Protective films safeguard surfaces in various industries by providing a resilient barrier against scratches, abrasions, and environmental damage. In manufacturing, electronics, and automotive sectors, these films ensure the preservation of product integrity during handling, transportation, and storage. They play a pivotal role in the booming e-commerce landscape, protecting goods from damage during shipping and delivery. It contributes to maintaining the aesthetics and functionality of surfaces, whether in construction projects, industrial applications, or daily consumer use. Their importance extends to meeting stringent quality standards, fostering innovation, and aligning with sustainability goals, reflecting their versatile and indispensable role in surface protection across diverse applications.

Access Full Report at https://www.databridgemarketresearch.com/reports/north-america-protective-films-market

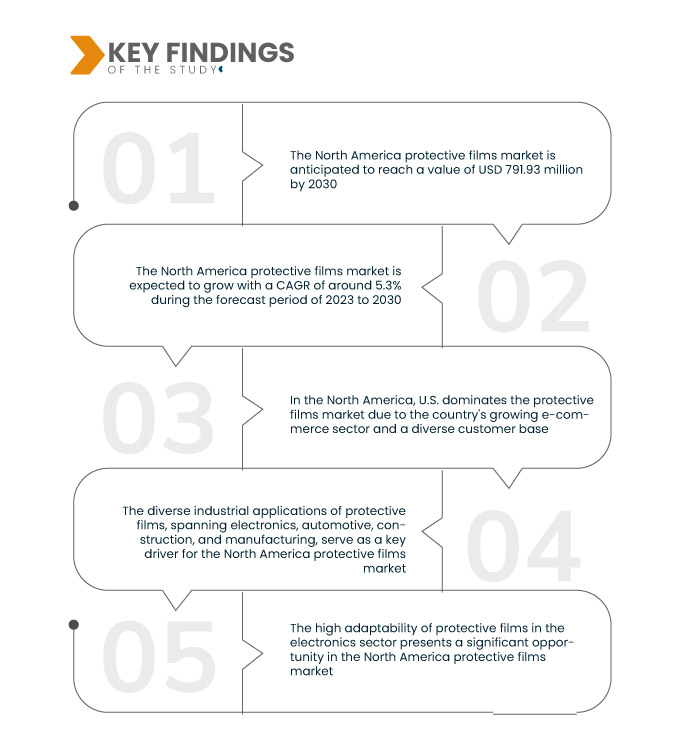

Data Bridge Market Research analyses the North America Protective Films Market which was USD 644.13 million in 2022, is expected to reach USD 791.93 million by 2030, and is expected to undergo a CAGR of 5.3% during the forecast period of 2023 to 2030. The rise in e-commerce activities across North America is a major driver for the growth of the protective films market. As online shopping becomes increasingly popular, the demand for protective films rises sharply because they help these films safeguard products throughout the shipping and delivery.

Key Findings of the Study

Increasing logistics advancement is expected to drive the market's growth rate

The advanced logistics infrastructure in North America is a pivotal driver for the protective films market. The region's well-established and efficient supply chain network relies on protective films to safeguard products during transportation. These films act as a crucial barrier against scratches, abrasions, and environmental factors, ensuring that goods reach their destinations in optimal condition. The seamless integration of protective films within the logistics process preserves product integrity and addresses the growing demand for reliable packaging solutions within the supply chain.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2023 to 2030

|

Base Year

|

2022

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Tons, Pricing in USD

|

Segments Covered

|

Класс (с клеевым покрытием, самоклеящийся), Материал (полиэтилен, полипропилен , полиэтилентерефталат, поливинилхлорид, полиуретан, полиамид, полиэстер, бумага, другие), Толщина (0–2 мм, 2–4 мм, 4–6 мм, 6–8 мм, 8–10 мм, другие), Поверхность (металлы, стекло, текстиль, дерево, мрамор, формованные пластмассы, другие), Текстура (непрозрачная, прозрачная, глянцевая, матовая, другие), Конечный пользователь (строительство, автомобилестроение, электроника, биология, аэрокосмическая промышленность, упаковка, промышленность, судостроение, другие)

