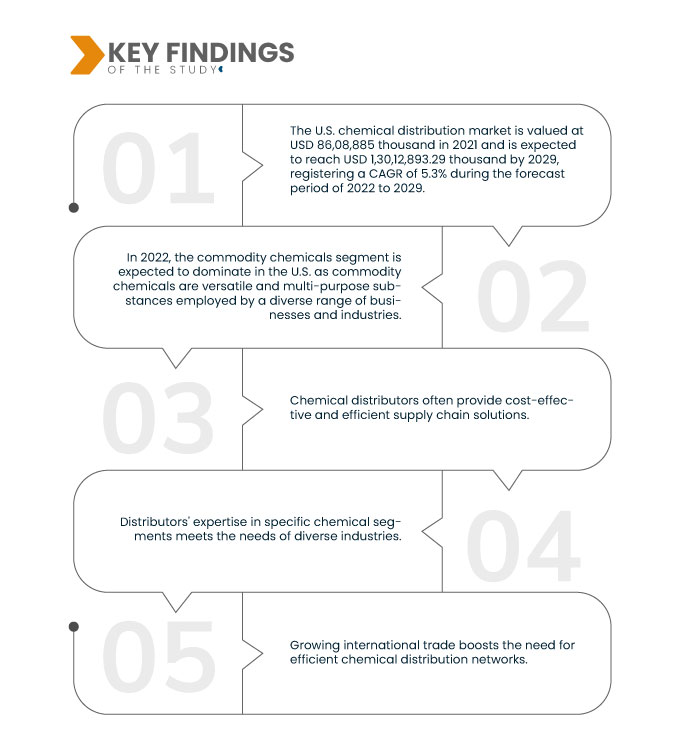

Chemical distribution plays a pivotal role in supplying a wide array of chemicals to various industries, including manufacturing, agriculture, healthcare, and more. Its key features include specialized expertise in handling chemicals, efficient supply chain management, and compliance with stringent regulations. These services encompass sourcing, storage, transportation, and customized solutions to meet industry-specific needs. Chemical distribution ensures the timely availability of chemicals, supports industrial processes, fosters innovation, and promotes safety and compliance, making it an essential component of many sectors' operations.

Access Full Report @ https://www.databridgemarketresearch.com/reports/us-chemical-distribution-market

Data Bridge Market Research analyses that the U.S. Chemical Distribution Market is valued at USD 86,08,885 thousand in 2021 and is expected to reach USD 1,30,12,893.29 thousand by 2029, registering a CAGR of 5.3% during the forecast period of 2022 to 2029. The chemical distribution market is buoyed by growing chemical demand across diverse industries. As sectors such as manufacturing, agriculture, and healthcare rely on chemicals for various processes, chemical distributors play a pivotal role in efficiently supplying these products, meeting industry-specific requirements, and supporting economic growth by ensuring the availability of essential chemicals.

Key Findings of the Study

Regulatory compliance is expected to drive the market's growth rate

Stringent regulations in the chemical industry require a high level of expertise to navigate and ensure compliance. Chemical distributors are well-versed in these complex regulatory frameworks, including safety, environmental, and quality standards. They help manufacturers and end-users source and handle chemicals in accordance with these regulations, mitigating legal and environmental risks. Distributors also provide documentation, labeling, and storage solutions that meet compliance requirements. This specialized knowledge and capability are crucial in maintaining the integrity of the supply chain, protecting public safety, and avoiding costly penalties for non-compliance.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Thousands, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Chemical Type (Commodity Chemicals, Specialty Chemicals), Distribution Channel (B2B, Third Party Distribution, E-commerce and Others), Distribution Method (Airways Distribution, Rail Distribution, Road Distribution and Shipping Distribution), Chemical Packaging (Drums, Intermediate Bulk Container (IBC), Flexitanks and Others), Packaging Size (100 to 250 Liters, 250 to 500 Liters and above 500 Liters)

|

|

Market Players Covered

|

Brenntag SE (Germany), DKSH Management Ltd. (Switzerland), Univar Solutions Inc. (U.S.), Hydrite Chemical (U.S.), Wilbur-Ellis Holdings, Inc. (U.S.), IMCD Group (Netherlands), ICC Industries Inc. (U.S.), Azelis (Belgium), HELM AG (Germany), Aceto (U.S.), Prinova Group LLC (U.S.),, Barentz (Netherlands), Caldic B.V. (Netherlands), Safic-Alcan (France), GTM (Germany)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The U.S. chemical distribution market is segmented on the basis of chemical type, distribution channel, distribution method, chemical packaging, and packaging size.

