Apac Newborn Screening Market

Market Size in USD Million

CAGR :

%

USD

300.30 Million

USD

841.71 Million

2024

2032

USD

300.30 Million

USD

841.71 Million

2024

2032

| 2025 –2032 | |

| USD 300.30 Million | |

| USD 841.71 Million | |

|

|

|

|

Asia-Pacific Newborn Screening Market Size

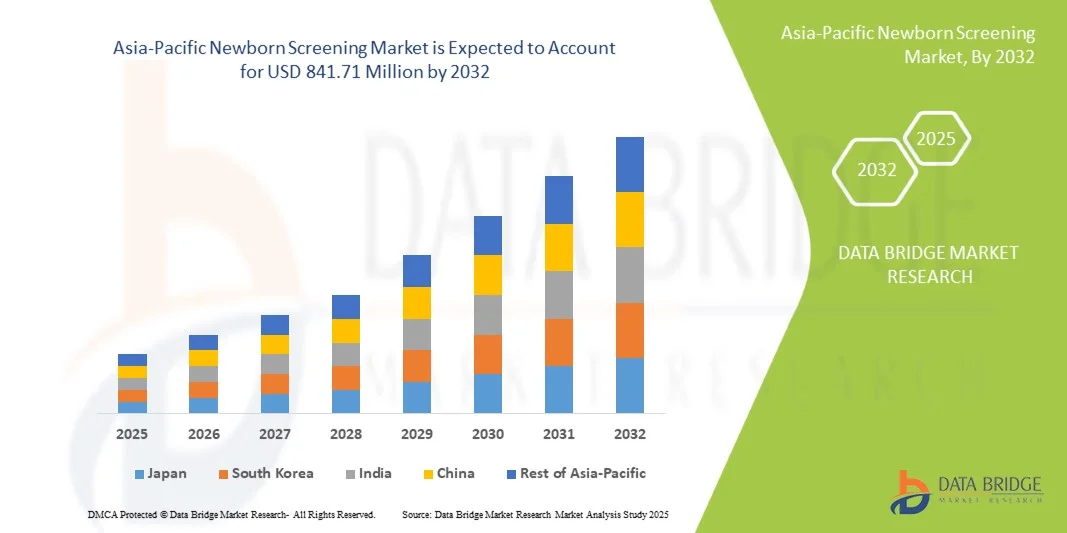

- The Asia-Pacific newborn screening market size was valued at USD 300.30 million in 2024 and is expected to reach USD 841.71 million by 2032, at a CAGR of 13.75% during the forecast period

- The market growth is largely fueled by the increasing government initiatives and healthcare programs aimed at early detection of congenital and metabolic disorders, along with rising awareness about the benefits of newborn screening across the region

- Furthermore, growing investments in advanced diagnostic technologies, coupled with the expanding healthcare infrastructure in emerging economies, are driving the adoption of comprehensive newborn screening panels, thereby significantly boosting the market's growth

Asia-Pacific Newborn Screening Market Analysis

- Newborn screening, involving early detection of congenital, metabolic, and genetic disorders in infants, is increasingly recognized as a critical component of pediatric healthcare in both developed and emerging Asia-Pacific countries due to its potential to prevent long-term disabilities and improve survival rates

- The escalating demand for newborn screening is primarily fueled by rising awareness among parents and healthcare providers, government mandates for mandatory screening programs, and advancements in high-throughput diagnostic technologies enabling faster and more comprehensive testing

- China dominated the Asia-Pacific newborn screening market with the largest revenue share of 40.2% in 2024, characterized by large birth rates, expanding healthcare infrastructure, and strong government initiatives, with urban hospitals and private diagnostic centers experiencing substantial growth in screening adoption, driven by innovations in tandem mass spectrometry and DNA-based assays

- India is expected to be the fastest growing market in the region during the forecast period due to increasing healthcare investments, expanding neonatal care programs, and growing parental awareness of early disease detection

- Dried Blood Spot Test segment dominated the Asia-Pacific newborn screening market with a market share of 42% in 2024, driven by its established reliability, ease of sample collection, and widespread integration into national newborn screening programs across the region

Report Scope and Asia-Pacific Newborn Screening Market Segmentation

|

Attributes |

Asia-Pacific Newborn Screening Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Newborn Screening Market Trends

“Advancements in High-Throughput and DNA-Based Technologies”

- A significant and accelerating trend in the Asia-Pacific newborn screening market is the adoption of high-throughput technologies and DNA-based assays, enabling faster, more accurate, and comprehensive detection of congenital and metabolic disorders in infants

- For instance, the use of tandem mass spectrometry combined with next-generation sequencing panels allows simultaneous screening of multiple disorders from a single dried blood spot, improving early diagnosis rates

