Heavy-duty corrugated packaging ensures supply chain efficiency within complex networks. With goods traversing multiple stages of handling and transportation, the structural integrity provided by heavy-duty corrugated packaging is essential. Its robust design enables smooth movement and secure storage of products, safeguarding them from potential damage. This reliability protects the integrity of the goods and minimizes disruptions in the supply chain.

Access full Report @ https://www.databridgemarketresearch.com/reports/north-america-heavy-duty-corrugated-packaging-market

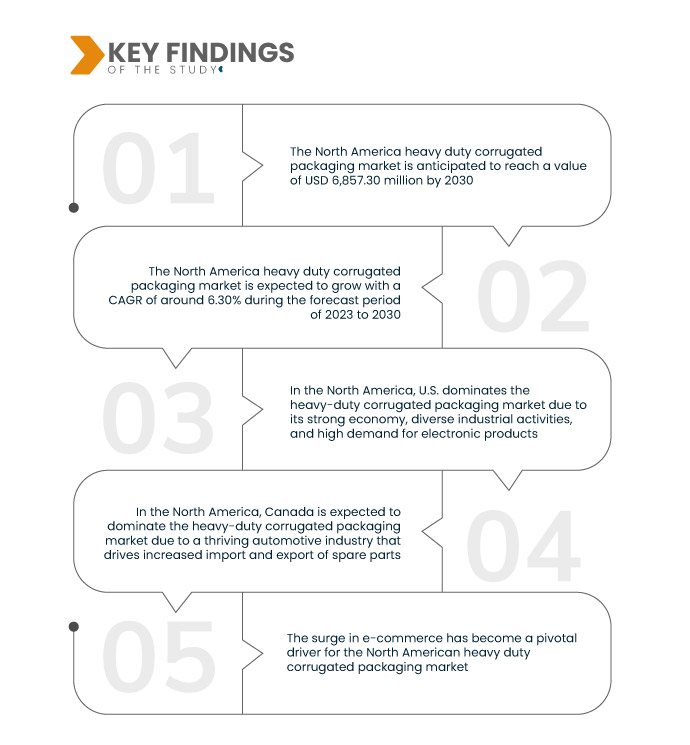

Data Bridge Market Research analyses the North America Heavy Duty Corrugated Packaging Market was valued at USD 4,206.17 million in 2022 and is expected to reach the value of USD 6,857.30 million by 2030, at a CAGR of 6.30% during the forecast period of 2023 to 2030. The growth and expansion of industrial sectors, particularly in manufacturing and logistics, act as a primary driver for the North America heavy duty corrugated packaging market. Industries such as automotive, electronics, and e-commerce, dependent on secure transportation, fuel the demand for heavy-duty corrugated packaging due to its reliability and protective qualities.

Key Findings of the Study

Increasing sustainability concerns is expected to drive the market's growth rate

Sustainability concerns act as a prominent driver in the North America heavy duty corrugated packaging market. Heightened awareness and a growing emphasis on sustainable practices prompt the adoption of eco-friendly materials, particularly recyclable and biodegradable heavy-duty corrugated packaging. As companies strive to align with stringent environmental standards and cater to evolving consumer preferences for eco-conscious products, the market experiences significant growth. This trend reflects a broader industry shift towards environmentally responsible packaging solutions, driven by both regulatory requirements and a rising demand for sustainable practices across various sectors in North America.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Tons, Pricing in USD

|

Segments Covered

|

Product Type (Standard Boxes, Octabins, Vegetable Totes, Large Load Carriers (GLTS), Modularsmall Load Carriers (KLT), Pallet Boxes, Pop Displays, Others), Board Type (Single Wall Board, Double Wall Board, Triple Wall Board, Others), Capacity (Up To 100 LBS, 100-300 LBS and Above 300 LBS), Print Type (Printed, Non-Printed), Size (0-10 Inches, 10-20 Inches, 20-30 Inches, above 30 inches) End-User (Food and Beverages, Chemicals and Petrochemicals, Heavy duty corrugated, Electrical and Electronics, Homecare, Automotive, Glassware and Ceramics, Healthcare, Oil and Gas, Industrial and Other)

|

Countries Covered

|

U.S., Canada, Mexico in North America

|

Market Players Covered

|

Amcor plc (Australia), Dow (U.S.), Bemis Company, Inc. (U.S.), Westrock Company (U.S.), Sealed Air Corporation (U.S.), DS Smith (U.K.), Huhtamaki Oyj (Finland), Berry Plastic Corporation (U.S.), Ball Corporation (U.S.), Genpak, LLC (U.S.), Union packaging (U.S.), Robert Bosch GmbH (Germany), Tetra Pak International S.A. (Switzerland), Coesia S.p.A. (Italy)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis:

