou le whisky.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2022 à 2029

|

Année de base

|

2021

|

Années historiques

|

2020 (personnalisable de 2014 à 2019)

|

Unités quantitatives

|

Chiffre d'affaires en millions USD, volumes en unités, prix en USD

|

Segments couverts

|

Type de produit (Mezcal Joven, Mezcal Reposado, Mezcal Anejo, Mezcal Espadin, Mezcal Tepztate, Mezcal Arroqueño, Mezcal Ensamble et autres), concentré (100 % Tequila et Mix Tequila), catégorie de prix (Premium, Standard et Économique), teneur en alcool (40 % et plus et moins de 40 %), année (18-24 ans, 25-44 ans, 45-64 ans, 65 ans et plus), type d'emballage (bouteille, canettes et autres), taille (251-500 ml, 501-750 ml, 751-1000 ml et plus de 100 ml), type d'arôme (nature/original et aromatisé), type de producteur (microbrasserie, distillateurs, brasserie artisanale, brasserie sous contrat, brasserie artisanale régionale, grande brasserie, etc.) Autres), catégorie de produit (Mezcan de distillerie et Mezcan artisanal/Mezcan artisanal), utilisateur final (restaurants, hôtels et bars, cafés, traiteurs, compagnies aériennes, ménages et autres), canal de distribution (commerce hors ligne et commerce en ligne)

|

Pays couverts

|

États-Unis, Canada, Mexique en Amérique du Nord, Allemagne, Suède, Pologne, Danemark, Italie, Royaume-Uni, France, Espagne, Pays-Bas, Belgique, Suisse, Turquie, Russie, Reste de l'Europe en Europe, Japon, Chine, Inde, Corée du Sud, Nouvelle-Zélande, Vietnam, Australie, Singapour, Malaisie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Brésil, Argentine, Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud, Émirats arabes unis, Arabie saoudite, Oman, Qatar, Koweït, Afrique du Sud, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA)

|

Acteurs du marché couverts

|

Davide Campari-Milano NV (Italie), BACARDI (Bermudes), Craft Distillers (États-Unis), MADRE MEZCAL (États-Unis), Familia Camarena (États-Unis), Brown-Forman (États-Unis), Diageo (Royaume-Uni), Pernod Ricard (France), WILLIAM GRANT & SONS LTD (Royaume-Uni), Rey Campero (Mexique), Tequila & Mezcal Private Brands SA de CV (Mexique), Destilería Tlacolula (Mexique), El Silencio Holdings, INC. (États-Unis), Sauza Tequila Import Company (États-Unis), Dos Hombres LLC. (États-Unis), Del Maguey (États-Unis), Wahaka Mezcal (Mexique), BOZAL MEZCAL (États-Unis), Sombra (États-Unis), Pensador Mezcal (Royaume-Uni), Ilegal Mezcal (États-Unis)

|

Points de données couverts dans le rapport

|

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie par des experts, une production et une capacité géographiquement représentées par entreprise, des configurations de réseau de distributeurs et de partenaires, une analyse détaillée et mise à jour des tendances des prix et une analyse des déficits de la chaîne d'approvisionnement et de la demande.

|

Analyse des segments :

Le marché du mezcal est segmenté en fonction du type de produit, du concentré, de la catégorie de prix, de la teneur en ABV, de l'année, du type d'emballage, de la taille, du type de saveur, du type de producteur, de la catégorie de produit, de l'utilisateur final et du canal de distribution.

- Selon le type de produit, le marché mondial du mezcal est segmenté en mezcal jeune, mezcal reposado, mezcal anejo, mezcal espadin, mezcal tepztate, mezcal arroqueño et mezcal ensamble, entre autres. Le segment du mezcal espadin devrait dominer le marché mondial avec un TCAC de 27,9 % sur la période de prévision 2022-2029, grâce à sa polyvalence dans les cocktails et à son utilisation fréquente comme alcool de base dans divers cocktails à base de mezcal. Il peut également être dégusté pur ou avec des glaçons pour savourer ses saveurs complexes et son goût fumé unique.

- En termes de concentré, le marché mondial du mezcal est segmenté en tequila 100 % et tequila mixte. En 2022, le segment de la tequila 100 % devrait dominer le marché mondial du mezcal avec 77,40 % de parts de marché sur la période 2022-2029, grâce aux initiatives croissantes des entreprises pour développer leurs activités.

- En fonction des catégories de prix, le marché mondial du mezcal est segmenté en catégories premium, standard et économique. En 2022, le segment premium devrait dominer le marché mondial du mezcal avec 54,74 % de parts de marché sur la période de prévision (2022-2029), grâce à l'augmentation du nombre d'unités de production.

En 2022, le segment premium devrait dominer la catégorie de prix du marché mondial du mezcal

En 2022, le segment premium devrait dominer le marché mondial du mezcal en raison de l'augmentation du nombre d'unités de production et de la demande croissante des consommateurs pour des spiritueux de haute qualité et exclusifs avec 54,74 % de parts de marché.