- Integration of automated sample processing and digital reporting systems reduces human error, shortens turnaround times, and facilitates centralized monitoring of newborn health data

- The seamless adoption of these advanced technologies by regional hospitals and diagnostic centers enables efficient expansion of national screening programs and supports standardized care protocols

- This trend towards more precise, rapid, and scalable newborn screening solutions is reshaping expectations for early infant healthcare, with companies such as PerkinElmer and BGI implementing automated DNA-based workflows to enhance detection efficiency

- The demand for high-throughput and DNA-based newborn screening solutions is growing rapidly across both public and private healthcare sectors, as governments and hospitals increasingly prioritize early detection and intervention programs

Asia-Pacific Newborn Screening Market Dynamics

Driver

“Increasing Government Initiatives and Parental Awareness”

- The rising government initiatives promoting mandatory newborn screening programs, coupled with growing parental awareness about the benefits of early disease detection, is a major driver for market growth

- For instance, in March 2024, the Chinese Ministry of Health expanded its national newborn screening program to include additional metabolic disorders, aiming to cover more than 90% of newborns in urban and semi-urban areas

- Governments are investing in advanced diagnostic infrastructure, training healthcare professionals, and providing financial incentives to ensure widespread adoption of newborn screening

- Growing awareness among parents about treatable congenital disorders motivates early testing, creating higher demand for comprehensive newborn screening panels and follow-up care services

- Hospitals and pediatric clinics increasingly integrate newborn screening with broader maternal and child health initiatives, facilitating early intervention and improving overall healthcare outcomes

- The convenience of early detection, coupled with government support and public health campaigns, continues to propel the adoption of newborn screening across both urban and rural regions

Restraint/Challenge

“High Costs and Limited Access in Rural Areas”

- The relatively high cost of advanced screening technologies, including tandem mass spectrometry and DNA-based assays, poses a significant challenge for widespread adoption in cost-sensitive markets

- For instance, smaller regional hospitals and rural clinics in India and Southeast Asia often face budgetary constraints that limit access to comprehensive newborn screening services

- Limited availability of trained personnel, laboratory infrastructure, and follow-up diagnostic facilities further hinders market penetration in remote areas

- Awareness gaps among rural populations and logistical challenges in sample collection and transportation can delay testing and diagnosis, reducing overall program effectiveness

- Addressing these challenges requires subsidized programs, mobile screening units, and partnerships between governments, NGOs, and private players to expand reach and affordability

- Overcoming cost and access barriers through policy support, education, and technology adaptation is crucial for sustainable growth of the Asia-Pacific newborn screening market

Asia-Pacific Newborn Screening Market Scope

The market is segmented on the basis of test type, product type, technology, disease type, and end user.

- By Test Type

On the basis of test type, the Asia-Pacific newborn screening market is segmented into dried blood spot test, hearing screen test, and critical congenital heart diseases (CCHD) test. The Dried Blood Spot Test segment dominated the market with the largest revenue share of 42% in 2024, owing to its high reliability, ease of sample collection, and ability to screen multiple disorders from a single sample. Hospitals and pediatric clinics widely prefer dried blood spot tests due to their standardized protocols and proven accuracy. Governments integrate these tests into national newborn screening programs, supporting early detection of congenital and metabolic disorders. Advanced automation and high-throughput technologies reduce turnaround times and improve reporting efficiency. In addition, the test’s cost-effectiveness enables wider adoption in both urban and semi-urban healthcare settings.

The CCHD Test segment is expected to witness the fastest growth rate of 22.1% from 2025 to 2032, driven by rising awareness of congenital heart disease among parents and healthcare providers. Pulse oximetry-based CCHD screening provides a non-invasive, rapid, and accurate method for early detection. Expansion of government-mandated programs and increasing adoption in urban hospitals and neonatal care units accelerate market growth. Rising investment in specialized screening devices and training for medical personnel further boosts adoption. Early detection enables timely surgical interventions, reducing infant morbidity and mortality.

- By Product Type

On the basis of product type, the Asia-Pacific newborn screening market is segmented into instruments and reagents & assay kits. The Reagents & Assay Kits segment dominated the market with a revenue share of 44.3% in 2024, driven by the recurring need for consumables in routine newborn screening. Hospitals and clinics rely on reagents and assay kits to maintain uninterrupted testing capacity. The segment benefits from technological advancements such as multiplex assays, which allow simultaneous detection of multiple conditions. Adoption is further supported by government-mandated screening programs across the region. Emerging markets in Asia-Pacific are increasingly procuring reagents and kits for expanding national coverage. High reliability and standardized quality of these kits ensure accurate and repeatable results.

