Asia Pacific Menstrual Cups Market

Market Size in USD Million

CAGR :

%

USD

311.65 Million

USD

515.78 Million

2024

2032

USD

311.65 Million

USD

515.78 Million

2024

2032

| 2025 –2032 | |

| USD 311.65 Million | |

| USD 515.78 Million | |

|

|

|

|

Asia-Pacific Menstrual Cups Market Size

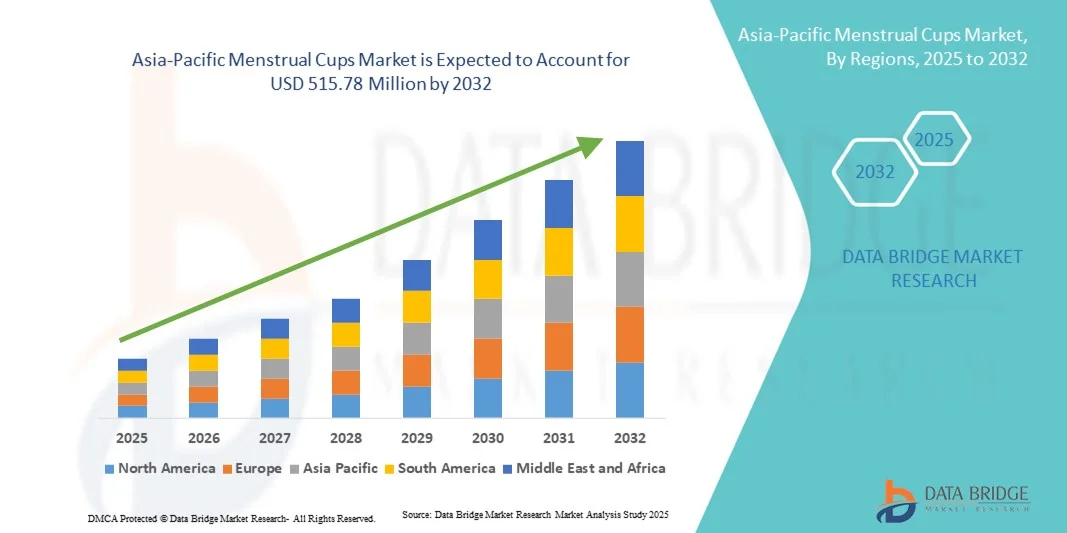

- The Asia-Pacific menstrual cups market size was valued at USD 311.65 million in 2024 and is expected to reach USD 515.78 million by 2032, at a CAGR of 6.5% during the forecast period

- The market growth is primarily driven by increasing awareness of sustainable menstrual hygiene solutions and the rising adoption of reusable feminine hygiene products. This trend is supported by growing environmental consciousness and regulatory encouragement to reduce plastic waste

- In addition, the growing demand for eco-friendly and cost-effective alternatives to traditional menstrual products is establishing menstrual cups as a preferred choice among consumers. These converging factors are accelerating the uptake of menstrual cup solutions, thereby significantly boosting the industry's growth

Asia-Pacific Menstrual Cups Market Analysis

- Menstrual cups, offering reusable and sustainable feminine hygiene solutions, are increasingly gaining traction in both urban and semi-urban regions of Asia-Pacific due to their cost-effectiveness, eco-friendliness, and convenience compared to traditional sanitary products

- The growing adoption of menstrual cups is primarily fueled by rising awareness of sustainable menstrual hygiene practices, increasing health consciousness among women, and the shift toward environmentally friendly alternatives to disposable products

- India dominated the Asia-Pacific menstrual cups market with the largest revenue share of 38.5% in 2024, driven by widespread awareness campaigns, government initiatives promoting menstrual hygiene, and strong distribution networks of key players targeting both urban and rural consumers

- China is expected to be the fastest-growing market in the Asia-Pacific region during the forecast period due to rising disposable incomes, increasing urbanization, and expanding online retail channels facilitating easier access to menstrual cups

