The warehousing encompasses the physical infrastructure, storage services, and logistical operations involved in the storage, management, and distribution of goods serving various industries and sectors including manufacturing, retail, e-commerce, and logistics providers. The Saudi Arabia warehousing market includes a network of warehouses, cold storage facilities, and third-party logistics services, driven by factors such as increasing consumer demand, supply chain optimization, and government regulations to facilitate efficient storage, inventory management, and order fulfillment, contributing to the overall efficiency and effectiveness of the country's supply chain and trade activities.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-warehousing-market

Data Bridge Market Research analyzes that the Saudi Arabia Warehousing Market is expected to reach USD 13,214.96 million by 2030 from USD 9,314.17 million in 2022, growing with a substantial CAGR of 4.5% in the forecast period of 2023 to 2030. This surge in e-commerce activities, coupled with the need for last-mile delivery solutions, has led to a growing importance on specialized e-commerce warehouses that are equipped to handle the unique requirements of online retail. The market is witnessing a development driven by the rising demand for e-commerce, making it a pivotal and transformative force in the country's logistics and supply chain industry.

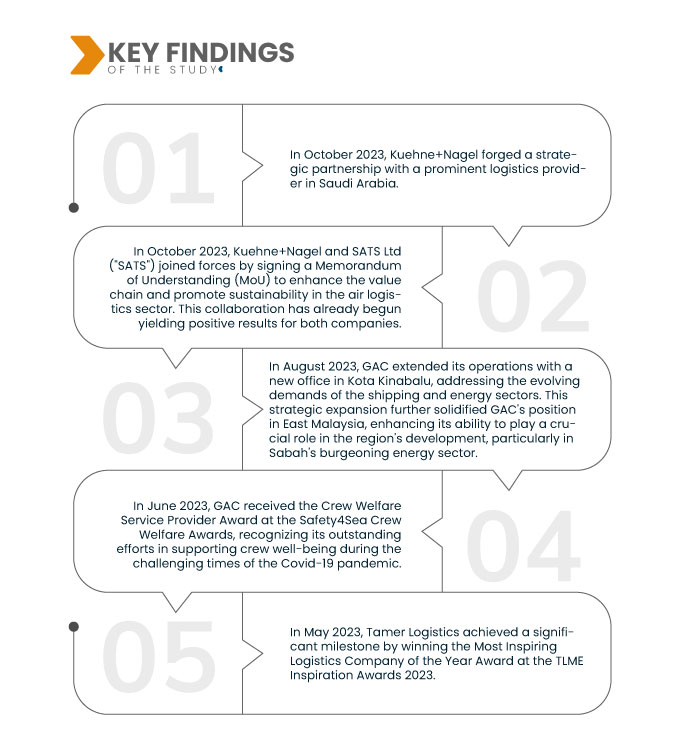

Key Findings of the Study

Rising Expansion of the Manufacturing Sector

Companies need places to store goods due to more factories and industries producing goods. A warehouse is a big storage space where companies keep their products before they are sent to stores or customers. Manufacturing is on the rise in Saudi Arabia, so the demand for warehouses is increasing as they provide a safe and organized way to store all the things that are manufactured. This trend is boosting the warehousing market in Saudi Arabia creating opportunities for businesses that provide warehousing services.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 - 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Hardware/System, Software, and Services), Function (Inventory Control and Management, Asset Tracking, Yard & Dock Management, Order Fulfilment, and Workforce & Task (Process) Management, Shipping, Predictive Maintenance, and Others), Type (Insource Warehousing and Outsource Warehousing), Size (Small, Medium, and Large), Ownership (Public Warehouses, Private Warehouses, Bonded Warehouses, and Consolidated Warehouse), Warehousing Storage Nature (Ambient Warehousing (Around 80°F), Air Conditioned (56°F and 75°F), Refrigerated (33°F and 55°F), and Cold/Frozen (Of or Below 32°F)), WMS Tier Type (Advanced WMS, Basic WMS, and Intermediate WMS), End User (Retail and E-Commerce, Transportation and Logistics, Automotive, Healthcare, Food and Beverages, Electrical and Electronics, Chemical, Agriculture, Energy and Utilities, and Others)

|

|

Country Covered

|

Saudi Arabia

|

|

Market Players Covered

|

Kuehne+Nagel (Germany), CEVA Logistics (Saudi Arabia), YBA KANOO (Bahrain), GAC (U.A.E.) Tamer Logistics (Saudi Arabia), Almajdouie Logistics (Saudi Arabia), DB Schenker (Germany), Wared Logistics (Saudi Arabia), Aramex (U.A.E.), MLS (Saudi Arabia), SMSA Express Transportation Company Ltd. (Saudi Arabia), Binzagr (Saudi Arabia), DHL (Germany), HALA (Saudi Arabia), Sign Logistics (Saudi Arabia), LSC Warehousing & Logistics Company (Saudi Arabia), Agility (Denmark), Aiduk (Saudi Arabia), Takhzeen (Saudi Arabia), fourwinds-ksa (Saudi Arabia), Camels Party Logistics (Saudi Arabia), BAFCO (Saudi Arabia), S.A. TALKE Ltd. (Saudi Arabia), LogiPoint (Saudi Arabia), and United Group (Saudi Arabia)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The Saudi Arabia warehousing market is segmented into eight notable segments based on component, function, type, size, ownership, warehousing storage nature, WMS tier type, and end user.

