통합 의료 서비스망(IDN)은 병원, 의원, 1차 진료 기관 등 다양한 의료 시설을 통합하여 환자 맞춤형 의료 서비스를 제공하는 의료 시스템입니다. 중앙 집중식 환자 데이터 접근을 통해 시의적절하고 정보에 기반한 의사 결정을 보장합니다. IDN은 행정 절차를 간소화하고, 자원 배분을 최적화하며, 환자 치료 결과를 향상시킵니다. IDN의 적용 분야는 인구 건강 관리, 의료 질 향상, 그리고 비용 효율적인 의료 서비스 제공 등입니다. IDN은 환자 건강을 최우선으로 하고 예방적이고 전인적인 의료에 중점을 두는 가치 기반 의료 모델에서 매우 중요합니다.

https://www.databridgemarketresearch.com/reports/us-integrated-delivery-network-market 에서 전체 보고서를 확인하세요.

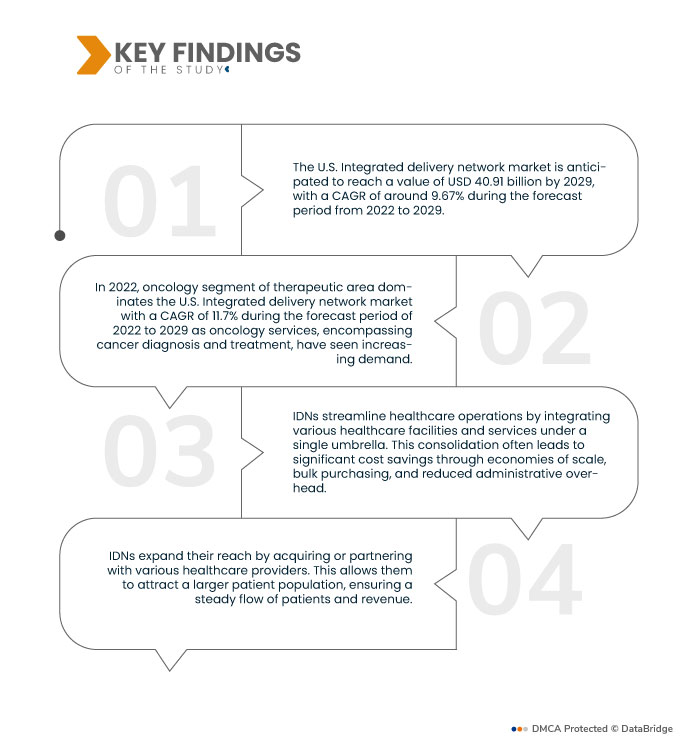

데이터 브리지 마켓 리서치(Data Bridge Market Research)에 따르면 미국 통합 의료 서비스 네트워크(IDN) 시장 규모는 2021년 195억 5천만 달러에서 2029년 409억 1천만 달러로 성장하여 2022년부터 2029년까지 연평균 9.67%의 성장률을 기록할 것으로 예상됩니다. IDN은 고품질의 통합 의료 서비스 제공에 중점을 둡니다. 환자 정보를 공유하고 네트워크 전반에 걸쳐 의료 프로토콜을 표준화함으로써 환자 치료 결과를 개선하고 의료 과실을 줄일 수 있습니다.

연구의 주요 결과

가치 기반 케어가 시장 성장률을 견인할 것으로 예상됩니다.

가치 기반 의료로의 전환은 기존의 행위별 수가제 방식보다 환자의 웰빙을 우선시합니다. 통합 의료 서비스 제공 네트워크(IDN)는 다양한 의료 서비스 제공자 간의 의료 조정을 간소화하므로 이러한 변화에 매우 적합합니다. IDN은 환자 정보를 공유하고 표준화된 의료 프로토콜을 준수함으로써 의료의 질과 결과를 향상시킵니다. 이러한 환자 중심적 접근 방식은 가치 기반 모델과 일치하며, 환자가 궁극적으로 건강과 웰빙을 증진하는 전인적이고 효율적이며 효과적인 의료 서비스를 받을 수 있도록 보장합니다.