|

Страны, охваченные

|

США, Канада, Мексика в Северной Америке

|

Охваченные участники рынка

|

Lamin-x (США), Tee Group Films (США), Mactac (дочерняя компания LINTEC Corporation) (США), DuPont (США), Arkema (Франция), Hitachi Chemical Co., Ltd. (Япония), Saint-Gobain (Франция) и 3M (США)

|

Данные, отраженные в отчете

|

Помимо аналитических данных о рыночных сценариях, таких как рыночная стоимость, темпы роста, сегментация, географический охват и основные игроки, рыночные отчеты, подготовленные Data Bridge Market Research, также включают в себя углубленный экспертный анализ, географически представленные данные о производстве и мощностях компаний, схемы сетей дистрибьюторов и партнеров, подробный и обновленный анализ ценовых тенденций и анализ дефицита цепочки поставок и спроса.

|

Анализ сегмента:

Рынок защитных пленок в Северной Америке сегментирован по классу, материалу, толщине, поверхности, текстуре и конечному потребителю.

- По классу рынок защитных пленок в Северной Америке сегментируется на самоклеящиеся и самоклеящиеся.

- По материалу рынок защитных пленок в Северной Америке сегментируется на полиэтиленовые, полипропиленовые, полиэтилентерефталатные , поливинилхлоридные , полиуретановые , полиамидные , полиэфирные, бумажные и другие.

- По толщине рынок защитных пленок в Северной Америке сегментируется на 0 - 2 мм, 2 - 4 мм, 4 - 6 мм, 6 - 8 мм, 8 - 10 мм и другие.

- По типу поверхности рынок защитных пленок в Северной Америке сегментируется на металлы, стекло, текстиль , дерево, мрамор, формованные пластмассы и другие.

- По текстуре рынок защитных пленок в Северной Америке сегментируется на непрозрачные, прозрачные, глянцевые, матовые и другие.

- По конечному потребителю рынок защитных пленок в Северной Америке сегментируется на следующие отрасли: строительство, автомобилестроение, электроника, биология, авиакосмическая промышленность, упаковка, промышленность, судостроение и другие.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве основных игроков на североамериканском рынке защитных пленок: Lamin-x (США), Tee Group Films (США), Mactac (дочерняя компания LINTEC Corporation) (США), DuPont (США), Arkema (Франция), Hitachi Chemical Co., Ltd. (Япония), Saint-Gobain (Франция)

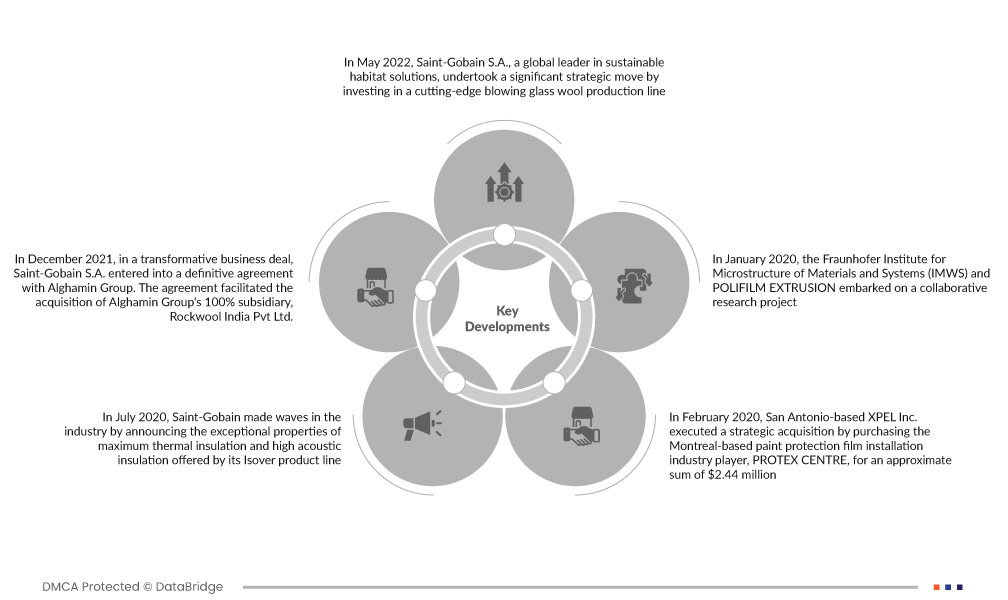

Развитие рынка

- В мае 2022 года Saint-Gobain SA, мировой лидер в области решений для устойчивой среды обитания, предприняла важный стратегический шаг, инвестировав в передовую линию по производству выдувной стекловаты. Это примечательное событие произошло на ее заводе ISOVER, расположенном во Франции. Основной целью этих инвестиций было удовлетворение растущего спроса на французском рынке на передовые решения по теплоизоляции подкровельного пространства. Этот шаг отражает стремление Saint-Gobain оставаться на переднем крае инноваций в области строительных материалов и удовлетворять меняющиеся потребности рынка.