- En fonction du degré d'alcool, le marché mondial du mezcal est segmenté en deux catégories : 40 % et plus et moins de 40 %. En 2022, le segment des 40 % et plus devrait dominer le marché mondial du mezcal avec un TCAC de 26,3 % sur la période de prévision (2022-2029), grâce à la production traditionnelle de mezcal, qui permet de préserver les arômes et le caractère puissants du spiritueux.

- Sur la base des années, le marché mondial du mezcal est segmenté en 18-24 ans, 25-44 ans, 45-64 ans et 65 ans et plus. En 2022, le segment des 25-44 ans devrait dominer le marché mondial du mezcal avec un TCAC de 25,6 % sur la période de prévision 2022-2029, grâce à un revenu disponible plus élevé pour l'achat de spiritueux de meilleure qualité. La réputation croissante du mezcal en tant que spiritueux raffiné et artisanal répond au désir de cette tranche d'âge de vivre des expériences de dégustation uniques et haut de gamme.

- Selon le type d'emballage, le marché mondial du mezcal est segmenté en bouteilles, canettes et autres. En 2022, le segment des bouteilles devrait dominer le marché mondial du mezcal avec un TCAC de 24,9 % sur la période de prévision (2022-2029), grâce aux perspectives favorables des solutions d'emballage avancées et intelligentes.

- En termes de taille, le marché mondial du mezcal est segmenté en moins de 250 ml, 251-500 ml, 501-750 ml, 751-1000 ml et plus de 100 ml. En 2022, le segment 751-1000 ml devrait dominer le marché mondial du mezcal avec 48,05 % de parts de marché sur la période de prévision 2022-2029, en raison de sa taille plus importante et de sa préférence pour les consommateurs qui consomment du mezcal plus fréquemment ou pour les grands rassemblements.

- En fonction du type d'arôme, le marché mondial du mezcal est segmenté en deux catégories : nature/original et aromatisé. En 2022, le segment aromatisé devrait dominer le marché mondial du mezcal avec un TCAC de 25,3 % sur la période de prévision (2022-2029), grâce aux variations de ce spiritueux, infusées ou mélangées à des arômes supplémentaires, créant une expérience gustative unique.

- Selon le type de producteur, le marché mondial du mezcal est segmenté en microbrasseries, distilleries, brasseries artisanales, brasseries sous contrat, brasseries artisanales régionales, grandes brasseries, etc. En 2022, le segment des microbrasseries devrait dominer le marché mondial du mezcal avec un TCAC de 27,9 % sur la période de prévision (2022-2029), grâce à l'augmentation des unités de production.

- En fonction des catégories de produits, le marché mondial du mezcal est segmenté en mezcan de distillerie et mezcan artisanal. En 2022, le segment du mezcan de distillerie devrait dominer le marché mondial du mezcal avec 76,80 % de parts de marché sur la période 2022-2029, grâce à l'augmentation du nombre d'unités de production.

En 2022, le segment mezcan du distillateur devrait dominer la catégorie de produits du marché mondial du mezcal

En 2022, le segment mezcan du distillateur devrait dominer le marché mondial du mezcal en raison de l'augmentation des unités de production et du mezcal produit commercialement à l'aide de techniques de distillation modernes, offrant des profils de saveur cohérents et une production à plus grande échelle avec 76,80 % de parts de marché.

- En fonction de l'utilisateur final, le marché mondial du mezcal est segmenté en restaurants, hôtels et bars, cafés, traiteurs, compagnies aériennes, ménages, etc. En 2022, le segment des hôtels et bars devrait dominer le marché mondial du mezcal avec 34,64 % de parts de marché sur la période de prévision (2022-2029), en raison de la demande croissante de mezcal.

- En fonction des canaux de distribution, le marché mondial du mezcal est segmenté en commerce hors ligne et en ligne. En 2022, le segment hors ligne devrait dominer le marché mondial du mezcal avec un TCAC maximal de 23,0 % sur la période de prévision (2022-2029). Les consommateurs connaissent ce canal de distribution et privilégient ce mode de distribution pour bénéficier de réductions, d'achats en gros et d'une disponibilité accrue des produits.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les principaux acteurs du marché du mezcal : Davide Campari-Milano NV (Italie), BACARDI (Bermudes), Craft Distillers (États-Unis), MADRE MEZCAL (États-Unis), Familia Camarena (États-Unis), Brown-Forman (États-Unis), Diageo (Royaume-Uni), Pernod Ricard (France), WILLIAM GRANT & SONS LTD (Royaume-Uni), Rey Campero (Mexique), Tequila & Mezcal Private Brands SA de CV (Mexique)