- On the basis of chemical type, the chemical distribution market is segmented into commodity chemicals and specialty chemicals. In 2022, the commodity chemicals segment is expected to dominate in the U.S. as commodity chemicals are versatile and multi-purpose substances employed by a diverse range of businesses and industries.

In 2022, the commodity chemicals segment is expected to dominate in U.S. chemical distribution market

In 2022, the commodity chemicals segment is expected to dominate in U.S. chemical distribution market as their broad applicability stems from their fundamental roles as raw materials and intermediates in various manufacturing processes. Industries such as agriculture, pharmaceuticals, construction, automotive, and electronics all rely on commodity chemicals such as solvents, acids, and polymers. Their ubiquity arises from their indispensable functions in producing countless everyday products, from plastics to detergents. This diversity in applications ensures a consistent demand for commodity chemicals, making them a cornerstone of many industries' supply chains and economic activities.

- On the basis of distribution channel, the chemical distribution market is segmented into B2B, third party distribution, E-commerce, and others. In 2022, B2B is expected to dominate in U.S. chemical distribution market as E-commerce offers a multitude of advantages to both buyers and sellers, driving its widespread adoption.

In 2022, B2B is expected to dominate in U.S. chemical distribution market

In 2022, B2B is expected to dominate in U.S. chemical distribution market as it provides unparalleled convenience by enabling shopping from anywhere at any time. Sellers benefit from increased profits through reduced operational costs and a broader customer reach. Additionally, e-commerce platforms offer enhanced security measures for financial transactions, protecting both parties from potential fraud. These combined benefits foster trust in online transactions and create a seamless marketplace experience, making e-commerce a preferred choice for modern consumers and businesses such as.

- On the basis of distribution method, the chemical distribution market is segmented into airways distribution, rail distribution, road distribution, and shipping distribution. In 2022, rail distribution is expected to dominate in the U.S. due to its cost-effectiveness and suitability for long-distance transport, coupled with its superior carrier capacity.

- On the basis of chemical packaging, the chemical distribution market are segmented into drums, intermediate bulk container (IBC), flexitanks, and others. In 2022, intermediate bulk containers (IBC) are expected to dominate in the U.S. due to the ideal choice for bulk chemical distribution, and intermediate bulk containers (IBCs) are renowned for their zero-waste properties.

- On the basis of packaging size, the chemical distribution market is segmented into 100 to 250 liters, 250 to 500 liters, and above 500 liters. In 2022, 250 to 500 liters is expected to dominate in the U.S. because It is well-suited for the bulk transport of goods, whether on an international or domestic scale.

Major Players

Data Bridge Market Research recognizes the following companies as the major U.S. chemical distribution market players in U.S. chemical distribution market are Brenntag SE (Germany), DKSH Management Ltd. (Switzerland), Univar Solutions Inc. (U.S.), Hydrite Chemical (U.S.), Wilbur-Ellis Holdings, Inc. (U.S.), IMCD Group (Netherlands), ICC Industries Inc. (U.S.), Azelis (Belgium), HELM AG (Germany), Aceto (U.S.)

Market Developments

- In August 2021, Brenntag SE, a renowned global leader in chemicals and ingredients distribution, successfully acquired all operational assets and business operations of Matrix Chemical, LLC. As the largest distributor of acetone in North America and a prominent solvents distributor, this acquisition positions Brenntag SE to meet the demands of its North American customers more effectively and efficiently.

- In August 2021, Univar Solutions Inc. initiated the construction of a new, tailor-made facility in Abbotsford, British Columbia, Canada. This facility, designed to be SAP-ready, is slated to commence operations in the first half of 2023. It strongly aligns with the company's enduring sustainability pledge to attain net-zero emissions by 2050. This expansion is expected to facilitate the company in expanding its customer base and enhancing its presence in the region.

For more detailed information about the U.S. chemical distribution market report, click here – https://www.databridgemarketresearch.com/reports/us-chemical-distribution-market