- Silicone-based menstrual cups dominated the Asia-Pacific menstrual cups market with a market share of 46.8% in 2024, owing to their durability, safety, and widespread consumer preference over other materials

Report Scope and Asia-Pacific Menstrual Cups Market Segmentation

|

Attributes |

Asia-Pacific Menstrual Cups Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Asia-Pacific Menstrual Cups Market Trends

Rising Adoption of Sustainable and Eco-Friendly Menstrual Solutions

- A key trend in the Asia-Pacific menstrual cups market is the increasing preference for sustainable, reusable menstrual products over disposable alternatives, driven by growing environmental awareness and the push to reduce plastic waste

- For instance, brands such as DivaCup and Lena Cup are promoting menstrual cups as eco-friendly alternatives to pads and tampons, highlighting their long-term cost savings and lower environmental impact

- Awareness campaigns and influencer-led education programs are helping women understand proper usage, hygiene practices, and benefits of menstrual cups, driving higher acceptance in urban and semi-urban populations

- Convenience, comfort, and the long lifespan of menstrual cups are reshaping consumer expectations around feminine hygiene, with users seeking products that combine sustainability with practicality

- This trend toward eco-conscious and reusable menstrual products is encouraging manufacturers to innovate in materials, design, and regional customization, supporting broader adoption across diverse markets

- The demand for menstrual cups that are easy to use, safe, and environmentally sustainable is growing rapidly as consumers prioritize long-term cost-effectiveness and health-conscious choices

Asia-Pacific Menstrual Cups Market Dynamics

Driver

Growing Awareness of Menstrual Health and Hygiene Practices

- The increasing focus on menstrual health education and hygiene awareness is a major driver of the growing adoption of menstrual cups in the Asia-Pacific region

- For instance, government initiatives in India, such as free distribution programs and school-level education campaigns, are increasing knowledge about sustainable menstrual products and encouraging adoption among women of reproductive age

- Rising concerns about the environmental impact of disposable pads and tampons are pushing consumers toward reusable menstrual products that are safer, hygienic, and cost-effective over time

- The convenience of long-term use, reduced frequency of product changes, and lower overall cost are motivating women to transition from traditional products to menstrual cups in both urban and semi-urban areas

- Growing online sales channels and social media awareness campaigns are further expanding access to menstrual cups and educating potential users about their benefits, boosting market penetration

- The combination of health education, environmental consciousness, and product accessibility is strongly driving the menstrual cup market in the Asia-Pacific region

Restraint/Challenge

Cultural Taboos and Limited Awareness Hindering Adoption

- Cultural and social taboos surrounding menstruation in many Asia-Pacific countries pose a significant challenge to menstrual cup adoption, affecting discussions on feminine hygiene and acceptance of reusable products

- For instance, in rural regions of India and Southeast Asia, limited awareness and misconceptions about menstrual cups make some women hesitant to try them despite their benefits

- Concerns about discomfort, fear of improper insertion, or lack of guidance can create barriers for first-time users, slowing the growth of the market in conservative communities

- The relatively high upfront cost of quality menstrual cups compared to traditional disposable products can deter price-sensitive consumers, particularly in developing regions with limited purchasing power

- Addressing these challenges requires targeted educational campaigns, influencer-led awareness programs, and the promotion of starter-friendly and affordable menstrual cup options to build trust among potential users

- Overcoming cultural taboos, expanding awareness, and providing accessible solutions will be vital for sustained growth of the menstrual cup market in the Asia-Pacific region

Asia-Pacific Menstrual Cups Market Scope

The market is segmented on the basis of type, material, size, usability, shape, and distribution channel.

- By Type

On the basis of type, the Asia-Pacific menstrual cups market is segmented into vaginal cups and cervical cups. The vaginal cup segment dominated the market with the largest revenue share of 61.4% in 2024, driven by its ease of use, wide consumer familiarity, and compatibility with most body types. Women often prefer vaginal cups for their comfort, reliability, and lower learning curve compared to cervical cups. Extensive promotional campaigns and educational programs across urban and semi-urban regions have further strengthened their market presence. Vaginal cups are widely available in multiple sizes and materials, enhancing adoption across demographics. Online and offline accessibility, combined with competitive pricing, also contributes to their dominance. Growing urbanization and shifting consumer attitudes toward sustainable menstrual hygiene products are additional drivers for this segment.