보고서 범위 및 시장 세분화

보고서 메트릭

|

세부

|

예측 기간

|

2022년부터 2029년까지

|

기준 연도

|

2021

|

역사적인 해

|

2020 (2014-2019년으로 맞춤 설정 가능)

|

양적 단위

|

매출(10억 달러), 볼륨(단위), 가격(USD)

|

다루는 세그먼트

|

서비스 유형(수직 통합, 수평 통합), 유형(급성 치료, 1차 진료, 장기 건강, 전문 클리닉, 재택 치료 서비스, 기타), 치료 영역(종양학, 중재 심장학, 2형 당뇨병, 고콜레스테롤혈증, 만성 폐쇄성 폐 질환 , 파킨슨병, 건선 , 정형외과, 성형외과, 기타), 최종 사용자(의료 시설, 단체 구매 기관, 제약 회사, 의료 기기 회사)

|

포함 국가

|

이

|

시장 참여자 포함

|

CommonSpirit Health(미국), Ascension(미국), Providence(미국), TH Medical(미국), Trinity Health(미국), Regents of the University of California(미국), Universal Health Services, Inc.(미국), CHSPSC, LLC.(미국), Northwell Health(미국), UPMC HEALTH PLAN, INC.(미국), Cleveland Clinic(미국), Baylor Scott & White Health(미국), NewYork-Presbyterian Hospital(미국), Sutter Health(미국), Adventist Health(미국)

|

보고서에서 다루는 데이터 포인트

|

Data Bridge Market Research에서 큐레이팅한 시장 보고서에는 시장 가치, 성장률, 세분화, 지리적 범위 및 주요 참여자와 같은 시장 시나리오에 대한 통찰력 외에도 심층 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석 및 규제 프레임워크가 포함됩니다.

|

세그먼트 분석:

미국의 통합 배송 네트워크 시장은 서비스 유형, 유형, 치료 영역 및 최종 사용자를 기준으로 세분화됩니다.

- 서비스 유형을 기준으로 미국 통합 의료 서비스 네트워크 시장은 수직 통합과 수평 통합으로 구분됩니다. 2022년에는 수직 통합 부문이 2022년부터 2029년까지 연평균 성장률 11.1%로 미국 통합 의료 서비스 네트워크 시장을 주도할 것으로 예상됩니다. 여기에는 병원, 진료소, 심지어 보험사까지 포함하는 다양한 의료 서비스 제공 기관이 포함됩니다.

2022년에는 수직 통합 부문이 2022년부터 2029년까지의 예측 기간 동안 11.1%의 CAGR로 미국 통합 배송 네트워크 시장을 지배할 것입니다.

2022년에는 수직 통합 부문이 미국 통합 의료 서비스 네트워크(IDN) 시장을 장악할 것으로 예상되며, 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률(CAGR) 11.1%를 기록할 것으로 예상됩니다. IDN은 이러한 요소들을 관리함으로써 운영을 간소화하고, 진료 조정을 개선하며, 비용을 절감할 수 있습니다. 이러한 통합 모델은 가치 기반 의료로의 전환 추세에 발맞춰 IDN이 양질의 진료 결과, 환자 만족, 그리고 비용 효율성에 집중할 수 있도록 지원하여 궁극적으로 의료 분야에서 성장과 영향력을 확대할 것입니다.

- 미국 통합 의료 서비스 시장은 유형별로 급성 치료, 1차 진료, 장기 요양, 전문 클리닉, 가정 간병 서비스 등으로 세분화됩니다. 2022년에는 급성 치료 부문이 미국 통합 의료 서비스 시장을 주도할 것으로 예상되는데, 이는 병원과 같은 급성 치료 시설이 필수 의료 서비스 제공에 중추적인 역할을 하기 때문입니다. 2022년부터 2029년까지의 예측 기간 동안 급성 치료 부문은 연평균 성장률 9.7%를 기록할 것으로 예상됩니다.