The Instruments segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by investments in modern laboratory infrastructure and automation. Advanced instruments such as tandem mass spectrometers, DNA sequencers, and pulse oximeters enhance diagnostic accuracy and reduce human error. Hospitals and pediatric clinics are increasingly adopting these instruments to meet rising screening demands. Partnerships with technology providers accelerate instrument deployment. Government subsidies and grants in emerging countries also support adoption. Automation and integrated systems reduce operational costs over time.

- By Technology

On the basis of technology, the Asia-Pacific newborn screening market is segmented into tandem mass spectrometry, hearing screen technology, pulse oximetry screening technology, immunoassays & enzymatic assays, Electrophoresis, and DNA-Based Assays. Tandem Mass Spectrometry dominated the market with a 39.8% revenue share in 2024, due to its ability to detect multiple metabolic disorders from a single blood sample. It is widely adopted in national newborn screening programs. Hospitals rely on this technology for its high sensitivity and specificity, which reduces false positives. Integration with automated workflows improves laboratory efficiency. The technology allows rapid sample processing for large-scale screening. Continuous innovation in mass spectrometry enhances detection capabilities, further driving adoption.

DNA-Based Assays are expected to witness the fastest growth rate of 23.4% from 2025 to 2032, driven by next-generation sequencing and PCR-based advancements. These assays enable precise detection of genetic mutations. Specialized pediatric clinics and private hospitals increasingly adopt DNA-based assays for early diagnosis of rare disorders. Expansion of government-funded genetic programs accelerates growth. Automation and high-throughput platforms enhance testing efficiency. Parents and healthcare providers value the accuracy and early intervention opportunities DNA-based assays provide.

- By Disease Type

On the basis of disease type, the Asia-Pacific newborn screening market is segmented into critical congenital heart diseases, newborn hearing loss, sickle cell disease, phenylketonuria (PKU), cystic fibrosis (CF), maple syrup urine disease, and others. Critical Congenital Heart Diseases dominated the market with a revenue share of 38.2% in 2024, due to the high clinical significance of early detection. Pulse oximetry-based screening is widely used for rapid, non-invasive diagnosis. Hospitals integrate CCHD testing into routine neonatal care for timely intervention. Early detection allows life-saving surgeries and reduces infant mortality rates. Growing awareness among healthcare providers and parents supports broader adoption. Government programs promote universal CCHD screening across urban and semi-urban regions.

Newborn Hearing Loss segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising parental awareness and government mandates for universal hearing screening. Automated auditory brainstem response and otoacoustic emission devices allow quick, reliable screening. Early identification enables timely intervention with hearing aids or cochlear implants. Pediatric clinics and hospitals are increasingly expanding hearing screening services. Public health campaigns raise awareness of developmental benefits of early treatment. Rising investments in neonatal care infrastructure further accelerate adoption.

- By End User

On the basis of end user, the Asia-Pacific newborn screening market is segmented into hospitals, pediatric clinics, and clinics. Hospitals dominated the market with a revenue share of 45.7% in 2024, driven by established neonatal units, access to advanced instruments, and capacity to handle large volumes of newborns. Hospitals actively implement government-mandated programs and procure advanced reagents and assay kits. Integration with electronic health records enhances reporting and follow-up care. Partnerships with diagnostic technology providers ensure access to cutting-edge instruments. Urban hospitals benefit from trained personnel and automation systems. Growing awareness and public health initiatives further increase hospital adoption.

Pediatric Clinics are expected to witness the fastest growth rate of 21.9% from 2025 to 2032, fueled by parental awareness and expansion of outpatient screening services. Clinics provide specialized follow-up care, genetic counseling, and early intervention. Adoption is rising in urban and semi-urban regions with expanding private pediatric healthcare. Government support and training programs help clinics implement advanced technologies. Pediatric clinics complement hospital-based programs for wider coverage. Early interventions improve long-term health outcomes, boosting clinic-based demand.

Asia-Pacific Newborn Screening Market Regional Analysis

- China dominated the Asia-Pacific newborn screening market with the largest revenue share of 40.2% in 2024, characterized by large birth rates, expanding healthcare infrastructure, and strong government initiatives, with urban hospitals and private diagnostic centers experiencing substantial growth in screening adoption, driven by innovations in tandem mass spectrometry and DNA-based assays

- Hospitals and pediatric clinics across urban and semi-urban regions are increasingly adopting advanced screening technologies such as tandem mass spectrometry and DNA-based assays for faster and more accurate diagnosis of congenital and metabolic disorders

- This widespread adoption is further supported by government-mandated screening programs, rising parental awareness, and significant investments in neonatal healthcare, establishing newborn screening as a critical and standard practice in China’s pediatric care system

The China Newborn Screening Market Insight

The China newborn screening market captured the largest revenue share of 40.2% in 2024 within Asia-Pacific, driven by strong government initiatives, large birth rates, and expanding healthcare infrastructure focused on early disease detection. Hospitals and pediatric clinics across urban and semi-urban regions are increasingly adopting advanced screening technologies such as tandem mass spectrometry and DNA-based assays for accurate and timely diagnosis of congenital and metabolic disorders. Rising parental awareness and government-mandated universal screening programs further fuel adoption. Increasing investment in neonatal care and digital health integration supports the growth of comprehensive screening services. China’s emphasis on public health and standardization of newborn screening protocols establishes it as the dominant market in the region.