The cervical cup segment is anticipated to witness the fastest growth rate of 10.8% from 2025 to 2032, fueled by rising awareness of alternative menstrual hygiene options and the desire for higher capacity products. Cervical cups are preferred by women with heavier flows or those seeking discreet products for extended wear. Marketing initiatives emphasizing hygiene, safety, and comfort are boosting adoption. The increasing presence of cervical cups in online marketplaces is widening consumer access. Innovation in ergonomic designs and premium materials is attracting health-conscious urban users. Rising disposable incomes and improved awareness campaigns are accelerating the growth of this segment.

- By Material

On the basis of material, the Asia-Pacific menstrual cups market is segmented into silicone, thermoplastic isomer, rubber, and latex. The silicone segment dominated the market with the largest share of 46.8% in 2024 due to its safety, durability, and hypoallergenic properties. Silicone menstrual cups are flexible, easy to clean, and resistant to bacterial growth, making them highly preferred by consumers. Leading brands actively promote silicone cups as cost-effective yet premium menstrual hygiene solutions. Silicone cups are available across various sizes and designs, ensuring compatibility with most users. Government and NGO-led campaigns promoting reusable and safe menstrual products further strengthen adoption. Consumer trust in silicone as a non-toxic material is another key factor supporting the segment’s dominance.

The thermoplastic isomer (TPE) segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, driven by increasing demand for softer, beginner-friendly cups. TPE-based cups appeal to younger women and users with sensitivity concerns due to their flexibility and comfort. Brands are innovating in TPE material composition to enhance durability and hygiene. Educational campaigns and tutorials are increasing consumer confidence and usability. Availability through online channels makes TPE cups accessible to urban and semi-urban populations. Rising awareness of material alternatives and beginner-friendly features are boosting adoption rates.

- By Size

On the basis of size, the Asia-Pacific menstrual cups market is segmented into small and large. The small size segment dominated the market with a share of 54.7% in 2024, due to suitability for younger users, first-time users, and women with lighter menstrual flow. Small cups are beginner-friendly and easier to insert and remove, which encourages adoption in urban and semi-urban areas. Their availability across multiple brands and competitive pricing further supports market dominance. Awareness campaigns emphasize comfort, hygiene, and discreet use during daily activities. Online and offline retail availability ensures strong penetration across regions. Government-led adolescent education programs also help expand adoption.

The large size segment is anticipated to witness the fastest growth rate of 9.8% from 2025 to 2032, driven by women with heavier flows or those seeking extended wear. Large cups provide higher capacity, comfort, and convenience for active lifestyles, travel, or work environments. Awareness campaigns highlighting hygiene and safety benefits are boosting adoption. E-commerce platforms increase reach to previously untapped consumers. Product innovations in ergonomic design and flexible materials further support the segment. Rising disposable incomes and progressive attitudes toward menstrual hygiene products enhance market growth.

- By Usability

On the basis of usability, the Asia-Pacific menstrual cups market is segmented into reusable and disposable. The reusable segment dominated the market with the largest share of 88.1% in 2024, driven by sustainability, long-term cost savings, and environmental consciousness. Reusable menstrual cups reduce dependency on disposable pads and tampons, significantly lowering plastic waste. Strong consumer education programs and campaigns promote proper hygiene and product longevity. Reusable cups are compatible with multiple designs and body types, further boosting adoption. Consumer trust in brand reliability and product durability strengthens market dominance. Government and NGO initiatives supporting reusable menstrual products reinforce adoption across urban and semi-urban populations.

The disposable segment is expected to witness the fastest growth rate of 12.3% from 2025 to 2032, driven by convenience-focused users and healthcare institutions. Disposable cups appeal to travelers, students, and working women seeking minimal maintenance. Marketing emphasizes portability, hygiene, and ease of use. Online platforms increase reach to first-time or skeptical users. Collaborations with pharmacies and retail chains further expand accessibility. Rising awareness about hygiene and the benefits of single-use products supports market growth.