- В декабре 2021 года Saint-Gobain SA заключила окончательное соглашение с Alghamin Group в рамках преобразующей бизнес-сделки. Соглашение способствовало приобретению 100% дочерней компании Alghamin Group, Rockwool India Pvt Ltd. Известная как крупный производитель каменной ваты в Индии, Rockwool India Pvt Ltd может похвастаться широким ассортиментом изоляционных продуктов, предназначенных для тепловых, акустических и противопожарных применений. Это стратегическое приобретение позиционирует Saint-Gobain как ключевого игрока на индийском рынке изоляции, что соответствует глобальной стратегии роста компании

- В июле 2020 года Saint-Gobain произвел фурор в отрасли, объявив об исключительных свойствах максимальной тепловой и высокой звукоизоляции, предлагаемых линейкой продуктов Isover. Это открытие было продемонстрировано на примере его применения в новой штаб-квартире немецкой пресс-группы Axel Springer. Проект получил сертификацию Eurofins Indoor Air Comfort Gold, что подтвердило качество и устойчивость продукта. Успех этого нововведения не только продемонстрировал стремление Saint-Gobain к совершенству, но и внес значительный вклад в формирование портфеля брендов и увеличение спроса на рынке

- В феврале 2020 года базирующаяся в Сан-Антонио компания XPEL Inc. осуществила стратегическое приобретение, купив монреальского игрока в области установки защитных пленок для лакокрасочного покрытия PROTEX CENTRE примерно за 2,44 млн долларов. Это приобретение стало ключевым шагом в стратегии расширения XPEL, укрепив ее присутствие на рынке защитных пленок для лакокрасочного покрытия. Этот шаг позиционировал XPEL как ключевого игрока на рынке автозапчастей, используя опыт и ресурсы, полученные в результате приобретения.

- В январе 2020 года Институт микроструктуры материалов и систем Фраунгофера (IMWS) и POLIFILM EXTRUSION приступили к совместному исследовательскому проекту. Инициатива была сосредоточена на разработке биополимерных пленок для упаковки пищевых продуктов с целью повышения устойчивости пищевых продуктов к микробиологическим воздействиям. Этот совместный исследовательский проект стал значительным шагом на пути к устойчивым и инновационным решениям в индустрии упаковки пищевых продуктов, решая экологические проблемы и безопасность пищевых продуктов. Сотрудничество подчеркнуло приверженность вовлеченных организаций развитию технологий и устойчивости в секторе упаковки.

Региональный анализ

Географически в отчете о рынке защитных пленок в Северной Америке рассматриваются следующие страны: США, Канада и Мексика в Северной Америке.

Согласно анализу Data Bridge Market Research:

По оценкам, США станут самым быстрорастущим регионом на североамериканском рынке защитных пленок в прогнозируемом периоде 2023–2030 гг.

Ожидается, что США будут доминировать на рынке защитных пленок Северной Америки, который закреплен в процветающем ландшафте электронной коммерции страны, которая стала свидетелем существенного всплеска онлайн-активности. С обширной и разнообразной клиентской базой, охватывающей различные отрасли, включая электронику и автомобилестроение, рынок США демонстрирует значительный спрос на защитные пленки, которые обеспечивают целостность продукта во время транспортировки и хранения. Строгие стандарты качества и правила еще больше стимулируют принятие этих пленок, особенно в отраслях, где защита продукта имеет первостепенное значение. Акцент рынка США на устойчивости и его приверженность инновациям ставят его на передовые позиции в разработке защитных пленок.

Более подробную информацию об отчете о рынке защитных пленок в Северной Америке можно получить здесь – https://www.databridgemarketresearch.com/reports/north-america-protective-films-market