The North America heavy duty corrugated packaging market is segmented on the basis of product type, board type, capacity, print type, size, and end-user.

- On the basis of product type, the North America heavy duty corrugated packaging market is segmented into standard boxes, octabins, vegetable totes, large load carriers (GLTS), modular small load carriers (KLT), pallet boxes, pop displays, and others

- On the basis of board type, the North America heavy duty corrugated packaging market is segmented into single wall board, double wall board, triple wall board, and others

- On the basis of capacity, the North America heavy duty corrugated packaging market is segmented into up to 100 lbs, 100-300 lbs and above 300 lbs

- On the basis of print type, the North America heavy duty corrugated packaging market is segmented into printed, and non-printed

- On the basis of size, the North America heavy duty corrugated packaging market is segmented into 0-10 inches, 10-20 inches, 20-30 inches, and above 30 inches

- On the basis of end-user, the North America heavy duty corrugated packaging market is segmented into food and beverages, chemicals and petrochemicals, heavy duty corrugated, electrical and electronics, homecare, automotive, glassware and ceramics, healthcare, oil and gas, industrial and other

Major Players

Data Bridge Market Research recognizes the following companies as the major North America heavy duty corrugated packaging market players in North America heavy duty corrugated packaging market are Amcor plc (Australia), Dow (U.S.), Bemis Company, Inc. (U.S.), Westrock Company (U.S.), Sealed Air Corporation (U.S.), DS Smith (U.K.), Huhtamaki Oyj (Finland), Berry Plastic Corporation (U.S.), Ball Corporation (U.S.).

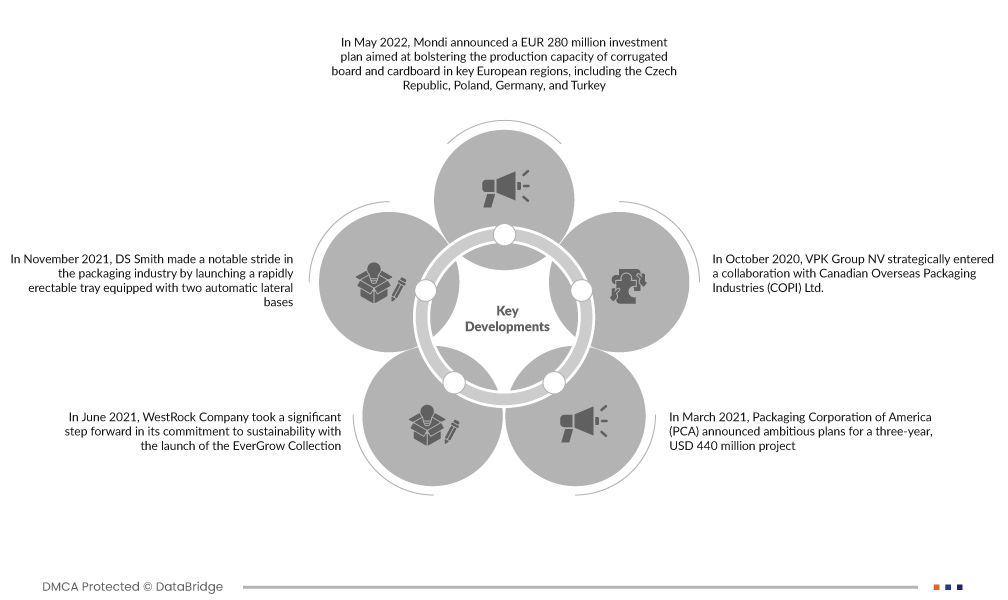

Market Developments

- In May 2022, Mondi announced a EUR 280 million investment plan aimed at bolstering the production capacity of corrugated board and cardboard in key European regions, including the Czech Republic, Poland, Germany, and Turkey. This substantial investment is anticipated to expand overall capacity and enhance operational efficiency. Significantly, EUR 185 million of the investment has been allocated to strengthen Corrugated Solutions' plant networks in Central and Eastern Europe, showcasing Mondi's commitment to fortifying its presence in these regions