India Newborn Screening Market Insight

The India newborn screening market is expected to witness the fastest CAGR during the forecast period, driven by rising birth rates, rapid urbanization, and expanding middle-class population. Hospitals, pediatric clinics, and specialized diagnostic centers are increasingly integrating advanced screening technologies such as pulse oximetry, tandem mass spectrometry, and DNA-based assays. Government-backed initiatives promoting universal newborn screening programs, along with growing parental awareness about early disease detection and treatment, are accelerating market adoption. The availability of affordable screening kits and instruments, coupled with private healthcare investment, is enabling wider access across urban and semi-urban regions. Expansion of neonatal care infrastructure and public health campaigns further supports the rapid growth of the market.

Japan Newborn Screening Market Insight

The Japan newborn screening market is gaining momentum due to the country’s well-developed healthcare system, high awareness of pediatric health, and adoption of advanced diagnostic technologies. Hospitals and neonatal care centers utilize DNA-based assays and automated tandem mass spectrometry platforms for early detection of rare and common congenital disorders. Government-supported universal screening programs, along with private healthcare facilities providing specialized services, enhance coverage. Integration with digital reporting systems improves efficiency and accuracy of follow-up care. Rising parental awareness and demand for reliable pediatric healthcare are further driving market growth.

Australia Newborn Screening Market Insight

The Australia newborn screening market is growing steadily due to the country’s established healthcare system, universal health coverage, and high awareness of pediatric health. Hospitals and clinics widely implement tandem mass spectrometry and DNA-based assays for accurate detection of metabolic and genetic disorders. Government-mandated screening programs ensure nearly universal coverage of newborns, with strong emphasis on follow-up care and early intervention. Technological integration, such as digital tracking and reporting systems, enhances efficiency and reliability. Rising parental awareness and growing demand for comprehensive pediatric care are driving adoption in both urban and regional healthcare centers. Government support for research and infrastructure expansion further strengthens market growth.

Asia-Pacific Newborn Screening Market Share

The Asia-Pacific Newborn Screening industry is primarily led by well-established companies, including:

- Bio-Rad Laboratories, Inc. (U.S.)

- PerkinElmer (U.S.)

- Natus Medical Incorporated (U.S.)

- Masimo (U.S.)

- Trivitron Healthcare (India)

- Medtronic (Ireland)

- Agilent Technologies, Inc. (U.S.)

- Waters Corporation (U.S.)

- AB SCIEX LLC (U.S.)

- ZenTech S.A. (Belgium)

- LifeCell International Pvt. Ltd. (India)

- Baebies, Inc. (U.S.)

- Chromsystems Instruments & Chemicals GmbH (Germany)

- Recipe Chemicals+Instruments (Germany)

- Luminex Corporation (U.S.)

- Revvity (U.S.)

- Zentech (U.S.)

- Tulip Diagnostics (P) Ltd (India)

- GE Healthcare (U.K.)

- Thermo Fisher Scientific Inc. (U.S.)

What are the Recent Developments in Asia-Pacific Newborn Screening Market?

- In September 2025, Australia's Health Ministers agreed to add biotinidase deficiency to the national newborn bloodspot screening program. This expansion aims to identify infants at risk of this treatable condition early, ensuring timely intervention and improved health outcomes

- In June 2025, the Indian Council of Medical Research (ICMR) reported that its newborn screening initiative had significantly reduced sickle cell disease (SCD) mortality among infants from 20–30% to less than 5% between 2019 and 2024. This achievement underscores the program's effectiveness in early detection and timely intervention

- In May 2025, the WHO South-East Asia Regional Office released new implementation guidance for universal newborn screening. This framework supports countries in planning and integrating screening for conditions such as hearing impairment, eye abnormalities, and neonatal jaundice into health systems, aiming for early detection and timely intervention for all newborns

- In August 2024, Queensland, Australia, launched a pioneering "Heel Prick 2.0" test aimed at detecting a broader range of genetic conditions in newborns. This enhanced screening builds upon the existing newborn bloodspot screening (NBS) program, which traditionally identified 32 disorders

- In March 2024, China's National Health Commission announced improvements in treatments for high-risk pregnancies and increased screenings for congenital birth defects. These measures are part of efforts to address the rising number of older mothers and emphasize quality care for newborns

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.