- 치료 영역을 기준으로 미국 통합 전달망 시장은 종양학, 중재적 심장학, 제2형 당뇨병, 고콜레스테롤혈증, 만성 폐쇄성 폐 질환, 파킨슨병 , 건선, 정형외과, 성형외과 등으로 세분화됩니다. 2022년에는 종양학 분야가 미국 통합 전달망 시장을 주도할 것으로 예상되는데, 이는 암 진단 및 치료를 포함하는 종양학 서비스에 대한 수요가 증가함에 따라 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 11.7%를 기록할 것으로 예상됩니다.

2022년에는 종양학 부문이 2022년부터 2029년까지의 예측 기간 동안 11.7%의 CAGR로 미국 통합 전달 네트워크 시장을 지배할 것입니다.

IDN(통합 의료 네트워크)들이 이러한 수요를 충족하고 포괄적이고 전문적인 치료를 제공하기 위해 종양학 서비스를 전략적으로 확장함에 따라, 2022년에는 종양학 부문이 미국 통합 의료 네트워크 시장을 장악할 것으로 예상됩니다. 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률(CAGR)은 11.7%에 달할 것입니다. 암이 만연한 건강 문제인 만큼, 종양학 치료에 탁월한 IDN은 환자를 유치하고, 파트너십을 구축하며, 의료 시장에서 상당한 점유율을 확보할 가능성이 높아 전반적인 성장과 명성에 기여할 것입니다.

- 최종 사용자 기준으로 미국 통합 전달망(IDN) 시장은 의료 시설, 단체 구매 기관, 제약 회사, 의료기기 회사로 세분화됩니다. 2022년에는 의료 시설 부문이 2022년부터 2029년까지의 예측 기간 동안 연평균 성장률 10.8%로 미국 통합 전달망 시장을 주도할 것으로 예상됩니다. 이는 병원, 진료소, 전문 센터를 포함한 의료 시설이 통합 전달망(IDN) 시장 성장에 상당한 영향을 미치기 때문입니다. 이러한 시설은 IDN의 중추를 이루며 환자 진료의 주요 장소 역할을 합니다.

주요 플레이어

Data Bridge Market Research는 다음 회사를 미국 통합 배송 네트워크 시장의 주요 미국 통합 배송 네트워크 시장 참여자로 인식합니다. CommonSpirit Health(미국), Ascension(미국), Providence(미국), TH Medical(미국), Trinity Health(미국), Regents of the University of California(미국), Universal Health Services, Inc.(미국), CHSPSC, LLC.(미국), Northwell Health(미국)

시장 개발

- 2020년 2월, 65개의 급성기 및 전문 병원으로 구성된 통합 의료 서비스 네트워크인 TH Medical은 굿 사마리탄(Good Samaritan)과 세인트 메리(St. Mary's) 의료 센터 인수를 발표했습니다. TH Medical의 목표는 해당 병원의 인프라를 개선하고 환자와 의사 모두의 만족도를 높이는 것입니다. 이러한 전략적 조치는 입원 환자 증가로 이어져 궁극적으로 회사의 전반적인 수익성을 향상시킬 것으로 예상됩니다.

- 2020년 2월, HCA Healthcare Inc.는 Pearland Town Center에 48,400제곱피트 규모의 교육 센터를 건립하고 2021년 초 운영을 시작할 계획이라고 발표했습니다. 이 이니셔티브는 약 7,000명의 간호사가 지속적인 임상 교육 및 훈련을 받을 수 있도록 교육 리소스를 강화하려는 회사의 의지를 강화하는 것입니다.

미국 통합 배송 네트워크 시장 보고서 에 대한 자세한 내용은 여기를 클릭하세요 - https://www.databridgemarketresearch.com/reports/us-integrated-delivery-network-market