- In November 2021, DS Smith made a notable stride in the packaging industry by launching a rapidly erectable tray equipped with two automatic lateral bases. Its swift assembly, the incorporation of two automatic lateral bases, ultimately saving valuable time in logistics operations, characterizes this innovative packaging solution. Moreover, the stability and material optimization of the tray contribute to its efficiency. Notably, the tray is developed using 100% recyclable construction, emphasizing DS Smith's commitment to sustainability. Crafted entirely from 100% corrugated cardboard, this packaging solution aligns with eco-friendly practices while offering a quick and efficient solution for various logistics needs

- In June 2021, WestRock Company took a significant step forward in its commitment to sustainability with the launch of the EverGrow Collection. This expansion of product packaging offerings is designed with a focus on environmental responsibility. The EverGrow packaging stands out for being curbside recyclable when emptied and flattened, aligning with WestRock's overarching goal of reducing waste. The initiative reflects the company's ambitious vision to create a 100% reusable, recyclable and compostable product portfolio. By prioritizing recyclability at the curbside level, WestRock emphasizes its dedication to building a more sustainable and eco-friendly approach to packaging

- In March 2021, Packaging Corporation of America (PCA) announced ambitious plans for a three-year, USD 440 million project. This initiative aimed to permanently remodel a paper machine at its Clark County, Alabama, plant to produce linerboards for corrugated boards. After temporarily switching its production focus to linerboards, PCA embarked on the transformation of its factory paper machines. The objective is to convert these machines into high-performance virgin kraft linerboard machines, producing an impressive 700,000 tons annually. The phased approach over the next 36 months signifies a strategic and deliberate effort by PCA to enhance its production capabilities and meet the evolving demands of the packaging industry

- In October 2020, VPK Group NV strategically entered a collaboration with Canadian Overseas Packaging Industries (COPI) Ltd. The objective of this collaboration was to facilitate the acquisition of Encase Ltd., a move strategically designed to secure and strengthen VPK Group's position in the corrugated cardboard packaging business. This strategic partnership underscores VPK Group's commitment to portfolio diversification and expansion through the acquisition of key industry players

Regional Analysis

Geographically, the countries covered in the North America heavy duty corrugated packaging market report are U.S., Canada, and Mexico in North America.

As per Data Bridge Market Research analysis:

U.S. is the dominant country in North America heavy duty corrugated packaging market during the forecast period 2023-2030

In the North America, U.S. dominates in the heavy-duty corrugated packaging market can be attributed to various factors. The country's robust economic strength, diverse industrial activities, and advanced technology sectors, particularly in electronics, contribute to a significant demand for heavy-duty packaging materials. The well-developed supply chain, globalization, and adherence to regulatory standards further bolster the U.S. position. Additionally, the country's proactive adoption of innovations in materials and manufacturing processes, coupled with a strong logistics infrastructure, ensures a competitive edge in meeting evolving market demands.

Canada is estimated to be the fastest growing country in North America heavy duty corrugated packaging market the forecast period 2023-2030

In the North America, Canada is expected to dominate in the heavy-duty corrugated packaging market is attributed to a thriving automotive industry marked by increased import and export of automotive spare parts. The country's strong trade relationships, particularly with the U.S., contribute to the high demand for secure and durable packaging materials. The growing heavy-duty corrugated sector in Canada reflects an increased need for robust packaging solutions, possibly linked to expanding industrial production and manufacturing activities. Additionally, Canada's success in this market may stem from its ability to innovate, adapt to market demands, and strengthen its supply chain, ensuring efficient and secure transportation of goods.

For more detailed information about the North America heavy duty corrugated packaging market report, click here – https://www.databridgemarketresearch.com/reports/north-america-heavy-duty-corrugated-packaging-market