- On the basis of component, the market is segmented into hardware/system, software, and services. In 2023, the hardware/system segment is expected to dominate the market

In 2023, the hardware/system segment is expected to dominate the market

In 2023, the hardware/system segment is expected to dominate the market with a 51.83% market share due to its ability to automate tasks efficiently, reduce labor costs, and enhance precision in inventory management, ultimately improving overall operational productivity.

- On the basis of function, the market is segmented into inventory control and management, asset tracking, yard & dock management, order fulfilment, workforce & task (process) management, shipping, predictive maintenance, and others

In 2023, the inventory control and management segment is expected to dominate the market

In 2023, the inventory control and management segment is expected to dominate the market with a 24.36% market share due to their capacity to streamline supply chain operations, minimize inventory carrying costs, and ensure compliance with stringent regulatory requirements, thus optimizing the efficiency and profitability of warehouses in the region.

- On the basis of type, the market is segmented into insource warehousing and outsource warehousing. In 2023, the insource warehousing segment is expected to dominate the market with a 52.43% market share

- On the basis of size, the market is segmented small, medium, and large. In 2023, the small segment is expected to dominate the market with a 39.05% market share

- On the basis of ownership, the market is segmented into public warehouses, private warehouses, bonded warehouses, and consolidated warehouse. In 2023, the public warehouses segment is expected to dominate the market with a 56.90% market share

- On the basis of warehousing storage nature, the market is segmented into ambient warehousing (around 80°F), air conditioned (56°F and 75°F), refrigerated (33°F and 55°F), and cold/frozen (of or below 32°F). In 2023, the ambient warehousing (around 80°F) segment is expected to dominate the market with a 36.79% share

- On the basis of WMS tier type, the market is segmented into advanced WMS, basic WMS, and intermediate WMS. In 2023, the basic WMS segment is expected to dominate the market with a 48.72% market share

- On the basis of end user, the market is segmented into retail and e-commerce, transportation and logistics, automotive, healthcare, food and beverages, electrical and electronics, chemical, agriculture, energy and utilities, and others. In 2023, the food and beverages segment is expected to dominate the market with a 20.10% market share

Major Players

Data Bridge Market Research analyzes Kuehne+Nagel (Germany), CEVA Logistics (Saudi Arabia), YBA KANOO (Bahrain), GAC (U.A.E.), and Tamer Logistics (Saudi Arabia) as the major players operating in the Saudi Arabia warehousing market.

Market Development

- In October 2023, Kuehne+Nagel forged a strategic partnership with a prominent logistics provider in Saudi Arabia. This collaboration significantly bolstered their service offerings, enabling them to provide comprehensive end-to-end supply chain solutions to both their global and domestic clients. The move is poised to enhance efficiency and expand Kuehne+Nagel's reach in the region, ultimately strengthening its position in the competitive logistics market

- In October 2023, Kuehne+Nagel and SATS Ltd ("SATS") joined forces by signing a Memorandum of Understanding (MoU) to enhance the value chain and promote sustainability in the air logistics sector. This collaboration has already begun yielding positive results for both companies. By combining their expertise and resources, Kuehne+Nagel and SATS are streamlining operations, reducing costs, and implementing eco-friendly practices. This partnership not only strengthens their market positions but also contributes to a more sustainable and efficient air logistics industry, meeting the evolving needs of their customers and the environment

- In August 2023, GAC extended its operations with a new office in Kota Kinabalu, addressing the evolving demands of the shipping and energy sectors. This strategic expansion further solidified GAC's position in East Malaysia, enhancing its ability to play a crucial role in the region's development, particularly in Sabah's burgeoning energy sector

- In June 2023, GAC received the Crew Welfare Service Provider Award at the Safety4Sea Crew Welfare Awards, recognizing its outstanding efforts in supporting crew well-being during the challenging times of the Covid-19 pandemic. This award not only reaffirmed GAC's commitment to crew welfare but also highlighted its leadership and dedication in the maritime industry, further strengthening its reputation and relationships with stakeholders

- In May 2023, Tamer Logistics achieved a significant milestone by winning the Most Inspiring Logistics Company of the Year Award at the TLME Inspiration Awards 2023. This prestigious recognition not only celebrated their ability to adapt and innovate in a rapidly changing industry but also reinforced their position as a genuine leader in FMCG, Healthcare, Cosmetics, and Third-Party Logistics within the Kingdom of Saudi Arabia. This award served as a testament to their commitment to excellence and highlighted their role in redefining supply chain and logistics, ultimately contributing to enhanced reputation and industry leadership

For more detailed information about the Saudi Arabia warehousing market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-warehousing-market