- By Shape

On the basis of shape, the Asia-Pacific menstrual cups market is segmented into round, hollow, pointy, and flat. The round shape segment dominated the market with the largest share of 51.5% in 2024 due to ergonomic design, ease of insertion, and compatibility with most anatomies. Round cups are widely recommended by gynecologists and promoted by leading brands, reinforcing consumer confidence. Their design ensures optimal flow capture, comfort, and leak prevention. Marketing campaigns highlight reliability, ease of use, and beginner-friendliness. Availability across offline and online channels supports strong adoption. Educational initiatives further encourage adoption among first-time users and adolescents.

The hollow shape segment is anticipated to witness the fastest growth rate of 10.2% from 2025 to 2032, fueled by innovative designs that improve flexibility and insertion comfort. Hollow cups offer higher suction efficiency and are marketed as premium options for heavy flow management. Online tutorials and influencer promotions increase consumer awareness and confidence. Urban populations are increasingly adopting hollow-shaped cups due to comfort and convenience. E-commerce and retail availability further support market growth. Brands are investing in R&D to optimize hollow cup designs, driving adoption in Asia-Pacific countries.

- By Distribution Channel

On the basis of distribution channel, the Asia-Pacific menstrual cups market is segmented into online stores, retail pharmacies, department stores, supermarkets, and others. The online store segment dominated the market with the largest share of 45.8% in 2024, driven by doorstep convenience, wide product variety, and detailed information availability. E-commerce allows access to tier-2 and tier-3 cities with limited offline retail presence. Consumer reviews, social media campaigns, and digital marketing further drive adoption. Subscription models and digital payment options enhance convenience and repeat purchases. Fast delivery and diverse product offerings support widespread penetration. Brands leverage online platforms to educate first-time users and promote proper usage.

The retail pharmacy segment is expected to witness the fastest growth rate of 11.5% from 2025 to 2032, fueled by consumer trust in pharmacies for authentic products and guidance from trained staff. Pharmacies provide a hands-on experience for first-time users seeking assistance. Availability in urban and semi-urban regions enhances convenience. Marketing collaborations between brands and pharmacy chains increase visibility. Educational pamphlets and demonstrations further support awareness. Rising preference for offline guidance and expert consultation contributes to the rapid growth of this distribution channel.

Asia-Pacific Menstrual Cups Market Regional Analysis

- India dominated the Asia-Pacific menstrual cups market with the largest revenue share of 38.5% in 2024, driven by widespread awareness campaigns, government initiatives promoting menstrual hygiene, and strong distribution networks of key players targeting both urban and rural consumers

- Indian consumers are increasingly valuing the convenience, cost-effectiveness, and eco-friendliness offered by menstrual cups compared to disposable pads and tampons. Awareness campaigns and educational programs have strengthened understanding of proper usage, hygiene benefits, and long-term savings

- This widespread adoption is further supported by rising disposable incomes, expanding e-commerce platforms, and urbanization, which enhance access to menstrual cups and encourage use in both urban and semi-urban populations

The India Menstrual Cups Market Insight (Dominant)

India dominated the Asia-Pacific menstrual cups market with the largest revenue share in 2024, driven by increasing awareness of menstrual hygiene, urbanization, and a growing middle-class population. Government initiatives, school-level programs, and NGO-led campaigns are accelerating adoption among adolescents and working women. The availability of affordable menstrual cups through domestic manufacturers is improving accessibility across urban and semi-urban regions. Rising disposable incomes, cultural acceptance, and a growing focus on sustainable hygiene practices are supporting strong growth. Online retail channels and social media education campaigns are further boosting adoption. India remains the largest contributor to the regional menstrual cups market.