Développement du marché

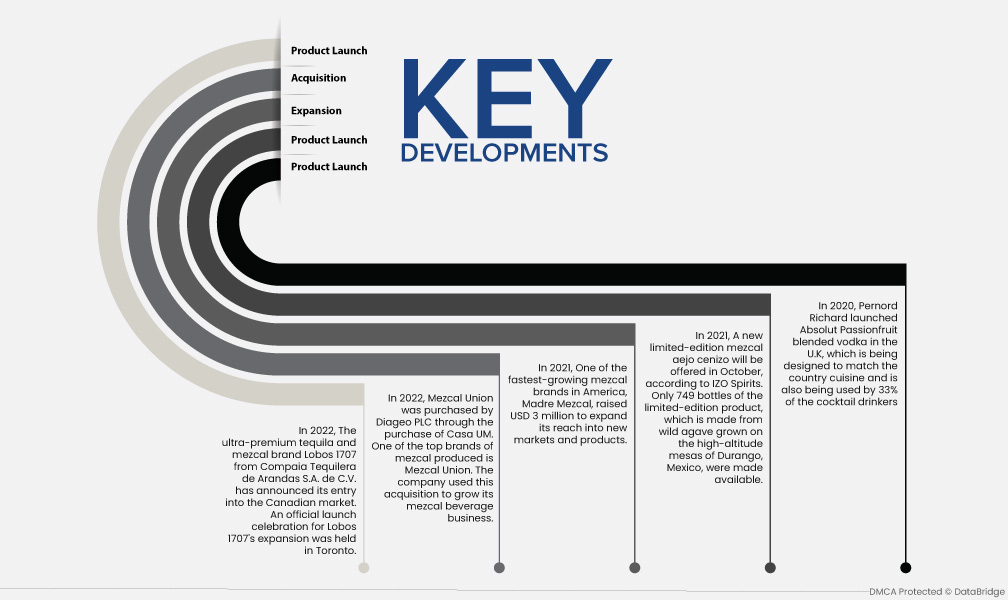

- En 2022, la marque de tequila et de mezcal ultra-premium Lobos 1707 de Compaia Tequilera de Arandas SA de CV a annoncé son entrée sur le marché canadien. Une cérémonie officielle de lancement de l'expansion de Lobos 1707 a eu lieu à Toronto.

- En 2022, Mezcal Union a été racheté par Diageo PLC via l'acquisition de Casa UM. Mezcal Union est l'une des marques de mezcal les plus réputées. L'entreprise a profité de cette acquisition pour développer son activité de boissons au mezcal.

- En 2021, l'une des marques de mezcal à la croissance la plus rapide en Amérique, Madre Mezcal, a levé 3 millions de dollars pour étendre sa portée à de nouveaux marchés et produits.

- Selon IZO Spirits, une nouvelle édition limitée de mezcal aejo cenizo sera proposée en octobre 2021. Seules 749 bouteilles de cette édition limitée, élaborée à partir d'agave sauvage cultivé sur les mesas d'altitude de Durango, au Mexique, ont été produites.

- En 2020, Pernord Richard a lancé au Royaume-Uni la vodka mélangée Absolut Passionfruit, conçue pour s'accorder avec la cuisine du pays et également utilisée par 33 % des amateurs de cocktails.

Analyse régionale

Géographiquement, les pays couverts dans le rapport sur le marché du mezcal sont les États-Unis, le Canada, le Mexique en Amérique du Nord, l'Allemagne, la Suède, la Pologne, le Danemark, l'Italie, le Royaume-Uni, la France, l'Espagne, les Pays-Bas, la Belgique, la Suisse, la Turquie, la Russie, le reste de l'Europe en Europe, le Japon, la Chine, l'Inde, la Corée du Sud, la Nouvelle-Zélande, le Vietnam, l'Australie, Singapour, la Malaisie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), le Brésil, l'Argentine, le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud, les Émirats arabes unis, l'Arabie saoudite, Oman, le Qatar, le Koweït, l'Afrique du Sud, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA)

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord est la région dominante sur le marché du mezcal au cours de la période de prévision 2022 à 2029

L'Amérique du Nord, et plus particulièrement les États-Unis, s'est imposée comme un acteur majeur sur le marché mondial du mezcal. La région bénéficie d'une industrie des boissons bien établie et diversifiée, qui constitue une base solide pour la croissance du marché. La croissance exponentielle de la consommation de boissons aux États-Unis a joué un rôle majeur dans l'essor du marché du mezcal, les consommateurs explorant et adoptant de plus en plus les spiritueux à base d'agave comme le mezcal dans leurs préférences en matière de boissons.

L'Europe devrait être la région connaissant la croissance la plus rapide sur le marché du mezcal pour la période de prévision 2022 à 2029.

L'Europe connaît une croissance significative du marché du mezcal, portée par la consommation croissante de boissons artisanales haut de gamme. L'augmentation de la clientèle millennials dans la région incite les entreprises à accroître leur présence. Par exemple, Diageo a acquis Pierde Almas, une marque mexicaine de mezcal, afin d'enrichir son offre en Europe et à l'international. Ces acquisitions permettent aux entreprises de répondre à la demande croissante de mezcal et de répondre aux préférences changeantes des consommateurs européens.

Pour plus d'informations sur le marché du mezcal , cliquez ici : https://www.databridgemarketresearch.com/reports/global-mezcal-market