China Menstrual Cups Market Insight (Fastest Growing)

The China menstrual cups market is anticipated to witness the fastest growth rate during the forecast period, driven by rising awareness of menstrual hygiene and increasing urbanization. Consumers are increasingly adopting reusable, cost-effective, and eco-friendly menstrual products over disposable alternatives. Government initiatives and NGO-led campaigns promoting sustainable feminine care are accelerating market penetration. The rapid expansion of e-commerce platforms and social media campaigns is improving accessibility and awareness among younger women. Rising female workforce participation and changing lifestyles in urban areas are encouraging adoption. Continuous innovation in designs and materials further supports the fast growth of the market in China.

Japan Menstrual Cups Market Insight

The Japan menstrual cups market is growing steadily due to high health consciousness, technological awareness, and urban lifestyles. Consumers increasingly prefer convenient, reusable, and environmentally friendly menstrual hygiene products. Awareness campaigns, online retail availability, and educational initiatives on proper usage and hygiene are driving adoption. Japan’s aging population also increases demand for comfortable and easy-to-use menstrual cups suitable for older women. Social acceptance of menstrual cups and growing retail penetration in urban areas are supporting market expansion. Premium product designs and high-quality materials further enhance consumer confidence and adoption rates.

South Korea Menstrual Cups Market Insight

The South Korea menstrual cups market is witnessing strong growth, fueled by rising awareness of sustainable menstrual products and increasing urbanization. Consumers are attracted to eco-friendly, cost-effective, and convenient menstrual hygiene solutions. Online retail channels and social media campaigns are improving product visibility and education, particularly among younger women. Urban populations are adopting menstrual cups for comfort, hygiene, and long-term cost savings. Government and NGO initiatives promoting menstrual health further support market penetration. Rising disposable incomes and shifting cultural perceptions of menstruation are contributing to continued market expansion.

Asia-Pacific Menstrual Cups Market Share

The Asia-Pacific Menstrual Cups industry is primarily led by well-established companies, including:

- Diva International Inc. (Canada)

- ME LUNA CUP (Germany)

- Lena Cup (U.S.)

- Flex (U.S.)

- Blossom Cup (U.S.)

- Lyv Life, Inc. (U.S.)

- Fleurcup (France)

- Peptonic Medical (Sweden)

- Pixie Cup, LLC (U.S.)

- Saalt (U.S.)

- Lunette (Finland)

- Jaguara s.r.o. (Czech Republic)

- INTIMINA (Sweden)

- Ruby Cup (Germany)

- The Keeper, Inc. (U.S.)

- Sirona Hygiene Private Limited (India)

- Redcliffe (India)

What are the Recent Developments in Asia-Pacific Menstrual Cups Market?

- In September 2025, Japanese auto parts manufacturer GomunoInaki announced plans to launch its silicone menstrual cups in Singapore and Vietnam by the end of 2025. The company aims to leverage its expertise in medical-grade silicone to offer high-quality, eco-friendly period care solutions in these markets

- In July 2025, Furuize, a Chinese company specializing in menstrual hygiene products, reported unprecedented growth in the domestic menstrual disc market. The company has earned high praise for its product quality and has become a standout player in the market. This growth reflects the increasing acceptance and demand for alternative menstrual hygiene products in China

- In June 2025, Meghalaya Chief Minister Conrad K. Sangma inaugurated the 'She-Rise' production unit in Laitkroh, East Khasi Hills, focusing on manufacturing reusable sanitary pads as part of a zero-waste menstrual hygiene initiative. The project aims to improve menstrual hygiene, promote environmental sustainability, and empower women in Northeast India

- In April 2025, The Kerala government, in collaboration with HLL Lifecare Ltd, announced the distribution of 300,000 menstrual cups across all local bodies in Kerala for the 2025-26 financial year. This initiative aims to increase acceptance of menstrual cups, particularly in rural areas, by providing free access and conducting awareness sessions

- In April 2025, Saathi, an Indian company specializing in sustainable menstrual products, showcased its eco-friendly solutions at Expo 2025 Osaka. The event, held from April 13 to October 13, 2025, provided a platform for Saathi to promote its vision of a future where periods are kind to women and the planet

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.